Nyheter

Is gold good or not?

Central banks are confusing investors, most likely they are confusing themselves

The central banks in the world play a funny role in the world of gold. As I have pointed out in my last month’s issue, they officially still abide by the important function of gold as an important element of global monetary reserves. They have owned gold throughout history, some more than others, but during the recent years, they have been generally on the sell-side of the market. Opposed to the almost blind belief in the shiny yellow metal that ever characterized the central banks, in modern times that belief was often questioned by politicians who saw the gold reserves as only dead money, not bringing any return on capital at all.

Amazing in this respect was that these sounds were particularly heard in times when the gold price was not a subject of excitement as for instance in the later 1990’s. It is a fact that most selling of gold by the central banks was done at prices that should make those politicians and bankers ashamed of themselves now. In this respect, it is noteworthy to quote a few things that George Osborne, the U.K. Chancellor of the Exchequer (what a beautiful name for a Minister of Finance!), said in his 2012 budget speech: ”Gordon Brown’s sale of 400 tons of gold in 1999 has cost the United Kingdom GBP11 billion”. The decision to sell the gold was ”. . . one of the worst economic judgements ever made by a chancellor.” Brown was Chancellor of the Exchequer under the then ruling Labour Party.

Osborne’s dig at the opposition Labour Party during his March 21 budget speech led to an uproar in House of Commons. He also announced the Treasury is getting back into bullion. ”We are also taking the opportunity to rebuild Britain’s reserves, which had fallen to historically low levels”, said Osborne, ”I can confirm our gold holdings have risen in value to £11 billion. This does not include the 400 or so tonnes of gold sold a decade ago for £2 billion, and which would now be worth six times that at over £13 billion pounds.”

I would like to comment that of course, it seems not too difficult to blame Gordon Brown now in full hindsight. As politicians have come to use the phrase ”with the knowledge we have today…….” whenever they are making those easy statements, mostly for their political glory, they tend to come away with them this way.

In another news item, quite a remarkable statement appeared. The IMF, the mother of all central banks, usually doesn’t say much about gold. But early this week, they made a statement about their expectation that commodity prices will suffer as a result of the global economy remaining weak. Although it was generally expected that Spain would have difficulty in selling their 10-year bonds, the news came yesterday that it had succeeded to do so, albeit at a high interest rate. For the time being, its threatening insolvency has been turned off. I like to remind you that also with Greece, solutions were found that later proved not be real solutions. Let’s see how it will go with Spain.

Under the precarious circumstances of a global credit crisis, investors are facing less and less possibilities to find a safe haven for their money. The IMF believes that high rated government securities will be the largest safe haven choice. But it said in its recent World Economic Outlook that it also recognizes gold as a safe haven. The IMF report states, ”In the future, there will be rising demand for safe assets, but fewer of them will be available, increasing the price for safety in global markets. In principle, investors evaluate all assets based on their intrinsic characteristics”. Translated in plain words: they said that investors will be increasingly pursuing safe havens that do not carry counter-party risk. Gold and silver are about the only assets that fit that description perfectly.

When I talked to some fellow gold watchers at the Precious Metals Summit in Geneva last week, I noticed that some recent significant news apparently did not reach the world outside of our small country. Last month, the Dutch central bank lost a dispute in court that was initiated by one of our pension funds. The verdict made very clear that the central bank’s function as watch dog over the country’s pension funds’ investment policies has its limits. In 2010, the central bank had signalled that the Verenigde Glasfabrieken (United Glass) pension fund had invested 13% of its portfolio in gold.

The central bank deemed it necessary to tell the pension fund that it didn’t like what it saw and urged the fund to sell part of its gold holdings, stating it found the investment of 13% of the fund’s investments in gold too risky. In the central bank’s vision, a gold holding should not exceed 1 to 3% of the fund’s portfolio. The consequence of these directed-from-above gold sales was that the fund could not benefit from the significant rise of the gold price as it had expected and missed the opportunity to add another €12 million in value. It therefore decided to take the central bank to court. The recent verdict of the court did not leave any doubts. It judged that central bank had no issue in interfering with the fund’s choice to invest this portion of its portfolio in gold! The court added that the central bank’s argumentation that ”no other pension fund was investing in the same way as the Verenigde Glas was investing in gold” missed any substantial grounds.

I think I don’t have to say that in my opinion, the court’s verdict is a rightful one. But this case also brings out another point of value. The Dutch central bank may not like to see a pension fund to put 13% of its holdings in gold, but it said that between 1 and 3% would be alright. Can you imagine what it would mean if and when pension funds in general would invest that percentage in gold? It would make the prediction of Shayne McGuire that gold could reach €10,000 per ounce feasible and come true easily.

At the moment I am writing this, today’s newspaper comes in. The financial pages have an article on the vision of our central bank on the lasting impact of the currency crisis to our economy. It included ”the outlook for financial stability in the Netherlands is worrying…..” and ”Dutch pension funds are deeply underwater”. They need €90bn in extra funding to meet future obligations, and $200bn to restore buffers….”. I could not help smiling when I was reading this. It prompted me to think that if our central bank would not have taken its unnecessarily prudent stance on gold in 2010 and instead, would have allowed and maybe even stimulated the pension funds to invest part of their portfolio in gold some time ago, then first of all, there would not have been this not very flattering court verdict and more important, the pension funds would have been in much better shape. But that is probably asking for too much………..?!

Next week we may have a better insight in how the world’s financial situation can be helped and organized to solve some of the international problems. This weekend, the G20 are together in the spring meeting of the IMF in Washington. There could be a decision to bring the European fund for emergencies over the desired €1,000 billion although it is more likely that the final decision will be postponed until the next top meeting, to be held in Mexico in June. Not all the countries that are needed to contribute are ready to render their decision on how much they will chip in.

Whatever the result of the Washington meeting will be, fact is that money, much money will be needed to prevent several European countries to slide into some kind of bankruptcy. On all fronts, governments have to cut their costs and expenses, stringent measures have to be taken in their economies, wages have to be controlled, tax laws have to be reformed, foreign aid will be cut (instead they should be re-evaluated and reorganized), cultural subsidies will be victimized, and very importantly, something should be invented to help their citizens to control their debt situations.

The situation looks dim when it comes to Europe, yet it is the main subject of current attention and conversation. But how about the United States? I hope we have not forgotten about their total debt of over $14,300 billion. How can they ever get out of that? How ”United” the States are when it comes to a countrywide effort to overcome these financial woes, was shown last week when the Republicans torpedoed Obama’s proposal for the ’Buffett tax’. As long as the many American millionaires and billionaires continue to pay less taxes than their secretaries, how can the United States ever adopt a healthy financial household on the government level? Did I hear anyone say something about ”printing money”…….?

Last week, I was attending the Precious Metals Summit in Geneva. Around 100 exploration companies presented their cases to a prime selection of European professional investors. You can imagine how much information was brought to the attendees and as the presentations were held simultaneously in two rooms, it was only possible to listen to half of the companies. So choices had to be made. Fortunately, the event website supplies the links to all the companies that were presenting (www.precioussummit.com) which makes it possible for you to select and absorb all the company presentation in the leisure of your office or home. I tell you, it is worth digging, there are some real treasures to be found….. The Precious Metals Summit was kicked off by a presentation on

[quote]The European Crisis and Implications for Gold[/quote]

by my old (in time, not in age….) friend Martin Murenbeeld, who remains to be one of the most worthwhile speakers to listen to. He always has a solid story, explaining what is happening and how he sees the outlook of economies, money and gold. From his presentation, I just highlight some of his ever remarkable thoughts:

- Europe is in for quite a period of dark clouds and thunderstorms. Martin sees it lead to a kind of split-up between the stronger and the weaker countries. In particular, the countries in southern Europe will continue to get weaker, despite all the measures of help from outside. They will remain and get even more uncompetitive, illustrated by his frightening chart on the current unemployment rate in Spain, even exceeding the one of Greece, and to a bit lesser extent, Portugal. The question about the Eurozone scenario is not whether we will see a break-up but whether it will be an orderly or disorderly break-up. A lot if not everything will depend on what the ECB and the IMF collectively will work out to prevent Portugal, Spain and Italy to follow Greece;

- there needs to be very little doubt whether the governments have re-commenced to put their money-printing facilities at work. The United States, the United Kingdom and the ECB have certainly printed (are printing would probably be a better description) whereas others at least look suspicious;

- Murenbeeld is convinced that sooner or later, there will be two kinds of Euro’s, one for the stronger countries (including Germany, France, the Netherlands and Finland) and one for the weaker countries, each with its own value;

- as to the implications for gold, Murenbeeld paints three different scenarios with weighted average price forecasts as follows:

I suggest you study his whole slide presentation at www.precioussummit.com and make your own evaluation. If you want to find more of his work, you can follow him at www.dundeewealtheconomics.com.

Avino Silver & Gold Mines Ltd

NYSE-AMEX, TSXV:ASM – price April 21: C$1.80 shares outstanding: 27.0 million, fully diluted: 34.9 million

The Avino mine near Durango, Mexico, has been known as ”Mountain of Silver” for over 500 (!) years. The Avino Ltd. acquired the project in 1974 and produced 16 million ounces of silver, 96,000 ounces of gold and 24 million lbs of copper during 27 years. In those years, Avino as a company only had a 50% interest. Operations ceased in 2001 when its key custom smelter closed and world market prices made mining uneconomic at $4 per ounce silver. In 2006, new management, headed by David Wolfin, who succeeded his father, mining legend Louis Wolfin, made new plans, also stimulated by the increasing silver prices. Full control of the Avino mine was acquired, exploration started at high potential areas, 30,000 meters of drilling, re-furbishing the facilities and raising $13 million between 2003 and 2006 and another $10 million in 2010. With a capacity of 250tpd, milling started in late August 2010. Current capacity is 1250tpd on two separate circuits and by achieving full commercial production at the San Gonzalo resource, reprocessingthe rich tailings resource from the past and resuming production at the main Avino vein, the company is aiming to become a multimillion ounce silver producer in the next 3 to 4 years.

The Avino mine near Durango, Mexico, has been known as ”Mountain of Silver” for over 500 (!) years. The Avino Ltd. acquired the project in 1974 and produced 16 million ounces of silver, 96,000 ounces of gold and 24 million lbs of copper during 27 years. In those years, Avino as a company only had a 50% interest. Operations ceased in 2001 when its key custom smelter closed and world market prices made mining uneconomic at $4 per ounce silver. In 2006, new management, headed by David Wolfin, who succeeded his father, mining legend Louis Wolfin, made new plans, also stimulated by the increasing silver prices. Full control of the Avino mine was acquired, exploration started at high potential areas, 30,000 meters of drilling, re-furbishing the facilities and raising $13 million between 2003 and 2006 and another $10 million in 2010. With a capacity of 250tpd, milling started in late August 2010. Current capacity is 1250tpd on two separate circuits and by achieving full commercial production at the San Gonzalo resource, reprocessingthe rich tailings resource from the past and resuming production at the main Avino vein, the company is aiming to become a multimillion ounce silver producer in the next 3 to 4 years.

I know Avino and their management since long. I already covered the company when they were an appreciated silver producer. I am really pleased to see them back in shape, back to the production stage and back as a Supporting Company. It will be interesting to see them achieve their goals.

Coral Gold Resources Ltd

TSXV:CLH – price April 21: C$0.37 shares outstanding: 33.0 million, fully diluted: 43.2 million

Coral Gold belongs, like Avino, to the Oniva group of companies.Coral Gold’s properties are strategically located along the Cortez gold trend in north-central Nevada and are known as the Robertson Project. The project adjoins Barrick Gold’s Cortez Mine, one of the lowest cost gold producers in Nevada. In 2011, the Cortez production came to 1.42 million ounces of gold at total cash costs of $235 per ounce. Coral’s exploration programs have increased its inferred gold resource estimate to 3.4 million contained ounces. At this time, the company is about to start its spring drilling program which is designed to determine if ”historic” Amax and Placer Dome drilling data can be used to upgrade the level of confidence in resources contained in the oxidized zones, which are amenable to heap leaching. This program is Coral’s first step towards pre-feasibility as defined by the PEA (preliminary economic assessment) that was published last February. Coral Gold’s key objective is to move the Robertson project towards production.

Coral Gold belongs, like Avino, to the Oniva group of companies.Coral Gold’s properties are strategically located along the Cortez gold trend in north-central Nevada and are known as the Robertson Project. The project adjoins Barrick Gold’s Cortez Mine, one of the lowest cost gold producers in Nevada. In 2011, the Cortez production came to 1.42 million ounces of gold at total cash costs of $235 per ounce. Coral’s exploration programs have increased its inferred gold resource estimate to 3.4 million contained ounces. At this time, the company is about to start its spring drilling program which is designed to determine if ”historic” Amax and Placer Dome drilling data can be used to upgrade the level of confidence in resources contained in the oxidized zones, which are amenable to heap leaching. This program is Coral’s first step towards pre-feasibility as defined by the PEA (preliminary economic assessment) that was published last February. Coral Gold’s key objective is to move the Robertson project towards production.

Also with Coral Gold I have a long history. I always sawtheir Nevada property as a little jewel in the middle of other precious gold properties, run by others. I always have been surprised it was not a take-over target; I hope they indeed will become a small but successful gold producer on their own.

CuOro Resources Corporation

TSXV:CUA – price April 21: C$1.02 shares outstanding: 29.3 million, fully diluted: 38.8 million

CuOro is currently working on the Santa Elena copper-gold project and the Barranco de Loba gold-silver project, both situated in Colombia, north of Medelin. In 2011, the company raised a total of $25 million in 2011 and included HudBayMinerals (TSX,NYSE:HBM) as one of the participants. At present, a 25,000 meter drilling program is underway at the Santa Elena project with 4 drills on site. The results have been very encouraging so far with the best hole returning 102.9 meters at 1.44% copper including 14m at 2.9% copper. The Santa Elena is in a very prosperous area and has all the characteristics to possibly become Colombia’s first copper producer. The focus for 2012 is on advanced drilling, studies and establishing a resource. The Barranco de Loba project is an early staged project, surrounding the Gloria mine where 2,000 artesian miners are working. CuOro identified a gold geochemical anomaly over 5km. Samples of the underground workings returned some impressive results varying from 6.7 g/t to 87.5 g/t gold. Surface exploration will be continuing over the year. I am very pleased to be able to write and present this company as it represents the emergence of Colombia’s mining industry. Although CuOro’s first target is to become the country’s first copper producer, it will surely pursue its gold future too, as the company name already reflects.

CuOro is currently working on the Santa Elena copper-gold project and the Barranco de Loba gold-silver project, both situated in Colombia, north of Medelin. In 2011, the company raised a total of $25 million in 2011 and included HudBayMinerals (TSX,NYSE:HBM) as one of the participants. At present, a 25,000 meter drilling program is underway at the Santa Elena project with 4 drills on site. The results have been very encouraging so far with the best hole returning 102.9 meters at 1.44% copper including 14m at 2.9% copper. The Santa Elena is in a very prosperous area and has all the characteristics to possibly become Colombia’s first copper producer. The focus for 2012 is on advanced drilling, studies and establishing a resource. The Barranco de Loba project is an early staged project, surrounding the Gloria mine where 2,000 artesian miners are working. CuOro identified a gold geochemical anomaly over 5km. Samples of the underground workings returned some impressive results varying from 6.7 g/t to 87.5 g/t gold. Surface exploration will be continuing over the year. I am very pleased to be able to write and present this company as it represents the emergence of Colombia’s mining industry. Although CuOro’s first target is to become the country’s first copper producer, it will surely pursue its gold future too, as the company name already reflects.

Tembo Gold Corp

TSXV:TEM – price April 21: C$0.98 shares outstanding: 40.35 million, fully diluted: 54.72 million

Tembo Gold may be a young company but it has some very positive factors working for them. The company has a very prospective project, situated in the right area, where gold mineralization is all around, and it has attracted a highlycapable and experienced management. Its property consists of 110km² of active licenses and an additional 13km² under application and it is situated adjacent to African Barrick’s 20 million ounces Bulyanhulu Mine in the prolific Lake Victoria greenstone belt of Tanzania. The company management knows the area in and out, the CEO and the Chairman are both former executives of African Barrick with long experience in the area. Gold is a most sought metal in the region: over 2,000 artisanal miners are operating in over 100 active mine shafts up to 90m depth, extracting high grade values of 5 to 50 g/t gold. The Tembo Gold project has the same geology and structural continuity of the adjacent Bulyanhulu property. The first drill holes have confirmed significant gold grades and show additional potential. The company has commenced a 12-month drill program which will comprise 87,000 meters of drilling in anticipation of resource determination and feasibility studies.

Tembo Gold may be a young company but it has some very positive factors working for them. The company has a very prospective project, situated in the right area, where gold mineralization is all around, and it has attracted a highlycapable and experienced management. Its property consists of 110km² of active licenses and an additional 13km² under application and it is situated adjacent to African Barrick’s 20 million ounces Bulyanhulu Mine in the prolific Lake Victoria greenstone belt of Tanzania. The company management knows the area in and out, the CEO and the Chairman are both former executives of African Barrick with long experience in the area. Gold is a most sought metal in the region: over 2,000 artisanal miners are operating in over 100 active mine shafts up to 90m depth, extracting high grade values of 5 to 50 g/t gold. The Tembo Gold project has the same geology and structural continuity of the adjacent Bulyanhulu property. The first drill holes have confirmed significant gold grades and show additional potential. The company has commenced a 12-month drill program which will comprise 87,000 meters of drilling in anticipation of resource determination and feasibility studies.

With my warm feelings for Africa, it is not surprising that I very much welcome the opportunity to introduce Tembo Gold and report on their developments to you. When I discovered the company, I was immediately attracted by their characteristics. They have all the ingredients to become a success story.

As I regard each of these four new Supporting Companies a quality addition to the group, it will be exciting and a pleasure to follow them closely for you and report their progress over the next 12 months. I am confident my reports will bring you several winners……

[hr]

European Gold Centre

European Gold Centre analyzes and comments on gold, other metals & minerals and international mining and exploration companies in perspective to the rapidly changing world of economics, finance and investments. Through its publications, The Centre informs international investors, both institutional and private, primarily in Europe but also worldwide, who have an interest in natural resources and investing in resource companies.

The Centre also provides assistance to international mining and exploration companies in building and expanding their European investor following and shareholdership.

Henk J. Krasenberg

After my professional career in security analysis, investment advisory, porfolio management and investment banking, I made the decision to concentrate on and specialize in the world of metals, minerals and mining finance. From 1983 to 1992, I have been writing and consulting about gold, other metals and minerals and resource companies.

The depressed metal markets of the early 1990’s led me to a temporary shift. I pursued one of my other hobbies and started an art gallery in contemporary abstracts, awaiting a new cycle in metals and mining. That started to come in the early 2000’s and I returned to metals and mining in 2002 with the European Gold Centre.

With my GOLDVIEW reports, I have built an extensive institutional investor following in Europe and more of a private investor following in the rest of the world. In 2007, I introduced my MINING IN AFRICA publication, to be followed by MINING IN EUROPE in 2010 and MINING IN MEXICO in 2012.

For more information: www.europeangoldcentre.com

Nyheter

Guld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

Jeffrey Christian på CPM Group gästar Monex för att prata guld och silver. Det framhålls att vi befinner oss i en tid av extrem osäkerhet, präglad av politiska, ekonomiska och sociala spänningar som bedöms vara mer oroande än under kriserna i slutet av 1970-talet. Detta har drivit investerare mot tryggare tillgångar som guld, silver och även platina.

Priserna på ädelmetaller ligger nu på rekordnivåer, med guld nära 3 900 dollar per uns och silver omkring 48 dollar. Analytiker menar att uppgången främst beror på oro för den globala utvecklingen snarare än tekniska prisnivåer. De bedömer att priserna kommer fortsätta stiga tills det sker en tydlig förbättring i det politiska och ekonomiska klimatet, något som inte förväntas inom den närmaste framtiden.

Samtidigt påpekas att guld och dollarn ibland kan stiga parallellt, vilket tidigare skett under perioder av stor osäkerhet. Den kommande osäkerheten kring ett möjligt amerikanskt regeringsstopp kan enligt bedömare förstärka trenden mot fortsatt stark efterfrågan på ädelmetaller.

Nyheter

Blykalla och amerikanska Oklo inleder ett samarbete

Kärnkraftsföretagen Oklo från USA och svenska Blykalla har ingått ett strategiskt partnerskap för att främja tekniksamarbete, samordna leverantörskedjor och dela regulatorisk kunskap mellan länderna. Samarbetet inkluderar att Oklo går in som en av de större investerarna i Blykallas kommande investeringsrunda med ett åtagande på cirka 5 miljoner dollar.

Genom ett gemensamt teknikutvecklingsavtal ska bolagen utbyta insikter om material, komponenter och licensieringspraxis i både USA och Sverige. Målet är att minska kostnader och tidsrisker i utvecklingen av små modulära reaktorer (SMR).

Blykalla utvecklar SEALER, en blykyld snabbreaktor på 55 MWe, medan Oklo fokuserar på natriumkylda reaktorer upp till 75 MWe för industriella och militära tillämpningar i USA.

“Det här samarbetet stärker det växande ekosystemet för avancerade reaktorer i en tid av globalt ökande energibehov,” säger Oklo-grundaren Jacob DeWitte. Blykallas vd Jacob Stedman tillägger: “Vår gemensamma industriella strategi kan hjälpa leverantörer att planera för uppskalning, oavsett vilken sida av Atlanten de befinner sig på.”

Intervju på Bloomberg om samarbetet

Nyheter

Fortsatt stabilt elpris – men dubbelt så dyrt som i fjol

Snittpriset på el för höstmånaderna september till november väntas landa på strax under 50 öre per kilowattimme. Det är nästan en fördubbling jämfört med hösten 2024, då snittet låg på drygt 30 öre. Men nivåerna är fortfarande betydligt lägre än under elpriskrisen 2022. Det visar elbolaget Bixias höstprognos.

Att elpriserna är högre än i fjol beror främst på lägre tillgänglighet i kärnkraften och en svagare hydrologisk balans efter en torr sommar. Även om hösten har börjat blött och september ser ut att bli den nederbördsrikaste månaden sedan 2018, räcker det inte till för att vända vattenbalansen.

– Höstens elpriser är stabila, men klart högre än i fjol. Det är framför allt osäkerheten kring kärnkraften som påverkar där Oskarshamn 3 har varit ur drift längre än planerat. Samtidigt har den hydrologiska balansen inte återhämtat sig efter sommarens underskott, trots den blöta inledningen på hösten. Men jämfört med krisåren 2021 och 2022 ligger priserna fortfarande på en låg nivå, säger Johan Sigvardsson, elprisanalytiker på Bixia.

I september bidrog bristen på kärnkraft till att elpriset nästan fördubblades jämfört med samma månad i fjol. Priset landade på cirka 40 öre per kilowattimme, att jämföra med 22 öre i september 2024. Flera reaktorer stod stilla, däribland Oskarshamn 3, Forsmark 1 samt Lovisa 1 och 2 i Finland. Trots mycket regn under månaden var vattennivåerna fortsatt låga efter den torra sommaren, medan blåsiga perioder tillfälligt pressade ner priserna.

I oktober väntas elpriset hamna runt 45 öre per kilowattimme, jämfört med 27 öre i fjol, och i november kring 60 öre, mot 43 öre förra året. Sammantaget ger det ett höstsnitt i system på knappt 50 öre, jämfört med drygt 30 öre samma period i fjol. Under krisåret 2022 låg snittet för höstmånaderna på över 1,15 kronor per kilowattimme, med perioder på upp mot 4 kronor.

Liten risk för höga höstpriser

Bixia bedömer att priserna kan komma att stiga tillfälligt om vädret blir kallare än normalt eller om kärnkraftsreaktorer får fortsatt försening i återstart. Om till exempel Oskarshamn 3, vars återstart redan skjutits på fem gånger, inte kommer igång enligt plan i mitten av oktober, finns risk att priserna ökar under andra halvan av månaden.

– Risken för pristoppar ökar ju längre in på säsongen vi kommer, eftersom förbrukningen stiger när temperaturen sjunker. Men väderprognoserna ser i nuläget gynnsamma ut, och även om det skulle bli kallare än väntat ser vi inte någon risk för extremt höga priser, säger Johan Sigvardsson.

Dyrare el i syd

Södra Sverige har betalat betydligt mer för elen än norra delarna. Priserna har legat på runt 15 öre per kWh i norr under september, medan syd haft priser på omkring 70 öre. En differentierad prisbild väntas även under resten av hösten, särskilt om kärnkraftsproduktionen i söder fortsätter att vara begränsad och det fortsätter att vara gott om vatten i norr.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEurobattery Minerals satsar på kritiska metaller för Europas självförsörjning

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals i en guldtrend

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuldpriset kan närma sig 5000 USD om centralbankens oberoende skadas

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOPEC signalerar att de inte bryr sig om oljepriset faller kommande månader

-

Analys3 veckor sedan

Analys3 veckor sedanVolatile but going nowhere. Brent crude circles USD 66 as market weighs surplus vs risk

-

Nyheter3 veckor sedan

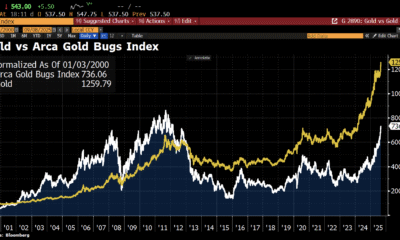

Nyheter3 veckor sedanAktier i guldbolag laggar priset på guld

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanKinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanTyskland har så höga elpriser att företag inte har råd att använda elektricitet