Nyheter

David Hargreaves on Metals week 7 2012

Fertiliser Minerals are here to stay. Production and consumption sources are diverse with major miners such as Canada, Russia and Jordan feeding the mega-users India, Brazil and China. Brazil is attempting to redress the local imbalance with a big push on domestic deposits. Its major miner, Vale, best known for iron ore and nickel, is reported to be negotiating to ‘rent’ the Carnelita potassium deposit in NE Brazil, from Petrobras, the state-controlled oil company. Vale also has a potash project in Argentina and a nitrates mine in Peru. Like BHPB, it has committed to the sector but appears better balanced and with a shorter time plan to production.

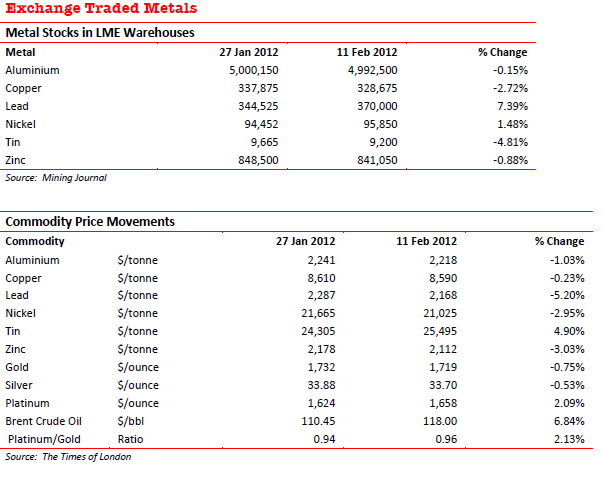

Precious Metals

Rum times. South Africa’s platinum industry, thus 75% of the world base, is in a mess of its own making. The street price is falling even as the output is falling. So demand must be falling, must it not? Gold cannot complain, at c. $1750 per ounce. It was under $1000/oz only a year or two ago. Yet an industry luminary, the CEO of Anglo Gold Ashanti. (World No 2, no less) tells us that at $1650 the miners will only just scrape by. Really, Mr. Cutifani. And Harmony’s CEO agrees with him. Now how come just as much was coming out of the ground recently at $800, $900, $1000? Could it just be that you have allowed untenable wage increases to creep in? That you have let yourselves be browbeaten by avaricious governments who only view the industry as a cash cow? As an argument it only just falls short of the – world – running out of – raw materials syndrome. Remember dividends? Now those were the days.

PGM recycling. It is always useful to read some well stated numbers on a hot industry. Thus we thank the world leader in its field Johnson Matthey for a reprint from Recycling Today on platinum’s link to the automobile industry. New Pt production is about 6Moz annually with 46% absorbed in the auto industry. New Pd production is similar but with 61% into autos. At current prices recycling is doubly worthwhile and is on the increase as older, heavy usage models, are scrapped. Thus in 2012 we could see a 20% increase in scrap recovery to perhaps 1.80Moz combined Pt and Pd. It might go some way to explaining the glut of the metal right now. But new car usage will surely soon overtake it. China, for instance has about one road vehicle per 20 people. Europe’s ratio is c. 5.0 and North America below 3.0. That will be a lot more PGMs on the road. If China and India catch up.

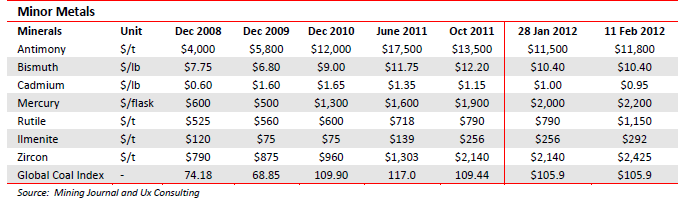

Minor Metals

Generally quiet but if our trusty source, Mining Journal, is to be believed, the titanium feed stocks, ilmenite and rutile, are well marked up. The only news of international note includes Rio Tinto and BHPB swapping shares in the major Richards Bay facility in RSA. Zircon, too, found mostly in RSA and Australia showed some life. Mercury has had an impressive run from $600/flask to a current $2000. This itself is an almost 40% rise in a few months. The major outlets for the metal remains as an amalgam in gold concentration, and in specialised batteries. This represents its future, despite its being highly toxic. Its major production source is Spain.

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

Vad guldets uppgång egentligen betyder för världen

Guldpriset har nyligen nått rekordnivåer, över 4 000 dollar per uns. Denna uppgång är inte bara ett resultat av spekulation, utan speglar djupare förändringar i den globala ekonomin. Bloomberg analyserar hur detta hänger samman med minskad tillit till dollarn, geopolitisk oro och förändrade investeringsmönster.

Guldets roll som säker tillgång har stärkts i takt med att förtroendet för den amerikanska centralbanken minskat. Osäkerhet kring Federal Reserves oberoende, inflationens utveckling och USA:s ekonomiska stabilitet har fått investerare att söka alternativ till fiatvalutor. Donald Trumps handelskrig har också bidragit till att underminera dollarns status som global reservvaluta.

Samtidigt ökar den geopolitiska spänningen, särskilt mellan USA och Kina. Kapitalflykt från Kina, driven av oro för övertryckta valutor och instabilitet i det finansiella systemet, har lett till ökad efterfrågan på guld. Även kryptovalutor som bitcoin stiger i värde, vilket tyder på ett bredare skifte mot hårda tillgångar.

Bloomberg lyfter fram att derivatmarknaden för guld visar tecken på spekulativ överhettning. Positioneringsdata och avvikelser i terminskurvor tyder på att investerare roterar bort från aktier och obligationer till guld. ETF-flöden och CFTC-statistik bekräftar denna trend.

En annan aspekt är att de superrika nu köper upp alla tillgångsslag – aktier, fastigheter, statsobligationer och guld – vilket bryter mot traditionella investeringslogiker där vissa tillgångar fungerar som motvikt till andra. Detta tyder på att marknaden är ur balans och att kapitalfördelningen är skev.

Sammanfattningsvis är guldets prisrally ett tecken på en värld i ekonomisk omkalibrering. Det signalerar misstro mot fiatvalutor, oro för geopolitisk instabilitet och ett skifte i hur investerare ser på risk och trygghet.

Nyheter

Spotpriset på guld över 4300 USD och silver över 54 USD

Guldpriset stiger i ett spektakulärt tempo, nya rekord sätts nu på löpande band. Terminspriset ligger oftast före i utvecklingen, men ikväll passerade även spotpriset på guld 4300 USD per uns. Guldet är just nu som ett ångande tåg som det hela tiden skyfflas in mer kol i. En praktisk fördel med ett högre pris är att det totala värdet på guld även blir högre, vilket gör att centralbanker och privatpersoner kan placera mer pengar i guld.

Även spotpriset på silver har nu passerat 54 USD vilket innebär att alla pristoppar från Hunt-brödernas klassiska squeeze på silver har passerats med marginal. Ett högt pris på guld påverkar främst köpare av smycken, men konsekvensen av ett högt pris på silver är betydligt mer kännbar. Silver är en metall som används inom många olika industrier, i allt från solceller till medicinsk utrustning.

Nyheter

Guld och silver stiger hela tiden mot nya höjder

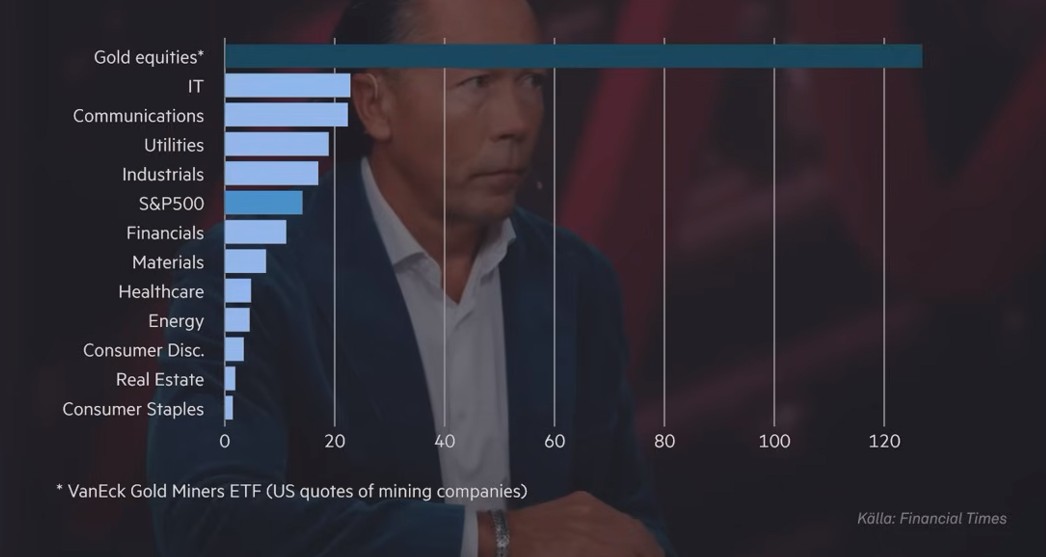

Priserna på guld och silver stiger hela tiden mot nya höjder. Eric Strand går här igenom vilka faktorerna som ligger bakom uppgångarna och vad som kan hända framöver. Han får även kommentera aktier inom guldgruvbolag som har haft en bättre utveckling än nästan allt annat. Han säger bland annat att uppgången kommer från låga nivåer och att det i genomsnitt är en mycket högre kvalitet på ledningarna för bolagen idag.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEtt samtal om guld, olja, fjärrvärme och förnybar energi

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Analys3 veckor sedan

Analys3 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuldpriset uppe på nya höjder, nu 3750 USD

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanEtt samtal om guld, olja, koppar och stål