Nyheter

David Hargreaves on Exchange Traded Metals, week 39 2014

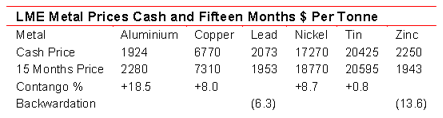

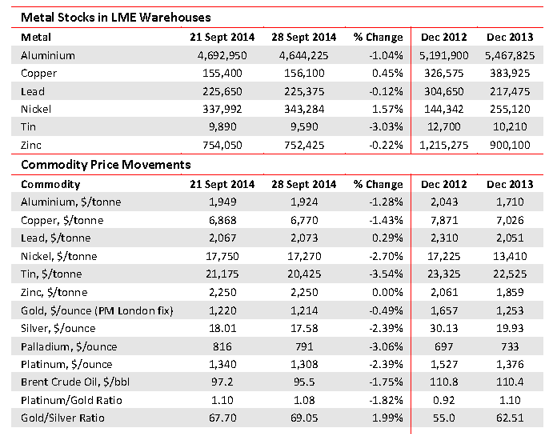

Neither the movement in warehouse stocks nor metal prices was indicative and whilst the pressure remains down, some trends emerge. Indonesia has compromised with Newmont, to allow copper concentrates to flow again and tin has also loosened up. We are warned of a pending zinc shortage as major old mines close and are not replaced. Ye has an economic recovery remains on the cards for 2015 onwards, we see forward prices holding firm.

These numbers are in contradiction to what many analysts fear. On copper, they note that what was going to be a massive surplus shrinking to about 285,000t in 2015 out of a 20Mt market. As ever the pick-up in the US economy is cited. Backing this are majors MMG who, with Chinese partners, strong armed Glencore into selling the developing Las Bambas mine in Peru, slated to build up to 2Mt/yr copper in concentrate, starting in 2015.

Zambia has got its knickers in a twist over copper exports. It levies VAT on metal leaving the country and only repays it on proof of arrival at destination. A problem, as the goods can change hands several times before final delivery. The Chamber of Mines has weighed in on the miners’ cause pointing out the crucial nature of copper exports to the country, like 750,000t/yr and 90,000 jobs.

Aluminium owes its rosy forward picture – see above – to some producer led restraint in the downturn, although stocks remain high. Of its three stages of production, the conversion of bauxite to alumina then to aluminium metal are energy intensive. So it makes sense to do them where power is cheap. Thus the UAE, via State-owned Emirates Global Aluminium, plans to build a $3bn aluminium refinery in Abu Dhabi. It will build to 4Mt/yr.

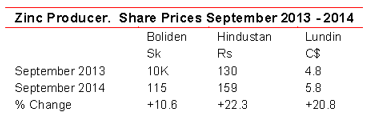

The zinc story will run. Nobody has more of a vested interest than major miner and trader Glencore which, following its merger with Xstrata, has over 15% of mining clout alone. The warning is about the impending closure of big, tired old mines with a deficit looming as early as next year. WIM says: The market does not share this view. The price backwardation to early 2015, as we show, is almost 14%. LME stocks alone are 23 days world needs, compared with its stablemate lead at 9 days. One to watch. Shares were down on the week, but up on the year.

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

Blykalla, Evroc och Studsvik vill bygga kärnkraftsdrivna datacenter i Sverige

Blykalla, Evroc och Studsvik har undertecknat ett samförståndsavtal för att undersöka möjligheten att utveckla Sveriges första kärnkraftsdrivna datacenter vid Studsviks licensierade kärnkraftsanläggning i Nyköping.

Blykalla utvecklar avancerade blykylda kärnreaktorer för att leverera säker, kostnadseffektiv och hållbar basenergi. Evroc bygger hyperscale-moln- och AI-infrastruktur för att driva Europas digitala framtid. Studsvik driver en licensierad kärnkraftsanläggning i Nyköping och tillhandahåller livscykeltjänster för kärnkraftssektorn, inklusive bränsle, material och avfallshantering. Tillsammans kombinerar de teknik, infrastruktur och anläggningsexpertis för att påskynda utbyggnaden av kärnkraftsdrivna datacenter.

Det finns en växande internationell efterfrågan på kärnkraftsdrivna datacenter, driven av parallella krav från AI och elektrifiering. Med sin kapacitet att leverera ren, pålitlig baskraft och inbyggd redundans är små modulära reaktorer särskilt väl lämpade för att möta detta behov.

Belastar inte elnätet

En stor fördel med att bygga datacenter och kärnkraftverk bredvid varandra är att elnätet inte belastas. Det gör totalpriset för elektriciteten blir lägre, samtidigt som det inte tillkommer investeringskostnader för operatören av elnätet.

Vill etablera Sverige som en föregångare

Med detta avtal strävar parterna efter att etablera Sverige som en föregångare i denna globala omställning, genom att utnyttja Studsviks licensierade anläggning, Evrocs digitala infrastruktur och Blykallas avancerade SMR-teknik.

”Detta samarbete är en möjlighet för Sverige att bli ledande inom digital infrastruktur. Det ger oss möjlighet att visa hur små modulära reaktorer kan tillhandahålla den stabila, fossilfria energi som krävs för AI-revolutionen”, säger Jacob Stedman, vd för Blykalla. ”Studsviks anläggning och evrocs ambitioner erbjuder rätt förutsättningar för ett banbrytande projekt.”

Samförståndsavtalet fastställer en ram för samarbete mellan de tre parterna. Målet är att utvärdera den kommersiella och tekniska genomförbarheten av att samlokalisera datacenter och SMR på Studsviks licensierade anläggning, samarbeta med kommuner och markägare samt definiera hur en framtida kommersiell struktur för elköpsavtal skulle kunna se ut.

”Den ständigt växande efterfrågan på AI understryker det akuta behovet av att snabbt bygga ut en massiv hyperskalig AI-infrastruktur. Genom vårt samarbete med Blykalla och Studsvik utforskar vi en modell där Sverige kan ta ledningen i byggandet av en klimatneutral digital infrastruktur”, kommenterar Mattias Åström, grundare och VD för Evroc.

”Studsvik erbjuder en unik plattform med anläggningsinfrastruktur och unik kompetens för att kombinera avancerad kärnkraft med nästa generations industri. Detta samförståndsavtal är ett viktigt steg för att utvärdera hur sådana synergier kan realiseras i Sverige”, kommenterar Karl Thedéen, vd för Studsvik.

Parterna kommer nu att inrätta en gemensam styrgrupp för att utvärdera anläggningen och affärsmodellen, med målet att inleda formella partnerskapsförhandlingar senare i år. Deras fortsatta samarbete ska möjliggöra ren och säker energi för Europas AI-infrastruktur och digitala infrastruktur.

Nyheter

Toppmöte om framtidens kärnkraft runt Östersjön hölls idag

Sveriges regering arrangerade på tisdagen ett toppmöte om framtidens kärnkraft i Östersjöregionen tillsammans med Finland. Ministrar från Polen, Lettland och Estland deltog, liksom investerare, banker och kärnkraftsbolag. EFN:s reporter Thomas Arnroth rapporterar från mötet.

Energi- och näringsminister Ebba Busch betonade att målet är att göra Sverige till regionens ledande kärnkraftsnation och en hub för kärnkraft i Östersjöområdet.

Tanken är att länderna ska samarbeta och se regionen som en gemensam marknad, vilket kan påskynda och sänka kostnaderna för nya reaktorer. Kunskap kan användas gemensamt över hela regionen och en reaktortyp skulle bara behöva godkännas en gång.

Nyheter

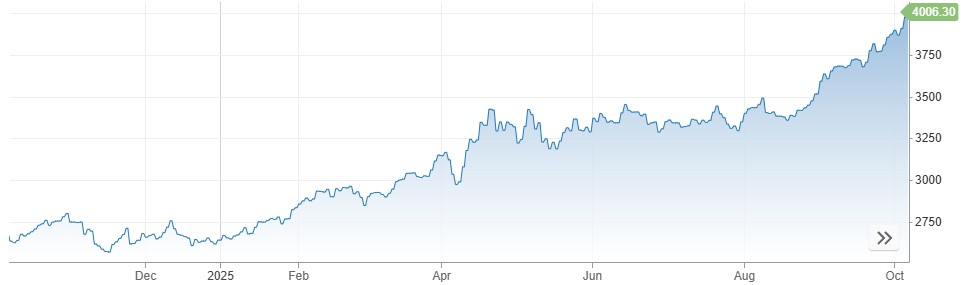

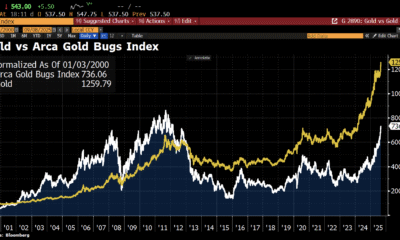

Nytt prisrekord, guld stiger över 4000 USD

Priset på guld på CME-börsen steg precis för första gången någonsin över 4000 USD per uns. Detta efter att både investerare och centralbanker söker en trygg hamn, om än av delvis olika orsaker. Vi har tidigare idag rapporterat att Goldman Sachs skruvat upp sin guldprognos för slutet av 2026 till 4900 USD per uns.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMahvie Minerals i en guldtrend

-

Analys4 veckor sedan

Analys4 veckor sedanVolatile but going nowhere. Brent crude circles USD 66 as market weighs surplus vs risk

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAktier i guldbolag laggar priset på guld

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanKinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanTyskland har så höga elpriser att företag inte har råd att använda elektricitet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuld når sin högsta nivå någonsin, nu även justerat för inflation

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanDet stigande guldpriset en utmaning för smyckesköpare

-

Analys4 veckor sedan

Analys4 veckor sedanWaiting for the surplus while we worry about Israel and Qatar