Analys

A moment in markets – was it a shift in sentiment?

On Tuesday, 11 August, gold fell by over 5% and silver retreated nearly 15% prompting investors to wonder if there had been a material shift in market sentiment. Are defensive hedges no longer required? How important are gold and silver as risk sentiment improves? A glance towards the wider market, and indeed economic fundaments, can help answer these questions.

A wider look at the market

Here is a look at how other defensive and risk assets have behaved since 11 August (‘the day’):

- Defensive assets:

- US dollar bounced up on the day – this triggered the initial sell-off in other safe-haven assets. It was unable to sustain its recovery and remains weak so far this year. The dollar basket is down around 3.7% year-to-date.

- 10-year US treasury yields added over 10 basis points over three days since the day but remain close to record lows at around 0.68% compared to around 1.9% at the start of the year.

- Risk assets:

- The S&P 500 has largely been flat since the day but generally been on a steady upward trajectory since March.

- The Euro Stoxx 50 Index has outpaced the S&P 500 Index since the day and is up around 1.4% since the close of 10 August (in EUR terms).

The question of sentiment

How will a shift in economic and risk sentiment affect asset markets? Consider the following scenarios:

- If sentiment improves: Risk assets, such as equities and cyclical commodities, will certainly benefit from an improvement in economic growth sentiment. And while treasuries may pull back, gold will remain in demand as a hedge against any uptick in inflation. Silver – on account of its high correlation with gold (historically between 0.7 and 0.8), and strong industrial demand (more than half of silver’s use comes from industrial applications including electronics, medical equipment and solar power generation) – will continue to offer a cautious play on the cyclical recovery.

- If sentiment deteriorates: Such a scenario will naturally not be conducive for risk assets. Having said that, US equities have shown meaningful resilience year-to-date owing to strong policy support and tech sector strength. A murkier economic outlook will bring the defensive elements of gold and silver into play.

Did sentiment shift last week?

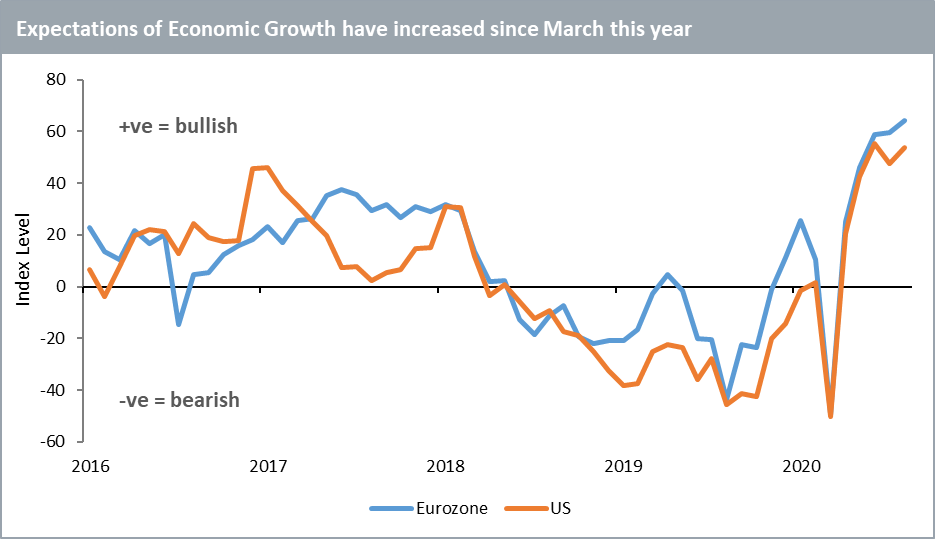

Sentiment – both among economists and in markets – has been improving since the peak of the crisis in March (see figure above). The release of the ZEW USA and Eurozone Expectations of Economic Growth Indices on Tuesday 11 August merely point to a continuation in the trend. The reversal in the CBOE Volatility Index (VIX) since March presents a similar picture of improving confidence in markets. Thus, sentiment did not shift last week but continued along the path it has been on since March.

After the acute contraction in the second quarter, the global economic recovery is likely to be slow and protracted. Gradually improving economic sentiment and a challenging outlook are not mutually exclusive. In fact, they are the ingredients of a steady, U-shaped economic recovery – our central scenario at WisdomTree.

Gold and silver are already making gains this week highlighting how they have become integral components of diversified portfolios. In an age of low to negative interest rates and uncertainty as the global economy recovers, they offer balance by participating in the upside but offering protection in the downside. Strategic investors would do well to ignore momentary volatility and tactical investors are likely to see the price declines, such as those of last week, as buying opportunities.

Mobeen Tahir, Associate Director, Research, WisdomTree

Unless otherwise stated data is source from WisdomTree, Bloomberg as of 17 August 2020.

Analys

OPEC+ in a process of retaking market share

Oil prices are likely to fall for a fourth straight year as OPEC+ unwinds cuts and retakes market share. We expect Brent crude to average USD 55/b in Q4/25 before OPEC+ steps in to stabilise the market into 2026. Surplus, stock building, oil prices are under pressure with OPEC+ calling the shots as to how rough it wants to play it. We see natural gas prices following parity with oil (except for seasonality) until LNG surplus arrives in late 2026/early 2027.

Oil market: Q4/25 and 2026 will be all about how OPEC+ chooses to play it

OPEC+ is in a process of unwinding voluntary cuts by a sub-group of the members and taking back market share. But the process looks set to be different from 2014-16, as the group doesn’t look likely to blindly lift production to take back market share. The group has stated very explicitly that it can just as well cut production as increase it ahead. While the oil price is unlikely to drop as violently and lasting as in 2014-16, it will likely fall further before the group steps in with fresh cuts to stabilise the price. We expect Brent to fall to USD 55/b in Q4/25 before the group steps in with fresh cuts at the end of the year.

Natural gas market: Winter risk ahead, yet LNG balance to loosen from 2026

The global gas market entered 2025 in a fragile state of balance. European reliance on LNG remains high, with Russian pipeline flows limited to Turkey and Russian LNG constrained by sanctions. Planned NCS maintenance in late summer could trim exports by up to 1.3 TWh/day, pressuring EU storage ahead of winter. Meanwhile, NE Asia accounts for more than 50% of global LNG demand, with China alone nearing a 20% share (~80 mt in 2024). US shale gas production has likely peaked after reaching 104.8 bcf/d, even as LNG export capacity expands rapidly, tightening the US balance. Global supply additions are limited until late 2026, when major US, Qatari and Canadian projects are due to start up. Until then, we expect TTF to average EUR 38/MWh through 2025, before easing as the new supply wave likely arrives in late 2026 and then in 2027.

Analys

Manufacturing PMIs ticking higher lends support to both copper and oil

Price action contained withing USD 2/b last week. Likely muted today as well with US closed. The Brent November contract is the new front-month contract as of today. It traded in a range of USD 66.37-68.49/b and closed the week up a mere 0.4% at USD 67.48/b. US oil inventory data didn’t make much of an impact on the Brent price last week as it is totally normal for US crude stocks to decline 2.4 mb/d this time of year as data showed. This morning Brent is up a meager 0.5% to USD 67.8/b. It is US Labor day today with US markets closed. Today’s price action is likely going to be muted due to that.

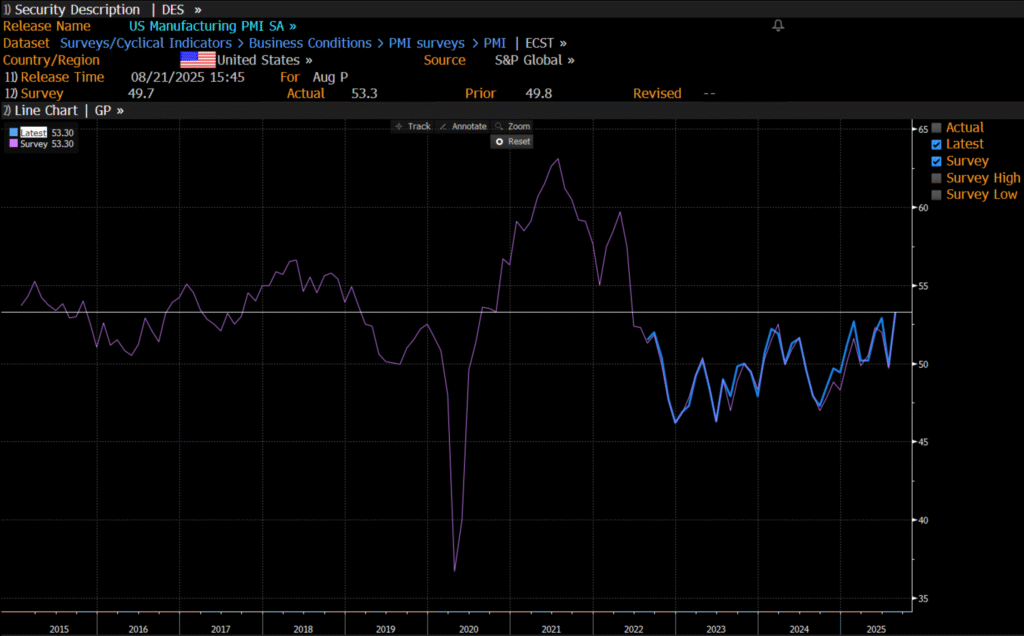

Improving manufacturing readings. China’s manufacturing PMI for August came in at 49.4 versus 49.3 for July. A marginal improvement. The total PMI index ticked up to 50.5 from 50.2 with non-manufacturing also helping it higher. The HCOB Eurozone manufacturing PMI was a disastrous 45.1 last December, but has since then been on a one-way street upwards to its current 50.5 for August. The S&P US manufacturing index jumped to 53.3 in August which was the highest since 2022 (US ISM manufacturing tomorrow). India manufacturing PMI rose further and to 59.3 for August which is the highest since at least 2022.

Are we in for global manufacturing expansion? Would help to explain copper at 10k and resilient oil. JPMorgan global manufacturing index for August is due tomorrow. It was 49.7 in July and has been below the 50-line since February. Looking at the above it looks like a good chance for moving into positive territory for global manufacturing. A copper price of USD 9935/ton, sniffing at the 10k line could be a reflection of that. An oil price holding up fairly well at close to USD 68/b despite the fact that oil balances for Q4-25 and 2026 looks bloated could be another reflection that global manufacturing may be accelerating.

US manufacturing PMI by S&P rose to 53.3 in August. It was published on 21 August, so not at all newly released. But the US ISM manufacturing PMI is due tomorrow and has the potential to follow suite with a strong manufacturing reading.

Analys

Crude stocks fall again – diesel tightness persists

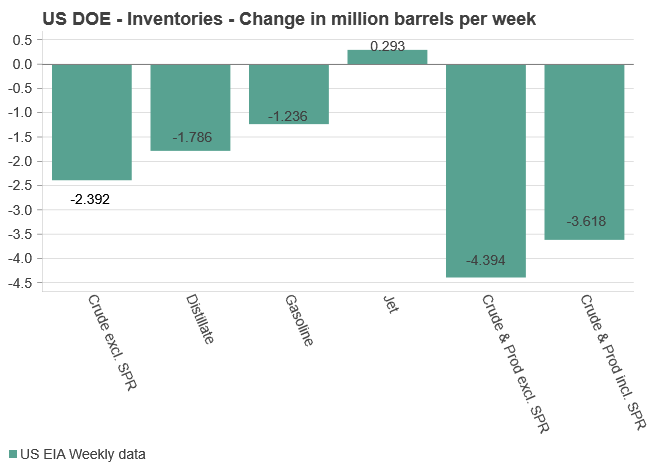

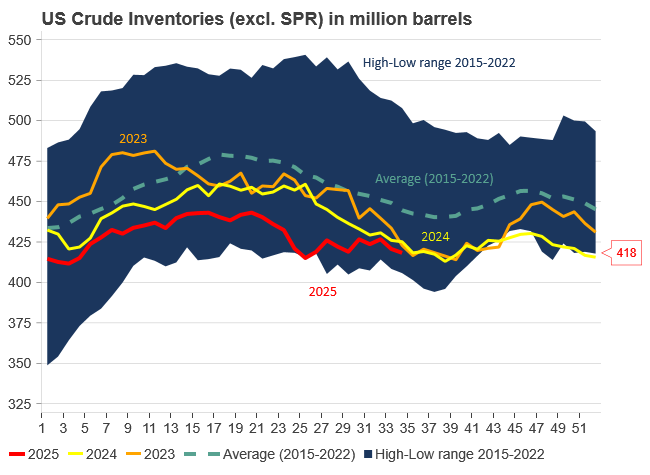

U.S. commercial crude inventories posted another draw last week, falling by 2.4 million barrels to 418.3 million barrels, according to the latest DOE report. Inventories are now 6% below the five-year seasonal average, underlining a persistently tight supply picture as we move into the post-peak demand season.

While the draw was smaller than last week’s 6 million barrel decline, the trend remains consistent with seasonal patterns. Current inventories are still well below the 2015–2022 average of around 449 million barrels.

Gasoline inventories dropped by 1.2 million barrels and are now close to the five-year average. The breakdown showed a modest increase in finished gasoline offset by a decline in blending components – hinting at steady end-user demand.

Diesel inventories saw yet another sharp move, falling by 1.8 million barrels. Stocks are now 15% below the five-year average, pointing to sustained tightness in middle distillates. In fact, diesel remains the most undersupplied segment, with current inventory levels at the very low end of the historical range (see page 3 attached).

Total commercial petroleum inventories – including crude and products but excluding the SPR – fell by 4.4 million barrels on the week, bringing total inventories to approximately 1,259 million barrels. Despite rising refinery utilization at 94.6%, the broader inventory complex remains structurally tight.

On the demand side, the DOE’s ‘products supplied’ metric – a proxy for implied consumption – stayed strong. Total product demand averaged 21.2 million barrels per day over the last four weeks, up 2.5% YoY. Diesel and jet fuel were the standouts, up 7.7% and 1.7%, respectively, while gasoline demand softened slightly, down 1.1% YoY. The figures reflect a still-solid late-summer demand environment, particularly in industrial and freight-related sectors.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOmgående mångmiljardfiasko för Equinors satsning på Ørsted och vindkraft

-

Nyheter4 veckor sedan

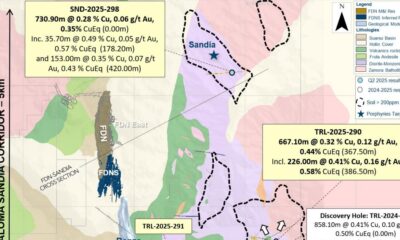

Nyheter4 veckor sedanLundin Gold hittar ny koppar-guld-fyndighet vid Fruta del Norte-gruvan

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMeta bygger ett AI-datacenter på 5 GW och 2,25 GW gaskraftverk

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuld stiger till över 3500 USD på osäkerhet i världen

-

Analys3 veckor sedan

Analys3 veckor sedanWhat OPEC+ is doing, what it is saying and what we are hearing

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAlkane Resources och Mandalay Resources har gått samman, aktör inom guld och antimon

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanAker BP gör ett av Norges största oljefynd på ett decennium, stärker resurserna i Yggdrasilområdet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanLyten, tillverkare av litium-svavelbatterier, tar över Northvolts tillgångar i Sverige och Tyskland