Nyheter

The gold market reigns supreme

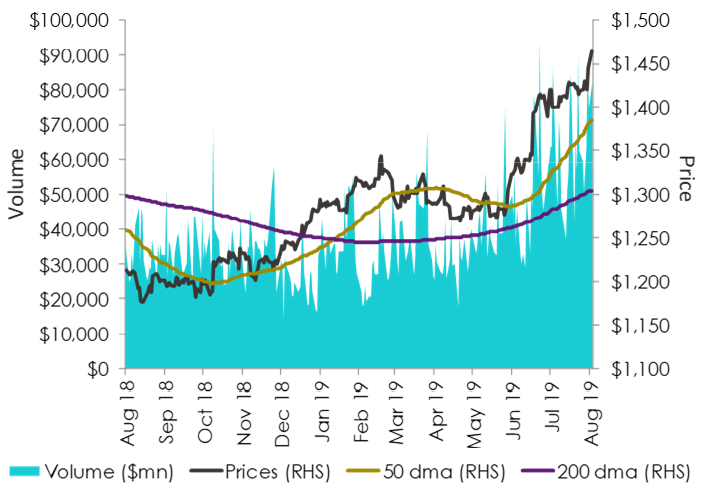

Gold prices are trading at a 6-year high (as at 7 August 2019) as the US-China trade tensions intensify. The troika formed by the interplay amongst Trump, China and the US Federal Reserve (Fed) is resulting in a negative feedback loop that is likely to keep gold prices elevated over the course of 2019.

Figure 1: Gold price trading 12.3% above its 200-day moving average (dma)

US-China-Fed trapped in a negative feedback loop

Trump’s announcement to raise tariffs on the remaining US$ 300Bn worth of Chinese goods to 10% from September 1, 2019 has rattled financial markets paving the way for a significant market sell-off. The announcement coincidentally was made a day after the Federal Open Market Committee (FOMC) meeting on 30-31 July 2019. As expected, the Fed lowered interest rates by 25 basis points (bps) and ended its Quantitative Tightening program. The real surprise emerged at the post-meeting press conference where Fed chairman Jay Powell appeared hawkish as he alluded to the interest rate cut as merely a “mid-cycle adjustment to policy” and “not the beginning of a long series of cuts” thereby dampening the prospect of further rate cuts. Powell also cited trade uncertainties as one of the three pillars which led to the decision of the quarter point rate cut. Trump’s tariff hike announcement on Chinese goods is most likely a tactic being used by him to push the Fed to lower interest rates further in order to soften the blow to US economic growth while he raises the ante against China. At the same time, China is determined to be the world’s leading economic power and will not let Trump stand in its way. In response to Trump’s tariff announcement, the Chinese government has instructed state owned companies to suspend imports of US agricultural products and has devalued the Chinese Yuan. China is also strategically aware of Trump’s overarching goal to win the 2020 US presidential elections and is likely to embark on a tougher trade stance in order to lower Trump’s chances of winning the next US election. The reality is, US economic growth appears steady so far. The latest jobs report confirms that US consumers remain in a solid shape but the growth in job creation is slowing, wage growth remains subdued and core private consumption deflator inflation is running at 1.6% year-on-year (yoy) which justified the last US rate cut. We believe, the Fed’s hand will only be forced to act again if the deterioration of global trade starts to impact the US economy. This appears seemingly likely owing to the hard stance being adopted on trade policy by both the US and Chinese government.

Gold continues to reap the benefits

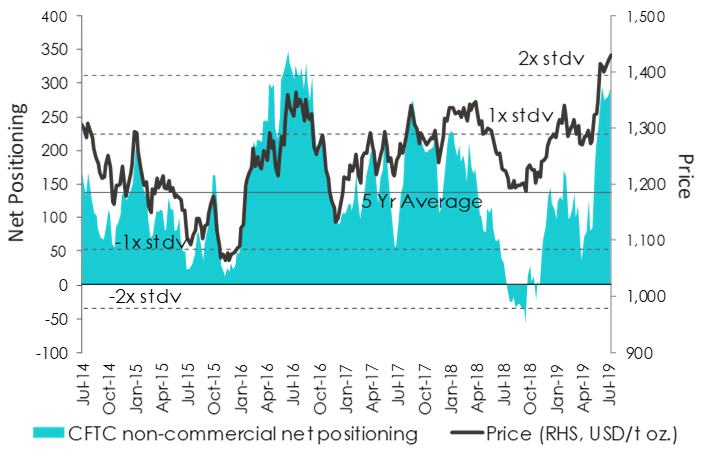

Rising economic uncertainty on global trade is reviving gold’s safe haven status and remains at the forefront of investors’ minds. This is evident from the net speculative futures positioning data on gold futures which are now at 292,847 contracts, more than 1-standard deviation above its five-year average, according to data from the Commodity Futures Trading Commission (CFTC).

Figure 2: Net speculative positioning more than 1-standard deviation above the 5-year average

In addition, net central bank purchases in the H1 2019 totalled 374.1tonnes, 57% higher over the prior year and the highest level since they became net purchasers in 2010 according to the World Gold Council (WGC). This record purchases by global central banks underscores the need to diversify their reserves away from the US dollar. Central bank buying of gold tends to be the stickier money and cannot be underestimated. Gold is also inversely related to the US dollar and we expect further US dollar weakness to unfold owing to the added pressure from Trump on the Fed, the dollar’s reduced yield advantage versus non-US dollar alternatives and the expansion of national debt which will outpace with US economic growth.

Non-yielding assets such as gold appear more attractive compared to other haven assets such as bonds that are yielding low to negative yields. Currently nearly US$12 trillion of global sovereign debt is negative yielding according to Bloomberg. Capital is clearly in search of better opportunities and this is likely to continue to favour gold in the long run. Gold has disappointed since 2012, as global monetary easing has helped bid up riskier financial assets. However, we believe there are limits to how much monetary easing by global central banks can achieve and as market participants soon come to terms with that reality, gold’s price trajectory is likely to take the next leg higher.

By: Aneeka Gupta, Associate Director of Research

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Nyheter

Gruvbolaget Boliden överträffade analytikernas förväntningar

Gruvbolaget Boliden överträffade analytikernas förväntningar med bred marginal när man presenterade resultatet för det tredje kvartalet. Mikael Staffas, vd för Boliden, kommenterar kvartalet och hur han ser på råvarumarknaden och bolagets olika gruvprojekt.

Nyheter

Australien och USA investerar 8,5 miljarder USD för försörjningskedja av kritiska mineraler

USA:s president Donald Trump och Australiens premiärminister Anthony Albanese undertecknade på måndagen ett avtal som ska tillföra miljarder dollar till projekt inom kritiska mineraler.

Länderna kommer tillsammans att bidra med 1-3 miljarder dollar till projekten under de kommande sex månaderna. Den totala projektportföljen är värd 8,5 miljarder dollar, enligt regeringarna.

Galliumraffinaderi med kapacitet för 5x USA:s efterfrågan

Som en del av avtalet kommer det amerikanska försvarsdepartementet även att investera i ett galliumraffinaderi i västra Australien med en kapacitet på 100 ton per år. För närvarande importerar USA omkring 21 ton gallium, vilket motsvarar hela den inhemska konsumtionen, enligt den amerikanska geologiska myndigheten.

Initiativet kommer samtidigt som Kina har infört exportrestriktioner på vissa mineraler, däribland sällsynta jordartsmetaller, som är avgörande för tillverkningen av elektronik och elmotorer. Gallium används till exempel i mikrovågskretsar samt blå och violetta lysdioder (LED), vilka kan användas för att skapa kraftfulla lasrar.

Nyheter

Vad guldets uppgång egentligen betyder för världen

Guldpriset har nyligen nått rekordnivåer, över 4 000 dollar per uns. Denna uppgång är inte bara ett resultat av spekulation, utan speglar djupare förändringar i den globala ekonomin. Bloomberg analyserar hur detta hänger samman med minskad tillit till dollarn, geopolitisk oro och förändrade investeringsmönster.

Guldets roll som säker tillgång har stärkts i takt med att förtroendet för den amerikanska centralbanken minskat. Osäkerhet kring Federal Reserves oberoende, inflationens utveckling och USA:s ekonomiska stabilitet har fått investerare att söka alternativ till fiatvalutor. Donald Trumps handelskrig har också bidragit till att underminera dollarns status som global reservvaluta.

Samtidigt ökar den geopolitiska spänningen, särskilt mellan USA och Kina. Kapitalflykt från Kina, driven av oro för övertryckta valutor och instabilitet i det finansiella systemet, har lett till ökad efterfrågan på guld. Även kryptovalutor som bitcoin stiger i värde, vilket tyder på ett bredare skifte mot hårda tillgångar.

Bloomberg lyfter fram att derivatmarknaden för guld visar tecken på spekulativ överhettning. Positioneringsdata och avvikelser i terminskurvor tyder på att investerare roterar bort från aktier och obligationer till guld. ETF-flöden och CFTC-statistik bekräftar denna trend.

En annan aspekt är att de superrika nu köper upp alla tillgångsslag – aktier, fastigheter, statsobligationer och guld – vilket bryter mot traditionella investeringslogiker där vissa tillgångar fungerar som motvikt till andra. Detta tyder på att marknaden är ur balans och att kapitalfördelningen är skev.

Sammanfattningsvis är guldets prisrally ett tecken på en värld i ekonomisk omkalibrering. Det signalerar misstro mot fiatvalutor, oro för geopolitisk instabilitet och ett skifte i hur investerare ser på risk och trygghet.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEtt samtal om guld, olja, fjärrvärme och förnybar energi

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Analys4 veckor sedan

Analys4 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuldpriset uppe på nya höjder, nu 3750 USD

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om guld, olja, koppar och stål