Nyheter

Where is all the gold? It may not be where we think it is

Questions of GATA deserve answers now

”GOLD REMAINS AN IMPORTANT ELEMENT OF GLOBAL MONETARY RESERVES”

is the statement that was reaffirmed in the third Central Bank Gold Agreement, currently in force between the western Central Banks in a more than a decade-long history of gold agreements. For those who like gold, a comforting thought. When we think of all the gold that is owned by the Central Banks, we get visions of those great pictures showing cellars full of the gold bars. Fort Knox is the first name that comes to our minds as a heaven for every gold fan, with the cellars below the unbelievable the Bahnhofstrasse in Zurich being a good second. Logically, every central bank fulfils the same role in every country as the place where the country’s gold is. The pictures mainly appeal to a dream of richness that is unattainable to most of us but it is also giving us a feeling of reassurance that those gold holdings are the basis of the system that regulates, manages and backs the paper and viral money that we do have.

However, in the last few weeks, several news sources have released articles that should make the attentive reader aware of the need for a more critical attitude towards the ”comforting” language of the Central Banks and for raising some truly viable questions related to ”is the gold really where we think it is?” and ”is all the gold they say there is, still there?”

But before elaborating on why I think these questions deserve to be asked, let me give you some historic perspective of the relationship of gold and the central financial systems. The World Gold Council has posted the entire history on their website, the following excerpts give a brief overview.

But before elaborating on why I think these questions deserve to be asked, let me give you some historic perspective of the relationship of gold and the central financial systems. The World Gold Council has posted the entire history on their website, the following excerpts give a brief overview.

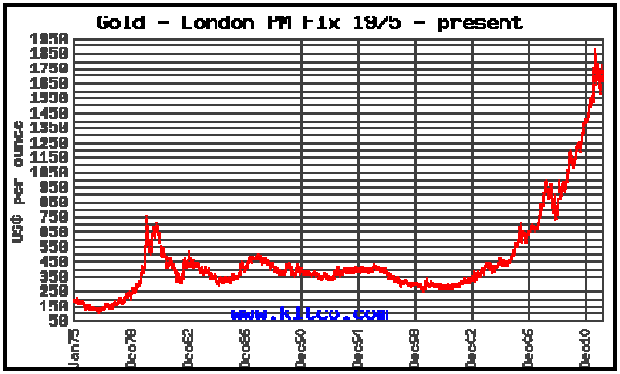

The first international agreement came with the establishment of the IMF in 1944. All member countries committed to establish ”par values” for their currencies in terms of gold or US dollars which was pegged to gold. The fixed value of gold was set at $35 per ounce. Gold became the foundation of the first international monetary system.

In the early 1960’s, gold experienced some speculative buying that brought the price up from the standard $35 to $40 an ounce. That triggered another agreement between central banks, known as ’The Gold Pool’, aiming to hold the price of gold close to the official $35. At the time, the Bank of England stated: ”this state of affairs threatened the whole structure of exchange relationships in the western world”.

Further speculative upward price pressure resulted in an agreement between the central banks of Western Europe and the U.S. Federal Reserve -October 1961- to stabilise the market. The main instrument to accomplish that was by supplying gold to the gold market. That lasted until 1968 when The Gold Pool was abolished, agreeing that they would no longer supply gold to the market but transact only among themselves at the official price. Then, in August 1971, President Nixon was responsible for suspending the convertibility of the dollar into gold. Gold was set free!

Yet, it lasted till 1978, when the Second Amendment of the IMF articles came, that the members were barred from fixing their exchange rates to gold and the obligation on members to conduct transactions in gold at the still official gold price was removed.

In an effort to drive gold out of the monetary system, the IMF was instructed to sell 50 million ounces of its gold, almost one-third of its total gold stock. The gold was sold on one part to the IMF-members, the central banks, and on the other part in the open world gold market.

Looking back, this disposal of gold by the IMF can be seen as the first real step to the freedom of gold as the wider availability of gold stimulated many smart investors to enter the markets. The growing interest from investors and speculators culminated to a first record high of $850 per ounce of gold in January 1980 after which the price lingered on for many years around a general average of $350 per ounce. It took the new primary bull market which started in 2002, to reach the former $850 record in 2007 and surpass it gloriously in the years beyond.

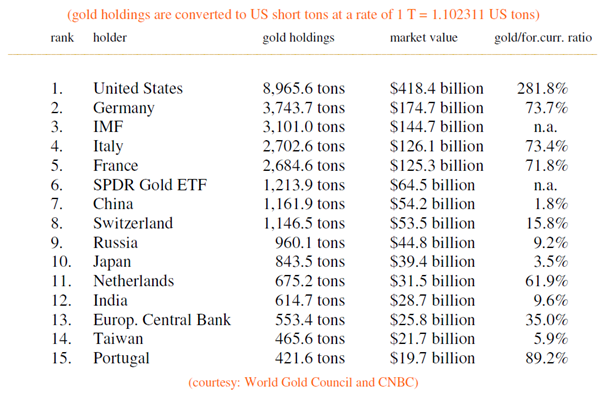

Although gold is no longer the backbone for our monetary system, it still functions as a kind of only valuable commodity to own. The central banks of the world still dominate the top list of gold holders as you can see in the table below. But in my opinion more important than the numbers of the gold holdings, are the figures in the last column of the table, which show the ratio between gold owned and the holdings in foreign currency. The biggest individual holders of gold, such as central banks, international organizations and governments, are believed to account or approximately 16.5% or 30,700 tons of the world’s gold. Here are the top 15 of the gold holders:

Based on these figures, several interesting observations can be made. Let me give you some of the thoughts that came up in my mind, just at random:

- The big differences in the gold/foreign currency holdings are remarkable and show that there is apparently no universal guideline as to how that ratio preferably should be. It would have been interesting to also have stated the current deficits of all the countries mentioned. These ratios reflect the differences in monetary policy of the respective countries and the difference of confidence that the holders have in gold, respectively the lack of trust they have in foreign currencies;

- I find it remarkable that countries like Italy and Portugal are still in this top-10 list. Both have recently been named as the next possible countries that will turn out to have the same problems as Greece had and still has. It is at least a bit strange that these countries have such big gold holdings and would need huge financial support from the other European countries;

- I find it amazing that countries like China, Japan and India have such low holdings of gold. In particular China and India since they are experiencing strong economic growth and a vast inflow of foreign currencies as a result of that. We know that China, which is now the number One gold producer in the world, absorbs its total gold production internally and is a substantial buyer of gold in the world markets. And India has shown to be a strong buyer of gold (a.o. from the recent IMF sales). In both cases at government levels but also because of a strongly growing purchasing of the yellow metal by the public. As there is no end in sight in the economic growth of China and India, I see a great potential of additional gold buying in the next few years;

- reflecting the evident gold buying by international investment communities is the position on number 6 of the only ETF in the top ranks. I would not be surprised if we would see more ETF’s growing strongly over the next few years, maybe even to the point that they will reach the top-10 as well;

- and then, the United States, the leader of the pack, both in the gold reserves that are in Fort Knox (see the picture) and in the gold/foreign currency ratio rankings. This doesn’t mean the US is the richest country of them all. There is that huge and still growing deficit to take into consideration. The high ratio of gold to foreign currency may not mean that it is because of all the gold the own but rather that their exports don’t bring in enough foreign currencies;

another thing comes to mind and that are the critical sounds that have recently been taken more seriously than ever before and which have brought forward the questions with which I started this editorial: ”is the gold really where we think it is?” and ”is all the gold they say there is, still there?”.

These questions are not new. It was in the fall of 1998 that Bill Murphy, a financial commentator at his LeMetropoleCafe.com, and Chris Powell, a newspaper editor in Connecticut, each wrote an essay. Bill reported evidence of financial institutions combining efforts to suppress the price of gold. Chris replied and proposed that gold mining and investor interests should act on Bill’s essays by bringing antitrust lawsuits against those financial institutions. Their essays were so well received that they decided in January 1999 to form GATA, the GOLD ANTI-TRUST ACTION COMMITTEE.

These questions are not new. It was in the fall of 1998 that Bill Murphy, a financial commentator at his LeMetropoleCafe.com, and Chris Powell, a newspaper editor in Connecticut, each wrote an essay. Bill reported evidence of financial institutions combining efforts to suppress the price of gold. Chris replied and proposed that gold mining and investor interests should act on Bill’s essays by bringing antitrust lawsuits against those financial institutions. Their essays were so well received that they decided in January 1999 to form GATA, the GOLD ANTI-TRUST ACTION COMMITTEE.

Over the years, GATA has become not only the watchdog in the world of gold but also a dog that bites if necessary. We all know that fighting the establishment is not an easy task because the opponent has historically proven not to be shy of using all kinds of mean tricks to defend itself and reverse any attack with mean force. Nevertheless, GATA’s actions have been pretty successful; for instance, one court case that was initiated on basis of GATA’s reasoning, contributed to Barrick Gold’s decision to stop the forward selling of their gold.

The GATA guys are not stupid, neither are they Don Quichote’s, on the contrary, they are smart and intelligent and above all, persistent. Often they were not taken very seriously by many and even ridiculed from several sides, despite growing evidence that they had a solid and hard case.

Throughout 2008 and 2009, GATA tried to get access to the gold-related records of the Federal Reserve, eliciting an admission from the Fed that it had -and still has- gold swap arrangements with foreign banks which they didn’t openly report to keep them secret. In February 2011, GATA got a remarkable verdict in their case against the Fed.

The court ruled that most of the Fed’s gold records could remain secret but that one had to be disclosed: minutes of the April 1997 meeting of the G-10 Committee on Gold and Foreign Exchange. The minutes, released by the Fed two weeks after the court’s ruling, showed G-10 member treasury and central bank officials secretly discussing the coordination of their policies toward the gold market. The court ordered the Fed to pay court costs to GATA. Since then, GATA has expressed their doubts about the presence of (all) the U.S. gold reserves and the assurance that the gold that was loaned out would eventually be returned. GATA has collected and published dozens of documents showing Western treasury and central bank efforts to intervene both openly and surreptitiously against a free market in gold. Through www.gata.org and its free daily reports by e-mail, GATA unfolds a scenario that should worry everyone that is involved with gold but actually everyone that is concerned about the world of general finance. Aren’t we all?

The court ruled that most of the Fed’s gold records could remain secret but that one had to be disclosed: minutes of the April 1997 meeting of the G-10 Committee on Gold and Foreign Exchange. The minutes, released by the Fed two weeks after the court’s ruling, showed G-10 member treasury and central bank officials secretly discussing the coordination of their policies toward the gold market. The court ordered the Fed to pay court costs to GATA. Since then, GATA has expressed their doubts about the presence of (all) the U.S. gold reserves and the assurance that the gold that was loaned out would eventually be returned. GATA has collected and published dozens of documents showing Western treasury and central bank efforts to intervene both openly and surreptitiously against a free market in gold. Through www.gata.org and its free daily reports by e-mail, GATA unfolds a scenario that should worry everyone that is involved with gold but actually everyone that is concerned about the world of general finance. Aren’t we all?

RECENT DEVELOPMENTS MAY BRING THE MOMENT OF TRUTH

As a clear sign that the concern about the real status of international and in particular the US gold reserves is spreading and not restricted to the average investor, I signal that from several official sides, sounds were heard that several countries would like to end all uncertainty by bringing their gold back to where it belongs, in the vaults of their own central banks. It began on August 17, 2011 when Venezuela announced that it would not only transfer $6.3 billion of its cash reserves from abroad but also would bring 211 tons of gold back from abroad to the Venezuelan Central Bank where its remaining 154 tons of gold is kept. In addition, President Hugo Chavez announced plans to nationalize its gold industry to use the gold produced to further strengthen the country’s gold reserves.

More recently, Germany and Switzerland have come out saying they want their gold back from storage at the New York Fed where the ’other people’s gold’ is stored. At least they want proof that their gold is in vaults where it is supposed to be. Also in my own country, The Netherlands, there is a public movement to question the situation of our Dutch gold. So far, our Central Bank has only said that indeed a part of our gold is stored at the New York Fed and posted a 1.38 minute video to give the assurance that our gold is safe: Youtube video. We may come to join the other countries and ask for our gold back. With all this, and possibly more countries coming for their gold, the Fed is increasingly pressed to come forward with the answers to the questions that are being asked by GATA, these countries, the media and the public:

WHERE IS ALL THE GOLD?

”is the gold really where we think it is?”

”is all the gold they say there is, still there?”

A most interesting comment on this situation dates from two weeks ago when legendary trader and investor Jim Sinclair told King World News that ”a number of European countries are beginning to ask themselves where the gold is coming from which is being used for interventions in the gold market” adding ”some European countries are beginning to think it is their gold, stored by the US Fed, which is being used for these interventions”.

Another fascinating sound came the other day from Eric Sprott, the widely appreciated driving force of Sprott Asset Management, and David Baker. They commented on the obvious intervention in the gold market in the beginning of this month. Just before the beginning of the largest mining event in Toronto, where almost all the gold bugs and mining people gathered, gold dropped $100 in one day. Sprott and Baker analyzed what happened. They did not mention any names but they pointed their finger into a direction that left very little doubt. I think they meant the Fed……

All this made me think of an article that I read some years ago. It was about the most famous gold vault in the world, Fort Knox where the US Treasury gold is stored. I will not elaborate on the article here but it was pretty shocking. And believe me, it was not based on rumours, it was actually found out in reality. It came from a reliable source. I will do some more investigating and have initiated getting the proper permissions to republish the article as a Special of GOLDVIEW ALERT. I do hope I will be able to bring it to you in the near future.

As I said many times, gold is an intriguing commodity, with an ages old myth as token of value and greed. The most interesting metal in the world, delivering a shine that warms people but sometimes also blinds people. Seen my many, understood by few. It looks that there may be some scary news facts coming out over the next few years.

They will not discourage people to take an interest in the yellow metal, on the contrary, they will further attract investors to give gold a place in their portfolios. And not to forget, gold-related investments, such as shares in ETF’s, gold investment companies and shares of mining and exploration companies. Just realize that even in these times, after the strong uptrend market for gold, the world’s investment public has only invested 2% of their total savings in gold and gold-related investments. I am sure there will be enough reasons coming forward to trust that gold and gold shares will continue to be a very desirable and much wanted treasure.

Henk J. Krasenberg

European Gold Centre

[hr]

European Gold Centre

European Gold Centre analyzes and comments on gold, other metals & minerals and international mining and exploration companies in perspective to the rapidly changing world of economics, finance and investments. Through its publications, The Centre informs international investors, both institutional and private, primarily in Europe but also worldwide, who have an interest in natural resources and investing in resource companies.

The Centre also provides assistance to international mining and exploration companies in building and expanding their European investor following and shareholdership.

Henk J. Krasenberg

After my professional career in security analysis, investment advisory, porfolio management and investment banking, I made the decision to concentrate on and specialize in the world of metals, minerals and mining finance. From 1983 to 1992, I have been writing and consulting about gold, other metals and minerals and resource companies.

The depressed metal markets of the early 1990’s led me to a temporary shift. I pursued one of my other hobbies and started an art gallery in contemporary abstracts, awaiting a new cycle in metals and mining. That started to come in the early 2000’s and I returned to metals and mining in 2002 with the European Gold Centre.

With my GOLDVIEW reports, I have built an extensive institutional investor following in Europe and more of a private investor following in the rest of the world. In 2007, I introduced my MINING IN AFRICA publication, to be followed by MINING IN EUROPE in 2010 and MINING IN MEXICO in 2012.

For more information: www.europeangoldcentre.com

Nyheter

Tyskland har så höga elpriser att företag inte har råd att använda elektricitet

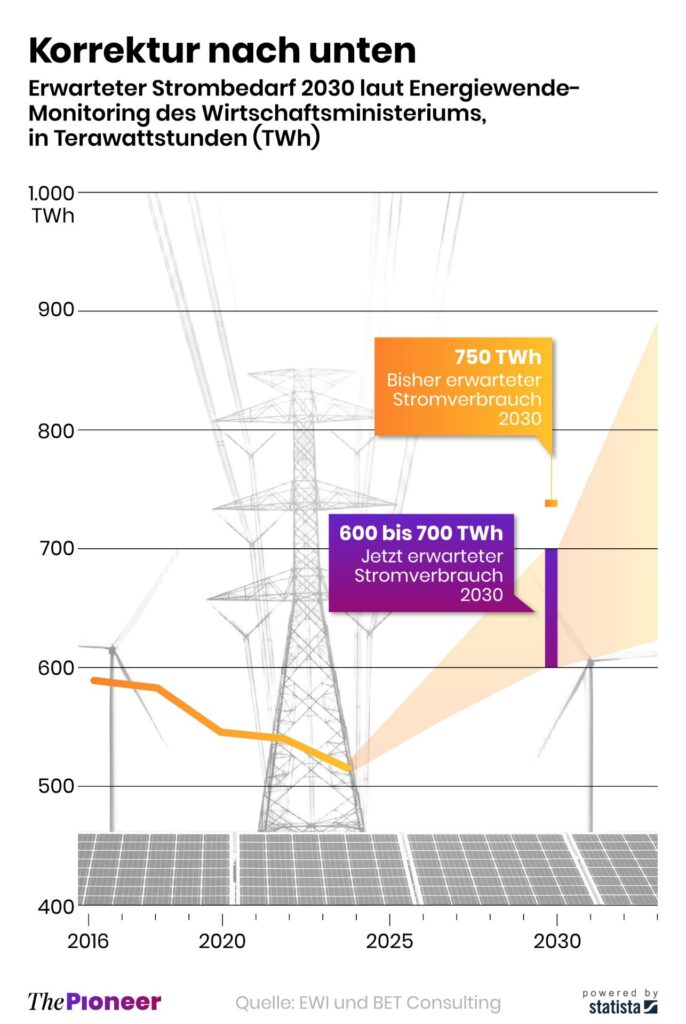

Tyskland har skrivit ner prognosen på hur mycket elektricitet landet kommer att behöva 2030. Hittills har prognosen varit 750 TWh, vilken nu har skrivits ner till 600-700 TWh,

Det kan vid en första anblick låta positivt. Men orsaken är inte att effektiviseringar. Utan priserna är så pass höga att företag inte har råd att använda elektriciteten. Elintensiv industri flyttar sin verksamhet till andra länder och få företag satsar på att etablera energikrävande verksamhet i landet.

Tyskland har inte heller någon plan för att förändra sin havererade energipolitik. Eller rättare sagt, planen är att uppfinna fusionskraft och använda det som energikälla. Något som dock inte löser problemet på några årtionden.

Nyheter

Kinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

Kinas officiella statistik för elproduktion har släppts för augusti och den visar att landet slog ett nytt rekord. Under augusti producerades 936 TWh elektricitet.

Stephen Stapczynski på Bloomberg lyfter fram att det är ungefär lika mycket som Japan producerar per år, vilket innebär är de producerar ungefär lika mycket elektricitet per invånare.

Kinas elproduktion kom i augusti från:

| Fossil energi | 67 % |

| Vattenkraft | 16 % |

| Vind och Sol | 13 % |

| Kärnkraft | 5 % |

Stapczynskis kollega Javier Blas uppmärksammar även att det totala rekordet inkluderade ett nytt rekord för kolkraft. Termisk energi (där nästan allting är kol) producerade 627,4 TWh under augusti. Vi rapporterade tidigare i år att Kina under första kvartalet slog ett nytt rekord i kolproduktion.

Nyheter

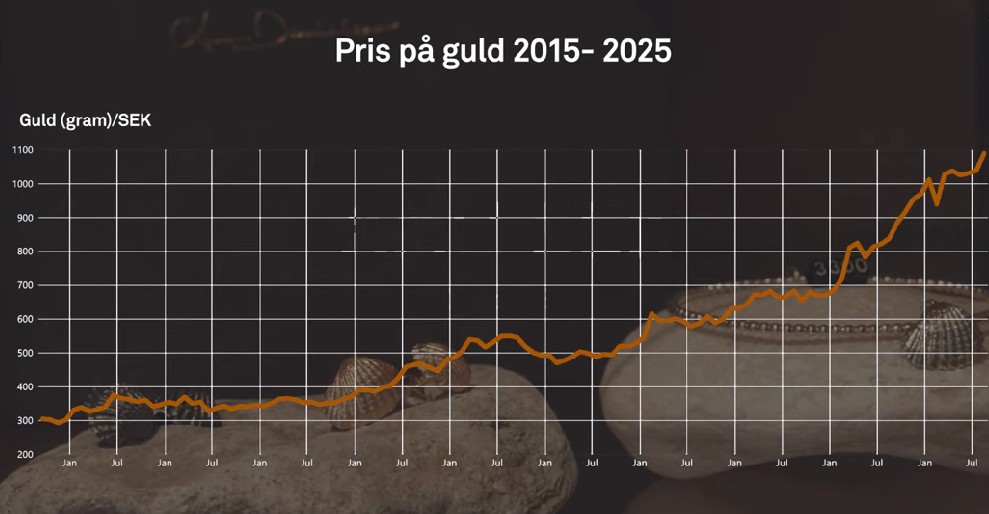

Det stigande guldpriset en utmaning för smyckesköpare

Guldpriset når hela tiden nya höjder och det märks för folk när de ska köpa smycken. Det gör att butikerna måste justera upp sina priser löpande och kunder funderar på om det går att välja något med lägre karat eller mindre diamant. Anna Danielsson, vd på Smyckevalvet, säger att det samtidigt gör att kunderna får upp ögonen för värdet av att äga guld. Det högre guldpriset har även gjort att gamla smycken som ligger hemma i folks byrålådor kan ha fått ett överraskande högt värde.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMeta bygger ett AI-datacenter på 5 GW och 2,25 GW gaskraftverk

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAker BP gör ett av Norges största oljefynd på ett decennium, stärker resurserna i Yggdrasilområdet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSommarens torka kan ge högre elpriser i höst

-

Analys4 veckor sedan

Analys4 veckor sedanBrent edges higher as India–Russia oil trade draws U.S. ire and Powell takes the stage at Jackson Hole

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals är verksamt i guldrikt område i Finland

-

Analys4 veckor sedan

Analys4 veckor sedanIncreasing risk that OPEC+ will unwind the last 1.65 mb/d of cuts when they meet on 7 September

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanNeil Atkinson spår att priset på olja kommer att stiga till 70 USD

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanEurobattery Minerals satsar på kritiska metaller för Europas självförsörjning