Nyheter

David Hargreaves on Precious Metals week 15 2012

The big guns still call gold higher – Paulson’s Funds fall – Equities continue to underperform – India is the catalyst – What’s about the dollar and a gold standard? Platinum Piggy-backs – Lonmin looks beyond RSA – Zim rides roughshod as the majors kow-tow – and we hear it for conflict gold.

The big guns still call gold higher – Paulson’s Funds fall – Equities continue to underperform – India is the catalyst – What’s about the dollar and a gold standard? Platinum Piggy-backs – Lonmin looks beyond RSA – Zim rides roughshod as the majors kow-tow – and we hear it for conflict gold.

Gold. The shouting is more subdued now and it is not for $5000/oz. The fall in a short week was only 2%, to $1628/oz, but a further fall it was. Investec, the powerful RSA finance house, is looking for a 10% uplift to around $1850/oz this year. It has a tad of a vested interest, with a heavy gold stock representation in its $100 billion of client funds. It speaks of the metal being a currency in its own right and other currencies growing faster than the supply of new gold. Let’s just dwell on that for a minute.

- Officially held gold stocks are c. 30,000 t at $1600/oz = $1.5 x 1012

- World GDP is c. $70 x 1012, so gold covers it 2% only.

- World GDP is growing at c. 6% per year on average so $3.5 x 1012

- Newly mined gold is c. 2600tpy, worth at $1600/oz, $0.133 x 1012

- So newly mined gold cover against new money is 0.133/3.5 = 3.8%

- Phew, we are safe unless GDP rises above 11% or gold output falls.

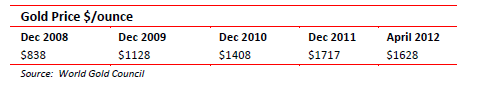

Good try, Investec, but you need more than scare tactics to reignite the fire. Let’s look, too, at where the gold price has come from of late:

Have our economic woes really doubled in less than three and a half years?

India holds the aces. Panic-buying propels most gold price surges and when the panic subsides, so does the gold price. Steady purchases underpin a base price. India imports around 900tpy, over 35% of all new production. This is from a country with a c.17% of the world’s population and less than 5% of its GDP. It is a habit which will not easily be broken, but it is seriously worrying the government. So, in January, it upped the import duty, first from 1% to 2% in January, then to 4% in March. As a result, imports fell 55% in Q1 coincident with a jewellers’ strike. Gold fabrication is a major trade in the country and these moves are also hitting silver. Gold imports were noted as 90 tonnes in January-March as opposed to 280 tonnes in Q1 2011. Q2 purchases are also called down, at perhaps 150 tonnes against 250 in 2011. The concern of course is that the general population pours into gold what could otherwise be flowing into investment and industry. The Associated Chambers of Commerce and Industry warn that imports could reach $100bn by 2015-16 unless they are arbitrarily slowed. That is an almost unthinkable 2000 tonnes at current prices.

Paulson’s Woes Continue. The manager of the $24 bn fund which bears his name is currently suffering for his adherence to gold shares. It lost 13% in March as his holdings in blue chips such as Anglo Gold Ashanti and Nova Gold took it on the chin. The fund is 25% allocated to gold-related investments.

Gold and Silver: The “Ultimate Currency”. A strong case for the precious metal is made by the Emerging Trends Report. It goes back to the late 18th Century and speaks of the USA having been on a gold standard. Not true. Very little gold circulated in the USA; it was on a silver standard as gold was a very scarce commodity until the California gold rush of 1849-51. In 1850 only Britain was on the gold standard, but by 1900 every major nation bar China was on it (T. Green, The Ages of Gold, p. 326).

Platinum. The African dominated metal continues to take its lead from gold, despite having little in common except corrosion resistance. Despite the price having dropped over 20% from its recent peak and the monopoly RSA mining sector strikes, a surplus persists as does labour unrest. The NUM clearly feels it won the last round of negotiations, as it gained double-digit wage increases and now refuses to budge from its 12% demand at the Modwika Mine, a J/V between Anglo American Platinum and African Rainbow Minerals. So the companies have withdrawn from negotiations. The union says it will accelerate the strike and spread it to further mines. It would be interesting to learn what the NUM does about strike pay.

Lonmin. The world’s No 3 platinum producer, at 22tpy, 12% of total, is spreading its wings. It is exercising its rights to enter a J/V in the Wallbridge Mining Company’s North Range properties in the Sudbury area of Ontario, Canada. Over an area of 408sq km. they are prospecting for PGMs, copper, nickel and gold. This will add some welcome geographical diversity to the group portfolio, as long as the local mumbo-jumbo tribe or whatever does not demand overwhelming first nation rights. Lonmin (1012p; Hi-Lo 1760-941p). The shares rallied 13.5p on the news.

Conflict Free Gold. Although first publicised through the antics of the West African diamond trade, the ethic of channelling the spoils of mining to the financing of wars can apply to the other inputs of portable collateral including coloured gemstones and precious metals, particularly artisanal gold. It has prompted the World Gold Council to design a conflict-free gold standard. The WGC tells us 10-15% of all newly mined gold comes from artisanal and small scale sources (260-400tpy), in locations most likely to cause problems. The five-part standard means well, just as does the Kimberley Process for diamonds. The same problems loom:

- Those likely to join are those least likely to break the rules.

- Governance will be almost an impossibility and the funding difficult to obtain.

- Once processed, how can you determine the origin of the gold?

A new Platinum extraction process. Time was (here we go, rocking chair tips over backwards into the pool) they scoffed at the idea of smelting metals other than by using charcoal. Only when the forests disappeared did they hit on coking coal.

Well, now comes the Kel Process for hydrometallurgically leaching PGMs from concentrate. Patented by one Keith Liddell. It claims to slash the all-inhibiting use of electricity in smelting, to recover 99% of the platinum and 98% of the other PGMs. It consumes but 14% of the electricity that smelting does, requires no milling and emits less than 15% of the CO2. To add Kel to a 250,000 oz/year operation costs $65 millions, about the same as a two-day work stoppage at Rustenberg.

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

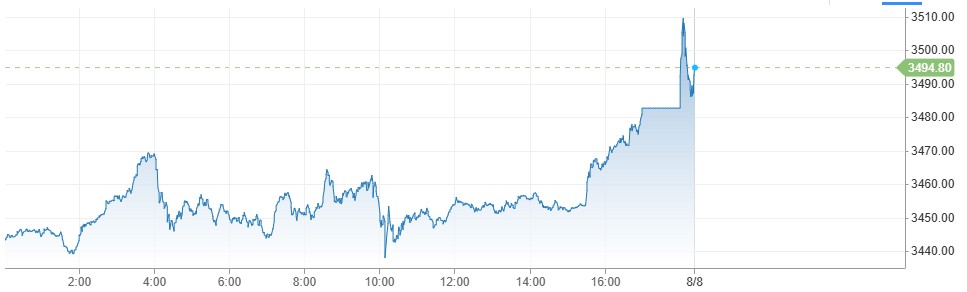

Guld stiger till över 3500 USD på osäkerhet i världen

Investerare har den senaste tiden sökt sig till guld som en säker hamn i en konfliktfylld värld. Trumps ständiga attacker på både vänner och fiender har skapat en stor oreda. Med en ökad sannolikhet för en sänkt ränta i USA så blir guld ännu mer tilltalande. Kring midnatt mellan torsdag och fredag svensk tid passerade den gula ädelmetallen 3500 USD per uns på Comex-börsen.

Nyheter

Lyten, tillverkare av litium-svavelbatterier, tar över Northvolts tillgångar i Sverige och Tyskland

Amerikanska Lyten, världsledande inom litium-svavelbatterier, har tecknat ett bindande avtal om att förvärva Northvolts återstående tillgångar i Sverige och Tyskland. I affären ingår batterifabrikerna Northvolt Ett och Ett Expansion i Skellefteå, Northvolt Labs i Västerås samt planerade Northvolt Drei i tyska Heide. Dessutom förvärvas alla immateriella rättigheter (IP) från Northvolt.

De tillgångar Lyten nu tar över har tidigare värderats till cirka 5 miljarder dollar och omfattar 16 GWh i befintlig batteriproduktionskapacitet samt ytterligare 15 GWh under uppbyggnad. Transaktionen, som är helt finansierad med eget kapital från privata investerare, väntas slutföras under det fjärde kvartalet 2025, förutsatt myndighetsgodkännande.

Återstart av verksamheter och jobbtillfällen

Lyten planerar att omedelbart återuppta verksamheten vid anläggningarna i Skellefteå och Västerås efter att affären slutförts. Bolaget har även för avsikt att återanställa en stor del av den personal som tidigare sagts upp från Northvolt och ser långsiktiga sysselsättningsmöjligheter som en nyckel till fortsatt framgång.

– Det här är ett avgörande ögonblick för Lyten. Förvärvet ger oss de anläggningar och den svenska kompetens som krävs för att snabbare möta den kraftigt ökande efterfrågan på våra litium-svavelbatterier, säger Dan Cook, vd och medgrundare av Lyten.

Positivt mottagande från svenska regeringen

Förvärvet välkomnas även från politiskt håll.

– Det här är en vinst för Sverige och för våra ambitioner inom energi och industriell innovation, säger Ebba Busch, Sveriges vice statsminister.

Fortsatt global expansion

Förvärvet i Sverige och Tyskland är en del av Lytens större strategi att bygga en stark närvaro i både Europa och Nordamerika. Tidigare i år har Lyten också köpt Northvolt Dwa i Polen – Europas största tillverkare av batterilagringssystem – samt förvärvat Northvolts IP-portfölj för energilagring. Bolaget har även uttryckt intresse för att ta över Northvolt Six i Quebec, Kanada.

Batterier för framtiden – även i rymden

Lyten har utvecklat en egen teknikplattform baserad på 3D-grafen och fokuserar på nästa generations litium-svavelbatterier – en teknik med potential att revolutionera batteribranschen. Förutom försäljning till drönar- och försvarsindustrin förbereder Lyten även en batterilansering på den internationella rymdstationen ISS senare i år.

En svensk medgrundare, Lars Herlitz

Även om Lyten är amerikanskt så finns det en svensk medgrundare, Lars Herlitz.

Nyheter

Lundin Gold hittar ny koppar-guld-fyndighet vid Fruta del Norte-gruvan

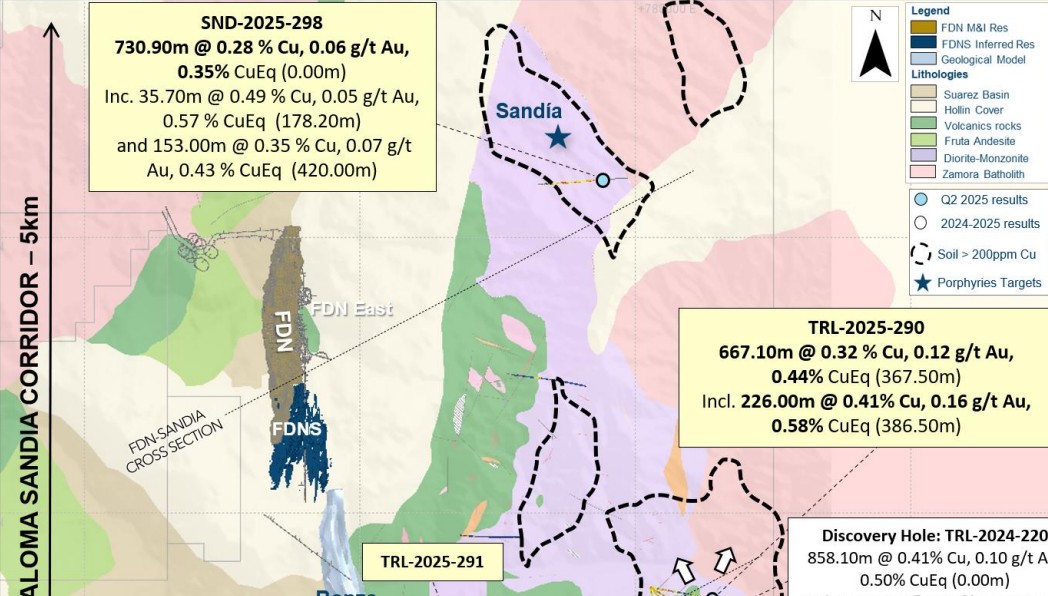

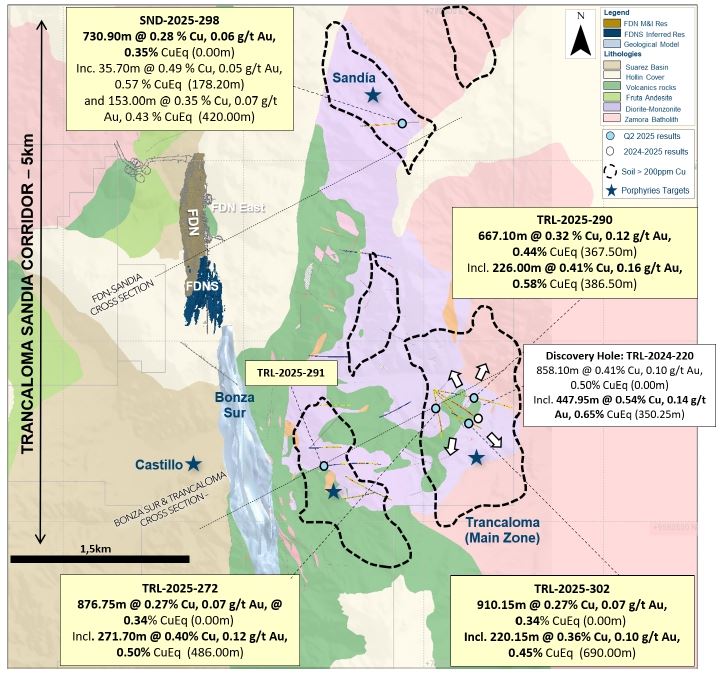

Gruvbolaget Lundin Gold har presenterat starka resultat från sin pågående prospektering vid Fruta del Norte-gruvan i Ecuador. Bolaget meddelar att man har utökat mineraliseringen vid Trancaloma samt upptäckt ett nytt koppar-guld-porfyrsystem vid Sandia, endast fyra kilometer norr om Trancaloma.

Enligt vd Ron Hochstein visar resultaten på den stora, ännu outnyttjade potentialen i området. ”Vi har nu bekräftat att mineraliseringen vid Trancaloma är kontinuerlig och sträcker sig både på djupet och i sidled. Samtidigt har vi upptäckt ett helt nytt system vid Sandia, vilket stärker bilden av en lovande porfyrkorridor direkt intill vår befintliga verksamhet,” säger han.

Bland höjdpunkterna från borrprogrammet märks ett borrhål vid Trancaloma som visade 667 meter med en koppar-ekvivalent (CuEq) på 0,44 %, inklusive 226 meter med 0,58 % CuEq. Vid Sandia påträffades 730 meter med 0,35 % CuEq från markytan, vilket bekräftar förekomsten av ett andra porfyrsystem.

Utforskningsprogrammet för 2025 är det största hittills inom området kring Fruta del Norte, med över 48 000 meter borrning genomförd hittills. Fokus ligger på att identifiera nya fyndigheter i närheten av den befintliga gruvan.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanUSA inför 93,5 % tull på kinesisk grafit

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanFusionsföretag visar hur guld kan produceras av kvicksilver i stor skala – alkemidrömmen ska bli verklighet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanWestinghouse planerar tio nya stora kärnreaktorer i USA – byggstart senast 2030

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanRyska militären har skjutit ihjäl minst 11 guldletare vid sin gruva i Centralafrikanska republiken

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEurobattery Minerals förvärvar majoritet i spansk volframgruva

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanKopparpriset i fritt fall i USA efter att tullregler presenterats

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanLundin Gold rapporterar enastående borrresultat vid Fruta del Norte

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanKina skärper kontrollen av sällsynta jordartsmetaller, vill stoppa olaglig export