Analys

US crude oil 2018 production forecast by EIA still too low

Price action – Higher on Nigeria strike, Fortis pipeline outage, lower oil rig count, softer USD and positive equities

Price action – Higher on Nigeria strike, Fortis pipeline outage, lower oil rig count, softer USD and positive equities

Brent crude is gaining 0.9% this morning as it climbs to $63.8/b along with a 0.2% softer USD index and positive equity gains. A part of the positive oil price drive today is the Nigerian oil union declaring a strike as they protest against unfair labour practices thus posing a risk to Nigeria’s production of 1.7 mb/d. The Fortis pipeline carrying xxx kb/d is still off-line with the operator declares force majeure as it expects repairs of the hairline will take some 2-4 weeks. The key concern is that there might be a wider problem stretching along the whole pipeline. If the reason for the current crack is the higher sulphur content in the Buzzard crude flowing in the Fortis crude stream and sulphide corrosion as a consequence of this then the outage of the pipe could be much, much longer. The pipe carries some 450 kb/d and thus a major share of the physical supply into the Brent spot market. A decline of 2 US oil rigs last week adds some support on the margin.

Crude oil comment – US crude oil 2018 production forecast by EIA still too low

Later today we’ll have the monthly update from the US EIA on shale oil drilling productivity in the US. We expect the EIA to revise its productivity as well as its production higher. Their last productivity report had data points to Dec 2017. We expect the EIA to show that the strong production growth of on average 91 kb/d/mth from July to December this year stays intact at around 90 kb/d/mth also in January and also that well completions continued to rise also in November as they have done every month since January this year.

We do not think that the EIA update later today will necessarily hit the Brent crude oil price bearishly. More likely we expect the Brent to WTI price spread to widen further on the back of such news.

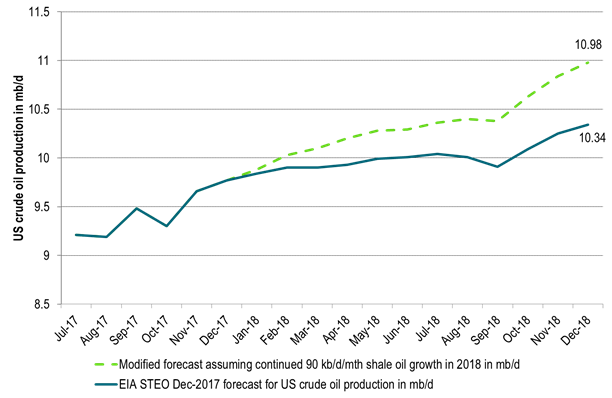

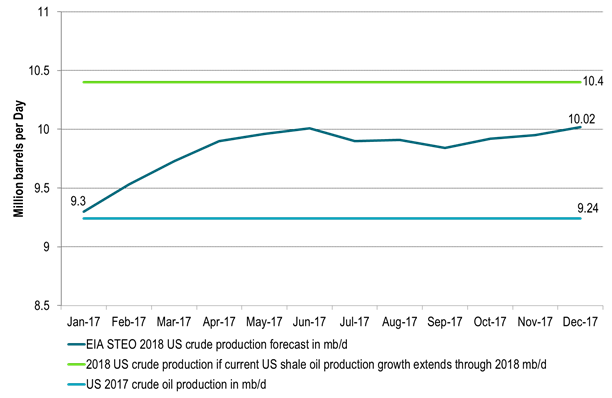

The US EIA last Tuesday adjusted its 2018 forecast for US crude oil production upwards from 9.95 mb/d to an average of 10.02 mb/d thus growing 0.78 mb/d y/y to 2018. The increase in forecast of 70 kb/d was the third upwards revision in three months. We still think that the US EIA is significantly behind the curve in terms of its projections for US crude oil production for 2018. As such we expect the US EIA to continue to revise its projection for 2018 higher in the months to come until it reaches at least an average crude oil production of around 10.4 mb/d for 2018.

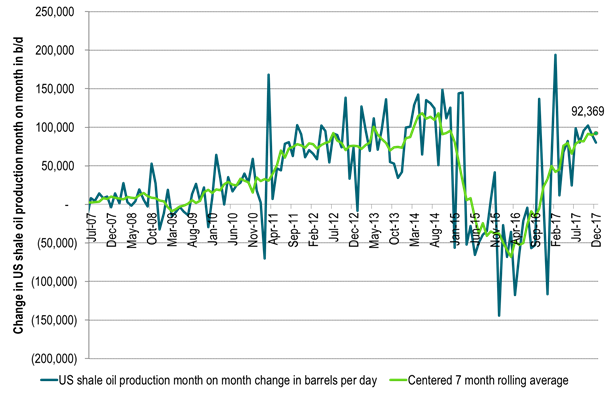

US shale oil production growth is currently running at some 90 kb/d/mth. That is the exit shale oil growth rate for 2017 while the average growth rate from July to December has been 91 kb/d/mth. The implied marginal, annualized production growth rate is thus currently running at 1.1 mb/d/yr. The US EIA is however assuming that US shale oil production will only grow by some 37 kb/d/mth in 2018. That is 40% lower than the current growth rate in shale oil production. From Dec-17 to Dec-18 the EIA projects that US lower 48 (ex GoM) will grow by only 440 kb/d. If we instead apply the current 90 kb/d/mth growth rate through 2018 then L48 ex GoM would grow by 1.1 mb/d from Dec-17 to Dec-18.

If we extrapolate the current shale oil production growth rate through 2018 it would lead US crude oil production to exit 2018 at 11 mb/d versus EIA’s forecast of 10.34 mb/d. If we include NGLs, Bio-fuels and refinery gains it would lift total US liquids production to close to 18 mb/d in December 2018 and drive total US liquids production growth to 1.7 mb/d y/y Dec-17 to Dec-18.

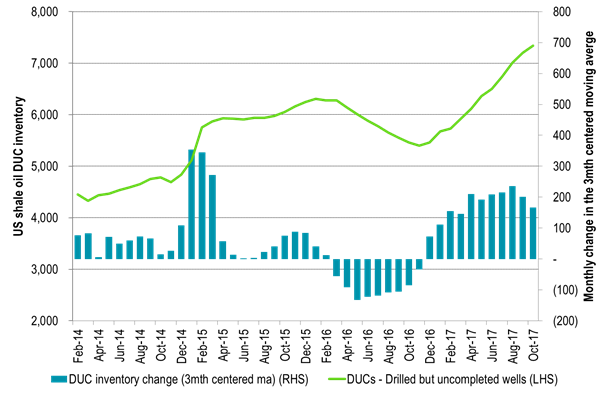

US shale oil well completions is still rising (+35 wells m/m in October), the drilled but uncompleted numbers of wells is still rising and oil prices have been on a constant trend upwards since mid-June . So if anything the current trend is for stronger US shale oil production growth month/month in the months ahead and not at all the sudden drop-off in shale oil production growth which the EIA predicts for 1Q18 where they expect a monthly average growth rate of only 23 kb/d/mth.

We think that one of the key reasons for why the US EIA has a too low production growth target for 2018 is due to the build-up in the DUC (Drilled but uncompleted wells) inventory which gives an impression of declining shale oil volume productivity. This decline in volume productivity is in our view not real. In our calculations we see US shale oil volume drilling productivity has continued to tick higher even though now mostly sideways. But at least we do not see productivity in decline as the official headline numbers indicate.

There is a lot of focus on a shift in investor focus from rewarding production growth and now instead demanding profits. This could possibly change shale oil producer behaviour and as such lead to softer US shale oil production growth than indicated above.

In our view such a shift should primarily hit drilling rather than completions as the shale oil companies have a huge stack of uncompleted wells which they can convert to oil and money in 2018. They can ease back on the drilling and continue to ramp up completions. Completions have been trailing drilling for a full year now. If shale oil companies pull back on investments then this should switch around in 2018 to a situation where drilling is lower than completions while spending on completions continues at a high level and drilling at a lower. Completions in 2018 could run some 20% above the Jan to Oct average completion level of 2017.

In terms of capex spending we had news last week that Keane Group, one of the largest pure-play providers of US shale completion services yesterday announced that they will order three new frac fleets on top of their existing 26. The order is a response to robust 2018 US shale oil investments announced latest weeks. Completions are the thing for 2018 which means more shale oil production.

Ch1: US shale oil production growth is exiting 2017 at a rate of about 90 kb/d/mth (1.1 mb/d on a marginal annualized rate)

It is now growing as strongly as it did through 2012 and 2013

Ch2: If US shale oil production grows in 2018 as it exits 2017 (~90 kb/d/mth) then total US crude production will grow by 1.1 mb/d y/y to 10.4 mb/d y/y

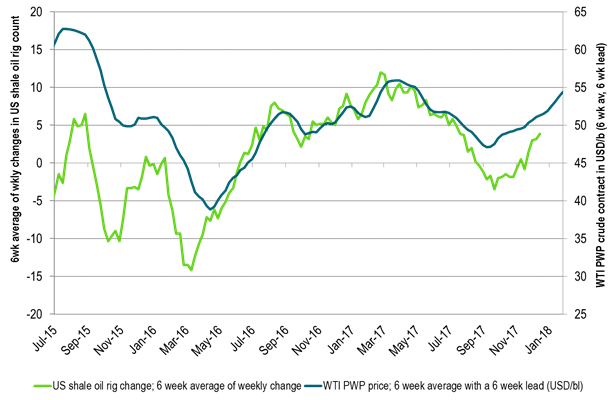

Ch3: The Production Weighting Price (PWP) of a new shale oil well with a 6 week lead has moved higher since Sep

If history is anything to go by then US shale oil action will increase in response. Drilling and or completions

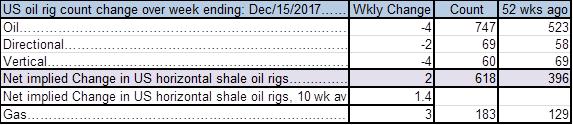

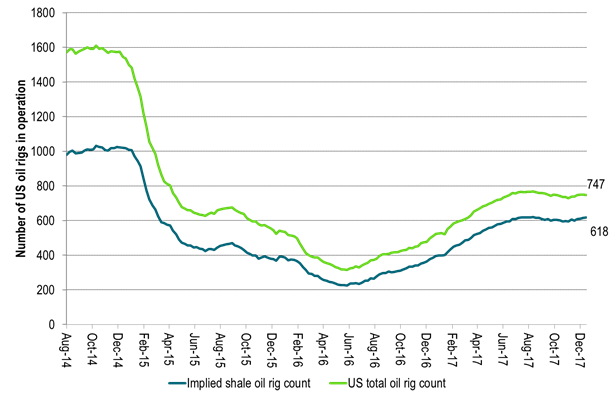

Ch4: US oil rig count moved down 4 last week but implied shale oil rigs increased by 2

US oil rig count is up by 22 over the last 5 weeks which is 17 rigs shy of the level in August

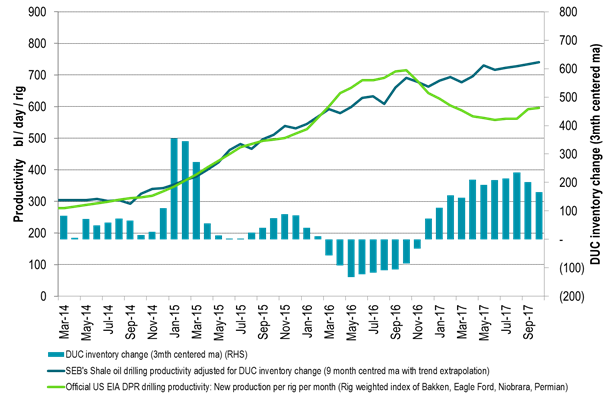

Ch5: The mirage of declining shale oil productivity created from the large build-up in DUCs (uncompleted wells)

The official US shale oil productivity was running higher than our estimate during the DUC draw down in 2016.

It is running way below our productivity estimate in 2017 during a huge build up in the DUC inventory during 2017.

As the DUC inventory eventually draws down the official productivity will again be running above our estimate

Ch6: A lot of uncompleted wells to complete in 2018!!

The DUC inventory was still BUILDING in October (the last data point)

So drilling new wells can decline a lot in 2018 while completions can increase some 20% y/y

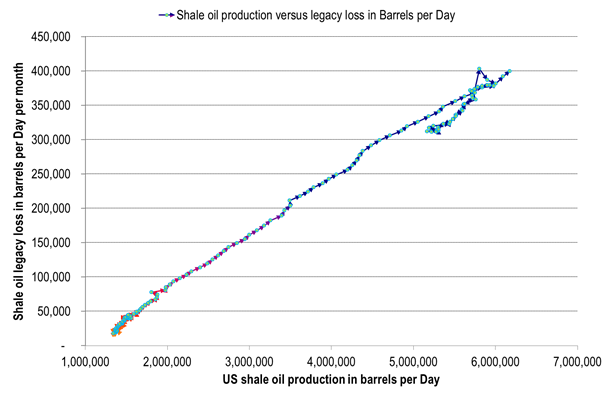

Ch7: No top-down sign that US shale oil resources are deteriorating as losses in existing production stays on scale to production level

No top-down sign as of yet of run-away losses in existing production versus production level

Ch8: US EIA crude oil production forecast likely to be lifted further up towards 10.4 mb/d

EIA lifting it forecast 3 mths in a row

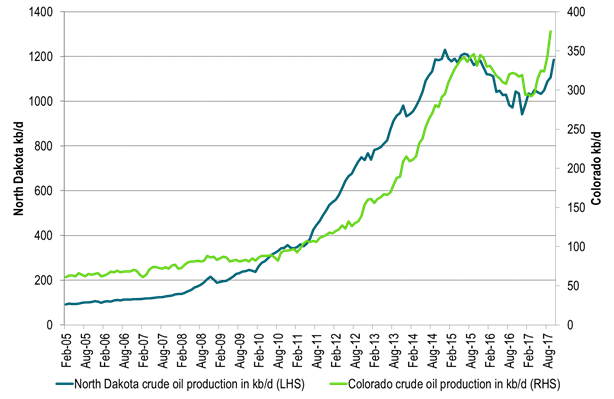

Ch9: Volume wise there are good shale oil days in both Colorado and Bakken North Dakota these days

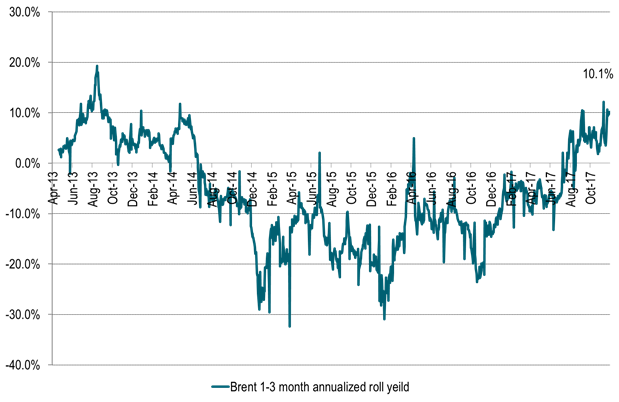

Ch10: Annualized 1-3 mth Brent backwardation fully funded roll-yield of 10% pa

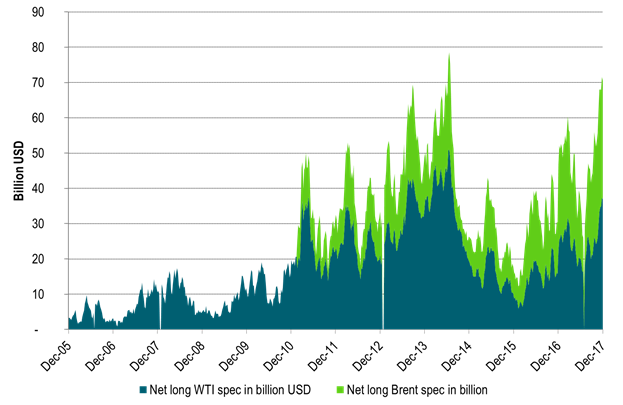

Ch11: The positive roll-yield in Brent continues to suck in more long spec into both Brent and WTI front end crude’

Kind regards

Bjarne Schieldrop

Chief analyst, Commodities

SEB Markets

Merchant Banking

Analys

Diesel concerns drags Brent lower but OPEC+ will still get the price it wants in Q3

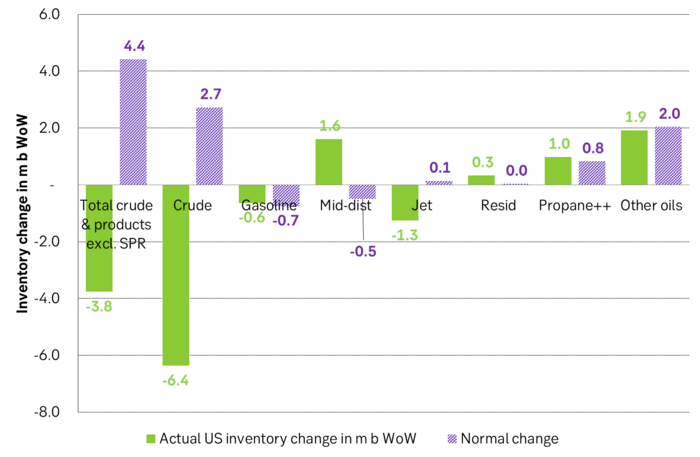

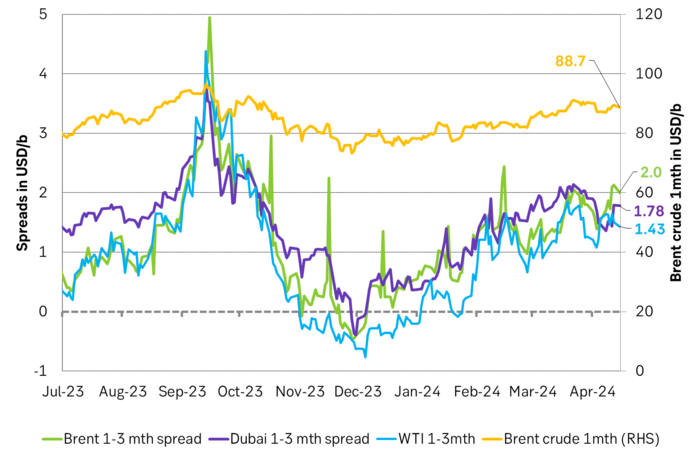

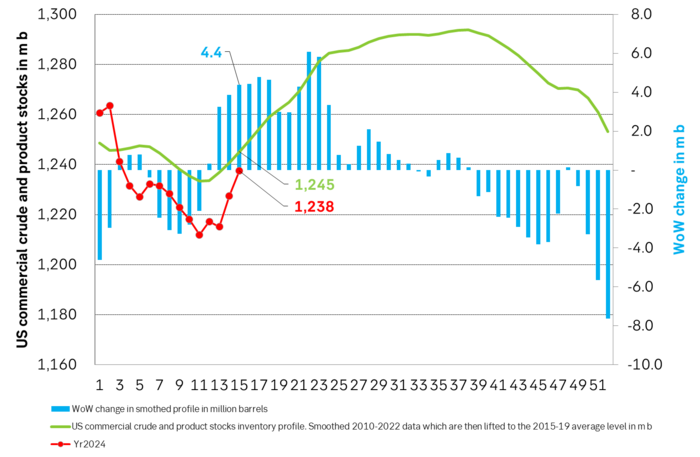

Brent rallied 2.5% last week on bullish inventories and bullish backdrop. Brent crude gained 2.5% last week with a close of the week of USD 89.5/b which also was the highest close of the week. The bullish drivers were: 1) Commercial crude and product stocks declined 3.8 m b versus a normal seasonal rise of 4.4 m b, 2) Solid gains in front-end Brent crude time-spreads indicating a tight crude market, and 3) A positive backdrop of a 2.7% gain in US S&P 500 index.

Brent falling back 1% on diesel concerns this morning. But positive backdrop may counter it later. This morning Brent crude is pulling back 0.9% to USD 88.7/b counter to the fact that the general backdrop is positive with a weaker USD, equity gains both in Asia and in European and US futures and not the least also positive gains in industrial metals with copper trading up 0.4% at USD 10 009/ton. This overall positive market backdrop clearly has the potential to reverse the initial bearish start of the week as we get a little further into the Monday trading session.

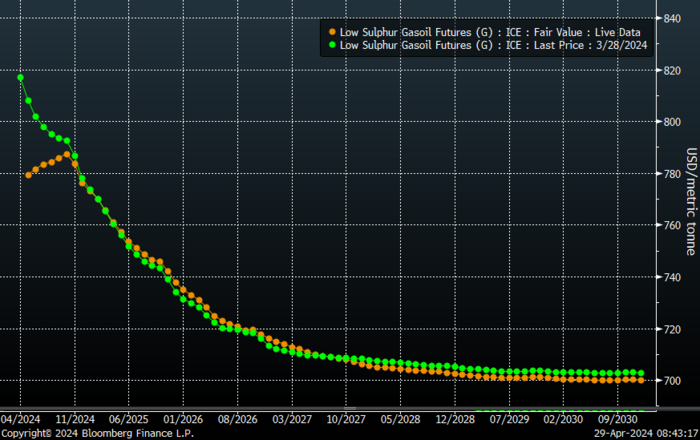

Diesel concerns at center stage. The bearish angle on oil this morning is weak diesel demand with diesel forward curves in front-end contango and predictions for lower refinery runs in response this down the road. I.e. that the current front-end strength in crude curves (elevated backwardation) reflecting a current tight crude market will dissipate in not too long due to likely lower refinery runs.

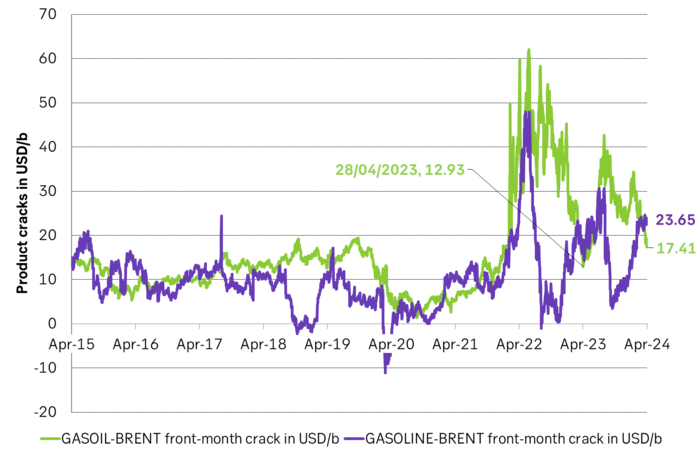

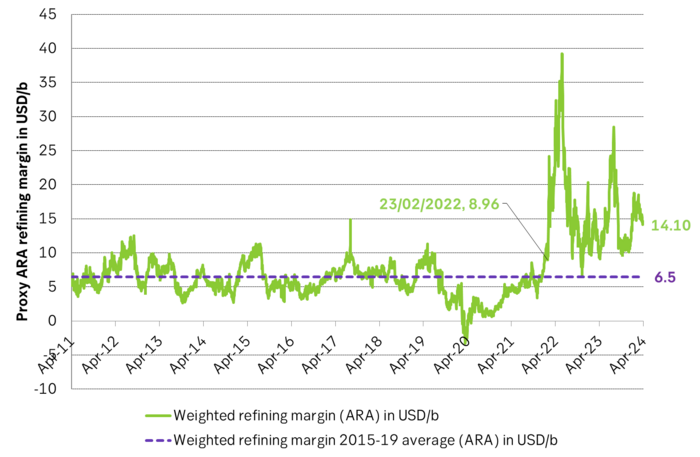

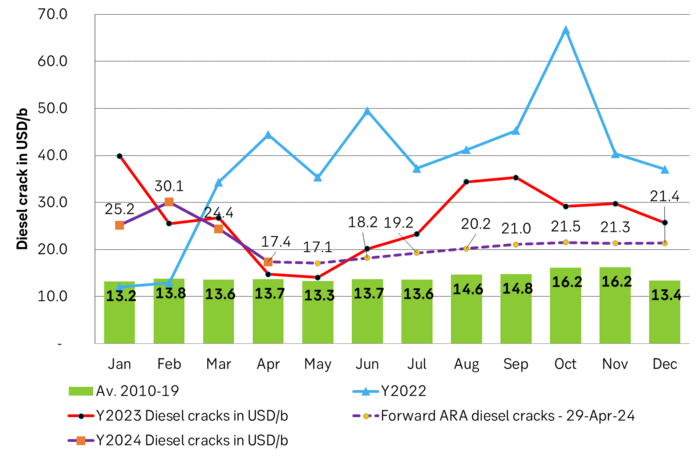

But gasoline cracks have rallied. Diesel weakness is normal this time of year. Overall refining margin still strong. Lots of focus on weakness in diesel demand and cracks. But we need to remember that we saw the same weakness last spring in April and May before the diesel cracks rallied into the rest of the year. Diesel cracks are also very seasonal with natural winter-strength and likewise natural summer weakness. What matters for refineries is of course the overall refining margin reflecting demand for all products. Gasoline cracks have rallied to close to USD 24/b in ARA for the front-month contract. If we compute a proxy ARA refining margin consisting of 40% diesel, 40% gasoline and 20% bunkeroil we get a refining margin of USD 14/b which is way above the 2015-19 average of only USD 6.5/b. This does not take into account the now much higher costs to EU refineries of carbon prices and nat gas prices. So the picture is a little less rosy than what the USD 14/b may look like.

The Russia/Ukraine oil product shock has not yet fully dissipated. What stands out though is that the oil product shock from the Russian war on Ukraine has dissipated significantly, but it is still clearly there. Looking at below graphs on oil product cracks the Russian attack on Ukraine stands out like day and night in February 2022 and oil product markets have still not fully normalized.

Oil market gazing towards OPEC+ meeting in June. OPEC+ will adjust to get the price they want. Oil markets are increasingly gazing towards the OPEC+ meeting in June when the group will decide what to do with production in Q3-24. Our view is that the group will adjust production as needed to gain the oil price it wants which typically is USD 85/b or higher. This is probably also the general view in the market.

Change in US oil inventories was a bullish driver last week.

Crude oil time-spreads strengthened last week

ICE gasoil forward curve has shifted from solid backwardation to front-end contango signaling diesel demand weakness. Leading to concerns for lower refinery runs and softer crude oil demand by refineries down the road.

ARA gasoline crack has rallied towards while Gasoil crack has fallen back. Not a totally unusual pattern.

Proxy ARA refining margin with 40% gasoil crack, 40% gasoline crack and 20% bunker oil crack.

ARA diesel cracks saw the exact same pattern last year. Dipping low in April and May before rallying into the second half of the year. Diesel cracks have fallen back but are still clearly above normal levels both in spot and on the forward curve. I.e. the ”Russian diesel stress” hasn’t fully dissipated quite yet.

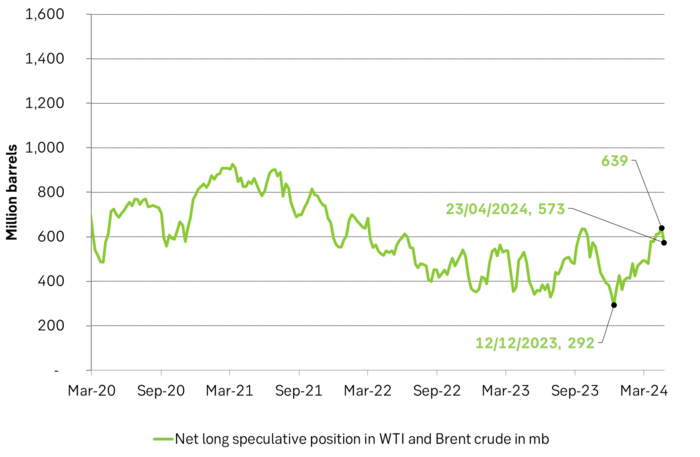

Net long specs fell back a little last week.

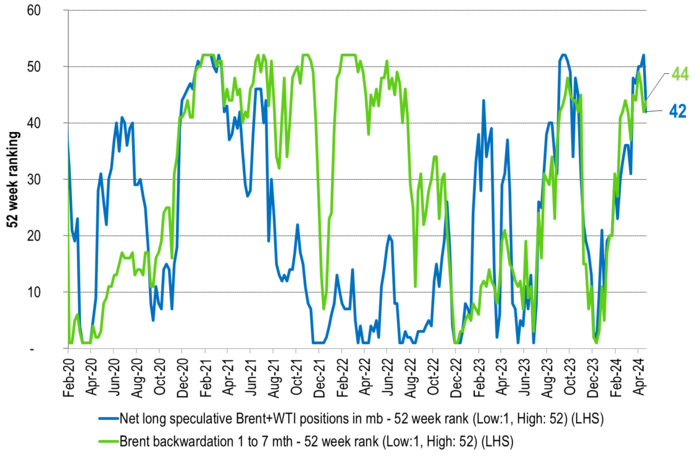

52-week ranking of net long speculative positions in Brent and WTI as well as 52-week ranking of the strength of the Brent 1-7 mth backwardation

Analys

’wait and see’ mode

So far this week, Brent Crude prices have strengthened by USD 1.3 per barrel since Monday’s opening. While macroeconomic concerns persist, they have somewhat abated, resulting in muted price reactions. Fundamentals predominantly influence global oil price developments at present. This week, we’ve observed highs of USD 89 per barrel yesterday morning and lows of USD 85.7 per barrel on Monday morning. Currently, Brent Crude is trading at a stable USD 88.3 per barrel, maintaining this level for the past 24 hours.

Additionally, there has been no significant price reaction to Crude following yesterday’s US inventory report (see page 11 attached):

- US commercial crude inventories (excluding SPR) decreased by 6.4 million barrels from the previous week, standing at 453.6 million barrels, roughly 3% below the five-year average for this time of year.

- Total motor gasoline inventories decreased by 0.6 million barrels, approximately 4% below the five-year average.

- Distillate (diesel) inventories increased by 1.6 million barrels but remain weak historically, about 7% below the five-year average.

- Total commercial petroleum inventories (crude + products) decreased by 3.8 million barrels last week.

Regarding petroleum products, the overall build/withdrawal aligns with seasonal patterns, theoretically exerting limited effect on prices. However, the significant draw in commercial crude inventories counters the seasonality, surpassing market expectations and API figures released on Tuesday, indicating a draw of 3.2 million barrels (compared to Bloomberg consensus of +1.3 million). API numbers for products were more in line with the US DOE.

Against this backdrop, yesterday’s inventory report is bullish, theoretically exerting upward pressure on crude prices.

Yet, the current stability in prices may be attributed to reduced geopolitical risks, balanced against demand concerns. Markets are adopting a wait-and-see approach ahead of Q1 US GDP (today at 14:30) and the Fed’s preferred inflation measure, “core PCE prices” (tomorrow at 14:30). A stronger print could potentially dampen crude prices as market participants worry over the demand outlook.

Geopolitical “risk premiums” have decreased from last week, although concerns persist, highlighted by Ukraine’s strikes on two Russian oil depots in western Russia and Houthis’ claims of targeting shipping off the Yemeni coast yesterday.

With a relatively calmer geopolitical landscape, the market carefully evaluates data and fundamentals. While the supply picture appears clear, demand remains the predominant uncertainty that the market attempts to decode.

Analys

Also OPEC+ wants to get compensation for inflation

Brent crude has fallen USD 3/b since the peak of Iran-Israel concerns last week. Still lots of talk about significant Mid-East risk premium in the current oil price. But OPEC+ is in no way anywhere close to loosing control of the oil market. Thus what will really matter is what OPEC+ decides to do in June with respect to production in Q3-24 and the market knows this very well. Saudi Arabia’s social cost-break-even is estimated at USD 100/b today. Also Saudi Arabia’s purse is hurt by 21% US inflation since Jan 2020. Saudi needs more money to make ends meet. Why shouldn’t they get a higher nominal pay as everyone else. Saudi will ask for it

Brent is down USD 3/b vs. last week as the immediate risk for Iran-Israel has faded. But risk is far from over says experts. The Brent crude oil price has fallen 3% to now USD 87.3/b since it became clear that Israel was willing to restrain itself with only a muted counter attack versus Israel while Iran at the same time totally played down the counterattack by Israel. The hope now is of course that that was the end of it. The real fear has now receded for the scenario where Israeli and Iranian exchanges of rockets and drones would escalate to a point where also the US is dragged into it with Mid East oil supply being hurt in the end. Not everyone are as optimistic. Professor Meir Javedanfar who teaches Iranian-Israeli studies in Israel instead judges that ”this is just the beginning” and that they sooner or later will confront each other again according to NYT. While the the tension between Iran and Israel has faded significantly, the pain and anger spiraling out of destruction of Gaza will however close to guarantee that bombs and military strifes will take place left, right and center in the Middle East going forward.

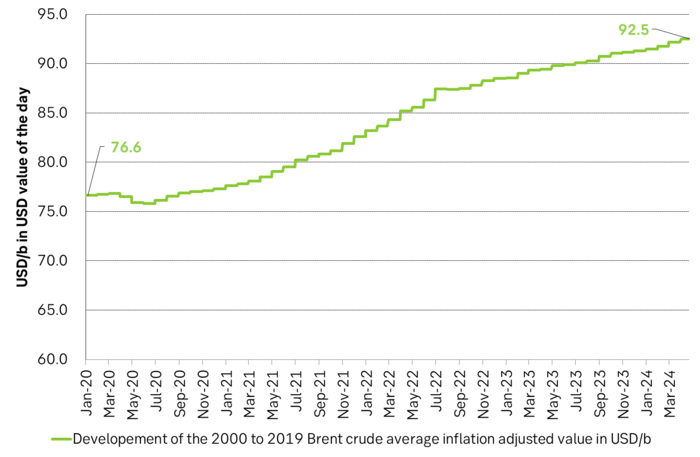

Also OPEC+ wants to get paid. At the start of 2020 the 20 year inflation adjusted average Brent crude price stood at USD 76.6/b. If we keep the averaging period fixed and move forward till today that inflation adjusted average has risen to USD 92.5/b. So when OPEC looks in its purse and income stream it today needs a 21% higher oil price than in January 2020 in order to make ends meet and OPEC(+) is working hard to get it.

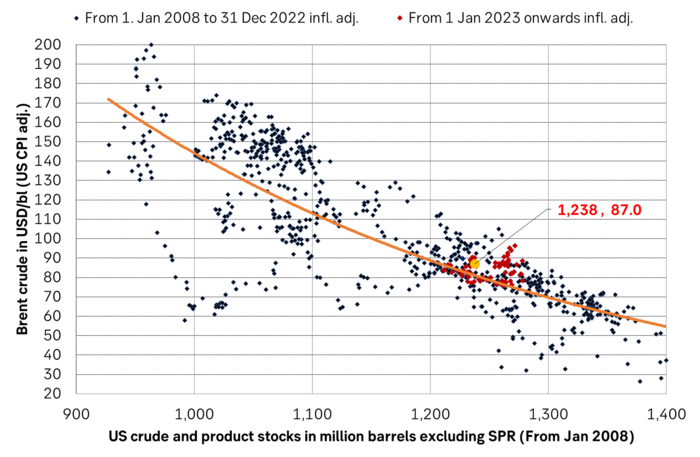

Much talk about Mid-East risk premium of USD 5-10-25/b. But OPEC+ is in control so why does it matter. There is much talk these days that there is a significant risk premium in Brent crude these days and that it could evaporate if the erratic state of the Middle East as well as Ukraine/Russia settles down. With the latest gains in US oil inventories one could maybe argue that there is a USD 5/b risk premium versus total US commercial crude and product inventories in the Brent crude oil price today. But what really matters for the oil price is what OPEC+ decides to do in June with respect to Q3-24 production. We are in no doubt that the group will steer this market to where they want it also in Q3-24. If there is a little bit too much oil in the market versus demand then they will trim supply accordingly.

Also OPEC+ wants to make ends meet. The 20-year real average Brent price from 2000 to 2019 stood at USD 76.6/b in Jan 2020. That same averaging period is today at USD 92.5/b in today’s money value. OPEC+ needs a higher nominal price to make ends meet and they will work hard to get it.

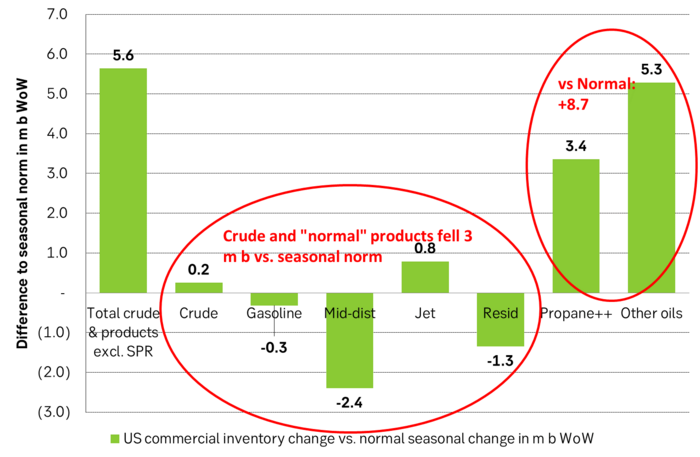

Inflation adjusted Brent crude price versus total US commercial crude and product stocks. A bit above the regression line. Maybe USD 5/b risk premium. But type of inventories matter. Latest big gains were in Propane and Other oils and not so much in crude and products

Total US commercial crude and product stocks usually rise by 4-5 m b per week this time of year. Gains have been very strong lately, but mostly in Propane and Other oils

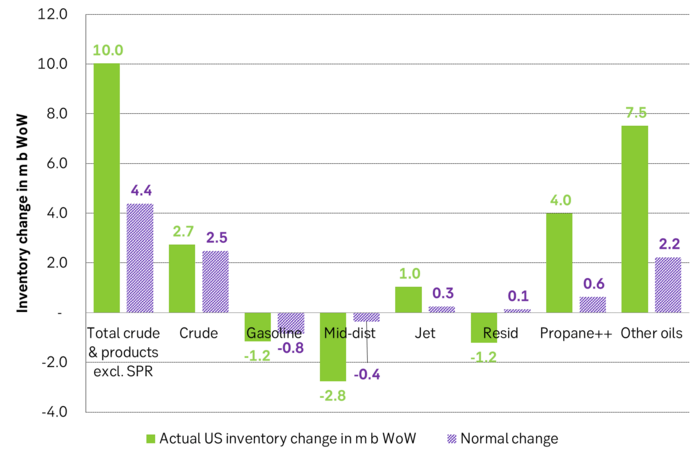

Last week’s US inventory data. Big rise of 10 m b in commercial inventories. What really stands out is the big gains in Propane and Other oils

Take actual changes minus normal seasonal changes we find that US commercial crude and regular products like diesel, gasoline, jet and bunker oil actually fell 3 m b versus normal change.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanFortum och Vargön Alloys tecknar femårigt avtal om kärnkraftsel

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanOljan letar efter en högre botten

-

Analys3 veckor sedan

Analys3 veckor sedanBrace for Covert Conflict

-

Analys2 veckor sedan

Analys2 veckor sedanAlso OPEC+ wants to get compensation for inflation

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanElpriset fortsätter att sjunka – halverade priser i april jämfört med 2023

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanAI ökar det totala elbehovet i USA med 100 % kommande 15 år

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanKaffepriserna rör på sig

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanBörsveckan ger en köprekommendation till aktien i oljeservicebolaget Beerenberg