Nyheter

Fake gold bars in Fort Knox! What´s next?

By Gary Vey, editor viewzone.com

By Gary Vey, editor viewzone.com

The first release of this story came on 4 December 2009, written by Dan Eden for Viewzone, a website that takes ”a look at life from different angles….” and comments on every possible subject that it finds worthwhile or necessary to comment on.

The man behind viewzone.com is Gary Vey, the editor, who happens to be the same man as Dan Eden. When I found this updated version on the net, I was alarmed and upon reading it, I was impressed and shocked at the same time. But not surprised because, as you could read in my March issue of GOLDVIEW, I signalled my doubts and questions about the intervening policies and acts of the Federal Reserve in relation to gold and the gold market. As I found this story should be read by much larger circles, I asked Gary for his permission to re-distribute it as an issue of GOLDVIEW ALERT.

I am pleased to be able to bring it to you.

Henk J. Krasenberg

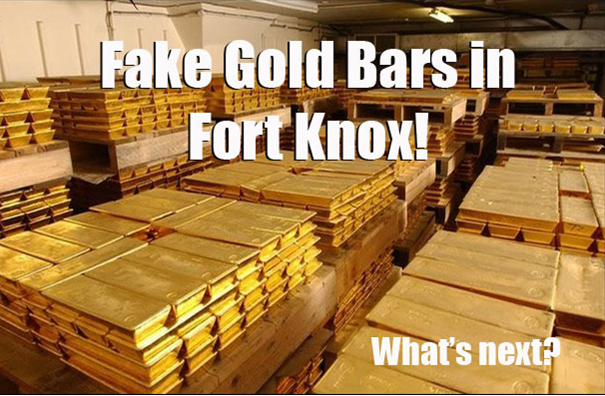

Fake gold bars in Fort Knox!

It’s one thing to counterfeit a twenty or hundred dollar bill. The amount of financial damage is usually limited to a specific region and only affects dozens of people and thousands of dollars. Secret Service agents quickly notify the banks on how to recognize these phoney bills and retail outlets usually have procedures in place (such as special pens to test the paper) to stop their proliferation.

It’s one thing to counterfeit a twenty or hundred dollar bill. The amount of financial damage is usually limited to a specific region and only affects dozens of people and thousands of dollars. Secret Service agents quickly notify the banks on how to recognize these phoney bills and retail outlets usually have procedures in place (such as special pens to test the paper) to stop their proliferation.

But what about gold? This is the most sacred of all commodities because it is thought to be the most trusted, reliable and valuable means of saving wealth.

A recent discovery — in October of 2009 — has been suppressed by the main stream media but has been circulating among the ”big money” brokers and financial kingpins and is just now being revealed to the public. It involves the gold in Fort Knox — the US Treasury gold — that is the equity of our national wealth. In short, millions (with an ”m”) of gold bars are fake!

Who did this? Apparently our own government.

Background

In October of 2009 the Chinese received a shipment of gold bars. Gold is regularly exchanges between countries to pay debts and to settle the so-called balance of trade. Most gold is exchanged and stored in vaults under the supervision of a special organization based in London, the London Bullion Market Association (or LBMA). When the shipment was received, the Chinese government asked that special tests be performed to guarantee the purity and weight of the gold bars. In this test, four small holed are drilled into the gold bars and the metal is then analyzed.

In October of 2009 the Chinese received a shipment of gold bars. Gold is regularly exchanges between countries to pay debts and to settle the so-called balance of trade. Most gold is exchanged and stored in vaults under the supervision of a special organization based in London, the London Bullion Market Association (or LBMA). When the shipment was received, the Chinese government asked that special tests be performed to guarantee the purity and weight of the gold bars. In this test, four small holed are drilled into the gold bars and the metal is then analyzed.

Officials were shocked to learn that the bars were fake. They contained cores of tungsten with only a outer coating of real gold. What’s more, these gold bars, containing serial numbers for tracking, originated in the US and had been stored in Fort Knox for years. There were reportedly between 5,600 to 5,700 bars, weighing 400 oz. each, in the shipment! At first many gold experts assumed the fake gold originated in China, the world’s best knock-off producers. The Chinese were quick to investigate and issued a statement that implicated the US in the scheme.

What the Chinese uncovered

Roughly 15 years ago — during the Clinton Administration [think Robert Rubin, Sir Alan Greenspan and Lawrence Summers] — between 1.3 and 1.5 million 400 oz tungsten blanks were allegedly manufactured by a very high-end, sophisticated refiner in the USA [more than 16 Thousand metric tonnes]. Subsequently, 640,000 of these tungsten blanks received their gold plating and WERE shipped to Ft. Knox and remain there to this day.

According to the Chinese investigation, the balance of this 1.3 million to 1.5 million 400 oz tungsten cache was also gold plated and then allegedly ”sold” into the international market. Apparently, the global market is literally ”stuffed full of 400 oz salted bars”. Perhaps as much as 600-billion dollars worth.

According to the Chinese investigation, the balance of this 1.3 million to 1.5 million 400 oz tungsten cache was also gold plated and then allegedly ”sold” into the international market. Apparently, the global market is literally ”stuffed full of 400 oz salted bars”. Perhaps as much as 600-billion dollars worth.

An obscure news item originally published in the N.Y. Post [written by Jennifer Anderson] in late Jan. 04 perhaps makes sense now.

DA investigating NYMEX executive

Manhattan, New York, –Feb. 2, 2004. A top executive at the New York Mercantile Exchange is being investigated by the Manhattan district attorney. Sources close to the exchange said that Stuart Smith, senior vice president of operations at the exchange, was served with a search warrant by the district attorney’s office last week. Details of the investigation have not been disclosed, but a NYMEX spokeswoman said it was unrelated to any of the exchange’s markets. She declined to comment further other than to say that charges had not been brought. A spokeswoman for the Manhattan district attorney’s office also declined comment.”

The offices of the Senior Vice President of Operations — NYMEX — is exactly where you would go to find the records [serial number and smelter of origin] for EVERY GOLD BAR ever PHYSICALLY settled on the exchange. They are required to keep these records. These precise records would show the lineage of all the physical gold settled on the exchange and hence ”prove” that the amount of gold in question could not have possibly come from the U.S. mining operations — because the amounts in question coming from U.S. smelters would undoubtedly be vastly bigger than domestic mine production.

No one knows whatever happened to Stuart Smith. After his offices were raided he took ”administrative leave” from the NYMEX and he has never been heard from since.

Amazingly, there never was any follow up on in the media on the original story as well as ZERO developments ever stemming from D.A. Morgenthau’s office who executed the search warrant.

Are we to believe that NYMEX offices were raided, the Sr. V.P. of operations then takes leave — all for nothing?

The revelations of fake gold bars also explains another highly unusual story that also happened in 2004:

LONDON, April 14, 2004 (Reuters) — NM Rothschild & Sons Ltd., the Londonbased unit of investment bank Rothschild [ROT.UL], will withdraw from trading commodities, including gold, in London as it reviews its operations, it said on Wednesday. Interestingly, GATA’s Bill Murphy speculated about this back in 2004;

”Why is Rothschild leaving the gold business at this time my colleagues and I conjectured today? Just a guess on my part, but [I] suspect something is amiss.

They know a big scandal is coming and they don’t want to be a part of it… [The] Rothschild wants out before the proverbial ”S” hits the fan.” — BILL MURPHY, LEMETROPOLE, 4-18-2004

[box]

What is the GATA?

The Gold Antitrust Action Committee (GATA) is an organisation which has been nipping at the heels of the US Treasury Federal Reserve for several years now.

The basis of GATA’s accusations is that these institutions, in coordination with other complicit central banks and the large gold-trading investment banks in the US, have been manipulating the price of gold for decades.

[/box]

[box]

What is GLD?

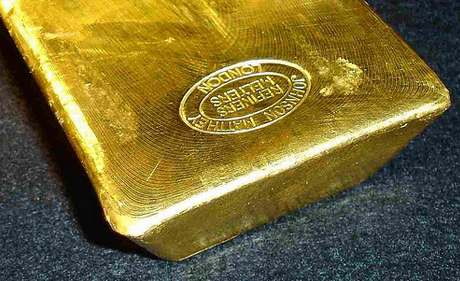

GLD is a short form for Good London Delivery. The London Bullion Market Association (LBMA) has defined ”good delivery” as a delivery from an entity which is listed on their delivery list or meets the standards for said list and whose bars have passed testing requirements established by the association and updated from time to time. The bars have to be pure for AU in an area of 995.0 to 999.9 per 1000. Weight, Shape, Appearance, Marks and Weight Stamps are regulated as follows:

Weight: minimum 350 fine ounces AU;

maximum 430 fine ounces AU,

gross weight of a bar is expressed in troy ounces, in multiples of 0.025, rounded down to the nearest 0.025 of an troy ounce;

Dimensions: the recommended dimensions for a Good Delivery gold bar are:

Top Surface: 255 x 81 mm;

Bottom Surface: 236 x 57 mm;

Thickness: 37 mm;

Fineness: the minimum 995.0 parts per thousand fine gold;

Marks: Serial number;

Assay stamp of refiner;

Fineness (to four significant figures);

Year of manufacture (expressed in four digits).

[/box]

After reviewing their prospectus yet again, it becomes pretty clear that GLD was established to purposefully deflect investment dollars away from legitimate gold pursuits and to create a stealth, cesspool / catch-all, slush-fund and a likely destination for many of these fake tungsten bars where they would never see the light of day — hidden behind the following legalese ”shield” from the law [Excerpt from the GLD prospectus on page 11]:

”Gold bars allocated to the Trust in connection with the creation of a Basket may not meet the London Good Delivery Standards and, if a Basket is issued against such gold, the Trust may suffer a loss. Neither the Trustee nor the Custodian independently confirms the fineness of the gold bars allocated to the Trust in connection with the creation of a Basket. The gold bars allocated to the Trust by the Custodian may be different from the reported fineness or weight required by the LBMA standards for gold bars delivered in settlement of a gold trade, or the London Good Delivery Standards, the standards required by the Trust. If the Trustee nevertheless issues a Basket against such gold, and if the Custodian fails to satisfy its obligation to credit the Trust the amount of any deficiency, the Trust may suffer a loss.”

Federal Reserve knows but is apparently part of the schema

Earlier this year GATA filed a second Freedom of Information Act (FOIA) request with the Federal Reserve System for documents from 1990 to date having to do with gold swaps, gold swapped, or proposed gold swaps. On Aug. 5, The Federal Reserve responded to this FOIA request by adding two more documents to those disclosed to GATA in April 2008 from the earlier FOIA request. These documents totalled 173 pages, many parts of which were redacted (blacked out). The Fed’s response also noted that there were 137 pages of documents not disclosed that were alleged to be exempt from disclosure.

GATA appealed this determination on Aug. 20. The appeal asked for more information to substantiate the legitimacy of the claimed exemptions from disclosure and an explanation on why some documents, such as one posted on the Federal Reserve Web site that discusses gold swaps, were not included in the Aug. 5 document release.

In a Sept. 17, 2009, letter on Federal Reserve System letterhead, Federal Reserve governor Kevin M. Warsh completely denied GATA’s appeal. The entire text of this letter can be examined here (pdf).

The first paragraph on the third page is the most revealing: ”In connection with your appeal, I have confirmed that the information withheld under exemption 4 consists of confidential commercial or financial information relating to the operations of the Federal Reserve Banks that was obtained within the meaning of exemption 4. This includes information relating to swap arrangements with foreign banks on behalf of the Federal Reserve System and is not the type of information that is customarily disclosed to the public. This information was properly withheld from you.”

The above statement is an admission that the Federal Reserve has been involved with the fake gold bar swaps and that it refuses to disclose any information about its activities!

Why use tungsten?

If you are going to print fake money you need to have the special paper, otherwise the bills don’t feel right and can be easily detected by special pens that most merchants and banks use. Likewise, if you are going to fake gold bars you had better be sure they have the same weight and properties of real gold.

In early 2008 millions of dollars in gold at the central bank of Ethiopia turned out to be fake. What were supposed to be bars of solid gold turned out to be nothing more than gold-plated steel. They tried to sell the stuff to South Africa and it was sent back when the South Africans noticed this little problem.

The problem with making good quality fake gold is that gold is remarkably dense. It’s almost twice the density of lead, and two-and-a half times more dense than steel.

You don’t usually notice this because small gold rings and the like don’t weigh enough to make it obvious, but if you’ve ever held a larger bar of gold, it’s absolutely unmistakable: The stuff is very, very heavy.

The standard gold bar for bank-tobank trade, known as a ”London good delivery bar” weighs 400 troy ounces (over thirty-three pounds), yet is no bigger than a paperback novel. A bar of steel the same size would weigh only thirteen and a half pounds.

According to gold expert, Theo Gray, the problem is that there are very few metals that are as dense as gold, and with only two exceptions they all cost as much or more than gold.

The first exception is depleted uranium, which is cheap if you’re a government, but hard for individuals to get. It’s also radioactive, which could be a bit of an issue.

The second exception is a real winner: tungsten. Tungsten is vastly cheaper than gold (maybe $30 dollars a pound compared to $12,000 a pound for gold right now). And remarkably, it has exactly the same density as gold, to three decimal places. The main differences are that it’s the wrong color, and that it’s much, much harder than gold. (Very pure gold is quite soft, you can dent it with a fingernail.)

A top-of-the-line fake gold bar should match the color, surface hardness, density, chemical, and nuclear properties of gold perfectly. To do this, you could start with a tungsten slug about 1/8-inch smaller in each dimension than the gold bar you want, then cast a 1/16-inch layer of real pure gold all around it.

This bar would feel right in the hand, it would have a dead ring when knocked as gold should, it would test right chemically, it would weigh *exactly* the right amount, and though I don’t know this for sure, I think it would also pass an x-ray fluorescence scan, the 1/16″ layer of pure gold being enough to stop the x-rays from reaching any tungsten. You’d pretty much have to drill it to find out it’s fake.

Such a top-quality fake London good delivery bar would cost about $50,000 to produce because it’s got a lot of real gold in it, but you’d still make a nice profit considering that a real one is worth closer to $400,000.

What is going to happen now?

Politicians like Ron Paul have been demanding that the Federal Reserve be more transparent and open up their records for public scrutiny. But the Fed has consistently refused, stating that these disclosures would undermine its operation. Yes, it certainly would!

The manufacture of fake gold bars goes back years and, because of this, it is not likely that the originator of this scheme will ever be revealed or brought to justice. Meanwhile the world is just beginning to learn that much of its national reserves of gold may be fake. If more testing reveals that this gold was guaranteed by Fort Knox and the US Treasury then perhaps they will demand an exchange for ”real” gold — wouldn’t you? This is all happening at a time when the US economy is at its lowest and most vulnerable. The effects could be devastating. Some investors are already selling gold commodities before these facts are widely known. They are investing instead in silver — the next best metal. This will undoubtedly drive silver prices up.

According to Jim Willie, 24 year market analyst and PhD in statistics, ”The bust cometh, and it will be spectacular. The stories told in the press will be peculiar, since not told objectively. The headlines might be a comedy, with phoney reports of foreign subterfuge, when the perpetrators are home grown.” This is yet another story in the decline of America and capitalism — a decline based on greed, deception and fraud.

[box]

UPDATE: Audit of Fed Reserve Amendment passes!

In an unprecedented defeat for the Federal Reserve, an amendment to audit the multi-trillion dollar institution was approved by the House Finance Committee with an overwhelming and bipartisan 43-26 vote on a Thursday afternoon despite harried last-minute lobbying from top Fed officials and the surprise opposition of Chairman Barney Frank (D-Mass.), who had previously been a supporter.

The measure, cosponsored by Reps. Ron Paul (R-Texas) and Alan Grayson (D-Fla.), authorizes the Government Accountability Office to conduct a wide-ranging audit of the Fed’s opaque deals with foreign central banks and major U.S. financial institutions. The Fed has never had a real audit in its history and little is known of what it does with the trillions of dollars at its disposal.

[/box]

[hr]

European Gold Centre

European Gold Centre analyzes and comments on gold, other metals & minerals and international mining and exploration companies in perspective to the rapidly changing world of economics, finance and investments. Through its publications, The Centre informs international investors, both institutional and private, primarily in Europe but also worldwide, who have an interest in natural resources and investing in resource companies.

The Centre also provides assistance to international mining and exploration companies in building and expanding their European investor following and shareholdership.

Henk J. Krasenberg

After my professional career in security analysis, investment advisory, porfolio management and investment banking, I made the decision to concentrate on and specialize in the world of metals, minerals and mining finance. From 1983 to 1992, I have been writing and consulting about gold, other metals and minerals and resource companies.

The depressed metal markets of the early 1990’s led me to a temporary shift. I pursued one of my other hobbies and started an art gallery in contemporary abstracts, awaiting a new cycle in metals and mining. That started to come in the early 2000’s and I returned to metals and mining in 2002 with the European Gold Centre.

With my GOLDVIEW reports, I have built an extensive institutional investor following in Europe and more of a private investor following in the rest of the world. In 2007, I introduced my MINING IN AFRICA publication, to be followed by MINING IN EUROPE in 2010 and MINING IN MEXICO in 2012.

For more information: www.europeangoldcentre.com

Nyheter

Blykalla och amerikanska Oklo inleder ett samarbete

Kärnkraftsföretagen Oklo från USA och svenska Blykalla har ingått ett strategiskt partnerskap för att främja tekniksamarbete, samordna leverantörskedjor och dela regulatorisk kunskap mellan länderna. Samarbetet inkluderar att Oklo går in som en av de större investerarna i Blykallas kommande investeringsrunda med ett åtagande på cirka 5 miljoner dollar.

Genom ett gemensamt teknikutvecklingsavtal ska bolagen utbyta insikter om material, komponenter och licensieringspraxis i både USA och Sverige. Målet är att minska kostnader och tidsrisker i utvecklingen av små modulära reaktorer (SMR).

Blykalla utvecklar SEALER, en blykyld snabbreaktor på 55 MWe, medan Oklo fokuserar på natriumkylda reaktorer upp till 75 MWe för industriella och militära tillämpningar i USA.

“Det här samarbetet stärker det växande ekosystemet för avancerade reaktorer i en tid av globalt ökande energibehov,” säger Oklo-grundaren Jacob DeWitte. Blykallas vd Jacob Stedman tillägger: “Vår gemensamma industriella strategi kan hjälpa leverantörer att planera för uppskalning, oavsett vilken sida av Atlanten de befinner sig på.”

Intervju på Bloomberg om samarbetet

Nyheter

Fortsatt stabilt elpris – men dubbelt så dyrt som i fjol

Snittpriset på el för höstmånaderna september till november väntas landa på strax under 50 öre per kilowattimme. Det är nästan en fördubbling jämfört med hösten 2024, då snittet låg på drygt 30 öre. Men nivåerna är fortfarande betydligt lägre än under elpriskrisen 2022. Det visar elbolaget Bixias höstprognos.

Att elpriserna är högre än i fjol beror främst på lägre tillgänglighet i kärnkraften och en svagare hydrologisk balans efter en torr sommar. Även om hösten har börjat blött och september ser ut att bli den nederbördsrikaste månaden sedan 2018, räcker det inte till för att vända vattenbalansen.

– Höstens elpriser är stabila, men klart högre än i fjol. Det är framför allt osäkerheten kring kärnkraften som påverkar där Oskarshamn 3 har varit ur drift längre än planerat. Samtidigt har den hydrologiska balansen inte återhämtat sig efter sommarens underskott, trots den blöta inledningen på hösten. Men jämfört med krisåren 2021 och 2022 ligger priserna fortfarande på en låg nivå, säger Johan Sigvardsson, elprisanalytiker på Bixia.

I september bidrog bristen på kärnkraft till att elpriset nästan fördubblades jämfört med samma månad i fjol. Priset landade på cirka 40 öre per kilowattimme, att jämföra med 22 öre i september 2024. Flera reaktorer stod stilla, däribland Oskarshamn 3, Forsmark 1 samt Lovisa 1 och 2 i Finland. Trots mycket regn under månaden var vattennivåerna fortsatt låga efter den torra sommaren, medan blåsiga perioder tillfälligt pressade ner priserna.

I oktober väntas elpriset hamna runt 45 öre per kilowattimme, jämfört med 27 öre i fjol, och i november kring 60 öre, mot 43 öre förra året. Sammantaget ger det ett höstsnitt i system på knappt 50 öre, jämfört med drygt 30 öre samma period i fjol. Under krisåret 2022 låg snittet för höstmånaderna på över 1,15 kronor per kilowattimme, med perioder på upp mot 4 kronor.

Liten risk för höga höstpriser

Bixia bedömer att priserna kan komma att stiga tillfälligt om vädret blir kallare än normalt eller om kärnkraftsreaktorer får fortsatt försening i återstart. Om till exempel Oskarshamn 3, vars återstart redan skjutits på fem gånger, inte kommer igång enligt plan i mitten av oktober, finns risk att priserna ökar under andra halvan av månaden.

– Risken för pristoppar ökar ju längre in på säsongen vi kommer, eftersom förbrukningen stiger när temperaturen sjunker. Men väderprognoserna ser i nuläget gynnsamma ut, och även om det skulle bli kallare än väntat ser vi inte någon risk för extremt höga priser, säger Johan Sigvardsson.

Dyrare el i syd

Södra Sverige har betalat betydligt mer för elen än norra delarna. Priserna har legat på runt 15 öre per kWh i norr under september, medan syd haft priser på omkring 70 öre. En differentierad prisbild väntas även under resten av hösten, särskilt om kärnkraftsproduktionen i söder fortsätter att vara begränsad och det fortsätter att vara gott om vatten i norr.

Nyheter

Ett samtal om guld, olja, koppar och stål

Samtal om att guldet ständigt slår nya prisrekord, att oljepriserna pressas och vad som händer på kopparmarknaden. Vidare kommenterar Jernkontorets Kristian Ljungblad läget i stålbranschen och hur de svenska stålbolagen mår.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEurobattery Minerals satsar på kritiska metaller för Europas självförsörjning

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals i en guldtrend

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuldpriset kan närma sig 5000 USD om centralbankens oberoende skadas

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOPEC signalerar att de inte bryr sig om oljepriset faller kommande månader

-

Analys3 veckor sedan

Analys3 veckor sedanVolatile but going nowhere. Brent crude circles USD 66 as market weighs surplus vs risk

-

Nyheter3 veckor sedan

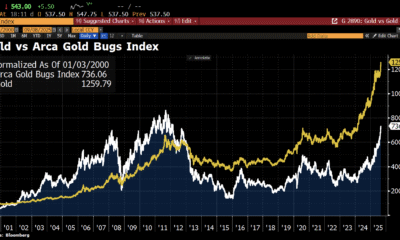

Nyheter3 veckor sedanAktier i guldbolag laggar priset på guld

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanKinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanTyskland har så höga elpriser att företag inte har råd att använda elektricitet