Analys

SHB Råvaruplanket 19 september 2012

Centralbankerna har sista ordet

Centralbankerna har sista ordet

Bottenfiske lönade sig

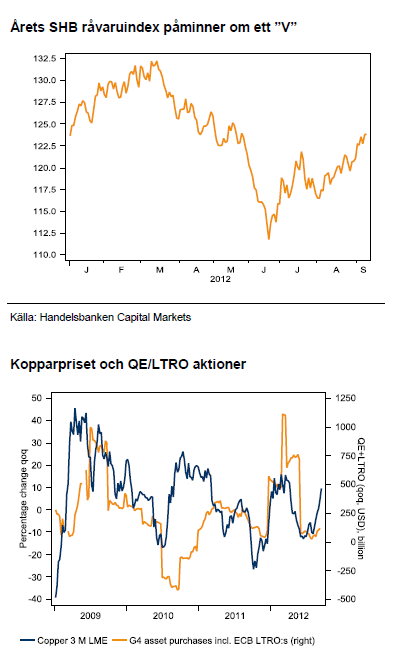

För ett kvartal sedan hittade vi mycket som pekade på att vi var nära botten i det negativa sentimentet. Det ser alltid som mörkast ut innan det vänder – och så var det även den gången. Vi trodde att olja, bas- och ädelmetaller skulle stiga från låga nivåer. Ett kvartal senare står de flesta råvaror 15-20 % högre i pris och årets utveckling påminner om ett ”V”.

Goda utsikter trots fladdrig realekonomi

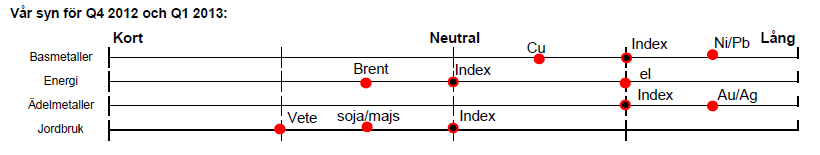

Högre priser på råvaror och nedreviderade utsikter för de stora ekonomierna skapar förnimmelser av en marknad likt ett korthus. Vi lutar oss dock mot att Kina intensifierat stimulansvågen och att centralbankerna åter satt ner foten både genom mycket prat men till slut även handling, viktigast genom QE3. Perioder med lättare penningpolitik har under de senaste åren gett en råvarumarknad som ”glider uppåt”. Med stimulanser i luften tror vi att breda råvaruindex kommer stiga under resten av året. I en sådan miljö, med ett starkare Kina och stimulanspengar i systemet, förväntar vi oss att bas- och ädelmetaller kommer stiga mer än olja och spannmål. Guld har fått styrfart uppåt på utsikterna om frikostig penningpolitik i USA och Europa och vi intensifierar vår tro på ett stigande guldpris.

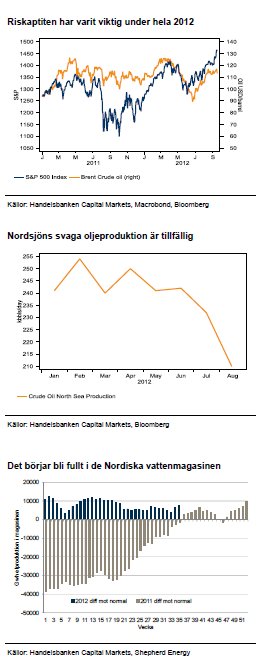

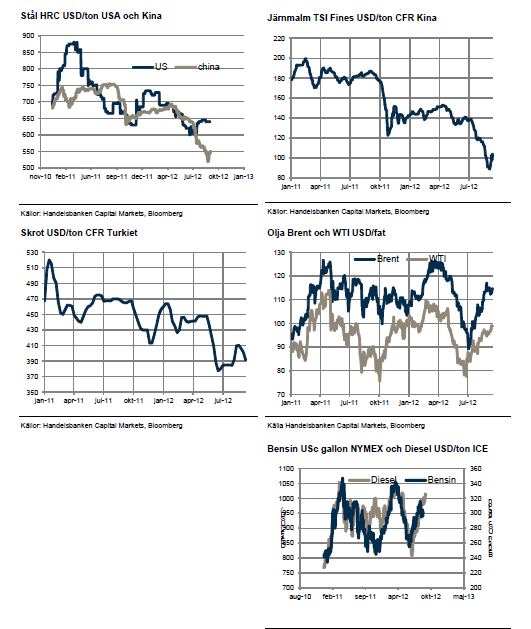

Oljerallyt drivet av ”en perfekt storm”

Strejken i Norge, stundande orkansäsong på Atlanten, konflikten mellan Israel och Iran samt ökad riskvilja på finansiella marknaden är oberoende händelser som snabbt drivit upp oljan från årslägsta omkring midsommar. Vi tycker att underliggande fundamenta är väl balanserad och ser inte högre oljepriser med mindre än en krigshandling från Israel mot Iran – vilket vi håller som osannolikt före valet i USA.

Vete har nått toppen

Efter den amerikanska torkans inverkan på vetepriset har mycket elände prisats in i grödan som, trots allt, har goda lagernivåer. Vi tror på lägre priser.

Basmetaller

Kinas nedgång är inprisad

Det kan tyckas udda att vi håller basmetallerna bland det mest köpvärda i råvaru-universum just nu när ekonomer reviderat ner kinas tillväxtutsikter och Kina konsumerar 45 % av den globala produktionen av dessa konjunkturkänsliga metaller. Svaga globala tillväxtutsikter och en inbromsning i Kina är dock knappast en överraskning för någon längre. Kinas inköpschefsindex har kretsat omkring 50 i 12 månader nu. Fysiska handlare har haft gott om tid att sälja av lager av metall medan hedgefonder har kunnat ta positioner för en fallande marknad under lång tid. Därmed är också ett sämre Kina inprisat i dagens låga nivåer på basmetaller. Ett tydligt tecken på det är att basmetallerna inte föll när svag kinesisk makrodata för augusti släpptes.

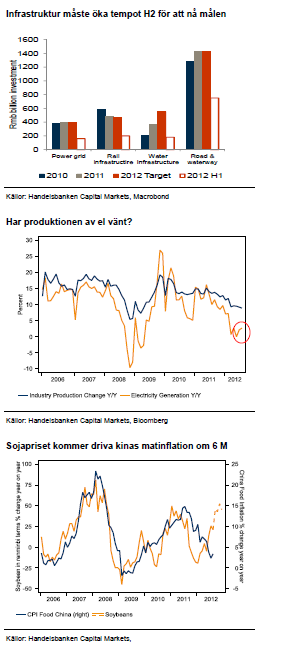

Ny våg av stimulanser

Den kinesiska ekonomin har inte responderat speciellt väl på de stimulanser som har annonserats. Förklaringen är enkel; efterfrågan på krediter är klart lägre och därför får inte centralbankens likviditetsinjektioner lika stor effekt som under tidigare cykler. Vi tänker oss att de kinesiska ledarna har blivit tagna på sängen av den starka inbromsningen, delvis därför att de – som många andra- underskattat eurokrisens styrka och därmed underskattat exportbortfallets påverkan på BNP. Ledarna har helt enkelt hamnat bakom kurvan i ambitionen att styra ekonomin. I kölvattnet ser vi att ytterligare stimulansåtgärder annonserats. Denna gång dock inte i form av ökade krediter utan i form av infrastruktur projekt. Den medicin som fungerade så väl 2009. På längre sikt skapar detta mer av samma problem som man redan har men på kort sikt hjälper det ekonomin att hålla farten uppe.

Se upp för sojaprisdriven inflation

Sommarens värmebölja i USA har drivit upp priserna på bland annat sojabönor. Kina är världens största importör med en självförsörjningsgrad på låga 15 %. Kinas inflation drivs till stor del av livsmedelspriserna där soja är den enskilt viktigaste komponenten. I grafen till höger ses det starka sambandet mellan förändringar i sojapriset och kinas matinflation. Vi flaggar för att Kina står inför en kraftigt ökande importerad inflation från den stundande globala matpriskrisen simultant som inhemska stimulanser bidrar till inflationen. Två oberoende händelser som kommer verka för att mönstret med en allt starkare inhemsk konjunkturcykel i Kina håller på att växa fram -först stimulans sedan inflation.

Lång basmetallkorgen och lång nickel

Energi

USA ovilligt att stödja Israel

Under hela året har oljan handlats upp och ner på konflikten mellan Israel och Iran. Israel vill undanröja Irans möjligheter att anrika uran till halter dugliga för kärnvapen. Sanktionerna från USA och Europa gör att Iran nu har mycket svårt att exportera olja och därmed har produktionen fallit. I dag är det bara Indien och Kina som köper Irans olja.

Nyligen uttryckte Israels premiärminister, Netanyahu frustration över att USA sagt att man har ett år på sig att agera före Iran lyckats utveckla kärnvapen. Uttalandet är den första publika indikationen på att Washington och Israel inte drar jämt om hur Tehran ska hanteras. Israel fokuserar på riskerna kring att Iran skaffar sig möjligheterna att bygga kärnvapen medan USA avvaktar i fall de verkligen bygger kärnvapen. Vi tror inte att Israel vågar gå i krig med Iran utan stöd från USA, vilket israelerna verkar ha svårt att få under den rådande presidentvalskampanjen i USA. Mot den bakgrunden tycker vi att Brent handlas på höga nivåer med en stor riskpremie som snabbt kan pysa ut.

Utbudsstörningar i Nordsjön

Brent handlas FOB Shetlandsöarna. Utbudsstörningar i Nordsjön har haft en kraftig inverkan på priset under september. Dessa är av tillfällig art, Nordsjön kommer öka med 25 % i oktober och vi ser mer nedsida än uppsida i Brentpriset rent fundamentalt. Att centralbankerna står på gasen väger dock på uppsidan. Vi upprepar vår prognos för H2 på 110 USD.

Nu handlar SHB Power mot Q1 terminspris

Alla grundläggande fundamenta talar för låga elpriser; mycket vatten i magasinen inför vintern, låga kolpris, lågt pris på utsläppsrätter och en situation för kärnkraften som ser ovanligt bra ut. Dessa fundamenta är också inprisat i terminskurvan som handlas på riktigt låga nivåer. Vi ser därför att den samlade bilden talar för att risken ligger för högre elpriser den här vintern. Vad som krävs för att ge priset styrfart uppåt är ett omslag i väderprognosen, från nu rådande blöta läge med mycket vatten i magasinen. I grafen till höger är noll ett normalår för vattenmagasinen, definierat som senaste fem årens medelvärde för vattenståndet.

Lång El

Ädelmetaller

ECB och Fed har riggat för guld-rally

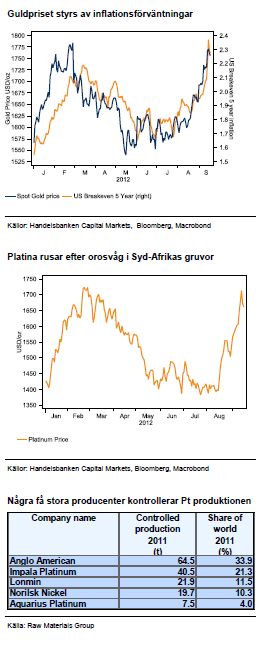

Vi har trott på stigande guld- och silverpriser sedan i april då vi såg den upptornande skuldkrisen och svaga amerikanska ekonomin som goda skäl för investarere att söka sig till de ädla värdebevarande metallerna.

Under de senaste veckorna har EMU:s stödfond ESM kommit i ordning, ECB har signalerat oändliga interventioner och ovanpå detta lanserade Fed QE3. När det gäller Fed är det anmärkningsvärt vad den centralbanken har utfäst sig att göra. Man ska fortsätta eller öka stimulansåtgärderna fram till att utsikterna för arbetsmarknaden förbättras påtagligt förutsatt att centralbankens inflationsmål möts. Inflationsförväntningarna hoppade också upp kraftigt efter Feds besked och guldet har handlats hand i hand med förväntningarna, se bild upp till höger.

Åtgärderna från centralbankerna skapar den sedvanliga ”chock och bävan”-effekten. Tillgångspriserna stiger när centralbankernas balansräkning växer. Den enkla förklaringen lyder: mer risk för skattebetalarna betyder mindre risk för privat sektor. Guld och silver gynnas särskilt i egenskap av traditionellt skydd mot inflation. Guld har stigit 70 % under Feds två tidigare QE perioder då man hållit lånekostnaderna låga och köpt obligationer för 2,3 triljoner USD. Nu ska Fed köpa obligationer för 40 miljarder USD i månaden och hålla räntorna låga till 2015. Vi tror därför på högre guld och silverpriser.

Platina-brist efter strejkerna

Oron i Syd-afrikas platinagruvor har fått platinapriset att rusa. Vågen av uppror startade i gruvan Marikana som ägs av Lonmin och Anglo. Produktionen har nu varit stängd i fem veckor efter att polis öppnat eld mot gruvarbetare. Anglo har stängt fem andra gruvschakt för att kunna garantera säkerheten för arbetskraften, som består av 26 000 personer. Gold Fields är en annan producent som haft två strejker som avlöst varandra.

Platinagruvorna i Syd-afrika är dåligt mekaniserade har dålig infrastruktur och är därför arbetskraftintensiva. I början på året hade Impala en strejk som varade i 6 veckor vilket då fick priset att rusa. Vi tror att orosvågen kommer att fortsätta och konsekvenserna av den kommer försämra produktionen i Syd-afrika som står för 76 % av den globala produktionen.

Lång guld och ädelmetallkorgen

Jordbruk

Torkan har satt sina spår

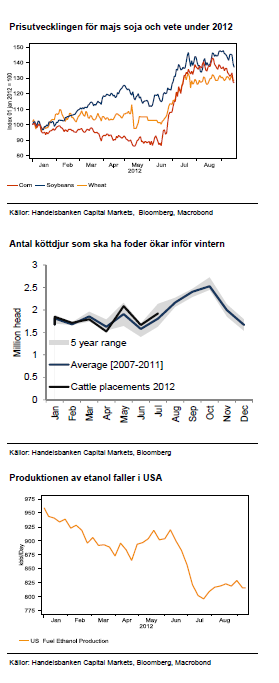

Efter en vinter och vår som såg mycket lovande ut för årets grödor så kom den värsta torkan i USA på mannaminne och förstörde mellan 12-15 % av den amerikanska soja- och majsskörden. Bristen på majs driver upp priset på vete som kan ersätta majs som djurfoder.

I den senaste rapporten från amerikanska jordbruksdepartementet fanns dock få justeringar för vete, soja och majs. Vi tror nu att det mesta från den fundamentala bilden kring årets skörd är känt och marknaden för soja börjar se ”toppig” ut med minskande export de senaste veckorna, trots det har terminerna stigit i pris. Vi tror att priserna kommer vara höga baserat på den strama marknaden men tror att terminskurvan kommer att skifta nedåt.

Framför oss ligger nu sådd av höstvete i USA, Europa och kring Svarta Havet, skörd av höstvete i Australien och sedan skörd av höstvete, soja och majs i Argentina och Brasilien efter nyår.

”Demand destruction” för majs

Efterfrågan på spannmål må vara inelastisk när vi människor konsumerar spannmålsbaserad mat. För djurfoder och etanoltillverkning är däremot kalkylerna avgörande för efterfrågan. Vi ser nu att en stor mängd köttdjur slaktas ut, framför allt i USA därför att fodret har blivit för dyrt med nuvarande köttpriser. Vi ser också att USAs etanolproduktion saktar ner även om marginalen åter blivit positiv med dagens höga pris på råolja som driver upp priset på bensin.

Starkt för soja svagt för vete

Starkast fundamenta har fortfarande soja där kinas import ligger kring rekord varje månad, trots höga priser. Kina har förmodligen nått sitt inhemska produktionstak och importen stiger för varje år. Soja har också längst till dess att odlingsåret avslutas med skörd i Argentina i februari. Svagast fundamenta finner vi för vete där utgående lager är bra och med mindre substitutionsdrivet stöd från majs så har vete stor fallhöjd sett över de kommande 6 månaderna. Det kanske bästa tecknet på att spannmålsmarknaden är ”toppig” är att den inte ”orkar” stiga ens när normalt prisdrivande data kommer ut.

Kort vete

Spreaden: Kort majs lång live cattle

Data

[box]SHB Råvaruplanket är producerat av Handelsbanken och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Ansvarsbegränsning

Detta material är producerat av Svenska Handelsbanken AB (publ) i fortsättningen kallad Handelsbanken. De som arbetar med innehållet är inte analytiker och materialet är inte oberoende investeringsanalys. Innehållet är uteslutande avsett för kunder i Sverige. Syftet är att ge en allmän information till Handelsbankens kunder och utgör inte ett personligt investeringsråd eller en personlig rekommendation. Informationen ska inte ensamt utgöra underlag för investeringsbeslut. Kunder bör inhämta råd från sina rådgivare och basera sina investeringsbeslut utifrån egen erfarenhet.

Informationen i materialet kan ändras och också avvika från de åsikter som uttrycks i oberoende investeringsanalyser från Handelsbanken. Informationen grundar sig på allmänt tillgänglig information och är hämtad från källor som bedöms som tillförlitliga, men riktigheten kan inte garanteras och informationen kan vara ofullständig eller nedkortad. Ingen del av förslaget får reproduceras eller distribueras till någon annan person utan att Handelsbanken dessförinnan lämnat sitt skriftliga medgivande. Handelsbanken ansvarar inte för att materialet används på ett sätt som strider mot förbudet mot vidarebefordran eller offentliggörs i strid med bankens regler.

Analys

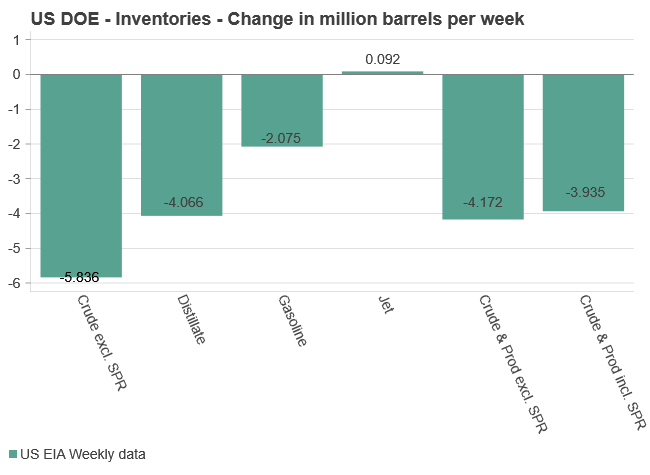

Tightening fundamentals – bullish inventories from DOE

The latest weekly report from the US DOE showed a substantial drawdown across key petroleum categories, adding more upside potential to the fundamental picture.

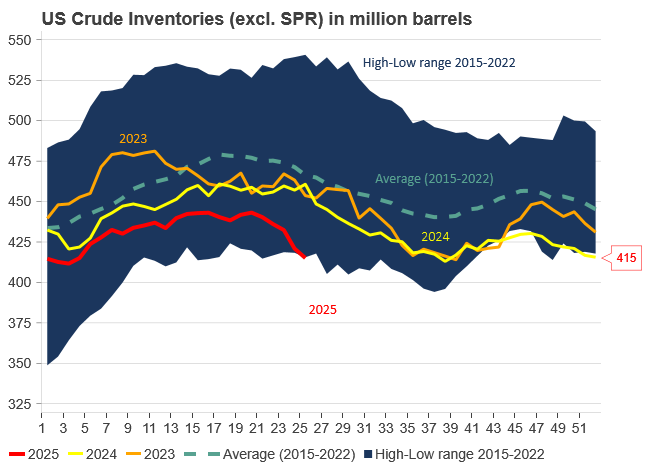

Commercial crude inventories (excl. SPR) fell by 5.8 million barrels, bringing total inventories down to 415.1 million barrels. Now sitting 11% below the five-year seasonal norm and placed in the lowest 2015-2022 range (see picture below).

Product inventories also tightened further last week. Gasoline inventories declined by 2.1 million barrels, with reductions seen in both finished gasoline and blending components. Current gasoline levels are about 3% below the five-year average for this time of year.

Among products, the most notable move came in diesel, where inventories dropped by almost 4.1 million barrels, deepening the deficit to around 20% below seasonal norms – continuing to underscore the persistent supply tightness in diesel markets.

The only area of inventory growth was in propane/propylene, which posted a significant 5.1-million-barrel build and now stands 9% above the five-year average.

Total commercial petroleum inventories (crude plus refined products) declined by 4.2 million barrels on the week, reinforcing the overall tightening of US crude and products.

Analys

Bombs to ”ceasefire” in hours – Brent below $70

A classic case of “buy the rumor, sell the news” played out in oil markets, as Brent crude has dropped sharply – down nearly USD 10 per barrel since yesterday evening – following Iran’s retaliatory strike on a U.S. air base in Qatar. The immediate reaction was: “That was it?” The strike followed a carefully calibrated, non-escalatory playbook, avoiding direct threats to energy infrastructure or disruption of shipping through the Strait of Hormuz – thus calming worst-case fears.

After Monday morning’s sharp spike to USD 81.4 per barrel, triggered by the U.S. bombing of Iranian nuclear facilities, oil prices drifted sideways in anticipation of a potential Iranian response. That response came with advance warning and caused limited physical damage. Early this morning, both the U.S. President and Iranian state media announced a ceasefire, effectively placing a lid on the immediate conflict risk – at least for now.

As a result, Brent crude has now fallen by a total of USD 12 from Monday’s peak, currently trading around USD 69 per barrel.

Looking beyond geopolitics, the market will now shift its focus to the upcoming OPEC+ meeting in early July. Saudi Arabia’s decision to increase output earlier this year – despite falling prices – has drawn renewed attention considering recent developments. Some suggest this was a response to U.S. pressure to offset potential Iranian supply losses.

However, consensus is that the move was driven more by internal OPEC+ dynamics. After years of curbing production to support prices, Riyadh had grown frustrated with quota-busting by several members (notably Kazakhstan). With Saudi Arabia cutting up to 2 million barrels per day – roughly 2% of global supply – returns were diminishing, and the risk of losing market share was rising. The production increase is widely seen as an effort to reassert leadership and restore discipline within the group.

That said, the FT recently stated that, the Saudis remain wary of past missteps. In 2018, Riyadh ramped up output at Trump’s request ahead of Iran sanctions, only to see prices collapse when the U.S. granted broad waivers – triggering oversupply. Officials have reportedly made it clear they don’t intend to repeat that mistake.

The recent visit by President Trump to Saudi Arabia, which included agreements on AI, defense, and nuclear cooperation, suggests a broader strategic alignment. This has fueled speculation about a quiet “pump-for-politics” deal behind recent production moves.

Looking ahead, oil prices have now retraced the entire rally sparked by the June 13 Israel–Iran escalation. This retreat provides more political and policy space for both the U.S. and Saudi Arabia. Specifically, it makes it easier for Riyadh to scale back its three recent production hikes of 411,000 barrels each, potentially returning to more moderate increases of 137,000 barrels for August and September.

In short: with no major loss of Iranian supply to the market, OPEC+ – led by Saudi Arabia – no longer needs to compensate for a disruption that hasn’t materialized, especially not to please the U.S. at the cost of its own market strategy. As the Saudis themselves have signaled, they are unlikely to repeat previous mistakes.

Conclusion: With Brent now in the high USD 60s, buying oil looks fundamentally justified. The geopolitical premium has deflated, but tensions between Israel and Iran remain unresolved – and the risk of missteps and renewed escalation still lingers. In fact, even this morning, reports have emerged of renewed missile fire despite the declared “truce.” The path forward may be calmer – but it is far from stable.

Analys

A muted price reaction. Market looks relaxed, but it is still on edge waiting for what Iran will do

Brent crossed the 80-line this morning but quickly fell back assigning limited probability for Iran choosing to close the Strait of Hormuz. Brent traded in a range of USD 70.56 – 79.04/b last week as the market fluctuated between ”Iran wants a deal” and ”US is about to attack Iran”. At the end of the week though, Donald Trump managed to convince markets (and probably also Iran) that he would make a decision within two weeks. I.e. no imminent attack. Previously when when he has talked about ”making a decision within two weeks” he has often ended up doing nothing in the end. The oil market relaxed as a result and the week ended at USD 77.01/b which is just USD 6/b above the year to date average of USD 71/b.

Brent jumped to USD 81.4/b this morning, the highest since mid-January, but then quickly fell back to a current price of USD 78.2/b which is only up 1.5% versus the close on Friday. As such the market is pricing a fairly low probability that Iran will actually close the Strait of Hormuz. Probably because it will hurt Iranian oil exports as well as the global oil market.

It was however all smoke and mirrors. Deception. The US attacked Iran on Saturday. The attack involved 125 warplanes, submarines and surface warships and 14 bunker buster bombs were dropped on Iranian nuclear sites including Fordow, Natanz and Isfahan. In response the Iranian Parliament voted in support of closing the Strait of Hormuz where some 17 mb of crude and products is transported to the global market every day plus significant volumes of LNG. This is however merely an advise to the Supreme leader Ayatollah Ali Khamenei and the Supreme National Security Council which sits with the final and actual decision.

No supply of oil is lost yet. It is about the risk of Iran closing the Strait of Hormuz or not. So far not a single drop of oil supply has been lost to the global market. The price at the moment is all about the assessed risk of loss of supply. Will Iran choose to choke of the Strait of Hormuz or not? That is the big question. It would be painful for US consumers, for Donald Trump’s voter base, for the global economy but also for Iran and its population which relies on oil exports and income from selling oil out of that Strait as well. As such it is not a no-brainer choice for Iran to close the Strait for oil exports. And looking at the il price this morning it is clear that the oil market doesn’t assign a very high probability of it happening. It is however probably well within the capability of Iran to close the Strait off with rockets, mines, air-drones and possibly sea-drones. Just look at how Ukraine has been able to control and damage the Russian Black Sea fleet.

What to do about the highly enriched uranium which has gone missing? While the US and Israel can celebrate their destruction of Iranian nuclear facilities they are also scratching their heads over what to do with the lost Iranian nuclear material. Iran had 408 kg of highly enriched uranium (IAEA). Almost weapons grade. Enough for some 10 nuclear warheads. It seems to have been transported out of Fordow before the attack this weekend.

The market is still on edge. USD 80-something/b seems sensible while we wait. The oil market reaction to this weekend’s events is very muted so far. The market is still on edge awaiting what Iran will do. Because Iran will do something. But what and when? An oil price of 80-something seems like a sensible level until something do happen.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanStor uppsida i Lappland Guldprospekterings aktie enligt analys

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanBrookfield ska bygga ett AI-datacenter på hela 750 MW i Strängnäs

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSommaren inleds med sol och varierande elpriser

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOPEC+ ökar oljeproduktionen trots fallande priser

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSilverpriset släpar efter guldets utveckling, har mer uppsida

-

Analys4 veckor sedan

Analys4 veckor sedanBrent needs to fall to USD 58/b to make cheating unprofitable for Kazakhstan

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanTradingfirman XTX Markets bygger datacenter i finska Kajana för 1 miljard euro

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanUppgången i oljepriset planade ut under helgen