Analys

LME Week London 18 oktober 2012

Hemma efter årets LME-vecka sammanfattar vi diskussioner över middagar och presentationer. 135 år gammal står fortfarande Londons metallbörs för 85 % av handeln med basmetaller och handeln under september månad var den största någonsin. LME veckan är traditionellt metallhandlarnas tid att underhålla sina kunder. Industrin använder LME-veckan som förhandlingsstart för nästa års smält- och rafflöner. Tusentals metallhandlare samlas i London för att träffa industrirepresentanter med förhoppningen att öka förståelsen för vart marknaden ska ta vägen. Sällan har dock koncensus syn på marknaden varit så tight som i år.

Hemma efter årets LME-vecka sammanfattar vi diskussioner över middagar och presentationer. 135 år gammal står fortfarande Londons metallbörs för 85 % av handeln med basmetaller och handeln under september månad var den största någonsin. LME veckan är traditionellt metallhandlarnas tid att underhålla sina kunder. Industrin använder LME-veckan som förhandlingsstart för nästa års smält- och rafflöner. Tusentals metallhandlare samlas i London för att träffa industrirepresentanter med förhoppningen att öka förståelsen för vart marknaden ska ta vägen. Sällan har dock koncensus syn på marknaden varit så tight som i år.

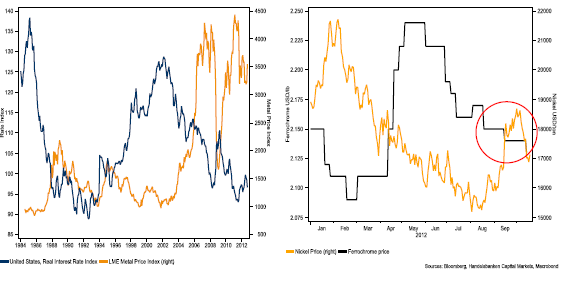

Låga räntor skickar in pengar i metaller vilket gjort att nickel stiger när FeCr faller

Effekterna av lagerhusens köer

Den första lagerfrågan är tillgång till metall från LME:s lager. Frågan var högt på agendan redan förra året men situationen har eskalerat sedan dess. Lagernivåerna för LME metallerna har trendat uppåt under året men simultant har de fysiska premierna (den avgift man får betala ovanpå börspriset för att få ut fysisk metall) stigit. Nuvarande höga premier för zink, aluminium och bly indikerar att tillgången till fysisk metall är begränsad. Kötiden för att få ut metall ur vissa LME-hus är över ett år. Situationen har förvärrats i kölvattnet av QE och Fed policyn att hålla räntorna låga till 2015. Låga räntor gör det extremt billigt att finansiera metall i lager och mycket metall är bunden i finansiella positioner. Synen på hur detta påverkar prisbilden debatterades kraftfullt. LME:s Martin Abbott förekom frågorna med beskedet att man ”tillsatt en utredning” vilket fick mycket ljummen respons.

Låga lager i värdekedjan

Den enskilt viktigaste diskussionen för nästa års prisbild för metallerna var, i våra ögon, lagernivåerna i tillverkningskedjan. Flera rapporter har slagit fast att lagren av metallintensiva varor är höga i Kina men tillgänglig statistik och anekdotiska bevis från de som varit där i närtid tyder på att lagernivåerna är låga efter att ha nått sin topp under 2012 kring det kinesiska nyåret. Detta är speciellt påtagligt för koppar som är den metall som drivs mest av kinas utveckling. Lägre lönsamhet i de kinesiska bolagen och starka intressen att minska arbetande kapital har minskat lagernivåerna i Kina (och Europa) under året. Appropå Kina så diskuterades som vanligt det stundande ledarskapsskiftets inverkan på den kinesiska efterfrågan. Wang Qing från CICC adresserade problemet med kommentaren ”med mindre än en mer avslappnad policy kring fastighetssektorn så kommer återhämtningen att vara svag”

Nästa års smält- och rafflöner

Diskussionen om kommande smält och rafflöner var ursprunget till LME veckan. Numera får dessa diskussioner mycket lite utrymme. Åtminstone bland de finansiella aktörerna. På sidolinjen till konferenserna står dock fortfarande de fysiska aktörerna och diskuterar. Vårt intryck är att både koppar och zink kommer att se högre TC/RC under 2013. För koppar är det kommande överskottet på koncentrat skälet. För zink beror det på att Kina förväntas importera mindre koncentrat i spåren av en inbromsande ekonomi och expanderande gruvproduktion av zinkkoncentrat vilket skapar större överskott i väst samtidigt som de kinesiska smältverken förlorar pengar på nuvarande nivåer och behöver högre smält och rafflöner.

10 % högre TCRC för zink verkar vara koncensus.

Kontentan av årets LME är att alla väntar på vad som ska hända i Kina efter ledarskapsskiftet. De presentationer som gavs var alla slående lika till innehållet; Kina, Eurokrisen och USA:s fiscal cliff dominerade utan att ge något banbrytande på endera tema.

Högst på agendan fanns lagerproblemen

Redan under förra årets LME vecka diskuterades problemet med längre och längre köer för att få ut metall ur LME:s lagerhus. Nu när situationen blivit ännu värre var frågan bland de mest diskuterade. (En industriell aktör säger sig ha fått beskedet att behöva vänta 1 år på att få ut aluminium ur LMEs lagerhus i Detroit). En annan het lagerfråga var de låga lagernivåerna av metall och metallvaror i värdekedjan under 2012. Vidare diskuterades den pågående euforin på finansmarknaden kontra de dystra utsikterna för den fysiska marknaden.

Inbromsningen och ledarskapsskifte i Kina, debaclet i Europa och den ovanligt tysta fysiska marknaden var stående samtalsämnen. Sist men inte minst fick den verkliga huvudfrågan fokus: TC/RC för koppar väntas stiga något under 2013 i spåren av begynnande koncentrat- överskott från stigande gruvproduktion medan zinkgruvor och smältverk verkar stå ganska nära varandra och endast små justeringar uppåt för TC/RC är att vänta för 2013.

Har finansmarknaden prisat in för mycket i metallerna?

Ännu en gång är avvikelsen mellan den fysiska och finansiella marknaden för basmetaller påtaglig, när en svag fysisk marknad står i kontrast till det rally som ägt rum på LME sedan QE annonserades. Fler pengar jagar nu samma tillgångar och en del av QE pengarna söker sig in i basmetaller. Särskilt uppenbart är det på marknaden för rostfritt stål där den finansiellt handlade legeringsmetallen nickel dragit i väg med 10 % under september medan den icke finansiellt handlade krom har fallit i pris.

Analys

Tightening fundamentals – bullish inventories from DOE

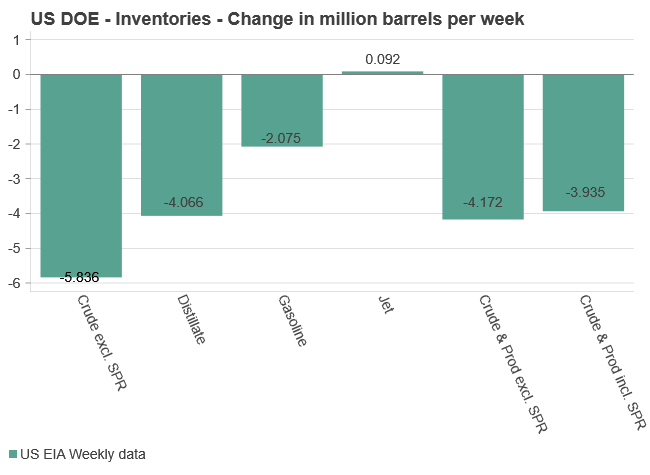

The latest weekly report from the US DOE showed a substantial drawdown across key petroleum categories, adding more upside potential to the fundamental picture.

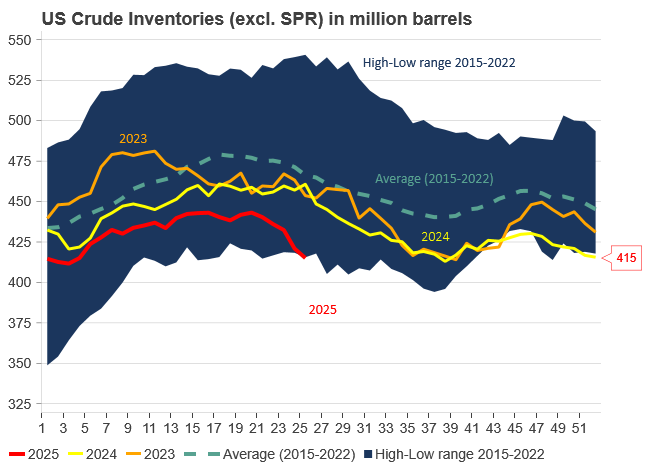

Commercial crude inventories (excl. SPR) fell by 5.8 million barrels, bringing total inventories down to 415.1 million barrels. Now sitting 11% below the five-year seasonal norm and placed in the lowest 2015-2022 range (see picture below).

Product inventories also tightened further last week. Gasoline inventories declined by 2.1 million barrels, with reductions seen in both finished gasoline and blending components. Current gasoline levels are about 3% below the five-year average for this time of year.

Among products, the most notable move came in diesel, where inventories dropped by almost 4.1 million barrels, deepening the deficit to around 20% below seasonal norms – continuing to underscore the persistent supply tightness in diesel markets.

The only area of inventory growth was in propane/propylene, which posted a significant 5.1-million-barrel build and now stands 9% above the five-year average.

Total commercial petroleum inventories (crude plus refined products) declined by 4.2 million barrels on the week, reinforcing the overall tightening of US crude and products.

Analys

Bombs to ”ceasefire” in hours – Brent below $70

A classic case of “buy the rumor, sell the news” played out in oil markets, as Brent crude has dropped sharply – down nearly USD 10 per barrel since yesterday evening – following Iran’s retaliatory strike on a U.S. air base in Qatar. The immediate reaction was: “That was it?” The strike followed a carefully calibrated, non-escalatory playbook, avoiding direct threats to energy infrastructure or disruption of shipping through the Strait of Hormuz – thus calming worst-case fears.

After Monday morning’s sharp spike to USD 81.4 per barrel, triggered by the U.S. bombing of Iranian nuclear facilities, oil prices drifted sideways in anticipation of a potential Iranian response. That response came with advance warning and caused limited physical damage. Early this morning, both the U.S. President and Iranian state media announced a ceasefire, effectively placing a lid on the immediate conflict risk – at least for now.

As a result, Brent crude has now fallen by a total of USD 12 from Monday’s peak, currently trading around USD 69 per barrel.

Looking beyond geopolitics, the market will now shift its focus to the upcoming OPEC+ meeting in early July. Saudi Arabia’s decision to increase output earlier this year – despite falling prices – has drawn renewed attention considering recent developments. Some suggest this was a response to U.S. pressure to offset potential Iranian supply losses.

However, consensus is that the move was driven more by internal OPEC+ dynamics. After years of curbing production to support prices, Riyadh had grown frustrated with quota-busting by several members (notably Kazakhstan). With Saudi Arabia cutting up to 2 million barrels per day – roughly 2% of global supply – returns were diminishing, and the risk of losing market share was rising. The production increase is widely seen as an effort to reassert leadership and restore discipline within the group.

That said, the FT recently stated that, the Saudis remain wary of past missteps. In 2018, Riyadh ramped up output at Trump’s request ahead of Iran sanctions, only to see prices collapse when the U.S. granted broad waivers – triggering oversupply. Officials have reportedly made it clear they don’t intend to repeat that mistake.

The recent visit by President Trump to Saudi Arabia, which included agreements on AI, defense, and nuclear cooperation, suggests a broader strategic alignment. This has fueled speculation about a quiet “pump-for-politics” deal behind recent production moves.

Looking ahead, oil prices have now retraced the entire rally sparked by the June 13 Israel–Iran escalation. This retreat provides more political and policy space for both the U.S. and Saudi Arabia. Specifically, it makes it easier for Riyadh to scale back its three recent production hikes of 411,000 barrels each, potentially returning to more moderate increases of 137,000 barrels for August and September.

In short: with no major loss of Iranian supply to the market, OPEC+ – led by Saudi Arabia – no longer needs to compensate for a disruption that hasn’t materialized, especially not to please the U.S. at the cost of its own market strategy. As the Saudis themselves have signaled, they are unlikely to repeat previous mistakes.

Conclusion: With Brent now in the high USD 60s, buying oil looks fundamentally justified. The geopolitical premium has deflated, but tensions between Israel and Iran remain unresolved – and the risk of missteps and renewed escalation still lingers. In fact, even this morning, reports have emerged of renewed missile fire despite the declared “truce.” The path forward may be calmer – but it is far from stable.

Analys

A muted price reaction. Market looks relaxed, but it is still on edge waiting for what Iran will do

Brent crossed the 80-line this morning but quickly fell back assigning limited probability for Iran choosing to close the Strait of Hormuz. Brent traded in a range of USD 70.56 – 79.04/b last week as the market fluctuated between ”Iran wants a deal” and ”US is about to attack Iran”. At the end of the week though, Donald Trump managed to convince markets (and probably also Iran) that he would make a decision within two weeks. I.e. no imminent attack. Previously when when he has talked about ”making a decision within two weeks” he has often ended up doing nothing in the end. The oil market relaxed as a result and the week ended at USD 77.01/b which is just USD 6/b above the year to date average of USD 71/b.

Brent jumped to USD 81.4/b this morning, the highest since mid-January, but then quickly fell back to a current price of USD 78.2/b which is only up 1.5% versus the close on Friday. As such the market is pricing a fairly low probability that Iran will actually close the Strait of Hormuz. Probably because it will hurt Iranian oil exports as well as the global oil market.

It was however all smoke and mirrors. Deception. The US attacked Iran on Saturday. The attack involved 125 warplanes, submarines and surface warships and 14 bunker buster bombs were dropped on Iranian nuclear sites including Fordow, Natanz and Isfahan. In response the Iranian Parliament voted in support of closing the Strait of Hormuz where some 17 mb of crude and products is transported to the global market every day plus significant volumes of LNG. This is however merely an advise to the Supreme leader Ayatollah Ali Khamenei and the Supreme National Security Council which sits with the final and actual decision.

No supply of oil is lost yet. It is about the risk of Iran closing the Strait of Hormuz or not. So far not a single drop of oil supply has been lost to the global market. The price at the moment is all about the assessed risk of loss of supply. Will Iran choose to choke of the Strait of Hormuz or not? That is the big question. It would be painful for US consumers, for Donald Trump’s voter base, for the global economy but also for Iran and its population which relies on oil exports and income from selling oil out of that Strait as well. As such it is not a no-brainer choice for Iran to close the Strait for oil exports. And looking at the il price this morning it is clear that the oil market doesn’t assign a very high probability of it happening. It is however probably well within the capability of Iran to close the Strait off with rockets, mines, air-drones and possibly sea-drones. Just look at how Ukraine has been able to control and damage the Russian Black Sea fleet.

What to do about the highly enriched uranium which has gone missing? While the US and Israel can celebrate their destruction of Iranian nuclear facilities they are also scratching their heads over what to do with the lost Iranian nuclear material. Iran had 408 kg of highly enriched uranium (IAEA). Almost weapons grade. Enough for some 10 nuclear warheads. It seems to have been transported out of Fordow before the attack this weekend.

The market is still on edge. USD 80-something/b seems sensible while we wait. The oil market reaction to this weekend’s events is very muted so far. The market is still on edge awaiting what Iran will do. Because Iran will do something. But what and when? An oil price of 80-something seems like a sensible level until something do happen.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanUppgången i oljepriset planade ut under helgen

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals växlar spår – satsar fullt ut på guld

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanLåga elpriser i sommar – men mellersta Sverige får en ökning

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanOljan, guldet och marknadens oroande tystnad

-

Analys4 veckor sedan

Analys4 veckor sedanVery relaxed at USD 75/b. Risk barometer will likely fluctuate to higher levels with Brent into the 80ies or higher coming 2-3 weeks

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanJonas Lindvall är tillbaka med ett nytt oljebolag, Perthro, som ska börsnoteras

-

Analys3 veckor sedan

Analys3 veckor sedanA muted price reaction. Market looks relaxed, but it is still on edge waiting for what Iran will do

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanDomstolen ger klartecken till Lappland Guldprospektering