Analys

Råvaruplanket: Politiska spel avgör råvarornas andra halvår

![]() Utbudsstörningar balanserar oljemarknaden

Utbudsstörningar balanserar oljemarknaden

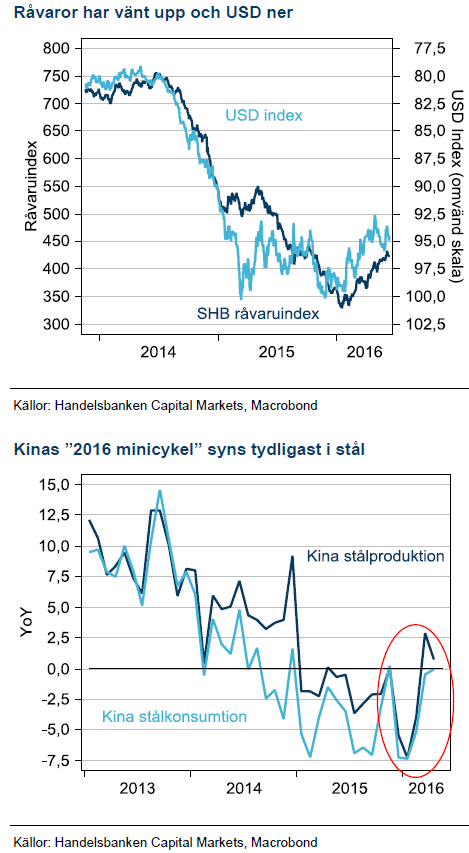

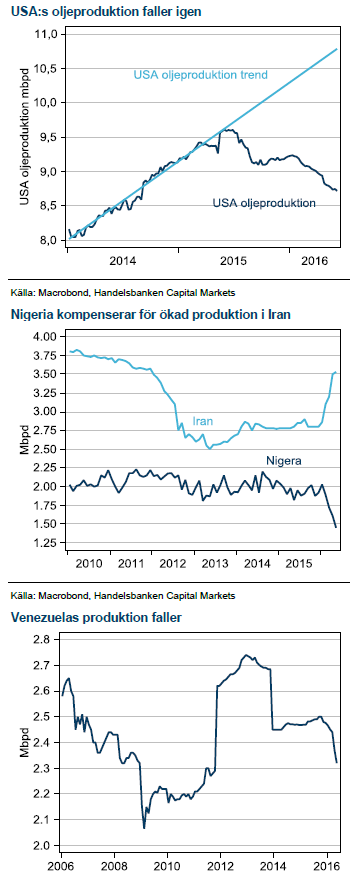

Sedan mars då vi trodde att nästa rörelse för oljan skulle bli ner har oljan stigit kraftigt. Ökad aktivitet i skifferfälten som vi väntade oss då, har börjat synas nu istället, nästan tre månader senare. Det vittnar om hur pressade skifferproducenterna har varit. Samtidigt har utbudsstörningar snabbt förbättrat marknadsbalansen. Andra halvåret blir nu ett svårt vågspel på hur Nigeria och Venezuelas komplexa produktion utvecklar sig. Vi tror fortfarande att priserna kommer ner något, men inte så mycket som i mars och vi ser helt klart ökad risk på uppsidan i vårt prisantagande med Brent kring USD 40 i slutet av året.

Av våra ”key case” detta år, stigande zink och nickelpriser har zink tagit fart och stigit med 30 % så här långt. Nickel ligger dock kvar trots att marknadsbalansen ser allt mer ansträngd ut. Efter zinkuppgången håller vi nickel som främsta råvara med chans att stiga 15 % i pris till slutet av året med vårt prismål på USD 10600. Zink håller vi kvar på USD 2200 och koppar tar vi ner från USD 5000 till USD 4500 då gruvbolagen fortsätter öka produktionen och Kina inte svarar upp till ökad efterfrågan.

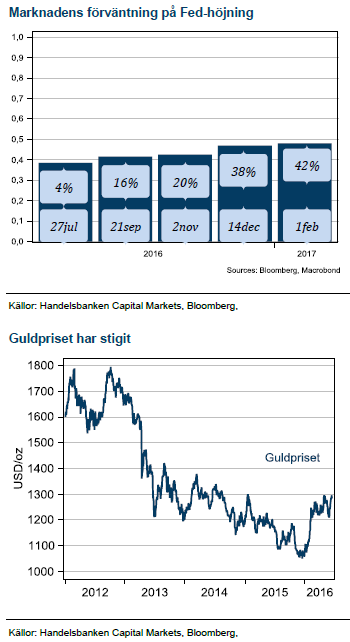

Fed velar och Brexit spökar

Fed:s ledare, Yellen behöll utsagan om två höjningar i år. Guld och ädelmetallers starka korrelation till huruvida Fed höjer eller ej skapar risk på nedsidan i ädelmetallerna då två höjningar inte är prissatta i marknaden. I andra vågskålen ligger veckans utkomst från omröstningen i Storbritannien. Ett tydligt ”lämna EU” resultat, låt säga 60-40 tror vi är gnistan till ett ny hållbar guldprisuppgång där kommande val i Spanien, Belgien och Holland kan ge influenser som ökar intresset för guld som säker hamn. Vår prognos med guld till USD 1300 har precis infallit och vi höjer den till USD 1400 på större sannolikhet för europeiskt tumult än en aggressivt räntehöjande Fed under andra halvåret.

Vår syn för Q3 och Q4 2016:

Basmetaller

Efterfrågan stjälper snarare än hjälper

Efterfrågan stjälper snarare än hjälper

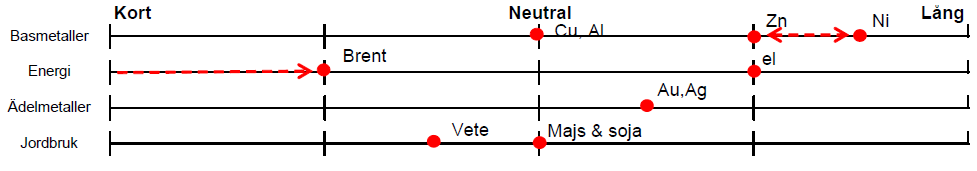

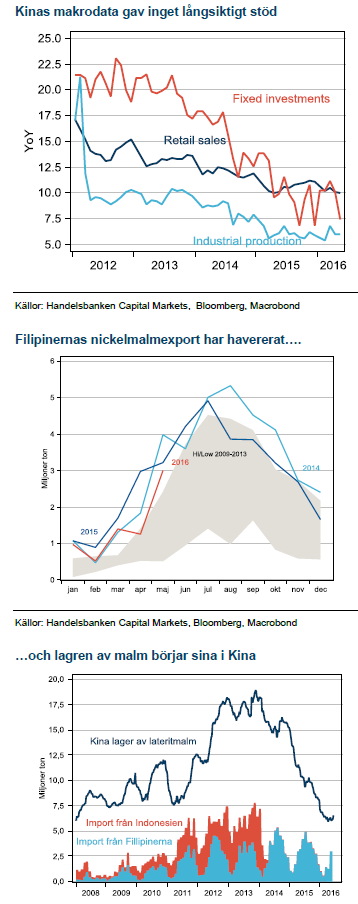

Förra kvartalet höjde vi utsikterna för koppar, baserat på bättre makrodata i Kina. Tre månader senare har det visat sig att trenden inte var hållbar och efterfrågan från Kina snarare tynger än stärker basmetallerna. I den miljön är det på utbudssidan vi letar för att hitta olika fundamenta för metallerna.

Zink sticker ut

Marknadsbalansen för zink har halkat ner i brist efter att den väl annonserade historien om stora gruvor som stänger då de är utbrutna börjar synas i data. Redan före jul skeppade den största av dem, Century sin sista malm men det är först nu som det verkligen börjar märkas och priserna stiger. Den långa ledtiden förklaras av den svaga efterfrågan. Trots att zink har stigit 30% till sin topp i år tror vi att den här historien har mer kraft och behåller vårt målpris på USD 2200, 8% över dagens pris.

Nickel näst på tur?

Näst efter zink har vi hållit nickel som mest trolig att hamna i underskott. Efter Indonesiens exportförbud på latteritmalm 2014 har det dröjt oväntat länge före marknadsbalansen stramats åt. Fillipinerna började ta en del av Indonesien marknadsandel och Kina som är köparen av malmen hade bunkrat lager. Nu sinar lagren och exporten från Filipinerna minskar efter politiska restriktioner för att värna miljön. Vi ser 15% uppsida till USD 10,600 i nickel under andra halvåret.

Aluminium och koppar svagast fundamenta

Erfarenheterna från årets minicykel i Kina har tydligt visat att aluminium är den basmetall där avställd kapacitet snabbast kommer i produktion när priserna stiger. Det hindrar alla prisuppgångar från att bli långvariga. Givet vår syn att energipriserna bör dämpas något under andra halvåret så ser vi att aluminium återvänder till USD 1500-1550.

Kopparproduktionen ökade inte riktigt som förväntat förra året men gruvbolagen håller kvar sina expansionsplaner, de har snarare försenats något än bordlagts. Kinesiska efterfrågan har varit svagare än väntat i år, trots bättre makrodata. Det senaste trenden med stigande lager på LME är oroande då det sannolikt är metall som hållits utanför marknaden i Kina tidigare. Vi sänker vår prognos tillbaka till USD 4500 från det tillfälliga lyftet till USD 5000 förra kvartalet.

Energi

Utbudsstörningarna högsta på fem år

Utbudsstörningarna högsta på fem år

Efter att spenderat det mesta av januari och februari omkring 30-strecket studsade oljan plötsligt upp i mitten av mars. Utbudsstörningar i Irak, Nigeria, Venezuela och Kanada samtidigt som USA:s skifferolja minskade produktionen i sviterna av de låga priserna ligger bakom uppgången.

Temporära eller strukturella

Just nu gör marknaden skillnad på strukturella produktionsnedgångar som skifferolja som inte klarade prisnedgången under första kvartalet och därför minskar produktionen. Andra nedgångar är temporära, dit räknas branden i Kanada som tvingat producenterna av oljesand att evakuera personal men också nedgången i Nigeria och Venezuela. Produktionsfaciliteterna i oljesanden är inte skadade och väntas vara i full produktion i slutet av juni och bidrar då till att öka produktionsöverskottet igen.

De svaga i OPEC rebalanserar

Nigeria och Venezuela ser vi som mycket större långsiktiga hot. I Venezuela har staten sänkt antalet arbetsdagar för statligt anställda från fem till två efter brist på medel att betala ut löner. All oljeproduktion sker genom det statliga oljebolaget. Produktionen har gått ner och lägre produktion ger ytterligare lägre intäkter till staten. I Nigeria anfaller militanta grupper som tidigare fick monetära stöd av staten oljeproduktionssystemet i protest mot att utländska oljebolag fortsätter produktionen när landet får allt sämre finanser. När produktionen faller får staten ännu sämre möjligheter att ”köpa sig fri” från aktivisternas attacker. Båda länderna är alltså inne i en negativ spiral som är svår att bryta och det ökar riskerna för oljepriset under andra halvåret. Vårt huvudscenario är dock fortfarande att oljan faller tillbaka något när skifferproduktion börjar öka i slutet av tredje kvartalet och Kanadas oljesand är tillbaka i full produktion.

Kol stärker elpriserna

Kolpriserna har inte bara slutat falla utan även vänt upp sedan april. Tillsammans med stigande olja har de längre elterminerna stigit omkring 45 % sedan botten i februari. Kolprisuppgången tror vi främst beror på svagare USD efter Feds uteblivna räntehöjningar. Kolproducenterna har produktionskostnad i lokal valuta och säljer i USD.

Ädelmetaller

Feds huvudvärk är guldets gnista

Feds huvudvärk är guldets gnista

Vi har tidigare argumenterat för att Feds supermjuka penningpolitik var den främsta drivkraften till guldprisuppgången efter finanskrisen. Guld föll också kraftigt när Fed började med ”tapering”. Efter att Fed startat höjningscykeln i december 2015 har mycket utvecklats på ett ogynnsamt vis för den Amerikanska centralbanken. Makrodata har visserligen förbättrats och finansiella marknader har i stort återhämtat sig sedan decemberhöjningen. Osäkerheten i marknaden består dock och det är långt kvar till räntemarknaden åter prisar höjningar från Fed likt vid decembermötet.

Vid junimötet hade Yellen chansen med valde att prata bort risken för en höjning en vecka före mötet. Fed indikerar dock fortfarande två höjningar i år. Troligen väljer de att höja i september och december. Om de höjer. Räntemarknaden prissätter knappt 40% sannolikhet för en höjningen före årsskiftet. Om Fed överraskar och höjer två gånger enligt sin utsago betyder det högst sannolikt att guld faller i pris.

Europa i nytt tumult

I andra vågskålen ligger det tumultartade scenario som målas upp för Europa om Storbritannien röstar för att tydligt lämna EU. Ett resultat med knapp majoritet för att lämna betyder sannolikt inte så mycket men en 60-40 för att lämna betyder att man ska ut och kommer sannolikt starta en opinionsvåg i andra länder som blir negativ för finansiella marknader. I sådan miljö brukar guld ha sin bästa tid. Tyvärr ser vi politisk turbulens som drivkraft, eventuellt tillsammans med en avvaktade Fed som mer sannolikt än en aggressivt räntehöjnade Fed. Därmed fortsätter vi tro på högre guld och ädelmetaller och lyfter guldprognosen med USD 100 till USD 1400.

Jordbruk

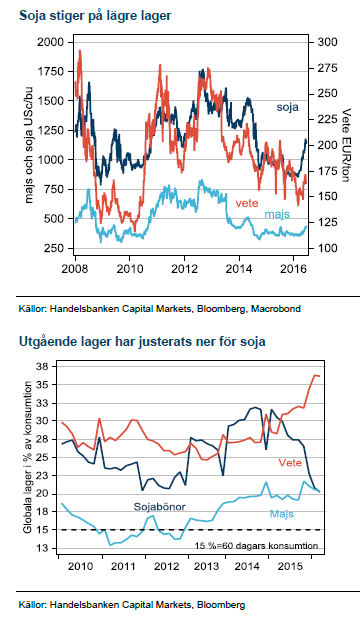

Vete i Paris har fallit tillbaka ner mot årets lägsta nivåer efter en tillfällig uppgång i början av juni. Regn och översvämningar i Europa och Ryssland låg bakom mycket av uppgången. När nu vädret blir bättre faller priserna tillbaka igen. I USA är omständigheterna närmst perfekta med torrt väder i Södern där skörden nu är igång samtidigt som Norra delarna får regn, passande för de senare grödorna där.

Väderproblemen har försenat det prisfall vi tänkte oss för tre månader sedan. Trots det ser vi inget, förutom väderproblem i något av de större odlingsområdena som kan vända pristrenden. Terminer med längre löptid handlas till en stor premie, främst en riskpremie för eventuellt sämre skörd. Normalt faller denna riskpremie ur successivt fram till skörd. Vi fortsätter tro på priser kring 140 EUR/ton vid årets skörd, en prövning som kan komma att balansera produktionen för nästa år och därmed dämpa lageruppbyggnaden.

Sojalagren faller

Globala lager av sojabönor har justerats ner successivt. Främst har det skett efter regn Argentina. Lagerjusteringen ger visst stöd till vete och majs via substitution, om än i mindre utsträckning än mellan vete och majs. Lägre sojalager kan vara en riskfaktor att se upp med framöver och vi ser sojaskörden som den mest viktiga faktorn att bevaka i år.

[box]SHB Råvarukommentar är producerat av Handelsbanken och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Ansvarsbegränsning

Detta material är producerat av Svenska Handelsbanken AB (publ) i fortsättningen kallad Handelsbanken. De som arbetar med innehållet är inte analytiker och materialet är inte oberoende investeringsanalys. Innehållet är uteslutande avsett för kunder i Sverige. Syftet är att ge en allmän information till Handelsbankens kunder och utgör inte ett personligt investeringsråd eller en personlig rekommendation. Informationen ska inte ensamt utgöra underlag för investeringsbeslut. Kunder bör inhämta råd från sina rådgivare och basera sina investeringsbeslut utifrån egen erfarenhet.

Informationen i materialet kan ändras och också avvika från de åsikter som uttrycks i oberoende investeringsanalyser från Handelsbanken. Informationen grundar sig på allmänt tillgänglig information och är hämtad från källor som bedöms som tillförlitliga, men riktigheten kan inte garanteras och informationen kan vara ofullständig eller nedkortad. Ingen del av förslaget får reproduceras eller distribueras till någon annan person utan att Handelsbanken dessförinnan lämnat sitt skriftliga medgivande. Handelsbanken ansvarar inte för att materialet används på ett sätt som strider mot förbudet mot vidarebefordran eller offentliggörs i strid med bankens regler.

Analys

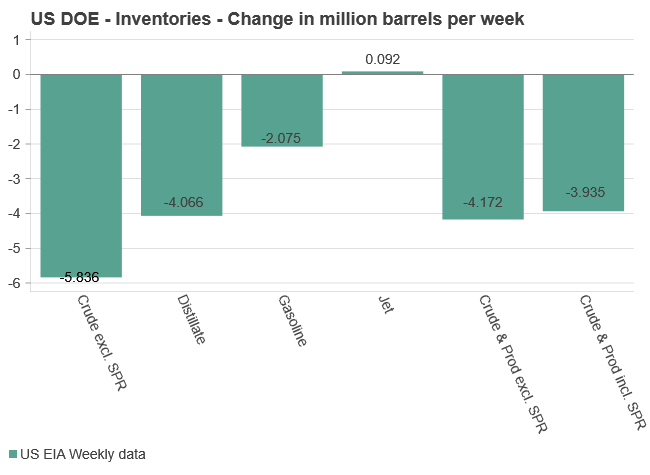

Tightening fundamentals – bullish inventories from DOE

The latest weekly report from the US DOE showed a substantial drawdown across key petroleum categories, adding more upside potential to the fundamental picture.

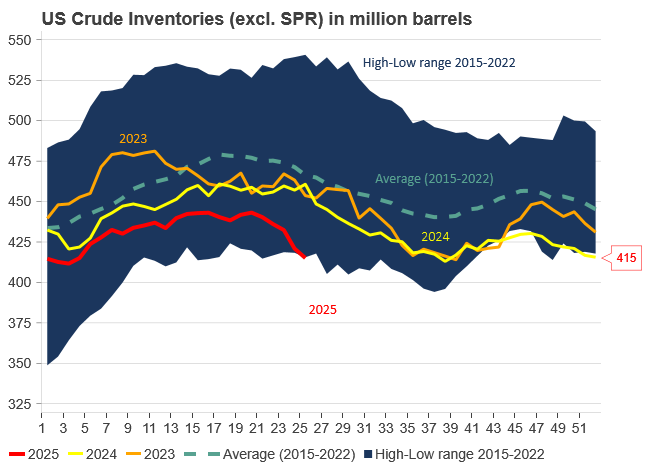

Commercial crude inventories (excl. SPR) fell by 5.8 million barrels, bringing total inventories down to 415.1 million barrels. Now sitting 11% below the five-year seasonal norm and placed in the lowest 2015-2022 range (see picture below).

Product inventories also tightened further last week. Gasoline inventories declined by 2.1 million barrels, with reductions seen in both finished gasoline and blending components. Current gasoline levels are about 3% below the five-year average for this time of year.

Among products, the most notable move came in diesel, where inventories dropped by almost 4.1 million barrels, deepening the deficit to around 20% below seasonal norms – continuing to underscore the persistent supply tightness in diesel markets.

The only area of inventory growth was in propane/propylene, which posted a significant 5.1-million-barrel build and now stands 9% above the five-year average.

Total commercial petroleum inventories (crude plus refined products) declined by 4.2 million barrels on the week, reinforcing the overall tightening of US crude and products.

Analys

Bombs to ”ceasefire” in hours – Brent below $70

A classic case of “buy the rumor, sell the news” played out in oil markets, as Brent crude has dropped sharply – down nearly USD 10 per barrel since yesterday evening – following Iran’s retaliatory strike on a U.S. air base in Qatar. The immediate reaction was: “That was it?” The strike followed a carefully calibrated, non-escalatory playbook, avoiding direct threats to energy infrastructure or disruption of shipping through the Strait of Hormuz – thus calming worst-case fears.

After Monday morning’s sharp spike to USD 81.4 per barrel, triggered by the U.S. bombing of Iranian nuclear facilities, oil prices drifted sideways in anticipation of a potential Iranian response. That response came with advance warning and caused limited physical damage. Early this morning, both the U.S. President and Iranian state media announced a ceasefire, effectively placing a lid on the immediate conflict risk – at least for now.

As a result, Brent crude has now fallen by a total of USD 12 from Monday’s peak, currently trading around USD 69 per barrel.

Looking beyond geopolitics, the market will now shift its focus to the upcoming OPEC+ meeting in early July. Saudi Arabia’s decision to increase output earlier this year – despite falling prices – has drawn renewed attention considering recent developments. Some suggest this was a response to U.S. pressure to offset potential Iranian supply losses.

However, consensus is that the move was driven more by internal OPEC+ dynamics. After years of curbing production to support prices, Riyadh had grown frustrated with quota-busting by several members (notably Kazakhstan). With Saudi Arabia cutting up to 2 million barrels per day – roughly 2% of global supply – returns were diminishing, and the risk of losing market share was rising. The production increase is widely seen as an effort to reassert leadership and restore discipline within the group.

That said, the FT recently stated that, the Saudis remain wary of past missteps. In 2018, Riyadh ramped up output at Trump’s request ahead of Iran sanctions, only to see prices collapse when the U.S. granted broad waivers – triggering oversupply. Officials have reportedly made it clear they don’t intend to repeat that mistake.

The recent visit by President Trump to Saudi Arabia, which included agreements on AI, defense, and nuclear cooperation, suggests a broader strategic alignment. This has fueled speculation about a quiet “pump-for-politics” deal behind recent production moves.

Looking ahead, oil prices have now retraced the entire rally sparked by the June 13 Israel–Iran escalation. This retreat provides more political and policy space for both the U.S. and Saudi Arabia. Specifically, it makes it easier for Riyadh to scale back its three recent production hikes of 411,000 barrels each, potentially returning to more moderate increases of 137,000 barrels for August and September.

In short: with no major loss of Iranian supply to the market, OPEC+ – led by Saudi Arabia – no longer needs to compensate for a disruption that hasn’t materialized, especially not to please the U.S. at the cost of its own market strategy. As the Saudis themselves have signaled, they are unlikely to repeat previous mistakes.

Conclusion: With Brent now in the high USD 60s, buying oil looks fundamentally justified. The geopolitical premium has deflated, but tensions between Israel and Iran remain unresolved – and the risk of missteps and renewed escalation still lingers. In fact, even this morning, reports have emerged of renewed missile fire despite the declared “truce.” The path forward may be calmer – but it is far from stable.

Analys

A muted price reaction. Market looks relaxed, but it is still on edge waiting for what Iran will do

Brent crossed the 80-line this morning but quickly fell back assigning limited probability for Iran choosing to close the Strait of Hormuz. Brent traded in a range of USD 70.56 – 79.04/b last week as the market fluctuated between ”Iran wants a deal” and ”US is about to attack Iran”. At the end of the week though, Donald Trump managed to convince markets (and probably also Iran) that he would make a decision within two weeks. I.e. no imminent attack. Previously when when he has talked about ”making a decision within two weeks” he has often ended up doing nothing in the end. The oil market relaxed as a result and the week ended at USD 77.01/b which is just USD 6/b above the year to date average of USD 71/b.

Brent jumped to USD 81.4/b this morning, the highest since mid-January, but then quickly fell back to a current price of USD 78.2/b which is only up 1.5% versus the close on Friday. As such the market is pricing a fairly low probability that Iran will actually close the Strait of Hormuz. Probably because it will hurt Iranian oil exports as well as the global oil market.

It was however all smoke and mirrors. Deception. The US attacked Iran on Saturday. The attack involved 125 warplanes, submarines and surface warships and 14 bunker buster bombs were dropped on Iranian nuclear sites including Fordow, Natanz and Isfahan. In response the Iranian Parliament voted in support of closing the Strait of Hormuz where some 17 mb of crude and products is transported to the global market every day plus significant volumes of LNG. This is however merely an advise to the Supreme leader Ayatollah Ali Khamenei and the Supreme National Security Council which sits with the final and actual decision.

No supply of oil is lost yet. It is about the risk of Iran closing the Strait of Hormuz or not. So far not a single drop of oil supply has been lost to the global market. The price at the moment is all about the assessed risk of loss of supply. Will Iran choose to choke of the Strait of Hormuz or not? That is the big question. It would be painful for US consumers, for Donald Trump’s voter base, for the global economy but also for Iran and its population which relies on oil exports and income from selling oil out of that Strait as well. As such it is not a no-brainer choice for Iran to close the Strait for oil exports. And looking at the il price this morning it is clear that the oil market doesn’t assign a very high probability of it happening. It is however probably well within the capability of Iran to close the Strait off with rockets, mines, air-drones and possibly sea-drones. Just look at how Ukraine has been able to control and damage the Russian Black Sea fleet.

What to do about the highly enriched uranium which has gone missing? While the US and Israel can celebrate their destruction of Iranian nuclear facilities they are also scratching their heads over what to do with the lost Iranian nuclear material. Iran had 408 kg of highly enriched uranium (IAEA). Almost weapons grade. Enough for some 10 nuclear warheads. It seems to have been transported out of Fordow before the attack this weekend.

The market is still on edge. USD 80-something/b seems sensible while we wait. The oil market reaction to this weekend’s events is very muted so far. The market is still on edge awaiting what Iran will do. Because Iran will do something. But what and when? An oil price of 80-something seems like a sensible level until something do happen.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals växlar spår – satsar fullt ut på guld

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanUppgången i oljepriset planade ut under helgen

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanLåga elpriser i sommar – men mellersta Sverige får en ökning

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanJonas Lindvall är tillbaka med ett nytt oljebolag, Perthro, som ska börsnoteras

-

Analys3 veckor sedan

Analys3 veckor sedanA muted price reaction. Market looks relaxed, but it is still on edge waiting for what Iran will do

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOljan, guldet och marknadens oroande tystnad

-

Analys4 veckor sedan

Analys4 veckor sedanVery relaxed at USD 75/b. Risk barometer will likely fluctuate to higher levels with Brent into the 80ies or higher coming 2-3 weeks

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanDomstolen ger klartecken till Lappland Guldprospektering