Nyheter

David Hargreaves on Precious Metals, week 22 2012

Some People Don’t Buy gold. Now Why? A glance at the weekly changes would tell us precious metals prices are moribund with gold’s two stablemates following its lead. It was not quite like that. There were 2% daily swings in both directions. That the Euro crisis continued without an action plan, that China’s slowdown hit economy-based commodities, that Iran has not promised to put its nuclear toys away should normally have sounded the starting gun, should it not? It did not. Why? Theories abound and the perennial bulls are telling us to be patient, it will. $2000, $3000, $5000 are just around the corner. Yet one feature is being overlooked. Who buys a metal which nobody uses and why? The only offtakers of consequence are central banks and ordinary people. The CBs have to commit central funds which are in rather short supply right now. Some, as we note below, are adding, but these are previously insignificant holders, so hardly signify. So what of people? Given the parlous state of the Eurozone, 17 nations handling 25% of the world’s GDP via a single currency, should not its population be forming lines outside the jewellery shops? They do not because they only buy gold on special occasions, like in engagement and wedding rings. They don’t hoard it, why? Because those with the firepower, Germany, France, Belgium, Spain, Italy, Portugal, enjoyed stable currencies which were made of the precious metals gold and silver.

If they wanted to hoard they did so in money, real money. They are yet to be convinced the Euro is rubbish, so why hoard precious metals?

Conversely China, India, Indonesia, Brazil, never did have that luxury. It is an historic thing and we are not yet seeing a mass panic into gold or gold-backed instruments like ETFs or even shares. What’s more, those nations with the insatiable appetites are staring down the double barrels of slower growth and rising appetites for consumables. So the gold addicts waiting for the mover to take it to $2000 and beyond, will have to be patient.

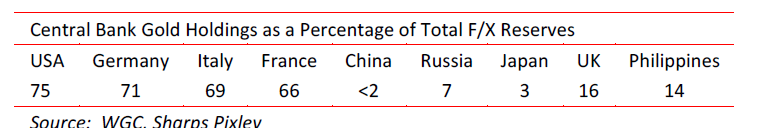

Central Bank Gold Purchases. None of the CBs is a seller right now and a few have turned buyers. Cheerleader was the Philippines, which added a sizeable 24 tonnes to add to its existing 153.6 tonnes. Not too shabby, as the table below shows. Mexico, Kazakhstan and Ukraine also made minor purchases. Total CB purchases is Q1 2012 were 80.9 tonnes, 7% of global offtake. Gold is now 13.6% of the Philippines total foreign exchange reserves, of which a selection shows:

India’s Gold Demand. We are reminded that June-August is the marriage season in India so expect gold demand to jump. It needs to, since it fell 28% in Q1. In what appears to be someone talking his own game, our correspondent also says there will be a “normal” monsoon season. This means crops will grow and we shall all live happily ever after.

Newmont Pares its CAPEX. Newmont, the world No 2 gold miner at 170t/yr, has a massive development, the Conga project in Peru but it is beset by environmental impact challenges. The company is at odds with the government and locals about it and has announced cutting back its CAPEX spend from $1.5bn to $440M over the next 18 months. Positioning, or a view on the market? Newmont still expects to up its gold output to c. 220t/yr by 2017. Conga has a 1.0Moz/yr (31 tonne) look about it.

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

Brookfield köper bränsleceller för 5 miljarder USD av Bloom Energy för att driva AI-datacenter

Brookfield och Bloom Energy inleder ett partnerskap där Brookfield i den första fasen köper bränsleceller för 5 miljarder USD av Bloom Energy för att driva AI-datacenter. Bränslecellerna kommer att installeras bakom elmätarna och AI-datacentren kommer således inte att belasta eller vara beroende av elnätet.

Partnerskapet markerar den första fasen i en gemensam vision om att bygga AI-datacenter som kan möta den snabbt växande efterfrågan på beräkningskapacitet och energi inom artificiell intelligens.

AI-datacenter kräver infrastruktur som integrerar beräkningskraft, energi, datacenterarkitektur och kapital på ett tätt och effektivt sätt. Bloom Energys bränsleceller levererar pålitlig, skalbar och lokal energi som snabbt kan tas i drift utan beroende av traditionella elnät. Brookfield tillför världsledande kompetens inom infrastrukturutveckling och finansiering.

I kärnan av det nya partnerskapet kommer Brookfield att investera upp till 5 miljarder dollar för att införa Blooms avancerade bränslecellsteknik. Bolagen samarbetar aktivt kring utformning och leverans av AI-datacenter globalt – inklusive en europeisk anläggning som kommer att offentliggöras innan årets slut.

”AI-infrastruktur måste byggas som en fabrik – med syfte, hastighet och skala,” säger KR Sridhar, grundare, ordförande och vd för Bloom Energy. ”Till skillnad från traditionella fabriker kräver AI-fabriker enorm energitillgång, snabb etablering och realtidsanpassning till belastning – något som gamla elnät inte klarar av. Den effektiva AI-fabriken uppnås genom att energi, infrastruktur och beräkningskraft designas i harmoni från dag ett. Det är den principen som styr vårt samarbete med Brookfield när vi omformar framtidens datacenter. Tillsammans skapar vi en ny ritning för hur AI skalas upp med kraft.”

”Energilösningar bakom mätaren är avgörande för att överbrygga elnätsgapet för AI-fabriker,” säger Sikander Rashid, global chef för AI-infrastruktur på Brookfield. ”Blooms avancerade bränslecellsteknik ger oss en unik möjlighet att designa och bygga moderna AI-fabriker med ett helhetsperspektiv på energibehov. Som världens största investerare inom AI-infrastruktur tillför detta partnerskap ett kraftfullt nytt verktyg till vår globala tillväxtstrategi – särskilt i en marknad där tillgången till elnät är begränsad.”

AI-datacenter i USA förväntas använda 100 gigawatt vid 2035

Enligt prognosoer väntas elförbrukningen från AI-datacenter i USA växa exponentiellt och överstiga 100 gigawatt till 2035. Bränsleceller har blivit en nyckellösning för att möta detta problem, och partnerskapet mellan Bloom Energy och Brookfield är utformat för att hantera just detta energigap.

Bloom Energy har erfarenhet

Bloom Energy har redan installerat hundratals megawatt av sin bränslecellsteknik i datacenter och levererar el till några av världens mest kritiska digitala infrastrukturer genom partnerskap med American Electric Power (AEP), Equinix och Oracle.

Brookfield är en jätte inom digital infrastruktur

Detta partnerskap utgör Brookfields första investering inom sin dedikerade AI-infrastruktur-strategi, som fokuserar på investeringar i stora AI-datacenter, energilösningar, beräkningsinfrastruktur och strategiska kapitalpartnerskap. Strategin bygger vidare på Brookfields erfarenhet av att ha investerat över 100 miljarder dollar i digital infrastruktur globalt.

Nyheter

Teck Resources kan förse Nordamerika och kanske hela G7 med all germanium som behövs

Kanadensiska gruvbolaget Teck Resources för samtal med både USA och Kanada om att leverera kritiska mineraler till de båda ländernas försvarsindustrier – bara en dag efter att Kina skärpt sina exportregler för sällsynta jordartsmetaller.

Enligt Financial Times diskuterar bolaget möjligheterna att leverera germanium, antimon och gallium, under förutsättning att det kan få garantier för minimipriser och köpvolymer.

Kinas senaste besked innebär en utvidgning och förtydligande av de omfattande exportkontroller som infördes redan i april. De tidigare restriktionerna ledde till stora bristsituationer globalt innan nya avtal med Europa och USA gjorde det möjligt att återuppta leveranser. Den nya regeln klargör dock att exportlicenser sannolikt kommer att nekas till vapenproducenter och vissa halvledarföretag.

Vid FT Metals and Mining Summit uppgav Teck Resources vd att bolaget kan producera tillräckligt med germanium för att täcka hela Nordamerikas behov – och möjligen även G7-ländernas.

Teck Resources och Anglo American går samman

Teck Resources och Anglo American är mitt uppe i en fusion, vilket beskrivs som ett samgående av två jämbördiga parter.

Nyheter

Leading Edge Materials är på rätt plats i rätt tid

Leading Edge Materials har tre olika projekt, men det är ett som är bolagets huvudfokus, Norra Kärr. Den tillgången har tunga sällsynta jordartsmetaller som är viktiga för Sveriges och hela EU:s oberoende när det gäller dessa kritiska råvaror. Kina som kontrollerar större delen av världens sällsynta jordartsmetaller drar hela tiden åt tumskruvarna på resten av världen. Denna vecka införde Kina extremt aggressiva regler som gör att större delen av världens företag som på ett eller annat sätt använder eller producerar metallerna måste ansöka om tillstånd av kinesiska staten för att kunna exportera sina produkter.

Norra Kärr-projektet har i denna kontext blivit strategiskt viktig för hela EU.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanKinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanTyskland har så höga elpriser att företag inte har råd att använda elektricitet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanDet stigande guldpriset en utmaning för smyckesköpare

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanOPEC+ missar produktionsmål, stöder oljepriserna

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEtt samtal om guld, olja, fjärrvärme och förnybar energi

-

Analys4 veckor sedan

Analys4 veckor sedanBrent crude ticks higher on tension, but market structure stays soft

-

Analys3 veckor sedan

Analys3 veckor sedanAre Ukraine’s attacks on Russian energy infrastructure working?

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanGuld nära 4000 USD och silver 50 USD, därför kan de fortsätta stiga