Nyheter

Gold Momentum Gains Heading into 2020

Structural Shift in Positioning

The gold market was impressive in December for what didn’t happen over the holidays. Net speculative positioning on Comex (New York Commodities Exchange) has stood near all-time highs since the gold price peaked in September. This potentially made the gold market vulnerable to a selloff, especially during thin holiday trading. However, gold didn’t sell down, it actually trended higher into year-end. This price action suggests that positioning has experienced a structural shift to higher levels as investors have become comfortable holding long positions. For the month, gold advanced $53.29 (3.6%) to $1,517.27 per ounce.

The gold market found support from the dollar as the U.S. Dollar Index (DXY) fell to the bottom of its recent range. Gold was also supported by strong advances in metals prices, especially copper and palladium, as the U.S. and China put their economic war on hold on December 14 to announce details of the first stage of a trade deal.

Gold wasn’t deterred by the booming stock market, which continued to post all-time highs. It has become obvious to us that stocks are being pumped up by liquidity supplied by the U.S. Federal Reserve (Fed) and corporate buy-backs. According to the Wall Street Journal, in 2019 through December 5, investors pulled $135 billion from U.S. stock-focused funds for the biggest annual withdrawal on record. Investor selling has been more than offset by net corporate purchases, which Goldman Sachs figures will total $480 billion in 2019. Meanwhile, since September, the Fed has pumped over $400 billion into the financial system with its purchase of treasuries aimed at propping up the dysfunctional repo market. The Fed plans to continue these purchases into 2020 at the rate of $60 billion per month. Gold was able to trade higher with the stock market because a market that trades on liquidity, rather than fundamentals, is vulnerable to shocks, a drop in liquidity or other risks.¨

Holiday Deals Abound

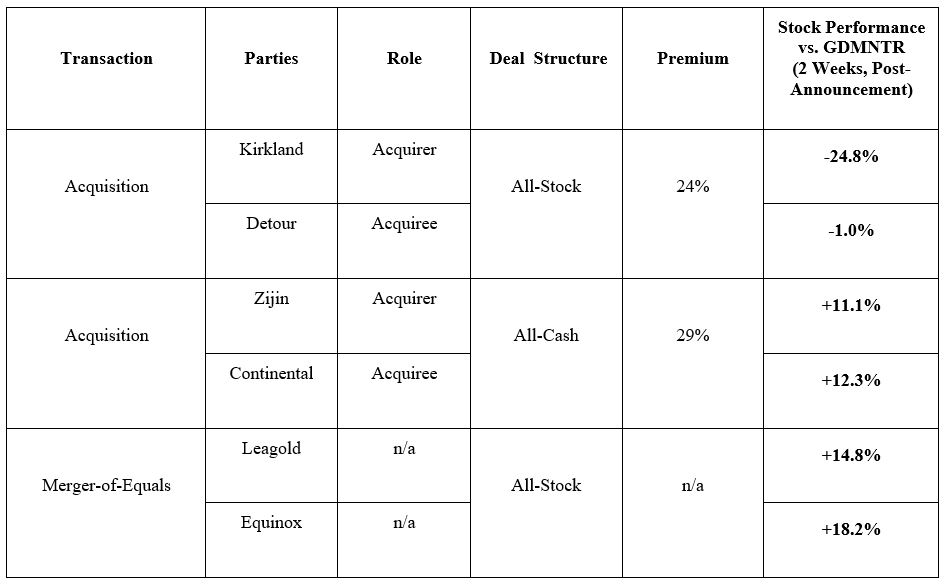

Gold stocks had a strong advance in December with industry mergers and acquisitions (M&A) dominating the news. There were seven M&A deals announced involving 12 companies in the last two months of 2019, which is possibly the most we have seen in just two months. Four of the deals were asset sales whereby mid-tier companies are buying non-core mining properties located in Canada, Australia and Senegal from super-majors Barrick and Newmont. The other three deals were mergers or acquisitions, each with a different deal structure (as seen below). To gauge the market reaction to these three deals, we looked at the two-week performance after the deal announcement for each company relative to the NYSE Arca Gold Miners Index (GDMNTR):

The market clearly favored the all-cash and merger-of-equals (MOE) deals over the all-stock premium deal. We believe there are three reasons for this: 1) cash and MOE deals are structures that limit speculation from arbitrageurs, 2) premium stock deals have a legacy of destroying value for shareholders, and 3) investors frown on large, potentially dilutive quantities of stock being issued. In the longer term we believe that all of these deals will create value, however, we can’t over-emphasize the importance of properly structuring a deal so that the newly formed combination moves forward with positive performance and enthusiastic support from shareholders.

Reasons For Continued Optimism in 2020

Gold and gold stocks had outstanding performances in 2019. The gold price surged $235 per ounce (18.3%). The leverage of gold stocks to the price of gold was on full display, as the GDMNTR gained 41.6% and the MVIS Global Junior Gold Miners Index (MVGDXJTR)3 advanced 42.5%. Encouragingly, we believe that there are several reasons for continued optimism for gold and gold stocks in 2020.

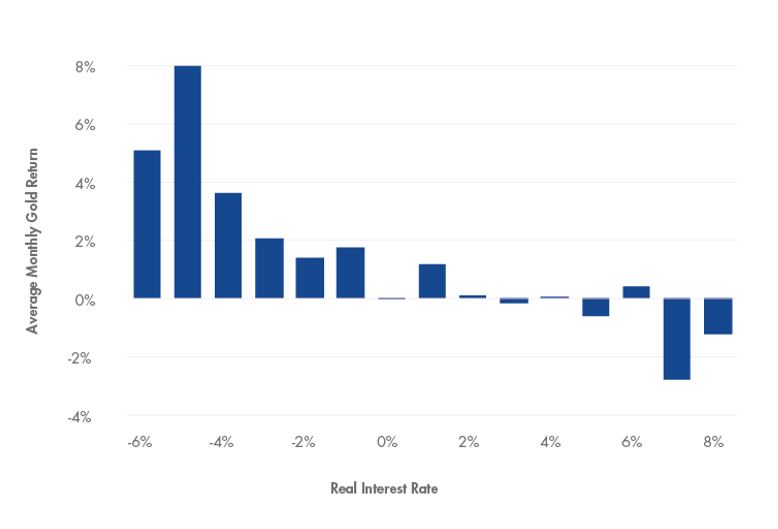

The interest rate environment has become very supportive of gold prices. Real rates on one-year treasuries turned negative in 2019. The Fed cut rates three times in 2019 and, while on hold at the moment, might continue the rate cutting cycle later in 2020. The chart below shows that gold performs well as real rates fall below two percent, with improving performance as real rates become more negative. This is because gold is seen by many as a better store of value than bonds when real rates are negative. Also, deeply negative real rates are usually accompanied by stressful levels of inflation or deflation that drive investors to gold as a safe haven.

Gold Can Really Shine With Sub-2% (or Negative) Real Rates

The dollar experienced significant strength from 2014 to 2016 and again in 2018. This was the result of globally superior U.S. economic performance, which has been priced into the dollar. As a result, with its best performance behind it, the DXY drifted sideways in 2019, while gold rose against most currencies. Without above-trend U.S. gross domestic product (GDP) growth and with the uncertainty and potential chaos of the 2020 presidential election, we doubt that the dollar presents headwinds for gold.

And, If All Else Fails…

Looking further into the new decade, long-term cycles in debt, the economy, stock markets and the social/political realm may culminate in financial difficulties that we haven’t seen since the Global Financial Crisis and social unrest that we haven’t seen since the sixties. Already we are seeing an escalation in tensions in the Middle East with the January 3 U.S. airstrike in Iraq. The overwhelming sovereign debt that continues to grow is unsustainable, while corporate debt levels are worrying. Likewise, negative-yielding debt in Europe and Japan makes little financial sense. Ludwig von Mises said there are only two ways to end a credit-fueled boom: “The first is to withdraw the credit. The second is the utter debasement of the currency.” Also known as a debt jubilee, helicopter money, monetization or Modern Monetary Theory, von Mises’ second option has been chosen throughout civilization. The Romans and Weimar Germany are prominent historic examples, while Zimbabwe and Venezuela are modern examples. In the midst of a future crisis, debt monetization might again become the solution of choice in the U.S. and other major economies. The Dutch National Bank website suggests a post monetary debasement financial structure: “If the system collapses, the gold stock can serve as a basis to build it up again. Gold bolsters confidence in the stability of the central bank’s balance sheet and creates a sense of security.”

Nyheter

Gruvbolaget Boliden överträffade analytikernas förväntningar

Gruvbolaget Boliden överträffade analytikernas förväntningar med bred marginal när man presenterade resultatet för det tredje kvartalet. Mikael Staffas, vd för Boliden, kommenterar kvartalet och hur han ser på råvarumarknaden och bolagets olika gruvprojekt.

Nyheter

Australien och USA investerar 8,5 miljarder USD för försörjningskedja av kritiska mineraler

USA:s president Donald Trump och Australiens premiärminister Anthony Albanese undertecknade på måndagen ett avtal som ska tillföra miljarder dollar till projekt inom kritiska mineraler.

Länderna kommer tillsammans att bidra med 1-3 miljarder dollar till projekten under de kommande sex månaderna. Den totala projektportföljen är värd 8,5 miljarder dollar, enligt regeringarna.

Galliumraffinaderi med kapacitet för 5x USA:s efterfrågan

Som en del av avtalet kommer det amerikanska försvarsdepartementet även att investera i ett galliumraffinaderi i västra Australien med en kapacitet på 100 ton per år. För närvarande importerar USA omkring 21 ton gallium, vilket motsvarar hela den inhemska konsumtionen, enligt den amerikanska geologiska myndigheten.

Initiativet kommer samtidigt som Kina har infört exportrestriktioner på vissa mineraler, däribland sällsynta jordartsmetaller, som är avgörande för tillverkningen av elektronik och elmotorer. Gallium används till exempel i mikrovågskretsar samt blå och violetta lysdioder (LED), vilka kan användas för att skapa kraftfulla lasrar.

Nyheter

Vad guldets uppgång egentligen betyder för världen

Guldpriset har nyligen nått rekordnivåer, över 4 000 dollar per uns. Denna uppgång är inte bara ett resultat av spekulation, utan speglar djupare förändringar i den globala ekonomin. Bloomberg analyserar hur detta hänger samman med minskad tillit till dollarn, geopolitisk oro och förändrade investeringsmönster.

Guldets roll som säker tillgång har stärkts i takt med att förtroendet för den amerikanska centralbanken minskat. Osäkerhet kring Federal Reserves oberoende, inflationens utveckling och USA:s ekonomiska stabilitet har fått investerare att söka alternativ till fiatvalutor. Donald Trumps handelskrig har också bidragit till att underminera dollarns status som global reservvaluta.

Samtidigt ökar den geopolitiska spänningen, särskilt mellan USA och Kina. Kapitalflykt från Kina, driven av oro för övertryckta valutor och instabilitet i det finansiella systemet, har lett till ökad efterfrågan på guld. Även kryptovalutor som bitcoin stiger i värde, vilket tyder på ett bredare skifte mot hårda tillgångar.

Bloomberg lyfter fram att derivatmarknaden för guld visar tecken på spekulativ överhettning. Positioneringsdata och avvikelser i terminskurvor tyder på att investerare roterar bort från aktier och obligationer till guld. ETF-flöden och CFTC-statistik bekräftar denna trend.

En annan aspekt är att de superrika nu köper upp alla tillgångsslag – aktier, fastigheter, statsobligationer och guld – vilket bryter mot traditionella investeringslogiker där vissa tillgångar fungerar som motvikt till andra. Detta tyder på att marknaden är ur balans och att kapitalfördelningen är skev.

Sammanfattningsvis är guldets prisrally ett tecken på en värld i ekonomisk omkalibrering. Det signalerar misstro mot fiatvalutor, oro för geopolitisk instabilitet och ett skifte i hur investerare ser på risk och trygghet.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Analys4 veckor sedan

Analys4 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanLeading Edge Materials är på rätt plats i rätt tid

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om guld, olja, koppar och stål

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanNytt prisrekord, guld stiger över 4000 USD