Nyheter

Smart money should go for mining shares

GOLD REPRESENTS VICTORY

– sports show what it takes to get it –

I am not sure whether it is the early spring that has pushed the worries about financial and economic crises to the background or that all the bad and worrisome news of the last few months has made us punchdrunk like a boxer after a stiff beating, but I have the feeling that it has become a kind of quiet. But don’t let the silence put you asleep. The problems are still all over the world and the solutions are still far beyond reach. The recent G20 meeting in Washington has not brought any major changes so we have to wait till in their next meeting in Mexico in June.

In the meantime, it is interesting to see how the general public is feeling about the recent period of financial stress and even more so about the proposed further necessary cuts in spending by both governments and populations. The voters seem to be fed up with the politicians and appear to be ready to accept some drastic measures but rather in government spending than in measures that affect their own purse. In France, President Nicolas Sarkozy already had to absorb his defeat in last weekend’s elections, losing out to his opponent François Hollande who promised not to cut spending as much as ”Europe” would like. Also in Greece, the voters have sent the right side politicians home in a protest to too heavy cuts in spending, as they were required by the EU in return for their financial help.

Therefore, it didn’t come as a surprise that commentators explained the outcome of the French and Greek elections as a sign of an increasing opposition to the influence of the European Union on the affairs of its individual members. And let’s face it, it is difficult to understand that Europe wants its member countries to abide by the standard maximum 3% that spending may exceed budgets while the EU itself proposed to increase its expenditures by 6.8%. The people may be simple but are not stupid.

The public also will have the ultimate say (albeit only once every 4 years) in the circus of the USA presidential elections. The Republican primaries have shown a rather erratic behaviour of the voters. To my relief, the amazingly strong support for candidate Rick Santorum did not come to fruition; it would have been weird and for me unthinkable that the US would have a President that has no awareness that there is a world beyond the US borders and that seems to prefer his church over the White House……

Then, unless libertarian candidate Ron Paul, favoured by many in the financial world, will surprise everybody in the still undecided states, we are left with Mitt Romney. What can we expect from someone whose most remarkable statement said that he favours the size of the perfect trees in Michigan over all the other trees in his country. Will he have a chance against President Barack Obama? I don’t think so but also here, the eventual public vote will be the ultimate determining factor. But there is no more volatile electorate than the US electorate. If they will elect for change, it will be very difficult to predict what the world will be like in the years ahead.

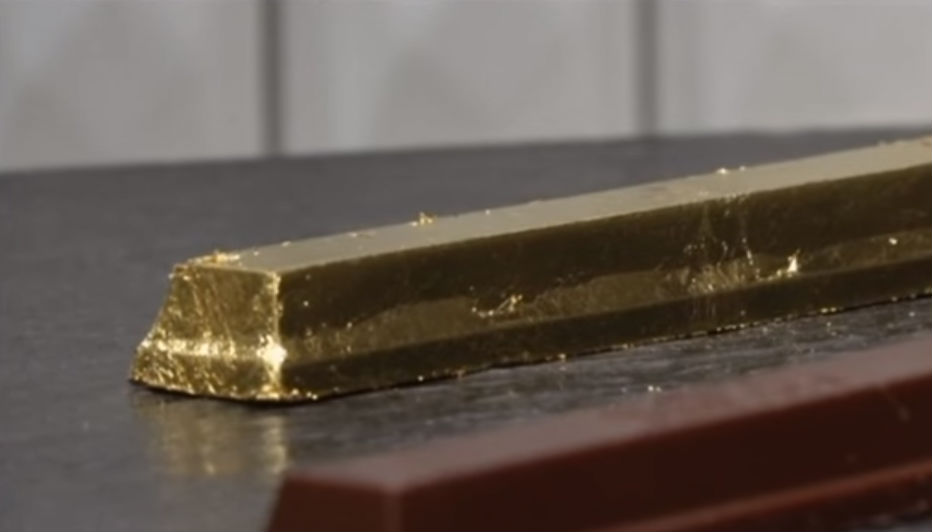

OK, enough about politics, I would like to say. As only politics will create the path that we will have to walk on in the coming years, whatever the kind of politics we will get, it is easier to say that the general outlook for the world economy will likely not be a very bright one. In my view, we will have more years of uncertainty, sacrifices, reforms, marginal growth, deficits, spending cuts, higher taxes ahead of us than we may currently expect. And, as in times of war, the churches fill up, I think that in times of prolonged uncertainty and tainted values, gold will be one of the few assets, if not the only one, that will shine more than before.

Although more and more investors are coming to realize this, it is still remarkable that all the investments in gold and silver, and in gold- and silver- related investments only amount to less than 2% of all investment capital. I am sure this percentage will be increasing over the next few years as the consequences of the currently developing economic and financial situation will unfold.

As a sports fan, I would like to point out how sportsmen and -women will symbolize the value of gold this summer. Both at the European Championship, to be held in Poland and Ukraine from the opening matches on June 8 to the final on July 1 and the Summer Olympics, to be  held in London, UK from the opening ceremony on July 27 to the closing ceremony on August 12, respectively the top football players and the best athletes of the world will give the best of their talents and fruits of their intensive training efforts to go for what they deem to be the highest possible achievement, the gold medal that they have been dreaming of for so long.

held in London, UK from the opening ceremony on July 27 to the closing ceremony on August 12, respectively the top football players and the best athletes of the world will give the best of their talents and fruits of their intensive training efforts to go for what they deem to be the highest possible achievement, the gold medal that they have been dreaming of for so long.

An incredible effort by many that know that the ultimate reward will only be available to a few happy ones. Both events are great efforts to watch and will unite billions of viewers in front of their screens. All will realize, consciously and subconsciously, that in those periods gold will the be only thing to go for, with silver as a good second. It should be the dream of everybody in the mining and exploration industry if these events will cause only a fraction of those billions of followers to want some gold and silver of their own. Or, as I explained, some interest in gold and silver values by adding some mining and exploration shares to their portfolio. You may be one of them. Fortunately, it would be available to you at a lot less strenuous effort. No months and years of training, no physical input and competing. Just giving it a well-worth evaluation and taking a well-thought decision. Go for the gold yourself, it could be the best decision you have taken since a long time. At the finish, you will be among the winners. You will see for yourself that…….gold will make the difference!

[box]

My regular readers know that from time to time, I have mentioned several commentators that have spoken about the possibilities of $10,000 gold. Two more valued gold watchers have recently issues their latest observations.

Analyst and money manager Peter Schiff, known for his very outspoken opinions on financial, economical and political issues, has recently reiterated his 2010 views on that magic gold price. Peter is always worth listening to. Spend some of your time to an enlightening 6:58 minutes at this video clip.

Gold at $2000 may be the bargain of the year. According to John Butler, as early as next year developments may start to unfold that could take gold prices to $10,000 per ounce. A return to the gold standard is inevitable. His new book ’The Golden Revolution’ tells the story. See video clip.

[/box]

In my view, mining and exploration shares offer the most flexible way to take an interest in gold and silver themselves. They have both advantages and disadvantages compared to owning the metals outright. There are some more risks involved, but on the other hand, the rewards may be a lot higher. The main reason for that is that the value of mining shares is not only depending on the price fluctuations of the metal prices, they are also relying upon factors like the quality of management, the project base, the success of exploration, the attention from the investment community and other investors and a few others. As this writing is not pretending to be a crash course for investing in resource stocks, I will only elaborate on some of the main factors and the actuality that influence the choice to invest in the metals or in mining shares. For the sake of simplicity, when I talk about gold, you could also read silver or any other metal.

Gold above the ground versus gold in the ground. The value of gold as in the daily gold price, is mainly a reflection of the valuation of the gold that has been mined and is still physically present. Of course, other factors like supply and demand and market expectations are taken into consideration too but they are less measurable. In resource stocks, the share prices can attribute more weight to what the company has achieved and is in the process of achieving such as establishing the presence of proven and probable reserves in the ground and future development. This leverage factor can have a highly positive influence on the future share prices, in particular as plans to move a project forward to the stages of feasibility and a production decision. The other side of the coin is also true. If and when the project just remains a gold-in-the-ground project without the necessary continuation or a decision not to proceed with the project is taken, it can have an adverse effect on the price of the shares.

Shares offer possibility to diversify more than gold itself. Gold is gold and when you own it, the value of your investment is directly depending on the world market price. This can be good and bad because there is a distinct discrepancy between the world prices of metals and the market movement of mining shares. So, it makes quite a difference if you invest an amount in gold or in a group of well-diversified mining shares.

Shares offer possibility to diversify more than gold itself. Gold is gold and when you own it, the value of your investment is directly depending on the world market price. This can be good and bad because there is a distinct discrepancy between the world prices of metals and the market movement of mining shares. So, it makes quite a difference if you invest an amount in gold or in a group of well-diversified mining shares.

Diversification in the companies’ development status (production-developmentdiscovery-exploration-grassroots), sorts of different metals (gold-silver-base metals rare earth metals), companies and projects in several geographic choices or listing in different markets.

Performance of mining shares versus gold itself. Because in my view, the advantages of mining shares over gold outweigh the risks involved and the leverage factor should deserve to be rewarded, mining shares should be selling at a premium. But over the last few years, that has not been the case. On the contrary, mining shares have been performing quite a lot poorer than the gold prices. The reasons for that underperforming can be attributed to a few different factors; I will mention just the ones that I find most remarkable: the choice for gold versus the choice for mining shares. By definition, a decision to invest in gold is not a common one for most investors. The idea of investing in gold is not very often endorsed by the investor advisors, such as the banks, the brokers, the money managers, the accountants, the bookkeepers and ”well-meaning” friends and family. Usually, the cause of the matter is that ’what you don’t know, you don’t eat’. But to invest in gold is a major choice. Once you have derived at it, it is much easier to buy gold outright, than evaluate the possible alternatives. Like I said, gold is gold and that’s it. Price is price, every day in every major news paper, value is value, liquidity is not a question, no headaches except storage, insurance, etc. This certainly is a factor of importance for the real large investors and institutions. Investing a huge amount in mining shares takes considerably more study, information and evaluation; the marketability of gold versus mining shares. The market of gold is a big market. No matter how big the amount to be invested, the gold markets can absorb it.

This factor works on both sides. Buying and selling never really creates a problem. In comparison, the liquidity of gold is a lot different from the liquidity in mining shares. Most people may think that the mining and exploration industry is a huge and worldwide industry. Worldwide yes, but huge no. We are talking about a real compact industry compared to the more usual types of industrial companies. So for international investment companies, for instance, it is not very desirable to justify the time, effort and other implications that would be necessary to invest in an industry that makes it impossible or very difficult to apply the huge sums of money they have to invest.

Yet, I would like to plead the case for investing in mining shares at this time. Based on my many years of following many mining and exploration companies, and seeing the results many of those companies have made and are in the process of making in the development of their projects, I can only conclude that mining shares in general are grossly undervalued at the present time. For no obvious reason.

Mining shares are offering an excellent opportunity to investors to get positioned for the scenario that I see developing in the next few years. The most fundamental basis for my case is that I am truly convinced that there will be no end in the world’s need for metals despite economic stagnations. The ongoing growth of China and other developing nations will continue to make them hungry for the metals. Supplies will be trailing international demand, prices are bound to rise. If you study the world situation of mining and exploration, we see that the countries that the fastest developing nations are establishing their strategic positions to secure their access to all possible metals.

Not surprisingly, China is taking the lead but also other nations such as Brazil, India, Russia, Australia are very active in this respect. See what is happening all over Africa for instance. Their own development and their vision on the world’s development prompt them to these actions. In my view, these circumstances will lead to higher metal prices over the next few years. There are several trends that point into that direction. But other than you may think, a crisis scenario is not the most important reason for my case, on the contrary.

GOLD DOES NOT NEED DOOM AND GLOOM TO SHINE!

In other words, I accept the current price level as more than sufficient to predict a good environment for the mining and exploration industry to flourish. At these levels, the production companies can operate successfully and profitably and enjoying cash flows that enable them to finance their further expansive developments internally. In addition, the current metal prices continue to make it worthwhile for exploration companies to pursue their search for and development of their reserves.

In addition, there are a few other factors that could turn out to be quite stimulating, such as increased merger and acquisitions activities that should lead to larger entities and further concentration in the industry, increased entrance of conventional private investors to the mining and exploration sector as metal prices show continuation of current price levels and possibly higher price levels in the future, as a result of the above factors, it is likely to expect a further growing awareness of the markets’ prospects from institutional investors as the market will continue to expand in volume and size, smart money has already taken the lead in choosing mining and exploration shares as home for a profitable future for their investments. The explosive growth that several international funds for gold and resource shares serves as a clear indication, it seems justified to say that as more intelligent money will flow into the resource markets as a result of growing awareness and positive market actions, the discount of mining and exploration shares is likely to disappear.

To illustrate that I am not a newcomer with this positive attitude, I like to let you read what I did write in March 2007 as an appeal to representatives of the financial industry at a time that gold was selling at $663 per ounce:

”The best advice I can give to the managers of money that we have not seen in the resource markets yet, is the following. I realize that the resource markets are way too small to your standards and liking and that not all mining and exploration companies are meeting the criteria that you normally practice in your investment evaluations. I know you work with formulas and benchmarks that are not accepting international mining and exploration shares. But wasn’t that also the case when the high tech, the ICT and the bio-tech markets started? Then, you found your creative ways to set aside the normal standards and yes I know to make room in your investment portfolios, and we all know how most of the results have been on average. But you cannot miss out in this future of the metals that is going to last for the many, many years that the world will be fundamentally changing into a global market place where the oriental markets will be determining what is good for the rest of the world. You should take mining and exploration shares more serious as investment alternatives and decide to allocate (more) money to them. Trust me, they have a great potential and, not less important, they are a lot more fun!”

Taking the current price levels as a good base and adding the factors that I stated above, seems to be a sound principle to me. The considerable undervaluation and the significant intrinsic upside potential justify confidence and optimism at these price levels. I don’t take considerably higher prices for granted, but I fully accept their possibility and even probability. Fundamentally the mining and exploration industry has a very healthy point of departure for a very prospective future. Tell me, what other industry can operate at such sound price levels for their end product and what other industry has such a potential for future price increases? I don’t think there is any such other industry……

[hr]

European Gold Centre

European Gold Centre analyzes and comments on gold, other metals & minerals and international mining and exploration companies in perspective to the rapidly changing world of economics, finance and investments. Through its publications, The Centre informs international investors, both institutional and private, primarily in Europe but also worldwide, who have an interest in natural resources and investing in resource companies.

The Centre also provides assistance to international mining and exploration companies in building and expanding their European investor following and shareholdership.

Henk J. Krasenberg

After my professional career in security analysis, investment advisory, porfolio management and investment banking, I made the decision to concentrate on and specialize in the world of metals, minerals and mining finance. From 1983 to 1992, I have been writing and consulting about gold, other metals and minerals and resource companies.

The depressed metal markets of the early 1990’s led me to a temporary shift. I pursued one of my other hobbies and started an art gallery in contemporary abstracts, awaiting a new cycle in metals and mining. That started to come in the early 2000’s and I returned to metals and mining in 2002 with the European Gold Centre.

With my GOLDVIEW reports, I have built an extensive institutional investor following in Europe and more of a private investor following in the rest of the world. In 2007, I introduced my MINING IN AFRICA publication, to be followed by MINING IN EUROPE in 2010 and MINING IN MEXICO in 2012.

For more information: www.europeangoldcentre.com

Nyheter

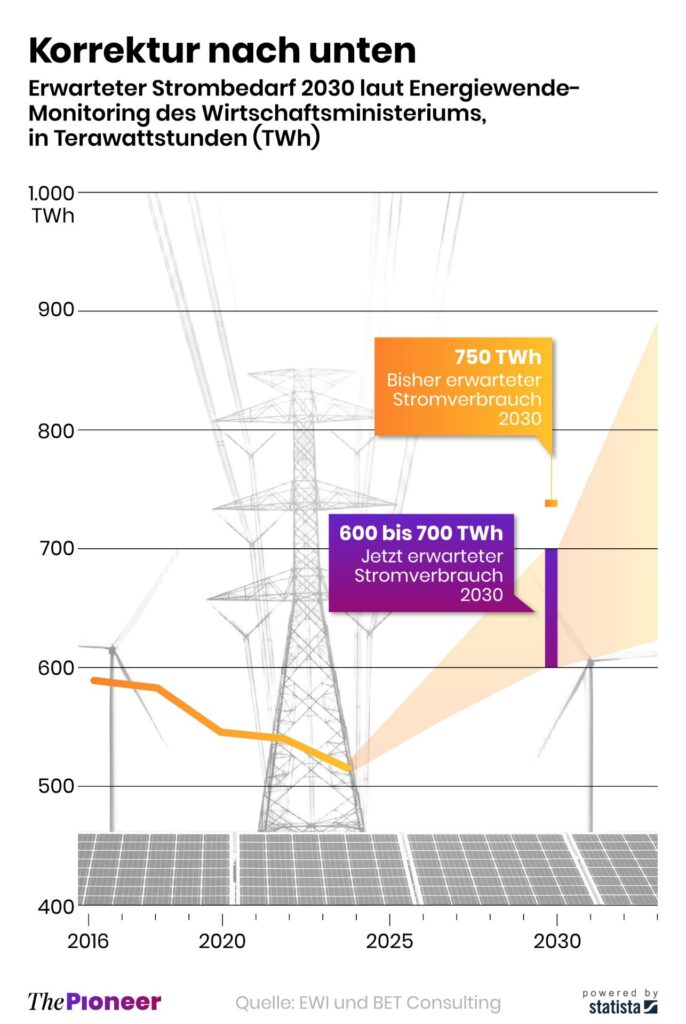

Tyskland har så höga elpriser att företag inte har råd att använda elektricitet

Tyskland har skrivit ner prognosen på hur mycket elektricitet landet kommer att behöva 2030. Hittills har prognosen varit 750 TWh, vilken nu har skrivits ner till 600-700 TWh,

Det kan vid en första anblick låta positivt. Men orsaken är inte att effektiviseringar. Utan priserna är så pass höga att företag inte har råd att använda elektriciteten. Elintensiv industri flyttar sin verksamhet till andra länder och få företag satsar på att etablera energikrävande verksamhet i landet.

Tyskland har inte heller någon plan för att förändra sin havererade energipolitik. Eller rättare sagt, planen är att uppfinna fusionskraft och använda det som energikälla. Något som dock inte löser problemet på några årtionden.

Nyheter

Kinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

Kinas officiella statistik för elproduktion har släppts för augusti och den visar att landet slog ett nytt rekord. Under augusti producerades 936 TWh elektricitet.

Stephen Stapczynski på Bloomberg lyfter fram att det är ungefär lika mycket som Japan producerar per år, vilket innebär är de producerar ungefär lika mycket elektricitet per invånare.

Kinas elproduktion kom i augusti från:

| Fossil energi | 67 % |

| Vattenkraft | 16 % |

| Vind och Sol | 13 % |

| Kärnkraft | 5 % |

Stapczynskis kollega Javier Blas uppmärksammar även att det totala rekordet inkluderade ett nytt rekord för kolkraft. Termisk energi (där nästan allting är kol) producerade 627,4 TWh under augusti. Vi rapporterade tidigare i år att Kina under första kvartalet slog ett nytt rekord i kolproduktion.

Nyheter

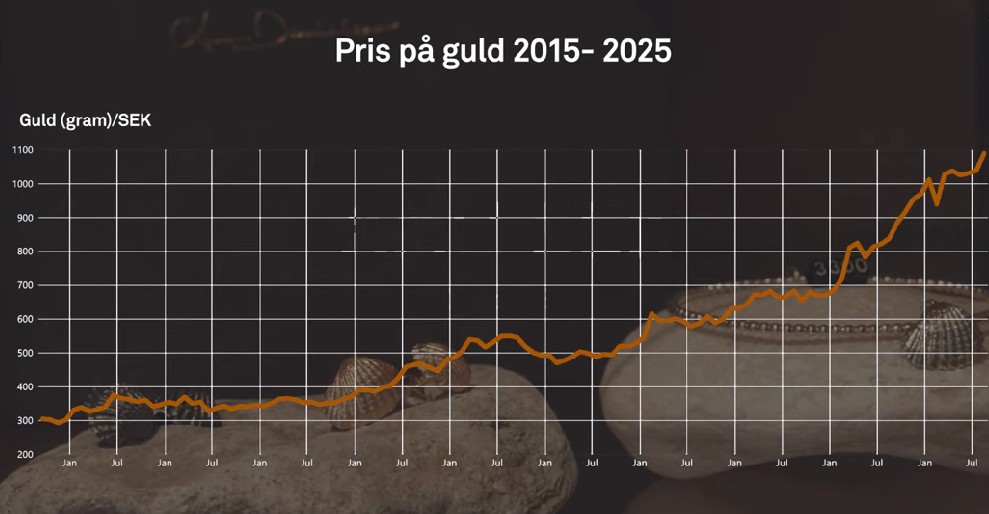

Det stigande guldpriset en utmaning för smyckesköpare

Guldpriset når hela tiden nya höjder och det märks för folk när de ska köpa smycken. Det gör att butikerna måste justera upp sina priser löpande och kunder funderar på om det går att välja något med lägre karat eller mindre diamant. Anna Danielsson, vd på Smyckevalvet, säger att det samtidigt gör att kunderna får upp ögonen för värdet av att äga guld. Det högre guldpriset har även gjort att gamla smycken som ligger hemma i folks byrålådor kan ha fått ett överraskande högt värde.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMeta bygger ett AI-datacenter på 5 GW och 2,25 GW gaskraftverk

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAker BP gör ett av Norges största oljefynd på ett decennium, stärker resurserna i Yggdrasilområdet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSommarens torka kan ge högre elpriser i höst

-

Analys4 veckor sedan

Analys4 veckor sedanBrent edges higher as India–Russia oil trade draws U.S. ire and Powell takes the stage at Jackson Hole

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals är verksamt i guldrikt område i Finland

-

Analys4 veckor sedan

Analys4 veckor sedanIncreasing risk that OPEC+ will unwind the last 1.65 mb/d of cuts when they meet on 7 September

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanNeil Atkinson spår att priset på olja kommer att stiga till 70 USD

-

Analys2 veckor sedan

Analys2 veckor sedanOPEC+ in a process of retaking market share