Analys

What is behind the recent fall in US crude oil stocks?

US crude oil stocks have fallen significantly during the summer months. This was mainly attributable to an increase in crude oil processing. In this way US refineries reacted to robust demand for middle distillates, which is reflected in low US distillate stocks and record US distillate exports. As crude oil processing declines, US crude oil stocks will likely rise again in the fourth quarter. Robust US distillate exports are exerting pressure on refinery margins in Europe, which will probably increase Europe’s dependency on imports of oil products.

US crude oil stocks have fallen significantly during the summer months. This was mainly attributable to an increase in crude oil processing. In this way US refineries reacted to robust demand for middle distillates, which is reflected in low US distillate stocks and record US distillate exports. As crude oil processing declines, US crude oil stocks will likely rise again in the fourth quarter. Robust US distillate exports are exerting pressure on refinery margins in Europe, which will probably increase Europe’s dependency on imports of oil products.

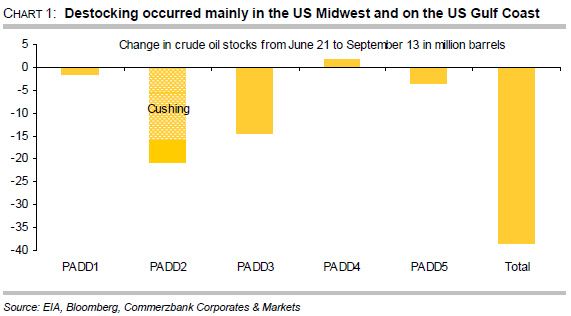

US crude oil stocks have fallen significantly during the summer months. Since the end of June they have declined by 38m barrels and in mid-September reached their lowest level for 18 months. Destocking has been concentrated on two regions: in the Midwest (PADD 2) stocks have fallen by more than 20m barrels, and on the US Gulf Coast (PADD 3) by more than 14m barrels (chart 1). The lion’s share of the destocking in the Midwest related to the storage hub in Cushing, where stocks have fallen by a total of 16.5m barrels for 13 weeks in succession. What is the reason for this surprising trend and will the destocking continue?

US crude oil stocks have fallen significantly during the summer months. Since the end of June they have declined by 38m barrels and in mid-September reached their lowest level for 18 months. Destocking has been concentrated on two regions: in the Midwest (PADD 2) stocks have fallen by more than 20m barrels, and on the US Gulf Coast (PADD 3) by more than 14m barrels (chart 1). The lion’s share of the destocking in the Midwest related to the storage hub in Cushing, where stocks have fallen by a total of 16.5m barrels for 13 weeks in succession. What is the reason for this surprising trend and will the destocking continue?

The trend in stock levels can be divided into three sub-components: on the supply side are US oil production and US oil imports, and on the demand side, crude oil processing by refineries. US oil production has increased until recently. In mid-September it reached its highest level since May 1989 of more than 7.4m barrels per day. This component cannot therefore explain the destocking of recent weeks. On the other hand, imports of crude oil have fallen sharply. In the summer months they were, on average, 1m barrels per day lower than in the previous year. However, this will not be sufficient to balance out the simultaneous increase in US oil production. Between the end of June and mid-September this was, on average, 1.4m barrels per day above the previous year’s level. The trend on the supply side would therefore have been an indication of stockbuilding. The main reason for the significant destocking this summer is therefore to be found on the demand side, i.e. from the higher volumes of crude oil processed at refineries.

Crude oil processing in the USA was higher than usual this summer

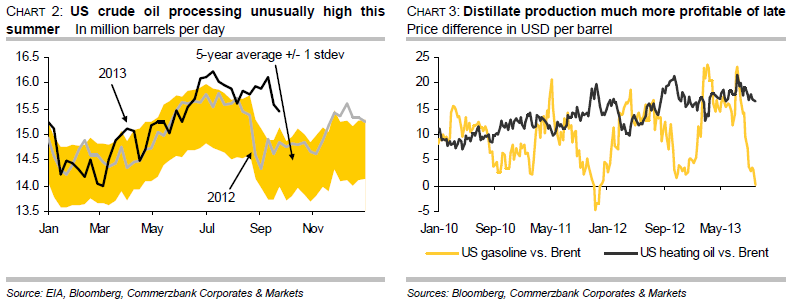

US refineries stepped up crude oil processing much more significantly than usual this summer. Between the end of June and mid-September, an average of 16m barrels of crude oil was processed daily. This was 600,000 barrels per day more than in the corresponding period last year, and 900,000 barrels per day more than the long-term average level (chart 2). At the beginning of July, more crude oil was processed than at any time in the last eight years. It was also striking that refineries maintained processing rates at their high levels of July and August up to mid-September. Normally, refineries scale back their utilisation from the end of August as the summer driving season approaches an end. Refineries usually use the time in early autumn to carry out maintenance and to switch operations to the winter season. Hence, significantly more crude oil has been processed this summer than would otherwise be normal at this time of the year. This has only been possible by consistently dipping into crude oil stocks, although more crude oil has also been available as a result of the increased level of domestic oil production.

This cannot be explained with trends in the US gasoline market…

The fact that US refineries have increased their crude oil processing so strongly over an extended period this summer cannot be explained by trends in the US gasoline market, which is normally the most important driver of refinery activity in the summer months. Demand for gasoline in the US during the summer driving season showed virtually no increase compared to last year. US gasoline stocks have remained consistently 5 to 6 per cent above their long-term average for weeks with a few exceptions. US gasoline production was just slightly higher this summer than in the previous years. Moreover, the US exported less gasoline between March and July than one year ago, according to the EIA.

…but is attributable to distillate production in particular

The reason for the unusually high level of refinery activity over a prolonged period is above all attributable to middle distillates. US refineries have significantly increased the production of middle distillates in particular. This increased to an average of 5m barrels per day in the summer months, which was 13% higher than average for the last five years. More than half of the increase in crude oil processing this summer is therefore attributable to the middle distillates segment. The varying trend in processing margins is likely to have played a part here. While margins for gasoline production have fallen to the lowest level since end of 2011, they are still relatively high for middle distillates (chart 3). The fact that margins for middle distillates have held up much better is attributable to low US distillate stocks, which have remained well below their long-term average levels despite robust production of middle distillates.

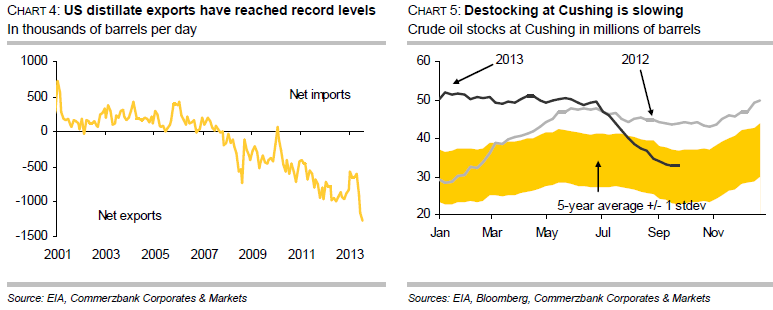

Strong demand for distillates in and outside the USA

This is mainly the result of higher domestic demand and robust demand for distillates from abroad. Distillate demand from US consumers was 10% higher than last year during the summer months and 6% above the average of the last five years. Moreover, the USA exported 1.276m barrels of middle distillates per day on balance in July after having reached a level nearly as high in June (chart 4, page 3). Daily net distillate exports were almost twice as high in June and July as in the first four months of the year and also 26% above the same period last year. Weekly estimates from the US Energy Information Administration also indicate that distillate exports remained at a similarly high level in August and September.

Refinery activity is unlikely to sustain these exceptionally high levels

US refineries have benefited from cheaper crude oil from the country’s interior until recently, which, thanks to new pipeline capacity, can be transported to the US Gulf Coast, where roughly half of US refinery capacity is situated. This also enables US refineries to avoid the continuing restrictions on crude oil exports from the USA, since these restrictions do not apply to the export of oil products. Despite everything, US refineries are unlikely to maintain their distinctly high levels of crude oil processing of recent months, given lower margins. The EIA expects average crude oil processing of 15.3m barrels per day in the fourth quarter. This would still be more than 500,000 barrels per day above the average of the last five years, but some 600,000 barrels per day less than in the third quarter. The lower demand for crude oil from refineries indicates higher stock levels, if US oil imports are not being reduced markedly, as US oil production is likely to increase further as a result of the surge in shale oil production in North Dakota and Texas. In fact, the decline in US crude oil stocks seems to have come to an end. In the second half of September stocks were already increasing by roughly 8m barrels, due to lower volume of crude oil processing and higher oil imports.

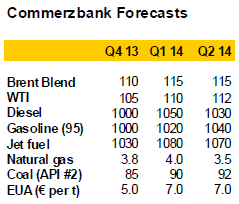

Decline in crude oil stocks has recently also slowed at Cushing

The 13-week long decline in crude oil stocks at Cushing has also weakened visibly in recent weeks (chart 5). Whereas, between the beginning of July and the end of August, on balance an average of 1.36m barrels of crude oil per week were drained off Cushing, in September the figure had fallen to an average of less than 500,000 barrels per week. At the end of September, the decline in stocks at Cushing had almost come to an end. Should stocks be built up also at Cushing in the weeks ahead, this would not be attributable to a lack of transport or processing capacities. These are now sufficient – as the steady fall in Cushing stocks over the summer months despite rising shale oil production in the Midwest demonstrated. In fact, once the Southern leg of the Keystone XL pipeline is completed, additional transport capacities of 700,000 barrels per day will be available by year-end. A stock build-up would instead be attributable to lower crude oil processing at refineries. This should exert pressure on the WTI price in particular.

Record US distillate exports creating problems for refineries in Europe

What are the implications of these trends for Europe? According to data from the EIA, the USA was already exporting record volumes of middle distillates to Europe in May and June. Based on shipping data, this trend has continued in September. The high levels of US distillate exports will exert pressure on refinery margins in Europe. Despite low gasoil stocks, the price differential between gasoil and Brent oil has been moving in a narrow range around USD 15 per barrel for some months, which is hardly sufficient to offset the very low margins in gasoline production. The situation has been compounded by the fact that the USA itself has now become a net gasoline exporter. As a result the US market – formerly the most important sales market for European refineries – has been lost. At the same time, the USA is also competing in gasoline on other sales markets such as South America, for instance. Further refinery closures in Europe are thus on the cards, which would further increase Europe’s dependency on imports of oil products.

Analys

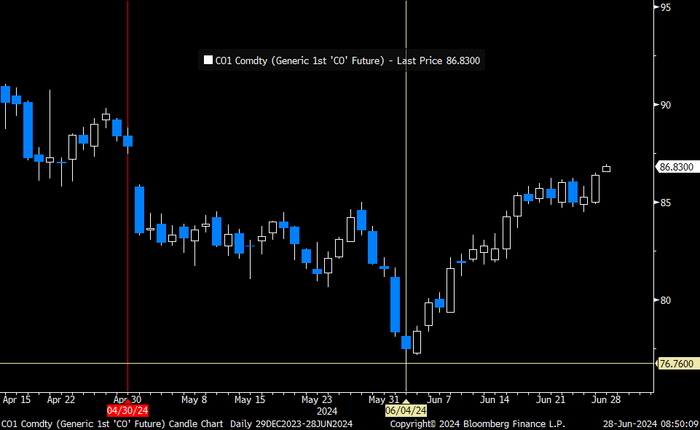

Brent crude inching higher on optimism that US inflationary pressures are fading

Brent crude price inching higher on optimistic that US inflationary pressures are fading. Brent crude closed up 1.1 USD/b ydy to a close of USD 86.39/b which was the highest close since the end of April. This morning it is trading up another half percent to USD 86.9/b along with comparable gains in industrial metals and Asian equities. At 14:30 CET the US will publish its preferred inflation gauge, the PCE figure. Recent data showed softer US personal spending in Q1. Expectations are now high that the PCE inflation number for May will show fading inflationary pressures in the US economy thus lifting the probability for rate cuts later this year which of course is positive for the economy and markets in general and thus positive for oil demand and oil prices. Hopes are high for sure.

Brent crude is trading at the highest since the end of April

The rally in Brent crude since early June is counter to rising US oil inventories and as such a bit puzzling to the market.

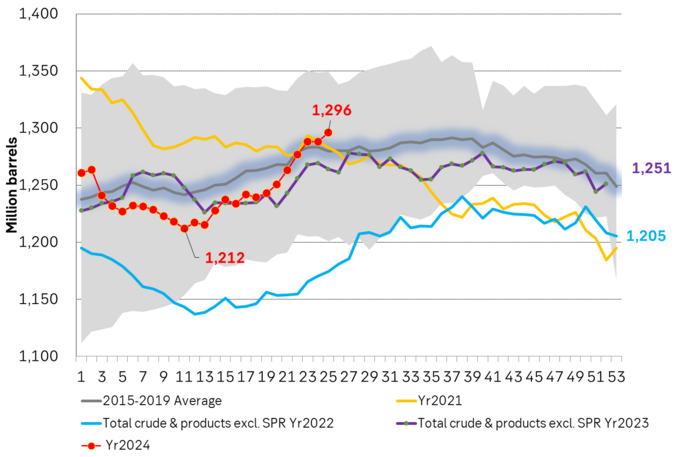

US commercial crude and oil product stocks excluding SPR.

Actual US crude oil production data for April will be published later today. Zero growth in April is likely. Later today the US EIA will publish actual production data for US crude and liquids production for April. Estimates based on US DPR and DUC data indicates that there will indeed be zero growth in US crude oil production MoM in April. This will likely driving home the message that there is no growth in US crude oil production despite a Brent crude oil price of USD 83/b over the past 12 mths. The extension of this is of course rising expectations that there will be no growth in US crude oil production for the coming 12 months either as long as Brent crude hoovers around USD 85/b.

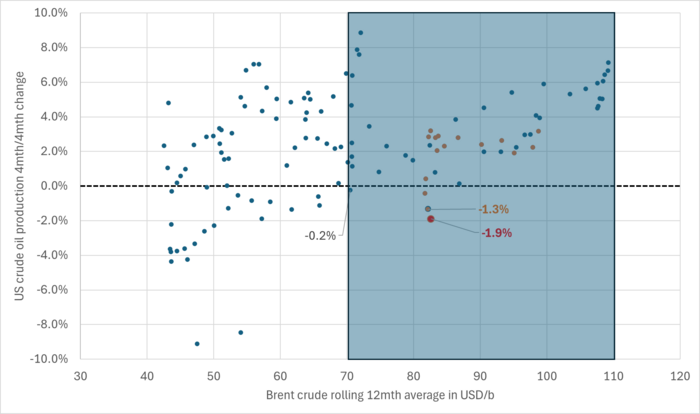

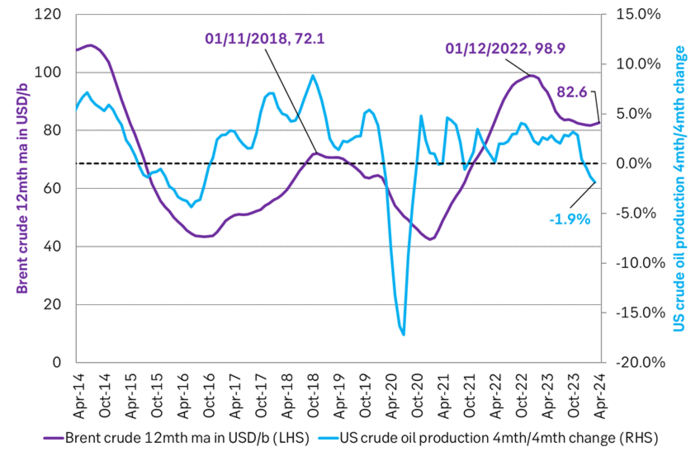

US production breaking a pattern since Jan 2014. No growth at USD 83/b. What stands out when graphing crude oil prices versus growth/decline in US crude oil production is that since January 2014 we have not seen a single month that US crude oil production is steady state or declining when the Brent crude oil price has been averaging USD 70.5/b or higher.

US Senate looking into the possibility that US shale oil producers are now colluding by holding back on investments, thus helping to keep prices leveled around USD 85/b.

Brent crude 12mth rolling average price vs 4mth/4mth change in US crude oil production. Scatter plot of data starting Jan 2014. Large red dot is if there is no change in US crude oil production from March to April. Orange dots are data since Jan 2023. The dot with ”-1.3%” is the March data point.

Brent crude 12mth rolling average price vs 4mth/4mth change in US crude oil production. Data starting Jan 2014. The last data point is if there is no change in US crude oil production from March to April.

Analys

Price forecast update: Weaker green forces in the EU Parliament implies softer EUA prices

We reduce our forecast for EUA prices to 2030 by 10% to reflect the weakened green political agenda in the EU Parliament following the election for the Parliament on 6-9 June. The upcoming election in France on 7 July is an additional risk to the political stability of EU and thus in part also to the solidity of the blocks green agenda. Environmental targets for 2035 and 2040 are most at risk of being weakened on the margin. EUA prices for the coming years to 2030 relate to post-2030 EUA prices through the bankability mechanism. Lower post-2030 climate ambitions and lower post-2030 EUA prices thus have a bearish impact on EUA prices running up to 2030. Actual softening of post-2030 climate ambitions by the EU Parliament have yet to materialize. But when/if they do, a more specific analysis for the consequences for prices can be carried out.

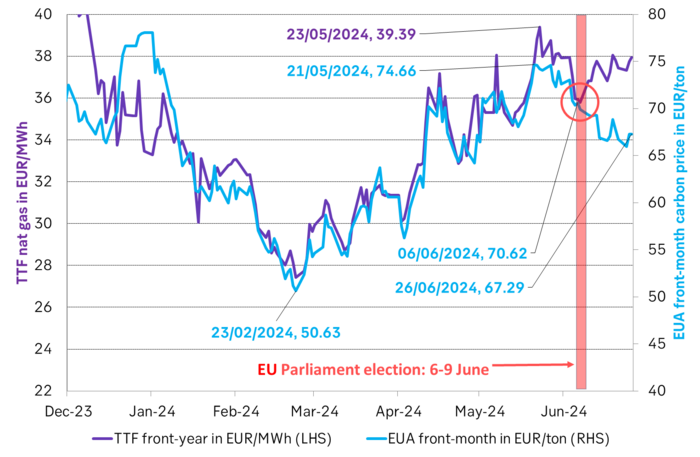

EUA prices broke with its relationship with nat gas prices following the EU Parliament election. The EUA price has dutifully followed the TTF nat gas price higher since they both bottomed out on 23 Feb this year. The EUA front-month price bottomed out with a closing price of EUR 50.63/ton on 23 Feb. It then reached a recent peak of EUR 74.66/ton on 21 May as nat gas prices spiked. Strong relationship between EUA prices and nat gas prices all the way. Then came the EU Parliament election on 6-9 June. Since then the EUA price and TTF nat gas prices have started to depart. Bullish nat gas prices are no longer a simple predictor for bullish EUA prices.

The front-month EUA price vs the front-year TTF nat gas price. Hand in hand until the latest EU Parliament election. Then departing.

The EU Parliament election on 6-9 June was a big backlash for the Greens. The Greens experienced an euphoric victory in the 2019 election when they moved from 52 seats to 74 seats in the Parliament. Since then we have had an energy crisis with astronomic power and nat gas prices, rampant inflation and angry consumers being hurt by it all. In the recent election the Greens in the EU Parliament fell back to 53 seats. Close to where they were before 2019.

While green politics and CO2 prices may have gotten a lot of blame for the pain from energy prices over the latest 2-3 years, the explosion in nat gas prices are largely to blame. But German green policies to replace gas and oil heaters with heat pumps and new environmental regulations for EU farmers are also to blame for the recent pullback in green seats in the Parliament.

Green deal is still alive, but it may not be fully kicking any more. Existing Green laws may be hard to undo, but targets for 2035 and 2040 will be decided upon over the coming five years and will likely be weakened.

At heart the EU ETS system is a political system. As such the EUA price is a politically set price. It rests on the political consensus for environmental priorities on aggregate in EU.

The changes to the EU Parliament will likely weaken post-2030 environmental targets. The changes to the EU Parliament may not change the supply/demand balance for EUAs from now to 2030. But it will likely weaken post-2030 environmental targets and and thus projected EU ETS balances and EUA prices post-2030. And through the bankability mechanism this will necessarily impact EUA prices for the years from now to 2030.

Weaker post-2030 ambitions, targets and prices implies weaker EUA prices to 2030. EUA prices are ”bankable”. You can buy them today and hold on to them and sell them in 2030 or 2035. The value of an EUA today fundamentally rests on expected EUA prices for 2030/35. These again depends on EU green policies for the post 2030 period. Much of these policies will be ironed out and decided over the coming five years.

Weakening of post-2030 targets have yet to materialize. But just talking about it is a cold shower for EUAs. These likely coming weakenings in post-2030 environmental targets and how they will impact EUA prices post 2030 and thus EUA prices from now to 2030 are hard to quantify. But what is clear to say is that when politicians shift their priorities away from the environment and reduce their ambitions for environmental targets post-2030 it’s like a cold shower for EUA prices already today.

On top of this we now also have snap elections in the UK on 4 July and in France on 7 July with the latter having the potential to ”trigger the next euro crisis” according to Gideon Rachman in a recent article in FT.

What’s to be considered a fair outlook for EUA prices for the coming five years in this new political landscape with fundamentally changed political priorities remains to be settled. But that EUA price outlooks will be lowered versus previous forecasts is almost certain.

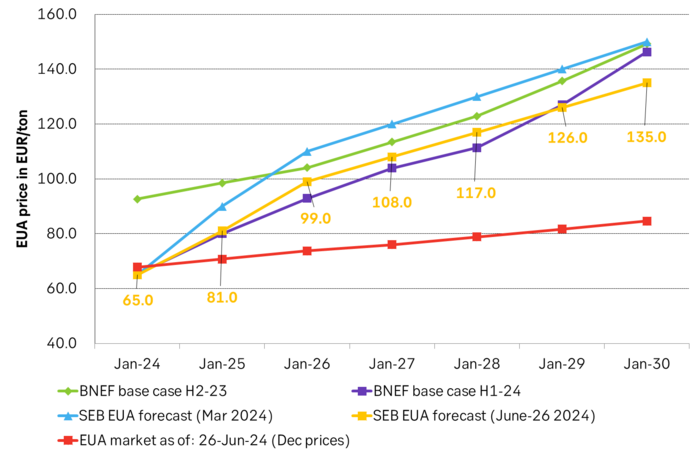

We reduce our EUA price forecast to 2030 by 10% to reflect the new political realities. To start with we reduce our EUA price outlook by 10% from 2025 to 2030 to reflect the weakened Green agenda in the EU parliament.

SEB’s EUA price forecast, BNEF price forecasts and current market prices in EUR/MWh

Analys

The most important data point in the global oil market will be published on Friday 28 June

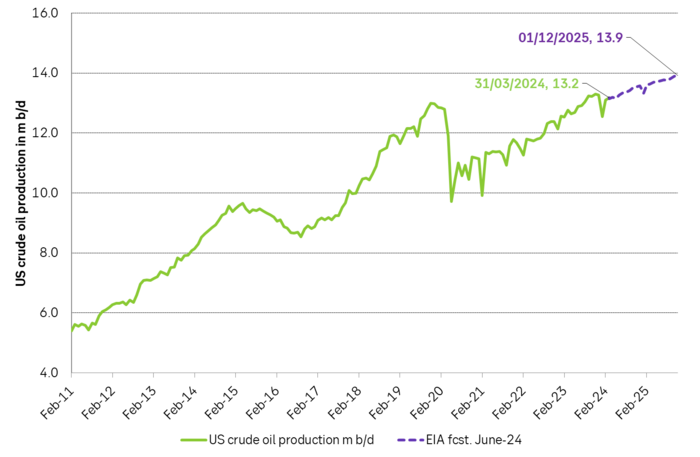

US crude oil production has been booming for more than a decade. Interrupted by two setbacks in response to sharp price declines. The US boom has created large waves in the global oil market and made life very difficult for OPEC(+). Brent crude has not traded below USD 70/b since Dec-2021 and over the past year, it has averaged USD 84/b. US shale oil production would typically boom with such a price level historically. However, there has been zero growth in US crude oil production from Sep-2023 to Mar-2024. This may be partially due to a cold US winter, but something fundamentally seems to have changed. We recently visited a range of US E&P and oil services companies in Houston. The general view was that there would be zero growth in US crude oil production YoY to May 2025. If so and if it also is a general shift to sideways US crude oil production beyond that point, it will be a tremendous shift for the global oil market. It will massively improve the position of OPEC+. It will also sharply change our perception of the forever booming US shale oil supply. But ”the proof is in the pudding” and that is data. More specifically the US monthly, controlled oil production data is to be published on Friday 28 June.

The most important data point in the global oil market will be published on Friday 28 June. The US EIA will then publish its monthly revised and controlled oil production data for April. Following years of booming growth, the US crude oil production has now gone sideways from September 2023 to March 2024. Is this a temporary blip in the growth curve due to a hard and cold US winter or is it the early signs of a huge, fundamental shift where US crude oil production moves from a decade of booming growth to flat-lining horizontal production?

We recently visited a range of E&P and oil services companies in Houston. The general view there was that US crude oil production will be no higher in May 2025 than it is in May 2024. I.e. zero growth.

It may sound undramatic, but if it plays out it is a huge change for the global oil market. It will significantly strengthen the position of OPEC+ and its ability to steer the oil price to a suitable level of its choosing.

The data point on Friday will tell us more about whether the companies we met are correct in their assessment of non-growth in the coming 12 months or whether production growth will accelerate yet again following a slowdown during winter.

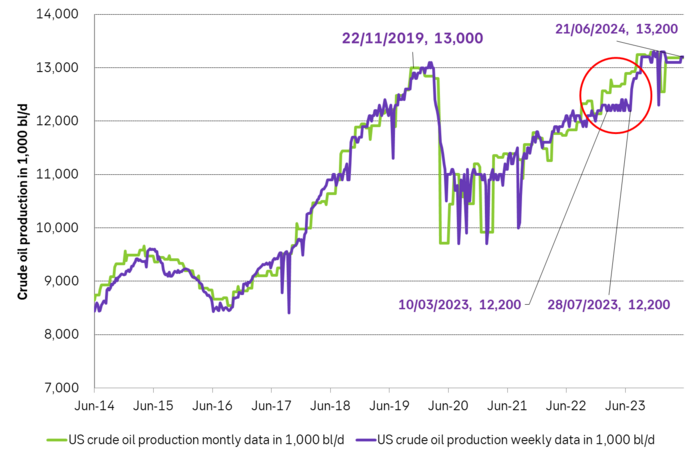

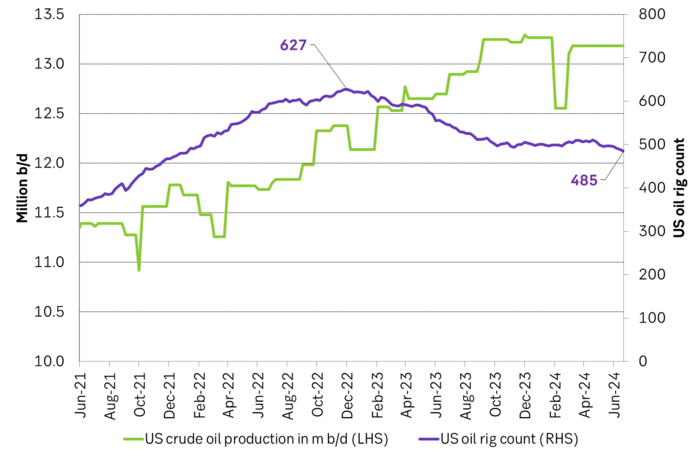

The US releases weekly estimates for its crude oil production but these are rough, temporary estimates. The market was fooled by these weekly numbers last year when the weekly numbers pointed to a steady production of around 12.2 m b/d from March to July while actual monthly data, with a substantial lag in publishing, showed that production was rising strongly.

The real data are the monthly, controlled data. These data will be the ”proof of the pudding” of whether US shale oil production now is about to shift from a decade of booming growth to instead flat-line sideways or whether it will drift gradually higher as projected by the US EIA in its latest Short-Term Energy Outlook.

US crude oil production given by weekly data and monthly data. Note that the monthly, controlled data comes with a significant lag. The market was thus navigating along the weekly data which showed ”sideways at 12.2 m b/d” for a significant period last year until actual data showed otherwise with a time-lag.

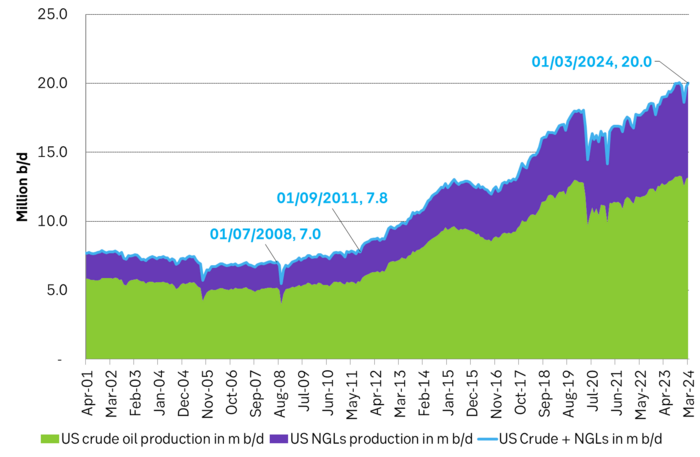

If we add in Natural Gas Liquids and zoom out to include history back to 2001 we see an almost uninterrupted boom in supply since Sep 2011 with a few setbacks. At first glance, this graph gives little support to a belief that US crude oil production now suddenly will go sideways. Simple extrapolation of the graph indicates growth, growth, growth.

US crude and liquids production has boomed since September 2011

However. The latest actual data point for US crude oil production is for March with a reading of 13.18 m b/d. What stands out is that production then was still below the September level of 13.25 m b/d.

The world has gotten used to forever growing US crude oil production due to the US shale oil revolution, with shorter periods of sharp production declines as a result of sharp price declines.

But the Brent crude oil price hasn’t collapsed. Instead, it is trading solidly in the range of USD 70-80-90/b. The front-month Brent crude oil contract hasn’t closed below USD 70/b since December 2021.

Experiences from the last 15 years would imply wild production growth and activity in US shale oil production at current crude oil prices. But US crude oil production has now basically gone sideways to lower from September to March.

The big, big question is thus: Are we now witnessing the early innings of a big change in US shale oil production where we shift from booming growth to flat-lining of production?

If we zoom in we can see that US liquids production has flat-lined since September 2023. Is the flat-lining from Sep to Mar due to the cold winter so that we’ll see a revival into spring and summer or are we witnessing the early signs of a huge change in the global oil market where US crude oil production goes from booming growth to flat-line production.

The message from Houston was that there will be no growth in US crude oil production until May 2025. SEB recently visited oil and gas producers and services providers in Houston to take the pulse of the oil and gas business. Especially so the US shale oil and shale gas business. What we found was an unusually homogeneous view among the companies we met concerning both the state of the situation and the outlook. The sentiment was kind of peculiar. Everybody was making money and was kind of happy about that, but there was no enthusiasm as the growth and boom years were gone. The unanimous view was that US crude oil production would be no higher one year from now than it is today. I.e. flat-lining from here.

The arguments for flat-lining of US crude oil production here onward were many.

1) The shale oil business has ”grown up” and matured with a focus on profits rather than growth for the sake of growth.

2) Bankruptcies and M&As have consolidated the shale oil companies into larger, fewer public companies now accounting for up to 75% of total production. Investors in these companies have little interest/appetite for growth after having burned their fingers during a decade and a half of capital destruction. These investors may also be skeptical of the longevity of the US shale oil business. Better to fully utilize the current shale oil infrastructure steadily over the coming years and return profits to shareholders than to invest in yet more infrastructure capacity and growth.

3) The remaining 25% of shale oil producers which are in private hands have limited scope for growth as they lack pipeline capacity for bringing more crude oil from field to market. Associated nat gas production is also a problem/bottleneck as flaring is forbidden in many places and pipes to transport nat gas from field to market are limited.

4) The low-hanging fruits of volume productivity have been harvested. Drilling and fracking are now mostly running 24/7 and most new wells today are all ”long wells” of around 3 miles. So hard to shave off yet another day in terms of ”drilling yet faster” and the length of the wells has increasingly reached their natural optimal length.

5) The average ”rock quality” of wells drilled in the US in 2024 will be of slightly lower quality than in 2023 and 2025 will be slightly lower quality than 2024. That is not to say that the US, or more specifically the Permian basin, is quickly running out of shale oil resources. But this will be a slight headwind. There is also an increasing insight into the fact that US shale oil resources are indeed finite and that it is now time to harvest values over the coming 5-10 years. One company we met in Houston argued that US shale oil production would now move sideways for 6-7 years and then overall production decline would set in.

The US shale oil revolution can be divided into three main phases. Each phase is probably equally revolutionary as the other in terms of impact on the global oil market.

1) The boom phase. It started after 2008 but didn’t accelerate in force before the ”Arab Spring” erupted and drove the oil price to USD 110/b from 2011 to 2014. It was talked down time and time again, but it continued to boom and re-boom to the point that today it is almost impossible to envision that it won’t just continue to boom or at least grow forever.

2) The plateau phase. The low-hanging fruits of productivity growth have been harvested. The highest quality resources have been utilized. The halfway point of resources has been extracted. Consolidation, normalization, and maturity of the business has been reached. Production goes sideways.

3) The decline phase. Eventually, the resources will have been extracted to the point that production unavoidably starts to decline.

Moving from phase one to phase two may be almost as shocking for the oil market as the experience of phase 1. The discussions we had with oil producers and services companies in Houston may indicate that we may now be moving from phase one to phase two. That there will be zero shale oil production growth YoY in 2025 and that production then may go sideways for 6-7 years before phase three sets in.

US EIA June STEO report with EIA’s projection for US crude oil production to Dec-2025. Softer growth, but still growth.

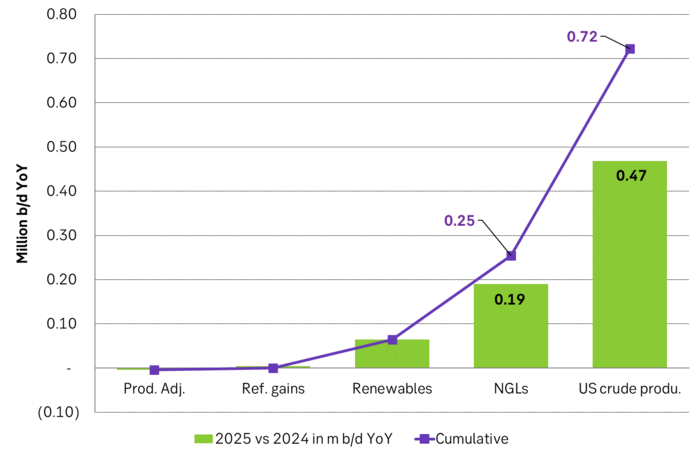

US EIA June STEO report with YoY outlook growth for 2025. Projects that US crude production will grow by 0.47 m b/d YoY in 2025 and that total liquids will grow by 720 k b/d YoY.

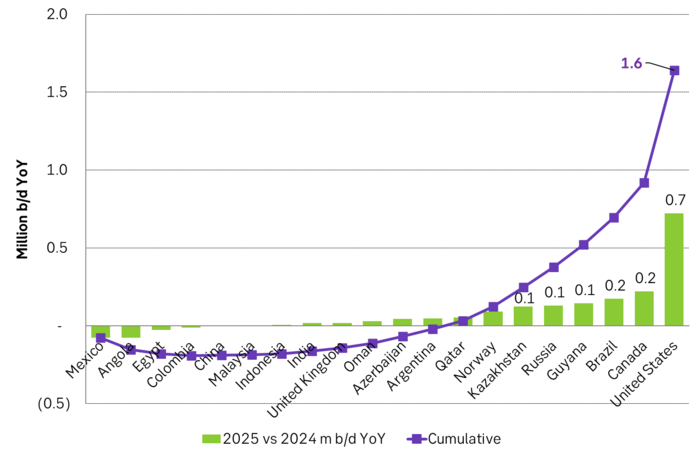

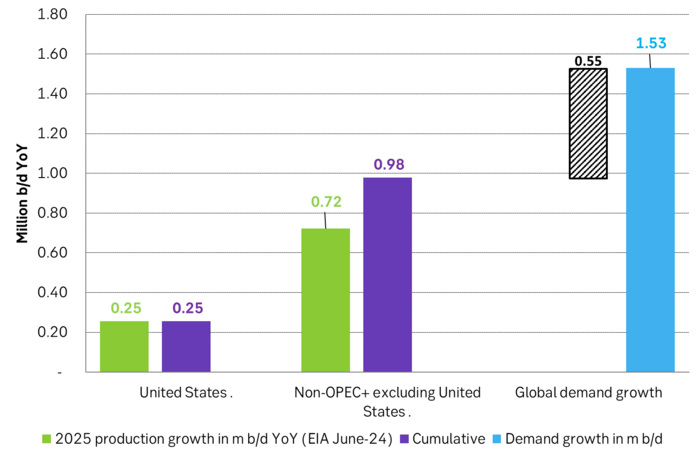

US EIA June STEO report with outlook for production growth by country in 2025. This shows how big the US production growth of 0.7 m b/d YoY really is compared to other producers around the world

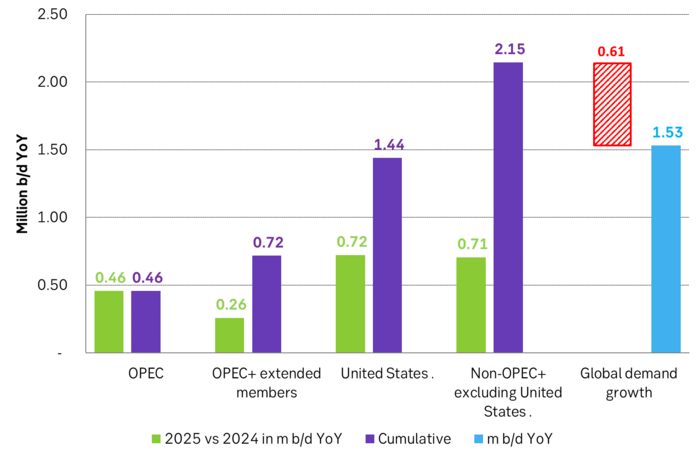

US EIA June STEO report with projected global growth in supply and demand YoY in 2025. Solid demand growth, but even strong supply growth with little room for OPEC+ to expand. Production growth by non-OPEC+ will basically cover global oil demand growth.

But if there instead is zero growth in US crude oil production in 2025 and the US liquids production only grows by 0.25 m b/d YoY due to NGLs and biofuels, then suddenly there is room for OPEC+ to put some of its current production cuts back into the market. Thus growth/no-growth in US shale oil production will be of huge importance for OPEC+ in 2025. If there is no growth in US shale oil then OPEC+ will have a much better position to control the oil price to where it wants it.

US crude oil production and drilling rig count

-

Nyheter7 dagar sedan

Nyheter7 dagar sedanDe tre bästa råvaruvaruaktierna just nu

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanLundin Mining vill köpa Filo Corp tillsammans med BHP

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAfrica Oil är bra att köpa anser Stifel som inleder analysbevakning

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanStor risk att Africa Energy inte överlever det kommande året

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanFirst Nordic Metals har fyra prospekteringsprojekt i Sverige

-

Analys4 veckor sedan

Analys4 veckor sedanBrent crude inching higher on optimism that US inflationary pressures are fading

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanUniper satsar på att göra elektrobränsle av sin elektricitet

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanTre bra aktier inom olja och oljeservice i Kanada