Nyheter

David Hargreaves on precious metals, week 38 2014

Our friend the gold price was sitting outside the bar, dribbling into a half pint of lemonade, sobbing uncontrollably. We tried to comfort him. “Cheer up”, we said, “Things could get worse.”

“Like you told me last week,” he said, “and things did get worse. Look 20% adrift in 18 months and no end to it.”

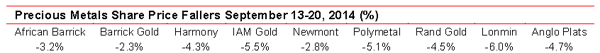

We empathised. It is cold comfort looking down the barrel of $1200 and realising some of your competitors are for $1000 or less. Yet that is the market. It is all about the threat of interest rates rising, the paper economy booming and who needs a sterile asset? Cold comfort, too, that platinum and silver, each with an industrial content, are following gold down the slippery slope. The gold/silver ratio was 55.0/1.0 in late 2012, now it is 67.0/1.0. So we are even turning our backs on the cheaper alternative. For how much longer? For as long as it takes, might be the bland reply. As long as the scare problems of the world are seen to be containable, as long as economic recovery remains a nearby prospect, we shall not ramp gold over its stablemates. Now most shares are suffering. A glance down this week’s shows:

There were spasmodic risers, mostly benefitting from positive news announcements. So: Anglo Gold Ashanti (+3.0%), Fresnillo (+8.3%), which we further report.

Gold Corp (G.TO C$25.91; Hi-Lo C$32.46-21.87) the world’s largest by market value, expects to top 4.0Moz/yr by 2016 which will anchor it at No 4 by output unless Anglogold capitulates. It qualifies by saying that quality not quantity is the yardstick, so at least, we hope, some lessons are learnt.

The London Gold Fix. The shake-out gathers steam. The gold fix had to be amended and it will be. By what? The London Bullion Market Association and its four contributing banks say a new system will be in place by October and at least 15 firms have thrown their hats in the ring! Silver bent to the same change-demand and there is now an electronic auction mechanism run by the CME jointly with Thompson Reuters.

The Shanghai Free Trade Zone (SFTZ) on which we commented last week, started business on September 18th.

WIM says: This is rapidly becoming the biggest physical gold trading centre in the world. Let’s hope it flies.

GFMS says gold is entering a ‘period of recuperation’. Is that the same as saying it is flat on its back and cannot get out of bed? Of course, one day, the price will recover, but – we ask – from what level?

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

Guld och silver stiger hela tiden mot nya höjder

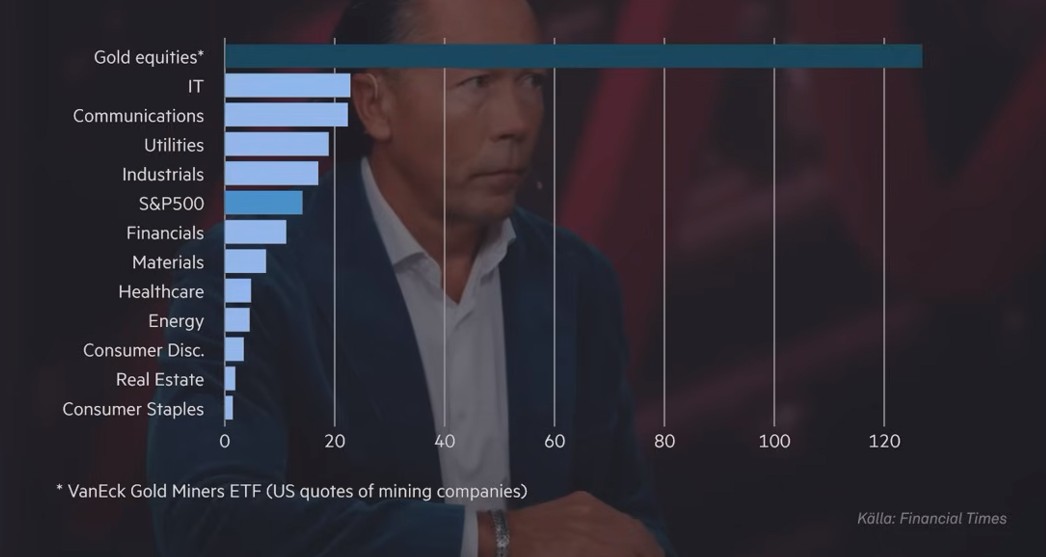

Priserna på guld och silver stiger hela tiden mot nya höjder. Eric Strand går här igenom vilka faktorerna som ligger bakom uppgångarna och vad som kan hända framöver. Han får även kommentera aktier inom guldgruvbolag som har haft en bättre utveckling än nästan allt annat. Han säger bland annat att uppgången kommer från låga nivåer och att det i genomsnitt är en mycket högre kvalitet på ledningarna för bolagen idag.

Nyheter

Samtal om sällsynta jordartsmetaller, guld och silver

Samtal om sällsynta jordartsmetaller, guld och silver, samt gruvbolag. Clara My Lernborg på EFN ger sin syn på sällsynta jordartsmetaller som blivit centrala i den globala geopolitiken. Sarah Tomlinson på Metals Focus ger sin syn på guld. Eric Strand på AuAg Fonder ger sin syn på guld, silver och relaterade gruvbolagsaktier.

Nyheter

Brookfield köper bränsleceller för 5 miljarder USD av Bloom Energy för att driva AI-datacenter

Brookfield och Bloom Energy inleder ett partnerskap där Brookfield i den första fasen köper bränsleceller för 5 miljarder USD av Bloom Energy för att driva AI-datacenter. Bränslecellerna kommer att installeras bakom elmätarna och AI-datacentren kommer således inte att belasta eller vara beroende av elnätet.

Partnerskapet markerar den första fasen i en gemensam vision om att bygga AI-datacenter som kan möta den snabbt växande efterfrågan på beräkningskapacitet och energi inom artificiell intelligens.

AI-datacenter kräver infrastruktur som integrerar beräkningskraft, energi, datacenterarkitektur och kapital på ett tätt och effektivt sätt. Bloom Energys bränsleceller levererar pålitlig, skalbar och lokal energi som snabbt kan tas i drift utan beroende av traditionella elnät. Brookfield tillför världsledande kompetens inom infrastrukturutveckling och finansiering.

I kärnan av det nya partnerskapet kommer Brookfield att investera upp till 5 miljarder dollar för att införa Blooms avancerade bränslecellsteknik. Bolagen samarbetar aktivt kring utformning och leverans av AI-datacenter globalt – inklusive en europeisk anläggning som kommer att offentliggöras innan årets slut.

”AI-infrastruktur måste byggas som en fabrik – med syfte, hastighet och skala,” säger KR Sridhar, grundare, ordförande och vd för Bloom Energy. ”Till skillnad från traditionella fabriker kräver AI-fabriker enorm energitillgång, snabb etablering och realtidsanpassning till belastning – något som gamla elnät inte klarar av. Den effektiva AI-fabriken uppnås genom att energi, infrastruktur och beräkningskraft designas i harmoni från dag ett. Det är den principen som styr vårt samarbete med Brookfield när vi omformar framtidens datacenter. Tillsammans skapar vi en ny ritning för hur AI skalas upp med kraft.”

”Energilösningar bakom mätaren är avgörande för att överbrygga elnätsgapet för AI-fabriker,” säger Sikander Rashid, global chef för AI-infrastruktur på Brookfield. ”Blooms avancerade bränslecellsteknik ger oss en unik möjlighet att designa och bygga moderna AI-fabriker med ett helhetsperspektiv på energibehov. Som världens största investerare inom AI-infrastruktur tillför detta partnerskap ett kraftfullt nytt verktyg till vår globala tillväxtstrategi – särskilt i en marknad där tillgången till elnät är begränsad.”

AI-datacenter i USA förväntas använda 100 gigawatt vid 2035

Enligt prognosoer väntas elförbrukningen från AI-datacenter i USA växa exponentiellt och överstiga 100 gigawatt till 2035. Bränsleceller har blivit en nyckellösning för att möta detta problem, och partnerskapet mellan Bloom Energy och Brookfield är utformat för att hantera just detta energigap.

Bloom Energy har erfarenhet

Bloom Energy har redan installerat hundratals megawatt av sin bränslecellsteknik i datacenter och levererar el till några av världens mest kritiska digitala infrastrukturer genom partnerskap med American Electric Power (AEP), Equinix och Oracle.

Brookfield är en jätte inom digital infrastruktur

Detta partnerskap utgör Brookfields första investering inom sin dedikerade AI-infrastruktur-strategi, som fokuserar på investeringar i stora AI-datacenter, energilösningar, beräkningsinfrastruktur och strategiska kapitalpartnerskap. Strategin bygger vidare på Brookfields erfarenhet av att ha investerat över 100 miljarder dollar i digital infrastruktur globalt.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om guld, olja, fjärrvärme och förnybar energi

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga

-

Analys3 veckor sedan

Analys3 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanGoldman Sachs höjer prognosen för guld, tror priset når 4900 USD

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanBlykalla och amerikanska Oklo inleder ett samarbete

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuldpriset uppe på nya höjder, nu 3750 USD

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanEtt samtal om guld, olja, koppar och stål