Nyheter

David Hargreaves on Precious Metals week 23 2012

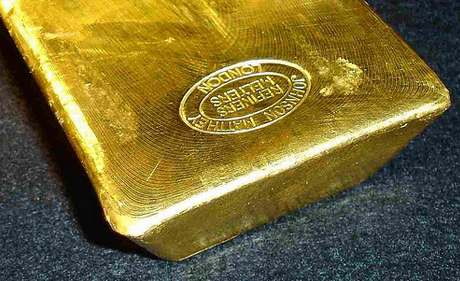

As noted, gold put on 3% in the week, to close at $1613/oz, thanks to its now usual Friday flurry. That this was its best effort despite Spain teetering on joining Greece in the emergency room still fails to underscore the next leg of a bull market. Spain is much more important than Greece. Its GDP of c. $1400bn dwarfs that of its fellow sufferer ($350bn) and its crisis is more defined. It is a property crash which has left its entire banking system exposed. Platinum holds its ground ($1438/oz) largely on the threats of closure and development slowdowns in RSA turning to reality. Silver, meanwhile, has resumed its place in the third class carriage.

As noted, gold put on 3% in the week, to close at $1613/oz, thanks to its now usual Friday flurry. That this was its best effort despite Spain teetering on joining Greece in the emergency room still fails to underscore the next leg of a bull market. Spain is much more important than Greece. Its GDP of c. $1400bn dwarfs that of its fellow sufferer ($350bn) and its crisis is more defined. It is a property crash which has left its entire banking system exposed. Platinum holds its ground ($1438/oz) largely on the threats of closure and development slowdowns in RSA turning to reality. Silver, meanwhile, has resumed its place in the third class carriage.

Central Bank Buying. The recent purchase figures are relatively small and not by major countries but they are nonetheless trend indicators. According to the World Gold Council CB purchases were 450 tonnes in 2011, about 17% of newly mined supply and could be 400 tonnes this year. Noted as recent buyers were: Turkey 29.7t, Mexico 2.92t, Kazakhstan 2.02t, Ukraine 1.4t, the Philippines (in March) 32t.

It is hoarding that counts. If, as we broadly believe, there are 140,000t of gold on the surface of the earth, but only 30,000t in bank vaults. The balance, c. 80% is under peoples’ beds or round their necks. We explained last week why this individual buying is largely an eastern thing. If the Indians only had a Rupee crisis to match the Euro you would see the price orbit. We know the Chinese are becoming increasingly fond. Now enter Vietnam. That country, which pays lip service to Communism and shares a long border with China, has major natural resources potential. Its rapidly growing population of c. 90 million with a GDP of $3100, just down from India ($3500). It also has rampant inflation and a taste for gold. The Vietnamese people have been buying gold to preserve their purchasing power and are said (Mineweb reports so it must be right) to be holding upwards of 1000t, second only to India. Now, we think the government, via the State Central Bank, wants to “mobilise” it. Just like Roosevelt, Hitler and Harold Wilson did. They speak of tradable gold certificates and we wish them well. At least Dick Turpin wore a mask.

Peru’s illegal gold exports. That mineral-rich country ranks No 6 world gold producer at c. 160t of which, says a report by a locally based consultancy firm, over 20% is exported illegally. Veterans of that continent would be tempted to ask “Why so little?” It goes on to say that this activity has now overtaken the drugs trade in turnover. We are reminded of a statement in a newspaper in the Maldive Islands which told us that car accidents had become the greatest single source of personal injury, replacing coconuts falling from trees.

Psst…Wanna buy 1700 tonnes of gold? The CEO of Sharps Pixley. Ross Norman, knows a thing or two about gold and is normally cautious with his forecasts. Last week he floated the possibility of the metal becoming a Tier 1 asset for commercial banks with a 100% instead of its present Tier 3 rating of just 50% risk weighting. He goes on to tell us that banks will, from early 2013, have to have a Tier 1 capital ratio of 6%, up from today’s 4%. That extra 2% (of the total Tier 1 requirement of $4276bn) equates to 1700 tonnes at current prices. We speak, of course, of commercial banking – that source of our woes – not the central ones.

Platinum miners and a reality check. As the gold price is buoyed by fear, the platinum price is bounded by industrial reality. Demand is down and output is up. A major surplus overhangs the market and the current level of $1438/oz owes more than much to the long term relationship. Yet the platinum to gold ratio of 1.24, 30 months ago, is under 0.90 now. Will it improve? The mining companies are feeling the pain and are starting to cut back. Eastplats (TSX, JSE) has suspended funding for two RSA projects, one the Maresburg open pit and the other the Kennedy’s Vale concentrator. The company sees no increase in demand in the foreseeable future. It reported a loss of $76.5M in 2011 compared with a profit of $13.4M in 2010. This is a company in a hole and it is trying to stop digging.

Impala Platinum, the World No 2 at 47.2t/yr has been plagued at its Rustenburg, RSA operation by wage disputes and illegal strikes. Its output in the March 2012 quarter fell 46%, to 230,000oz (7.26t) from 13.2t in like 2011. Its strikes have been accompanied by violence, much the result of battles for supremacy between rival unions.

In contrast Zimplats, subsidiary of the above, recorded a 7% rise in production in Q3, to end March 2012. Output was up to 45,000oz from 42,000oz. It puts a brave face on its expansion plans to increase to 270,000oz by 2014, but is this hay while the sun shines and before Uncle Bob’s mates hive off 51%? The latest edict seems to imply that 31% of this will be bought for cash at fair market value. Bets anyone?

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

USA ska införa 50 procent tull på koppar

USA:s president Donald Trump har precis meddelat att landet ska införa en tull på 50 procent på basmetallen koppar. Priset på råvarubörsen i USA stiger omgående med 10 procent.

USA har viss inhemsk produktion av koppar, men den inhemska efterfrågan överstiger produktionen. Därför måste landet importera koppar för att täcka behovet, särskilt för användning inom elnät, elektronik, byggindustri och fordonssektorn. De största exportörerna till USA är Chile, Kanada, Mexiko och Peru.

När tullar av denna typ införs uppstår prisskillnader i världen. Handlar man koppar på börsen är det därför viktigt att veta vilken börs man handlar på eller om man använder certifikat så är det viktigt att veta vilka underliggande värdepapper de följer.

Sedan är det som alltid med Trump, begreppet är som bekant TACO, Trump Always Chickens Out. Man ska alltså inte ta några definitiva stora beslut baserat på vad han säger. Saker och ting kan ändra sig från dag till dag.

Nyheter

Ryska staten siktar på att konfiskera en av landets största guldproducenter

En våg av panik sprider sig bland Moskvas elit sedan Vladimir Putins regim inlett en dramatisk offensiv för att beslagta tillgångarna hos Konstantin Strukov – en av Rysslands rikaste affärsmän och ägare till landets största guldgruvföretag, Yuzhuralzoloto. Åtgärden ses som ett tydligt tecken på hur långt Kreml är villigt att gå för att säkra ekonomiska resurser i takt med att kostnaderna för kriget i Ukraina stiger.

Strukovs förmögenhet, som uppskattas till över 3,5 miljarder dollar, byggdes upp under decennier i nära relation med maktens centrum i Ryssland. Men den 5 juli stoppades hans privatjet från att lyfta mot Turkiet. Enligt flera ryska medier deltog den federala säkerhetstjänsten FSB i ingripandet, och Strukovs pass beslagtogs. Händelsen ska vara kopplad till en omfattande rättsprocess där åklagare kräver att hela hans företagsimperium förverkas – med hänvisning till påstådd korruption och användning av skalbolag och familjemedlemmar för att dölja tillgångar.

Företaget själva förnekar att något inträffat och kallar rapporteringen för desinformation. De hävdar att Strukov befann sig i Moskva hela tiden. Trots det bekräftar rättsdokument att både han och hans familj förbjudits att lämna landet, och att myndigheterna snabbt verkställt beslutet.

Det som nu sker är en del av ett större mönster i ett Ryssland präglat av krigsekonomi: staten tar tillbaka kontrollen över strategiska sektorer som guld, olja och försvarsindustri – industrier som nu allt mer mobiliseras för att finansiera och stödja krigsinsatsen. Intressant nog handlar det inte om att Strukov ska ha varit illojal mot regimen – tvärtom har han varit en lojal allierad, med politiska uppdrag knutna till Putins parti. Men lojalitet räcker inte längre som skydd.

Medan tidigare utrensningar ofta riktade sig mot krigskritiker eller de som flydde landet, drivs dagens tillgångsövertaganden av något mer fundamentalt: ekonomisk nöd. De växande sanktionerna har nästan helt strypt inflödet av utländskt kapital. Statens oljeintäkter minskar och budgetunderskotten växer. Putins lösning är att vända sig inåt – till de oligarker han själv lyfte fram – för att fylla statskassan.

Det här är inte ett enskilt fall. På senare tid har flera framstående affärspersoner hamnat i plötsliga rättsliga tvister, omkommit under mystiska omständigheter eller sett sina bolag tas över av staten. Den oskrivna överenskommelsen som länge gällde i Putins Ryssland – rikedom i utbyte mot lojalitet – håller på att kollapsa.

Den 8 juli väntar en rättsförhandling som kan avgöra framtiden för Strukovs affärsimperium. Men budskapet till Rysslands näringslivselit är redan tydligt: ingen är för rik, för lojal eller för nära den politiska makten för att gå säker. I ett Ryssland där kriget kräver allt större uppoffringar riskerar oligarker att snabbt förvandlas till måltavlor.

Nyheter

Hur säkrar vi Sveriges tillgång till kritiska metaller och mineral i en ny geopolitisk verklighet?

När världsläget förändras ställs Europas beroende av metaller och mineral på sin spets. Geopolitiska spänningar, handelskonflikter och ett mer oförutsägbart USA gör att vi inte längre kan ta gamla allianser för givna. Samtidigt kontrolleras en stor del av de kritiska råvarorna vi är beroende av av andra makter – inte minst Kina. Vad händer med Sveriges industriella förmåga i ett läge där importen stryps? Hur påverkas försvarsindustrin av Kinas exportrestriktioner? Är EU:s nya råvarupolitik tillräcklig för att minska sårbarheten – eller krävs ytterligare statliga insatser och beredskapslagring? Svemin anordnade den 25 juni ett seminarium som bestod av bestod av deltagare från myndigheter, politik och industri. Man diskuterar Sveriges och EU:s strategiska vägval i en ny global verklighet – och vad som krävs för att säkra tillgången till metaller när vi behöver dem som mest.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanUppgången i oljepriset planade ut under helgen

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals växlar spår – satsar fullt ut på guld

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanLåga elpriser i sommar – men mellersta Sverige får en ökning

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanOljan, guldet och marknadens oroande tystnad

-

Analys4 veckor sedan

Analys4 veckor sedanVery relaxed at USD 75/b. Risk barometer will likely fluctuate to higher levels with Brent into the 80ies or higher coming 2-3 weeks

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanJonas Lindvall är tillbaka med ett nytt oljebolag, Perthro, som ska börsnoteras

-

Analys3 veckor sedan

Analys3 veckor sedanA muted price reaction. Market looks relaxed, but it is still on edge waiting for what Iran will do

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanDomstolen ger klartecken till Lappland Guldprospektering