Analys

Short term recovery due for platinum and palladium

The green industrialised precious metals – platinum and palladium have started 2020 on a weak footing owing to the spread of the COVID–19 pandemic globally. The price decline for platinum, down-21.0%, has been more severe than palladium -6.83% since the start of 2020. Palladium and platinum are known to derive a large portion of their usage (accounting for nearly 34% and 84% respectively) from the auto industry.

Owing to their extensive use in vehicle auto catalysts, demand for platinum and palladium remains particularly sensitive to economic, industrial and market conditions. Falling demand from the global auto industry due to automotive shutdowns being imposed globally are denting sentiment towards both platinum and palladium. Platinum has a more diverse demand base compared to palladium. In addition to auto demand – jewellery, industrial and investment demand account for about 25%, 28% and 13% of platinum’s total usage, respectively.

However, amidst the COVID-19 crisis, both jewellery and industrial demand are expected to fall further but investment demand is likely to strength amidst the uncertainty. While the weakness on the demand side remains a key focus, we expect attention to increasingly start to shift to the supply side aiding a short-term price recovery.

The slump in auto industry should start to recover in H2 as stringent lockdowns ease

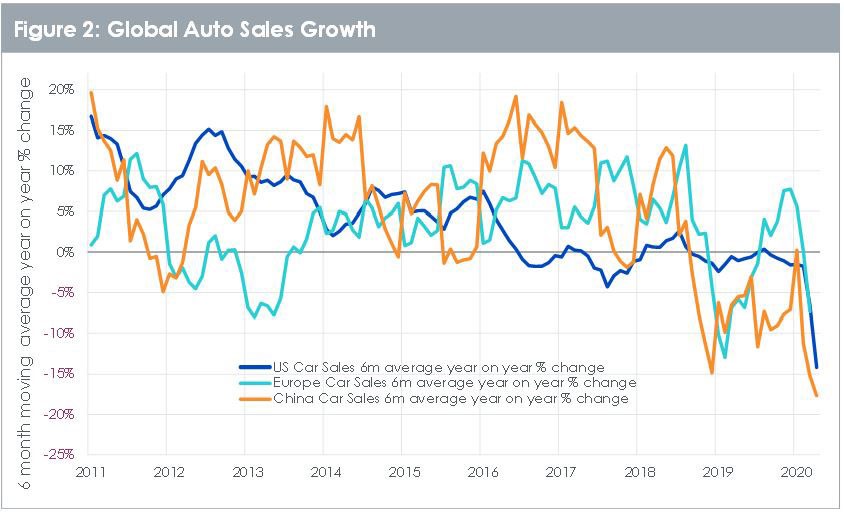

The impact of the COVID-19 crisis on the global automobile industry has been severe as production and sales of motor vehicles have come to a sudden halt globally. In the first quarter of 2020, the EU commercial vehicle market contracted by 23.2% as a direct consequence of March’s substantial slowdown. In March 2020, demand for new commercial vehicles fell by 47.3% across the EU, as measures to prevent the spread of the coronavirus led to the suspension of production at auto manufacturers.

Meanwhile in China, where the epidemic peaked in February, the market is slowly returning to normality. The Chinese automotive market recovered significantly from its prior slump in March. As the China Association of Automobile Manufacturers (CAAM) reported on 10 April 2020, car sales increased more than fourfold (compared to February) to 1.04mn units. According to reports from the CAAM, the Chinese auto industry regained around 75% of its normal operating level in March. The CAAM expects the vehicle market to continue its recovery in the second quarter although full capacity is only likely to be reached again in the second half of the year. In Europe, assembly lines are now restarting production and the same is expected in North America around mid-May.

As lockdown measures start to ease gradually across the rest of the globe, we expect to see a gradual recovery in demand for the green metals from the auto industry in the second half of the year. However, we remain cautious of end-consumer demand which is anticipated to stay weak as consumer’s propensity to purchase cars will be lower due to the economic impact of the COVID-19 crisis on their purchasing power.

Supply side destruction is likely to have a bigger impact on platinum vs palladium

South Africa’s Platinum Group Metal (PGM) producers have been hit by severe disruptions since the lockdowns have been imposed in April. South Africa produces around 38% of palladium and 75% of platinum globally. In the past, the South African mining industry faced a range of health issues, including HIV infections, and such concerns have always posed a risk to supply. The five-week lockdown in South Africa ordered by President Ramaphosa is expected to come to an end in the coming days.

While producers are attempting to prepare themselves to restart production at the mines again, the police are preventing them due to the spread of COVID-19. This implies that the current market tightness will only last for short duration. However, the process of ramping operations back to normal is likely to take time even after the shutdown period. It is also hard to determine at this stage if a second wave of infections might trigger another round of shutdowns causing supply disruptions to linger for longer. Initially the mines are expected to be allowed to operate at 50% capacity.

Palladium normally occurs as a by-product of platinum mining (South Africa) or nickel mining (Russia). About 40% of palladium’s supply comes from Russia. Supply of palladium appears to be at less of a risk as the world’s largest palladium producer Nornickel from Russia expects the global palladium market to show a small supply surplus this year for the first time in eight years.

This is because demand for palladium has been impacted severely by the COVID-19 led crisis. Nornickel reduced its 2020 estimate of palladium consumption owing to weaker global car sales. Reflecting on 2011, Gokran, the Russian state reserve fund unexpectedly supplied about 750,000 ounces out of its own stockpile which was followed by three years of palladium’s price decline. The caveat is no one knows how big Gokran’s stockpile or whether they would use this current period of weak demand for palladium to build up stockpile.

No substitution so far, despite palladium’s price premium over platinum

The recent price correction has driven the palladium to platinum ratio down from its peak of 3.1x to 2.4x. Despite palladium’s price premium to platinum it is less likely for platinum to be substituted for palladium in auto catalysts. The chief reason for this is platinum’s lower thermal durability which curtails its use in the widespread adoption of three-way catalysts.

The implementation of Real-Driving Emissions (RDE) testing involves stricter test cycles with faster driving speeds and higher engine temperatures which poses technical hurdles to platinum’s adoption in the three-way catalysts. At high operating temperatures experienced in a gasoline car, platinum particles may sinter, resulting in loss of surface area and hence of catalytic activity according to Johnson Matthey. Compared to palladium-rhodium formulations, the effectiveness of platinum-containing catalysts tends to deteriorate more rapidly as they age. While there might be some near-term potential for platinum to substitute some of the palladium used in diesel catalyst, we do not see a substitution effect in gasoline catalysts this year.

Platinum and palladium have witnessed a sharp downward price correction in 2020 owing to weak sentiment emanating from dwindling demand in the auto industry. Intermediate supply disruptions should aid a short-term price recovery for the green metals. The roll out of more stringent emissions standards globally are also likely to require higher content of platinum and palladium per unit of vehicle which should help offset the impact of weaker demand from the auto industry. Platinum’s supply is more concentrated in South Africa due to which platinum appears more exposed to supply disruptions versus palladium. In addition, palladium derives most of its use from the auto industry in comparison to platinum has a more diversified demand base. Platinum stands to benefit more than palladium owing to the prospect of having a more diversified demand base coupled with the exposure to higher supply risks.

Analys

Brent crude ticks higher on tension, but market structure stays soft

Brent crude has climbed roughly USD 1.5-2 per barrel since Friday, yet falling USD 0.3 per barrel this mornig and currently trading near USD 67.25/bbl after yesterday’s climb. While the rally reflects short-term geopolitical tension, price action has been choppy, and crude remains locked in a broader range – caught between supply-side pressure and spot resilience.

Prices have been supported by renewed Ukrainian drone strikes targeting Russian infrastructure. Over the weekend, falling debris triggered a fire at the 20mtpa Kirishi refinery, following last week’s attack on the key Primorsk terminal.

Argus estimates that these attacks have halted ish 300 kbl/d of Russian refining capacity in August and September. While the market impact is limited for now, the action signals Kyiv’s growing willingness to disrupt oil flows – supporting a soft geopolitical floor under prices.

The political environment is shifting: the EU is reportedly considering sanctions on Indian and Chinese firms facilitating Russian crude flows, while the U.S. has so far held back – despite Bessent warning that any action from Washington depends on broader European participation. Senator Graham has also publicly criticized NATO members like Slovakia and Hungary for continuing Russian oil imports.

It’s worth noting that China and India remain the two largest buyers of Russian barrels since the invasion of Ukraine. While New Delhi has been hit with 50% secondary tariffs, Beijing has been spared so far.

Still, the broader supply/demand balance leans bearish. Futures markets reflect this: Brent’s prompt spread (gauge of near-term tightness) has narrowed to the current USD 0.42/bl, down from USD 0.96/bl two months ago, pointing to weakening backwardation.

This aligns with expectations for a record surplus in 2026, largely driven by the faster-than-anticipated return of OPEC+ barrels to market. OPEC+ is gathering in Vienna this week to begin revising member production capacity estimates – setting the stage for new output baselines from 2027. The group aims to agree on how to define “maximum sustainable capacity,” with a proposal expected by year-end.

While the IEA pegs OPEC+ capacity at 47.9 million barrels per day, actual output in August was only 42.4 million barrels per day. Disagreements over data and quota fairness (especially from Iraq and Nigeria) have already delayed this process. Angola even quit the group last year after being assigned a lower target than expected. It also remains unclear whether Russia and Iraq can regain earlier output levels due to infrastructure constraints.

Also, macro remains another key driver this week. A 25bp Fed rate cut is widely expected tomorrow (Wednesday), and commodities in general could benefit a potential cut.

Summing up: Brent crude continues to drift sideways, finding near-term support from geopolitics and refining strength. But with surplus building and market structure softening, the upside may remain capped.

Analys

Volatile but going nowhere. Brent crude circles USD 66 as market weighs surplus vs risk

Brent crude is essentially flat on the week, but after a volatile ride. Prices started Monday near USD 65.5/bl, climbed steadily to a mid-week high of USD 67.8/bl on Wednesday evening, before falling sharply – losing about USD 2/bl during Thursday’s session.

Brent is currently trading around USD 65.8/bl, right back where it began. The volatility reflects the market’s ongoing struggle to balance growing surplus risks against persistent geopolitical uncertainty and resilient refined product margins. Thursday’s slide snapped a three-day rally and came largely in response to a string of bearish signals, most notably from the IEA’s updated short-term outlook.

The IEA now projects record global oversupply in 2026, reinforcing concerns flagged earlier by the U.S. EIA, which already sees inventories building this quarter. The forecast comes just days after OPEC+ confirmed it will continue returning idle barrels to the market in October – albeit at a slower pace of +137,000 bl/d. While modest, the move underscores a steady push to reclaim market share and adds to supply-side pressure into year-end.

Thursday’s price drop also followed geopolitical incidences: Israeli airstrikes reportedly targeted Hamas leadership in Doha, while Russian drones crossed into Polish airspace – events that initially sent crude higher as traders covered short positions.

Yet, sentiment remains broadly cautious. Strong refining margins and low inventories at key pricing hubs like Europe continue to support the downside. Chinese stockpiling of discounted Russian barrels and tightness in refined product markets – especially diesel – are also lending support.

On the demand side, the IEA revised up its 2025 global demand growth forecast by 60,000 bl/d to 740,000 bl/d YoY, while leaving 2026 unchanged at 698,000 bl/d. Interestingly, the agency also signaled that its next long-term report could show global oil demand rising through 2050.

Meanwhile, OPEC offered a contrasting view in its latest Monthly Oil Market Report, maintaining expectations for a supply deficit both this year and next, even as its members raise output. The group kept its demand growth estimates for 2025 and 2026 unchanged at 1.29 million bl/d and 1.38 million bl/d, respectively.

We continue to watch whether the bearish supply outlook will outweigh geopolitical risk, and if Brent can continue to find support above USD 65/bl – a level increasingly seen as a soft floor for OPEC+ policy.

Analys

Waiting for the surplus while we worry about Israel and Qatar

Brent crude makes some gains as Israel’s attack on Hamas in Qatar rattles markets. Brent crude spiked to a high of USD 67.38/b yesterday as Israel made a strike on Hamas in Qatar. But it wasn’t able to hold on to that level and only closed up 0.6% in the end at USD 66.39/b. This morning it is starting on the up with a gain of 0.9% at USD 67/b. Still rattled by Israel’s attack on Hamas in Qatar yesterday. Brent is getting some help on the margin this morning with Asian equities higher and copper gaining half a percent. But the dark cloud of surplus ahead is nonetheless hanging over the market with Brent trading two dollar lower than last Tuesday.

Geopolitical risk premiums in oil rarely lasts long unless actual supply disruption kicks in. While Israel’s attack on Hamas in Qatar is shocking, the geopolitical risk lifting crude oil yesterday and this morning is unlikely to last very long as such geopolitical risk premiums usually do not last long unless real disruption kicks in.

US API data yesterday indicated a US crude and product stock build last week of 3.1 mb. The US API last evening released partial US oil inventory data indicating that US crude stocks rose 1.3 mb and middle distillates rose 1.5 mb while gasoline rose 0.3 mb. In total a bit more than 3 mb increase. US crude and product stocks usually rise around 1 mb per week this time of year. So US commercial crude and product stock rose 2 mb over the past week adjusted for the seasonal norm. Official and complete data are due today at 16:30.

A 2 mb/week seasonally adj. US stock build implies a 1 – 1.4 mb/d global surplus if it is persistent. Assume that if the global oil market is running a surplus then some 20% to 30% of that surplus ends up in US commercial inventories. A 2 mb seasonally adjusted inventory build equals 286 kb/d. Divide by 0.2 to 0.3 and we get an implied global surplus of 950 kb/d to 1430 kb/d. A 2 mb/week seasonally adjusted build in US oil inventories is close to noise unless it is a persistent pattern every week.

US IEA STEO oil report: Robust surplus ahead and Brent averaging USD 51/b in 2026. The US EIA yesterday released its monthly STEO oil report. It projected a large and persistent surplus ahead. It estimates a global surplus of 2.2 m/d from September to December this year. A 2.4 mb/d surplus in Q1-26 and an average surplus for 2026 of 1.6 mb/d resulting in an average Brent crude oil price of USD 51/b next year. And that includes an assumption where OPEC crude oil production only averages 27.8 mb/d in 2026 versus 27.0 mb/d in 2024 and 28.6 mb/d in August.

Brent will feel the bear-pressure once US/OECD stocks starts visible build. In the meanwhile the oil market sits waiting for this projected surplus to materialize in US and OECD inventories. Once they visibly starts to build on a consistent basis, then Brent crude will likely quickly lose altitude. And unless some unforeseen supply disruption kicks in, it is bound to happen.

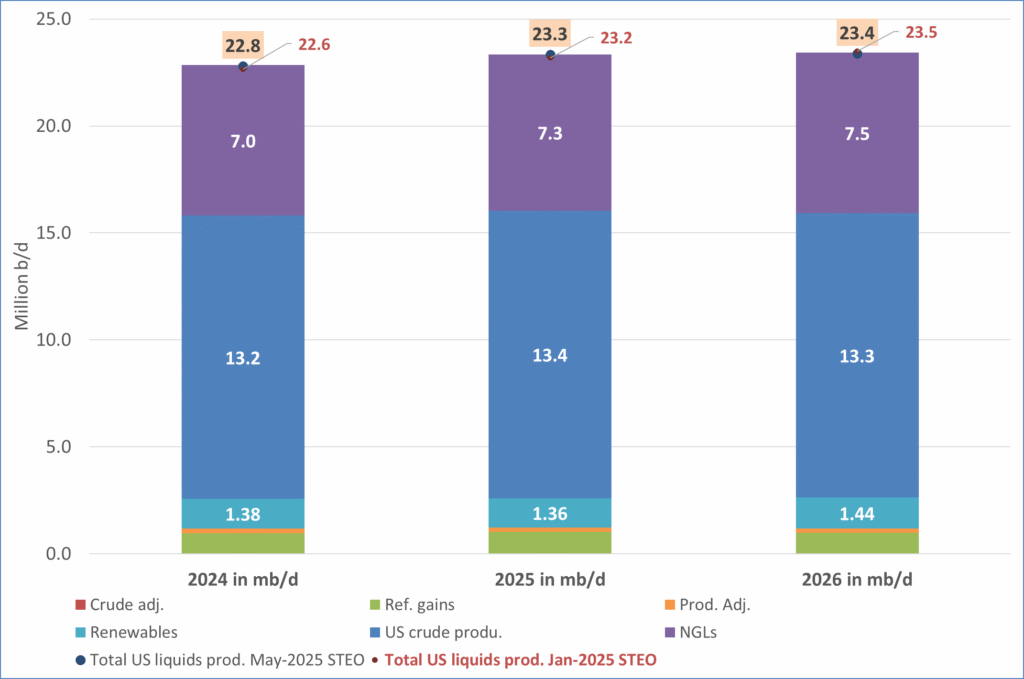

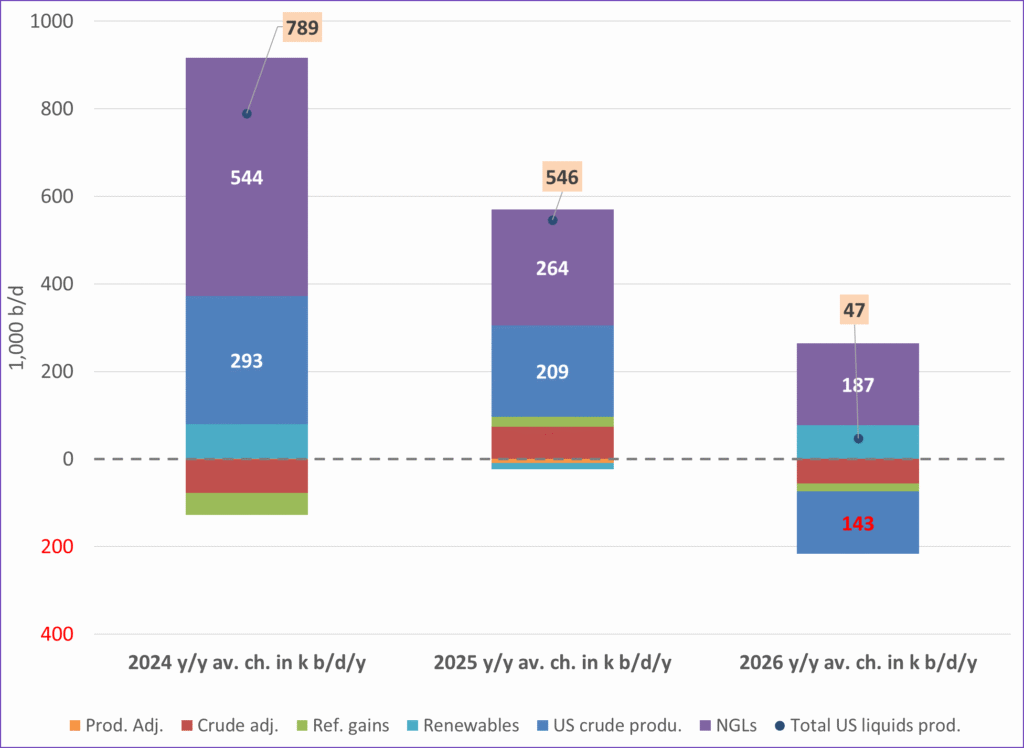

US IEA STEO September report. In total not much different than it was in January

US IEA STEO September report. US crude oil production contracting in 2026, but NGLs still growing. Close to zero net liquids growth in total.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMeta bygger ett AI-datacenter på 5 GW och 2,25 GW gaskraftverk

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAker BP gör ett av Norges största oljefynd på ett decennium, stärker resurserna i Yggdrasilområdet

-

Analys4 veckor sedan

Analys4 veckor sedanBrent sideways on sanctions and peace talks

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSommarens torka kan ge högre elpriser i höst

-

Analys4 veckor sedan

Analys4 veckor sedanBrent edges higher as India–Russia oil trade draws U.S. ire and Powell takes the stage at Jackson Hole

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals är verksamt i guldrikt område i Finland

-

Analys3 veckor sedan

Analys3 veckor sedanIncreasing risk that OPEC+ will unwind the last 1.65 mb/d of cuts when they meet on 7 September

-

Analys2 veckor sedan

Analys2 veckor sedanOPEC+ in a process of retaking market share