Nyheter

David Hargreaves on precious metals, week 46 2011

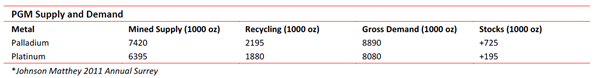

PGMs: No Such Thing as a Monopoly. If asked to pick a commodity firmly in the grip of its producers, most would go for platinum. South Africa mines 75% of it and Russia another 13%. But if you are thinking of switching to its cheaper (and less efficient) sister, palladium, those two countries account for 82% of that. So we should have a market grip even tighter than OPEC on oil, but we do not. Its price, whilst historically high, has followed the magnetic pull of gold, rather than its own price-demand profile. This is odd, since despite its precious qualities, it is an industrial metal and over a half is used in auto catalysts. This is where the fun starts. A PGM catalyst filters the exhaust fumes from an internal combustion engine and converts the noxious components into water vapour and nitrogen. Now they tell us the demand for oil burning vehicles is rising at 10% per year worldwide. With that industry taking 50% of all platinum (and 66% of palladium) that is a 5% per year increase in total demand. But it is not happening. Johnson Matthey says it will only be 3% in the automotive sector, so why? Well it is partly cost efficiencies, like using more palladium, partly smaller vehicles, the use of bio-fuels and rigorous recycling. But word has not penetrated into South Africa yet. They continue to crank the production handle with a forecast surplus of 195,000 oz this year. For palladium it will be more pronounced, at 725,000 oz or 8% of gross demand. A major feature is recycling, largely by the recovery of spent autocatalysts. It will provide 23% of new supply of platinum and 25% of palladium.

Amongst this are two looming and probably unstoppable trends. Non-South African production is rising from North America. But Zimbabwe, which could geologically provide over 10% of total world needs, is gearing up. Conversely for palladium, Russia has for many years supplied large tonnages from State stocks and these are thought to be nearly depleted. So we could see the price differential close. Recycling has been stepped up, in line with the metal price. Thus:

The focus of mining production remains South Africa. Conditions in the Bushveld are tough. The mines are deepish and dangerous but expansion is moving on apace as are wage demands. Yet the price is out of the industry’s control. If gold pulls back, so will the PGMs.

RSA Miners Still In Fighting Mode. The NUM union thinks striking a good idea, so is rejecting the 7.5%-8.5% wage offer by Lonmin, the 3rd largest platinum producer. That this is twice the rate of inflation, that youth unemployment is at 50%, and the union does not have a fighting fund. It also pushes the extension of welfare benefits across the board. Mark you, Lonmin’s earnings were up 64% in the year to Sept. 2011, at R1.8bn or $226M.

World Gold Mined Output remains steady. The 746t of Q3 indicates 2900t per year going forward, a sharp increase, but the trend for 2011 is c 2800t. Newish producers performing well include Burkina Faso, Cote d’Ivoire, Eritrea. The established mines in Mexico, Peru and Canada also moved ahead. Official purchases include Russia (15t to 852t,) Bolivia (14t), Thailand (25t).

Knowing from experience that price and demand can fall as well as rise, Lonmin warns that its growth strategy (to target 950,000 oz/yr) is not “set in stone” but dependant on market conditions. The 2011 target is 750,000 oz.

Silver, says GFMS, is a lining looking for a cloud. The most recent market review tells us to expect a price north of $50/oz compared with today’s mid $30’s. Much will be driven by investment demand, particularly coins and medals. For this year they look to average $35.66/oz up 77% year-on-year. The 2012 average sought is $45/oz. For mine production they expect a ninth successive annual gain, 4%. Government sales will continue to fall, fed by the CIS countries. Fabrication demand will rise 4%. Coin minting is expected up by a whopping 25%, but remember, that is portable collateral. (If gold were to follow the silver prediction it would be happy around $2300/oz. Somehow, we don’t see it).

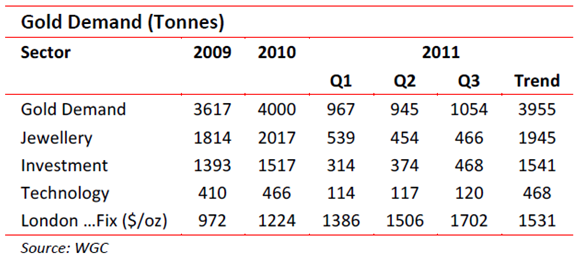

Gold Demand continues to rise, say the people who know: The World Gold Council. They tell us investment demand was the culprit. From around 12% in 1970 and negligible in 2000 it stands around 35% of total today. The call for jewellery has fallen, but still accounts for 50%.

Are there lessons to be learned? You bet your sweet life there are. We enjoyed 2009 on the crest of an economic wave and were content with gold below $1000/oz. The crash gathered momentum in late 2009 early 2010 so gold rose up, particularly investment demand. We have since had a false dawn of H1 2011 when commodity prices all bounced. Now we are locked in a currency crisis with gold taking the strain. If fiscal prudence is applied – and works – gold will not carry on reaching for the stars.

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

Australien och USA investerar 8,5 miljarder USD för försörjningskedja av kritiska mineraler

USA:s president Donald Trump och Australiens premiärminister Anthony Albanese undertecknade på måndagen ett avtal som ska tillföra miljarder dollar till projekt inom kritiska mineraler.

Länderna kommer tillsammans att bidra med 1-3 miljarder dollar till projekten under de kommande sex månaderna. Den totala projektportföljen är värd 8,5 miljarder dollar, enligt regeringarna.

Galliumraffinaderi med kapacitet för 5x USA:s efterfrågan

Som en del av avtalet kommer det amerikanska försvarsdepartementet även att investera i ett galliumraffinaderi i västra Australien med en kapacitet på 100 ton per år. För närvarande importerar USA omkring 21 ton gallium, vilket motsvarar hela den inhemska konsumtionen, enligt den amerikanska geologiska myndigheten.

Initiativet kommer samtidigt som Kina har infört exportrestriktioner på vissa mineraler, däribland sällsynta jordartsmetaller, som är avgörande för tillverkningen av elektronik och elmotorer. Gallium används till exempel i mikrovågskretsar samt blå och violetta lysdioder (LED), vilka kan användas för att skapa kraftfulla lasrar.

Nyheter

Vad guldets uppgång egentligen betyder för världen

Guldpriset har nyligen nått rekordnivåer, över 4 000 dollar per uns. Denna uppgång är inte bara ett resultat av spekulation, utan speglar djupare förändringar i den globala ekonomin. Bloomberg analyserar hur detta hänger samman med minskad tillit till dollarn, geopolitisk oro och förändrade investeringsmönster.

Guldets roll som säker tillgång har stärkts i takt med att förtroendet för den amerikanska centralbanken minskat. Osäkerhet kring Federal Reserves oberoende, inflationens utveckling och USA:s ekonomiska stabilitet har fått investerare att söka alternativ till fiatvalutor. Donald Trumps handelskrig har också bidragit till att underminera dollarns status som global reservvaluta.

Samtidigt ökar den geopolitiska spänningen, särskilt mellan USA och Kina. Kapitalflykt från Kina, driven av oro för övertryckta valutor och instabilitet i det finansiella systemet, har lett till ökad efterfrågan på guld. Även kryptovalutor som bitcoin stiger i värde, vilket tyder på ett bredare skifte mot hårda tillgångar.

Bloomberg lyfter fram att derivatmarknaden för guld visar tecken på spekulativ överhettning. Positioneringsdata och avvikelser i terminskurvor tyder på att investerare roterar bort från aktier och obligationer till guld. ETF-flöden och CFTC-statistik bekräftar denna trend.

En annan aspekt är att de superrika nu köper upp alla tillgångsslag – aktier, fastigheter, statsobligationer och guld – vilket bryter mot traditionella investeringslogiker där vissa tillgångar fungerar som motvikt till andra. Detta tyder på att marknaden är ur balans och att kapitalfördelningen är skev.

Sammanfattningsvis är guldets prisrally ett tecken på en värld i ekonomisk omkalibrering. Det signalerar misstro mot fiatvalutor, oro för geopolitisk instabilitet och ett skifte i hur investerare ser på risk och trygghet.

Nyheter

Spotpriset på guld över 4300 USD och silver över 54 USD

Guldpriset stiger i ett spektakulärt tempo, nya rekord sätts nu på löpande band. Terminspriset ligger oftast före i utvecklingen, men ikväll passerade även spotpriset på guld 4300 USD per uns. Guldet är just nu som ett ångande tåg som det hela tiden skyfflas in mer kol i. En praktisk fördel med ett högre pris är att det totala värdet på guld även blir högre, vilket gör att centralbanker och privatpersoner kan placera mer pengar i guld.

Även spotpriset på silver har nu passerat 54 USD vilket innebär att alla pristoppar från Hunt-brödernas klassiska squeeze på silver har passerats med marginal. Ett högt pris på guld påverkar främst köpare av smycken, men konsekvensen av ett högt pris på silver är betydligt mer kännbar. Silver är en metall som används inom många olika industrier, i allt från solceller till medicinsk utrustning.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEtt samtal om guld, olja, fjärrvärme och förnybar energi

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Analys4 veckor sedan

Analys4 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuldpriset uppe på nya höjder, nu 3750 USD

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om guld, olja, koppar och stål