Nyheter

Molybdenum’s dramatic price response

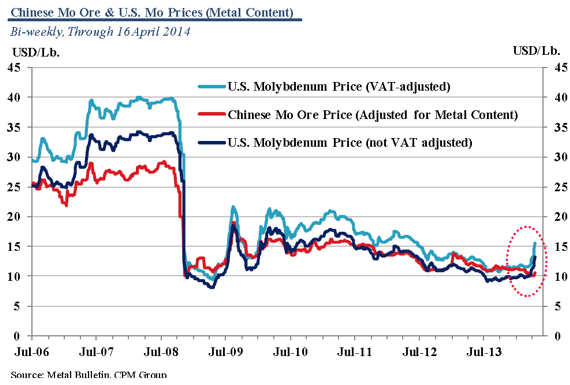

Molybdenum prices in Europe have risen rapidly following the World Trade Organization’s confirmation that the export duties and quotas imposed by China on molybdenum are incompatible with its WTO obligations. This report concludes a dispute initiated in March 2012 when the European Union, Japan, and the United States filed a formal request with the WTO for consultation with China over its restrictions on exports of rare earths, tungsten, and molybdenum. As of 16 April molybdenum prices have jumped nearly 31% to $13.20 (basis Metal Bulletin, US$ per pound Mo contained) since the 26 March report. Prices in China meanwhile are up just 4.2% over this same period.

Molybdenum prices in Europe have risen rapidly following the World Trade Organization’s confirmation that the export duties and quotas imposed by China on molybdenum are incompatible with its WTO obligations. This report concludes a dispute initiated in March 2012 when the European Union, Japan, and the United States filed a formal request with the WTO for consultation with China over its restrictions on exports of rare earths, tungsten, and molybdenum. As of 16 April molybdenum prices have jumped nearly 31% to $13.20 (basis Metal Bulletin, US$ per pound Mo contained) since the 26 March report. Prices in China meanwhile are up just 4.2% over this same period.

China has yet to announce a formal response to the WTO’s ruling. There is a possibility that China may remove the export duties on some molybdenum products as a concession in order to keep duties and quotas on tungsten and rare earths. As part of a January 2013 response to a WTO ruling on a separate case regarding export taxes on silicon metal, silicon carbide, manganese, magnesium, zinc, bauxite, coking coal, fluorspar and yellow phosphorus, the Chinese government removed the 20% duty on the export of EMM as well as some of the duties of other metals.

China may be pushed to reduce or remove the current duties on molybdenum product exports, as had been the case with the electrolytic manganese (EMM) export duty. EMM exports rose strongly in response, possibly due to exporters officially reporting their goods at customs rather than smuggling them out of the country. Official EMM prices also fell.

The case for molybdenum differs from EMM, however, as it is a metal under consideration for a national resource classification. Official regulations for the molybdenum industry could be shifted to the Ministry of Land and Resources, which also manages tungsten and rare earths. There also are government concerns with regard to the price stability of these specialty metal markets. In the past, the Chinese government has adamantly opposed lowering prices for its raw material exports, particularly in instances related to price competition by a large number of domestic exporters. That said, there have been major producers voicing support for lowering trade barriers as they seek to expand sales internationally in response to the lack of orders for the surplus metal in the domestic market.

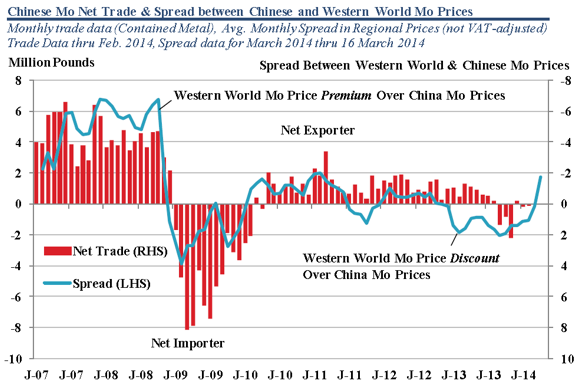

In 2013 China’s domestic molybdenum prices traded at premium (~14.3%) to western world prices so there was no incentive to export molybdenum. This trend remained in place until the run up in western world prices in the first two weeks in April. According to Metal Bulletin, Chinese prices held on average a $0.91 or 9.2% premium over western world price between 1 January and 21 March. Since the ruling, however, western world prices are at a premium to China. As of 16 April, Metal Bulletin reported western world molybdenum at $13.20 and Chinese molybdenum at roughly $10.55, a premium of $2.65 or 20%. Obviously both markets need time to process the news. However, western world prices have risen to levels that will likely encourage exports from China in the near term. Even with current duties in place on various molybdenum products, some of which are as high as 20%, arbitrage opportunities still exist for Chinese exporters. The current sizable price differential may act as an incentive for the Chinese government to keep present taxes in place to help disincentivize exports of their national molybdenum resource.

Furthermore molybdenum prices in the western world are being bolstered by robust demand, which has been strengthening in regions outside of China. This is most notable in Europe and South Korea, which have seen a strong rebound in steel production during first two months of 2014 growing 6.5% and 3.9% year-on-year, respectively, compared to -2.2% and -4.8% in all of 2013. Crude steel production is also strengthening in Japan, with output rising 3.8% in the first two months of 2014 from year ago levels.

[box]Denna analys är producerad av CPM Group och publiceras med tillstånd på Råvarumarknaden.se.[/box]

Disclaimer

Copyright CPM Group 2012. Not for reproduction or retransmission without written consent of CPM Group. Market Commentary is published by CPM Group and is distributed via e-mail. The views expressed within are solely those of CPM Group. Such information has not been verified, nor does CPM make any representation as to its accuracy or completeness.

Any statements non-factual in nature constitute only current opinions, which are subject to change. While every effort has been made to ensure that the accuracy of the material contained in the reports is correct, CPM Group cannot be held liable for errors or omissions. CPM Group is not soliciting any action based on it. Visit www.cpmgroup.com for more information.

Nyheter

Gruvbolaget Boliden överträffade analytikernas förväntningar

Gruvbolaget Boliden överträffade analytikernas förväntningar med bred marginal när man presenterade resultatet för det tredje kvartalet. Mikael Staffas, vd för Boliden, kommenterar kvartalet och hur han ser på råvarumarknaden och bolagets olika gruvprojekt.

Nyheter

Australien och USA investerar 8,5 miljarder USD för försörjningskedja av kritiska mineraler

USA:s president Donald Trump och Australiens premiärminister Anthony Albanese undertecknade på måndagen ett avtal som ska tillföra miljarder dollar till projekt inom kritiska mineraler.

Länderna kommer tillsammans att bidra med 1-3 miljarder dollar till projekten under de kommande sex månaderna. Den totala projektportföljen är värd 8,5 miljarder dollar, enligt regeringarna.

Galliumraffinaderi med kapacitet för 5x USA:s efterfrågan

Som en del av avtalet kommer det amerikanska försvarsdepartementet även att investera i ett galliumraffinaderi i västra Australien med en kapacitet på 100 ton per år. För närvarande importerar USA omkring 21 ton gallium, vilket motsvarar hela den inhemska konsumtionen, enligt den amerikanska geologiska myndigheten.

Initiativet kommer samtidigt som Kina har infört exportrestriktioner på vissa mineraler, däribland sällsynta jordartsmetaller, som är avgörande för tillverkningen av elektronik och elmotorer. Gallium används till exempel i mikrovågskretsar samt blå och violetta lysdioder (LED), vilka kan användas för att skapa kraftfulla lasrar.

Nyheter

Vad guldets uppgång egentligen betyder för världen

Guldpriset har nyligen nått rekordnivåer, över 4 000 dollar per uns. Denna uppgång är inte bara ett resultat av spekulation, utan speglar djupare förändringar i den globala ekonomin. Bloomberg analyserar hur detta hänger samman med minskad tillit till dollarn, geopolitisk oro och förändrade investeringsmönster.

Guldets roll som säker tillgång har stärkts i takt med att förtroendet för den amerikanska centralbanken minskat. Osäkerhet kring Federal Reserves oberoende, inflationens utveckling och USA:s ekonomiska stabilitet har fått investerare att söka alternativ till fiatvalutor. Donald Trumps handelskrig har också bidragit till att underminera dollarns status som global reservvaluta.

Samtidigt ökar den geopolitiska spänningen, särskilt mellan USA och Kina. Kapitalflykt från Kina, driven av oro för övertryckta valutor och instabilitet i det finansiella systemet, har lett till ökad efterfrågan på guld. Även kryptovalutor som bitcoin stiger i värde, vilket tyder på ett bredare skifte mot hårda tillgångar.

Bloomberg lyfter fram att derivatmarknaden för guld visar tecken på spekulativ överhettning. Positioneringsdata och avvikelser i terminskurvor tyder på att investerare roterar bort från aktier och obligationer till guld. ETF-flöden och CFTC-statistik bekräftar denna trend.

En annan aspekt är att de superrika nu köper upp alla tillgångsslag – aktier, fastigheter, statsobligationer och guld – vilket bryter mot traditionella investeringslogiker där vissa tillgångar fungerar som motvikt till andra. Detta tyder på att marknaden är ur balans och att kapitalfördelningen är skev.

Sammanfattningsvis är guldets prisrally ett tecken på en värld i ekonomisk omkalibrering. Det signalerar misstro mot fiatvalutor, oro för geopolitisk instabilitet och ett skifte i hur investerare ser på risk och trygghet.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanLeading Edge Materials är på rätt plats i rätt tid

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanNytt prisrekord, guld stiger över 4000 USD

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om guld, olja, koppar och stål

-

Analys3 veckor sedan

Analys3 veckor sedanOPEC+ will likely unwind 500 kb/d of voluntary quotas in October. But a full unwind of 1.5 mb/d in one go could be in the cards