Nyheter

Hedging Versus Speculating That Metal Prices Have Bottomed

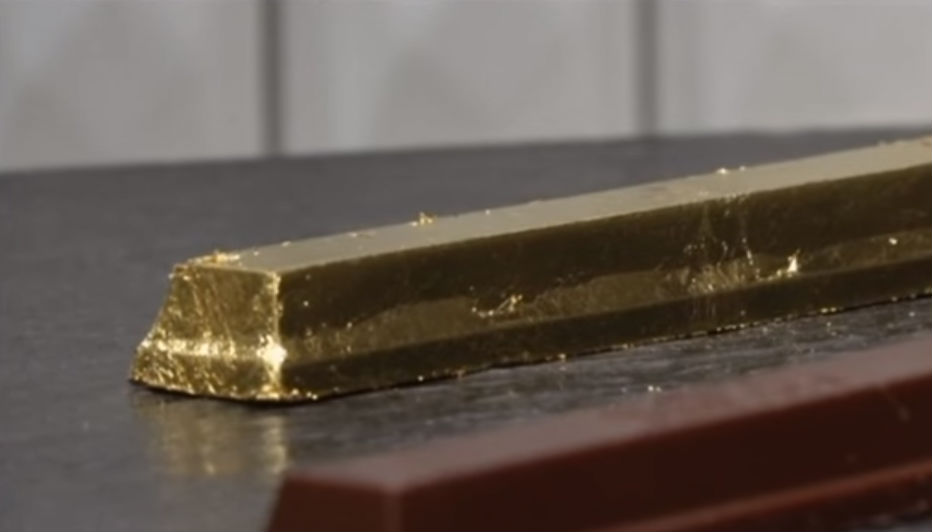

The prices of gold and most other metals have fallen sharply over the past two years, to levels at which many mining companies are financially stressed. Many of these companies do not protect themselves from declining prices. Now, with current prices extremely low, they are not sure whether they should buy an insurance policy.

The prices of gold and most other metals have fallen sharply over the past two years, to levels at which many mining companies are financially stressed. Many of these companies do not protect themselves from declining prices. Now, with current prices extremely low, they are not sure whether they should buy an insurance policy.

Mining companies’ reticence toward managing their financial exposure to the prices received for their products is rooted in several trends that emerged in the 1990s and early 2000s. Producers at that time sometimes bought insurance policies that protected them from falling prices at the expense of (a) their exposure to rising prices and (b) potentially unlimited financial risks if prices of their metal products rose at a time when they could not deliver into fixed-price hedges. All of this could have been avoided, and was by many mining companies, by using strategies that gave them (1) the floor price they sought while (2) preserving most of their exposure to rising prices and (3) capping any marked to market losses they might face at a low, pre-determined maximum level.

Meanwhile there was a misunderstanding about why shareholders invested in mining stocks, a misperception that persists to this day. Investors buy mining shares because they want exposure to rising prices, not prices. Investors will gladly lose their exposure to falling prices if they can maintain their exposure to rising prices. Often hedges were structured that did not provide exposure to rising prices and did not cap any marked to margin financial risks. With a handful of exceptions mining finance executives did not pursue these hedging structures on their own.

Today gold prices and the prices of other metals have fallen sharply from their 2011 – 2013 highs. Some mining executives are speculating that prices cannot fall further, but the history of metals prices show that prices indeed could fall further from even today’s seemingly low levels, and remain below even the average cost of production for several years.

Mining company management needs to use simple hedging structures that protect against further price deterioration while preserving their exposure to rising prices and do not put them at financial risk. This actually can be done easily with hedging strategies that have been around for decades. They also need to convey to their shareholders that when they hedge using such strategies it makes financial sense and protects the company’s viability, without putting it at risk.

All too often only fixed forward and collar hedging strategies are offered which take away the upside exposure and leave the mining companies open to large, unlimited risks. Forwards are touted as providing a floor price as an effective hedge. But when prices rise and a company has hedged using forwards at a lower price the company loses out on the upside and potentially may have to buy back the forwards at a loss. Zero-cost collars also are pushed by trading counterparties, but in reality these strategies are only marginally less destructive of shareholder value than are forwards. There is a price floor provided, but also a price cap that limits upside price participation.

Hedging should allow companies to participate in a rising gold price environment. There are various ways to do this. For example, CPM priced a zero-premium hedge for the next six months today, 18 September. The hedge locks in a floor price of $1,100 per ounce, gives the producer participation up to $1,150. Between $1,150 and $1,200 the producer would get $1,150, giving up a maximum of $50 per ounce of the upside. Above $1,200, the producer would get the market less $50, all the way up. If gold goes to $1,400 per ounce, the mining company gets $1,350. If, in the mining industry’s wildest dreams, the price goes to $2,000, the mining company gets $1,950. And, it gets to stay in business in the meantime, to enjoy the return to such halcyon days.

Many mining executives have commented that prices cannot go much lower, but prices can fall more. To say prices cannot go much lower is to speculate, and to speculate against statistically possible realities. The alternatives to hedging could trigger much more severe financial consequences.

[box]Denna analys är producerad av CPM Group och publiceras med tillstånd på Råvarumarknaden.se.[/box]

Disclaimer

Copyright CPM Group 2012. Not for reproduction or retransmission without written consent of CPM Group. Market Commentary is published by CPM Group and is distributed via e-mail. The views expressed within are solely those of CPM Group. Such information has not been verified, nor does CPM make any representation as to its accuracy or completeness.

Any statements non-factual in nature constitute only current opinions, which are subject to change. While every effort has been made to ensure that the accuracy of the material contained in the reports is correct, CPM Group cannot be held liable for errors or omissions. CPM Group is not soliciting any action based on it. Visit www.cpmgroup.com for more information.

Nyheter

Gruvbolaget Boliden överträffade analytikernas förväntningar

Gruvbolaget Boliden överträffade analytikernas förväntningar med bred marginal när man presenterade resultatet för det tredje kvartalet. Mikael Staffas, vd för Boliden, kommenterar kvartalet och hur han ser på råvarumarknaden och bolagets olika gruvprojekt.

Nyheter

Australien och USA investerar 8,5 miljarder USD för försörjningskedja av kritiska mineraler

USA:s president Donald Trump och Australiens premiärminister Anthony Albanese undertecknade på måndagen ett avtal som ska tillföra miljarder dollar till projekt inom kritiska mineraler.

Länderna kommer tillsammans att bidra med 1-3 miljarder dollar till projekten under de kommande sex månaderna. Den totala projektportföljen är värd 8,5 miljarder dollar, enligt regeringarna.

Galliumraffinaderi med kapacitet för 5x USA:s efterfrågan

Som en del av avtalet kommer det amerikanska försvarsdepartementet även att investera i ett galliumraffinaderi i västra Australien med en kapacitet på 100 ton per år. För närvarande importerar USA omkring 21 ton gallium, vilket motsvarar hela den inhemska konsumtionen, enligt den amerikanska geologiska myndigheten.

Initiativet kommer samtidigt som Kina har infört exportrestriktioner på vissa mineraler, däribland sällsynta jordartsmetaller, som är avgörande för tillverkningen av elektronik och elmotorer. Gallium används till exempel i mikrovågskretsar samt blå och violetta lysdioder (LED), vilka kan användas för att skapa kraftfulla lasrar.

Nyheter

Vad guldets uppgång egentligen betyder för världen

Guldpriset har nyligen nått rekordnivåer, över 4 000 dollar per uns. Denna uppgång är inte bara ett resultat av spekulation, utan speglar djupare förändringar i den globala ekonomin. Bloomberg analyserar hur detta hänger samman med minskad tillit till dollarn, geopolitisk oro och förändrade investeringsmönster.

Guldets roll som säker tillgång har stärkts i takt med att förtroendet för den amerikanska centralbanken minskat. Osäkerhet kring Federal Reserves oberoende, inflationens utveckling och USA:s ekonomiska stabilitet har fått investerare att söka alternativ till fiatvalutor. Donald Trumps handelskrig har också bidragit till att underminera dollarns status som global reservvaluta.

Samtidigt ökar den geopolitiska spänningen, särskilt mellan USA och Kina. Kapitalflykt från Kina, driven av oro för övertryckta valutor och instabilitet i det finansiella systemet, har lett till ökad efterfrågan på guld. Även kryptovalutor som bitcoin stiger i värde, vilket tyder på ett bredare skifte mot hårda tillgångar.

Bloomberg lyfter fram att derivatmarknaden för guld visar tecken på spekulativ överhettning. Positioneringsdata och avvikelser i terminskurvor tyder på att investerare roterar bort från aktier och obligationer till guld. ETF-flöden och CFTC-statistik bekräftar denna trend.

En annan aspekt är att de superrika nu köper upp alla tillgångsslag – aktier, fastigheter, statsobligationer och guld – vilket bryter mot traditionella investeringslogiker där vissa tillgångar fungerar som motvikt till andra. Detta tyder på att marknaden är ur balans och att kapitalfördelningen är skev.

Sammanfattningsvis är guldets prisrally ett tecken på en värld i ekonomisk omkalibrering. Det signalerar misstro mot fiatvalutor, oro för geopolitisk instabilitet och ett skifte i hur investerare ser på risk och trygghet.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Analys4 veckor sedan

Analys4 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanLeading Edge Materials är på rätt plats i rätt tid

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanNytt prisrekord, guld stiger över 4000 USD

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om guld, olja, koppar och stål