Analys

Kinafrossa inför 2018 – Råvaruplanket

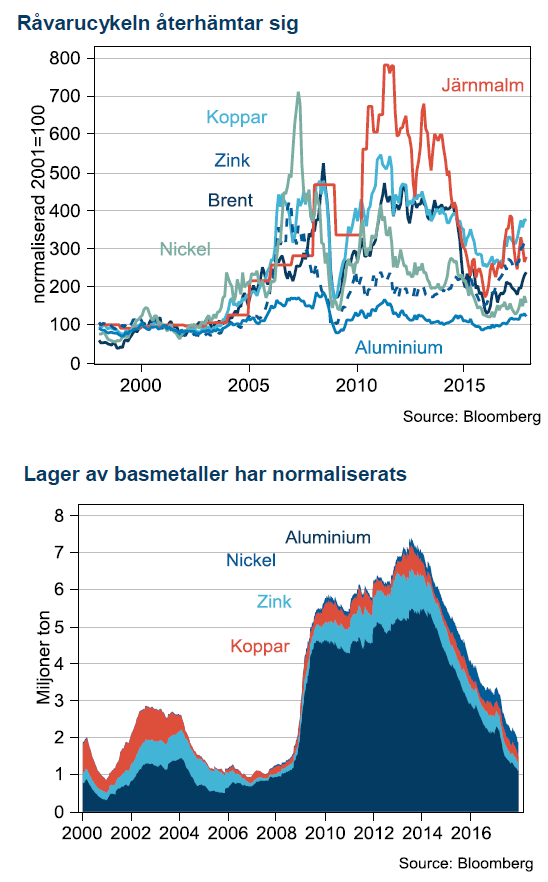

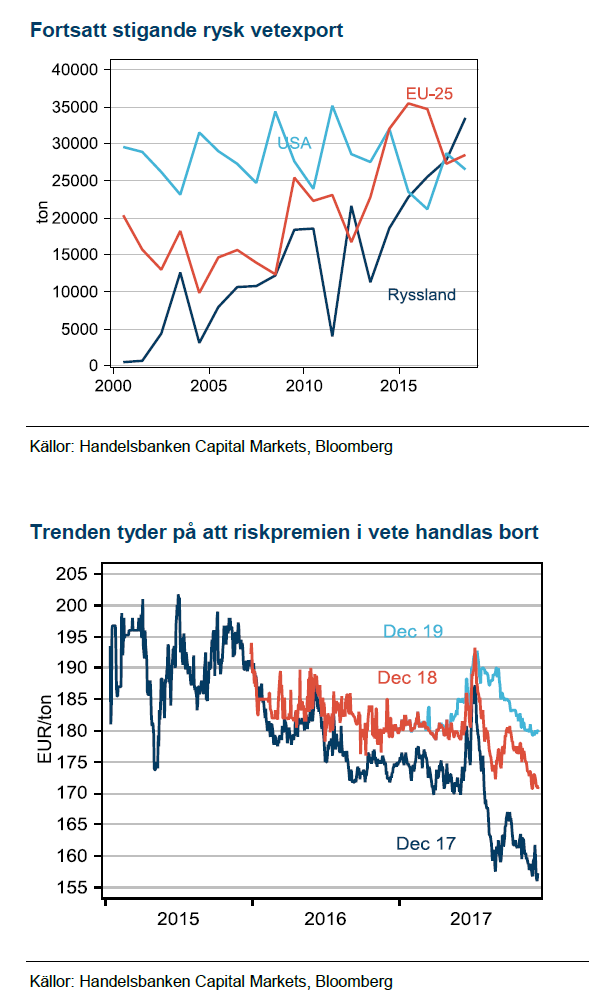

Råvarupriser har stigit markant under 2017, främst är det basmetallkomplexet som handlas omkring 20% högre sedan Kinas ekonomi utvecklats starkt i bakvattnet av 2015 och 16 års stimulanser. Oljepriset har också stigit, dock bara 8% över året men 35% sedan årets botten i juni. För olja har de fallande globala lagernivåerna varit avgörande, marknadens betydande överskott ser ut att var under avveckling och balans närmar sig. OPEC har fått hela äran och förlängningen av OPEC-avtalet hyllades av marknaden.

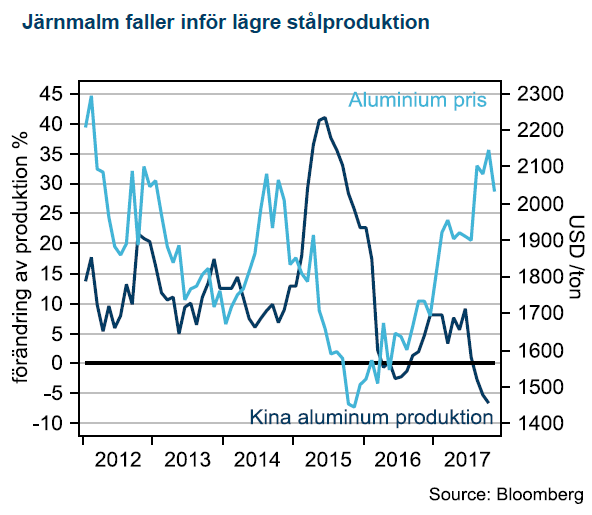

Vi tror att Kinas pågående produktionsreform kommer vara en mer långsiktig, strukturell förändring i råvarumarknaden än vad som initialt annonserats. Genom att minska på överproduktionen av vissa råvaror kan Kina slå två flugor i en smäll: lönsamheten stiger för de producenter som får vara kvar och luften blir bättre vilket gynnar alla.

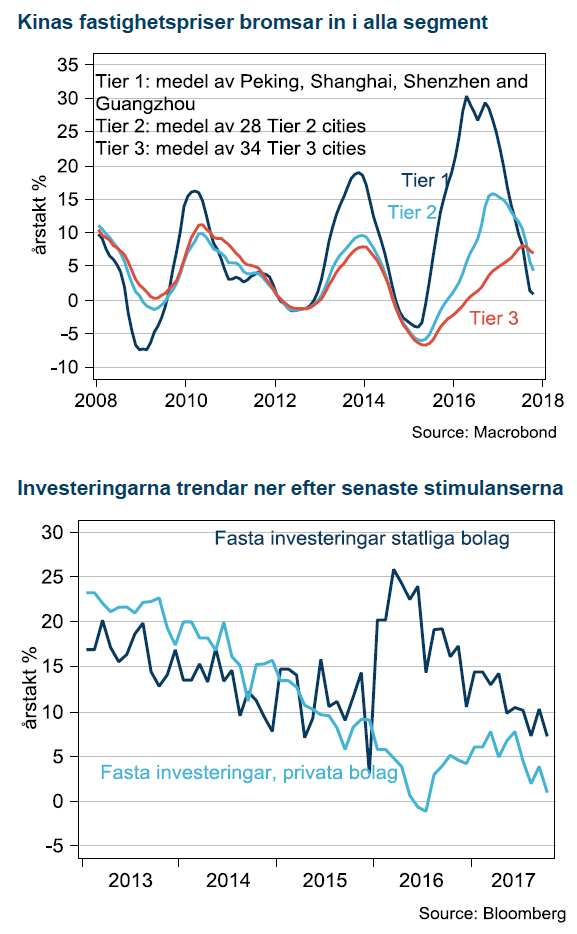

Trots det ser första halvåret 2018 kritiskt ut för Kina. Stimulansinjektionen har slutat verka, uppgången i bostadspriserna har stannat av i de stora städerna, investeringarna har minskat både från statliga och privata bolag. Mer stimulanser kommer säkert men först måste det blir sämre, vilket betyder att nästa stimulansvåg är att vänta tidigast andra halvåret 2018. Fram till dess ser vi risk för tillfällig dipp i basmetaller.

Motvind i öknen

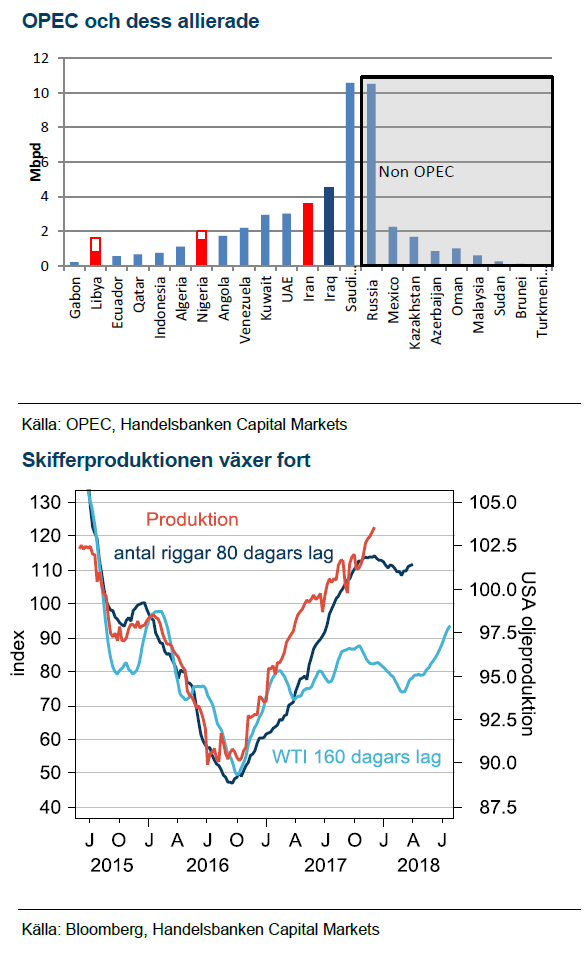

Även oljepriset står inför en nedgång när säsongsmönstret för den påbörjade lagernedgången byter rikting och börjar stiga under första kvartalet. Skifferoljan står också inför ökad aktivitet när höstens högre oljepris slår igenom med början i fler riggar till fälten. Vi har ett oljepris på USD 51 för 2018.

Vår syn för Q1-Q2 2018:

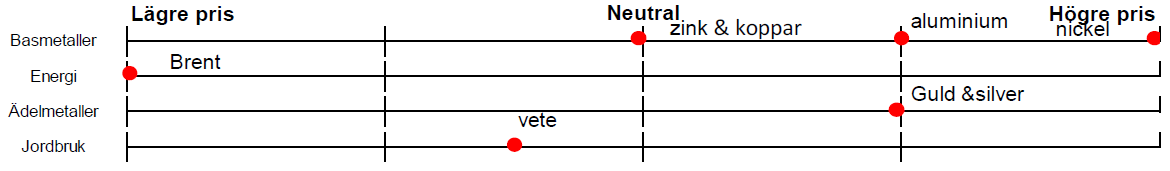

Basmetaller

Striktare plan för luftföroreningar

Striktare plan för luftföroreningar

Vi argumenterar för att när regeringen väl lyckats få en del av kapaciteten ur produktion så kommer den inte tillbaka. Det sammanfaller med regeringens långsiktiga mål att få bort olönsam småskalig produktion i miljöbelastande segment samtidigt som det gynnar de producenter som får vara kvar och säljer till högre pris.

Oron för Kina är makrobaserad och utbudsreformerna kommer sannolikt bara delvis hålla emot. Uppgången i fastighetspriserna har bromsat in, initialt kontrollerat, men nu växer oron för att de ska börja falla. Tillväxten i investeringar faller också efter snart två år utan stimulanser. Oron i investerarkollektivet växer då president Xi Jingping inte ”pratat upp” tillväxten, snarare motsatsen genom att säga att Kina prioriterar tillväxt av bättre kvalité.

Aluminium gynnas av produktionsreformer

Aluminium är den basmetall som gynnas mest av omstrukturering i Kinas produktion likt den i stålindustrin. Det skulle innebära mindre produktion från de olönsamma verken under den kommande vintern. Vi har USD 2175 som medelprognos för 2018.

Zinkrallyt har planat ut

Även för zink finns det viss påverkan från nedstängningar i Kina men med zink över USD 3000 ser vi ökad risk från mer produktion till marknaden plus makrorisk från Kina på efterfrågan. Vi har USD 2960 som medelprognos 2018.

Nickel – volatil men intressant

Nickel – volatil men intressant

Bland metaller som både drabbas av Kinas stängningar och rider på elbilsrevolutionen finns en tydlig stjärna och det är nickel. Metallens höga volatilitet gör dock att det är en nervös exponering. Vi har USD 13000 som medelprognos 2018.

Koppar – stöd i cykeln men makroexponerad

Koppar är den basmetall där de senaste årens låga investeringar börjar göra sig påmind genom en allt tunnare projektpipeline. Tillsammans med en högre påverkan från utbudsstörningar tror vi att koppar, rent cykliskt kan få bättre stöd framöver. På den negativa sidan är koppar fortfarande den metall som har högst Kinaexponering och speciellt mot fastighetsmarknaden. Vi har USD 6325 som medelprognos 2018.

Energi

Sommarens amerikanska ”driving season” blev startskottet på höstens oljeprisuppgång. På grund av att USA är en så stor del av globala lager har även de globala fallit som konsekvens av USA:s driving season och ökade export. Trots det har inte lagernivåerna kommit ner till normala nivåer, som är OPEC:s mål i den nuvarande kampanjen. Dessutom har Venezuelas kaosartade finansiella situation och Kronprins MBS framfart under antikorruptionskampanjen adderat en ordentlig riskpremie i oljepriset.

Skifferoljan är vinnare

I vår modell, som tjänat oss väl sedan oljekollapsen 2014, kommer antalet riggar att öka framöver som effekt av oljepriset vände i juli. Oljepriset leder produktionen med omkring 160 dagar och antalet riggar i oljefälten leder produktionen med omkring 80 dagar. Båda dessa ledande indikatorer talat nu för att produktionen kommer stiga under H1 2018.

OPEC-avtalet en tom gest

Även om OPEC har överraskat både oss och marknaden med bättre genomförande av de avtalade produktionssänkningarna än historiskt så tycker vi allt för mycket av lagernedgången tillskrivs OPEC. Ryssland sänker från rekordhöga nivåer som referenspunkt och mycket av sänkningarna utanför Saudiarabien är mer att betrakta som passiva sänkningar än aktiva. De fallande lagren är också en säsongsfaktor som kommer jobba mot OPEC under första kvartalet och vi tror då att oljan handlas ner mot USD 50 igen.

Slutet på avtalet under 2018

Under nästa år kommer fokus på tiden efter OPEC-avtalet att växa: Ryssland har understrukit att man vill ut ur avtalet så fort marknaden är i balans. Vårt mer negativa makroscenario för Kina kommer också att underminera priset när efterfrågan där inte motsvara förväntningarna. Vårt huvudscenario för nästa år är att USA adderar omkring 10 riggar per vecka under första halvåret, OPEC tar ingen ny riktning vid nästa OPEC-möte den 22a juni. Vid OPEC mötet i nov/dec avslutas avtalet och vi tror Brentoljan handlas på USD 51/fat i medel. Den största risken för vårt scenario ser vi i en finansiell kollaps i Venezuela som spiller över på oljeproduktionen eller mer aktivt motstånd bland saudiske prins MBS rivaler.

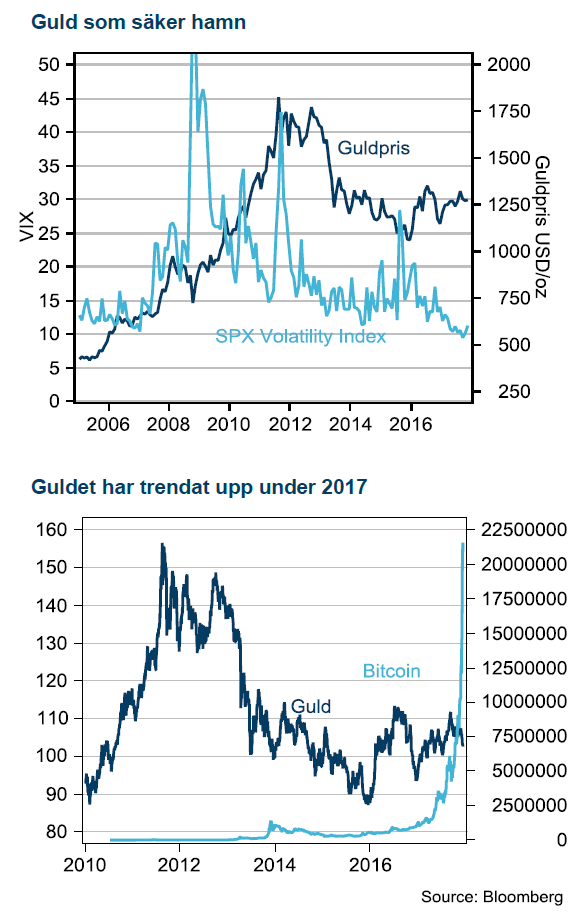

Ädelmetaller

Guldpriset har stigit 8% i år och fått en mycket tydligare koppling till risk och oro. Största hickan på senare år kom 2016 under Brexitomröstningen men utan stöd av vidare oro i aktiemarknaden har guld fallit tillbaka igen. Nordkoreas vapenskrammel har också fått guld att stiga men senaste tiden har guld pressats av en allt starkare USD och fortsatt frammarsch med räntehöjningar från Fed. Nästa val i raden är Italien som ska vara klart senast i maj nästa år men konsensusbilden verkar vara att det kommer inträffa i april. Just nu verkar Italiensk politik vara utanför marknadens radar då Italiensk statistik varit relativt bra på senaste tiden. Vi ser dock en tydlig risk att italiensk, EU-fientlig politik blossar upp igen i början av nästa år.

Utkonkurrerad av Bitcoin

Under det senaste året har dock guld fått stark konkurrens av bitcoin som alternativ tillgång och motvikt till det etablerade monetära systemet. Bitcoins har stigit på ett vis som inte går att relatera till traditionella risktillgångar och tilltalar delvis en liknande publik som guldinvesterare.

Fed höjer vidare

USA tror vi har mindre betydelse för guld framöver. Fed har genomfört fem höjningar som passerat marknaden utan något problem. Trots Fed:s optimistiska syn på konjunkturen räknar vi med att de finansiella förhållandena försämras framöver. Vår prognos är att Fed slutar höja styrräntan 2018 efter höjning i mars och september, därefter drabbas USA av lågkonjunktur 2019. I det scenariot står guld kvar som en fast tillgång som investerare gillar.

Jordbruk

Under de senaste två åren har vi argumenterat för att riskerna inför skörd skapar en osäkerhet som driver riskpremien för högt och när skörden väl landat i lagerhusen pyser riskpremien ut igen. Temat upprepade sig och vi handlar nu väldigt nära vårt riktmärke för decemberterminen i intervallet mot 160-165 EUR/ton.

Ryssland fortsätter sätta press

Förra året blev Rysslands höga veteexport ett sänke för MATIF-priserna. Det blev en repris i år. Vi ser också en stor sannolikhet för en repris 2018. USA kommer visserligen minska arealen ytterligare med kanske 2-3% efter att ha minskat den med 8,5% i år. Ryssland kommer å andra sidan odla konstant areal och skicket på höstsådda vetet är bättre än vid samma tid förra året. Australiens avkastning blev i år 40% lägre, 1,69 ton/ha mot 2,5 normalt. Vi tror att den skörden kommer normaliseras och sammantaget talar därför utsikterna för 2018 för en repris där decemberterminen förfaller omkring 160 EUR/ton även 2018.

[box]Handelsbankens råvarukommentar är producerad av Handelsbanken och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Ansvarsbegränsning

Handelsbanken Capital Markets, som är en division inom Svenska Handelsbanken AB (publ) (i fortsättningen kallad ”SHB”), är ansvarig för sammanställningen av analysrapporter. I Sverige står SHB under tillsyn av Finansinspektionen, i Norge av norska Finansinspektionen, i Finland av finska Finansinspektionen och i Danmark av danska Finansinspektionen. Alla analysrapporter bygger på information från handels- och statistiktjänster och annan information som SHB bedömt vara tillförlitlig. SHB har emellertid inte själv verifierat informationen och kan inte garantera att informationen är sann, korrekt eller fullständig. I den mån lagen tillåter tar varken SHB, styrelseledamöter, tjänstemän eller medarbetare, eller någon annan person, ansvar för någon som helst förlust, oavsett om den uppstår till följd av användning av en analysrapport eller dess innehåll eller på annat sätt uppstår i anslutning till något i denna.

Analys

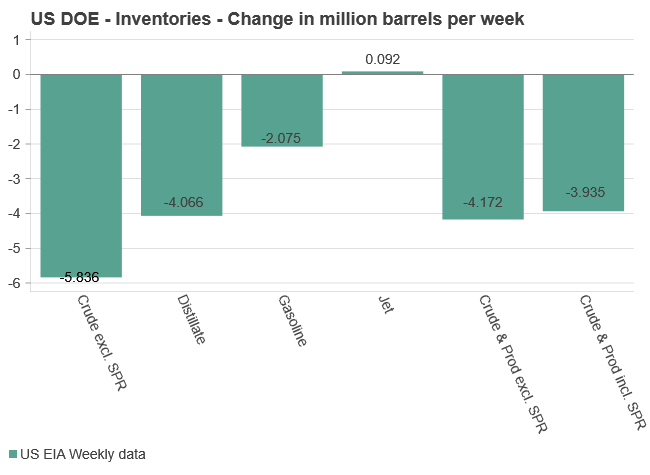

Tightening fundamentals – bullish inventories from DOE

The latest weekly report from the US DOE showed a substantial drawdown across key petroleum categories, adding more upside potential to the fundamental picture.

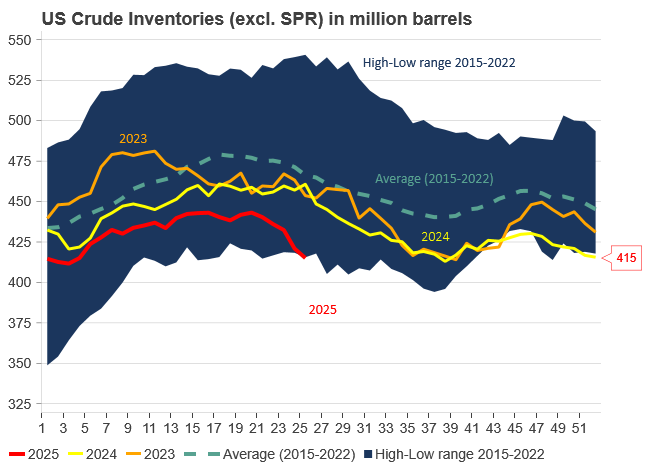

Commercial crude inventories (excl. SPR) fell by 5.8 million barrels, bringing total inventories down to 415.1 million barrels. Now sitting 11% below the five-year seasonal norm and placed in the lowest 2015-2022 range (see picture below).

Product inventories also tightened further last week. Gasoline inventories declined by 2.1 million barrels, with reductions seen in both finished gasoline and blending components. Current gasoline levels are about 3% below the five-year average for this time of year.

Among products, the most notable move came in diesel, where inventories dropped by almost 4.1 million barrels, deepening the deficit to around 20% below seasonal norms – continuing to underscore the persistent supply tightness in diesel markets.

The only area of inventory growth was in propane/propylene, which posted a significant 5.1-million-barrel build and now stands 9% above the five-year average.

Total commercial petroleum inventories (crude plus refined products) declined by 4.2 million barrels on the week, reinforcing the overall tightening of US crude and products.

Analys

Bombs to ”ceasefire” in hours – Brent below $70

A classic case of “buy the rumor, sell the news” played out in oil markets, as Brent crude has dropped sharply – down nearly USD 10 per barrel since yesterday evening – following Iran’s retaliatory strike on a U.S. air base in Qatar. The immediate reaction was: “That was it?” The strike followed a carefully calibrated, non-escalatory playbook, avoiding direct threats to energy infrastructure or disruption of shipping through the Strait of Hormuz – thus calming worst-case fears.

After Monday morning’s sharp spike to USD 81.4 per barrel, triggered by the U.S. bombing of Iranian nuclear facilities, oil prices drifted sideways in anticipation of a potential Iranian response. That response came with advance warning and caused limited physical damage. Early this morning, both the U.S. President and Iranian state media announced a ceasefire, effectively placing a lid on the immediate conflict risk – at least for now.

As a result, Brent crude has now fallen by a total of USD 12 from Monday’s peak, currently trading around USD 69 per barrel.

Looking beyond geopolitics, the market will now shift its focus to the upcoming OPEC+ meeting in early July. Saudi Arabia’s decision to increase output earlier this year – despite falling prices – has drawn renewed attention considering recent developments. Some suggest this was a response to U.S. pressure to offset potential Iranian supply losses.

However, consensus is that the move was driven more by internal OPEC+ dynamics. After years of curbing production to support prices, Riyadh had grown frustrated with quota-busting by several members (notably Kazakhstan). With Saudi Arabia cutting up to 2 million barrels per day – roughly 2% of global supply – returns were diminishing, and the risk of losing market share was rising. The production increase is widely seen as an effort to reassert leadership and restore discipline within the group.

That said, the FT recently stated that, the Saudis remain wary of past missteps. In 2018, Riyadh ramped up output at Trump’s request ahead of Iran sanctions, only to see prices collapse when the U.S. granted broad waivers – triggering oversupply. Officials have reportedly made it clear they don’t intend to repeat that mistake.

The recent visit by President Trump to Saudi Arabia, which included agreements on AI, defense, and nuclear cooperation, suggests a broader strategic alignment. This has fueled speculation about a quiet “pump-for-politics” deal behind recent production moves.

Looking ahead, oil prices have now retraced the entire rally sparked by the June 13 Israel–Iran escalation. This retreat provides more political and policy space for both the U.S. and Saudi Arabia. Specifically, it makes it easier for Riyadh to scale back its three recent production hikes of 411,000 barrels each, potentially returning to more moderate increases of 137,000 barrels for August and September.

In short: with no major loss of Iranian supply to the market, OPEC+ – led by Saudi Arabia – no longer needs to compensate for a disruption that hasn’t materialized, especially not to please the U.S. at the cost of its own market strategy. As the Saudis themselves have signaled, they are unlikely to repeat previous mistakes.

Conclusion: With Brent now in the high USD 60s, buying oil looks fundamentally justified. The geopolitical premium has deflated, but tensions between Israel and Iran remain unresolved – and the risk of missteps and renewed escalation still lingers. In fact, even this morning, reports have emerged of renewed missile fire despite the declared “truce.” The path forward may be calmer – but it is far from stable.

Analys

A muted price reaction. Market looks relaxed, but it is still on edge waiting for what Iran will do

Brent crossed the 80-line this morning but quickly fell back assigning limited probability for Iran choosing to close the Strait of Hormuz. Brent traded in a range of USD 70.56 – 79.04/b last week as the market fluctuated between ”Iran wants a deal” and ”US is about to attack Iran”. At the end of the week though, Donald Trump managed to convince markets (and probably also Iran) that he would make a decision within two weeks. I.e. no imminent attack. Previously when when he has talked about ”making a decision within two weeks” he has often ended up doing nothing in the end. The oil market relaxed as a result and the week ended at USD 77.01/b which is just USD 6/b above the year to date average of USD 71/b.

Brent jumped to USD 81.4/b this morning, the highest since mid-January, but then quickly fell back to a current price of USD 78.2/b which is only up 1.5% versus the close on Friday. As such the market is pricing a fairly low probability that Iran will actually close the Strait of Hormuz. Probably because it will hurt Iranian oil exports as well as the global oil market.

It was however all smoke and mirrors. Deception. The US attacked Iran on Saturday. The attack involved 125 warplanes, submarines and surface warships and 14 bunker buster bombs were dropped on Iranian nuclear sites including Fordow, Natanz and Isfahan. In response the Iranian Parliament voted in support of closing the Strait of Hormuz where some 17 mb of crude and products is transported to the global market every day plus significant volumes of LNG. This is however merely an advise to the Supreme leader Ayatollah Ali Khamenei and the Supreme National Security Council which sits with the final and actual decision.

No supply of oil is lost yet. It is about the risk of Iran closing the Strait of Hormuz or not. So far not a single drop of oil supply has been lost to the global market. The price at the moment is all about the assessed risk of loss of supply. Will Iran choose to choke of the Strait of Hormuz or not? That is the big question. It would be painful for US consumers, for Donald Trump’s voter base, for the global economy but also for Iran and its population which relies on oil exports and income from selling oil out of that Strait as well. As such it is not a no-brainer choice for Iran to close the Strait for oil exports. And looking at the il price this morning it is clear that the oil market doesn’t assign a very high probability of it happening. It is however probably well within the capability of Iran to close the Strait off with rockets, mines, air-drones and possibly sea-drones. Just look at how Ukraine has been able to control and damage the Russian Black Sea fleet.

What to do about the highly enriched uranium which has gone missing? While the US and Israel can celebrate their destruction of Iranian nuclear facilities they are also scratching their heads over what to do with the lost Iranian nuclear material. Iran had 408 kg of highly enriched uranium (IAEA). Almost weapons grade. Enough for some 10 nuclear warheads. It seems to have been transported out of Fordow before the attack this weekend.

The market is still on edge. USD 80-something/b seems sensible while we wait. The oil market reaction to this weekend’s events is very muted so far. The market is still on edge awaiting what Iran will do. Because Iran will do something. But what and when? An oil price of 80-something seems like a sensible level until something do happen.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals växlar spår – satsar fullt ut på guld

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanUppgången i oljepriset planade ut under helgen

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanLåga elpriser i sommar – men mellersta Sverige får en ökning

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanJonas Lindvall är tillbaka med ett nytt oljebolag, Perthro, som ska börsnoteras

-

Analys3 veckor sedan

Analys3 veckor sedanA muted price reaction. Market looks relaxed, but it is still on edge waiting for what Iran will do

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOljan, guldet och marknadens oroande tystnad

-

Analys4 veckor sedan

Analys4 veckor sedanVery relaxed at USD 75/b. Risk barometer will likely fluctuate to higher levels with Brent into the 80ies or higher coming 2-3 weeks

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanDomstolen ger klartecken till Lappland Guldprospektering