Analys

LME Week 2013 på en sida

![]() LME-veckan är dagarna då industrin för basmetaller samlas i London och försöker bilda sig en uppfattning om var priserna på metallerna ska ta vägen. Hemma efter årets LME-vecka sammanfattar vi diskussioner, teman och frågor.

LME-veckan är dagarna då industrin för basmetaller samlas i London och försöker bilda sig en uppfattning om var priserna på metallerna ska ta vägen. Hemma efter årets LME-vecka sammanfattar vi diskussioner, teman och frågor.

Lagerköer

För tredje året i rad, och med eskalerande intensitet diskuterades problemet med köer för att få ut metall ur LME:s lagerhus. LME:s karismatiske ledare Charles Li adresserade problemet med eftertryck (precis som förra året) men mellan orden ekade det tomt. Intet nytt under solen alltså när det gäller LME:s förmåga att få bukt med problemet att få ut metall ur lagerhusen. Situationen förklarar mycket av de höga premier på fysisk metall som vi sett under 2013. Zink och aluminium handlas omkring sina 10 års medelvärde men premien för fysisk metall ligger omkring 50-100 % över 10 års-snittet.

CFTC

”Commitment of Traders Report” har varit hett i försnacket inför veckan. Rapporteringen för råvaror handlade i USA ger en föredömlig översikt hur investerare är positionerade i respektive råvara. Trycket ökar på LME att avlägga motsvaran de data för de LME-handlade metallerna och Charles Li sade sig välkomna initiativet. LME har nog mycket att vinna på ökad transparens. LME säger att handelsvolymerna är 7 % högre hittills i år men de flesta metallhandlare vi talar med vittnar om lägre handlade volymer. En märklig diskrepans.

Överskott puttar ner koppar från tronen

LME index handlas 8 procent lägre under årets konferens än under 2012 års dito. Koppar har gått från att under 2012 vara den starkaste metallen till att hittills i år falla med 12 %. Starkare utsikter för ökad produktion är huvudskälet. Bland de metaller som fallit mest av samma skäl hittar vi nickel som tappat 19 % i år. Tenn är den enda basmetall som stigit hittills i år. Handlarna återspeglar också marknaden; bly och tenn var de metaller som flest trodde skulle stiga kommande 12 månader. En plats som koppar haft under de senaste åren. Favoritmetall att vara kort var återigen aluminium. Överskottet på metallmarknaden verkar vara det som plågar flest av deltagarna, främst på stål där antalet handelstvister (AD/ CVD) ökar kraftigt och utgör ett hot mot den öppna marknaden trots ett globalt kapacitetsutnyttjande om ca 75 %.

Olönsam produktion

Den senaste tiden har tvingat flera producenter att stänga produktion på grund av de låga priserna. Glencore:s nickelgruva Falcondo med kapacitet för 30 kt Nickel per år i Dominikanska rep är ett bra exempel. Alcoa och Rusal har stängt ner viss aluminiumproduktion. Stängningarna har varit inom nickel och aluminium, de två metaller som har högst lager och störst överskott. Ser vi till stål är efterfrågan i EU ned 30 % utan några större stängningar. Ca 5-7 ugnar kan tvingas stänga inom EU vilket blir en het politisk fråga precis som med Ilvas verk i Taranto.

Firm floor & soft ceiling

Supercykeln på råvaror är långt från över, kanske om man ser till cykeln av kraftiga prisrörelser, men fokus förflyttas till alla utmaningar på utbudssidan för att möta efterfrågan på längre sikt. Kraftigt ökade kostnader (vikande halter, geografiska och teknologiska utmaningar, miljöavgifter, brist på kvalificerad arbetskraft etc.) och svårigheter att få finansiering är oroande. Stora nedskrivningar av tillgångsvärden har gjort att investerarkollektivet fokuserar mer på projekt med starka kassaflöden och undviker projekt i riskzoner.

Fjolårets kinafokus fanns kvar men det rådde större tillit till landets framtid efter årets ledarskapsskifte. I likhet med vår egen tro på en starkare kinesisk utveckling de kommande 6 månaderna så får Kinesisk makro representera det mest positiva inslaget från dagarna i London.

Analys

Breaking some eggs in US shale

Lower as OPEC+ keeps fast-tracking redeployment of previous cuts. Brent closed down 1.3% yesterday to USD 68.76/b on the back of the news over the weekend that OPEC+ (V8) lifted its quota by 547 kb/d for September. Intraday it traded to a low of USD 68.0/b but then pushed higher as Trump threatened to slap sanctions on India if it continues to buy loads of Russian oil. An effort by Donald Trump to force Putin to a truce in Ukraine. This morning it is trading down 0.6% at USD 68.3/b which is just USD 1.3/b below its July average.

Only US shale can hand back the market share which OPEC+ is after. The overall picture in the oil market today and the coming 18 months is that OPEC+ is in the process of taking back market share which it lost over the past years in exchange for higher prices. There is only one source of oil supply which has sufficient reactivity and that is US shale. Average liquids production in the US is set to average 23.1 mb/d in 2025 which is up a whooping 3.4 mb/d since 2021 while it is only up 280 kb/d versus 2024.

Taking back market share is usually a messy business involving a deep trough in prices and significant economic pain for the involved parties. The original plan of OPEC+ (V8) was to tip-toe the 2.2 mb/d cuts gradually back into the market over the course to December 2026. Hoping that robust demand growth and slower non-OPEC+ supply growth would make room for the re-deployment without pushing oil prices down too much.

From tip-toing to fast-tracking. Though still not full aggression. US trade war, weaker global growth outlook and Trump insisting on a lower oil price, and persistent robust non-OPEC+ supply growth changed their minds. Now it is much more fast-track with the re-deployment of the 2.2 mb/d done already by September this year. Though with some adjustments. Lifting quotas is not immediately the same as lifting production as Russia and Iraq first have to pay down their production debt. The OPEC+ organization is also holding the door open for production cuts if need be. And the group is not blasting the market with oil. So far it has all been very orderly with limited impact on prices. Despite the fast-tracking.

The overall process is nonetheless still to take back market share. And that won’t be without pain. The good news for OPEC+ is of course that US shale now is cooling down when WTI is south of USD 65/b rather than heating up when WTI is north of USD 45/b as was the case before.

OPEC+ will have to break some eggs in the US shale oil patches to take back lost market share. The process is already in play. Global oil inventories have been building and they will build more and the oil price will be pushed lower.

A Brent average of USD 60/b in 2026 implies a low of the year of USD 45-47.5/b. Assume that an average Brent crude oil price of USD 60/b and an average WTI price of USD 57.5/b in 2026 is sufficient to drive US oil rig count down by another 100 rigs and US crude production down by 1.5 mb/d from Dec-25 to Dec-26. A Brent crude average of USD 60/b sounds like a nice price. Do remember though that over the course of a year Brent crude fluctuates +/- USD 10-15/b around the average. So if USD 60/b is the average price, then the low of the year is in the mid to the high USD 40ies/b.

US shale oil producers are likely bracing themselves for what’s in store. US shale oil producers are aware of what is in store. They can see that inventories are rising and they have been cutting rigs and drilling activity since mid-April. But significantly more is needed over the coming 18 months or so. The faster they cut the better off they will be. Cutting 5 drilling rigs per week to the end of the year, an additional total of 100 rigs, will likely drive US crude oil production down by 1.5 mb/d from Dec-25 to Dec-26 and come a long way of handing back the market share OPEC+ is after.

Analys

More from OPEC+ means US shale has to gradually back off further

The OPEC+ subgroup V8 this weekend decided to fully unwind their voluntary cut of 2.2 mb/d. The September quota hike was set at 547 kb/d thereby unwinding the full 2.2 mb/d. This still leaves another layer of voluntary cuts of 1.6 mb/d which is likely to be unwind at some point.

Higher quotas however do not immediately translate to equally higher production. This because Russia and Iraq have ”production debts” of cumulative over-production which they need to pay back by holding production below the agreed quotas. I.e. they cannot (should not) lift production before Jan (Russia) and March (Iraq) next year.

Argus estimates that global oil stocks have increased by 180 mb so far this year but with large skews. Strong build in Asia while Europe and the US still have low inventories. US Gulf stocks are at the lowest level in 35 years. This strong skew is likely due to political sanctions towards Russian and Iranian oil exports and the shadow fleet used to export their oil. These sanctions naturally drive their oil exports to Asia and non-OECD countries. That is where the surplus over the past half year has been going and where inventories have been building. An area which has a much more opaque oil market. Relatively low visibility with respect to oil inventories and thus weaker price signals from inventory dynamics there.

This has helped shield Brent and WTI crude oil price benchmarks to some degree from the running, global surplus over the past half year. Brent crude averaged USD 73/b in December 2024 and at current USD 69.7/b it is not all that much lower today despite an estimated global stock build of 180 mb since the end of last year and a highly anticipated equally large stock build for the rest of the year.

What helps to blur the message from OPEC+ in its current process of unwinding cuts and taking back market share, is that, while lifting quotas, it is at the same time also quite explicit that this is not a one way street. That it may turn around make new cuts if need be.

This is very different from its previous efforts to take back market share from US shale oil producers. In its previous efforts it typically tried to shock US shale oil producers out of the market. But they came back very, very quickly.

When OPEC+ now is taking back market share from US shale oil it is more like it is exerting a continuous, gradually increasing pressure towards US shale oil rather than trying to shock it out of the market which it tried before. OPEC+ is now forcing US shale oil producers to gradually back off. US oil drilling rig count is down from 480 in Q1-25 to now 410 last week and it is typically falling by some 4-5 rigs per week currently. This has happened at an average WTI price of about USD 65/b. This is very different from earlier when US shale oil activity exploded when WTI went north of USD 45/b. This helps to give OPEC+ a lot of confidence.

Global oil inventories are set to rise further in H2-25 and crude oil prices will likely be forced lower though the global skew in terms of where inventories are building is muddying the picture. US shale oil activity will likely decline further in H2-25 as well with rig count down maybe another 100 rigs. Thus making room for more oil from OPEC+.

Analys

Tightening fundamentals – bullish inventories from DOE

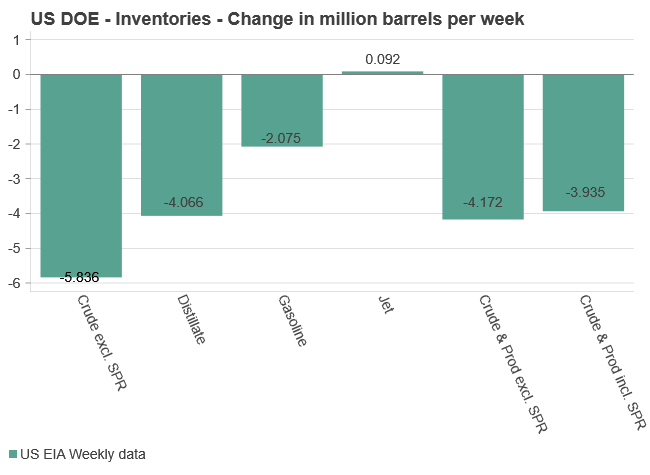

The latest weekly report from the US DOE showed a substantial drawdown across key petroleum categories, adding more upside potential to the fundamental picture.

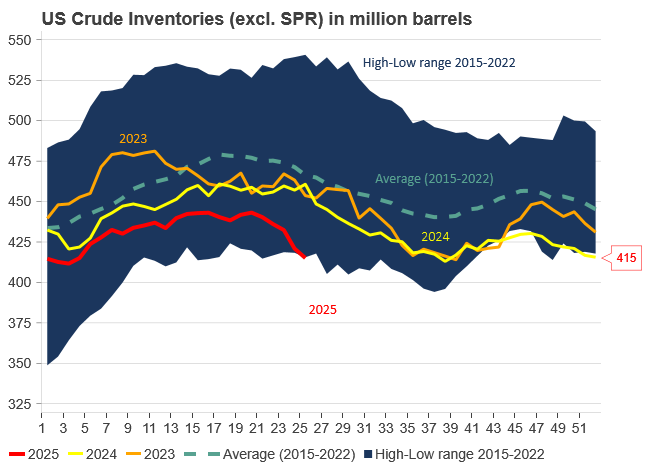

Commercial crude inventories (excl. SPR) fell by 5.8 million barrels, bringing total inventories down to 415.1 million barrels. Now sitting 11% below the five-year seasonal norm and placed in the lowest 2015-2022 range (see picture below).

Product inventories also tightened further last week. Gasoline inventories declined by 2.1 million barrels, with reductions seen in both finished gasoline and blending components. Current gasoline levels are about 3% below the five-year average for this time of year.

Among products, the most notable move came in diesel, where inventories dropped by almost 4.1 million barrels, deepening the deficit to around 20% below seasonal norms – continuing to underscore the persistent supply tightness in diesel markets.

The only area of inventory growth was in propane/propylene, which posted a significant 5.1-million-barrel build and now stands 9% above the five-year average.

Total commercial petroleum inventories (crude plus refined products) declined by 4.2 million barrels on the week, reinforcing the overall tightening of US crude and products.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanUSA inför 93,5 % tull på kinesisk grafit

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanFusionsföretag visar hur guld kan produceras av kvicksilver i stor skala – alkemidrömmen ska bli verklighet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanWestinghouse planerar tio nya stora kärnreaktorer i USA – byggstart senast 2030

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanRyska militären har skjutit ihjäl minst 11 guldletare vid sin gruva i Centralafrikanska republiken

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEurobattery Minerals förvärvar majoritet i spansk volframgruva

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanKopparpriset i fritt fall i USA efter att tullregler presenterats

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanLundin Gold rapporterar enastående borrresultat vid Fruta del Norte

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanKina skärper kontrollen av sällsynta jordartsmetaller, vill stoppa olaglig export