Analys

SHB Råvarukommentar 19 februari 2016

OLJA

OLJA

Brentoljan ser ut att sluta veckan i princip oförändrad, vilket dock döljer stor volatilitet i spåren av avtalet om att frysa produktionen. En uppgörelse mellan Saudiarabien, Ryssland, Venezuela och Qatar fick priset att stiga med 7% i onsdags. Vi bedömer att den prisuppgång som skett är en riskpremie för att Iran eller Irak ansluter sig. Saudiarabien fryser sin produktion på rekordnivåer men kungadömet konsumerar säsongsmässigt mer olja för kylbehov under sommaren och därmed finns det en risk att exporten blir något mindre under sommarmånaderna med avtalet på plats. Det kan dock komma att kompenseras av lägre konsumtion i spåren av budgetunderskott och senaste nedskärningarna på subventioner i el, vatten och petroleum.

Även Ryssland fryser på rekordnivåer men Ryssland har inte förutsättningar att öka produktionen under sanktionerna. Bibehållen produktion vore en positiv överraskning. Med budgetunderskott tror vi att fallande produktion ändå kan leda till stigande export, till priset av minskad inhemsk konsumtion.Qatar har relativt liten oljeproduktion, men är världens största exportör av naturgas som prisas mot olja. Qatar vill därför alltid medverka i prisstärkande aktiviteter på olja då inkomstbortfallet kompenseras flerfaldigat i högre pris på naturgasexporten. För Iran är det otänkbart att frysa produktionen då landet har ambitioner att återta sin förlorade marknad under sanktionerna men självklart kommer landet uttala sig positivt till att andra fryser.

Irak har relativt stora planer på att expandera produktionen i år. Projekten är redan upphandlade och under utbyggnad vilket gör att de inte går att avbryta. Att minska befintlig produktion samtidigt som man bygger ut ny verkar inte rimligt. Irak har också varit undantaget OPEC:s produktionskvot, när den fanns, för att kunna återuppbygga produktionen efter USA invasionen 2003.

Sammantaget tycker vi inte att avtalet har någon större innebörd och ser en risk att riskpremien från att Iran eller Irak ska ansluta sig till avtalet pyser ut nästa vecka. En viss riskpremie ser vi dock som motiverad av att Ryssland faktiskt slutit avtal med OPEC.

EL

Elpriset som fallit kraftigt under inledningen av året, -17 procent för Q216, vände denna vecka upp med närmare 2 euro till 16.50. Kallare väderutsikter framöver i kombination med stigande pris på tysk baskraft samt fossila bränslen är det som främst drivit uppgången. Även om de fossila bränslena fått stöd av den lite bredare uppgången befinner sig dock både kolet och gasen i en stark nedåtgående trend, kol har fallit 68% sedan toppen 2011 och gaspriset har nästan halverats. Svårt att se att någon av dessa faktorer kan generera någon större uppgång och inte heller från den hydrologiska balansen som visar på närmare 10 TWh överskott, men med stöd från en del ”bargain hunting” kan elpriset stiga ytterligare någon från dessa förhållandevis låga nivåer.

Guld

Guldpriset har fallit något under veckan när börsen rusat men har fortfarande stigit över 15% under 2016. Amerikanska centralbanken har tagit notis om senaste marknadsoron och marknaden har nu helt tappat tron på fler räntehöjningar det här året. Ytterligare räntehöjningar från Fed kan bromsa en uppgång för guldpriset, så en mindre hökaktig amerikansk centralbank är positivt.

Vi är fortsatt positiva på guld i den finansiellt oroliga miljö vi har, och guldet har i år stigit på egna meriter, inte enbart på en dollarförsvagning.

Basmetaller

Basmetaller har stigit över veckan, främst nickel som är upp med 7%. Huvudsakligen drivit av en omvändning i sentimentet kring råvaror men också förhoppningar om mer stimulanser i Kina efter svag makrodata.

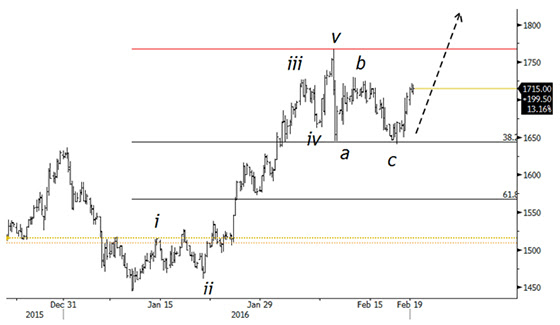

Teknisk analys: Zink

Zink började året med en större uppgång från 1450-nivån. Den första uppgångsfasen ser ut att vara avslutad vid 1767, varefter zink har rekylerat. Rekylen stannade vid 38% rekyl av uppgången, en relativt vanlig fibonaccinivå. Detta skulle kunna innebära att rekylen ner är färdig och att zink kan vara på gång att göra en ny uppgångsfas. Ett vanligt samband för uppgångarna är att vi får en lika lång upprörelse som vi redan sett, vilket i det här fallet skulle innebära ett möjligt mål runt 1960 USD per ton.

Ett möjligt problem med detta scenario är att den första rekylen på en uppgång ofta är mer än 38%, det är vanligare med 50% eller 62% rekyl. Detta skulle kunna innebära att idén att zink har mer uppsidepotential är korrekt, men att rekylen ner på den första uppgången inte är färdig. Dock var många av rekylerna uppåt i zinks tidigare nedgång också av ganska beskedlig magnitud, vilket skulle kunna vara ett argument för att det kanske räcker med den rekyl vi har sett.

Utifrån ett tekniskt perspektiv anser vi zink köpvärd kring dagens nivå vid 1640 USD per ton, med en stopploss under den senaste botten vid 1640 USD med ett mål runt 1960 USD om uppgångsscenariot är korrekt.

LME Zink, 4 timmarsgraf

[box]SHB Råvarukommentar är producerat av Handelsbanken och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Ansvarsbegränsning

Detta material är producerat av Svenska Handelsbanken AB (publ) i fortsättningen kallad Handelsbanken. De som arbetar med innehållet är inte analytiker och materialet är inte oberoende investeringsanalys. Innehållet är uteslutande avsett för kunder i Sverige. Syftet är att ge en allmän information till Handelsbankens kunder och utgör inte ett personligt investeringsråd eller en personlig rekommendation. Informationen ska inte ensamt utgöra underlag för investeringsbeslut. Kunder bör inhämta råd från sina rådgivare och basera sina investeringsbeslut utifrån egen erfarenhet.

Informationen i materialet kan ändras och också avvika från de åsikter som uttrycks i oberoende investeringsanalyser från Handelsbanken. Informationen grundar sig på allmänt tillgänglig information och är hämtad från källor som bedöms som tillförlitliga, men riktigheten kan inte garanteras och informationen kan vara ofullständig eller nedkortad. Ingen del av förslaget får reproduceras eller distribueras till någon annan person utan att Handelsbanken dessförinnan lämnat sitt skriftliga medgivande. Handelsbanken ansvarar inte för att materialet används på ett sätt som strider mot förbudet mot vidarebefordran eller offentliggörs i strid med bankens regler.

Analys

OPEC+ in a process of retaking market share

Oil prices are likely to fall for a fourth straight year as OPEC+ unwinds cuts and retakes market share. We expect Brent crude to average USD 55/b in Q4/25 before OPEC+ steps in to stabilise the market into 2026. Surplus, stock building, oil prices are under pressure with OPEC+ calling the shots as to how rough it wants to play it. We see natural gas prices following parity with oil (except for seasonality) until LNG surplus arrives in late 2026/early 2027.

Oil market: Q4/25 and 2026 will be all about how OPEC+ chooses to play it

OPEC+ is in a process of unwinding voluntary cuts by a sub-group of the members and taking back market share. But the process looks set to be different from 2014-16, as the group doesn’t look likely to blindly lift production to take back market share. The group has stated very explicitly that it can just as well cut production as increase it ahead. While the oil price is unlikely to drop as violently and lasting as in 2014-16, it will likely fall further before the group steps in with fresh cuts to stabilise the price. We expect Brent to fall to USD 55/b in Q4/25 before the group steps in with fresh cuts at the end of the year.

Natural gas market: Winter risk ahead, yet LNG balance to loosen from 2026

The global gas market entered 2025 in a fragile state of balance. European reliance on LNG remains high, with Russian pipeline flows limited to Turkey and Russian LNG constrained by sanctions. Planned NCS maintenance in late summer could trim exports by up to 1.3 TWh/day, pressuring EU storage ahead of winter. Meanwhile, NE Asia accounts for more than 50% of global LNG demand, with China alone nearing a 20% share (~80 mt in 2024). US shale gas production has likely peaked after reaching 104.8 bcf/d, even as LNG export capacity expands rapidly, tightening the US balance. Global supply additions are limited until late 2026, when major US, Qatari and Canadian projects are due to start up. Until then, we expect TTF to average EUR 38/MWh through 2025, before easing as the new supply wave likely arrives in late 2026 and then in 2027.

Analys

Manufacturing PMIs ticking higher lends support to both copper and oil

Price action contained withing USD 2/b last week. Likely muted today as well with US closed. The Brent November contract is the new front-month contract as of today. It traded in a range of USD 66.37-68.49/b and closed the week up a mere 0.4% at USD 67.48/b. US oil inventory data didn’t make much of an impact on the Brent price last week as it is totally normal for US crude stocks to decline 2.4 mb/d this time of year as data showed. This morning Brent is up a meager 0.5% to USD 67.8/b. It is US Labor day today with US markets closed. Today’s price action is likely going to be muted due to that.

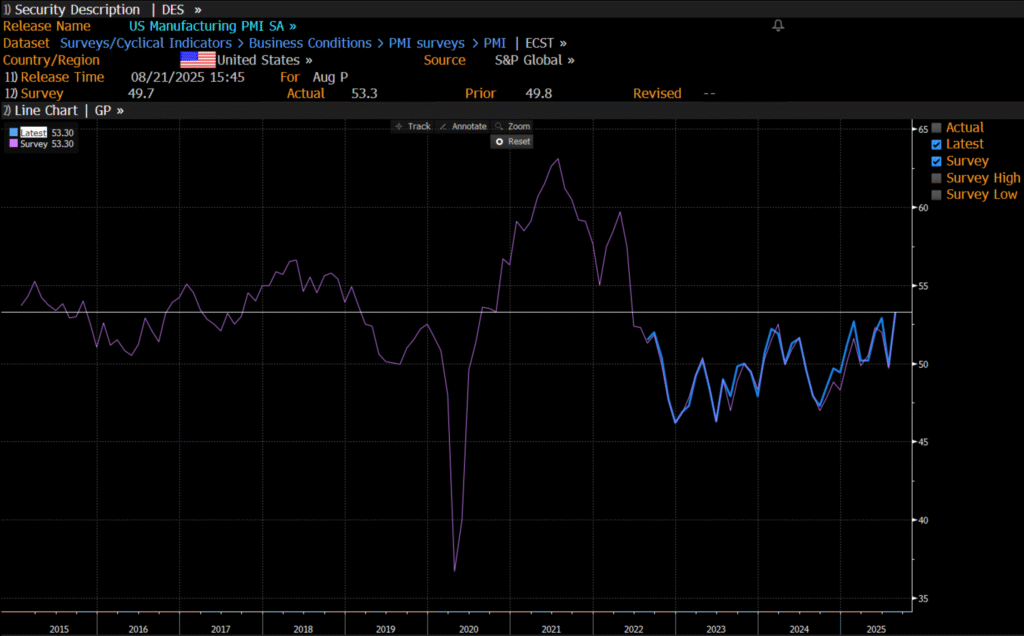

Improving manufacturing readings. China’s manufacturing PMI for August came in at 49.4 versus 49.3 for July. A marginal improvement. The total PMI index ticked up to 50.5 from 50.2 with non-manufacturing also helping it higher. The HCOB Eurozone manufacturing PMI was a disastrous 45.1 last December, but has since then been on a one-way street upwards to its current 50.5 for August. The S&P US manufacturing index jumped to 53.3 in August which was the highest since 2022 (US ISM manufacturing tomorrow). India manufacturing PMI rose further and to 59.3 for August which is the highest since at least 2022.

Are we in for global manufacturing expansion? Would help to explain copper at 10k and resilient oil. JPMorgan global manufacturing index for August is due tomorrow. It was 49.7 in July and has been below the 50-line since February. Looking at the above it looks like a good chance for moving into positive territory for global manufacturing. A copper price of USD 9935/ton, sniffing at the 10k line could be a reflection of that. An oil price holding up fairly well at close to USD 68/b despite the fact that oil balances for Q4-25 and 2026 looks bloated could be another reflection that global manufacturing may be accelerating.

US manufacturing PMI by S&P rose to 53.3 in August. It was published on 21 August, so not at all newly released. But the US ISM manufacturing PMI is due tomorrow and has the potential to follow suite with a strong manufacturing reading.

Analys

Crude stocks fall again – diesel tightness persists

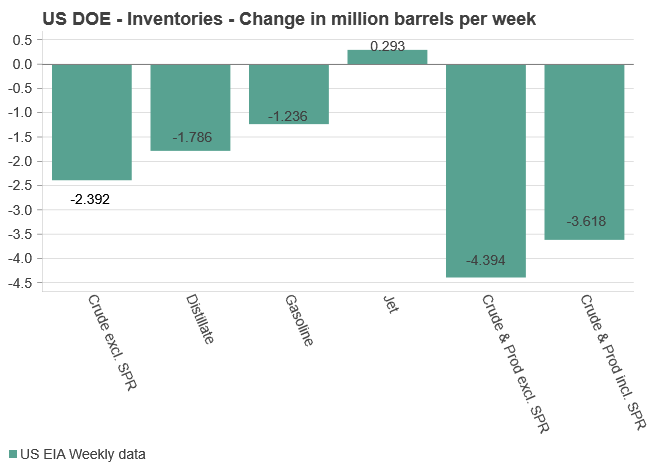

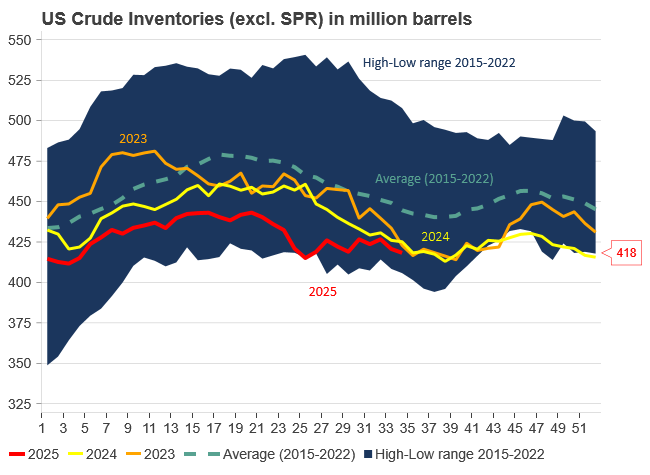

U.S. commercial crude inventories posted another draw last week, falling by 2.4 million barrels to 418.3 million barrels, according to the latest DOE report. Inventories are now 6% below the five-year seasonal average, underlining a persistently tight supply picture as we move into the post-peak demand season.

While the draw was smaller than last week’s 6 million barrel decline, the trend remains consistent with seasonal patterns. Current inventories are still well below the 2015–2022 average of around 449 million barrels.

Gasoline inventories dropped by 1.2 million barrels and are now close to the five-year average. The breakdown showed a modest increase in finished gasoline offset by a decline in blending components – hinting at steady end-user demand.

Diesel inventories saw yet another sharp move, falling by 1.8 million barrels. Stocks are now 15% below the five-year average, pointing to sustained tightness in middle distillates. In fact, diesel remains the most undersupplied segment, with current inventory levels at the very low end of the historical range (see page 3 attached).

Total commercial petroleum inventories – including crude and products but excluding the SPR – fell by 4.4 million barrels on the week, bringing total inventories to approximately 1,259 million barrels. Despite rising refinery utilization at 94.6%, the broader inventory complex remains structurally tight.

On the demand side, the DOE’s ‘products supplied’ metric – a proxy for implied consumption – stayed strong. Total product demand averaged 21.2 million barrels per day over the last four weeks, up 2.5% YoY. Diesel and jet fuel were the standouts, up 7.7% and 1.7%, respectively, while gasoline demand softened slightly, down 1.1% YoY. The figures reflect a still-solid late-summer demand environment, particularly in industrial and freight-related sectors.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOmgående mångmiljardfiasko för Equinors satsning på Ørsted och vindkraft

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMeta bygger ett AI-datacenter på 5 GW och 2,25 GW gaskraftverk

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuld stiger till över 3500 USD på osäkerhet i världen

-

Analys4 veckor sedan

Analys4 veckor sedanWhat OPEC+ is doing, what it is saying and what we are hearing

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanAker BP gör ett av Norges största oljefynd på ett decennium, stärker resurserna i Yggdrasilområdet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanLyten, tillverkare av litium-svavelbatterier, tar över Northvolts tillgångar i Sverige och Tyskland

-

Analys3 veckor sedan

Analys3 veckor sedanBrent sideways on sanctions and peace talks

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om koppar, kaffe och spannmål