Nyheter

David Hargraves on Exchange Traded Metals, week 50 2011

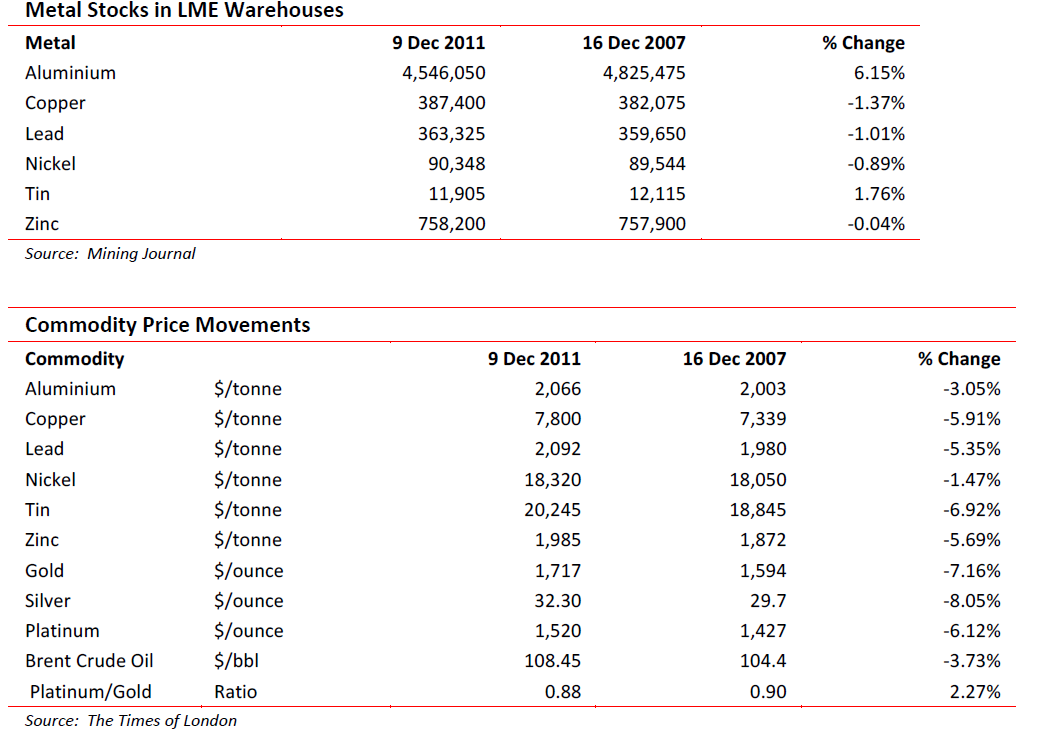

Hefty falls of 3-6% on the week and around 20% across the board for the year. Twelve months ago we were heralding continued recovery which indeed lasted through to mid-year. Just gold, silver and oil are higher than December 2010, but their trajectories are down. Not all is lost. Major Japanese trader Marubeni see an Aluminium supply deficit of 357,000t in 2013. That’s a tad precise and would hardly dent the 4.8Mt LME stockpile, but it is a start. They look for the price to start rising up towards $2800/t, compared with today’s $2000.

Bulk Minerals

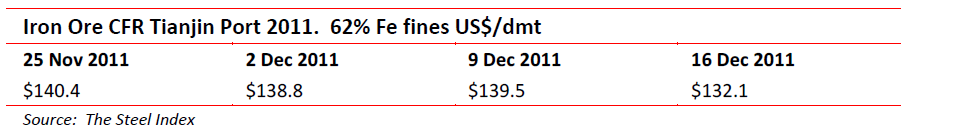

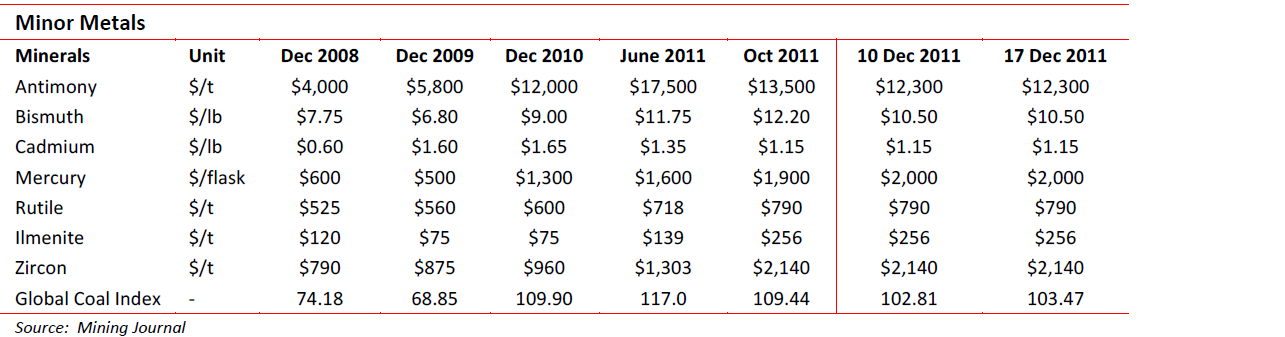

There are no strong markets. Spot coal, iron ore, steel industry additives, are all under attack. Now we hear it for potash. Fact is, some bulk minerals are less soggy than others.

Potash. The favourite fertilizer mineral (usage 55-60 Mtpy) differs from all others in the agricultural sector. Whereas you can switch from coffee to tea to cocoa, from barley to wheat and from apples to oranges, you have little choice about what makes them all grow. Added to its attractions as an essential ore, its relatively limited occurrences and its demand profile (an increasing population base seeking better nutritional standards), this does not present it behaving like any other commodity in an economic downturn. Plants will still grow if you miss a season’s dressing. Thus the price for standard grade potash, c. $500-600 per tonne, rose to $900 in 2008 only to fall to $300-350 as the last recession set in. Now it has slipped to c. $460, inventories are building up at the Canadian mines and short time working is in force. This may persist until nearer the March-April growing season. The longer term outlook promises a return to tight conditions in later 2012 and a strong run until new production comes on stream (UK, Brazil, Ethiopia) in 5 years time.

The underlying threat is that of an economic slowdown in China.

Precious Metals

Not so Precious Eh? So what happened to the flight into Egypt? Sorry, to true stores of value? Gold for the affluent purists, silver for the wannabees and platinum for the cognoscenti? We devoted last week’s leader to warning that the bull run is – for the time being at least – running out of steam. There was a loud hiss of exhaust gases this week, so let’s perspectivise:

Views and forecasts abound. We had a chartist/technical analyst, Dr. Nu Yu, calling gold down to $1600 and lower. He is right so far. Then the not-shy Rob McEwan is going for $5000 – on this run we are with Nu Yu but don’t see $1000 being tested or the downside.

Another late entrant in the hedge betting stakes is Mr Murenbeeld of Dundee Wealth, he says there will be an upward explosion in the gold price (explosions do tend to go up) “at some point in time, but just when is difficult to judge”. Spot on.

Meanwhile his stable mate Frank Holmes of US Global Investors thinks $10,000/oz gold not unattainable. Slowly, painfully they are getting to our mark of $40,000 which is where all the gold would equal all the dollars and we would all live happily ever after.

Platinum deserves more attention because it is a real metal, like being used in industry as well as having decorative properties and a handle on non-destructibility. Then since over 70% of it comes from a tight corner of South Africa it doubly grabs the analyst’s attention. Output has fallen heavily in Rustenburg this year. They speak of 27% – 36%. The reasons? The Safety Inspectorate has caught up on the untenable accident rates and ordered increasingly frequent stoppages. Combined with overgenerous wage increases and allowances and a falling metal price, these are not happy days. Share prices speak loud.

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

Vad guldets uppgång egentligen betyder för världen

Guldpriset har nyligen nått rekordnivåer, över 4 000 dollar per uns. Denna uppgång är inte bara ett resultat av spekulation, utan speglar djupare förändringar i den globala ekonomin. Bloomberg analyserar hur detta hänger samman med minskad tillit till dollarn, geopolitisk oro och förändrade investeringsmönster.

Guldets roll som säker tillgång har stärkts i takt med att förtroendet för den amerikanska centralbanken minskat. Osäkerhet kring Federal Reserves oberoende, inflationens utveckling och USA:s ekonomiska stabilitet har fått investerare att söka alternativ till fiatvalutor. Donald Trumps handelskrig har också bidragit till att underminera dollarns status som global reservvaluta.

Samtidigt ökar den geopolitiska spänningen, särskilt mellan USA och Kina. Kapitalflykt från Kina, driven av oro för övertryckta valutor och instabilitet i det finansiella systemet, har lett till ökad efterfrågan på guld. Även kryptovalutor som bitcoin stiger i värde, vilket tyder på ett bredare skifte mot hårda tillgångar.

Bloomberg lyfter fram att derivatmarknaden för guld visar tecken på spekulativ överhettning. Positioneringsdata och avvikelser i terminskurvor tyder på att investerare roterar bort från aktier och obligationer till guld. ETF-flöden och CFTC-statistik bekräftar denna trend.

En annan aspekt är att de superrika nu köper upp alla tillgångsslag – aktier, fastigheter, statsobligationer och guld – vilket bryter mot traditionella investeringslogiker där vissa tillgångar fungerar som motvikt till andra. Detta tyder på att marknaden är ur balans och att kapitalfördelningen är skev.

Sammanfattningsvis är guldets prisrally ett tecken på en värld i ekonomisk omkalibrering. Det signalerar misstro mot fiatvalutor, oro för geopolitisk instabilitet och ett skifte i hur investerare ser på risk och trygghet.

Nyheter

Spotpriset på guld över 4300 USD och silver över 54 USD

Guldpriset stiger i ett spektakulärt tempo, nya rekord sätts nu på löpande band. Terminspriset ligger oftast före i utvecklingen, men ikväll passerade även spotpriset på guld 4300 USD per uns. Guldet är just nu som ett ångande tåg som det hela tiden skyfflas in mer kol i. En praktisk fördel med ett högre pris är att det totala värdet på guld även blir högre, vilket gör att centralbanker och privatpersoner kan placera mer pengar i guld.

Även spotpriset på silver har nu passerat 54 USD vilket innebär att alla pristoppar från Hunt-brödernas klassiska squeeze på silver har passerats med marginal. Ett högt pris på guld påverkar främst köpare av smycken, men konsekvensen av ett högt pris på silver är betydligt mer kännbar. Silver är en metall som används inom många olika industrier, i allt från solceller till medicinsk utrustning.

Nyheter

Guld och silver stiger hela tiden mot nya höjder

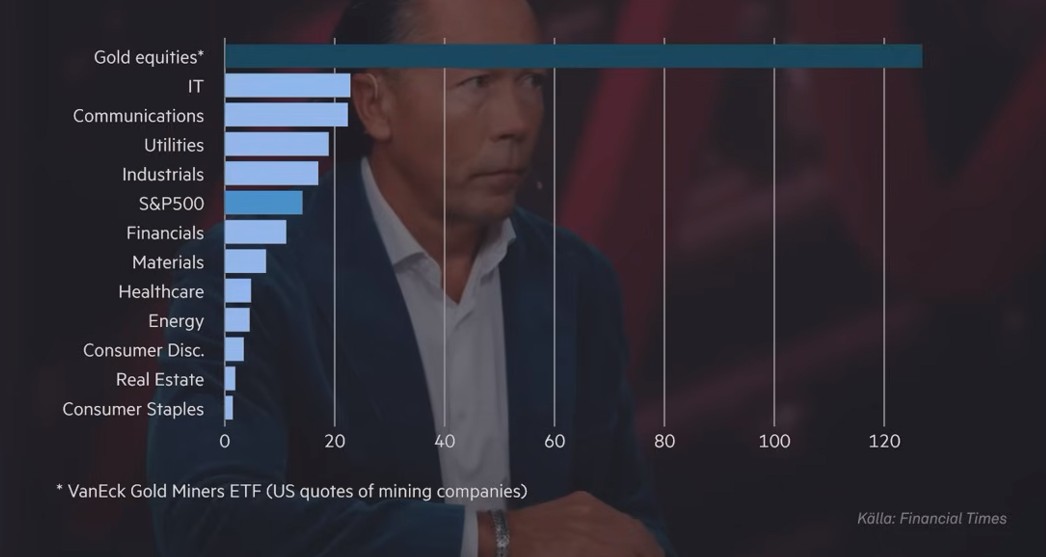

Priserna på guld och silver stiger hela tiden mot nya höjder. Eric Strand går här igenom vilka faktorerna som ligger bakom uppgångarna och vad som kan hända framöver. Han får även kommentera aktier inom guldgruvbolag som har haft en bättre utveckling än nästan allt annat. Han säger bland annat att uppgången kommer från låga nivåer och att det i genomsnitt är en mycket högre kvalitet på ledningarna för bolagen idag.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEtt samtal om guld, olja, fjärrvärme och förnybar energi

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Analys3 veckor sedan

Analys3 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuldpriset uppe på nya höjder, nu 3750 USD

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanEtt samtal om guld, olja, koppar och stål