Analys

Prices pull back as market awaits OPEC+ and demand signals

The Brent crude oil August contract traded briefly above the $40/bl line yesterday but has now pulled back again as the market is awaiting a decision by OPEC+ whether to roll current cuts of 9.7 m bl/d beyond June. We think that there is a better than even chance for this happening but a final decision is probably not available before mid-June as the group struggles with how to whip cheaters into line. Current demand signals from the US are also weak but will most definitely strengthen again at some point in time in the coming months. Crude oil prices are pulling back awaiting OPEC+ and demand signals. Use the opportunity to buy 2021.

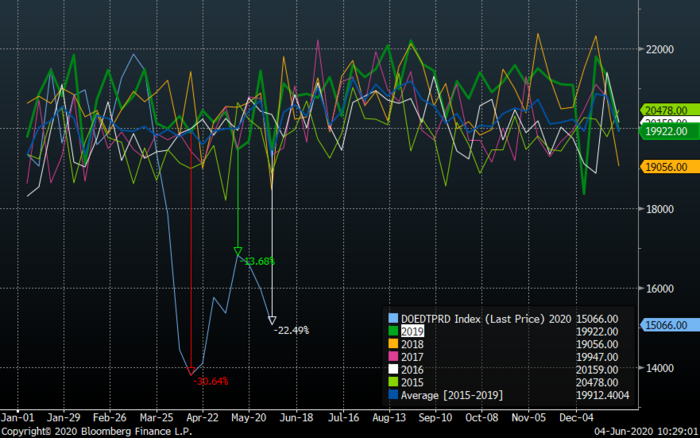

The Brent crude August contract has had a great run from its lowest quote in late April of $22.45/bl to a close yesterday of $39.79/bl which is just below the 38.2% Fibonacci retracement level. The rally has been supported by both a revival in demand as well as a sharp reduction in supply. Both of these two forces are now being placed into question. US shale oil players are contemplating a reopening of shale oil wells which were closed when demand and prices crashed. OPEC+ is scheduled to bring back supply from July unless current discord can be overcome while recent demand indications in the US published this week were weakening for a third week in a row with total products delivered down 22.5% YoY. There is thus quite a bit of headwind right now to propel the Brent crude oil price above and beyond the $40/bl line for now.

All eyes are now naturally focused on OPEC+ and their deliberations over what to do in July. Reduce cuts from 9.7 m bl/d in May and June to 7.7 m bl/d in July and H2 overall as planned or roll current cuts of 9.7 m bl/d forward for an additional 1-3 months’ time. Saudi Arabia, Kuwait and UAE have also had an additional 1.2 m bl/d of above target cuts in June which might be cancelled in July.

Saudi Arabia and Russia indicatively seems to be willing to roll current cuts forward for another 1-3 months’ time but limited compliance to the agreement in April has become a significant stumbling block with Nigeria and Iraq the two biggest offenders. Unless these offenders can be reined in there is not going to be any forward rolling of current cuts of 9.7 m bl/d.

The proposed early OPEC meeting on the 4th of June has been ditched and now the originally planned meeting on June 9 to 10 is probably being shifted out in time to mid-June. This to review more data on compliance as Saudi Arabia is getting ready for hard-ball negotiations with OPEC-cheats. Without guarantees of full compliance Russia is unlikely to come along rolling cuts of 9.7 m bl/d forward into July. Not only are cheaters being pushed to fully comply with the deal going forward but they are also asked to make up for what they did not deliver in May and June by additional deeper cuts in July and August. That sounds like a very tall order. Our first instinctive reaction: this will never happen.

We don’t hold a strong view over whether current cuts of 9.7 m bl/d will be rolled forward for another 1-3 months or not. Maybe, maybe not. What we shouldn’t forget here is what happened on the 6th of March when Russia and Saudi Arabia fell apart as Saudi wanted to chase prices higher through further cuts while Russia was getting sick of cutting and just wanted to get back to business as usual. This underlying conflict is still there between the two parties in OPEC+ as it originates from the fact that Saudi Arabia has a presumed social break-even oil price of $80-85/bl while Russia’s is closer to $40/bl. As such they naturally get different goals and strategies with Russia favouring volume growth at an oil price in the range of $45-55/bl (if that is the oil price in a shale oil world) while Saudi Arabia unavoidably wants to chase prices to $60-70-80/bl through production cuts.

Saudi Arabia can and probably must at some point in time shift its social break-even oil price from current $80-85/bl and down towards $50/bl by increasing exports by 30-40% while cutting budget spending by 20-30%. This is also the messages that Muhammed bin Salman gave to Saudi Aramco and state departments following the break-down with Russia on the 6th of March this year. Though Covid-19, demand collapse and Donald Trump’s political pressure later forced Russia and Saudi to cooperate again.

Saudi Arabia and Russia’s interests are probably aligned as long as the oil price is below $40-45/bl, shale oil production is deteriorating while global oil demand is significantly below normal. But once we get to $50/bl, US shale oil wells are re-started, drilling rig count is ticking higher and global demand is moving closer to normal then we think that the dividing line between Russia and Saudi Arabia again is likely to re-emerge.

Russia is happy with an oil price around the $50/bl mark and wants to get its volumes back into the market again at such a price level rather than to see that US shale again starts to eat away at its market share.

It is very difficult for us to understand why OPEC+ agreed in late April to hold production cuts all to the end of April 2022. By doing so the group will give US shale oil producers all the time in the world to shape up, get bankruptcies out of the way and rebound production to the extent that oil prices allow it to do. This is the same recipe and the same mistake that OPEC+ did through 2017,18,19 when it held medium cuts for a long time. This gave US shale oil producers all the runway in the world to ramp up production. Getting its production cuts back into the market became forever impossible without crashing the oil price and Russia was caught in forever lasting cut agreement.

A much better solution would be to cut hard, deep and fast. As such we support a solution where current cuts of 9.7 m bl/d are rolled forward for another 3-6 months. But it should be coupled with the message that cuts will thereafter rapidly be placed back into the market through Q1/Q2 2021.

In this way US shale oil players will not have time to revive production other than to place closed wells back into operation. There won’t be a good reason to ramp up shale oil drilling and fracking either because OPEC+’ volumes will be placed back into the market again already in H1-2021.

As such we are inclined to believe that there is probably a better than even chance that OPEC+ will roll its current cuts of 9.7 m bl/d forward to July, August,.. rather than to reduce cuts down to the originally planned 7.7 m bl/d cuts.

For now oil prices are pulling back awaiting a decision by OPEC+. The Brent crude August contract could easily pull back towards the $35-36/bl level but would definitely rebound up and above the $40/bl line again if OPEC+ decides to roll the 9.7 m bl/d cuts forward beyond June. Stronger demand revival signals would also be welcome. They will come for sure. Peak oil demand? Not at all yet. We will move back up to 100 m bl/d again and above. Just a matter of time.

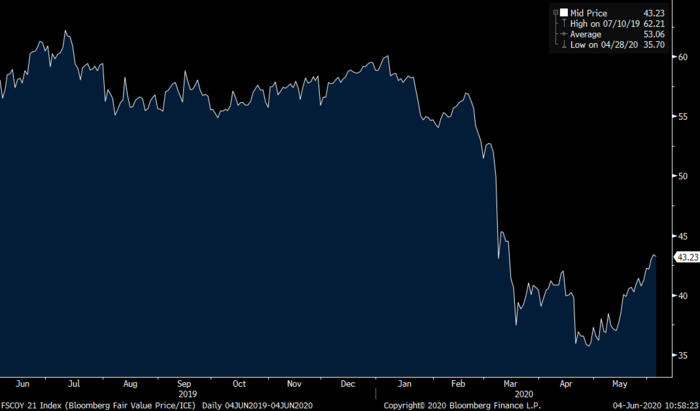

The Brent crude oil August contract closed just a fraction below the 38.2% Fibonacci retracement level yesterday. Now pulling back on weakness in US demand signals as well as awaiting a decision by OPEC+

Total US products delivered has dissapointed now three weeks in a row. It all looked good in terms of demand revival until mid-May but since then it has been a sad story

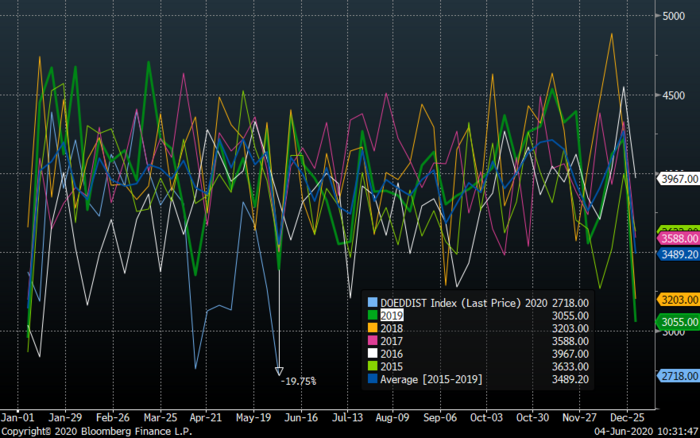

It is deliveries of US mid-dist products which is the weakness here. That is typically diesel and jet fuel.

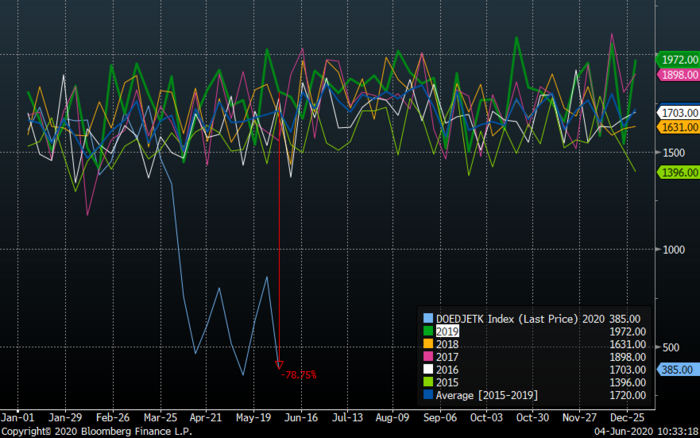

Deliveries of jet fuel in the US is still down 79% YoY. No solid signal of rebound yet there.

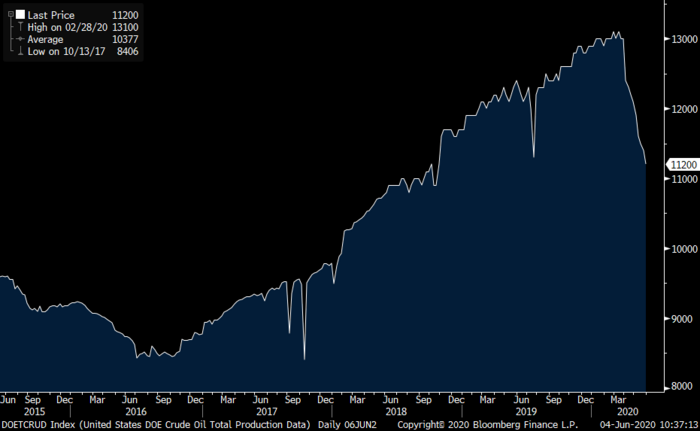

US crude oil continues to fall sharply in a combination of structural decline and deliberate shutting of wells. The underlying losses in US shale oil crude and NGL production in the US is in the range of 600 – 800 k bl/d per month. Currently there are only 222 active oil rigs in the US. These have an implied productive effect of about 165 k bl/d per month of new supply if all the wells they produce are placed into production (probably not done now). There is thus a significant ongoing structural decline in the US of up to 400 – 600 k bl/d per month today.

The Brent crude oil time spread of the 1 month minus the 6 month contract. The contango moved deeper than in 2009 but has come back faster. The front-month Brent contract has actually been in backwardation vs the second contract briefly in intraday trading lately. If cuts of 9.7 m bl/d are rolled forward beyond June then market is likely to move into deficit, inventories drawing down and poff we are back in backwardation.

The current set back in crude oil prices can provide yet another chance to purchase forward Brent crude for 2021 average delivery at very low, favorable price levels. We strongly advised our clients to purchase crude and oil products when the forward Brent 2021 contract traded in the range of $35-40/bl. We still view low-40ies as a very favorable level.

Analys

Tightening fundamentals – bullish inventories from DOE

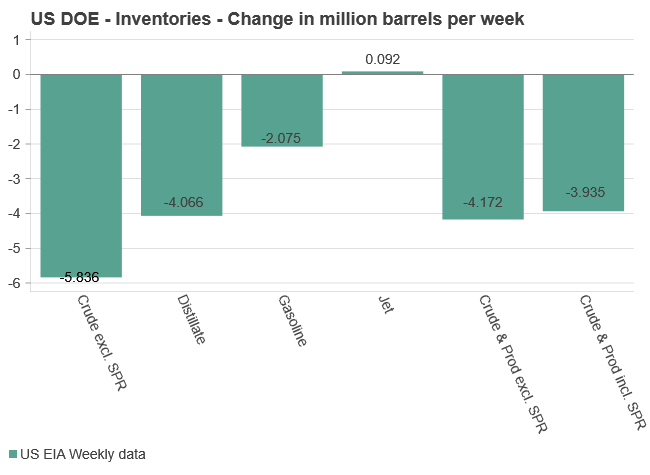

The latest weekly report from the US DOE showed a substantial drawdown across key petroleum categories, adding more upside potential to the fundamental picture.

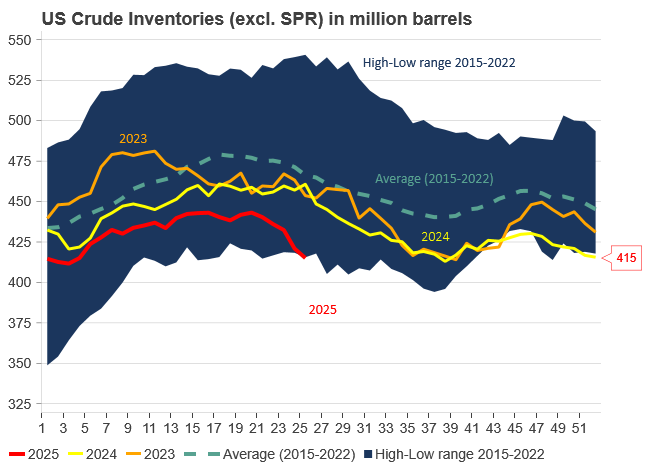

Commercial crude inventories (excl. SPR) fell by 5.8 million barrels, bringing total inventories down to 415.1 million barrels. Now sitting 11% below the five-year seasonal norm and placed in the lowest 2015-2022 range (see picture below).

Product inventories also tightened further last week. Gasoline inventories declined by 2.1 million barrels, with reductions seen in both finished gasoline and blending components. Current gasoline levels are about 3% below the five-year average for this time of year.

Among products, the most notable move came in diesel, where inventories dropped by almost 4.1 million barrels, deepening the deficit to around 20% below seasonal norms – continuing to underscore the persistent supply tightness in diesel markets.

The only area of inventory growth was in propane/propylene, which posted a significant 5.1-million-barrel build and now stands 9% above the five-year average.

Total commercial petroleum inventories (crude plus refined products) declined by 4.2 million barrels on the week, reinforcing the overall tightening of US crude and products.

Analys

Bombs to ”ceasefire” in hours – Brent below $70

A classic case of “buy the rumor, sell the news” played out in oil markets, as Brent crude has dropped sharply – down nearly USD 10 per barrel since yesterday evening – following Iran’s retaliatory strike on a U.S. air base in Qatar. The immediate reaction was: “That was it?” The strike followed a carefully calibrated, non-escalatory playbook, avoiding direct threats to energy infrastructure or disruption of shipping through the Strait of Hormuz – thus calming worst-case fears.

After Monday morning’s sharp spike to USD 81.4 per barrel, triggered by the U.S. bombing of Iranian nuclear facilities, oil prices drifted sideways in anticipation of a potential Iranian response. That response came with advance warning and caused limited physical damage. Early this morning, both the U.S. President and Iranian state media announced a ceasefire, effectively placing a lid on the immediate conflict risk – at least for now.

As a result, Brent crude has now fallen by a total of USD 12 from Monday’s peak, currently trading around USD 69 per barrel.

Looking beyond geopolitics, the market will now shift its focus to the upcoming OPEC+ meeting in early July. Saudi Arabia’s decision to increase output earlier this year – despite falling prices – has drawn renewed attention considering recent developments. Some suggest this was a response to U.S. pressure to offset potential Iranian supply losses.

However, consensus is that the move was driven more by internal OPEC+ dynamics. After years of curbing production to support prices, Riyadh had grown frustrated with quota-busting by several members (notably Kazakhstan). With Saudi Arabia cutting up to 2 million barrels per day – roughly 2% of global supply – returns were diminishing, and the risk of losing market share was rising. The production increase is widely seen as an effort to reassert leadership and restore discipline within the group.

That said, the FT recently stated that, the Saudis remain wary of past missteps. In 2018, Riyadh ramped up output at Trump’s request ahead of Iran sanctions, only to see prices collapse when the U.S. granted broad waivers – triggering oversupply. Officials have reportedly made it clear they don’t intend to repeat that mistake.

The recent visit by President Trump to Saudi Arabia, which included agreements on AI, defense, and nuclear cooperation, suggests a broader strategic alignment. This has fueled speculation about a quiet “pump-for-politics” deal behind recent production moves.

Looking ahead, oil prices have now retraced the entire rally sparked by the June 13 Israel–Iran escalation. This retreat provides more political and policy space for both the U.S. and Saudi Arabia. Specifically, it makes it easier for Riyadh to scale back its three recent production hikes of 411,000 barrels each, potentially returning to more moderate increases of 137,000 barrels for August and September.

In short: with no major loss of Iranian supply to the market, OPEC+ – led by Saudi Arabia – no longer needs to compensate for a disruption that hasn’t materialized, especially not to please the U.S. at the cost of its own market strategy. As the Saudis themselves have signaled, they are unlikely to repeat previous mistakes.

Conclusion: With Brent now in the high USD 60s, buying oil looks fundamentally justified. The geopolitical premium has deflated, but tensions between Israel and Iran remain unresolved – and the risk of missteps and renewed escalation still lingers. In fact, even this morning, reports have emerged of renewed missile fire despite the declared “truce.” The path forward may be calmer – but it is far from stable.

Analys

A muted price reaction. Market looks relaxed, but it is still on edge waiting for what Iran will do

Brent crossed the 80-line this morning but quickly fell back assigning limited probability for Iran choosing to close the Strait of Hormuz. Brent traded in a range of USD 70.56 – 79.04/b last week as the market fluctuated between ”Iran wants a deal” and ”US is about to attack Iran”. At the end of the week though, Donald Trump managed to convince markets (and probably also Iran) that he would make a decision within two weeks. I.e. no imminent attack. Previously when when he has talked about ”making a decision within two weeks” he has often ended up doing nothing in the end. The oil market relaxed as a result and the week ended at USD 77.01/b which is just USD 6/b above the year to date average of USD 71/b.

Brent jumped to USD 81.4/b this morning, the highest since mid-January, but then quickly fell back to a current price of USD 78.2/b which is only up 1.5% versus the close on Friday. As such the market is pricing a fairly low probability that Iran will actually close the Strait of Hormuz. Probably because it will hurt Iranian oil exports as well as the global oil market.

It was however all smoke and mirrors. Deception. The US attacked Iran on Saturday. The attack involved 125 warplanes, submarines and surface warships and 14 bunker buster bombs were dropped on Iranian nuclear sites including Fordow, Natanz and Isfahan. In response the Iranian Parliament voted in support of closing the Strait of Hormuz where some 17 mb of crude and products is transported to the global market every day plus significant volumes of LNG. This is however merely an advise to the Supreme leader Ayatollah Ali Khamenei and the Supreme National Security Council which sits with the final and actual decision.

No supply of oil is lost yet. It is about the risk of Iran closing the Strait of Hormuz or not. So far not a single drop of oil supply has been lost to the global market. The price at the moment is all about the assessed risk of loss of supply. Will Iran choose to choke of the Strait of Hormuz or not? That is the big question. It would be painful for US consumers, for Donald Trump’s voter base, for the global economy but also for Iran and its population which relies on oil exports and income from selling oil out of that Strait as well. As such it is not a no-brainer choice for Iran to close the Strait for oil exports. And looking at the il price this morning it is clear that the oil market doesn’t assign a very high probability of it happening. It is however probably well within the capability of Iran to close the Strait off with rockets, mines, air-drones and possibly sea-drones. Just look at how Ukraine has been able to control and damage the Russian Black Sea fleet.

What to do about the highly enriched uranium which has gone missing? While the US and Israel can celebrate their destruction of Iranian nuclear facilities they are also scratching their heads over what to do with the lost Iranian nuclear material. Iran had 408 kg of highly enriched uranium (IAEA). Almost weapons grade. Enough for some 10 nuclear warheads. It seems to have been transported out of Fordow before the attack this weekend.

The market is still on edge. USD 80-something/b seems sensible while we wait. The oil market reaction to this weekend’s events is very muted so far. The market is still on edge awaiting what Iran will do. Because Iran will do something. But what and when? An oil price of 80-something seems like a sensible level until something do happen.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanStor uppsida i Lappland Guldprospekterings aktie enligt analys

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSilverpriset släpar efter guldets utveckling, har mer uppsida

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanUppgången i oljepriset planade ut under helgen

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMahvie Minerals växlar spår – satsar fullt ut på guld

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanLåga elpriser i sommar – men mellersta Sverige får en ökning

-

Analys3 veckor sedan

Analys3 veckor sedanVery relaxed at USD 75/b. Risk barometer will likely fluctuate to higher levels with Brent into the 80ies or higher coming 2-3 weeks

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanOljan, guldet och marknadens oroande tystnad

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanJonas Lindvall är tillbaka med ett nytt oljebolag, Perthro, som ska börsnoteras