Analys

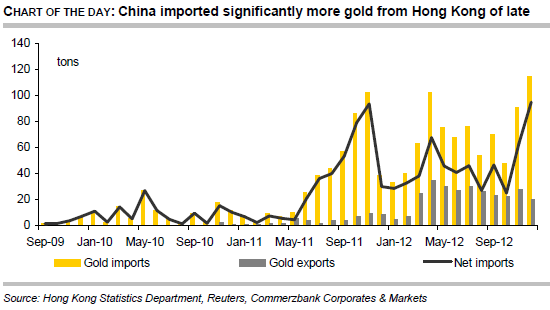

Record high Chinese gold imports

Energy: Thanks to the positive mood on the financial markets, oil has regained the ground lost on Monday. Brent rose $2 yesterday to reach $117.2 a barrel for a time, hitting a new 4½-month high. Any drop in prices is evidently being seen by market players as a chance to buy at present, suggesting further gains. According to API inventory data, US crude stocks increased by 3.6 million barrels last week, somewhat more than envisaged, whereas crude stocks at Cushing fell by 24 thousand barrels. The reduced throughput capacity of the Seaway pipeline is evidently still sufficient to prevent stocks at Cushing from building up.

Energy: Thanks to the positive mood on the financial markets, oil has regained the ground lost on Monday. Brent rose $2 yesterday to reach $117.2 a barrel for a time, hitting a new 4½-month high. Any drop in prices is evidently being seen by market players as a chance to buy at present, suggesting further gains. According to API inventory data, US crude stocks increased by 3.6 million barrels last week, somewhat more than envisaged, whereas crude stocks at Cushing fell by 24 thousand barrels. The reduced throughput capacity of the Seaway pipeline is evidently still sufficient to prevent stocks at Cushing from building up.

The next few weeks will reveal how long this will last, given the continuing rise in shale oil production in North Dakota and limited refinery capacity in the Midwest. At present, US crude stocks are at a 31-year high for this time of year. The price of WTI is suffering accordingly. It came under pressure when the API inventory figures were announced, and is now trading at under $96.5 a barrel. The difference between Brent and WTI clearly reflects the discrepancy in oil price developments. The gap this morning has widened to more than $20, the biggest since December. This afternoon the US Department of Energy will be publishing its official inventory data. With low capacity utilisation and rising crude imports, they too are expected to reveal another rise in stock levels.

Precious metals: According to figures provided by the Census and Statistics Department of the Hong Kong government, China imported record quantities of gold from Hong Kong in December. Year on year, imports were up to 114.4 tons, almost trebling. At the same time, “only” 19.6 tons of gold were exported to Hong Kong, the smallest volume since February.

The figures suggest strong demand for gold within China itself. Over the year as a whole, China imported a net quantity of 557.5 tons of gold from Hong Kong, likewise a record and 47% up on 2011. If it is assumed that China itself produced almost 400 tons of gold last year, the total Chinese gold demand will have been over 950 tons, which would mean that China had overtaken India as the world’s number one consumer of gold on a yearly basis.

Owing among other things to higher duties on gold imports, Indian gold demand is likely to have fallen last year to just over 700 tons. China is thus filling the gap left by India. With China’s population getting increasingly wealthier, demand for gold should remain high, and since the country cannot meet demand from its own gold resources, and the central bank is topping up its gold reserves, gold imports can be expected to remain at a high level, which should support prices.

[box]This article is published on Råvarumarknaden.se with permission from Commerzbank AG[/box]

This document has been created and published by the Corporates & Markets division of Commerzbank AG, Frankfurt/Main or Commerzbank’s branch offices mentioned in the document. Commerzbank Corporates & Markets is the investment banking division of Commerzbank, integrating research, debt, equities, interest rates and foreign exchange.

The author(s) of this report, certify that (a) the views expressed in this report accurately reflect their personal views; and (b) no part of their compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or views expressed by them contained in this document. The analyst(s) named on this report are not registered / qualified as research analysts with FINRA and are not subject to NASD Rule 2711.

Disclaimer

This document is for information purposes only and does not take account of the specific circumstances of any recipient.

Analys

Sell the rally. Trump has become predictable in his unpredictability

Hesitant today. Brent jumped to an intraday high of $66.36/b yesterday after having touched an intraday low of $60.07/b on Monday as Indian and Chinese buyers cancelled some Russian oil purchases and instead redirected their purchases towards the Middle East due to the news US sanctions. Brent is falling back 0.4% this morning to $65.8/b.

It’s our strong view that the only sensible thing is to sell this rally. In all Trump’s unpredictability he has become increasingly predictable. Again and again he has rumbled about how he is going to be tough on Putin. Punish Putin if he won’t agree to peace in Ukraine. Recent rumbling was about the Tomahawk rockets which Trump threatened on 10 October and 12 October to sell/send to Ukraine. Then on 17 October he said that ”the U.S. didn’t want to give away weapons (Tomahawks) it needs”.

All of Trump’s threats towards Putin have been hot air. So far Trump’s threats have been all hot air and threats which later have evaporated after ”great talks with Putin”. After all these repetitions it is very hard to believe that this time will be any different. The new sanctions won’t take effect before 21. November. Trump has already said that: ”he was hoping that these new sanctions would be very short-lived in any case”. Come 21. November these new sanctions will either evaporate like all the other threats Trump has thrown at Putin before fading them. Or the sanctions will be postponed by another 4 weeks or 8 weeks with the appearance that Trump is even more angry with Putin. But so far Trump has done nothing that hurt Putin/Russia. We can’t imagine that this will be different. The only way forward in our view for a propre lasting peace in Ukraine is to turn Ukraine into defensive porcupine equipped with a stinging tail if need be.

China will likely stand up to Trump if new sanctions really materialize on 21 Nov. Just one country has really stood up to Trump in his tariff trade war this year: China. China has come of age and strength. I will no longer be bullied. Trump upped tariffs. China responded in kind. Trump cut China off from high-end computer chips. China put on the breaks on rare earth metals. China won’t be bullied any more and it has the power to stand up. Some Chinese state-owned companies like Sinopec have cancelled some of their Russian purchases. But China’s Foreign Ministry spokesperson Guo Jiakun has stated that China “oppose unilateral sanctions which lack a basis in international law and authorization of the UN Security Council”. Thus no one, not even the US shall unilaterally dictate China from whom they can buy oil or not. This is yet another opportunity for China to show its new strength and stand up to Trump in a show of force. Exactly how China choses to play this remains to be seen. But China won’t be bullied by over something as important as its oil purchases. So best guess here is that China will defy Trump on this. But probably China won’t need to make a bid deal over this. Firstly because these new sanctions will either evaporate as all the other threats or be postponed once we get to 21 November. Secondly because the sanctions are explicit towards US persons and companies but only ”may” be enforced versus non-US entities.

Sanctions is not a reduction in global supply of oil. Just some added layer of friction. Anyhow, the new sanctions won’t reduce the supply of Russian crude oil to the market. It will only increase the friction in the market with yet more need for the shadow fleet and ship to ship transfer of Russian oil to dodge the sanctions. If they materialize at all.

The jump in crude oil prices is probably due to redirections of crude purchases to the Mid-East and not because all speculators are now turned bullish. Has oil rallied because all speculators now suddenly have turned bullish? We don’t think so. Brent crude has probably jumped because some Indian and Chinese oil purchasers of have redirected their purchases from Russia towards the Mid-East just in case the sanctions really materializes on 21 November.

Analys

Brent crude set to dip its feet into the high $50ies/b this week

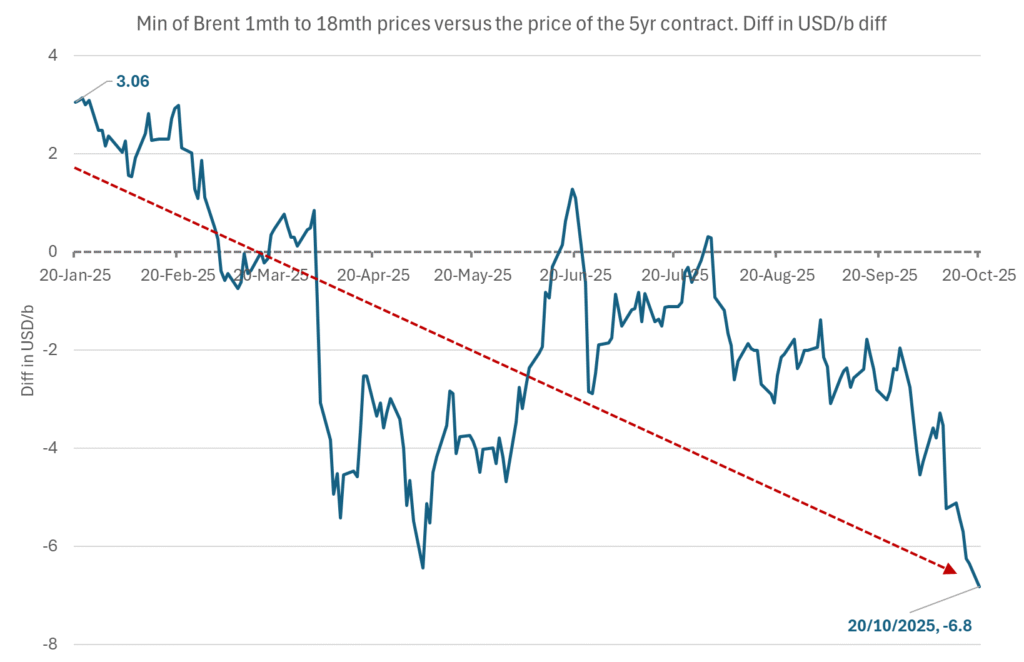

Parts of the Brent crude curve dipping into the high $50ies/b. Brent crude fell 2.3% over the week to Friday. It closed the week at $61.29/b, a slight gain on the day, but also traded to a low of $60.14/b that same day and just barely avoided trading into the $50ies/b. This morning it is risk-on in equities which seems to help industrial metals a little higher. But no such luck for oil. It is down 0.8% at $60.8/b. This week looks set for Brent crude to dip its feet in the $50ies/b. The Brent 3mth contract actually traded into the high $50ies/b on Friday.

The front-end backwardation has been on a weakening foot and is now about to fully disappear. The lowest point of the crude oil curve has also moved steadily lower and lower and its discount to the 5yr contract is now $6.8/b. A solid contango. The Brent 3mth contract did actually dip into the $50ies/b intraday on Friday when it traded to a low point of $59.93/b.

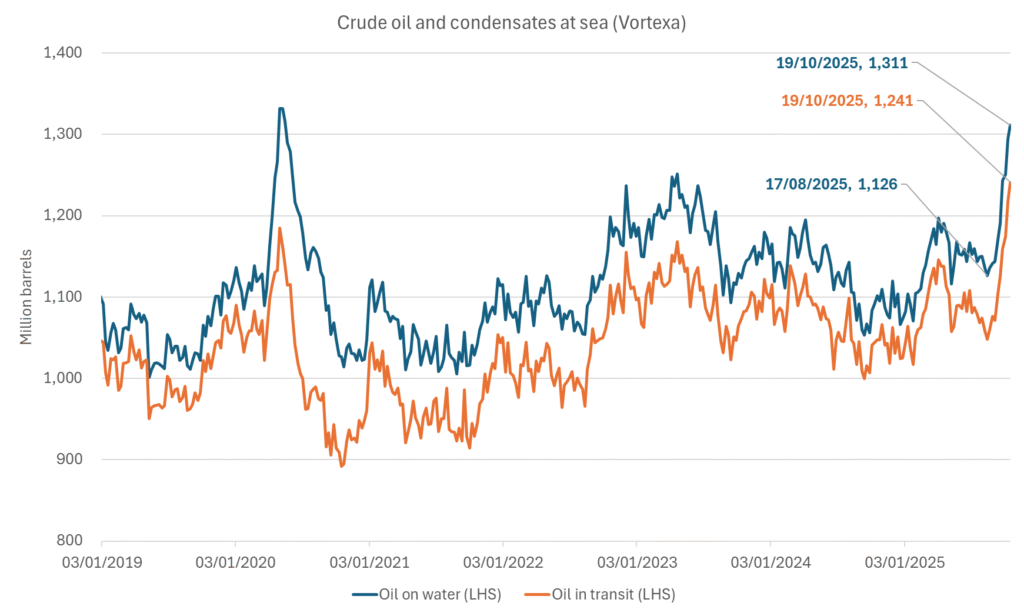

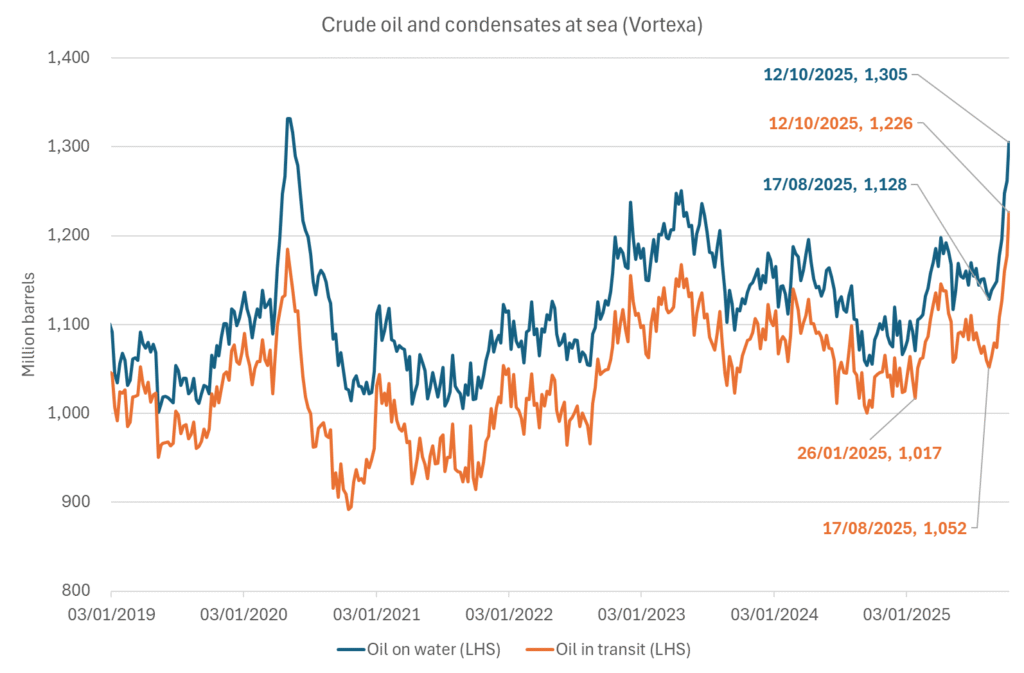

More weakness to come as lots of oil at sea comes to ports. Mid-East OPEC countries have boosted exports along with lower post summer consumption and higher production. The result is highly visibly in oil at sea which increased by 17 mb to 1,311 mb over the week to Sunday. Up 185 mb since mid-August. On its way to discharge at a port somewhere over the coming month or two.

Don’t forget that the oil market path ahead is all down to OPEC+. Remember that what is playing out in the oil market now is all by design by OPEC+. The group has decided that the unwind of the voluntary cuts is what it wants to do. In a combination of meeting demand from consumers as well as taking back market share. But we need to remember that how this plays out going forward is all at the mercy of what OPEC+ decides to do. It will halt the unwinding at some point. It will revert to cuts instead of unwind at some point.

A few months with Brent at $55/b and 40-50 US shale oil rigs kicked out may be what is needed. We think OPEC+ needs to see the exit of another 40-50 drilling rigs in the US shale oil patches to set US shale oil production on a path to of a 1 mb/d year on year decline Dec-25 to Dec-26. We are not there yet. But a 2-3 months period with Brent crude averaging $55/b would probably do it.

Oil on water increased 17 mb over the week to Sunday while oil in transit increased by 23 mb. So less oil was standing still. More was moving.

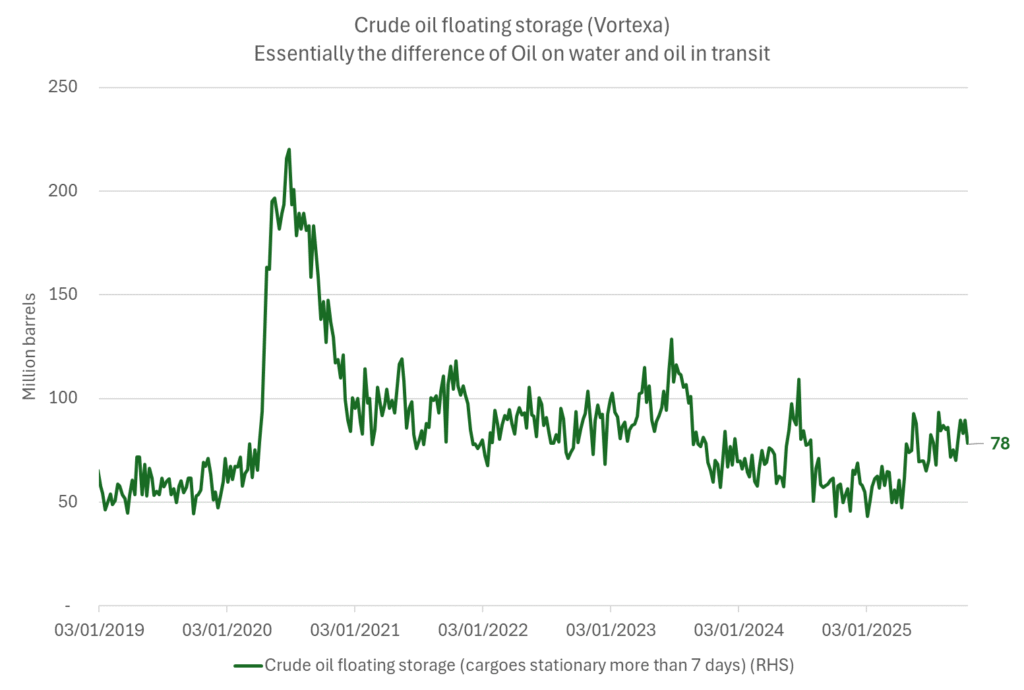

Crude oil floating storage (stationary more than 7 days). Down 11 mb over week to Sunday

The lowest point of the Brent crude oil curve versus the 5yr contract. Weakest so far this year.

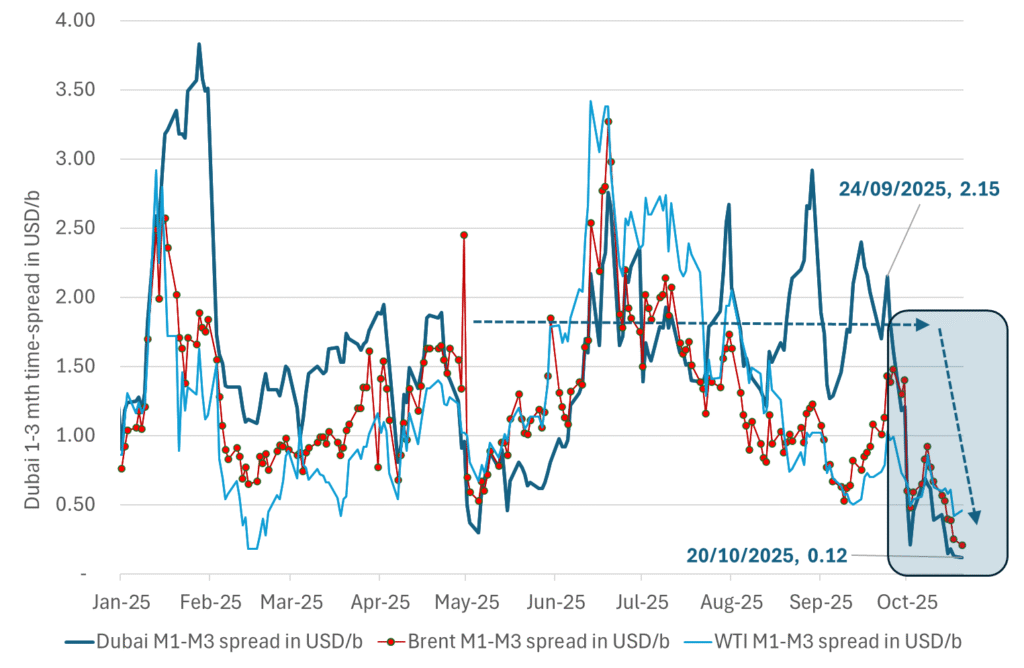

Crude oil 1mth to 3mth time-spreads. Dubai held out strongly through summer, but then that center of strength fell apart in late September and has been leading weakness in crude curves lower since then.

Analys

Crude oil soon coming to a port near you

Rebounding along with most markets. But concerns over solidity of Gaza peace may also contribute. Brent crude fell 0.8% yesterday to $61.91/b and its lowest close since May this year. This morning it is bouncing up 0.9% to $62.5/b along with a softer USD amid positive sentiment with both equities and industrial metals moving higher. Concerns that the peace in Gaza may be less solid than what one might hope for also yields some support to Brent. Bets on tech stocks are rebounding, defying fears of trade war. Money moving back into markets. Gold continues upwards its strong trend and a softer dollar helps it higher today as well.

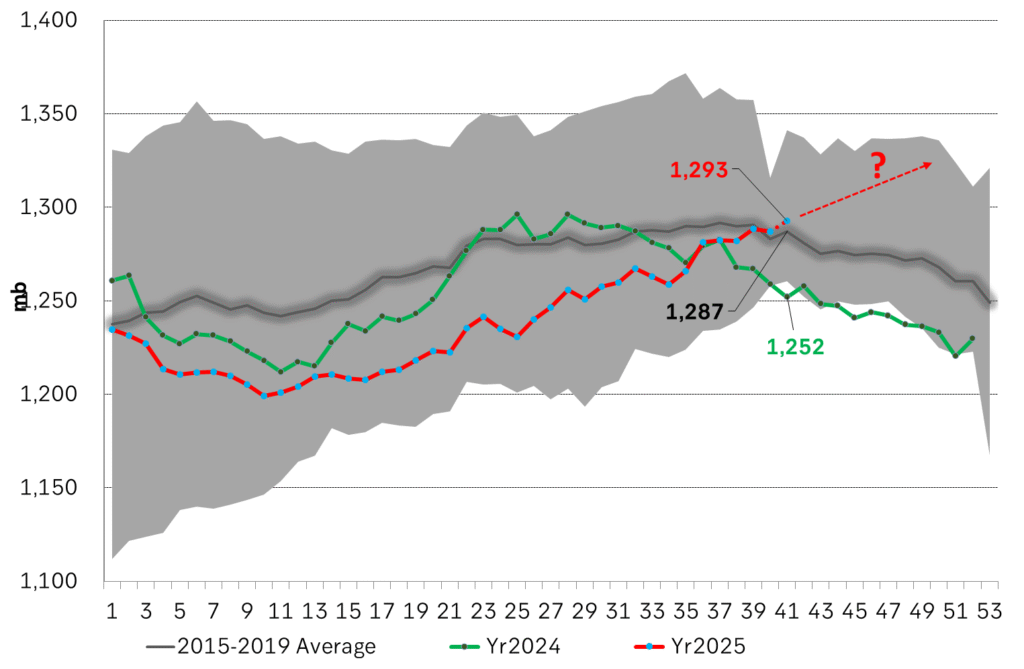

US crude & products probably rose 5.6 mb last week (API) versus a normal seasonal decline of 2.4 mb. The US API last night partial and thus indicative data for US oil inventories. Their data indicates that US crude stocks rose 7.4 mb last week, gasoline stocks rose 3.0 mb while Distillate stocks fell 4.8 mb. Altogether an increase in commercial crude and product stocks of 5.6 mb. Commercial US crude and product stocks normally decline by 2.4 mb this time of year. So seasonally adjusted the US inventories rose 8 mb last week according to the indicative numbers by the API. That is a lot. Also, the counter seasonal trend of rising stocks versus normally declining stocks this time of year looks on a solid pace of continuation. If the API is correct then total US crude and product stocks would stand 41 mb higher than one year ago and 6 mb higher than the 2015-19 average. And if we combine this with our knowledge of a sharp increase in production and exports by OPEC(+) and a large increase in oil at sea, then the current trend in US oil inventories looks set to continue. So higher stocks and lower crude oil prices until OPEC(+) switch to cuts. Actual US oil inventory data today at 18:00 CET.

US commercial crude and product stocks rising to 1293 mb in week 41 if last nights indicative numbers from API are correct.

Crude oil soon coming to a port near you. OPEC has lifted production sharply higher this autumn. At the same time demand for oil in the Middle-East has fallen as we have moved out of summer heat and crude oil burn for power for air-conditioning. The Middle-East oil producers have thus been able to lift exports higher on both accounts. Crude oil and condensates on water has shot up by 177 mb since mid-August. This oil is now on its way to ports around the world. And when they arrive, it will likely help to lift stocks onshore higher. That is probably when we will lose the last bit of front-end backwardation the the crude oil curves. That will help to drive the front-month Brent crude oil price down to the $60/b line and revisit the high $50ies/b. Then the eyes will be all back on OPEC+ when they meet in early November and then again in early December.

Crude oil and condensates at sea have moved straight up by 177 mb since mid-August as OPEC(+) has produced more, consumed less and exported more.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanLeading Edge Materials är på rätt plats i rätt tid

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanNytt prisrekord, guld stiger över 4000 USD

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEtt samtal om guld, olja, koppar och stål

-

Analys4 veckor sedan

Analys4 veckor sedanOPEC+ will likely unwind 500 kb/d of voluntary quotas in October. But a full unwind of 1.5 mb/d in one go could be in the cards

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanNeptune Energy bekräftar enorma litiumfyndigheter i Tyskland