Analys

SHB Råvarubrevet 19 april 2013

Råvaror allmänt

Råvaror allmänt

En vecka med motvind

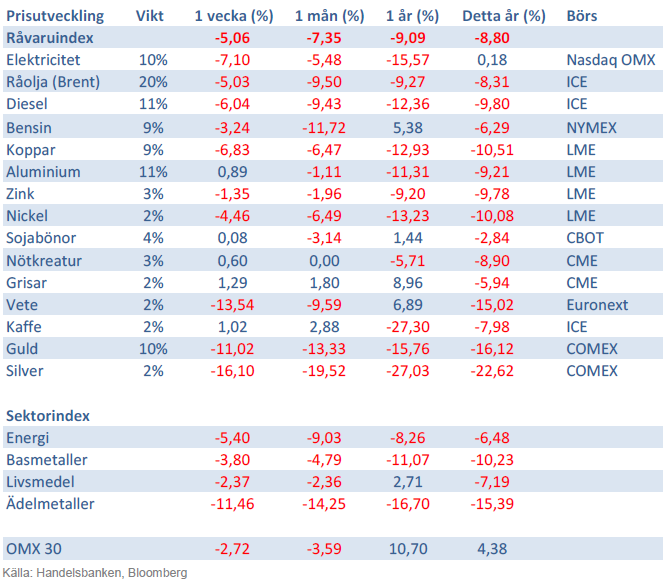

Marknaden har haft ordentlig motvind sedan förra veckan. Denna gång är det framförallt råvaror som har handlats ner. Brentoljan har dippat under 100 USD och koppar under 7000 USD samtidigt som guldet har genomlidit det största fallet under två dagar på 30 år. De senaste motgångarna är inte koncentrerade till Europa som vi vant oss vid utan kommer från makrodata i USA och Kina. Vi har påtalat risken för besvikelser i amerikanskt makro under våren och de senaste händelserna stödjer denna riskbild.

Den QE pådrivna börsen tar sig förbi svagare data medan räntemarknaden och råvarumarknaden prisar in den för fullt. En svagare data är antagligen de första tecknen på finanspolitisk åtstramning i USA och kan också vara tecken på att QE3 effekten nu börjar ebba ut. Samtidigt har data i Kina börjat oroa på svagare nivåer än väntat på det hela taget. Med problembarnet Europa ständigt närvarande ser vi få ljuspunkter i makrobilden just nu.

Basmetaller

Metallerna under marginalkostnad

Basmetallerna har haft ytterligare en vecka med fallande priser, där koppar tappat dryga 6 % och handlas nu under 7000 USD – i nivå vi inte sett sedan oktober 2011. Förhoppningar på Kinas konjunkturuppgång har inte infriats och med ett USA som samtidigt släpper svagare data har fått konjunktur känsliga metaller att falla. I närtid finns risk för mer dålig USA data och för Kina ororas vi av att de stimulanser som lanserats redan verkat i indikatorer och det finns därför inte mer lanserad stimulansdriven tillväxt att vänta i barometerdata.

En rad metaller har efter senaste veckans negativa rörelser nu sjunkit och handlas klart under marginalkostnad för produktion vilken brukar verka bättre som stöd vid fallande kurser. Om vi bortser från Koppar där denna ligger på ca 4,500 dollar eller strax över 6,000 dollar om man ser till det ”incentive-pris”, som gäller för nya investeringar, och kanske bättre symboliserar stödet vid en svag balans, har vi svårt att se att detta ska falla så värst mycket ytterligare. Vi förväntar oss dock inget kraftigt uppställ på kort sikt utan snarare att marknaden bottnar ur för att sedan på lite längre sikt börja stiga igen. Initialt mot marginalkostnad vilket gör att vi ser detta som köpterritorium för metaller och möjlighet att komma in på bra nivåer.

Trots fortsatt svag makromiljö, utan någon direkt ljusning ser vi ändå basmetaller som köpvärda på dessa nivåer. Vi tror på: LONG BASMET H

Ädelmetaller

Veckans snackis!

Guldet blev denna veckas stora samtalsämne efter att på måndagen ha fallit med över 11 % jämfört med fredagskvällens notering. Det cirkulerade många försök till förklaringar till den stora och plötsliga rörelsen, och varför den skedde just nu. Vi har inga bra svar på timingen, men konstaterar att det är en rörelse vi väntat på, och vi tror inte att den är över i och med detta fall. Vi har nu fallit med 26 % från toppen hösten 2011, och 16 % hittills i år. Silvret däremot – guldets sprallige lillebror – har mer än halverats sedan toppen, och fallit 22 % i år. Den stora frågan nu är naturligtvis huruvida det ska fortsätta, och isåfall hur långt.

Vårt resonemang har som bekant varit att guldet handlas i stort sett enbart ur perspektivet att man vill tjäna pengar – man köper guld för att sälja dyrare till någon annan – och att guldet inte har massvis med andra användningsområden. Det är helt korrekt, som många kommenterat, att guld används till smycken och viss industriell nytta, men vi anser inte att dessa delar är de som sätter priset på guld. Det är guldets likviditet, enkla omsättningsbarhet, och det upplevda skyddet mot finansiell osäkerhet och inflation som driver priset. Och när alla har ”köpt färdigt” guld, då blir dynamiken väldigt speciell…

Om majoriteten av guld och silverspekulanter inte längre tror att de kan köpa för att sälja dyrare till någon annan så finns det få anledningar att hålla guld. Detta konstaterades redan 1980 då guldet gjort en fantastisk resa uppåt under ett par intensiva år. Då föll det tillbaks 65 % på drygt två år, och sen dröjde det drygt två decennier innan man började intressera sig för guld på allvar igen.

Trots det största raset på 30 år tror vi att förtroendet för guld håller på urholkas och att trenden nedåt fortsätter. Vi tror på: SHRT GULD H

Energi

Utsläppsrätterna – i händer på politiken

Elkontraktet Q3 2013 faller tillbaka med över 5 procent under veckan och det är mest till följd av utsläppsrätterna som rasar med över 34 procent. Ser vi till CO2-marknaden kan dess fortsatta existens nu stark ifrågasättas efter att parlamentet röstat emot kommissionens förslag om att minska överskottet på rätter. Förslaget om ”backloading” innebär att hålla tillbaka allokeringen om 900 miljoner rätter mot slutet av fas III för att balansera marknaden men det är nu mycket ovisst vad som kommer hända framöver. Sannolikt att det kommer att handlas på nuvarande nivå om 2-3 euro, dvs ca 2 öre per kWh på elpriset, så länge det finns hopp om att kommissionen kommer att agera på något sätt för att upprätthålla förtroendet.

På dessa låga nivåer finns dock inga större incitament att investera i minskade utsläpp! Vi kan liksom tidigare konstatera att denna marknad varit fel utformad från dag 1 och lägg därtill misslyckandet om att få till ett globalt direktiv – en central del för en fungerande marknad och långsiktig överlevnad. Vi behöver en mer överskådlig parameter vad gäller utsläppskostnader och dess inverkan på elpriset. Inte omöjligt att det istället blir någon form av skatt emot vilken nuvarande överskott kan kvittas, på så sätt bör kommissionen kunna erkänna sitt misslyckande och ändå rädda ansiktet.

Kort om oljan, som under veckan handlas under 100 USD: OPEC har varit väldigt aktiva i att styra priset efter stora prisfall och vi väntar oss att kartellen griper in vilken dag som helst och drar tillbaka produktion. Vi ser olja under 100 som klart köpvärd.

OPEC har tidigare aktivt och framgångsrikt försvarat prismålet 100-110 USD och vi väntar oss handling snarare än besked från kartellen inom kort. Konflikten mellan Israel och Iran är nästa skäl att förvänta sig högre oljepriser under H2. Vi tror på: LONG OLJA H

Livsmedel

Än är inte faran över för vetet

Vete avslutar denna vecka i princip oförändrad (svagt ned). Än är vi inte helt ute ur en känslig period för höstvetet och än är inte vårsådden helt klar i alla områden. Dock förbättras situationen (om än sakta) i de flesta områden och risken för bakslag minskar. Det är dock långt kvar till skörd och väldigt mycket kan ske fram tills dess – med väldigt små lager får eventuella väderproblem lätt stora och snabba effekter i form av stigande priser. I dagsläget finner vi dock inte skäl till större oro utan är kvar i vår tro om en relativt kraftig återhämtning av den globala spannmålsproduktionen – med följden att vi väntar oss lägre priser på vete längre fram på året.

Under våren har priset på apelsinjuice skjutit i höjden p.g.a. minskad produktion som en följd av frost, bakteriesjukdom och torrt väder i Florida. I veckan nådde priset nästan årshögsta efter spekulationer kring en aktiv orkansäsong som närmar sig och som skulle hota den redan drabbade trädplanteringen i Florida ytterligare.

För kakao behåller vi vår vy och är fortsatt positiva efter signaler om stigande konsumtion. Siffror från National Confectioners Association i veckan ger fortsatt stöd till kakaopriset. Rapporten visade på ökat processande av kakao i Nordamerika för Q1-13 jämfört med samma period förra året.

Då priserna har på de stora jordbruksråvarorna soja, majs och vete har fallit tillbaka till nivåer före torkan i USA, tror vi att en nedsida är begränsad på kort sikt och därför är vi neutrala till utvecklingen för denna sektor.

Handelsbankens Råvaruindex

Handelsbankens råvaruindex består av de underliggande indexen för respektive råvara. Vikterna är bestämda till hälften från värdet av nordisk produktion (globala produktionen för sektorindex) och till hälften från likviditeten i terminskontrakten.

[box]SHB Råvarubrevet är producerat av Handelsbanken och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Ansvarsbegränsning

Detta material är producerat av Svenska Handelsbanken AB (publ) i fortsättningen kallad Handelsbanken. De som arbetar med innehållet är inte analytiker och materialet är inte oberoende investeringsanalys. Innehållet är uteslutande avsett för kunder i Sverige. Syftet är att ge en allmän information till Handelsbankens kunder och utgör inte ett personligt investeringsråd eller en personlig rekommendation. Informationen ska inte ensamt utgöra underlag för investeringsbeslut. Kunder bör inhämta råd från sina rådgivare och basera sina investeringsbeslut utifrån egen erfarenhet.

Informationen i materialet kan ändras och också avvika från de åsikter som uttrycks i oberoende investeringsanalyser från Handelsbanken. Informationen grundar sig på allmänt tillgänglig information och är hämtad från källor som bedöms som tillförlitliga, men riktigheten kan inte garanteras och informationen kan vara ofullständig eller nedkortad. Ingen del av förslaget får reproduceras eller distribueras till någon annan person utan att Handelsbanken dessförinnan lämnat sitt skriftliga medgivande. Handelsbanken ansvarar inte för att materialet används på ett sätt som strider mot förbudet mot vidarebefordran eller offentliggörs i strid med bankens regler.

Analys

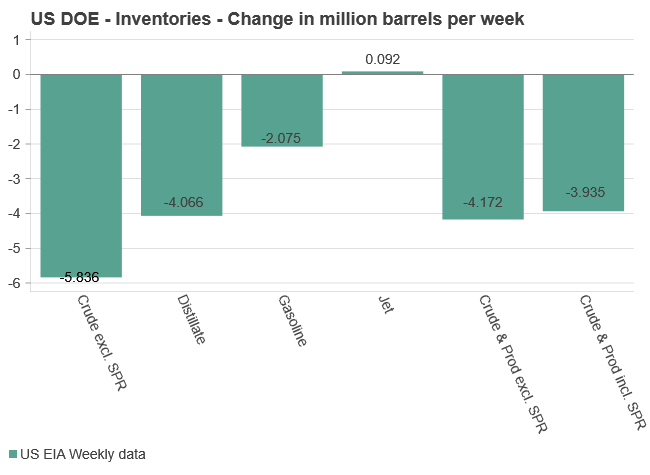

Tightening fundamentals – bullish inventories from DOE

The latest weekly report from the US DOE showed a substantial drawdown across key petroleum categories, adding more upside potential to the fundamental picture.

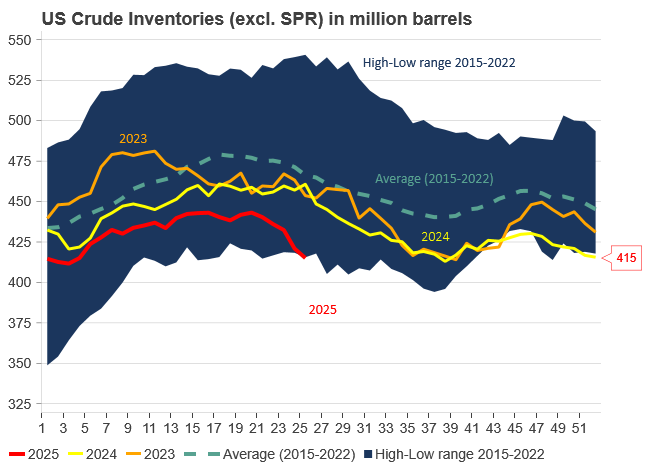

Commercial crude inventories (excl. SPR) fell by 5.8 million barrels, bringing total inventories down to 415.1 million barrels. Now sitting 11% below the five-year seasonal norm and placed in the lowest 2015-2022 range (see picture below).

Product inventories also tightened further last week. Gasoline inventories declined by 2.1 million barrels, with reductions seen in both finished gasoline and blending components. Current gasoline levels are about 3% below the five-year average for this time of year.

Among products, the most notable move came in diesel, where inventories dropped by almost 4.1 million barrels, deepening the deficit to around 20% below seasonal norms – continuing to underscore the persistent supply tightness in diesel markets.

The only area of inventory growth was in propane/propylene, which posted a significant 5.1-million-barrel build and now stands 9% above the five-year average.

Total commercial petroleum inventories (crude plus refined products) declined by 4.2 million barrels on the week, reinforcing the overall tightening of US crude and products.

Analys

Bombs to ”ceasefire” in hours – Brent below $70

A classic case of “buy the rumor, sell the news” played out in oil markets, as Brent crude has dropped sharply – down nearly USD 10 per barrel since yesterday evening – following Iran’s retaliatory strike on a U.S. air base in Qatar. The immediate reaction was: “That was it?” The strike followed a carefully calibrated, non-escalatory playbook, avoiding direct threats to energy infrastructure or disruption of shipping through the Strait of Hormuz – thus calming worst-case fears.

After Monday morning’s sharp spike to USD 81.4 per barrel, triggered by the U.S. bombing of Iranian nuclear facilities, oil prices drifted sideways in anticipation of a potential Iranian response. That response came with advance warning and caused limited physical damage. Early this morning, both the U.S. President and Iranian state media announced a ceasefire, effectively placing a lid on the immediate conflict risk – at least for now.

As a result, Brent crude has now fallen by a total of USD 12 from Monday’s peak, currently trading around USD 69 per barrel.

Looking beyond geopolitics, the market will now shift its focus to the upcoming OPEC+ meeting in early July. Saudi Arabia’s decision to increase output earlier this year – despite falling prices – has drawn renewed attention considering recent developments. Some suggest this was a response to U.S. pressure to offset potential Iranian supply losses.

However, consensus is that the move was driven more by internal OPEC+ dynamics. After years of curbing production to support prices, Riyadh had grown frustrated with quota-busting by several members (notably Kazakhstan). With Saudi Arabia cutting up to 2 million barrels per day – roughly 2% of global supply – returns were diminishing, and the risk of losing market share was rising. The production increase is widely seen as an effort to reassert leadership and restore discipline within the group.

That said, the FT recently stated that, the Saudis remain wary of past missteps. In 2018, Riyadh ramped up output at Trump’s request ahead of Iran sanctions, only to see prices collapse when the U.S. granted broad waivers – triggering oversupply. Officials have reportedly made it clear they don’t intend to repeat that mistake.

The recent visit by President Trump to Saudi Arabia, which included agreements on AI, defense, and nuclear cooperation, suggests a broader strategic alignment. This has fueled speculation about a quiet “pump-for-politics” deal behind recent production moves.

Looking ahead, oil prices have now retraced the entire rally sparked by the June 13 Israel–Iran escalation. This retreat provides more political and policy space for both the U.S. and Saudi Arabia. Specifically, it makes it easier for Riyadh to scale back its three recent production hikes of 411,000 barrels each, potentially returning to more moderate increases of 137,000 barrels for August and September.

In short: with no major loss of Iranian supply to the market, OPEC+ – led by Saudi Arabia – no longer needs to compensate for a disruption that hasn’t materialized, especially not to please the U.S. at the cost of its own market strategy. As the Saudis themselves have signaled, they are unlikely to repeat previous mistakes.

Conclusion: With Brent now in the high USD 60s, buying oil looks fundamentally justified. The geopolitical premium has deflated, but tensions between Israel and Iran remain unresolved – and the risk of missteps and renewed escalation still lingers. In fact, even this morning, reports have emerged of renewed missile fire despite the declared “truce.” The path forward may be calmer – but it is far from stable.

Analys

A muted price reaction. Market looks relaxed, but it is still on edge waiting for what Iran will do

Brent crossed the 80-line this morning but quickly fell back assigning limited probability for Iran choosing to close the Strait of Hormuz. Brent traded in a range of USD 70.56 – 79.04/b last week as the market fluctuated between ”Iran wants a deal” and ”US is about to attack Iran”. At the end of the week though, Donald Trump managed to convince markets (and probably also Iran) that he would make a decision within two weeks. I.e. no imminent attack. Previously when when he has talked about ”making a decision within two weeks” he has often ended up doing nothing in the end. The oil market relaxed as a result and the week ended at USD 77.01/b which is just USD 6/b above the year to date average of USD 71/b.

Brent jumped to USD 81.4/b this morning, the highest since mid-January, but then quickly fell back to a current price of USD 78.2/b which is only up 1.5% versus the close on Friday. As such the market is pricing a fairly low probability that Iran will actually close the Strait of Hormuz. Probably because it will hurt Iranian oil exports as well as the global oil market.

It was however all smoke and mirrors. Deception. The US attacked Iran on Saturday. The attack involved 125 warplanes, submarines and surface warships and 14 bunker buster bombs were dropped on Iranian nuclear sites including Fordow, Natanz and Isfahan. In response the Iranian Parliament voted in support of closing the Strait of Hormuz where some 17 mb of crude and products is transported to the global market every day plus significant volumes of LNG. This is however merely an advise to the Supreme leader Ayatollah Ali Khamenei and the Supreme National Security Council which sits with the final and actual decision.

No supply of oil is lost yet. It is about the risk of Iran closing the Strait of Hormuz or not. So far not a single drop of oil supply has been lost to the global market. The price at the moment is all about the assessed risk of loss of supply. Will Iran choose to choke of the Strait of Hormuz or not? That is the big question. It would be painful for US consumers, for Donald Trump’s voter base, for the global economy but also for Iran and its population which relies on oil exports and income from selling oil out of that Strait as well. As such it is not a no-brainer choice for Iran to close the Strait for oil exports. And looking at the il price this morning it is clear that the oil market doesn’t assign a very high probability of it happening. It is however probably well within the capability of Iran to close the Strait off with rockets, mines, air-drones and possibly sea-drones. Just look at how Ukraine has been able to control and damage the Russian Black Sea fleet.

What to do about the highly enriched uranium which has gone missing? While the US and Israel can celebrate their destruction of Iranian nuclear facilities they are also scratching their heads over what to do with the lost Iranian nuclear material. Iran had 408 kg of highly enriched uranium (IAEA). Almost weapons grade. Enough for some 10 nuclear warheads. It seems to have been transported out of Fordow before the attack this weekend.

The market is still on edge. USD 80-something/b seems sensible while we wait. The oil market reaction to this weekend’s events is very muted so far. The market is still on edge awaiting what Iran will do. Because Iran will do something. But what and when? An oil price of 80-something seems like a sensible level until something do happen.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanStor uppsida i Lappland Guldprospekterings aktie enligt analys

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSilverpriset släpar efter guldets utveckling, har mer uppsida

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanUppgången i oljepriset planade ut under helgen

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMahvie Minerals växlar spår – satsar fullt ut på guld

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanLåga elpriser i sommar – men mellersta Sverige får en ökning

-

Analys3 veckor sedan

Analys3 veckor sedanVery relaxed at USD 75/b. Risk barometer will likely fluctuate to higher levels with Brent into the 80ies or higher coming 2-3 weeks

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanOljan, guldet och marknadens oroande tystnad

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanJonas Lindvall är tillbaka med ett nytt oljebolag, Perthro, som ska börsnoteras