Nyheter

Gold above US$1400, where next?

Gold prices are currently trading at very important technical levels. The fact that gold surpassed and stayed above US$1400/oz is an important milestone, after breaching US$1350/oz on Thursday 20 June. US$1350/oz acted as a key resistance point, as gold failed to breach those levels 6 times before in September 2017, January 2018, February 2018, March 2018, April 2018 and February 2019. Having risen above another ‘round number’ is symbolically important. Gold is currently trading at highest levels since March 2013.

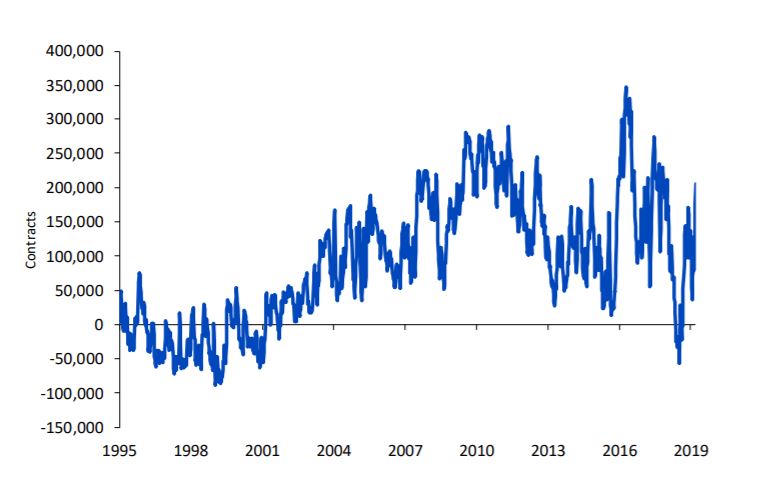

The last time gold traded above US$1350/oz was shortly after the UK’s referendum on EU membership in mid-2016, when speculative positioning in gold futures hit an all-time high.

Clearly something changed.

We previously expected the US Federal Reserve (Fed) to remain on hold for the year (although its ‘dot-plots’ were guiding the market for a hike in 2020). But the market forced the Fed’s hands, then the central bank indicated at its June meeting that it could cut rates in 2020 and the market is pricing in a cut at the July meeting.

US 10-year Treasury yields fell significantly below 2.0% (from 2.4% at the end of March 2019 and over 3% in October 2018). The recent surge in gold prices reflect the dovish stance of the Fed and this precipitous drop in yields.

The question is: is there still further upside? Based on our revised assumptions, we believe so.

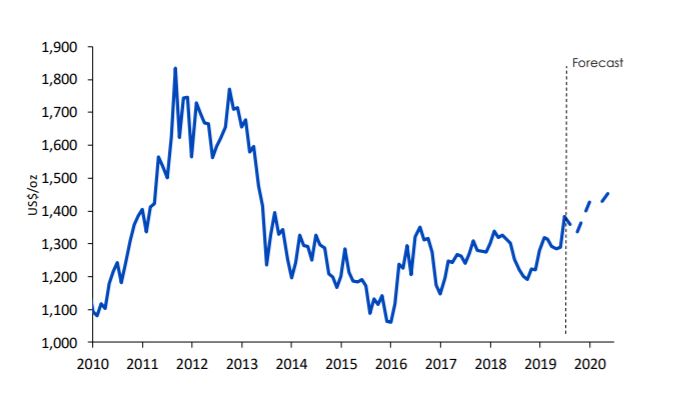

Figure 1: WisdomTree’s gold price forecast

Using WisdomTree’s quantitative framework outlined in “Gold: How we value the precious metal”, we project gold prices could rise to US$1480/oz by end of Q2 2020. This is based on a relatively conservative set of assumptions:

- US Treasury yields to remain at current levels. The market has largely priced-in more cuts that the Fed itself is guiding. Fed Fund futures are indicating the market is looking for two to three rate cuts in 2019. Our forecast for gold—at 1480—just uses current levels for longterm interest rates. A further drop in rates would support even higher prices.

- US dollar basket remaining around 97. Although cutting interest rates would normally be associated with currency weakness, we believe that the Fed will not be alone in expressing a dovish bias. That is likely to avoid large appreciation or depreciation of the US dollar. Indeed, with accusations of ‘currency wars’ re-emerging, gold could be seen as the haven currency during the course of the year (especially among emerging market central banks, who appear to want to diversify their foreign currency reserves), as it has been in the past.

- Inflation to reach 2%. Although weak inflation is the driver for the Fed’s change in policy course (with CPI inflation currently at 1.8%), we believe at the headline level, inflation could rise as a result of higher oil prices. We believe weakness in demand for oil – that could result from prolonged trade tensions for example – would be countered by the Organization of the Petroleum Exporting Countries (OPEC) policy decisions. OPEC’s policy meeting has been rescheduled for 1 st July, after the G20 meeting takes place on 28th/29th June, which highlights how the cartel wants to understand demand projections (which can only happen when we know where the world’s largest consumers—US and China—are heading).

- Investor sentiment for gold may not remain as elevated as today, but with so many geopolitical concerns, there are upside risks. Speculative positioning in gold futures has risen substantially in recent weeks and surpassed our expectations. Speculative length is over 205k contracts net long—a substantial rise from 55k net short in October 2018. We don’t think it will remain this elevated on a base case basis (and we assume positioning at 120k contracts). However, we note that many risks could crystallise in the near future. Within the next week are several keys risks:

- At the G20 meeting on 28th/29th June, China and US may not see eye-to-eye and disappoint the market with further escalation in their trade war

- On June 27th, Iran is likely to announce it has breached the nuclear accord and thus risks military intervention with the US

Figure 2: Net speculative positioning in gold futures

In conclusion, based on our quantitative model and a relatively conservative set of assumptions, we believe gold still has room to go materially higher.

– Nitesh Shah, Director – Research, WisdomTree

Nyheter

Australien och USA investerar 8,5 miljarder USD för försörjningskedja av kritiska mineraler

USA:s president Donald Trump och Australiens premiärminister Anthony Albanese undertecknade på måndagen ett avtal som ska tillföra miljarder dollar till projekt inom kritiska mineraler.

Länderna kommer tillsammans att bidra med 1-3 miljarder dollar till projekten under de kommande sex månaderna. Den totala projektportföljen är värd 8,5 miljarder dollar, enligt regeringarna.

Galliumraffinaderi med kapacitet för 5x USA:s efterfrågan

Som en del av avtalet kommer det amerikanska försvarsdepartementet även att investera i ett galliumraffinaderi i västra Australien med en kapacitet på 100 ton per år. För närvarande importerar USA omkring 21 ton gallium, vilket motsvarar hela den inhemska konsumtionen, enligt den amerikanska geologiska myndigheten.

Initiativet kommer samtidigt som Kina har infört exportrestriktioner på vissa mineraler, däribland sällsynta jordartsmetaller, som är avgörande för tillverkningen av elektronik och elmotorer. Gallium används till exempel i mikrovågskretsar samt blå och violetta lysdioder (LED), vilka kan användas för att skapa kraftfulla lasrar.

Nyheter

Vad guldets uppgång egentligen betyder för världen

Guldpriset har nyligen nått rekordnivåer, över 4 000 dollar per uns. Denna uppgång är inte bara ett resultat av spekulation, utan speglar djupare förändringar i den globala ekonomin. Bloomberg analyserar hur detta hänger samman med minskad tillit till dollarn, geopolitisk oro och förändrade investeringsmönster.

Guldets roll som säker tillgång har stärkts i takt med att förtroendet för den amerikanska centralbanken minskat. Osäkerhet kring Federal Reserves oberoende, inflationens utveckling och USA:s ekonomiska stabilitet har fått investerare att söka alternativ till fiatvalutor. Donald Trumps handelskrig har också bidragit till att underminera dollarns status som global reservvaluta.

Samtidigt ökar den geopolitiska spänningen, särskilt mellan USA och Kina. Kapitalflykt från Kina, driven av oro för övertryckta valutor och instabilitet i det finansiella systemet, har lett till ökad efterfrågan på guld. Även kryptovalutor som bitcoin stiger i värde, vilket tyder på ett bredare skifte mot hårda tillgångar.

Bloomberg lyfter fram att derivatmarknaden för guld visar tecken på spekulativ överhettning. Positioneringsdata och avvikelser i terminskurvor tyder på att investerare roterar bort från aktier och obligationer till guld. ETF-flöden och CFTC-statistik bekräftar denna trend.

En annan aspekt är att de superrika nu köper upp alla tillgångsslag – aktier, fastigheter, statsobligationer och guld – vilket bryter mot traditionella investeringslogiker där vissa tillgångar fungerar som motvikt till andra. Detta tyder på att marknaden är ur balans och att kapitalfördelningen är skev.

Sammanfattningsvis är guldets prisrally ett tecken på en värld i ekonomisk omkalibrering. Det signalerar misstro mot fiatvalutor, oro för geopolitisk instabilitet och ett skifte i hur investerare ser på risk och trygghet.

Nyheter

Spotpriset på guld över 4300 USD och silver över 54 USD

Guldpriset stiger i ett spektakulärt tempo, nya rekord sätts nu på löpande band. Terminspriset ligger oftast före i utvecklingen, men ikväll passerade även spotpriset på guld 4300 USD per uns. Guldet är just nu som ett ångande tåg som det hela tiden skyfflas in mer kol i. En praktisk fördel med ett högre pris är att det totala värdet på guld även blir högre, vilket gör att centralbanker och privatpersoner kan placera mer pengar i guld.

Även spotpriset på silver har nu passerat 54 USD vilket innebär att alla pristoppar från Hunt-brödernas klassiska squeeze på silver har passerats med marginal. Ett högt pris på guld påverkar främst köpare av smycken, men konsekvensen av ett högt pris på silver är betydligt mer kännbar. Silver är en metall som används inom många olika industrier, i allt från solceller till medicinsk utrustning.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEtt samtal om guld, olja, fjärrvärme och förnybar energi

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Analys4 veckor sedan

Analys4 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuldpriset uppe på nya höjder, nu 3750 USD

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om guld, olja, koppar och stål