Nyheter

The gold market reigns supreme

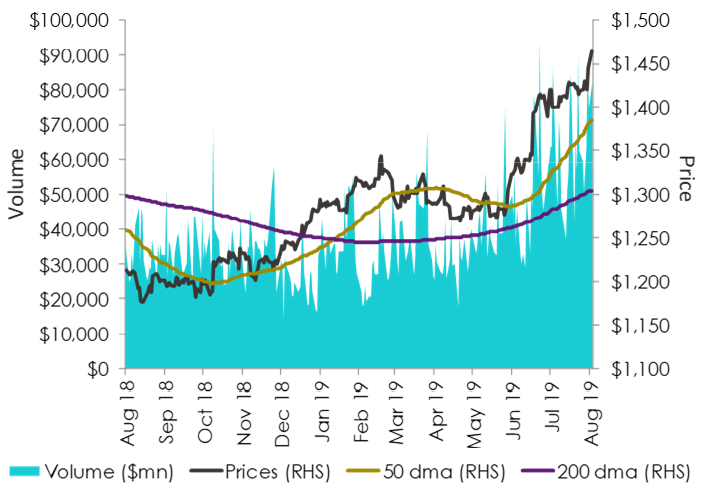

Gold prices are trading at a 6-year high (as at 7 August 2019) as the US-China trade tensions intensify. The troika formed by the interplay amongst Trump, China and the US Federal Reserve (Fed) is resulting in a negative feedback loop that is likely to keep gold prices elevated over the course of 2019.

Figure 1: Gold price trading 12.3% above its 200-day moving average (dma)

US-China-Fed trapped in a negative feedback loop

Trump’s announcement to raise tariffs on the remaining US$ 300Bn worth of Chinese goods to 10% from September 1, 2019 has rattled financial markets paving the way for a significant market sell-off. The announcement coincidentally was made a day after the Federal Open Market Committee (FOMC) meeting on 30-31 July 2019. As expected, the Fed lowered interest rates by 25 basis points (bps) and ended its Quantitative Tightening program. The real surprise emerged at the post-meeting press conference where Fed chairman Jay Powell appeared hawkish as he alluded to the interest rate cut as merely a “mid-cycle adjustment to policy” and “not the beginning of a long series of cuts” thereby dampening the prospect of further rate cuts. Powell also cited trade uncertainties as one of the three pillars which led to the decision of the quarter point rate cut. Trump’s tariff hike announcement on Chinese goods is most likely a tactic being used by him to push the Fed to lower interest rates further in order to soften the blow to US economic growth while he raises the ante against China. At the same time, China is determined to be the world’s leading economic power and will not let Trump stand in its way. In response to Trump’s tariff announcement, the Chinese government has instructed state owned companies to suspend imports of US agricultural products and has devalued the Chinese Yuan. China is also strategically aware of Trump’s overarching goal to win the 2020 US presidential elections and is likely to embark on a tougher trade stance in order to lower Trump’s chances of winning the next US election. The reality is, US economic growth appears steady so far. The latest jobs report confirms that US consumers remain in a solid shape but the growth in job creation is slowing, wage growth remains subdued and core private consumption deflator inflation is running at 1.6% year-on-year (yoy) which justified the last US rate cut. We believe, the Fed’s hand will only be forced to act again if the deterioration of global trade starts to impact the US economy. This appears seemingly likely owing to the hard stance being adopted on trade policy by both the US and Chinese government.

Gold continues to reap the benefits

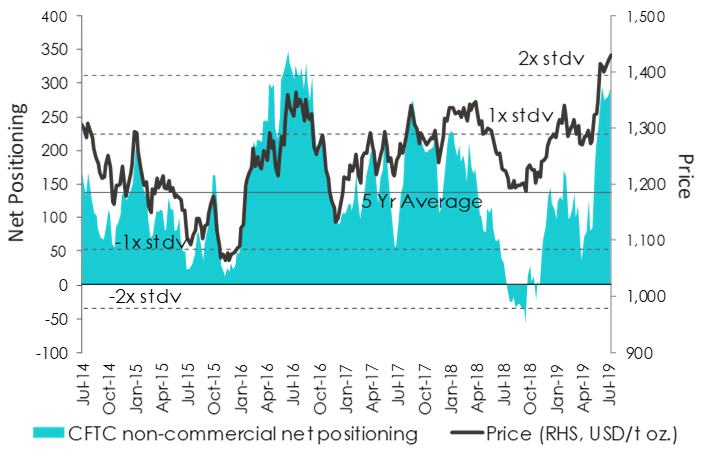

Rising economic uncertainty on global trade is reviving gold’s safe haven status and remains at the forefront of investors’ minds. This is evident from the net speculative futures positioning data on gold futures which are now at 292,847 contracts, more than 1-standard deviation above its five-year average, according to data from the Commodity Futures Trading Commission (CFTC).

Figure 2: Net speculative positioning more than 1-standard deviation above the 5-year average

In addition, net central bank purchases in the H1 2019 totalled 374.1tonnes, 57% higher over the prior year and the highest level since they became net purchasers in 2010 according to the World Gold Council (WGC). This record purchases by global central banks underscores the need to diversify their reserves away from the US dollar. Central bank buying of gold tends to be the stickier money and cannot be underestimated. Gold is also inversely related to the US dollar and we expect further US dollar weakness to unfold owing to the added pressure from Trump on the Fed, the dollar’s reduced yield advantage versus non-US dollar alternatives and the expansion of national debt which will outpace with US economic growth.

Non-yielding assets such as gold appear more attractive compared to other haven assets such as bonds that are yielding low to negative yields. Currently nearly US$12 trillion of global sovereign debt is negative yielding according to Bloomberg. Capital is clearly in search of better opportunities and this is likely to continue to favour gold in the long run. Gold has disappointed since 2012, as global monetary easing has helped bid up riskier financial assets. However, we believe there are limits to how much monetary easing by global central banks can achieve and as market participants soon come to terms with that reality, gold’s price trajectory is likely to take the next leg higher.

By: Aneeka Gupta, Associate Director of Research

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Nyheter

Guld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

Jeffrey Christian på CPM Group gästar Monex för att prata guld och silver. Det framhålls att vi befinner oss i en tid av extrem osäkerhet, präglad av politiska, ekonomiska och sociala spänningar som bedöms vara mer oroande än under kriserna i slutet av 1970-talet. Detta har drivit investerare mot tryggare tillgångar som guld, silver och även platina.

Priserna på ädelmetaller ligger nu på rekordnivåer, med guld nära 3 900 dollar per uns och silver omkring 48 dollar. Analytiker menar att uppgången främst beror på oro för den globala utvecklingen snarare än tekniska prisnivåer. De bedömer att priserna kommer fortsätta stiga tills det sker en tydlig förbättring i det politiska och ekonomiska klimatet, något som inte förväntas inom den närmaste framtiden.

Samtidigt påpekas att guld och dollarn ibland kan stiga parallellt, vilket tidigare skett under perioder av stor osäkerhet. Den kommande osäkerheten kring ett möjligt amerikanskt regeringsstopp kan enligt bedömare förstärka trenden mot fortsatt stark efterfrågan på ädelmetaller.

Nyheter

Blykalla och amerikanska Oklo inleder ett samarbete

Kärnkraftsföretagen Oklo från USA och svenska Blykalla har ingått ett strategiskt partnerskap för att främja tekniksamarbete, samordna leverantörskedjor och dela regulatorisk kunskap mellan länderna. Samarbetet inkluderar att Oklo går in som en av de större investerarna i Blykallas kommande investeringsrunda med ett åtagande på cirka 5 miljoner dollar.

Genom ett gemensamt teknikutvecklingsavtal ska bolagen utbyta insikter om material, komponenter och licensieringspraxis i både USA och Sverige. Målet är att minska kostnader och tidsrisker i utvecklingen av små modulära reaktorer (SMR).

Blykalla utvecklar SEALER, en blykyld snabbreaktor på 55 MWe, medan Oklo fokuserar på natriumkylda reaktorer upp till 75 MWe för industriella och militära tillämpningar i USA.

“Det här samarbetet stärker det växande ekosystemet för avancerade reaktorer i en tid av globalt ökande energibehov,” säger Oklo-grundaren Jacob DeWitte. Blykallas vd Jacob Stedman tillägger: “Vår gemensamma industriella strategi kan hjälpa leverantörer att planera för uppskalning, oavsett vilken sida av Atlanten de befinner sig på.”

Intervju på Bloomberg om samarbetet

Nyheter

Fortsatt stabilt elpris – men dubbelt så dyrt som i fjol

Snittpriset på el för höstmånaderna september till november väntas landa på strax under 50 öre per kilowattimme. Det är nästan en fördubbling jämfört med hösten 2024, då snittet låg på drygt 30 öre. Men nivåerna är fortfarande betydligt lägre än under elpriskrisen 2022. Det visar elbolaget Bixias höstprognos.

Att elpriserna är högre än i fjol beror främst på lägre tillgänglighet i kärnkraften och en svagare hydrologisk balans efter en torr sommar. Även om hösten har börjat blött och september ser ut att bli den nederbördsrikaste månaden sedan 2018, räcker det inte till för att vända vattenbalansen.

– Höstens elpriser är stabila, men klart högre än i fjol. Det är framför allt osäkerheten kring kärnkraften som påverkar där Oskarshamn 3 har varit ur drift längre än planerat. Samtidigt har den hydrologiska balansen inte återhämtat sig efter sommarens underskott, trots den blöta inledningen på hösten. Men jämfört med krisåren 2021 och 2022 ligger priserna fortfarande på en låg nivå, säger Johan Sigvardsson, elprisanalytiker på Bixia.

I september bidrog bristen på kärnkraft till att elpriset nästan fördubblades jämfört med samma månad i fjol. Priset landade på cirka 40 öre per kilowattimme, att jämföra med 22 öre i september 2024. Flera reaktorer stod stilla, däribland Oskarshamn 3, Forsmark 1 samt Lovisa 1 och 2 i Finland. Trots mycket regn under månaden var vattennivåerna fortsatt låga efter den torra sommaren, medan blåsiga perioder tillfälligt pressade ner priserna.

I oktober väntas elpriset hamna runt 45 öre per kilowattimme, jämfört med 27 öre i fjol, och i november kring 60 öre, mot 43 öre förra året. Sammantaget ger det ett höstsnitt i system på knappt 50 öre, jämfört med drygt 30 öre samma period i fjol. Under krisåret 2022 låg snittet för höstmånaderna på över 1,15 kronor per kilowattimme, med perioder på upp mot 4 kronor.

Liten risk för höga höstpriser

Bixia bedömer att priserna kan komma att stiga tillfälligt om vädret blir kallare än normalt eller om kärnkraftsreaktorer får fortsatt försening i återstart. Om till exempel Oskarshamn 3, vars återstart redan skjutits på fem gånger, inte kommer igång enligt plan i mitten av oktober, finns risk att priserna ökar under andra halvan av månaden.

– Risken för pristoppar ökar ju längre in på säsongen vi kommer, eftersom förbrukningen stiger när temperaturen sjunker. Men väderprognoserna ser i nuläget gynnsamma ut, och även om det skulle bli kallare än väntat ser vi inte någon risk för extremt höga priser, säger Johan Sigvardsson.

Dyrare el i syd

Södra Sverige har betalat betydligt mer för elen än norra delarna. Priserna har legat på runt 15 öre per kWh i norr under september, medan syd haft priser på omkring 70 öre. En differentierad prisbild väntas även under resten av hösten, särskilt om kärnkraftsproduktionen i söder fortsätter att vara begränsad och det fortsätter att vara gott om vatten i norr.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEurobattery Minerals satsar på kritiska metaller för Europas självförsörjning

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals i en guldtrend

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuldpriset kan närma sig 5000 USD om centralbankens oberoende skadas

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOPEC signalerar att de inte bryr sig om oljepriset faller kommande månader

-

Analys3 veckor sedan

Analys3 veckor sedanVolatile but going nowhere. Brent crude circles USD 66 as market weighs surplus vs risk

-

Nyheter3 veckor sedan

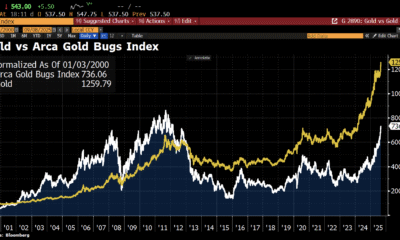

Nyheter3 veckor sedanAktier i guldbolag laggar priset på guld

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanKinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanTyskland har så höga elpriser att företag inte har råd att använda elektricitet