Nyheter

Much ado about nothing

William Shakespeare titled his play this way to emphasize that it was a fluffy enjoyable romantic comedy: No King Lear. What we these days call a summer date flick. This piece deals with a tempest in a teapot. Unfortunately, it is not a funny comedy. Investors falling prey to predatory marketing hype may experience a tradegy of losing money on bad investments.

William Shakespeare titled his play this way to emphasize that it was a fluffy enjoyable romantic comedy: No King Lear. What we these days call a summer date flick. This piece deals with a tempest in a teapot. Unfortunately, it is not a funny comedy. Investors falling prey to predatory marketing hype may experience a tradegy of losing money on bad investments.

Gold marketeers are bending over backward to find ways to try to scare investors into buying gold, into continuing to believe the dream based on an economic nightmare scenario that gold will rise and rise forever to unfathomable heights. The scare tactics used to center on an imminent collapse of the global financial system, or your local bank, failed, despite the best efforts of governments in the United States and Europe to help promote the idea of gold as a safe haven and portfolio diversifier.

Trying to scare people into buying gold based on the threat of hyperinflation also has failed, for the most part. There are still some believers in the inflation thesis out there, but most people have realized that when a significant part of the population does not have jobs that pay them enough to buy things, inflationary pressures tend to remain bottled up.

So the marketeers keep trying. Their current spiel focuses on a non-existent threat of insufficient gold in Comex registered and eligible inventories to meet demand, and, related to that, fears of a recently emergence but not really significant backwardation in gold prices. The first part says the more than 60% plunge in registered gold inventories, from 2,147,399 ounces at the end of April to roughly 785,118 ounces on 15 August means that there is not enough gold in the Comex warehouses for market participants to take deliveries. Secondly, the recent $0.10 to $0.20 price backwardation from 6 August through middle of August between thinly traded front months was cited as evidence of strong physical demand, to support the claims that there will be an imminent “default” of Comex paper gold. (The definition the marketeers use of a Comex default is neither legally nor market-wise accurate, but when you are making stuff up, facts like that do not seem to matter.)

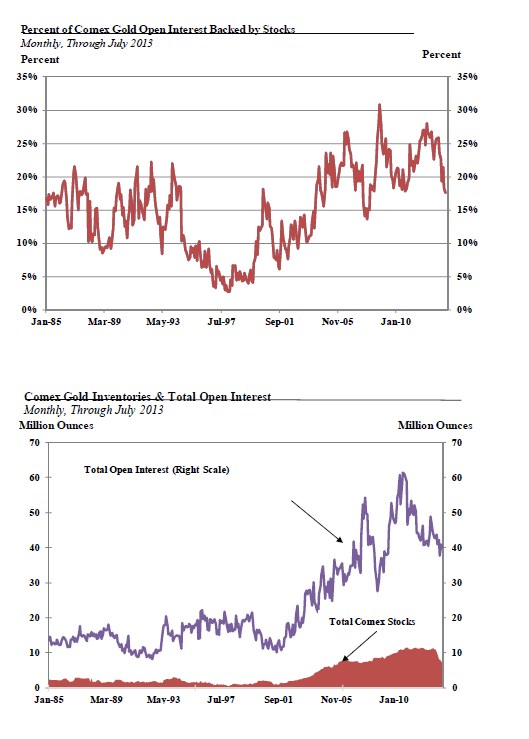

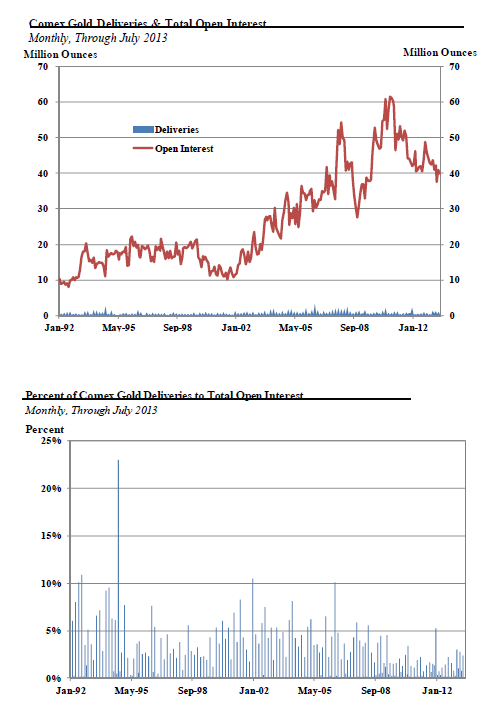

These claims cannot be further from the truth. First, registered stocks account for less than a third of total Comex reported gold stocks. While registered stocks have fallen sharply, combined registered and eligible stocks declined at a far less dramatic pace of 14.3% from end of April to 6,967,251 ounces as of 15 August. More importantly, monthly data from the Comex shows that there is a greater ‘cover’ of inventories as a percentage of open interest than there was historically. In July the percentage of open interest backed by total Comex gold inventories stood at 17.5%. While this percentage has been declining since reaching 28.0% in March 2012, stocks are equivalent to a vastly higher percentage of open interest than the period from January 1985 to April 2004, during which time the average was 12.0%. In fact, for much of the past decade the percentage of open interest covered by total stocks was much lower. It moved in a range of 6.1% – 16.8% between August 2000 and April 2004, and dipped to as low as 13.6% as recently as December 2007.

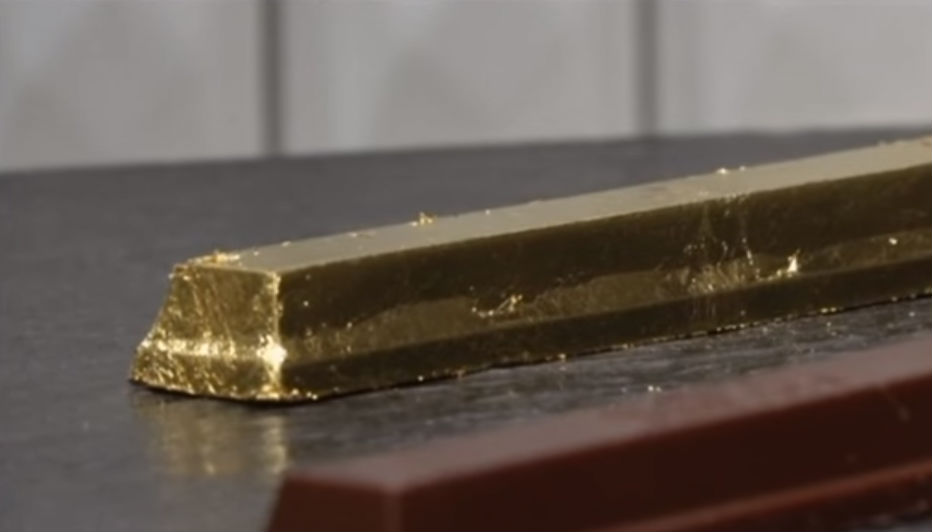

The same is true of deliveries relative to stocks, and deliveries relative to open interest. In both cases, the ratios show that there have been lower rates of deliveries in recent years compared to stocks and open interest than there was prior to 2005. The monthly ratio of deliveries relative to stocks averaged 7.1% from January to July, compared to 25.2% from January 1992 to December 2004. During the same period this year the monthly average ratio of deliveries to open interest was 1.47%, compared to 2.39% from January 1992 to December 2004.

Any talk of delivery problems, shortages, and defaults is totally unfounded based on these historical ratios.

Futures contracts are financial instruments designed to allow commercial entities to hedge the price risks inherent in their businesses, by attracting investors and speculators who are willing to take on that price risk with the hope of making a profit by taking on this risk. Futures contracts are not designed for physical delivery, and they largely are not used in that fashion. This is true across all commodities, and not just gold and silver. In almost all commodities the delivery rates are very low, usually a tiny fraction of the total open interest. The concerns of an imminent shortage of deliverable stocks are uncalled for.

[box]Denna analys är producerad av CPM Group och publiceras med tillstånd på Råvarumarknaden.se.[/box]

Disclaimer

Copyright CPM Group 2012. Not for reproduction or retransmission without written consent of CPM Group. Market Commentary is published by CPM Group and is distributed via e-mail. The views expressed within are solely those of CPM Group. Such information has not been verified, nor does CPM make any representation as to its accuracy or completeness.

Any statements non-factual in nature constitute only current opinions, which are subject to change. While every effort has been made to ensure that the accuracy of the material contained in the reports is correct, CPM Group cannot be held liable for errors or omissions. CPM Group is not soliciting any action based on it. Visit www.cpmgroup.com for more information.

Nyheter

Sommarvädret styr elpriset i Sverige

Många verksamheter tar nu ett sommaruppehåll och ute värmer solen, det är gott om vatten och vinden blåser. Lägre efterfrågan på el och goda förutsättningar för kraftproduktionen höll ner elpriserna under juni.

Elpriset på den nordiska elbörsen Nord Pool (utan påslag och exklusive moms) i elområde 1 och 2 (Norra Sverige) blev för juni 3,05 respektive 4,99 öre/kWh, vilket är rekordlågt och de lägsta på minst 25 år.

– Elpriset påverkas av en rad faktorer men vädret väger tyngst. På sommaren minskar efterfrågan på el och många verksamheter har ett uppehåll. Detta tillsammans med goda förutsättningar inom kraftproduktionen påverkar elpriset nedåt, säger Jonas Stenbeck, privatkundschef Vattenfall Försäljning Norden.

Den hydrologiska balansen, måttet för att uppskatta hur mycket vatten som finns lagrat ovanför kraftstationerna, ligger över normal nivå, särskilt i norra Skandinavien. Tillgängligheten för kärnkraften i Norden är just nu 82 procent av installerad effekt.

– De goda nordiska produktionsförutsättningarna gör elpriserna mindre känsliga för förändringar i omvärlden, säger Jonas Stenbeck.

Priserna på olja och gas kan dock ändras snabbt med anledning av en turbulent omvärld. På kontinenten har efterfrågan på gas sjunkit och nytt solkraftsrekord för Tyskland sattes på midsommarafton med en produktion på 52,5 GW.

– Många av de goda elvanor vi skaffade oss under elpriskrisen verkar leva kvar och gör nytta även på sommaren. De svenska hushållens elförbrukning under 2024 var faktiskt den lägsta detta millenium, säger Jonas Stenbeck.

| Medelspotpris | Juni 2024 | Juni 2025 |

| Elområde 1, Norra Sverige | 24,04 öre/kWh | 3,05 öre/kWh |

| Elområde 2, Norra Mellansverige | 24,04 öre/kWh | 4,99 öre/kWh |

| Elområde 3, Södra Mellansverige | 27,27 öre/kWh | 22,79 öre/kWh |

| Elområde 4, Södra Sverige | 62,70 öre/kWh | 40,70 öre/kWh |

Nyheter

Samtal om flera delar av råvarumarknaden

Ett samtal som sammanfattar ett relativt stabilt halvår på råvarumarknaden trots volatilitet och geopolitiska spänningar som sannolikt fortsätter in i andra halvan av året. Vi bjuds även på kommentarer från Carlos Mera, Rabobanks analyschef för jordbrukssektorn och Kari Kangas, skogsanalytiker.

Nyheter

Jonas Lindvall är tillbaka med ett nytt oljebolag, Perthro, som ska börsnoteras

Jonas Lindvall, ett välkänt namn i den svenska olje- och gasindustrin, är tillbaka med ett nytt företag – Perthro AB – som nu förbereds för notering i Stockholm. Med över 35 års erfarenhet från bolag som Lundin Oil, Shell och Talisman Energy, och som medgrundare till energibolag som Tethys Oil och Maha Energy, är Lindvall redo att än en gång bygga ett bolag från grunden.

Tillsammans med Andres Modarelli har han startat Perthro med ambitionen att bli en långsiktigt hållbar och kostnadseffektiv producent inom upstream-sektorn – alltså själva oljeutvinningen. Deras timing är strategisk. Med ett inflationsjusterat oljepris som enligt Lindvall är lägre än på 1970-talet, men med fortsatt växande efterfrågan globalt, ser de stora möjligheter att förvärva tillgångar till attraktiva priser.

Perthro har redan säkrat bevisade oljereserver i Alberta, Kanada – en region med rik oljehistoria. Bolaget tittar även på ytterligare projekt i Oman och Brasilien, där Lindvall har tidigare erfarenhet. Enligt honom är marknadsförutsättningarna idealiska: världens efterfrågan på olja ökar, medan utbudet inte hänger med. Produktionen från befintliga oljefält minskar med cirka fem procent per år, samtidigt som de största oljebolagen har svårt att ersätta de reserver som produceras.

”Det här skapar en öppning för nya aktörer som kan agera snabbare, tänka långsiktigt och agera med kapitaldisciplin”, säger Lindvall.

Perthro vill fylla det växande gapet på marknaden – med fokus på hållbar tillväxt, hög avkastning och effektiv produktion. Med Lindvalls meritlista och branschkunskap hoppas bolaget nu kunna bli nästa svenska oljebolag att sätta avtryck på världskartan – och på börsen.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanStor uppsida i Lappland Guldprospekterings aktie enligt analys

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanBrookfield ska bygga ett AI-datacenter på hela 750 MW i Strängnäs

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSilverpriset släpar efter guldets utveckling, har mer uppsida

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanTradingfirman XTX Markets bygger datacenter i finska Kajana för 1 miljard euro

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanUppgången i oljepriset planade ut under helgen

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanLåga elpriser i sommar – men mellersta Sverige får en ökning

-

Analys2 veckor sedan

Analys2 veckor sedanVery relaxed at USD 75/b. Risk barometer will likely fluctuate to higher levels with Brent into the 80ies or higher coming 2-3 weeks

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanMahvie Minerals växlar spår – satsar fullt ut på guld