Nyheter

David Hargreaves on precious metals, week 47 2011

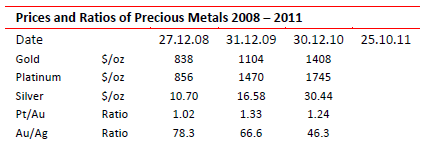

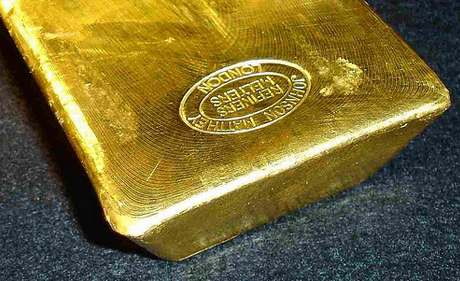

Can demand rise yet the price fall? Sure can. We have been warning for some time that in a severe recession the flight into tangibles will be halted because people will not be able to afford them. So platinum and silver, very much the industrial components of the precious metals trio, are already feeling the strain.

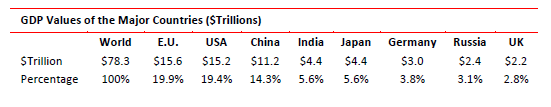

What does it signify? That what goes up might just come down. All three metals are already well below their 2011 highs and platinum is in surplus. The flight from currencies has been the driver for all three above, but a realisation is surely dawning: there is no alternative to the US dollar in volume. We have:

Whilst the EU/Eurozone one is normally the strongest bloc, it is currently struggling to stay alive and would hardly put itself up as the world reserve currency right now. China is wisely content to maintain a fixed parity to the dollar. The others do not have the volume singly and the possibility of their combining is non-existent. So George Washington it is. Now a strong dollar rarely betokens strong gold. So let’s beware the runaway prophets. Not that this will necessarily stop them, GFMS, no less, says investment demand will push silver over $50/oz by late 2012. So far this year it has been a not-soshabby $36. It admits there will be a production – to – consumption surplus, but investment will take up the slack. It forecasts 278Moz from that sector in 2011. Other commentators warn that silver’s very volatility holds its back. It topped $50/oz earlier this year yet slid over $20 in one trading hit. Not good for the digestion.

India should buy more gold. The inhabitants of the world’s second most populous country (it will overtake China soon) are very fond of gold. They took $11bn worth in Q3 2011, level with China and 27% of world total. But not so it’s Central Bank. It has told the Government to buy more. There is certainly scope. To perspectivise it: National stocks stand at 558 tonnes, less than 2% of world bank holdings. For almost 20% of the world’s population that is hardly flying the flag now is it? Even China has almost double that whilst the USA wallows in over 8000 tonnes. Meanwhile India’s Rupee has fallen massively against the dollar and it now at its lowest for 32 months.

Europe and Gold. Is it indicative that Europe bought more gold than either the US or China last year? It is hard to lay that at the doorstop of anything other than the Euro crisis. But with belt tightening its only choice we cannot see the trend continuing; bar a currency collapse, of course.

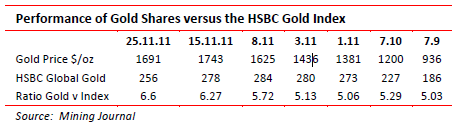

Shares versus Bullion? Only the market will answer the plaintive call for a rerating of gold shares relative to the gold price. So heavyweights like Soros and John Poulson are buying the stocks. Just one teensy problem, would you buy a share when its underlying commodity might go down as easily as go up? Historically, the boys have a case.

The trend is not dramatic but obvious. The current price level for gold is not trusted. Dividend growth is not keeping pace with earnings and even learner ore grades are being pursued.

Central Bank Buying. WGC tells us the national banks bought c. 150 tonnes of gold in Q3 2011 but nobody knows which ones. Clearly only those who can afford it, by virtue of their FOREX reserves. Top of the pops is China, with $3.2 x 10¹².

Before we get excited, that would buy them about 600 tonnes, to bring their total to c. 1700 tonnes, or a half of what Germany holds and about a fifth of Fort Knox levels. It would also curtail their shopping trips to Africa. Nor might it provide the insurance cover many think that brings. Portugal (the P in P11GS) has 82% of its foreign reserves in gold but has just had its government bonds reduced to junk status. Christmas has come early to India. Beside ATMA dispersing little bars of bullion they now throw out diamond jewellery. It will be interesting to learn what the buyback arrangements are.

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

Hur säkrar vi Sveriges tillgång till kritiska metaller och mineral i en ny geopolitisk verklighet?

När världsläget förändras ställs Europas beroende av metaller och mineral på sin spets. Geopolitiska spänningar, handelskonflikter och ett mer oförutsägbart USA gör att vi inte längre kan ta gamla allianser för givna. Samtidigt kontrolleras en stor del av de kritiska råvarorna vi är beroende av av andra makter – inte minst Kina. Vad händer med Sveriges industriella förmåga i ett läge där importen stryps? Hur påverkas försvarsindustrin av Kinas exportrestriktioner? Är EU:s nya råvarupolitik tillräcklig för att minska sårbarheten – eller krävs ytterligare statliga insatser och beredskapslagring? Svemin anordnade den 25 juni ett seminarium som bestod av bestod av deltagare från myndigheter, politik och industri. Man diskuterar Sveriges och EU:s strategiska vägval i en ny global verklighet – och vad som krävs för att säkra tillgången till metaller när vi behöver dem som mest.

Nyheter

Lundin Mining ska bli en av de tio största kopparproducenterna i världen

Lundin Mining är bolaget i Lundin-sfären som satsar stort på Vicuña-projektet i Argentina. Det ska lyfta Lundin Mining till att bli en av de tio största kopparproducenterna i världen skriver Affärsvärlden och upprepar sin köprekommendation för aktien.

”Även om en framgång inte är på förhand given tror vi att Vicuña har goda chanser att bli bra. Vi förnyar vårt köpråd för Lundin Mining”

Enligt Lundin Minings ledning kommer man att klara att finansiera sin del av investeringarna i Vicuña genom det löpande kassaflödet som man förväntar sig ska bli omkring 5 miljarder dollar kommande fem år i kombination med lån.

Nyheter

Sommarvädret styr elpriset i Sverige

Många verksamheter tar nu ett sommaruppehåll och ute värmer solen, det är gott om vatten och vinden blåser. Lägre efterfrågan på el och goda förutsättningar för kraftproduktionen höll ner elpriserna under juni.

Elpriset på den nordiska elbörsen Nord Pool (utan påslag och exklusive moms) i elområde 1 och 2 (Norra Sverige) blev för juni 3,05 respektive 4,99 öre/kWh, vilket är rekordlågt och de lägsta på minst 25 år.

– Elpriset påverkas av en rad faktorer men vädret väger tyngst. På sommaren minskar efterfrågan på el och många verksamheter har ett uppehåll. Detta tillsammans med goda förutsättningar inom kraftproduktionen påverkar elpriset nedåt, säger Jonas Stenbeck, privatkundschef Vattenfall Försäljning Norden.

Den hydrologiska balansen, måttet för att uppskatta hur mycket vatten som finns lagrat ovanför kraftstationerna, ligger över normal nivå, särskilt i norra Skandinavien. Tillgängligheten för kärnkraften i Norden är just nu 82 procent av installerad effekt.

– De goda nordiska produktionsförutsättningarna gör elpriserna mindre känsliga för förändringar i omvärlden, säger Jonas Stenbeck.

Priserna på olja och gas kan dock ändras snabbt med anledning av en turbulent omvärld. På kontinenten har efterfrågan på gas sjunkit och nytt solkraftsrekord för Tyskland sattes på midsommarafton med en produktion på 52,5 GW.

– Många av de goda elvanor vi skaffade oss under elpriskrisen verkar leva kvar och gör nytta även på sommaren. De svenska hushållens elförbrukning under 2024 var faktiskt den lägsta detta millenium, säger Jonas Stenbeck.

| Medelspotpris | Juni 2024 | Juni 2025 |

| Elområde 1, Norra Sverige | 24,04 öre/kWh | 3,05 öre/kWh |

| Elområde 2, Norra Mellansverige | 24,04 öre/kWh | 4,99 öre/kWh |

| Elområde 3, Södra Mellansverige | 27,27 öre/kWh | 22,79 öre/kWh |

| Elområde 4, Södra Sverige | 62,70 öre/kWh | 40,70 öre/kWh |

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanStor uppsida i Lappland Guldprospekterings aktie enligt analys

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSilverpriset släpar efter guldets utveckling, har mer uppsida

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanUppgången i oljepriset planade ut under helgen

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanLåga elpriser i sommar – men mellersta Sverige får en ökning

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMahvie Minerals växlar spår – satsar fullt ut på guld

-

Analys3 veckor sedan

Analys3 veckor sedanVery relaxed at USD 75/b. Risk barometer will likely fluctuate to higher levels with Brent into the 80ies or higher coming 2-3 weeks

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanOljan, guldet och marknadens oroande tystnad

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanJonas Lindvall är tillbaka med ett nytt oljebolag, Perthro, som ska börsnoteras