Nyheter

Gold: how we value the precious metal

Gold is a unique asset class. Indeed, many investors even question whether it is an asset class. Is it a commodity, or a currency? What’s also interesting about gold is that even though it has been viewed as a form of investment for several millennia, there’s little consensus on how to actually value it.

In this article, we’ll look at how we value gold at WisdomTree and explain how we use historic price behaviour to generate gold price forecasts for the future.

The difficulty in valuing gold

It’s easy to understand why valuing gold is complex.

For a start, gold does not generate cash flow like other assets do, so traditional valuation techniques such as discounted cash flow (DCF) models don’t work.

Another complication lies in the fact that there have been many regime shifts in relation to the precious metal over the years. For example, between 1933 and 1974, investment in gold bullion was all-but barred in the US after President Franklin D. Roosevelt signed Executive Order 61021. Similarly, in China, gold bullion investment was effectively prohibited between 1950 and 20042. Today, these two countries are among the largest bullion investing nations in the world. So, clearly, using extremely long timeseries of data to calibrate a gold valuation model is not appropriate.

With little consensus on valuation methods, financial commentators are often quite emotive in their projections for the metal. There are the ‘gold bugs,’ who tend to be perma-bulls, while there are also gold bears who believe that the metal has little value.

The WisdomTree gold model

At WisdomTree, our goal has been to develop a robust, impartial gold model.

We recognise that many factors affect the price of gold, so we have modelled the precious metal in a multivariate fashion. We have been able to build a basic model with four key explanatory variables and our gold price forecasts can be positive, negative, or neutral, depending on the direction of these underlying variables. Notably, our model describes gold as more of a monetary asset than a commodity.

In our gold model, we show that changes in US Dollar gold prices are driven by (direction in parenthesis):

- Changes in the US Dollar basket (-)

- Consumer Price Index (CPI) inflation (+)

- Changes in nominal yields on 10-year US Treasuries (-)

- Investor sentiment (measured by speculative positioning in the futures market) (+)

We chose to put both inflation and nominal yields into the model as a proxy for real yields, rather than real yields directly so that we could use a longer data set (Treasury Inflation Protected Securities have only been around since 1997), and our model goes back to 1995 when Commodity Futures Trading Commission (CFTC) data on speculative futures market positioning first starts.

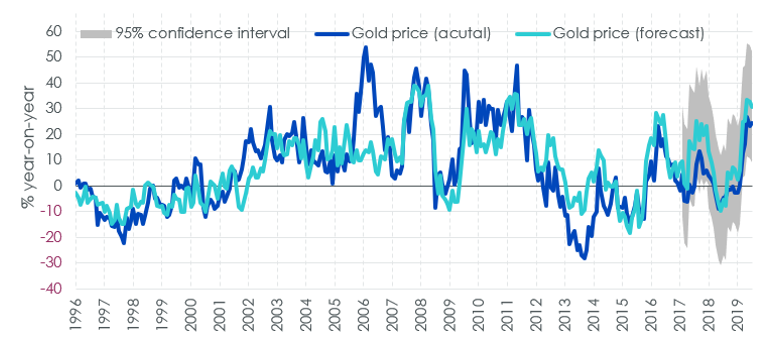

Figure 1 shows forecasts when calibrating our model using data from April 1996 to April 2017.

Figure 1. Gold price model in ”out of sample” test

As you can see, our model tracks the actual price of gold quite well. However, we have also added new variables to the model to see if they enhance its explanatory power.

Additional variables

To this base model we added a number of extra variables over the April 1995 to April 2018 period. Here’s what we found:

- Equity markets: Year-on-year changes in gold prices were negatively related to year-on-year changes in the S&P 500 and including the equity market indicator in the model weakened the significance of nominal yields. So, we chose not to include an equity market factor in our final model.

- Volatility: Changes in the option implied volatility of the S&P500 (CBOE Volatility Index, VIX) did not help explain gold prices. Many people regard gold as a hedge against surprises, but we found that the VIX didn’t have a significant impact in our model. This may have been related to the monthly frequency of our model as surprises are often too short-lived to be picked up in a monthly model.

- ETP assets: Gold prices appeared to be negatively associated with changes in gold exchange traded product (ETP) assets under management (measured in ounces) and the results cast doubt on the popular assertion that rising gold ETP demand has been responsible for higher gold prices.

- US Federal Reserve (Fed) balance sheet: Changes in the Fed’s balance sheet size and changes in US M2 money supply growth were also not a significant factor in explaining gold prices. This was a surprising result, given the focus on monetary expansion in the context of gold price movements. However, it could just be the case that the US Dollar basket picks up most of the relationship. Changes in the combined balance sheets of the Fed, European Central Bank, Bank of Japan and Swiss National Bank were also not significant.

Does physical demand matter?

We also looked at whether non-ETP demand for gold (jewellery, technology, bullion, and central bank purchases) can explain gold price movements. To do this, we switched to a quarterly model of gold prices in order to incorporate the quarterly gold demand data from the World Gold Council, and shortened the span of the model to 2005 due to data limitations.

Here, our research indicated that physical gold demand is also not a relevant factor in explaining gold prices.

What has been the most important driver of gold prices in the past?

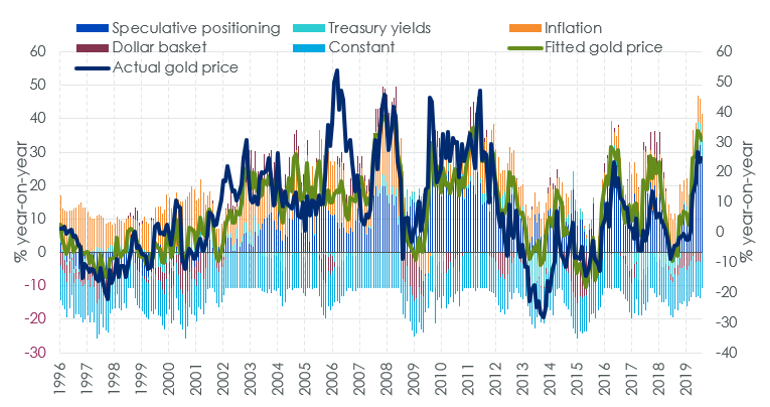

This is a question that comes up regularly and unfortunately, it’s not a simple question to answer. This is because, as shown in Figure 2, at times a variable can have a large impact on the price of gold and at other times its impact can be minimal.

Figure 2. The impact of each variable: attribution of fitted results vs. actual price

How we use our gold model

Ultimately, understanding gold’s historic behaviour allows us to make future gold price forecasts, as long as we have a view on the explanatory variables.

By analysing key macroeconomic factors, including Federal Reserve policy, Treasury yields, and exchange rates, our gold model can be used to produce gold price forecasts.

For those interested, we will shortly be releasing our updated outlook for gold prices up to Q2 2020.

By: Nitesh Shah, Director, Research, WisdomTree

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Nyheter

Blykalla och amerikanska Oklo inleder ett samarbete

Kärnkraftsföretagen Oklo från USA och svenska Blykalla har ingått ett strategiskt partnerskap för att främja tekniksamarbete, samordna leverantörskedjor och dela regulatorisk kunskap mellan länderna. Samarbetet inkluderar att Oklo går in som en av de större investerarna i Blykallas kommande investeringsrunda med ett åtagande på cirka 5 miljoner dollar.

Genom ett gemensamt teknikutvecklingsavtal ska bolagen utbyta insikter om material, komponenter och licensieringspraxis i både USA och Sverige. Målet är att minska kostnader och tidsrisker i utvecklingen av små modulära reaktorer (SMR).

Blykalla utvecklar SEALER, en blykyld snabbreaktor på 55 MWe, medan Oklo fokuserar på natriumkylda reaktorer upp till 75 MWe för industriella och militära tillämpningar i USA.

“Det här samarbetet stärker det växande ekosystemet för avancerade reaktorer i en tid av globalt ökande energibehov,” säger Oklo-grundaren Jacob DeWitte. Blykallas vd Jacob Stedman tillägger: “Vår gemensamma industriella strategi kan hjälpa leverantörer att planera för uppskalning, oavsett vilken sida av Atlanten de befinner sig på.”

Intervju på Bloomberg om samarbetet

Nyheter

Fortsatt stabilt elpris – men dubbelt så dyrt som i fjol

Snittpriset på el för höstmånaderna september till november väntas landa på strax under 50 öre per kilowattimme. Det är nästan en fördubbling jämfört med hösten 2024, då snittet låg på drygt 30 öre. Men nivåerna är fortfarande betydligt lägre än under elpriskrisen 2022. Det visar elbolaget Bixias höstprognos.

Att elpriserna är högre än i fjol beror främst på lägre tillgänglighet i kärnkraften och en svagare hydrologisk balans efter en torr sommar. Även om hösten har börjat blött och september ser ut att bli den nederbördsrikaste månaden sedan 2018, räcker det inte till för att vända vattenbalansen.

– Höstens elpriser är stabila, men klart högre än i fjol. Det är framför allt osäkerheten kring kärnkraften som påverkar där Oskarshamn 3 har varit ur drift längre än planerat. Samtidigt har den hydrologiska balansen inte återhämtat sig efter sommarens underskott, trots den blöta inledningen på hösten. Men jämfört med krisåren 2021 och 2022 ligger priserna fortfarande på en låg nivå, säger Johan Sigvardsson, elprisanalytiker på Bixia.

I september bidrog bristen på kärnkraft till att elpriset nästan fördubblades jämfört med samma månad i fjol. Priset landade på cirka 40 öre per kilowattimme, att jämföra med 22 öre i september 2024. Flera reaktorer stod stilla, däribland Oskarshamn 3, Forsmark 1 samt Lovisa 1 och 2 i Finland. Trots mycket regn under månaden var vattennivåerna fortsatt låga efter den torra sommaren, medan blåsiga perioder tillfälligt pressade ner priserna.

I oktober väntas elpriset hamna runt 45 öre per kilowattimme, jämfört med 27 öre i fjol, och i november kring 60 öre, mot 43 öre förra året. Sammantaget ger det ett höstsnitt i system på knappt 50 öre, jämfört med drygt 30 öre samma period i fjol. Under krisåret 2022 låg snittet för höstmånaderna på över 1,15 kronor per kilowattimme, med perioder på upp mot 4 kronor.

Liten risk för höga höstpriser

Bixia bedömer att priserna kan komma att stiga tillfälligt om vädret blir kallare än normalt eller om kärnkraftsreaktorer får fortsatt försening i återstart. Om till exempel Oskarshamn 3, vars återstart redan skjutits på fem gånger, inte kommer igång enligt plan i mitten av oktober, finns risk att priserna ökar under andra halvan av månaden.

– Risken för pristoppar ökar ju längre in på säsongen vi kommer, eftersom förbrukningen stiger när temperaturen sjunker. Men väderprognoserna ser i nuläget gynnsamma ut, och även om det skulle bli kallare än väntat ser vi inte någon risk för extremt höga priser, säger Johan Sigvardsson.

Dyrare el i syd

Södra Sverige har betalat betydligt mer för elen än norra delarna. Priserna har legat på runt 15 öre per kWh i norr under september, medan syd haft priser på omkring 70 öre. En differentierad prisbild väntas även under resten av hösten, särskilt om kärnkraftsproduktionen i söder fortsätter att vara begränsad och det fortsätter att vara gott om vatten i norr.

Nyheter

Ett samtal om guld, olja, koppar och stål

Samtal om att guldet ständigt slår nya prisrekord, att oljepriserna pressas och vad som händer på kopparmarknaden. Vidare kommenterar Jernkontorets Kristian Ljungblad läget i stålbranschen och hur de svenska stålbolagen mår.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEurobattery Minerals satsar på kritiska metaller för Europas självförsörjning

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals i en guldtrend

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuldpriset kan närma sig 5000 USD om centralbankens oberoende skadas

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOPEC signalerar att de inte bryr sig om oljepriset faller kommande månader

-

Analys3 veckor sedan

Analys3 veckor sedanVolatile but going nowhere. Brent crude circles USD 66 as market weighs surplus vs risk

-

Nyheter3 veckor sedan

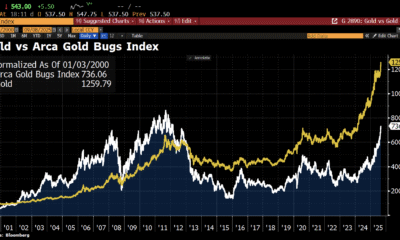

Nyheter3 veckor sedanAktier i guldbolag laggar priset på guld

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanKinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanTyskland har så höga elpriser att företag inte har råd att använda elektricitet