Nyheter

Gold has started next move

▬ good environment for mining shares to recover ▬

Several emerging explorers deserve attention

As you know from my comments over the last few months, I have been expecting the beginning of a new good era for mining and exploration share prices. The markets have been too low for too long, thus not reflecting the exciting progress reports from many companies in the last few months. I think the moment has come. A new period of recovering resource prices has started. Induced by the announcements from the ECB and Fed, the price of gold solidly broke through the $1,700 level and it seems the start of a next phase has entered. Encouraging is that also the prices of other metals joined the upward move. It looks like investors are finally regaining confidence after two years of depressing news about the all the financial, political and economical perils in the world. The stream of negative and fearful developments has been so long and consistent that I have become a kind of immune for bad news and hungry for more positive news. The mining sector certainly has been bringing that. Good reports about successful exploration programs, discoveries and increasing production are too many to ignore any longer. I have very strong feelings about the potential that many companies are offering. The next few years will be highly fascinating and rewarding. You cannot afford not to own (enough) resource stocks and you should not miss to be part of what in my view is coming.

Therefore, it is the right time now to do your homework, review your portfolio and adapt your list of shares, sell the dead ducks and add some of the more remarkable explorers. And if you are not in the market yet, it is time to take some necessary steps!

Last month, I mentioned the names of several emerging producers that in my opinion, have the right ingredients to be very attractive investment candidates. I also told you that I would report my findings at the Precious Metals Summit and the Denver Gold Forum in this issue and share some of the more interesting discoveries and experiences with you. I hereby do!

Both events offered me the opportunity to update my expertise with the latest developments of the many companies I follow, discuss the present and future with several of my Supporting Companies, refresh my relationships with some companies that I have followed in the past and not the least important, meet new companies and their management and make new friends. I can tell you that I have made several new discoveries of companies which I would love to be covering and report on to you in the future. Whether that will happen, time will tell! For the time being, you will have to do with my most eye- and ear-catching experiences in Denver.

It should not be surprising that I found quite a few interesting stories among companies that are operating in those world’s mining territories that have my special interest, such as Canada, United States, Mexico, Europe, Africa, my more recent interest for the resource developments in Colombia, some regions that I used to be following such as Papua New Guinea, Eastern Europe and Australia, a continent that I would find interesting to write about. In this respect, it was pleasant and noteworthy that there were a number of Australian companies present. Unfortunately, we don’t often have the opportunity to meet them.

The Precious Metals Summit — ”where the smart money goes prospecting”– kicked off with the impressive-as-ever presentation of my old friend and originally fellow-Dutchman Dr. Martin Murenbeeld, Chief Economist at Dundee WealthEconomics. He gave a thorough analysis of the current economics that make the gold price do what it did, does and will do. In all of the three scenarios that he painted, he is prudently optimistic about the gold prices that will materialize over the next 12 months.

Although the organization had succeeded to bring some 90 companies together, presenting their cases to a selective audience of investment specialists, I chose this time not to spend my time listening to all the presentations. Instead, I had a full schedule with one-on-meetings, having the advantage to meet management people rather than power-points. Virtually all of my discussions confirmed my view that quite many exploration companies are getting very nice results from their drilling programs and are due to continue to make solid progress at their projects, either towards feasibility or towards production decisions in the next two or three years.

Interesting companies that I met in my one-on-one meetings and that I would like to share with you were several with activities in the areas that I am following very closely. Of the ones that are (mainly) active in MEXICO, the first that deserves to be mentioned is MAG Silver (NYSE.A:MVG, TSX:MAG), one of my prime choices and a potential production candidate, Cayden Resources (TSXV:CYD), new to me but with a familiar management, International Northair Mines (TSXV:INM), a company that I used to cover in the old days and which is now heading towards a production decision phase, Kimber Resources (NYSE MKT:KBX, TSX:KBR), another company that I used to be writing about in the past and now expanding its resources to allow a production decision, Santa Cruz Silver Mining (TSXV:SCZ) which I discovered recently and is active on 3 advance stage projects with excellent potential for mining operations, Cerro Resources (TSXV,ASX:CJO) that expects a decision to mine by Q4 2012 and commence production in early 2014, and Dia Bras Exploration (TSXV:DIB), which has been pilot-mining silver, copper, zinc and lead zinc since 2005.

It was nice that there also was quite a number of companies with exploration activities in EUROPE. After all the finger-pointing from North America to the financial problems of Europe and the Euro, it was good that these companies showed so clearly that there are plenty of very promising resources possibilities in Europe being explored and advanced. For my older readers (not in age but in readership background), the name EurOmax Resources (TSXV:EOX) must sound familiar; a complete new management team coming from European Minerals, is dynamically reviving the company with its three core assets in Macedonia, Bulgaria and Serbia. I used to cover the company initially but then I stopped doing so when management problems were troubling the company’s progress. The new team made quite an impression as capable and determined to do justice to the company’s qualities and possibilities. Also with a very interesting gold project in Serbia, Avala Resources (TSXV:AVZ) has a very solid and fascinating story to tell. It is the largest exploration license holder in the country and it is establishing large areas of near-surface gold mineralization at its 3 active properties. A company that I met earlier in the year in Vancouver but now talked to more extensively, is Global Minerals (TSXV:CTG) which is quite advanced in rehabilitating its Strieborná silver mine situated on 135km² controlled exploration concessions with 90 known veins in Slovakia. Quite a surprise was to meet with Dalradian Resources (TSX:DNA) which has a completed PEA for its high-grade 2.7 million ounce gold resource in Northern Ireland and is the first active mineral discovery company in Norway where it has acquired several northern greenstone belts with known mineralization.

To my pleasure, I had the opportunity to meet several of the Canadian companies that are exploring in the newest mining country on the map of international investors, i.e. COLOMBIA. That suited me fine as I will soon announce my plans to launch my MINING IN COLOMBIA publication. The meeting with the management of SunWard Resources (TSX:SWD) gave me a very comfortable feeling; they know what they have –an NI43-101 M&I mineral resource of 4.58 million ounces of gold– and where they will go. And they have the grades. I met again with Batero Gold (TSXV:BAT), probably the most discussed Colombia exploration company in the recent months; they seem to be on the right track to indeed become the success story that is promised to be. Seafield Resources (TSXV:SFF) is worth looking at because they have their PEA completed, have shown some higher grade drill results and will drill test high grade gold zone of their main project in Q1 2013.

As said before, it was good to be able to meet with two of the Australian resource companies that came to Beaver Creek. I had a very enlightening discussion with GoldRoad Resources (ASX:GOR), for me totally new but quite impressive. They have an over 5,000 km² resource property in the Yamarna Belt in WESTERN AUSTRALIA, a highly prospective area for gold mineralization where several new significant discoveries have been made. GoldRoad has over 100 prospects which it is systematically exploring successfully –13 new gold discoveries in 30 months– and has established a JORC resource of more than 1 million ounces of gold so far. I have hardly ever seen a company that has such a great and actually worked-on pipeline of prospects. To give you an idea, all of the accomplishments have been reached within less than 1% of the tenement holding. The two key projects are now in feasibility and ready to complete construction and commence gold production in 2013/2014. The other Australian company was Indochine Mining (ASX:IDC) that owns a major JORC-compliant gold resource at its Mt Kare project in PAPUA NEW GUINEA with 1.8 million ounces of gold plus silver, currently the subject of a pre-feasibility study, expected to be completed this month. The next step will be a Bankable Feasibility, to be started in November. Assuming that study will provide the proper economics, production is target within 3 years. In the meantime, Indochine has acquired the largest mining property holding in CAMBODIA, a country that has had very limited modern exploration but is situated within a region known for large gold and copper deposits.

It may look as if there were no Canadian companies with activities in CANADA itself. Not true, I met with Western Copper and Gold (NYSE MKT:WRN) that is advancing its Casino Project to complete a Feasibility Study before the end of this year which could more than confirm the earlier pre-feasibility which set huge reserves and the economics of becoming a significant low-cost producer. A company that has an interesting project mix in NEVADA/UTAH, ARGENTINA and SPAIN and a portfolio of properties for its business model of entertaining joint ventures is Renaissance Gold (TSX:REN). They have an appealing number of earn-in agreements going with evenly impressive partners. The last meeting I had with one of the ‘hottest’ companies around since their sensational drill hole in the DOMINICAN REPUBLIC: GoldQuest Mining (TSXV:GQC). The fear that the hole was a one-time shot has now diminished after more great results (235m @4.7g/t gold) were reported. I know the project from writing about it a few years ago. I am not surprised about what is happening now. There is more to come! They also have indirect interests in PORTUGAL and SPAIN.

Of course, I also met with the SUPPORTING COMPANIES that were present. Such as Astur Gold (TSXV:AST) which is in a decision-awaiting and -taking period to determine whether its Alave mine in northern Spain will eventually be brought to production, Aurcana (TSXV:AUN) that is nicely proceeding with its silver mining operations at its Shafter mine in south-west Texas, USA and its La Negra mine in Queretaro, Mexico where a recent update of the Measured and Indicated resource estimate showed a 50-fold increase (!), CuOro Resources (TSXV:CUA) that is advancing its Santa Elena copper project in Colombia, SilverCrest Mines (TSXV:SVL, NYSE MKT:SVLC) increasing its silver production at its Santa Elena mine (don’t get confused, yes it has the same name as the CuOro project) and drilling its nearby Cruz de Mayo project in Sonora, Mexico and Tembo Gold (TSXV:TEM) which reported high-grade results from the initial drill holes at its Mgusu Target area.

At the Denver Gold Forum, I decided to spend my time attending the presentation sessions as the companies represented all were more advanced, having reached production or being very close to that stage.

There was one whole morning where several major producers were presenting. I didn’t want to miss that because of what I had written about them in the August issue. And I have to admit that some companies, or rather their presenting CEO’s (business is always a people’s business….) impressed me with their solid and down-to-earth attitude and realistic confidence about the future of their projects. In particular, I liked Barrick Gold (NYSE:ABX), Newmont Mining (NYSE:NEM), Goldcorp (NYSE:G), AngloGold Ashanti (NYSE:AU), Yamana Gold (TSX:YRI), Kinross Gold (TSX:K) and Randgold Resources (LSE:RRS).

I had one one-on-one meeting and what an interesting one that was. I didn’t know the company, as I am sure many people don’t, because it has not been around for so long. Mandalay Resources (TSX:MND) was formed in 2009 with the specific purpose to acquire assets that were somehow in trouble but could be put to production and generate cash flow quickly through quality exploration. It acquired two mines, the gold-antimony Costerfield mine in AUSTRALIA and the Cerro Bayo silver-gold mine in CHILE. After management’s vision has been put into practice, combined production for 2012 is expected to come to 26,000-34,000 ounces of gold, around 2,000t of antimony and 2,7-3,0 million ounces of silver. I was impressed by the story, the people and the upside potential for the future years.

Of the other company presentations that I attended, quite a few I found more interesting than others, because of their projects and accomplishments but mainly because of their management personality, dedication and vision. McEwen Mining (NYSE:MUX) is undoubtedly on its way to become a major in MEXICO and NEVADA; Endeavour Mining (TSX:EDV) has a very clear vision how to proceed to become a big party in AFRICA; Torex Gold (TSX:TXG) is building a mine at its Morelos property in MEXICO and in the process of finding another mine on the same property; G-Resources (HSX:1051) having its Martabe project in North Sumatra, INDONESIA, more than 90% complete with 9 million ounces of gold equivalent to be produced; Endeavour Silver (NYSE:EXK) which is continuing expanding with more mines and more ounces of production in MEXICO; SEMAFO (TSX:SMF), one of my long-time favourite companies, is solidly producing gold in AFRICA; Polymetal International (LSE:POLY) impressed me with their production target of 1 million ounces gold equivalent this year from their mines in RUSSIA and KAZAKHSTAN; Centamin (LSE:CEY, TSX:CEE) is producing gold since 2009 at the first large scale modern gold mine in EGYPT and has started its expansion in the Arabian-Nubian shield with an acquisition in ETHIOPIA; First Majestic Silver (NYSE:AG) keeps growing both by acquisition and internal growth of production in MEXICO which reflect management’s dedication to become one of the largest silver producers; Banro (TSX:BAA) which finally completed the transition from many years of exploration and developer into a gold producer by declaring commercial production as per last September 1 at its Twangiza-Namoya project in northeast Democratic Republic Congo, AFRICA where its production target is set at an annual +400,000 ounces of gold by 2017; Silvercorp Metals (NYSE,TSX:SVM) has grown into the largest primary silver producer in CHINA through the operation of 4 silver-lead-zinc mines in Hunan Province. Silvercorp must be the lowest cost producer of the world: in Q1 2013, ended June 30, 2012, 1.2 million ounces of silver were produced at a cash cost of $0.14 per ounce (!); last but certainly not least, Argonaut Gold (TSX:AR), an emerging producer from its two mines in MEXICO with which I have been in contact in the last few months but now finally met in person. Our meetings resulted in their decision to become a Supporting Company of The Centre. I refer you to the last part of this issue for more (interesting) information. This list could have been longer if I could have attended the closing day of the event. However, KLM/Delta sold me a ticket in which changes could not be made. What did they do? They changed my flight in an earlier one which made me miss the presentations of the last morning session……thanks!

Also at this event, several of the SUPPORTING COMPANIES were present. Paramount Gold and Silver (TSX:PZG) told me about their filing of its Final PEA report on its Sleeper Project in Nevada. The study predicts 17 years of operation with an average annual gold production of 172,000 ounces of gold and an estimated IRR of 26.8% at $1,384 gold. Great Panther Silver (TSX:GPR) which recently strengthened its position in Mexico by purchasing the surface rights for its San Ignacio project and acquiring the El Horcon silver-gold project that has excellent potential to be a satellite mine for its Guanajuato operations. SilverCrest Mines (TSXV:SVL) that upgraded its shareholder access by listing its shares at the NYSE MKT under the symbol SVLC. In their presentation, they elaborated on the plans for underground expansion and building its own mill at the Santa Elena mine and on the La Joya project as the next point of focus in the pipeline. Pre-feasibility work is underway on this near surface resource.

As they did in Beaver Creek, Aurcana (TSXV:AUN) was also presenting their interesting case for a very attentive audience here. I talked to Timmins Gold (TSX:TMM,NYSE MKT:TGD) where things are going extremely well. Production from the San Francisco mine in Mexico will come to 100,000 ounces of gold this year with 130,000 ounces expected in 2013 and beyond. More important, the resources and reserves are continually expanded by the 5 drills that are working right around the mine and equipment is added to enlarge the capacity.

One more point of interest to tell you about my visit to the Denver Gold Forum, which, I have to add, deserves a compliment for the way it was organized. Tim Wood and his competent staff really made it a class act, doing justice to the overall quality of the companies presented. It is about the keynote luncheon speaker Matthew Bishop, American Business Editor and New York Bureau Chief of The Economist with as theme “Gold, Money and the Economy”. Not only did he give a very entertaining speech full of humour and relativism, but he rightfully brought the message that everyone should take gold seriously because of what its price tells us about subjects such as the health of the economy, the outlook for inflation, the priorities and competence of government, and the prospects of paper currencies such as the dollar. His views and elaborations can be found in his book “In Gold We Trust? The Future of Money in an Age of Uncertainty” which he did not forget to promote. The Kindle version can be ordered from Amazon.com for the lump sum of $2.99 and it will be auto-delivered wirelessly. I did so and I can recommend it wholeheartedly!

Also read: Initiating coverage new Supporting Company – Argonaut Gold

Henk J. Krasenberg

[hr]

European Gold Centre

European Gold Centre analyzes and comments on gold, other metals & minerals and international mining and exploration companies in perspective to the rapidly changing world of economics, finance and investments. Through its publications, The Centre informs international investors, both institutional and private, primarily in Europe but also worldwide, who have an interest in natural resources and investing in resource companies.

The Centre also provides assistance to international mining and exploration companies in building and expanding their European investor following and shareholdership.

Henk J. Krasenberg

After my professional career in security analysis, investment advisory, porfolio management and investment banking, I made the decision to concentrate on and specialize in the world of metals, minerals and mining finance. From 1983 to 1992, I have been writing and consulting about gold, other metals and minerals and resource companies.

The depressed metal markets of the early 1990’s led me to a temporary shift. I pursued one of my other hobbies and started an art gallery in contemporary abstracts, awaiting a new cycle in metals and mining. That started to come in the early 2000’s and I returned to metals and mining in 2002 with the European Gold Centre.

With my GOLDVIEW reports, I have built an extensive institutional investor following in Europe and more of a private investor following in the rest of the world. In 2007, I introduced my MINING IN AFRICA publication, to be followed by MINING IN EUROPE in 2010 and MINING IN MEXICO in 2012.

For more information: www.europeangoldcentre.com

Nyheter

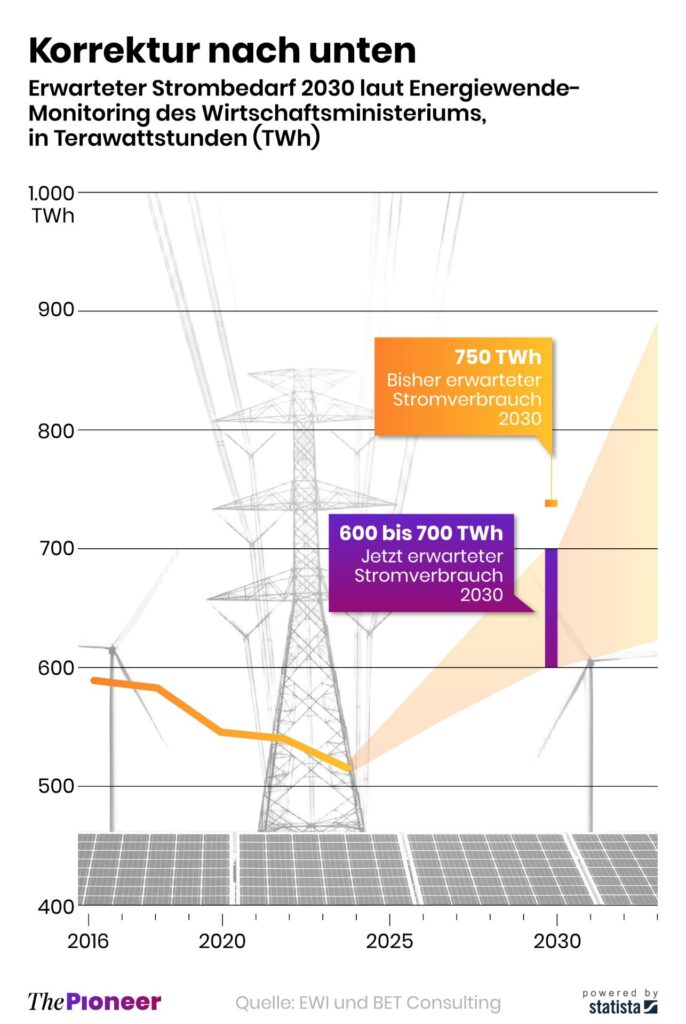

Tyskland har så höga elpriser att företag inte har råd att använda elektricitet

Tyskland har skrivit ner prognosen på hur mycket elektricitet landet kommer att behöva 2030. Hittills har prognosen varit 750 TWh, vilken nu har skrivits ner till 600-700 TWh,

Det kan vid en första anblick låta positivt. Men orsaken är inte att effektiviseringar. Utan priserna är så pass höga att företag inte har råd att använda elektriciteten. Elintensiv industri flyttar sin verksamhet till andra länder och få företag satsar på att etablera energikrävande verksamhet i landet.

Tyskland har inte heller någon plan för att förändra sin havererade energipolitik. Eller rättare sagt, planen är att uppfinna fusionskraft och använda det som energikälla. Något som dock inte löser problemet på några årtionden.

Nyheter

Kinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

Kinas officiella statistik för elproduktion har släppts för augusti och den visar att landet slog ett nytt rekord. Under augusti producerades 936 TWh elektricitet.

Stephen Stapczynski på Bloomberg lyfter fram att det är ungefär lika mycket som Japan producerar per år, vilket innebär är de producerar ungefär lika mycket elektricitet per invånare.

Kinas elproduktion kom i augusti från:

| Fossil energi | 67 % |

| Vattenkraft | 16 % |

| Vind och Sol | 13 % |

| Kärnkraft | 5 % |

Stapczynskis kollega Javier Blas uppmärksammar även att det totala rekordet inkluderade ett nytt rekord för kolkraft. Termisk energi (där nästan allting är kol) producerade 627,4 TWh under augusti. Vi rapporterade tidigare i år att Kina under första kvartalet slog ett nytt rekord i kolproduktion.

Nyheter

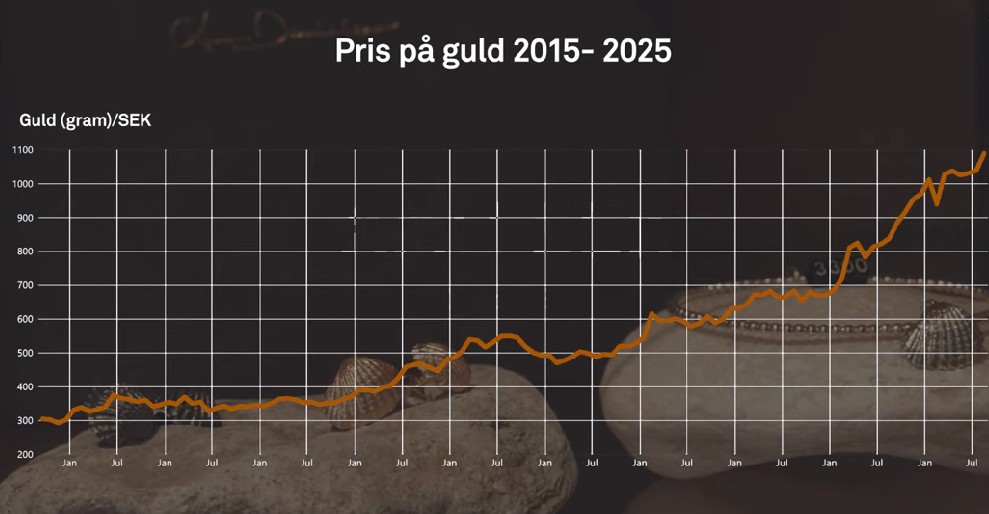

Det stigande guldpriset en utmaning för smyckesköpare

Guldpriset når hela tiden nya höjder och det märks för folk när de ska köpa smycken. Det gör att butikerna måste justera upp sina priser löpande och kunder funderar på om det går att välja något med lägre karat eller mindre diamant. Anna Danielsson, vd på Smyckevalvet, säger att det samtidigt gör att kunderna får upp ögonen för värdet av att äga guld. Det högre guldpriset har även gjort att gamla smycken som ligger hemma i folks byrålådor kan ha fått ett överraskande högt värde.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMeta bygger ett AI-datacenter på 5 GW och 2,25 GW gaskraftverk

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAker BP gör ett av Norges största oljefynd på ett decennium, stärker resurserna i Yggdrasilområdet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEtt samtal om koppar, kaffe och spannmål

-

Analys4 veckor sedan

Analys4 veckor sedanBrent sideways on sanctions and peace talks

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSommarens torka kan ge högre elpriser i höst

-

Analys4 veckor sedan

Analys4 veckor sedanBrent edges higher as India–Russia oil trade draws U.S. ire and Powell takes the stage at Jackson Hole

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals är verksamt i guldrikt område i Finland

-

Analys3 veckor sedan

Analys3 veckor sedanIncreasing risk that OPEC+ will unwind the last 1.65 mb/d of cuts when they meet on 7 September