Nyheter

GOLD SHARES vs ’NORMAL’ SHARES, unfamiliarity vs blind confidence

PAPER STILL SEEMS TO BE MORE TRUSTED THAN GOLD

Although there still seems to be a lot of doubts about higher gold prices, the price of gold has nicely recovered from the dips it had been experiencing in the last few months. Last week, it came even close again to the $1,800 level but the upward movement was not yet strong enough to break it to reach the more golden pastures. As you know, I have very little doubt that gold will continue its march to considerably higher gold prices. I have expressed my opinions and views several times in my writings and I also mentioned that I certainly am not the only one that is having those strong feelings and expectations about the future of gold.

Since I told you about the $10,000 gold price as Shayne McGuire was talking and writing about it, several other gold guru’s mentioned that level as distinctly possible in a not too far away future. You may feel they are wishfully dreaming about those high price levels for gold, but I hope to have madeclear to you that such a scenario could very well unfold if some of the currently prevailing economic and financial circumstances further would deteriorate. How many times has Greece been’saved’ and is it saved now? And is Greece the only nation that can hardly service its own debt?

As my so appreciated friend James Turk wrote in his most recent comment –just before last weekend- ”Greece remains in debtor’s prison. That horrible fate was confirmed this past week with the ‘group-sentencing’ handed down by Brussels’ eurocrats, Merkel, Sarkozy, the ECB and IMF, and most shameful of all, the Greek politicians who accepted the brazen ultimatum delivered to them. …………..

If Greek politicians were really acting in the best interests of the Greek people, they would have taken the same path chosen by Iceland’s leaders – default. ………….. There is no hope for Greece to repay its debts my meeting the draconian burden imposed on it. But the banks want their money back, even if it means keeping Greece in debtor’s prison.”

Last month, I wrote that all the so-called rescue measures and agreements would not really solve the problems. In times of crises, politicians usually don’t want to take the risk to be remembered for being the ones that had taken all those harsh decisions. They rather want us to believe that they were the ones that brought all the good news and wise decisions. But in times like we have today, it would be better to have leaders of the world that act to their real beliefs, rather than be concerned about their image and future voters. Yet, after all the ’solutions’ we have seen so far, another one is in the making. And of course, this time it will be the final one……. This past weekend, the leaders of the G20 countries were assembled in another session to come up with a ’once and for all’-solution for the financial crisis that was triggered by the collapse of Lehman Brothers in 2008 and now has spread over the debtridden European countries. The $1 trillion stimulant injection of three years ago was just not enough. So now they are working on another huge injection of money, this time $2 trillion, to draw an end to all headaches.

However, this time the G20 has to come up with real drastic measures, such as massive cuts in spending at the country levels, and other painful sacrifices, including the creation of new money (remember that I talked last month about getting the dust off the money printing presses?). Only then would non-EU countries, including Japan and China, be prepared to support any more rescue operations, as was so politely remarked by British finance minister George Osborne. I found it ironic that U.S. Treasury Secretary Timothy Geithner acknowledged that Europe had made significant progress in designing a ’credible’ solution for the crisis. It made me think that we should not give the same meaning to the word ’progress’ as we do to the word ’prosperity’ and that we are likely to see progress of more of those ’final solutions’ before we will see prosperity again…………..

This serious environment should give gold a solid opportunity to flourish and to continue its path to higher price levels. Whether we will see the earlier-mentioned $10,000 gold level remains to be see. But I don’t think that that is the real important question. The question is whether gold has the potential to go back down to for instance $1,200 or lower or are there more chances that it will go up considerable? Yes, there are enough people that are truly convinced that gold is not an investment vehicle. They include all those smart ones that defend their disbelief by pointing out that gold has only gone up because it was hyped up to the point that gold is now in a bubble. That is an easy one to attack. A bubble in gold is being created when a massive interest from investors is being converted in purchases of the metal. Let’s be realistic, who really owns gold, physical gold as an investment. Look in your family and circles of friends, can you name 10 of them of whom you know they own gold? Most likely not. Because, according to the current estimates, only around 2% of all assets are in physical gold and/or gold mining shares. Only if this percentage would increase tenfold in a relative short period of time, we could possibly speak of a bubble. A lot has to happen before we reach that stage.

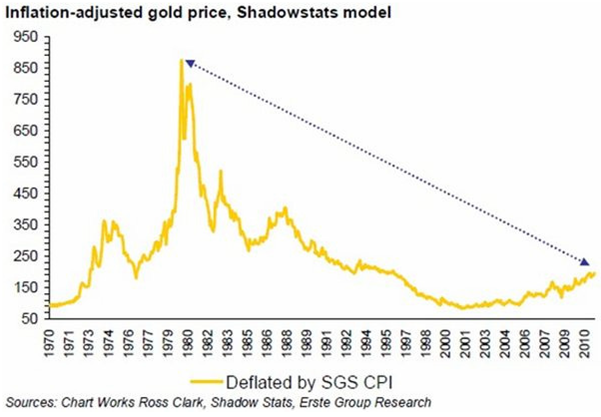

Another argument against gold as an investment is that gold is not really the best store of value as it is so branded often. True, but only if you just look at some figures without putting them in their real perspective. The former nominal high of all times was $850 dating from January 1980 was first seen again 28 years later, to be precise in January 2008. The picture looks already much better if you consider that the $850 high was mainly reached in all of the two preceding weeks since it had started 1980 at $550. As nobody mentions that $550 anymore, let’s indeed take the $850 as the former historical milestone. Then we would contently analyze that gold has more than doubled since 1980. True again, but not really. What has really happened to gold if we take into consideration what the loss of buying power, or call it inflation, has done to our money. The interesting chart below shows us how the real value of gold has developed since the $850 of 1980. Quite a different picture. This picture clearly contradicts what so many people think and say, that gold is too expensive at current prices. As I have elaborated on this in earlier reports, gold is not high from an historical point of view.

The $850 of January 1980, adjusted for official inflation figures, would equal to a current gold price of between $2,400 and $2,500 per ounce. For the other shiny metal, silver, the $50 high of 1980 would now have to be $150 per ounce to equal the value of then. Based on this alone, we still have a long way to go. Actually, we have a much longer way to go if we follow the reasoning of my colleague Jason Hamlin in one of his recent GoldStockBull issues: ”John Williams, the economist behind the website Shadow Stats (www.shadowstats.com), has done us the favour of stripping out the government gimmicks in order to derive the true inflation rate over the past thirty years. Using his SGS-Alternate Consumer Inflation Measure, gold would need to reach $8,890 per troy ounce and silver would need to reach $517 per troy ounce to match the highs from January of 1980.”

I do realize that it may not be easy for you to see all the high gold prices that I have talked about in my recent issues, as attainable. Also to me, and I am a fervent believer in gold for what seem to be quite realistic reasons to me, it feels sometimes funny to talk about $8,000 to $10,000 gold prices as long as gold isn’t strong enough to break through the $1,800 level. I know I have said it before but I feel urged to say it again. In my opinion, you can not afford to be cynical about the gold price. I am convinced it will surprise us. The potential value of gold is bound to be recognized by a much larger group of investors than the group that represent the 2% of assets that is in gold values today. To me, it is outright amazing that the overall investment public is still willing to prefer the regular stock markets for the majority of their investments. I just cannot understand the trust they have in paper values such as stocks, bonds and cash money, trust that has been affected so often already. It looks just like politics, selling solutions that later turn out not to work. Selling hope.

Admittedly, I also like to believe in hope. And in some kinds of paper too. Just enough cash to move around comfortably and paper backed by gold and silver, such as ETF’s, physical but virtual gold holdings and shares of mining and exploration companies that have proven to have metal reserves in the ground. Just the other day, I stumbled on a nice little video about why gold should not be neglected. You can find it here at Youtube. I gladly repeat the words that I used at the end my of my last issue. I believe they are so true.. a few years from now, gold (and silver) will have made the difference……..!

Henk J. Krasenberg

European Gold Centre

[hr]

European Gold Centre

European Gold Centre analyzes and comments on gold, other metals & minerals and international mining and exploration companies in perspective to the rapidly changing world of economics, finance and investments. Through its publications, The Centre informs international investors, both institutional and private, primarily in Europe but also worldwide, who have an interest in natural resources and investing in resource companies.

The Centre also provides assistance to international mining and exploration companies in building and expanding their European investor following and shareholdership.

Henk J. Krasenberg

After my professional career in security analysis, investment advisory, porfolio management and investment banking, I made the decision to concentrate on and specialize in the world of metals, minerals and mining finance. From 1983 to 1992, I have been writing and consulting about gold, other metals and minerals and resource companies.

The depressed metal markets of the early 1990’s led me to a temporary shift. I pursued one of my other hobbies and started an art gallery in contemporary abstracts, awaiting a new cycle in metals and mining. That started to come in the early 2000’s and I returned to metals and mining in 2002 with the European Gold Centre.

With my GOLDVIEW reports, I have built an extensive institutional investor following in Europe and more of a private investor following in the rest of the world. In 2007, I introduced my MINING IN AFRICA publication, to be followed by MINING IN EUROPE in 2010 and MINING IN MEXICO in 2012.

For more information: www.europeangoldcentre.com

Nyheter

Australien och USA investerar 8,5 miljarder USD för försörjningskedja av kritiska mineraler

USA:s president Donald Trump och Australiens premiärminister Anthony Albanese undertecknade på måndagen ett avtal som ska tillföra miljarder dollar till projekt inom kritiska mineraler.

Länderna kommer tillsammans att bidra med 1-3 miljarder dollar till projekten under de kommande sex månaderna. Den totala projektportföljen är värd 8,5 miljarder dollar, enligt regeringarna.

Galliumraffinaderi med kapacitet för 5x USA:s efterfrågan

Som en del av avtalet kommer det amerikanska försvarsdepartementet även att investera i ett galliumraffinaderi i västra Australien med en kapacitet på 100 ton per år. För närvarande importerar USA omkring 21 ton gallium, vilket motsvarar hela den inhemska konsumtionen, enligt den amerikanska geologiska myndigheten.

Initiativet kommer samtidigt som Kina har infört exportrestriktioner på vissa mineraler, däribland sällsynta jordartsmetaller, som är avgörande för tillverkningen av elektronik och elmotorer. Gallium används till exempel i mikrovågskretsar samt blå och violetta lysdioder (LED), vilka kan användas för att skapa kraftfulla lasrar.

Nyheter

Vad guldets uppgång egentligen betyder för världen

Guldpriset har nyligen nått rekordnivåer, över 4 000 dollar per uns. Denna uppgång är inte bara ett resultat av spekulation, utan speglar djupare förändringar i den globala ekonomin. Bloomberg analyserar hur detta hänger samman med minskad tillit till dollarn, geopolitisk oro och förändrade investeringsmönster.

Guldets roll som säker tillgång har stärkts i takt med att förtroendet för den amerikanska centralbanken minskat. Osäkerhet kring Federal Reserves oberoende, inflationens utveckling och USA:s ekonomiska stabilitet har fått investerare att söka alternativ till fiatvalutor. Donald Trumps handelskrig har också bidragit till att underminera dollarns status som global reservvaluta.

Samtidigt ökar den geopolitiska spänningen, särskilt mellan USA och Kina. Kapitalflykt från Kina, driven av oro för övertryckta valutor och instabilitet i det finansiella systemet, har lett till ökad efterfrågan på guld. Även kryptovalutor som bitcoin stiger i värde, vilket tyder på ett bredare skifte mot hårda tillgångar.

Bloomberg lyfter fram att derivatmarknaden för guld visar tecken på spekulativ överhettning. Positioneringsdata och avvikelser i terminskurvor tyder på att investerare roterar bort från aktier och obligationer till guld. ETF-flöden och CFTC-statistik bekräftar denna trend.

En annan aspekt är att de superrika nu köper upp alla tillgångsslag – aktier, fastigheter, statsobligationer och guld – vilket bryter mot traditionella investeringslogiker där vissa tillgångar fungerar som motvikt till andra. Detta tyder på att marknaden är ur balans och att kapitalfördelningen är skev.

Sammanfattningsvis är guldets prisrally ett tecken på en värld i ekonomisk omkalibrering. Det signalerar misstro mot fiatvalutor, oro för geopolitisk instabilitet och ett skifte i hur investerare ser på risk och trygghet.

Nyheter

Spotpriset på guld över 4300 USD och silver över 54 USD

Guldpriset stiger i ett spektakulärt tempo, nya rekord sätts nu på löpande band. Terminspriset ligger oftast före i utvecklingen, men ikväll passerade även spotpriset på guld 4300 USD per uns. Guldet är just nu som ett ångande tåg som det hela tiden skyfflas in mer kol i. En praktisk fördel med ett högre pris är att det totala värdet på guld även blir högre, vilket gör att centralbanker och privatpersoner kan placera mer pengar i guld.

Även spotpriset på silver har nu passerat 54 USD vilket innebär att alla pristoppar från Hunt-brödernas klassiska squeeze på silver har passerats med marginal. Ett högt pris på guld påverkar främst köpare av smycken, men konsekvensen av ett högt pris på silver är betydligt mer kännbar. Silver är en metall som används inom många olika industrier, i allt från solceller till medicinsk utrustning.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEtt samtal om guld, olja, fjärrvärme och förnybar energi

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Analys4 veckor sedan

Analys4 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuldpriset uppe på nya höjder, nu 3750 USD

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om guld, olja, koppar och stål