Nyheter

Investors pouring into platinum futures and options

Platinum has been a focal point for investors in the first half of 2014. This precious and strategic metal has many interesting fundamental developments suggesting prices will rise sharply, including a historically significant strike in the South African platinum mines, increased tension between second-major supplier Russia and the United States, and rising fabrication demand in the automotive catalytic converters as the European auto market revives.

Platinum has been a focal point for investors in the first half of 2014. This precious and strategic metal has many interesting fundamental developments suggesting prices will rise sharply, including a historically significant strike in the South African platinum mines, increased tension between second-major supplier Russia and the United States, and rising fabrication demand in the automotive catalytic converters as the European auto market revives.

The strike is moving toward a resolution as this is being written. As had been expected, platinum and palladium prices fell sharply this morning on the news that the union would take the producers’ offer to the workers for a vote. The workers still need to vote, but are likely to accept the deal. It should take up to two months to get the mines back to full production; they have been operating at around 60% capacity during the strike.

As explained below, the strike actually has been a negative factor for platinum prices over the past five months. With the strike behind the market now, platinum prices could rise more forcefully.

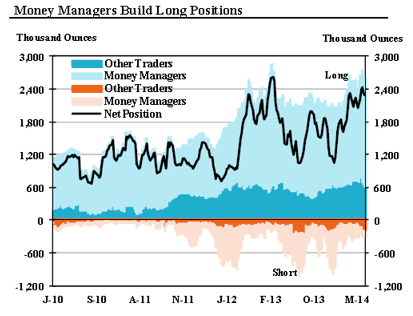

Investors are playing platinum in different ways. There has been an enormous increase in the trading volume and open interest of platinum on the CME’s Nymex futures and options contracts so far this year, as money managers, commodity trade advisors, commodity funds, and others have built historically record high long positions based on the supposition that prices will rise sharply. These investors are looking beyond the South African strike and see platinum as likely to experience significant future price increases. The buying primarily has been in Nymex futures and options, as the investors appear to be focusing on the leverage and ease of transactions provided in these investment vehicles compared to exchange traded funds or physical metal.

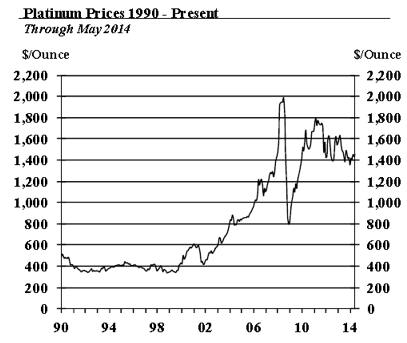

Prices meanwhile have moved mostly sideways since January. The pressure for higher prices due to the increased long positions and positive fundamentals has been offset, for now, by physical market selling by two groups of investors. The first group are stale-bull liquidators, investors who bought platinum in 2001 – 2007 at prices between $400 and $1,200. Up to early 2008 the investors made money as prices inexorably rose. Then prices entered an extremely volatile period, from 2008 through 2011. By the end of 2011 many of the hedge funds, family offices, and other investors who held this metal were shell-shocked by the volatility and began selling. Many of them still have very good profits in their platinum positions, having bought the metal at prices between $400 and $800 per ounce a decade ago. Since late 2011 they have been consistently selling.

The other sellers have been investors who have watched platinum prices flat-line in the face of all of these positive fundamental developments since January and have concluded that if prices were not going to rise during the strike prices should be expected to drop sharply but perhaps only briefly once the strike is settled. This week’s price drop confirmed that thesis. Investors now are trying to assess whether further declines are likely over the next few days as the strike completely resolves. While some of these investors are abandoning platinum many of them seem just as interested in being long platinum as the money managers building up positions on the Nymex. It’s just that they were selling during the strike with the plan to re-establish their platinum positions at lower prices once the strike settles, on the assumption that prices would drop on the news of a settlement, offering them an opportunity to rebuild their long positions at lower prices. If the price does not drop, they are likely to not have lost anything in the meantime, they reasoned.

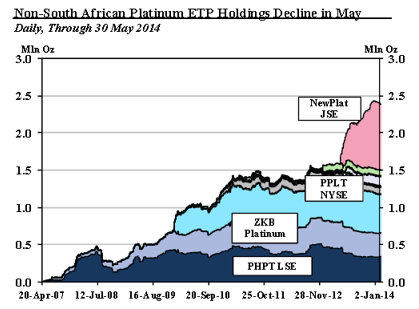

Interestingly, holdings of non-South African platinum exchange traded products have not risen but declined in May. This reflects the fact that investors are seeking the leverage Nymex futures and options offer, which is not available with platinum ETPs or physical metal.

Physical Market Trends Supporting Platinum Prices

The South African platinum mining industry, which produces 72% of world mine production and 60% of total supply including scrap, has been locked in this bitter, deadly strike since 23 January, slashing South African supplies by 40%. Total production losses will be more than one million ounces. As a result 13% to 20% of global refined platinum inventories are being absorbed due to the strike.

The strike is critical to the industry: In recent years a new, violent, Communist labor union, the Association of Mineworkers and Construction Union, has supplanted the old guard National Union of Mineworkers, offering to fight more forcefully for workers. AMCU is aligned with the Economic Freedom Fighters party, which promotes economic policies including mines nationalization. The NUM is aligned with the African National Congress. The militancy of the new union is one of the factors making investors bullish about platinum beyond the strike.

The major South African producers face even more difficult problems now that the strike is ending. Few people realize that South African production already has declined 19% between 2006 and 2013 due to long-term problems. Further reductions in production are likely, as these problems require radical restructuring of the PGM mining industry. Meanwhile some market participants have become worried about shipments of platinum from Russia, which at 754,000 ounces per year is the second largest source of platinum, due to the increased tensions and hostilities between Russia and the United States, with western Europe and Ukraine caught in the middle.

Use of platinum also has been rising. Auto sales, especially of European diesel passenger cars, are rising at strong rates this year, boosting platinum use. Sales of large commercial diesel vehicles using platinum were up 9% in the first quarter in the United States, and are expected to post healthy increases in sales, and demand for platinum, for the full year.

Opportunities in Nymex Futures and Options

With the strike now ending, the downward pressure from investor selling of physical metal based on expectations of a post-settlement drop in prices is behind the market. Investors have been building long positions in Nymex futures and options based on the view that platinum’s fundamentals beyond the strike suggest sharply higher prices. The rise in long positions held by money managers and other investors indicates the extent of this trend. So does the reduction in willingness to hold short positions. This investor interest is showing on the Nymex as investors are seeking the leverage offered by Nymex futures and options, as opposed to physical metal or ETFs.

[box]Denna analys är producerad av CPM Group och publiceras med tillstånd på Råvarumarknaden.se.[/box]

Disclaimer

Copyright CPM Group 2012. Not for reproduction or retransmission without written consent of CPM Group. Market Commentary is published by CPM Group and is distributed via e-mail. The views expressed within are solely those of CPM Group. Such information has not been verified, nor does CPM make any representation as to its accuracy or completeness.

Any statements non-factual in nature constitute only current opinions, which are subject to change. While every effort has been made to ensure that the accuracy of the material contained in the reports is correct, CPM Group cannot be held liable for errors or omissions. CPM Group is not soliciting any action based on it. Visit www.cpmgroup.com for more information.

Nyheter

Christian Kopfer kommenterar guld, koppar, olja och stål, samt några råvarubolag

Handelsbankens råvaruanalytiker Christian Kopfer kommenterar vad som just nu händer med råvarorna guld, koppar, olja och stål. Han tar bland annat upp att man inte vill att kopparpriset kommer upp FÖR mycket, utan att det i stället är högt under lång tid.

Han avslutar även med att ge några korta kommentar om råvaruaktier. Han anser att SSAB sköter sig bra samtidigt som värderingen är låg. Han gillar Lundin Mining och Boliden, även om den senare aktien kommit upp något senaste dagarna. Lundin Gold har banken ingen täckning på men han säger att det är ett fantastiskt bolag.

Nyheter

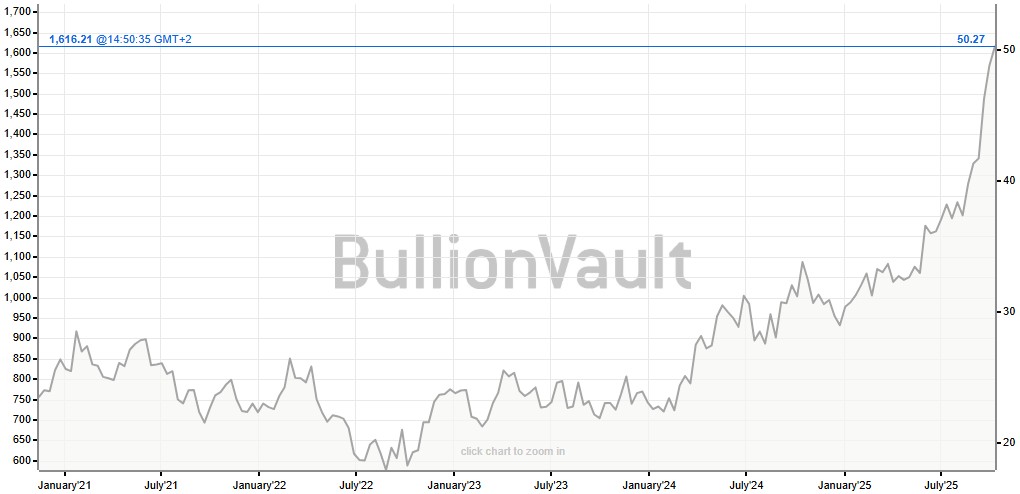

Silver spränger den magiska gränsen, kostar nu över 50 USD per uns

Ädelmetallen silver spränger en smått magisk gräns och handlas nu över 50 USD per uns. Priset har verkligen exploderat. Silver följer med i ett bredare rally där fult nyligen sprängde 4000 USD per uns-nivån. Priset för att låna silver har också skjutit i höjden på senare tid vilket indikerar att tillgången på silver på den fysiska marknaden har börjat bli lågt. Samtidig är efterfrågan från industrin bra och räntorna låga. Och på toppen av det kan vi lägga geopolitisk oro som gör att fler letar sig till fysiska tillgångar som silver.

Nyheter

Blykalla, Evroc och Studsvik vill bygga kärnkraftsdrivna datacenter i Sverige

Blykalla, Evroc och Studsvik har undertecknat ett samförståndsavtal för att undersöka möjligheten att utveckla Sveriges första kärnkraftsdrivna datacenter vid Studsviks licensierade kärnkraftsanläggning i Nyköping.

Blykalla utvecklar avancerade blykylda kärnreaktorer för att leverera säker, kostnadseffektiv och hållbar basenergi. Evroc bygger hyperscale-moln- och AI-infrastruktur för att driva Europas digitala framtid. Studsvik driver en licensierad kärnkraftsanläggning i Nyköping och tillhandahåller livscykeltjänster för kärnkraftssektorn, inklusive bränsle, material och avfallshantering. Tillsammans kombinerar de teknik, infrastruktur och anläggningsexpertis för att påskynda utbyggnaden av kärnkraftsdrivna datacenter.

Det finns en växande internationell efterfrågan på kärnkraftsdrivna datacenter, driven av parallella krav från AI och elektrifiering. Med sin kapacitet att leverera ren, pålitlig baskraft och inbyggd redundans är små modulära reaktorer särskilt väl lämpade för att möta detta behov.

Belastar inte elnätet

En stor fördel med att bygga datacenter och kärnkraftverk bredvid varandra är att elnätet inte belastas. Det gör totalpriset för elektriciteten blir lägre, samtidigt som det inte tillkommer investeringskostnader för operatören av elnätet.

Vill etablera Sverige som en föregångare

Med detta avtal strävar parterna efter att etablera Sverige som en föregångare i denna globala omställning, genom att utnyttja Studsviks licensierade anläggning, Evrocs digitala infrastruktur och Blykallas avancerade SMR-teknik.

”Detta samarbete är en möjlighet för Sverige att bli ledande inom digital infrastruktur. Det ger oss möjlighet att visa hur små modulära reaktorer kan tillhandahålla den stabila, fossilfria energi som krävs för AI-revolutionen”, säger Jacob Stedman, vd för Blykalla. ”Studsviks anläggning och evrocs ambitioner erbjuder rätt förutsättningar för ett banbrytande projekt.”

Samförståndsavtalet fastställer en ram för samarbete mellan de tre parterna. Målet är att utvärdera den kommersiella och tekniska genomförbarheten av att samlokalisera datacenter och SMR på Studsviks licensierade anläggning, samarbeta med kommuner och markägare samt definiera hur en framtida kommersiell struktur för elköpsavtal skulle kunna se ut.

”Den ständigt växande efterfrågan på AI understryker det akuta behovet av att snabbt bygga ut en massiv hyperskalig AI-infrastruktur. Genom vårt samarbete med Blykalla och Studsvik utforskar vi en modell där Sverige kan ta ledningen i byggandet av en klimatneutral digital infrastruktur”, kommenterar Mattias Åström, grundare och VD för Evroc.

”Studsvik erbjuder en unik plattform med anläggningsinfrastruktur och unik kompetens för att kombinera avancerad kärnkraft med nästa generations industri. Detta samförståndsavtal är ett viktigt steg för att utvärdera hur sådana synergier kan realiseras i Sverige”, kommenterar Karl Thedéen, vd för Studsvik.

Parterna kommer nu att inrätta en gemensam styrgrupp för att utvärdera anläggningen och affärsmodellen, med målet att inleda formella partnerskapsförhandlingar senare i år. Deras fortsatta samarbete ska möjliggöra ren och säker energi för Europas AI-infrastruktur och digitala infrastruktur.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMahvie Minerals i en guldtrend

-

Analys4 veckor sedan

Analys4 veckor sedanVolatile but going nowhere. Brent crude circles USD 66 as market weighs surplus vs risk

-

Nyheter4 veckor sedan

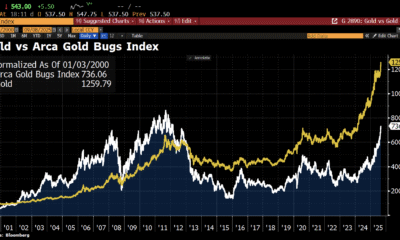

Nyheter4 veckor sedanAktier i guldbolag laggar priset på guld

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanKinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanTyskland har så höga elpriser att företag inte har råd att använda elektricitet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuld når sin högsta nivå någonsin, nu även justerat för inflation

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanDet stigande guldpriset en utmaning för smyckesköpare

-

Analys3 veckor sedan

Analys3 veckor sedanBrent crude ticks higher on tension, but market structure stays soft