Analys

SHB Råvarubrevet 10 oktober 2014

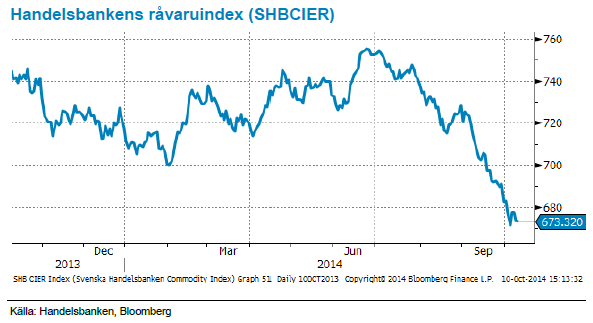

Råvaror allmänt: Händelserik vecka trots lite makrodata

Makro-agendan var tunn men blev trots det en besvikelse där Tyska tillverkningsorder och export varit överraskande svag i september. Europas viktigaste land följdes upp av ECB:s ledare Draghi som körde en upprepning av tidigare utsago och påtalade Europas strukturella problem snarare än konjunkturella. En ny besvikelse för marknaden och Europa är nu åter ett stort orosmoln. Draghi betonar att regeringar måste genomföra reformer. Regeringar med utrymme bör föra en mer expansiv finanspolitik

Från USA kom Fed protokollet (FOMC minutes) från mötet den 15-16 sep som visade ökad oro bland ledamöter för en starkare amerikansk dollar och global inbromsning med svaghet i europeisk ekonomi och inflation. Fed ledamöterna förordar räntor nära noll under en ”betydande tid” efter avslutade obligationsköp. Vissa förordar tålamod, snarare än motsatsen, i väntan på bevis om uthållig förbättring mot målet. Det var en Fed-röst som påtalade risker i globala tillväxten på ett sätt som marknaden inte förväntat sig.

Konjunkturhandlade råvaror, främst olja har varit svaga tillsammans med börsen på veckans utspel från centralbankerna.

Energi: Fokus på oljan

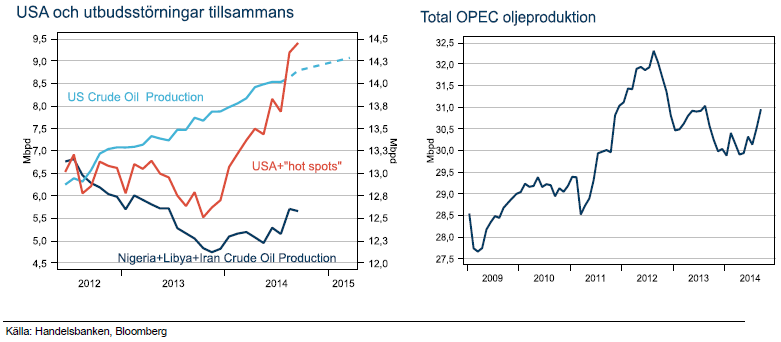

Oljan handlas nu under 90-strecket för första gången sedan juni 2012. Det året kunde man köpa olja för under 90 USD/fat dagen före midsommar i spåren av Libyens återkomst efter att Gaddafi hade störtats. Libyens oljeproduktion föll snart samman i efterföljande kamp om makten och priset steg tillbaka. Sedan 2011 har oljan rangehandlats till ett genomsnittspris på 110 USD/fat, medan WTI har handlats till rabatt p.g.a ökad inhemsk produktion och inlandshandelspunkt.

I år har oljan tappat 23 % från toppen i juni efter att USA:s oljeproduktion väntas nå 30 års högsta, att OPEC inte har skalat ned produktionen, att Rysslands oljeproduktion nära post-sovjet-all time high, att Saudi sänkte priset (istället för produktionen) på leveranser under november till Asien och att IMF sänkte prognosen för den globala tillväxten för 2015.

Varför har då inte oljan fallit tidigare om USA ökat produktionen sedan 2011? Det förklaras av att det under samma tid uppstått utbudsstörningar i en rad viktiga oljeländer som har inverkat negativt och kompenserat ut USA:s växande produktion. Effekten märktes inte i början av 2014 eftersom det fanns en rysslandsriskpremie i oljepriset men den har slagit igenom med full kraft efter den här sommaren. Se röd linje i graf nedan.

Marknadens oro har även ökat eftersom OPEC som brukligt inte aktivt bromsat fallet genom att strypa produktionen (se graf). Saudi minskade produktionen i augusti men data i september visade att OPEC ökat totala produktionen. Det betyder att övriga OPEC-länder inte följt Saudi. Flera medlemmar har varit överrens om förändring i produktion men endast Saudi har genomfört dem. Saudi vet att man i längden inte kan parera för USA:s årliga ökning utan man måste få med övriga kartellmedlemmar i båten.

Saudi svarade denna gång med att sänka priserna på november leveranser till Asien som är marginalköparen på den olja som USA inte längre importerar. Det ses som ett tecken på att OPEC håller på att destabiliseras och inte kan hantera USA:s växande produktion och minskade import. Nästa OPEC-möte är 27 november i Wien.

Ser vi till tillväxttakten i USA så har den toppat 2013, de enklaste brunnarna är borrade och halveringstakten är mycket hög vilket gör att det krävs allt mer investeringar för att fortsätta öka produktionen. Med senaste prognosen för 2015 som för första gången så kommer vi ner ordentligt i produktionstakt. Det vore ju därför märkligt om OPEC inte kan hantera situationen om nu USA effekten kommer minska inom 1 år.

Vi tror att den strukturella pressen kommer fortsätta, men på dessa nivåer kan den riskvillige köpa.

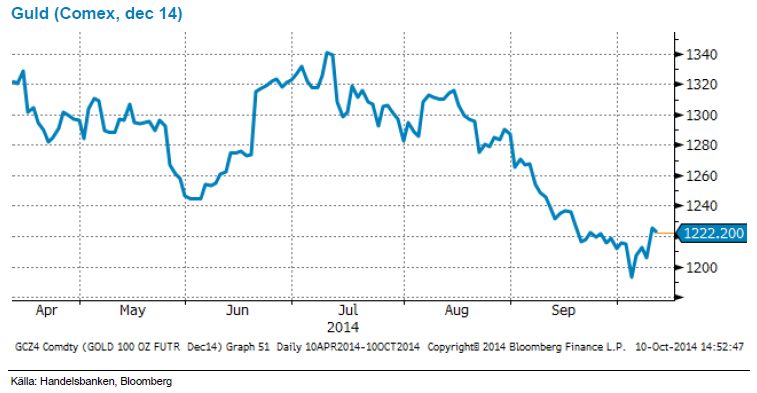

Ädelmetaller: Guldet studsar upp

Veckans FOMC minutes (Fed) gav guldpriset en ordentlig studs efter fallet på drygt 8 % under perioden juli till september. Protokollet tolkades som att Fed inte är alls så hökigt som tidigare befarat och fick dollarn på fall vilket gav ytterligare stöd till guldpriset.

Visst intresse för att köpa guld som säker hamn kan också skönjas efter senaste vågen av negativt sentiment kring Europa, tillspetsat av att IMF sänkte tillväxtprognosen för världen för 2015. Svagare börs hjälper också guld som alternativ investering. S&P är ner 4 % från toppen, fortsätter raset tror vi att det är läge att vara positiv till guldet.

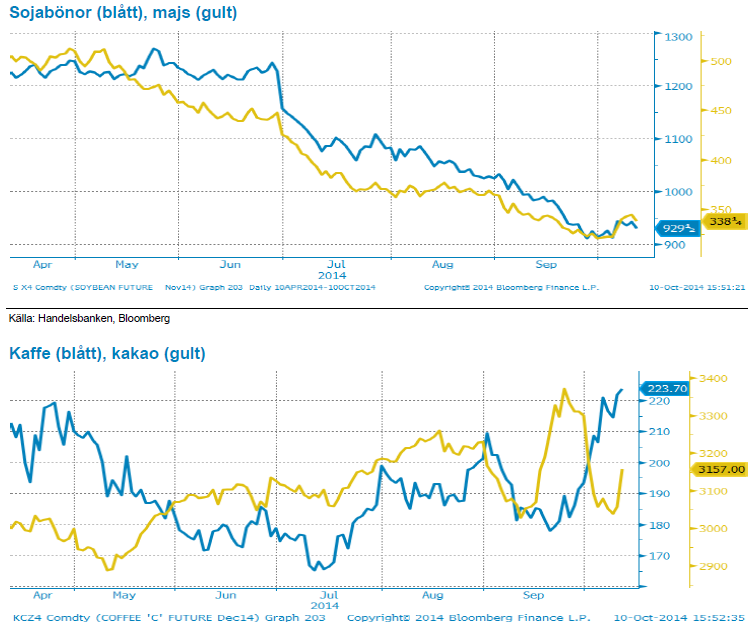

Livsmedel: Kakao på 4 års-högsta

Under sista veckan i september nådde kakaopriset 4–årshögsta efter senaste tidens rapporter om den förvärrade situationen i Västafrika i samband med Ebolaspridningen och en eventuell spridning till Elfenbenskusten. Kakao handlas nu återigen på samma nivåer som innan uppgången, skördearbetet är i full gång med en förväntad rekordskörd från Elfenbenskusten.

Kaffe har skjutit i höjden på nytt och har i veckan handlats på årshögsta. En tidig utblomning orsakat av det ojämna klimatet i sydöstra Brasilien under året och regionen är i kraftigt behov av nederbörd. Läget är akut och markfuktigheten är långt under normalen i de viktiga odlingsområdena. Fortsätter det torra vädret finns det stor risk att torkan slår ut blommorna och skapar ännu större osäkerhet kring kommande års prognoser.

Priset på sojabönor har stigit under veckan, delvis som följd av skördefördröjande regn i USA och torrt väder i Brasilien. Än har inte regnet i USA gjort någon skada och torrare väder väntas inom de närmsta dagarna. Precis som för majsen fortsätter rapporter att visa på rekordavkastning efterhand som skörden fortskrider norrut och vi förväntar oss ytterligare uppjustering av den amerikanska sojans avkastning i kvällens USDA-rapport. Dryga 10 procent av den brasilianska sådden är avklarad utan större problem om än torrt i vissa regioner. Såvida inte torkan i Brasilien förvärras i större omfattning eller utsträckning tror vi att sojapriserna har ytterligare mer att falla. Påminner om det tradingcase på spreadcertifikat majs/sojabönor vi skickat ut tidigare. Läs mer här.

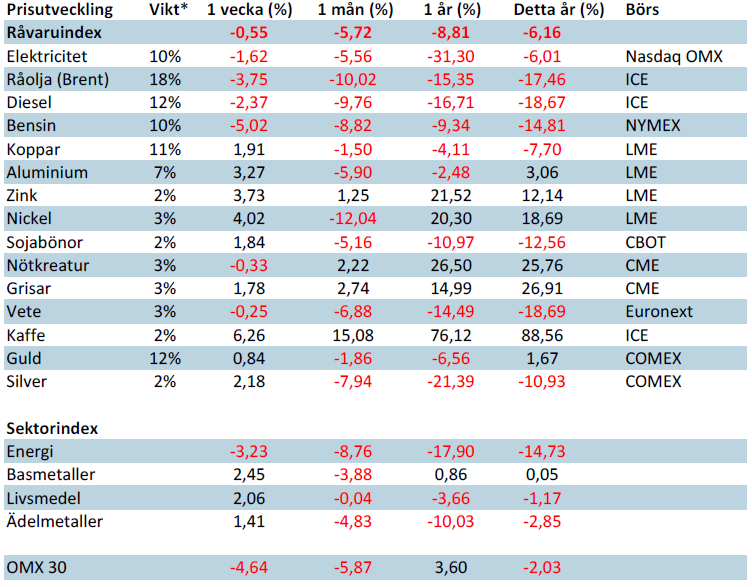

Handelsbankens råvaruindex (USD)

[box]SHB Råvarubrevet är producerat av Handelsbanken och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Ansvarsbegränsning

Detta material är producerat av Svenska Handelsbanken AB (publ) i fortsättningen kallad Handelsbanken. De som arbetar med innehållet är inte analytiker och materialet är inte oberoende investeringsanalys. Innehållet är uteslutande avsett för kunder i Sverige. Syftet är att ge en allmän information till Handelsbankens kunder och utgör inte ett personligt investeringsråd eller en personlig rekommendation. Informationen ska inte ensamt utgöra underlag för investeringsbeslut. Kunder bör inhämta råd från sina rådgivare och basera sina investeringsbeslut utifrån egen erfarenhet.

Informationen i materialet kan ändras och också avvika från de åsikter som uttrycks i oberoende investeringsanalyser från Handelsbanken. Informationen grundar sig på allmänt tillgänglig information och är hämtad från källor som bedöms som tillförlitliga, men riktigheten kan inte garanteras och informationen kan vara ofullständig eller nedkortad. Ingen del av förslaget får reproduceras eller distribueras till någon annan person utan att Handelsbanken dessförinnan lämnat sitt skriftliga medgivande. Handelsbanken ansvarar inte för att materialet används på ett sätt som strider mot förbudet mot vidarebefordran eller offentliggörs i strid med bankens regler.

Analys

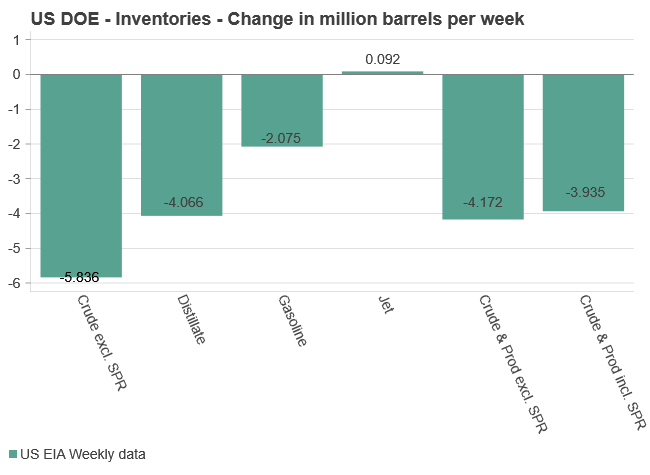

Tightening fundamentals – bullish inventories from DOE

The latest weekly report from the US DOE showed a substantial drawdown across key petroleum categories, adding more upside potential to the fundamental picture.

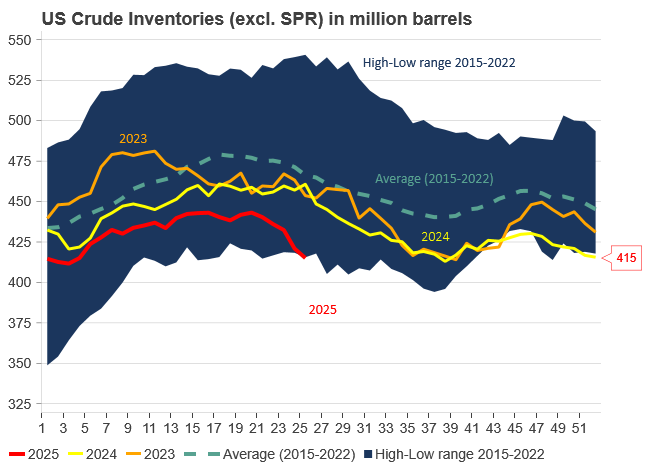

Commercial crude inventories (excl. SPR) fell by 5.8 million barrels, bringing total inventories down to 415.1 million barrels. Now sitting 11% below the five-year seasonal norm and placed in the lowest 2015-2022 range (see picture below).

Product inventories also tightened further last week. Gasoline inventories declined by 2.1 million barrels, with reductions seen in both finished gasoline and blending components. Current gasoline levels are about 3% below the five-year average for this time of year.

Among products, the most notable move came in diesel, where inventories dropped by almost 4.1 million barrels, deepening the deficit to around 20% below seasonal norms – continuing to underscore the persistent supply tightness in diesel markets.

The only area of inventory growth was in propane/propylene, which posted a significant 5.1-million-barrel build and now stands 9% above the five-year average.

Total commercial petroleum inventories (crude plus refined products) declined by 4.2 million barrels on the week, reinforcing the overall tightening of US crude and products.

Analys

Bombs to ”ceasefire” in hours – Brent below $70

A classic case of “buy the rumor, sell the news” played out in oil markets, as Brent crude has dropped sharply – down nearly USD 10 per barrel since yesterday evening – following Iran’s retaliatory strike on a U.S. air base in Qatar. The immediate reaction was: “That was it?” The strike followed a carefully calibrated, non-escalatory playbook, avoiding direct threats to energy infrastructure or disruption of shipping through the Strait of Hormuz – thus calming worst-case fears.

After Monday morning’s sharp spike to USD 81.4 per barrel, triggered by the U.S. bombing of Iranian nuclear facilities, oil prices drifted sideways in anticipation of a potential Iranian response. That response came with advance warning and caused limited physical damage. Early this morning, both the U.S. President and Iranian state media announced a ceasefire, effectively placing a lid on the immediate conflict risk – at least for now.

As a result, Brent crude has now fallen by a total of USD 12 from Monday’s peak, currently trading around USD 69 per barrel.

Looking beyond geopolitics, the market will now shift its focus to the upcoming OPEC+ meeting in early July. Saudi Arabia’s decision to increase output earlier this year – despite falling prices – has drawn renewed attention considering recent developments. Some suggest this was a response to U.S. pressure to offset potential Iranian supply losses.

However, consensus is that the move was driven more by internal OPEC+ dynamics. After years of curbing production to support prices, Riyadh had grown frustrated with quota-busting by several members (notably Kazakhstan). With Saudi Arabia cutting up to 2 million barrels per day – roughly 2% of global supply – returns were diminishing, and the risk of losing market share was rising. The production increase is widely seen as an effort to reassert leadership and restore discipline within the group.

That said, the FT recently stated that, the Saudis remain wary of past missteps. In 2018, Riyadh ramped up output at Trump’s request ahead of Iran sanctions, only to see prices collapse when the U.S. granted broad waivers – triggering oversupply. Officials have reportedly made it clear they don’t intend to repeat that mistake.

The recent visit by President Trump to Saudi Arabia, which included agreements on AI, defense, and nuclear cooperation, suggests a broader strategic alignment. This has fueled speculation about a quiet “pump-for-politics” deal behind recent production moves.

Looking ahead, oil prices have now retraced the entire rally sparked by the June 13 Israel–Iran escalation. This retreat provides more political and policy space for both the U.S. and Saudi Arabia. Specifically, it makes it easier for Riyadh to scale back its three recent production hikes of 411,000 barrels each, potentially returning to more moderate increases of 137,000 barrels for August and September.

In short: with no major loss of Iranian supply to the market, OPEC+ – led by Saudi Arabia – no longer needs to compensate for a disruption that hasn’t materialized, especially not to please the U.S. at the cost of its own market strategy. As the Saudis themselves have signaled, they are unlikely to repeat previous mistakes.

Conclusion: With Brent now in the high USD 60s, buying oil looks fundamentally justified. The geopolitical premium has deflated, but tensions between Israel and Iran remain unresolved – and the risk of missteps and renewed escalation still lingers. In fact, even this morning, reports have emerged of renewed missile fire despite the declared “truce.” The path forward may be calmer – but it is far from stable.

Analys

A muted price reaction. Market looks relaxed, but it is still on edge waiting for what Iran will do

Brent crossed the 80-line this morning but quickly fell back assigning limited probability for Iran choosing to close the Strait of Hormuz. Brent traded in a range of USD 70.56 – 79.04/b last week as the market fluctuated between ”Iran wants a deal” and ”US is about to attack Iran”. At the end of the week though, Donald Trump managed to convince markets (and probably also Iran) that he would make a decision within two weeks. I.e. no imminent attack. Previously when when he has talked about ”making a decision within two weeks” he has often ended up doing nothing in the end. The oil market relaxed as a result and the week ended at USD 77.01/b which is just USD 6/b above the year to date average of USD 71/b.

Brent jumped to USD 81.4/b this morning, the highest since mid-January, but then quickly fell back to a current price of USD 78.2/b which is only up 1.5% versus the close on Friday. As such the market is pricing a fairly low probability that Iran will actually close the Strait of Hormuz. Probably because it will hurt Iranian oil exports as well as the global oil market.

It was however all smoke and mirrors. Deception. The US attacked Iran on Saturday. The attack involved 125 warplanes, submarines and surface warships and 14 bunker buster bombs were dropped on Iranian nuclear sites including Fordow, Natanz and Isfahan. In response the Iranian Parliament voted in support of closing the Strait of Hormuz where some 17 mb of crude and products is transported to the global market every day plus significant volumes of LNG. This is however merely an advise to the Supreme leader Ayatollah Ali Khamenei and the Supreme National Security Council which sits with the final and actual decision.

No supply of oil is lost yet. It is about the risk of Iran closing the Strait of Hormuz or not. So far not a single drop of oil supply has been lost to the global market. The price at the moment is all about the assessed risk of loss of supply. Will Iran choose to choke of the Strait of Hormuz or not? That is the big question. It would be painful for US consumers, for Donald Trump’s voter base, for the global economy but also for Iran and its population which relies on oil exports and income from selling oil out of that Strait as well. As such it is not a no-brainer choice for Iran to close the Strait for oil exports. And looking at the il price this morning it is clear that the oil market doesn’t assign a very high probability of it happening. It is however probably well within the capability of Iran to close the Strait off with rockets, mines, air-drones and possibly sea-drones. Just look at how Ukraine has been able to control and damage the Russian Black Sea fleet.

What to do about the highly enriched uranium which has gone missing? While the US and Israel can celebrate their destruction of Iranian nuclear facilities they are also scratching their heads over what to do with the lost Iranian nuclear material. Iran had 408 kg of highly enriched uranium (IAEA). Almost weapons grade. Enough for some 10 nuclear warheads. It seems to have been transported out of Fordow before the attack this weekend.

The market is still on edge. USD 80-something/b seems sensible while we wait. The oil market reaction to this weekend’s events is very muted so far. The market is still on edge awaiting what Iran will do. Because Iran will do something. But what and when? An oil price of 80-something seems like a sensible level until something do happen.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanStor uppsida i Lappland Guldprospekterings aktie enligt analys

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSilverpriset släpar efter guldets utveckling, har mer uppsida

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanUppgången i oljepriset planade ut under helgen

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMahvie Minerals växlar spår – satsar fullt ut på guld

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanLåga elpriser i sommar – men mellersta Sverige får en ökning

-

Analys3 veckor sedan

Analys3 veckor sedanVery relaxed at USD 75/b. Risk barometer will likely fluctuate to higher levels with Brent into the 80ies or higher coming 2-3 weeks

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanOljan, guldet och marknadens oroande tystnad

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanJonas Lindvall är tillbaka med ett nytt oljebolag, Perthro, som ska börsnoteras