Nyheter

David Hargreaves on Precious Metals week 37 2013

As ever Gold dominates the sector. Yet the price gyrations have slowed and, barring a Syria debacle, a $1350-1450/oz price band looks set for some time, with short term trading the order of the day.

As ever Gold dominates the sector. Yet the price gyrations have slowed and, barring a Syria debacle, a $1350-1450/oz price band looks set for some time, with short term trading the order of the day.

Mining Journal held its Gold and Precious Metals Seminar in London September 6th, its second of the year. A panel of precious metal gurus concurred on the long-term shifts in attitudes towards the precious, particularly gold. The geographical emphasis switches from West to East. China and India now account for over a half of the purchases of the metal. Importantly these transactions put it into ‘safe’ long term hands. An intriguing question left hanging was whether the government of China will make a move towards increasing its relatively small holdings as a preliminary step towards breaking its link with the US dollar. A full report of the seminar, written by David Hargreaves, who chaired the meeting, will appear in next week’s Mining Journal.

Evidence, perhaps, of the East-West shift is that the demand for US gold coins fell to a six year low, down 77% in August to just 11,500oz, from 39,000oz in like 2012 and 55,500 in July. The sales of silver eagle coins also dropped 17.75% to 3.6 million ounces. Gold Eagle sales ran at 100,000 per month in the first seven months of 2013. Much, say those who claim to know, rests on will the US or will it not, intervene in Syria. More in Countries. But no stopping China. Despite being the largest miner of gold it is now eclipsing India as the major importer. Customs reports show an intake of 493 tonnes in H1 (2012, H1 = 239t). Total domestic consumption for H1 was reported 706t, a jump of 54%. Annualised, this is over a half of world newly mined supply. Total demand, which amounts to c 4000t worldwide, is made up of c. 2800t new and 1200t recycled. Much of the latter arises in the West.

WIM says: This is a fluid situation. There is a direct contrast between the Chinese government clearly encouraging gold holding by its citizens but India, for balance-of-payments reasons, actively discouraging it.

Where Will Lie the Balance in Supply and Demand? When the price of gold was fixed at $35/oz in 1934, most trade transactions had the backing of the metal. For that to happen again the price would now have to be c. $10,000/oz.

The prospect is encouraging new production despite the travails of major mines such as Barrick, Newmont and Anglo. Australia’s mines upped their output 6% in Q4 2013 to 67t, making 259t for the year, almost 10% of total mined. Star performers included Evolution, St. Barbara and Newcrest.

India’s balance of payments problem cannot, unlike gold, be swept under the bed. It is a unique case. The country has long been the major importer but also manufactures jewellery which it exports at added value. Sadly, much of the imported gold goes under and stays under, the bed. India has further problems with imports (see Countries) but is targeting gold, big time. The Reserve Bank (RBC) is tightening the screws like a demented carpenter. It is trying to restrict imports by increasing taxation and regulating flows. Whilst this may have a net effect, it is encouraging illicit dealing, smuggling and like skulduggery. Perversely, it is hurting exports of jewellery. These fell 70% in July because of a shortage of gold. They were $441M compared with $1500M in like 2012.

Gold and Local Currencies. We have not awarded a SOTBO* for some time, but here we go. A well-known and offquoted correspondent on Mineweb says if selected currencies cheapen, the price of gold in these countries will rise.

Have we missed something? He also says it will affect silver. Hadn’t thought of that.

South Africa’s Gold Wage Negotiations, we report on in more detail in Countries. Suffice here to say they are reaching a compromise at c. 8%.

Platinum sees its premium to gold slipping, but it has been there before.

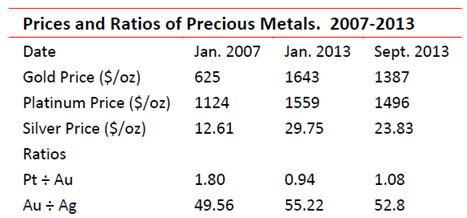

To remind:

Reasons for the swings abound. Platinum and silver have an industrial component; gold does not. The rise in the use of Pt and Pd in autocatalysis created a shortage. This was progressively filled by aggressive expansion in the major producing country, South Africa plus copious supplies from Russia. Silver, despite its supporting remains hostage to the gold price.

WIM says: Given that industrial peace may be returning to RSA, we expect Pt and Ad to slip to discount to gold once more, particularly if the Middle East problems escalate.

*SOTBO: Statement of the Blinding Obvious.

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

Australien och USA investerar 8,5 miljarder USD för försörjningskedja av kritiska mineraler

USA:s president Donald Trump och Australiens premiärminister Anthony Albanese undertecknade på måndagen ett avtal som ska tillföra miljarder dollar till projekt inom kritiska mineraler.

Länderna kommer tillsammans att bidra med 1-3 miljarder dollar till projekten under de kommande sex månaderna. Den totala projektportföljen är värd 8,5 miljarder dollar, enligt regeringarna.

Galliumraffinaderi med kapacitet för 5x USA:s efterfrågan

Som en del av avtalet kommer det amerikanska försvarsdepartementet även att investera i ett galliumraffinaderi i västra Australien med en kapacitet på 100 ton per år. För närvarande importerar USA omkring 21 ton gallium, vilket motsvarar hela den inhemska konsumtionen, enligt den amerikanska geologiska myndigheten.

Initiativet kommer samtidigt som Kina har infört exportrestriktioner på vissa mineraler, däribland sällsynta jordartsmetaller, som är avgörande för tillverkningen av elektronik och elmotorer. Gallium används till exempel i mikrovågskretsar samt blå och violetta lysdioder (LED), vilka kan användas för att skapa kraftfulla lasrar.

Nyheter

Vad guldets uppgång egentligen betyder för världen

Guldpriset har nyligen nått rekordnivåer, över 4 000 dollar per uns. Denna uppgång är inte bara ett resultat av spekulation, utan speglar djupare förändringar i den globala ekonomin. Bloomberg analyserar hur detta hänger samman med minskad tillit till dollarn, geopolitisk oro och förändrade investeringsmönster.

Guldets roll som säker tillgång har stärkts i takt med att förtroendet för den amerikanska centralbanken minskat. Osäkerhet kring Federal Reserves oberoende, inflationens utveckling och USA:s ekonomiska stabilitet har fått investerare att söka alternativ till fiatvalutor. Donald Trumps handelskrig har också bidragit till att underminera dollarns status som global reservvaluta.

Samtidigt ökar den geopolitiska spänningen, särskilt mellan USA och Kina. Kapitalflykt från Kina, driven av oro för övertryckta valutor och instabilitet i det finansiella systemet, har lett till ökad efterfrågan på guld. Även kryptovalutor som bitcoin stiger i värde, vilket tyder på ett bredare skifte mot hårda tillgångar.

Bloomberg lyfter fram att derivatmarknaden för guld visar tecken på spekulativ överhettning. Positioneringsdata och avvikelser i terminskurvor tyder på att investerare roterar bort från aktier och obligationer till guld. ETF-flöden och CFTC-statistik bekräftar denna trend.

En annan aspekt är att de superrika nu köper upp alla tillgångsslag – aktier, fastigheter, statsobligationer och guld – vilket bryter mot traditionella investeringslogiker där vissa tillgångar fungerar som motvikt till andra. Detta tyder på att marknaden är ur balans och att kapitalfördelningen är skev.

Sammanfattningsvis är guldets prisrally ett tecken på en värld i ekonomisk omkalibrering. Det signalerar misstro mot fiatvalutor, oro för geopolitisk instabilitet och ett skifte i hur investerare ser på risk och trygghet.

Nyheter

Spotpriset på guld över 4300 USD och silver över 54 USD

Guldpriset stiger i ett spektakulärt tempo, nya rekord sätts nu på löpande band. Terminspriset ligger oftast före i utvecklingen, men ikväll passerade även spotpriset på guld 4300 USD per uns. Guldet är just nu som ett ångande tåg som det hela tiden skyfflas in mer kol i. En praktisk fördel med ett högre pris är att det totala värdet på guld även blir högre, vilket gör att centralbanker och privatpersoner kan placera mer pengar i guld.

Även spotpriset på silver har nu passerat 54 USD vilket innebär att alla pristoppar från Hunt-brödernas klassiska squeeze på silver har passerats med marginal. Ett högt pris på guld påverkar främst köpare av smycken, men konsekvensen av ett högt pris på silver är betydligt mer kännbar. Silver är en metall som används inom många olika industrier, i allt från solceller till medicinsk utrustning.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEtt samtal om guld, olja, fjärrvärme och förnybar energi

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Analys4 veckor sedan

Analys4 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuldpriset uppe på nya höjder, nu 3750 USD

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om guld, olja, koppar och stål