Nyheter

Gold ready for new uptrend

– longer term confidence seems justified –

MINING SHARES GROSSLY UNDERVALUED

While the reports about the European currency worries continue to make the headlines, the mining and exploration industry is continuing making progress, here and there even in a remarkably manner. After I was in New York to attend the Hard Assets Investment Conference three weeks ago, I also was in Vancouver last week to be at Cambridge House’s World Resource Investment Conference. I listened to several of the best speakers you can find and the pictures they painted were not all blossoming but at all times realistic.

It is obvious that also the resource industry has to find its own way to escape the impact of the increasing consequences of the worldwide trend that people are hesitant to spend their money. Compared to almost any other industry, the resource industry has the big advantage that metal prices are maintaining their levels, despite the concerns of the imminent economic restraints. The growth of the new economic powers like China, India, Brazil and some other countries will continue and as a result, the need for all the metals will remain intact. Therefore, I am confident that the metal producers with their higher production figures, good cash flows and increasing profits and many exploration companies with their ongoing drill results and discoveries will lead the way to keep the long term bull market in the resource markets going.

So let me elaborate a bit on some of the speeches and meetings I had in New York and Vancouver with gold and silver guru’s, metals and mining specialists and executives. It is always amazing that being at this kind of events results in much better information and impressions than reading the tens of reports that I find in my inbox every day.

In New York, the most remarkable speakers were Dennis Gartman, Frank Holmes, Eric Sprott, Paul van Eeden. With Gartman and Van Eeden as the advocates from the negativo’s and Holmes and Sprott being the positivo’s. Gartman is not really known as an optimist but I see him as a very cautious person. He took the stand against the over-optimistic look that many speakers and writers have without bringing forward much to substantiate their optimism. He is a brilliant speaker, always interesting to listen to and giving the audience some interesting insight in how he evaluates the markets. Paul van Eeden always makes me wonder. He is a very nice and intelligent guy, knows how to catch his audience but then never surprises us with his outlook. He always finds something to be negative about. I have said it several times in the past: sometimes, I can’t even understand why he is in this business, there is no fun in being pessimistic all the time. But his prediction history has learned he is wrong most of the times….. On the positive side, it is always nice and interesting to listen to Frank Holmes and Eric Sprott. Both have a very good way to explain things to their audience.

Holmes with an impressive insight, understanding and reasoning of economics and translating his findings into the markets. Sprott radiates confidence for the longer term, built on his good reasons and showing in his own, always modest manner why he has been one of the most successful investors in the resource sector.

Of the many company presentations, I restricted myself to those that I am interested in the most. In this respect, I name Montero Mining (TSXV:MON) because of their rare earth elements project in Tanzania, Torex Gold (TSX:TXG) developing the Morelos Gold project in Mexico into a mine, Aurcana (TSXV:AUN) with the story about the exciting Shafter Silver Mine in Texas, Silvercorp (NYSE,TSX:SVM) with their most impressive silver production in China, Sunward Resources (TSX:SWD) with their most advanced Titiribi gold/copper project in Colombia, and lastly a true discovery, Auriga Gold (TSXV:AIA), building a mine at the Maverick Hold project in Manitoba.

![]() In Vancouver, I enjoyed listening to Brent Cook, Frank Holmes again, Rick Rule, David Morgan, Doug Casey and Peter Schiff. Although some were cautious, like Rick Rule issued a warning about the possible drying up of financing sources for many of the exploration companies six months from now, but all radiated their confidence in the gold price and gold, silver and other metals and mining shares as the appropriate way to invest in. As you know, these views are confirming my own vision that the resource markets are the markets to be in for investors.

In Vancouver, I enjoyed listening to Brent Cook, Frank Holmes again, Rick Rule, David Morgan, Doug Casey and Peter Schiff. Although some were cautious, like Rick Rule issued a warning about the possible drying up of financing sources for many of the exploration companies six months from now, but all radiated their confidence in the gold price and gold, silver and other metals and mining shares as the appropriate way to invest in. As you know, these views are confirming my own vision that the resource markets are the markets to be in for investors.

Expressing the opportunities that these markets are offering in these times of crises, economic and monetary problems, dubious support programs for countries in trouble, I had to think of a statement that one of the speakers in New York issued, ”A CRISIS IS A TERRIBLE THING TO WASTE”. I can’t agree more. Here, I want to refer to the presentation of Peter Schiff who I featured with a video in my previous issue. I have followed him rather closely since I met him a few years ago in Singapore. He is a very outspoken speaker who doesn’t hesitate to shake up his audience by bold statements which are nevertheless well-placed and true. In these times, where many point the fingers to the current problems of Europe to rescue countries like Greece, Spain, Portugal, Italy and possible others, he clearly stated the same as I do when asked for my opinion on Europe: Europe has issues to resolve yes, but the real problem is the financial situation of the United States! It may be relatively quiet there, as both Obama and Romney are suppressing the situation in an effort to keep their electorates happy, but some day it will come out with a revenge. Schiff’s comments will not make him very popular with a big part of the population in his own country but he is still very right with his observations.

As to the companies that I heard presenting and/or talked to, I find most worthwhile to mention SilverCrest Mines (TSXV:SVL), producing silver at their Santa Elena mine in Mexico, Revolution Resources (TSX:RV), exploring for gold in Mexico and the US, Riverside Resources (TSXV:RRI), with its impressive project base in Mexico, Columbus Gold (TSXV:CGT), exploring and developing their gold project in French Guyana, Orex Minerals (TSXV:REX), active in Mexico in Sweden and Edgewater Exploration (TSXV:EDW), with their interesting projects in Spain and Ghana.

Like I said above, a visit to these events is more inspiring and informative than reading all the reports and recommendations I receive everyday from the net. As in any other business, it is the people that counts, the personal approach and visions.

After all, it is the people involved that are determining for the eventual success of a resource project.

Another thing I observed is that where it is usual that the gold price takes a dive when a significant mining event is about to begin or taking place, the gold price jumped above the $1,600 lever just before the Vancouver event opened. I am sure that that price increase resulted in the more optimistic atmosphere at the Vancouver conference than there was in New York. But, as my regular followers could know, I was not surprised. I have been looking for a continuance of the good gold markets for some time already, because I just see the reasons why they should be performing well.

Based on my long-term view, and comforted by the views of those colleagues that I have come to value for their intelligent approached of all factors concerning the markets, I think that confidence the metals for the longer term is justified. I feel that the markets could still be testing their recent lows for a while but in general, that gold may be looking forward to a new, longer-term uptrend. And when the imminent financial situation of the United States will become more visible, there may be more than that. However, my confidence is not build on that. I am not preaching doom and gloom, I have said it before, gold doesn’t need that to be able to shine……

As gold is the barometer of many other markets, it certainly is the guideline for the valuation of mining and exploration shares. Although, judging from the currently remarkable undervaluation of those shares, you would not think so. It is obvious though, that this undervaluation is offering opportunities. I see quite a number of mining and exploration shares that are doing very, very well. Producers that are sure to experience and show further growth of their production figures, cash flows and earnings over the next few years, developers that will bring their projects into production, and explorers that will continue to report encouraging drill results and further progress to the development stage.

To me, it is clear that mining and exploration shares provide a good enough chance for nice investment results over the next few months and years.

As it is likely that the economic and financial developments in the world will not be solved overnight, not even in the foreseeable future, it is evenly likely that more investors will come to recognize the merits of the resource industry and adopt mining and exploration shares as a welcome addition to their portfolios.

Increasing production capacity and exploring existing mineral deposits at La Negra

Increasing production capacity and exploring existing mineral deposits at La Negra

Aurcana Corporation

TSXV:AUN – price May 28: C$0.95

shares outstanding: 430.8 million, fully diluted: 558.0 million

Aurcana acquired the La Negra silver-copper-zinc-lead mine in Queretaro State in March 2006. Before it was put on care and maintenance in 2000, the mine produced 36 million oz silver, 323 million lbs zinc, 70 million lbs copper and 161 million lbs lead between 1970 and 2000. Aurcana refurbished the mine and mill, started full production in April 2007 at 800tpd and resumed exploration activities. The mill capacity was soon increased to 1,000 tpd, further to 1,500tpd in 2010 and will be expanded to 2,000tpd this year. Based on a mill capacity of 1500tpd, La Negra produced 1.7 million ounces of silver equivalent last year. During the last few quarters, production achieved record levels; in Q1 of 2012, silver production was reported at 287,486 ounces, the largest quarter for silver production in Aurcana’s history.

On the property, 28 mineral deposits are outlined, 23 historically by Peñoles and 5 more by the La Negra staff, accessible through over 60km of underground development on 5 main levels unto 500m vertical. Illustrating the perspective is that the existing mineral resource is based mainly on 3 of the 28 deposits. These 3 deposits are open at depth and other deposits are being investigated. At present, a 15,000m exploration program is in progress. In December 2011, the company reported that it identified significant amounts of mineralization with strong silver and copper values at the 1920m level. An updated resource figure is expected real soon.

Aurcana is the newest Supporting Company and I am really pleased to be able to report their developments to you. I am impressed about what the company achieved since Lenec Rodriguez became its President & CEO in May 2009. He brought vision and financing ability to the company. The Grand Opening of their Shafter Mine in the US will be taking place next week (see the June issue of GOLDVIEW) and the La Negra project is developing rapidly into a nice second production project. Aurcana is definitely on the go!

Avrupa Minerals Ltd.

Avrupa Minerals Ltd.

TSXV:AVU – price June 18: C$0.24

shares outstanding: 20.1 million, fully diluted: 33.4 million

When I mention Avrupa to people, they often ask me where the name comes from. It is Turkish for Europe. The connection with Turkish is that Paul Kuhn, the President of Avrupa has spent 15 years as a geologist in Turkey and the connection with Europe is that Avrupa has set its eyes on being a ’project generator’ in Europe. This means that management’s goal is to explore projects up to the stage where they can be jointventured with or sold to larger companies for further exploration and development. Its project base now consists of 14 exploration licenses in Portugal, Kosovo and, quite surprisingly, in Germany, all in regions with existing mines and strong geological potential for more discoveries.

In the south of Portugal, Avrupa is looking for copper and zinc at the Marateca and Alvalade JV projects, for precious metals and rare earth elements in the Aljezur project area and for copper and gold porphyry potential in the newly issued Alvito project area. In the north of the country, Avrupa is focusing on tungsten and gold at the Covas JV and on gold, bismuth and tellurium on the recently awarded Arga license.

In Kosovo, the company is exploring for silver, lead and zinc at the Glavej, Kamenica, Selac and Bajgora properties in the Trepça Mineral Belt of the Vardar Zone, historically Europe’s most productive district for lead and zinc. In southern Kosovo, it has copper and gold potential with the Koritnik exploration license area.

Then, in Germany, not really considered to be a mining country except for its past as a substantial coal producer, Avrupa will be exploring for gold in the eastern part of the country with the 307km² Oelsnitz project, situated in the historic Erzgebirge Mining region, where tin, tungsten, silver, base metals and uranium have been produced for over 1000 years.

At present, exploration is ongoing at the Alvalade project, a joint-venture with Antofagasta, the copper-molybdenum-gold major, where a phase 1 drilling program was just completed, to be followed by a further phase 2 program in August.

Antofagasta has an expenditure option of US$4.3 million to earn-in 51% of the project and has already forwarded US$1.5 million to Avrupa for the project’s exploration work.

Just a few days ago, Avrupa announced that the first exploration work has started on the Oelsnitz project in Germany. Although most exploration work in the area are on tin and tungsten, Avrupa will be initially looking for gold, which is known to be there.

I am excited having Avrupa as a new Supporting Company and thus, being able to report on their progress. In these times that the world is pointing at Europe as the primary source of general uncertainty due to the financial problems of some of the EU members, I feel that the world should also come to realize that Europe has a substantial resource potential. Even within Europe, the investment communities hardly know about it. Avrupa is a very welcome addition and I am confident Paul Kuhn and his team could bring me and you some nice surprises. An interesting company, good management and fascinating projects.

An historic mining hero revives to become a solid gold producer in B.C. again

An historic mining hero revives to become a solid gold producer in B.C. again

Bralorne Gold Mines Ltd.

TSXV:BPM – price June 18: C$0.73

shares outstanding: 28.3 million, fully diluted: 31.7 million

The Bralorne gold mine used to be a landmark in southwest British Columbia’s mining history, as were the King and Pioneer mines. Together, these three historic mines represent the largest gold producer in the Canadian Cordillera, producing 4.1 million ounces of gold. That was between the years 1932 and 1971 when the fixed US$35 gold price made production uneconomic. But just a year ago, Bralorne Gold Mines celebrated the grand re-opening of the mine, situated at a distance of 150 air miles or a 5 hour drive from Vancouver, and used the occasion to pour the first 254 ounces gold and 59 ounces of silver brick, symbolizing the beginning of a new future as a gold producer. At present, the first focus is set on expanding resources and reserves and increase production over the next few years. Mill operations are still modest at 100tpd but expected to be expanded to a next level of 250-280tpd by 2013 with a possible further expansion to the already permitted 500tpd level thereafter.

The exploration program is primarily directed towards the gap areas between the three mines which are largely underexplored. In the old days, exploration was hardly done since the veins that were followed supplied ample of production feed. Over the last five years, exploration has been intensified and some remarkable results were achieved. A significant development is seen at the BK Zones between the Bralorne and King properties. Surface and underground drilling in 2010 and 2011 returned several real high grade interceptions, such as 140.46g/t over 0.6m, 43.51g/t over 0.9m and 1,764g/t over 0.9m, to be surpassed by an exciting interception of 94.3g/t over 71.9m this year.

At the Bralorne mine, exploration and production go hand in hand. There is sufficient mill feed on site to continue the operations during the next 18 months and the new discoveries are adding to the existing reserves.

Just two weeks ago, Bralorne has commissioned its technical consultants to deliver a new Preliminary Economic Assessment report on the operational sustainability of the current 100tpd operation. This report should be the basis to further realize management’s projections for 2013: at a production capacity of 250tpd, Bralorne could be producing 28,870 ounces of gold at cash production cost of $400-450 per ounce, bringing a revenue of $37.5 million (based on US$1300/oz).

Old production figures may not sound so impressive except when you translate them into money: the 4.15 million ounces of gold that were mined in the past, would be worth US$6.7 billion at today’s prices…. The reported exploration results indicate that there is still more of the richness of the historic gold camp present at the Bralorne grounds. I know President Bill Kocken and Director David Wolfin since long and I have no doubts that they, with their strengthened management team, will bring the mines and the company forward again to a modest but financially very successful gold mining operation.

Lomiko Metals

Lomiko Metals

TSXV:LMR – price June 18: C$0.075

shares outstanding: 66.3 million, fully diluted: 82.3 million

Graphite seems to be the newest darling of the Canadian mining and exploration industry. Many companies have joined the race for potential graphite properties and the attention of a growing group of investment commentators makes graphite look and sound like the newest gold. For an explanation of graphite, which is for 70% produced in China, I refer to the extensive information that is available on Lomiko’s website and other sites. In this context, I only mention the least abundant form of graphite, the graphite flakes which comprise 40% of the supply and then in particular the very limited high grade crystal flakes that can be used the ’Green Technology’ for Li-ion batteries, fuel cells and other green tech applications. Just for the impression, few people know that there is actually 10-20% more graphite than lithium in a Li-ion battery, used for smartphones, photography, electric cars, computer industry.

Lomiko Metals is one of quite a number of companies that have opened the search for graphite. The word graphite seems to be a sound of magic like the original sound of the gold rush, just like it was with uranium a few years ago.

From all the companies I have looked at and/or listened to, Lomiko stands out, principally for two reasons: 1. its management with Paul Gill as President and CEO, knows what they are talking about, and 2. it has acquired a property in Quebec, approximately 175km northwest of Montreal, with a comforting past history of graphite exploration. Lomiko acquired the original Quatre Miles Graphite property which was originally staked and explored by Graphicor Resources Inc. in 1989, way before the sound of graphite was associated with any glory. That company completed mapping, prospecting, ground geophysics and 26 hole diamond drill program to a total of 1625m. The work identified several conductive trends and at least three, relatively flat lying graphitic beds. Three surface samples were collected and analyzed returning results of 14.16% Cgf, 18.06% Cgf and 20.35% Cgf. Of the initial 26 drill holes, 23 intersected graphite concentrations with a highlight of 8.07% Cgf over 28.60m and a highest individual assay of 15.48% Cgf over 0.50m. It should be noted that these results date from the pre-NI43-101 era and need to be verified by current standards of exploration.

Last week, Lomiko Metals announced that it had started its first exploration work on the Quatre Miles property. The $307,028 Phase I program and the subsequent $724,041 Phase II program will focus on verifying the areas of the historical high-grade intersections. Management aims to complete both phases and establish a flake graphite resource at the property by December 2012.

I am excited to have Lomiko Metals as a Supporting Company and look forward to follow Lomiko’s progress in this fascinating ”new” graphite industry. The known results of the historic work are highly encouraging and if and when Lomiko succeeds to indeed verify the high grade graphite flake mineralization, the company will take a giant leap forward and thus, become one of the most advanced graphite companies. Quite a challenge!

Although the weather here does not reveal that we are in the right season, I do wish you a very pleasant and well-deserved……

Whenever and wherever you will go to enjoy your holiday, I am almost sure that you will keep in touch with the markets of gold, other metals and mining and exploration shares.

The politicians may take their long recess but the world’s issues don’t stop asking their attention, the markets don’t close but the metals don’t stop shining and the drills don’t stop making their rounds. It may be time for leisure, relaxing and pleasure but the opportunities don’t stop coming…………….

Be there, wherever you are, but above all, enjoy!!

Henk J. Krasenberg

[hr]

European Gold Centre

European Gold Centre analyzes and comments on gold, other metals & minerals and international mining and exploration companies in perspective to the rapidly changing world of economics, finance and investments. Through its publications, The Centre informs international investors, both institutional and private, primarily in Europe but also worldwide, who have an interest in natural resources and investing in resource companies.

The Centre also provides assistance to international mining and exploration companies in building and expanding their European investor following and shareholdership.

Henk J. Krasenberg

After my professional career in security analysis, investment advisory, porfolio management and investment banking, I made the decision to concentrate on and specialize in the world of metals, minerals and mining finance. From 1983 to 1992, I have been writing and consulting about gold, other metals and minerals and resource companies.

The depressed metal markets of the early 1990’s led me to a temporary shift. I pursued one of my other hobbies and started an art gallery in contemporary abstracts, awaiting a new cycle in metals and mining. That started to come in the early 2000’s and I returned to metals and mining in 2002 with the European Gold Centre.

With my GOLDVIEW reports, I have built an extensive institutional investor following in Europe and more of a private investor following in the rest of the world. In 2007, I introduced my MINING IN AFRICA publication, to be followed by MINING IN EUROPE in 2010 and MINING IN MEXICO in 2012.

For more information: www.europeangoldcentre.com

Nyheter

Guld och silver stiger hela tiden mot nya höjder

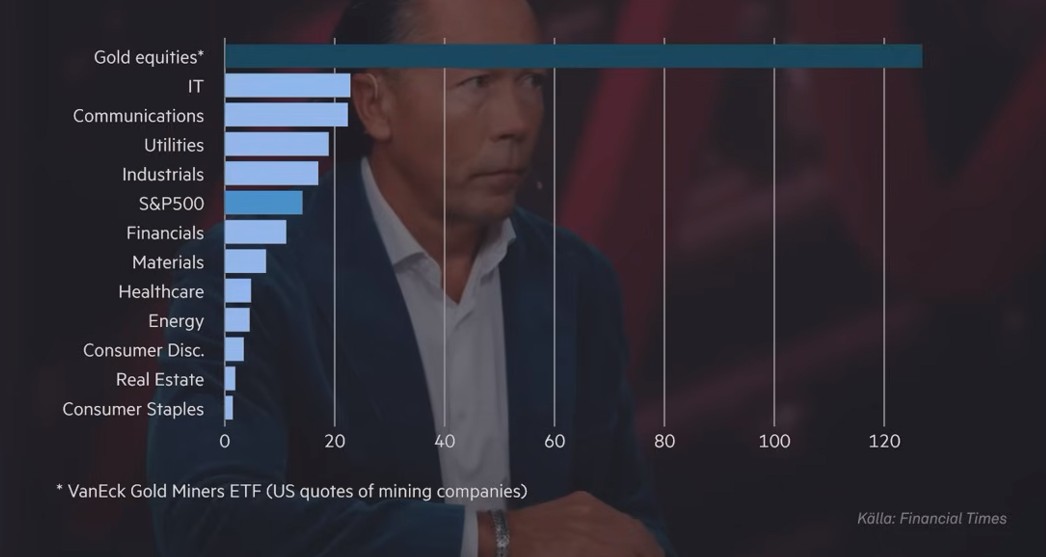

Priserna på guld och silver stiger hela tiden mot nya höjder. Eric Strand går här igenom vilka faktorerna som ligger bakom uppgångarna och vad som kan hända framöver. Han får även kommentera aktier inom guldgruvbolag som har haft en bättre utveckling än nästan allt annat. Han säger bland annat att uppgången kommer från låga nivåer och att det i genomsnitt är en mycket högre kvalitet på ledningarna för bolagen idag.

Nyheter

Samtal om sällsynta jordartsmetaller, guld och silver

Samtal om sällsynta jordartsmetaller, guld och silver, samt gruvbolag. Clara My Lernborg på EFN ger sin syn på sällsynta jordartsmetaller som blivit centrala i den globala geopolitiken. Sarah Tomlinson på Metals Focus ger sin syn på guld. Eric Strand på AuAg Fonder ger sin syn på guld, silver och relaterade gruvbolagsaktier.

Nyheter

Brookfield köper bränsleceller för 5 miljarder USD av Bloom Energy för att driva AI-datacenter

Brookfield och Bloom Energy inleder ett partnerskap där Brookfield i den första fasen köper bränsleceller för 5 miljarder USD av Bloom Energy för att driva AI-datacenter. Bränslecellerna kommer att installeras bakom elmätarna och AI-datacentren kommer således inte att belasta eller vara beroende av elnätet.

Partnerskapet markerar den första fasen i en gemensam vision om att bygga AI-datacenter som kan möta den snabbt växande efterfrågan på beräkningskapacitet och energi inom artificiell intelligens.

AI-datacenter kräver infrastruktur som integrerar beräkningskraft, energi, datacenterarkitektur och kapital på ett tätt och effektivt sätt. Bloom Energys bränsleceller levererar pålitlig, skalbar och lokal energi som snabbt kan tas i drift utan beroende av traditionella elnät. Brookfield tillför världsledande kompetens inom infrastrukturutveckling och finansiering.

I kärnan av det nya partnerskapet kommer Brookfield att investera upp till 5 miljarder dollar för att införa Blooms avancerade bränslecellsteknik. Bolagen samarbetar aktivt kring utformning och leverans av AI-datacenter globalt – inklusive en europeisk anläggning som kommer att offentliggöras innan årets slut.

”AI-infrastruktur måste byggas som en fabrik – med syfte, hastighet och skala,” säger KR Sridhar, grundare, ordförande och vd för Bloom Energy. ”Till skillnad från traditionella fabriker kräver AI-fabriker enorm energitillgång, snabb etablering och realtidsanpassning till belastning – något som gamla elnät inte klarar av. Den effektiva AI-fabriken uppnås genom att energi, infrastruktur och beräkningskraft designas i harmoni från dag ett. Det är den principen som styr vårt samarbete med Brookfield när vi omformar framtidens datacenter. Tillsammans skapar vi en ny ritning för hur AI skalas upp med kraft.”

”Energilösningar bakom mätaren är avgörande för att överbrygga elnätsgapet för AI-fabriker,” säger Sikander Rashid, global chef för AI-infrastruktur på Brookfield. ”Blooms avancerade bränslecellsteknik ger oss en unik möjlighet att designa och bygga moderna AI-fabriker med ett helhetsperspektiv på energibehov. Som världens största investerare inom AI-infrastruktur tillför detta partnerskap ett kraftfullt nytt verktyg till vår globala tillväxtstrategi – särskilt i en marknad där tillgången till elnät är begränsad.”

AI-datacenter i USA förväntas använda 100 gigawatt vid 2035

Enligt prognosoer väntas elförbrukningen från AI-datacenter i USA växa exponentiellt och överstiga 100 gigawatt till 2035. Bränsleceller har blivit en nyckellösning för att möta detta problem, och partnerskapet mellan Bloom Energy och Brookfield är utformat för att hantera just detta energigap.

Bloom Energy har erfarenhet

Bloom Energy har redan installerat hundratals megawatt av sin bränslecellsteknik i datacenter och levererar el till några av världens mest kritiska digitala infrastrukturer genom partnerskap med American Electric Power (AEP), Equinix och Oracle.

Brookfield är en jätte inom digital infrastruktur

Detta partnerskap utgör Brookfields första investering inom sin dedikerade AI-infrastruktur-strategi, som fokuserar på investeringar i stora AI-datacenter, energilösningar, beräkningsinfrastruktur och strategiska kapitalpartnerskap. Strategin bygger vidare på Brookfields erfarenhet av att ha investerat över 100 miljarder dollar i digital infrastruktur globalt.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om guld, olja, fjärrvärme och förnybar energi

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Analys3 veckor sedan

Analys3 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuldpriset uppe på nya höjder, nu 3750 USD

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanEtt samtal om guld, olja, koppar och stål