Nyheter

David Hargreaves on precious metals, Week 1 2012

We warned in the 10/12/2011 issue, but three weeks ago, that the precious metals might retreat. They have. We blamed it on the fear factor receding and it has, so let’s not be surprised if we see more on the downside. The world lost an unpredictable dictator in North Korea’s Kim Jong Il last week and the young replacement in the expensive overcoat will take time to learn the ropes. Iran is muttering about blockading the Straits of Hormuz and thus 20% of the world’s traded oil. This need not worry China, 50% dependant, or Japan 75% reliant on that seaway for their oil imports, because it is where the US 5th Fleet sits. That toy factory has enough fire power to turn Tehran into a moon of Saturn, so no fears there, eh? Anglo American might win its spat with Chile’s Codelco over 49% of a juicy copper mine. Britain has warned Argentina that if it gets ambitious about the Falklands again, the nuclear sub patrol will be put on high alert. This is big boy time. Venezuela has most of its gold back home and worth a lot less than when it called for it. Only one dictator to go (hi Bob!) and his threat to embargo platinum exports can only cheer the South Africans. The fear factor has switched from fisticuffs to financial. The further we lever ourselves into recession, the cheaper goods will become and that includes the precious.

Gold

The price run up in H2 owed much to the Euro crisis whilst the spike which saw it momentarily top $1900/oz mirrored fears of a sovereign debt failure. That gold has now subsided to beneath $1550 on the downside does not indicate that problem has been solved. It has been digested. The world would survive a Euro break up and $1500 would still be its highest ever pre Q2 2011 level. We may be still a long drop from a floor in the next few months of which the US dollar, which exerts an opposite pull, continues to remind us.

Investment demand remains the driver. The other two, jewellery and industrial, have been relatively constant since Q2 2010 whilst much has been made of changes in Central Bank holdings. They are relatively small.

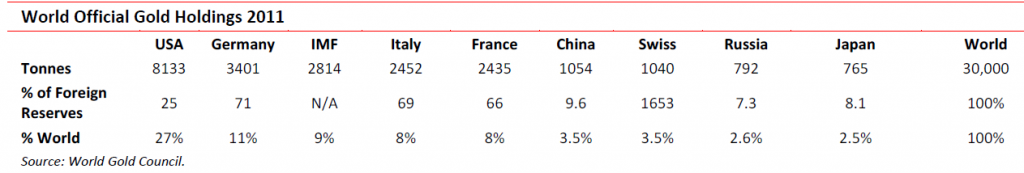

The close of 2010 saw a gold price of $1408/oz, registering the 10th successive annual rise. This continued to the short lived peak of $1900 in mid 2011 until the sobering pull back to $1500 on Dec. 30th. The major structural changes have been in private investment demand, particularly in China, India and other developing countries. Central Bank buying has been noted by developing countries but not the expected surge by China. The significance of such holdings is measured not only in their total tonnage, but as a percentage of total foreign assets. By mid 2011 they showed:

Of perhaps greater significance are total above ground stocks of gold, broadly estimated at 163,000 tonnes. Of these, c.84,000 tonnes is held as jewellery. In December a report by MacQuarie Bank suggested India alone accounted for 17,000 tonnes of this. The Chinese and Indians are displaying similar personal buying tendencies.

Supply

The pattern of mined supply remained similar to the previous five years, with the continuing decline of South Africa but increases from West Africa and Eurasia. The major producing countries remained China (13%), USA (11%), Australia (10%), RSA (8%), Russia (7%) and Peru (6%).

Outlook 2012

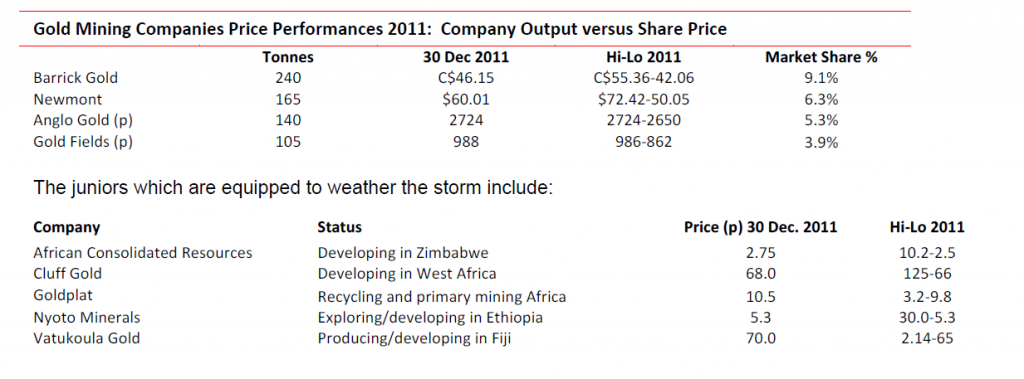

Gold. Any return to a major upside for gold will be driven by fear factors, not economic ones. The Middle East basin remains highly unstable and a knee-jerk oil price rise would pull gold along. Iran is clearly itching to put on a show, but unless fear becomes reality we do not see gold challenging its highs again, indeed the reverse. For supply it means South Africa may put on hold its plans to revamp the deep basin deposits and for marginal ventures worldwide to struggle with funding. The majors sit on healthy balance sheets, but cannot expect a market rerating. Of the larger ones:

The final day flip in gold (up $45 to $1578/oz) should not be confused with a rally. Only an ungovernable geological or political event is liable to drive it skywards. The world economy will stabilise and we should remember that as recently as 2008, gold was at $700/oz.

Platinum

This was the year the industry got it wrong. If ever a commodity was ripe for cartel action, in theory it is platinum. A single country, South Africa, supplies 75% of all newly mined metal and with Russia does 85% of all the platinum and palladium combined. Only four companies dominate and just two end uses, autocatalysts and jewellery, account for 70% of demand. Yet there is no cartel. London – based free market, daily fixing pricing dominates. That price has fallen progressively in 2011 from an opening $1745/oz to a closing $1407/oz, a fall of 19%. A weak economy, increased output and more intensive recycling, particularly of spent catalysts, were the culprits. Another feature – of longer term significance – was a round of overgenerous wage settlements, which have saddled the South African industry with untenable costs. This is an industry at a crossroads. A small surplus of c. 200,000 oz is calculated for 2011 from a mined supply of 6,400,000 oz and a total demand of 8,100,000 oz. The balance of supply is made up of recycling. Industrial demand is c. 2,000,000 oz and investment c. 500,000 oz.

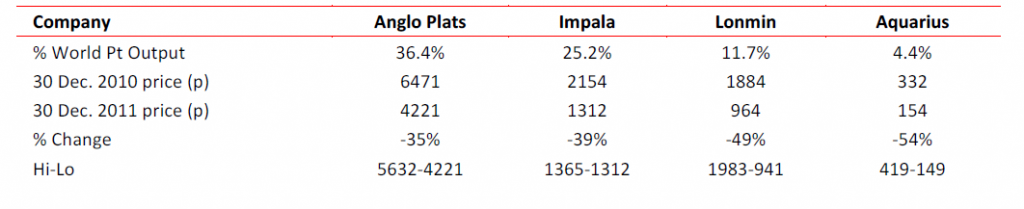

The shares had a miserable run:

There is nothing to suggest a short term rally, rather further weakness.

Silver

Silver owes its classification ‘precious’ more to its chemical characteristics than its scarcity. It is mined at an annual rate of c. 23,500 tonnes, or ten times that of gold. Yet its price ratio is far higher. Were it in relation to its production, the price of silver would be c. $160/oz, not $30. Its 2010-2011 open and closing levels of $30/oz and $28/oz disguise a run up in Q3 to over $50, prompting some analysts to call for $200.

This is not going to happen. Why?

- The total volume of silver on surface is vastly greater than its production ratio to gold. It has been mined in large quantities for much longer and was for centuries the world’s currency backing.

- Almost 50% is used industrially which, combined with other fabrication and jewellery accounts for c. 85% of all arisings.

- Ten countries combine to produce 80% of newly mined output and vast quantities are available for dishoarding at the right price.

- Most silver is recovered as a by-product of base metal mining, the few pure silver producers including Fresnillo (5.2% market share), Pan American (3.3%), Hochschild (2.4%) and Coeur D’ Alene (2.3%). We believe silver will continue to track gold at a price ratio of 50:1 – 60:1 with a narrowing in a bull market.

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

Sommarvädret styr elpriset i Sverige

Många verksamheter tar nu ett sommaruppehåll och ute värmer solen, det är gott om vatten och vinden blåser. Lägre efterfrågan på el och goda förutsättningar för kraftproduktionen höll ner elpriserna under juni.

Elpriset på den nordiska elbörsen Nord Pool (utan påslag och exklusive moms) i elområde 1 och 2 (Norra Sverige) blev för juni 3,05 respektive 4,99 öre/kWh, vilket är rekordlågt och de lägsta på minst 25 år.

– Elpriset påverkas av en rad faktorer men vädret väger tyngst. På sommaren minskar efterfrågan på el och många verksamheter har ett uppehåll. Detta tillsammans med goda förutsättningar inom kraftproduktionen påverkar elpriset nedåt, säger Jonas Stenbeck, privatkundschef Vattenfall Försäljning Norden.

Den hydrologiska balansen, måttet för att uppskatta hur mycket vatten som finns lagrat ovanför kraftstationerna, ligger över normal nivå, särskilt i norra Skandinavien. Tillgängligheten för kärnkraften i Norden är just nu 82 procent av installerad effekt.

– De goda nordiska produktionsförutsättningarna gör elpriserna mindre känsliga för förändringar i omvärlden, säger Jonas Stenbeck.

Priserna på olja och gas kan dock ändras snabbt med anledning av en turbulent omvärld. På kontinenten har efterfrågan på gas sjunkit och nytt solkraftsrekord för Tyskland sattes på midsommarafton med en produktion på 52,5 GW.

– Många av de goda elvanor vi skaffade oss under elpriskrisen verkar leva kvar och gör nytta även på sommaren. De svenska hushållens elförbrukning under 2024 var faktiskt den lägsta detta millenium, säger Jonas Stenbeck.

| Medelspotpris | Juni 2024 | Juni 2025 |

| Elområde 1, Norra Sverige | 24,04 öre/kWh | 3,05 öre/kWh |

| Elområde 2, Norra Mellansverige | 24,04 öre/kWh | 4,99 öre/kWh |

| Elområde 3, Södra Mellansverige | 27,27 öre/kWh | 22,79 öre/kWh |

| Elområde 4, Södra Sverige | 62,70 öre/kWh | 40,70 öre/kWh |

Nyheter

Samtal om flera delar av råvarumarknaden

Ett samtal som sammanfattar ett relativt stabilt halvår på råvarumarknaden trots volatilitet och geopolitiska spänningar som sannolikt fortsätter in i andra halvan av året. Vi bjuds även på kommentarer från Carlos Mera, Rabobanks analyschef för jordbrukssektorn och Kari Kangas, skogsanalytiker.

Nyheter

Jonas Lindvall är tillbaka med ett nytt oljebolag, Perthro, som ska börsnoteras

Jonas Lindvall, ett välkänt namn i den svenska olje- och gasindustrin, är tillbaka med ett nytt företag – Perthro AB – som nu förbereds för notering i Stockholm. Med över 35 års erfarenhet från bolag som Lundin Oil, Shell och Talisman Energy, och som medgrundare till energibolag som Tethys Oil och Maha Energy, är Lindvall redo att än en gång bygga ett bolag från grunden.

Tillsammans med Andres Modarelli har han startat Perthro med ambitionen att bli en långsiktigt hållbar och kostnadseffektiv producent inom upstream-sektorn – alltså själva oljeutvinningen. Deras timing är strategisk. Med ett inflationsjusterat oljepris som enligt Lindvall är lägre än på 1970-talet, men med fortsatt växande efterfrågan globalt, ser de stora möjligheter att förvärva tillgångar till attraktiva priser.

Perthro har redan säkrat bevisade oljereserver i Alberta, Kanada – en region med rik oljehistoria. Bolaget tittar även på ytterligare projekt i Oman och Brasilien, där Lindvall har tidigare erfarenhet. Enligt honom är marknadsförutsättningarna idealiska: världens efterfrågan på olja ökar, medan utbudet inte hänger med. Produktionen från befintliga oljefält minskar med cirka fem procent per år, samtidigt som de största oljebolagen har svårt att ersätta de reserver som produceras.

”Det här skapar en öppning för nya aktörer som kan agera snabbare, tänka långsiktigt och agera med kapitaldisciplin”, säger Lindvall.

Perthro vill fylla det växande gapet på marknaden – med fokus på hållbar tillväxt, hög avkastning och effektiv produktion. Med Lindvalls meritlista och branschkunskap hoppas bolaget nu kunna bli nästa svenska oljebolag att sätta avtryck på världskartan – och på börsen.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanStor uppsida i Lappland Guldprospekterings aktie enligt analys

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanBrookfield ska bygga ett AI-datacenter på hela 750 MW i Strängnäs

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSilverpriset släpar efter guldets utveckling, har mer uppsida

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanUppgången i oljepriset planade ut under helgen

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanLåga elpriser i sommar – men mellersta Sverige får en ökning

-

Analys3 veckor sedan

Analys3 veckor sedanVery relaxed at USD 75/b. Risk barometer will likely fluctuate to higher levels with Brent into the 80ies or higher coming 2-3 weeks

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMahvie Minerals växlar spår – satsar fullt ut på guld

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanOljan, guldet och marknadens oroande tystnad