Analys

Handelsbanken Jordbruk, 29 september 2014

Specifikationer för kvarnvete MATIF

Specifikationer för kvarnvete MATIF

Hela hösten har det spekulerats vilt om huruvida det vete som handlas på börsen i Paris verkligen representerar ett kvarnvete eller ej. Osäkerheten grundar sig i att i börsens kravspecifikation för vete som går till leverans finns inget skrivet om falltal utan endast följande:

Rymdvikt 76 kg/hl, vattenhalt 15%, skadade kärnor 4%, grodda kärnor 2% och renhet 2%. Därtill regler om t.ex. mykotoxinnivå och europeiskt ursprung men alltså inget om falltal och inte heller protein. Dock står det att de företag som driver för leverans godkända silos kan applicera ytterligare och mer restriktiva krav – vilket de gör.

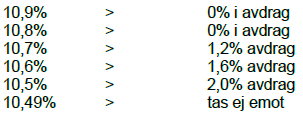

Ett av dessa företag är Senalia. De använder sig normalt, så även i år, av följande modell för prisjustering utifrån proteinhalt med bas 11%:

skörden nådde detta krav. Ett så bra år finns inga skäl för Senalia att godkänna annat än vete med falltal över 220. I diskussion i helgen med Laurent Martel, chef för Senalia, sa Laurent att de främst sätter sina krav utifrån hur efterfrågan på exportmarknaden ser ut och att det viktigaste för honom är att upprätthålla omsättning – alltså ta in vete som lever upp till kundernas behov. Men Senalia är ett företag som tjänar sina pengar på lagring och omsättning av vete och vill således ha så mycket volym som möjligt, och justerar därför sina krav utifrån rådande marknadssituation – vilken påverkas inte bara av efterfrågan men även av utbudet.

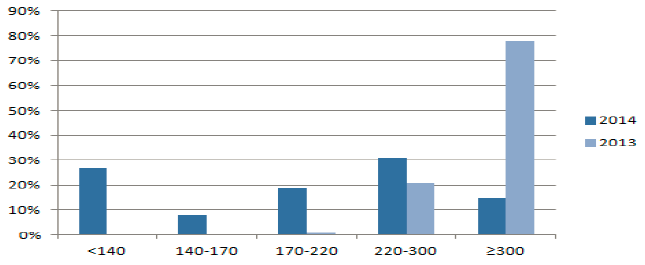

I år håller det franska vetet överlag en klart sämre kvalitet, åtminstone vad gäller falltal – bara 46% av landets vete håller, enligt officiell statistik, ett falltal över 220. Och Senalia har i år också sänkt sina falltalskrav, till som lägst 170.

Förmodligen är inte exportmöjligheterna speciellt stora för vete med falltal 170 – stora köpare som Egypten kräver som lägst 200 och Algeriet vill ha vete med falltal lägst 230. Men genom att sänka kraven på vete för att mer motsvara utbudet i landet får Senalia lättare att upprätthålla volym. Och helt klart kommer de att försöka blanda in detta vete i partier med bättre kvalitet så att även delar av denna volym når exportmarknaden – vilket nog inte är en helt olönsam affär ett år som detta med stor prisskillnad mellan olika kvaliteter.

Det är också rimligt att anta att om leverans kan ske av MATIF-vete med falltal på 170 så lär ingen i år låta sina kontrakt gå till leverans om det vete de innehar är av bättre kvalitet. Såvida inte leverans av MATIF-vetet var förenat även med prisjustering för falltal – vilket det alltså inte verkar vara idag. Så var det åtminstone år 1989 med prisavdrag på 1/1000 per sekund med maximalt 15 sekunder i avvikelse.

MATIF-vetet bör alltså idag rimligen prisas som ett vete med, förutom övriga kriterier, ett falltal på 170. På vissa marknader anses detta vara mer ett fodervete men på den franska kvarnmarknaden ses även detta vete som ett kvarnvete. Om än inte av bästa kvalitet men det duger för landets kvarnindustris generellt sett relativt låga krav med stor produktion av mjöl till kakor och baguetter. Svaret på den inledande frågan är alltså enligt vår uppfattning att MATIF-vetet representerar franskt kvarnvete, förutom övriga kriterier, när det är som sämst falltalsmässigt – vilket i år alltså är sämre än t.ex. förra året och normalåret.

Den stora frågan är sen om priset på MATIF-vetet idag är prisat rätt utifrån ett vete med falltal på 170? Fysiska priser i Frankrike noteras kring EUR 140 per ton för ren fodervete och kvarnvete med falltal 220 kring dryga EUR 160 per ton. MATIF-vetet handlas idag ganska så exakt i mitten av dessa två – vilket som vi uppfattar MATIF-vetet inte känns helt orimligt. Märk dock att detta gäller terminer för årets skörd. Vid prisande av terminer kopplade till 2015 års skörd bör marknaden rimligen anta en återgång till en mer normal fransk veteproduktion med högre falltal och en situation där Senalia inte godkänner falltal på 170 – dessa terminer handlas också till ett klart högre pris.

Framtida förändringar?

Börsen, Euronext, säger sig överväga framtida tillägg i kravspecifikationer framöver – vilket dock så fall får verkan först på kontrakt med förfall efter maj 2017 då ändringar inte kan göras i kontrakt med öppna positioner. Kanske vore ändå en modell där de mottagande siloföretagen inför prisjusteringar utifrån falltalsnivå och rådande marknadsläge för året i Frankrike, eller ännu hellre Europa med fler leveranspunkter, att föredra – där MATIF-vetet i grunden är ett kvarnvete med falltal 220 men där prisjustering nedåt sker utifrån fastställd skala under onormala år med sänkta falltalskrav som 2014.

[box]Handelsbanken Jordbruk är producerat av Handelsbanken och publiceras i samarbete och med tillstånd på Råvarumarknaden.se[/box]

Ansvarsbegränsning

Detta material är producerat av Svenska Handelsbanken AB (publ) i fortsättningen kallad Handelsbanken. De som arbetar med innehållet är inte analytiker och materialet är inte oberoende investeringsanalys. Innehållet är uteslutande avsett för kunder i Sverige. Syftet är att ge en allmän information till Handelsbankens kunder och utgör inte ett personligt investeringsråd eller en personlig rekommendation. Informationen ska inte ensamt utgöra underlag för investeringsbeslut. Kunder bör inhämta råd från sina rådgivare och basera sina investeringsbeslut utifrån egen erfarenhet.

Informationen i materialet kan ändras och också avvika från de åsikter som uttrycks i oberoende investeringsanalyser från Handelsbanken. Informationen grundar sig på allmänt tillgänglig information och är hämtad från källor som bedöms som tillförlitliga, men riktigheten kan inte garanteras och informationen kan vara ofullständig eller nedkortad. Ingen del av förslaget får reproduceras eller distribueras till någon annan person utan att Handelsbanken dessförinnan lämnat sitt skriftliga medgivande. Handelsbanken ansvarar inte för att materialet används på ett sätt som strider mot förbudet mot vidarebefordran eller offentliggörs i strid med bankens regler.

Analys

More weakness and lower price levels ahead, but the world won’t drown in oil in 2026

Some rebound but not much. Brent crude rebounded 1.5% yesterday to $65.47/b. This morning it is inching 0.2% up to $65.6/b. The lowest close last week was on Thursday at $64.11/b.

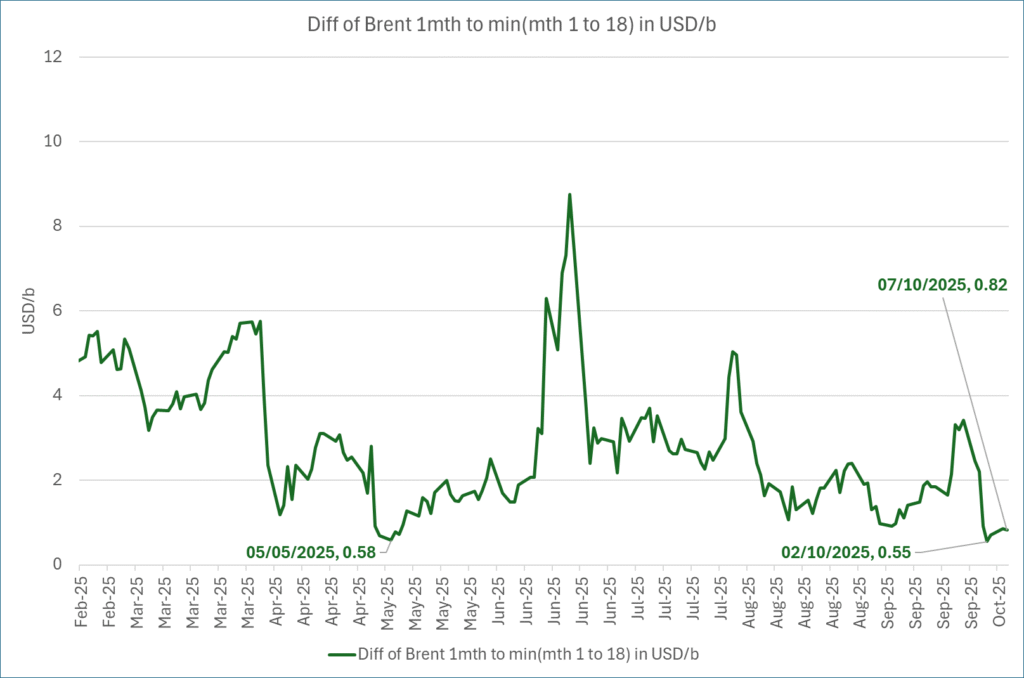

The curve structure is almost as week as it was before the weekend. The rebound we now have gotten post the message from OPEC+ over the weekend is to a large degree a rebound along the curve rather than much strengthening at the front-end of the curve. That part of the curve structure is almost as weak as it was last Thursday.

We are still on a weakening path. The message from OPEC+ over the weekend was we are still on a weakening path with rising supply from the group. It is just not as rapidly weakening as was feared ahead of the weekend when a quota hike of 500 kb/d/mth for November was discussed.

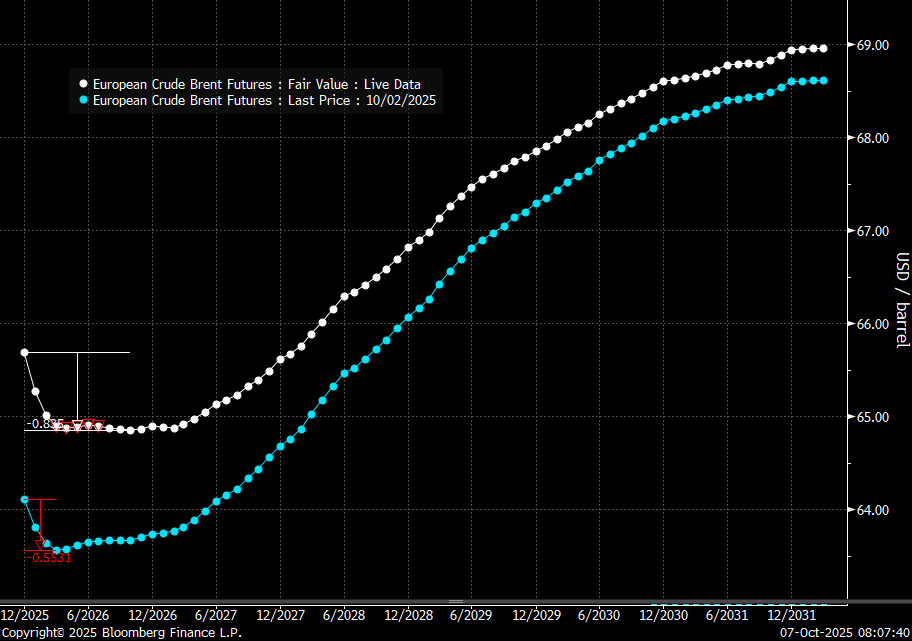

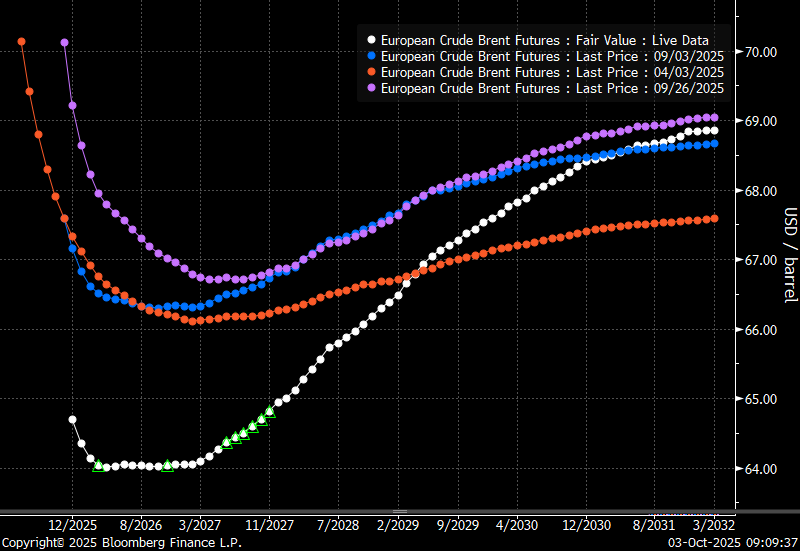

The Brent curve is on its way to full contango with Brent dipping into the $50ies/b. Thus the ongoing weakening we have had in the crude curve since the start of the year, and especially since early June, will continue until the Brent crude oil forward curve is in full contango along with visibly rising US and OECD oil inventories. The front-month Brent contract will then flip down towards the $60/b-line and below into the $50ies/b.

At what point will OPEC+ turn to cuts? The big question then becomes: When will OPEC+ turn around to make some cuts? At what (price) point will they choose to stabilize the market? Because for sure they will. Higher oil inventories, some more shedding of drilling rigs in US shale and Brent into the 50ies somewhere is probably where the group will step in.

There is nothing we have seen from the group so far which indicates that they will close their eyes, let the world drown in oil and the oil price crash to $40/b or below.

The message from OPEC+ is also about balance and stability. The world won’t drown in oil in 2026. The message from the group as far as we manage to interpret it is twofold: 1) Taking back market share which requires a lower price for non-OPEC+ to back off a bit, and 2) Oil market stability and balance. It is not just about 1. Thus fretting about how we are all going to drown in oil in 2026 is totally off the mark by just focusing on point 1.

When to buy cal 2026? Before Christmas when Brent hits $55/b and before OPEC+ holds its last meeting of the year which is likely to be in early December.

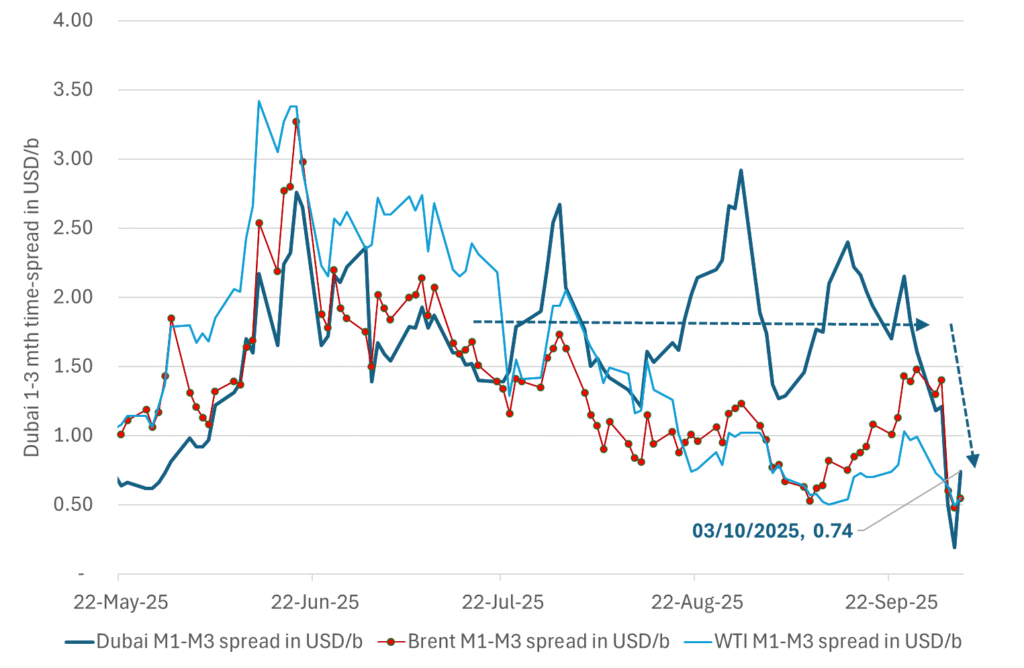

Brent crude oil prices have rebounded a bit along the forward curve. Not much strengthening in the structure of the curve. The front-end backwardation is not much stronger today than on its weakest level so far this year which was on Thursday last week.

The front-end backwardation fell to its weakest level so far this year on Thursday last week. A slight pickup yesterday and today, but still very close to the weakest year to date. More oil from OPEC+ in the coming months and softer demand and rising inventories. We are heading for yet softer levels.

Analys

A sharp weakening at the core of the oil market: The Dubai curve

Down to the lowest since early May. Brent crude has fallen sharply the latest four days. It closed at USD 64.11/b yesterday which is the lowest since early May. It is staging a 1.3% rebound this morning along with gains in both equities and industrial metals with an added touch of support from a softer USD on top.

What stands out the most to us this week is the collapse in the Dubai one to three months time-spread.

Dubai is medium sour crude. OPEC+ is in general medium sour crude production. Asian refineries are predominantly designed to process medium sour crude. So Dubai is the real measure of the balance between OPEC+ holding back or not versus Asian oil demand for consumption and stock building.

A sharp weakening of the front-end of the Dubai curve. The front-end of the Dubai crude curve has been holding out very solidly throughout this summer while the front-end of the Brent and WTI curves have been steadily softening. But the strength in the Dubai curve in our view was carrying the crude oil market in general. A source of strength in the crude oil market. The core of the strength.

The now finally sharp decline of the front-end of the Dubai crude curve is thus a strong shift. Weakness in the Dubai crude marker is weakness in the core of the oil market. The core which has helped to hold the oil market elevated.

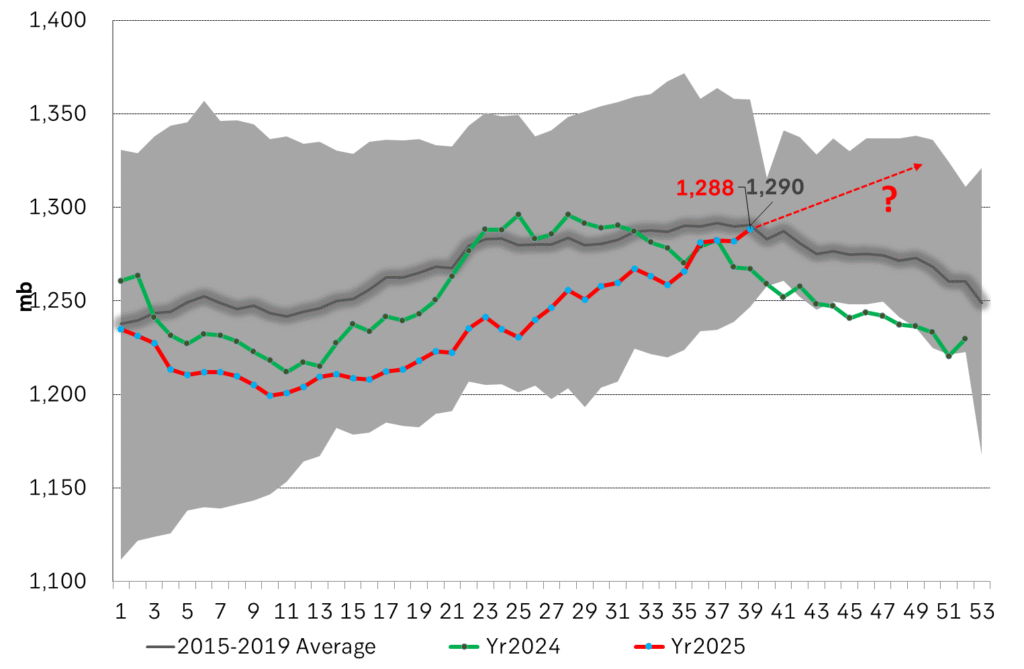

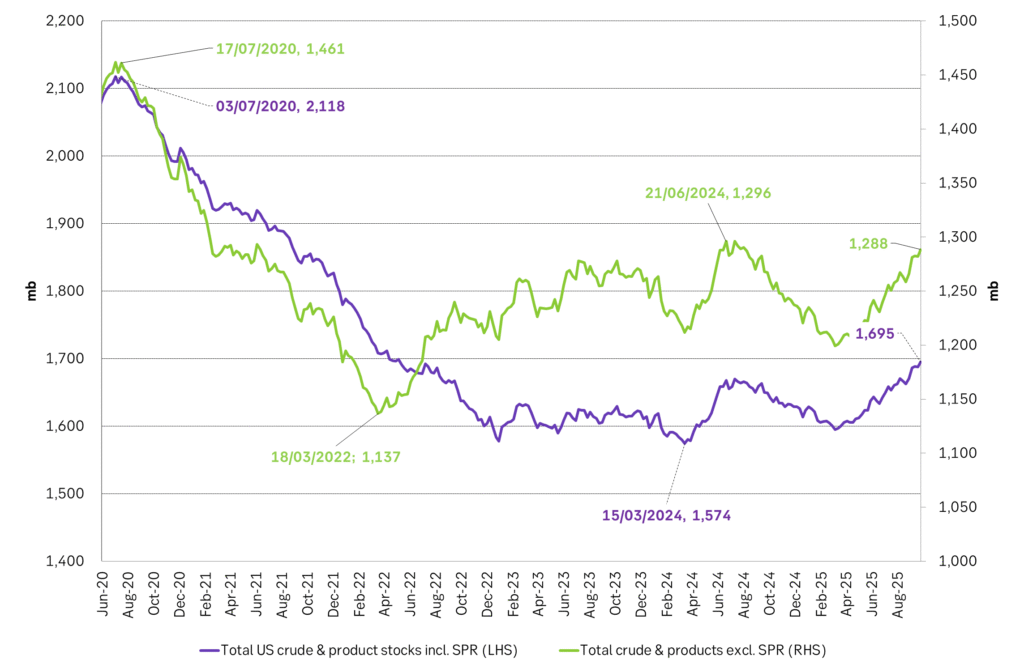

Facts supports the weakening. Add in facts of Iraq lifting production from Kurdistan through Turkey. Saudi Arabia lifting production to 10 mb/d in September (normal production level) and lifting exports as well as domestic demand for oil for power for air con is fading along with summer heat. Add also in counter seasonal rise in US crude and product stocks last week. US oil stocks usually decline by 1.3 mb/week this time of year. Last week they instead rose 6.4 mb/week (+7.2 mb if including SPR). Total US commercial oil stocks are now only 2.1 mb below the 2015-19 seasonal average. US oil stocks normally decline from now to Christmas. If they instead continue to rise, then it will be strongly counter seasonal rise and will create a very strong bearish pressure on oil prices.

Will OPEC+ lift its voluntary quotas by zero, 137 kb/d, 500 kb/d or 1.5 mb/d? On Sunday of course OPEC+ will decide on how much to unwind of the remaining 1.5 mb/d of voluntary quotas for November. Will it be 137 kb/d yet again as for October? Will it be 500 kb/d as was talked about earlier this week? Or will it be a full unwind in one go of 1.5 mb/d? We think most likely now it will be at least 500 kb/d and possibly a full unwind. We discussed this in a not earlier this week: ”500 kb/d of voluntary quotas in October. But a full unwind of 1.5 mb/d”

The strength in the front-end of the Dubai curve held out through summer while Brent and WTI curve structures weakened steadily. That core strength helped to keep flat crude oil prices elevated close to the 70-line. Now also the Dubai curve has given in.

Brent crude oil forward curves

Total US commercial stocks now close to normal. Counter seasonal rise last week. Rest of year?

Total US crude and product stocks on a steady trend higher.

Analys

OPEC+ will likely unwind 500 kb/d of voluntary quotas in October. But a full unwind of 1.5 mb/d in one go could be in the cards

Down to mid-60ies as Iraq lifts production while Saudi may be tired of voluntary cut frugality. The Brent December contract dropped 1.6% yesterday to USD 66.03/b. This morning it is down another 0.3% to USD 65.8/b. The drop in the price came on the back of the combined news that Iraq has resumed 190 kb/d of production in Kurdistan with exports through Turkey while OPEC+ delegates send signals that the group will unwind the remaining 1.65 mb/d (less the 137 kb/d in October) of voluntary cuts at a pace of 500 kb/d per month pace.

Signals of accelerated unwind and Iraqi increase may be connected. Russia, Kazakhstan and Iraq were main offenders versus the voluntary quotas they had agreed to follow. Russia had a production ’debt’ (cumulative overproduction versus quota) of close to 90 mb in March this year while Kazakhstan had a ’debt’ of about 60 mb and the same for Iraq. This apparently made Saudi Arabia angry this spring. Why should Saudi Arabia hold back if the other voluntary cutters were just freeriding? Thus the sudden rapid unwinding of voluntary cuts. That is at least one angle of explanations for the accelerated unwinding.

If the offenders with production debts then refrained from lifting production as the voluntary cuts were rapidly unwinded, then they could ’pay back’ their ’debts’ as they would under-produce versus the new and steadily higher quotas.

Forget about Kazakhstan. Its production was just too far above the quotas with no hope that the country would hold back production due to cross-ownership of oil assets by international oil companies. But Russia and Iraq should be able to do it.

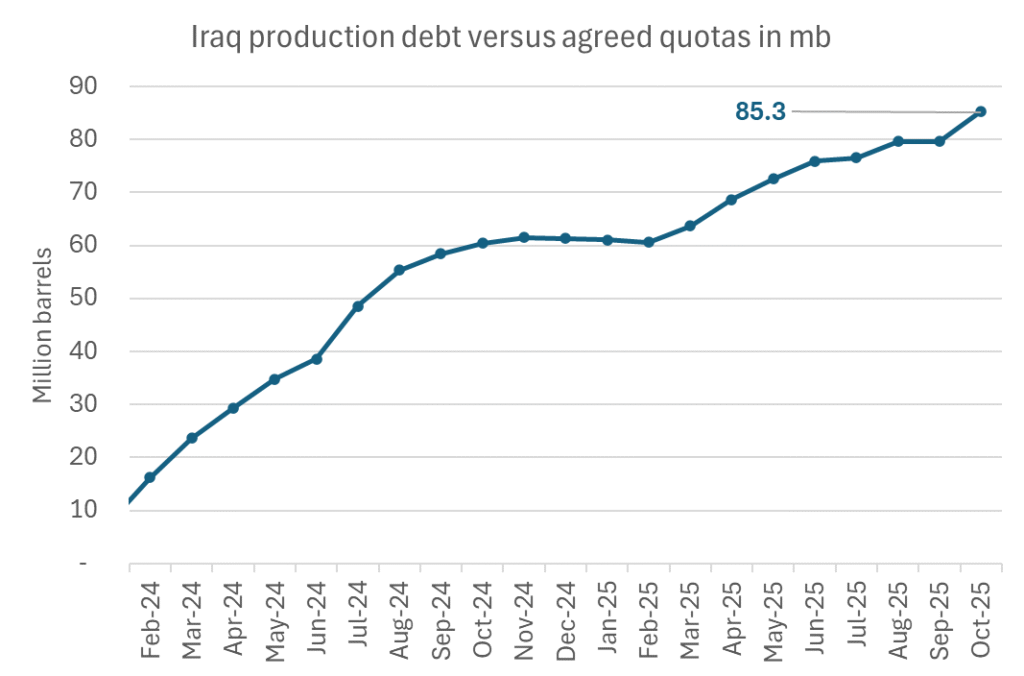

Iraqi cumulative overproduction versus quotas could reach 85-90 mb in October. Iraq has however steadily continued to overproduce by 3-5 mb per month. In July its new and gradually higher quota came close to equal with a cumulative overproduction of only 0.6 mb that month. In August again however its production had an overshoot of 100 kb/d or 3.1 mb for the month. Its cumulative production debt had then risen to close to 80 mb. We don’t know for September yet. But looking at October we now know that its production will likely average close to 4.5 mb/d due to the revival of 190 kb/d of production in Kurdistan. Its quota however will only be 4.24 mb/d. Its overproduction in October will thus likely be around 250 kb/d above its quota with its production debt rising another 7-8 mb to a total of close to 90 mb.

Again, why should Saudi Arabia be frugal while Iraq is freeriding. Better to get rid of the voluntary quotas as quickly as possible and then start all over with clean sheets.

Unwinding the remaining 1.513 mb/d in one go in October? If OPEC+ unwinds the remaining 1.513 mb/d of voluntary cuts in one big go in October, then Iraq’s quota will be around 4.4 mb/d for October versus its likely production of close to 4.5 mb/d for the coming month..

OPEC+ should thus unwind the remaining 1.513 mb/d (1.65 – 0.137 mb/d) in one go for October in order for the quota of Iraq to be able to keep track with Iraq’s actual production increase.

October 5 will show how it plays out. But a quota unwind of at least 500 kb/d for Oct seems likely. An overall increase of at least 500 kb/d in the voluntary quota for October looks likely. But it could be the whole 1.513 mb/d in one go. If the increase in the quota is ’only’ 500 kb/d then Iraqi cumulative production will still rise by 5.7 mb to a total of 85 mb in October.

Iraqi production debt versus quotas will likely rise by 5.7 mb in October if OPEC+ only lifts the overall quota by 500 kb/d in October. Here assuming historical production debt did not rise in September. That Iraq lifts its production by 190 kb/d in October to 4.47 mb/d (August level + 190 kb/d) and that OPEC+ unwinds 500 kb/d of the remining quotas in October when they decide on this on 5 October.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanKinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanTyskland har så höga elpriser att företag inte har råd att använda elektricitet

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om guld, olja, fjärrvärme och förnybar energi

-

Analys4 veckor sedan

Analys4 veckor sedanBrent crude ticks higher on tension, but market structure stays soft

-

Analys3 veckor sedan

Analys3 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuldpriset uppe på nya höjder, nu 3750 USD