Nyheter

David Hargreaves on Exchange Traded Metals, week 41 2013

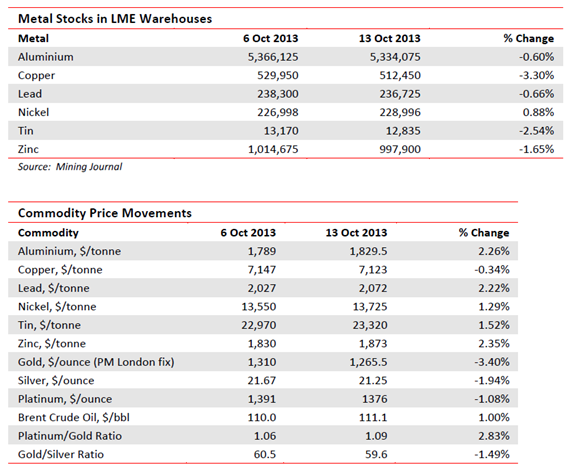

A week which saw warehouse stocks directionless, but a further fall in tin and prices of all bar copper nudge up, also had London hosting “LME Week”. Once a year in come the great and the good whose livelihoods depend on the market for the most important traded base metals, via the world’s largest clearing house, the London Metal Exchange.

A week which saw warehouse stocks directionless, but a further fall in tin and prices of all bar copper nudge up, also had London hosting “LME Week”. Once a year in come the great and the good whose livelihoods depend on the market for the most important traded base metals, via the world’s largest clearing house, the London Metal Exchange.

It culminates n a dinner where traditionally the speakers attempt to outdo each other in the boring stakes. This year it was a bit different because the exchange is now owned by the Chinese. Its CEO, Charles Li, spoke of looking beyond the offering of base metals, partnering with other bourses and increased access to China. Opinions were mixed on the direction of the metals, but most agreed the aluminium surplus will only be corrected by production cutbacks, that nickel, too, has a long term malaise look about it and copper supply, also, has been overdone. The warehousing system rightly came under fire. There are long delays getting materials out and consequently delivery premiums have risen. In the first nine months of 2013, over 3Mt moved in and out.

Aluminium. America’s Alcoa (AA.N $8.32; Hi-Lo $9.37-7.64) maintains its position in the top three for bauxite, alumina and refined metal and managed to turn out some credible results for the financial year end. Net income was $24M (2012 loss $134M) on slightly decreased sales. Noted was that the metal price has halved since 2008, so this performance was all about productivity gains. Well done.

Back to the LME. Its most valuable contract by value is probably aluminium. It was only launched in the early 1980s. Prior to that the US producer price held sway. It was never very popular since its mechanism was mostly unions asking for a wage increase, management conceding and sticking it on the price. Also, and still persisting, is the nonsensical habit of quoting in dollars per pound weight. With 40Mtpa mined, bought and sold (that is $80 bn) and the swap unit being tonnes, it makes no sense at all. Still, the Chicago Mercantile Exchange or CME intends to launch a rival contract to the London-based one. They have grounds given the recent problems but it could lead to a disorderly market or great arbitrage opportunities.

WIM says and we remember: The LME had the good sense to start pricing in dollars, the universal currency. If you, CME do launch, PLEASE make it tonnes and not lbs. If you insist on the latter, why not step-up to the plate with kilograms (don’t miss And Now Some Things… this week).

Nickel. It is the conference season in mining. They have just had one on nickel in Australia. Why not, world No 4 with 11% of production? Most of it comes from WA so that state’s Mines Minister had to put a spin on it. He says the price will return to its ‘former glory in the coming years’. Nothing like hedging your bets. He then SOTBOed his way through State and Federal reforms, innovation and have another tinnie. With respect, we would remind Mr Marmian (for it is he), that the price of nickel has had only two spikes above its present level since 1957. The unprecedented one of 2006-09 saw it transiently top $50,000/tonne (OK, CME 90c/lb), followed by an Eiger-like fall below $10,000. Today’s c.$13,800 is not life threatening. Just live within your means. Speaking of which, G-X and Vale who together have a grip on the production from the starter and most prolific area, Canada’s Sudbury basin, are said to be talking about joint activities. That could make sense as they speak for half of the country’s output. At Australia’s Paydirt Conference, one analyst nailed $8/lb (here we go, that’s c. $18,000/t) to the mast for post-2014

WIM says: Don’t rely on the post.

Copper will not go gently. It is nosing into surplus as Chinese demand softens but new developments continue apace. Chile’s CODELCO, at 12% of world output from the second largest producing country (17%) is gearing up. It is stateowned.

The government has sold $950M in international bonds, on a 5.775% yield, to help the cash-strapped miner. CODELCO has a $27 bn (no misprint) investment plan to keep it ahead of the game. This year, however, it will only be $4.0-4.5bn. Chile expects to produce c.5.7Mt of copper this year, 5% up on 2012, or 5.53Mt.

Peru’s Las Bambas Mine. This country remains a good jurisdiction although the natives are getting a little restless and el presidente has a colourful capitalist history (mining mostly) for a born-again socialist. The country houses the potentially major Las Bambas copper mine, on which we have reported previously. It belonged to Glencore, which has been forced to divest as part of China agreeing to the merger with Xstrata. OK, so far? So it is on the blocks. Well under development, they speak of it being worth $6 bn to date. Open to bidders, the favourites are Chinalco and Minmetals. Wonder where they spring from? Las Bambas is slated to produce 0.45Mt per year in its first five years and 300,000tpa thereafter. That puts it right up there with Antofagasta and Norilsk; also said to be sniffing is Newmont.

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

Blykalla och amerikanska Oklo inleder ett samarbete

Kärnkraftsföretagen Oklo från USA och svenska Blykalla har ingått ett strategiskt partnerskap för att främja tekniksamarbete, samordna leverantörskedjor och dela regulatorisk kunskap mellan länderna. Samarbetet inkluderar att Oklo går in som en av de större investerarna i Blykallas kommande investeringsrunda med ett åtagande på cirka 5 miljoner dollar.

Genom ett gemensamt teknikutvecklingsavtal ska bolagen utbyta insikter om material, komponenter och licensieringspraxis i både USA och Sverige. Målet är att minska kostnader och tidsrisker i utvecklingen av små modulära reaktorer (SMR).

Blykalla utvecklar SEALER, en blykyld snabbreaktor på 55 MWe, medan Oklo fokuserar på natriumkylda reaktorer upp till 75 MWe för industriella och militära tillämpningar i USA.

“Det här samarbetet stärker det växande ekosystemet för avancerade reaktorer i en tid av globalt ökande energibehov,” säger Oklo-grundaren Jacob DeWitte. Blykallas vd Jacob Stedman tillägger: “Vår gemensamma industriella strategi kan hjälpa leverantörer att planera för uppskalning, oavsett vilken sida av Atlanten de befinner sig på.”

Intervju på Bloomberg om samarbetet

Nyheter

Fortsatt stabilt elpris – men dubbelt så dyrt som i fjol

Snittpriset på el för höstmånaderna september till november väntas landa på strax under 50 öre per kilowattimme. Det är nästan en fördubbling jämfört med hösten 2024, då snittet låg på drygt 30 öre. Men nivåerna är fortfarande betydligt lägre än under elpriskrisen 2022. Det visar elbolaget Bixias höstprognos.

Att elpriserna är högre än i fjol beror främst på lägre tillgänglighet i kärnkraften och en svagare hydrologisk balans efter en torr sommar. Även om hösten har börjat blött och september ser ut att bli den nederbördsrikaste månaden sedan 2018, räcker det inte till för att vända vattenbalansen.

– Höstens elpriser är stabila, men klart högre än i fjol. Det är framför allt osäkerheten kring kärnkraften som påverkar där Oskarshamn 3 har varit ur drift längre än planerat. Samtidigt har den hydrologiska balansen inte återhämtat sig efter sommarens underskott, trots den blöta inledningen på hösten. Men jämfört med krisåren 2021 och 2022 ligger priserna fortfarande på en låg nivå, säger Johan Sigvardsson, elprisanalytiker på Bixia.

I september bidrog bristen på kärnkraft till att elpriset nästan fördubblades jämfört med samma månad i fjol. Priset landade på cirka 40 öre per kilowattimme, att jämföra med 22 öre i september 2024. Flera reaktorer stod stilla, däribland Oskarshamn 3, Forsmark 1 samt Lovisa 1 och 2 i Finland. Trots mycket regn under månaden var vattennivåerna fortsatt låga efter den torra sommaren, medan blåsiga perioder tillfälligt pressade ner priserna.

I oktober väntas elpriset hamna runt 45 öre per kilowattimme, jämfört med 27 öre i fjol, och i november kring 60 öre, mot 43 öre förra året. Sammantaget ger det ett höstsnitt i system på knappt 50 öre, jämfört med drygt 30 öre samma period i fjol. Under krisåret 2022 låg snittet för höstmånaderna på över 1,15 kronor per kilowattimme, med perioder på upp mot 4 kronor.

Liten risk för höga höstpriser

Bixia bedömer att priserna kan komma att stiga tillfälligt om vädret blir kallare än normalt eller om kärnkraftsreaktorer får fortsatt försening i återstart. Om till exempel Oskarshamn 3, vars återstart redan skjutits på fem gånger, inte kommer igång enligt plan i mitten av oktober, finns risk att priserna ökar under andra halvan av månaden.

– Risken för pristoppar ökar ju längre in på säsongen vi kommer, eftersom förbrukningen stiger när temperaturen sjunker. Men väderprognoserna ser i nuläget gynnsamma ut, och även om det skulle bli kallare än väntat ser vi inte någon risk för extremt höga priser, säger Johan Sigvardsson.

Dyrare el i syd

Södra Sverige har betalat betydligt mer för elen än norra delarna. Priserna har legat på runt 15 öre per kWh i norr under september, medan syd haft priser på omkring 70 öre. En differentierad prisbild väntas även under resten av hösten, särskilt om kärnkraftsproduktionen i söder fortsätter att vara begränsad och det fortsätter att vara gott om vatten i norr.

Nyheter

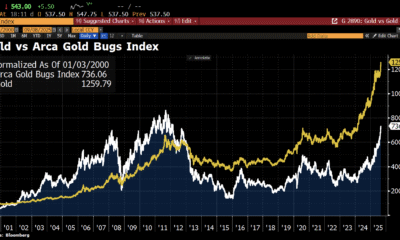

Ett samtal om guld, olja, koppar och stål

Samtal om att guldet ständigt slår nya prisrekord, att oljepriserna pressas och vad som händer på kopparmarknaden. Vidare kommenterar Jernkontorets Kristian Ljungblad läget i stålbranschen och hur de svenska stålbolagen mår.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEurobattery Minerals satsar på kritiska metaller för Europas självförsörjning

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals i en guldtrend

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuldpriset kan närma sig 5000 USD om centralbankens oberoende skadas

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOPEC signalerar att de inte bryr sig om oljepriset faller kommande månader

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanAktier i guldbolag laggar priset på guld

-

Analys3 veckor sedan

Analys3 veckor sedanVolatile but going nowhere. Brent crude circles USD 66 as market weighs surplus vs risk

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanKinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanTyskland har så höga elpriser att företag inte har råd att använda elektricitet