Nyheter

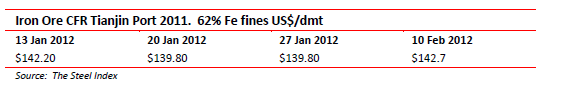

David Hargreaves on Metals week 7 2012

Fertiliser Minerals are here to stay. Production and consumption sources are diverse with major miners such as Canada, Russia and Jordan feeding the mega-users India, Brazil and China. Brazil is attempting to redress the local imbalance with a big push on domestic deposits. Its major miner, Vale, best known for iron ore and nickel, is reported to be negotiating to ‘rent’ the Carnelita potassium deposit in NE Brazil, from Petrobras, the state-controlled oil company. Vale also has a potash project in Argentina and a nitrates mine in Peru. Like BHPB, it has committed to the sector but appears better balanced and with a shorter time plan to production.

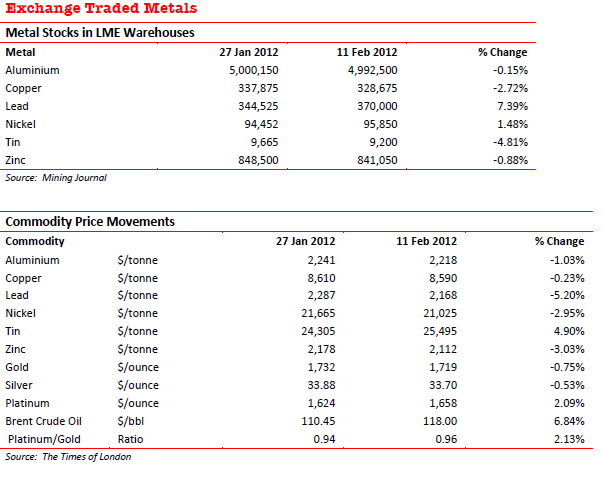

Precious Metals

Rum times. South Africa’s platinum industry, thus 75% of the world base, is in a mess of its own making. The street price is falling even as the output is falling. So demand must be falling, must it not? Gold cannot complain, at c. $1750 per ounce. It was under $1000/oz only a year or two ago. Yet an industry luminary, the CEO of Anglo Gold Ashanti. (World No 2, no less) tells us that at $1650 the miners will only just scrape by. Really, Mr. Cutifani. And Harmony’s CEO agrees with him. Now how come just as much was coming out of the ground recently at $800, $900, $1000? Could it just be that you have allowed untenable wage increases to creep in? That you have let yourselves be browbeaten by avaricious governments who only view the industry as a cash cow? As an argument it only just falls short of the – world – running out of – raw materials syndrome. Remember dividends? Now those were the days.

PGM recycling. It is always useful to read some well stated numbers on a hot industry. Thus we thank the world leader in its field Johnson Matthey for a reprint from Recycling Today on platinum’s link to the automobile industry. New Pt production is about 6Moz annually with 46% absorbed in the auto industry. New Pd production is similar but with 61% into autos. At current prices recycling is doubly worthwhile and is on the increase as older, heavy usage models, are scrapped. Thus in 2012 we could see a 20% increase in scrap recovery to perhaps 1.80Moz combined Pt and Pd. It might go some way to explaining the glut of the metal right now. But new car usage will surely soon overtake it. China, for instance has about one road vehicle per 20 people. Europe’s ratio is c. 5.0 and North America below 3.0. That will be a lot more PGMs on the road. If China and India catch up.

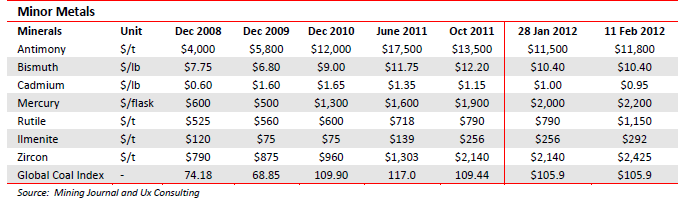

Minor Metals

Generally quiet but if our trusty source, Mining Journal, is to be believed, the titanium feed stocks, ilmenite and rutile, are well marked up. The only news of international note includes Rio Tinto and BHPB swapping shares in the major Richards Bay facility in RSA. Zircon, too, found mostly in RSA and Australia showed some life. Mercury has had an impressive run from $600/flask to a current $2000. This itself is an almost 40% rise in a few months. The major outlets for the metal remains as an amalgam in gold concentration, and in specialised batteries. This represents its future, despite its being highly toxic. Its major production source is Spain.

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

Jonas Lindvall är tillbaka med ett nytt oljebolag, Perthro, som ska börsnoteras

Jonas Lindvall, ett välkänt namn i den svenska olje- och gasindustrin, är tillbaka med ett nytt företag – Perthro AB – som nu förbereds för notering i Stockholm. Med över 35 års erfarenhet från bolag som Lundin Oil, Shell och Talisman Energy, och som medgrundare till energibolag som Tethys Oil och Maha Energy, är Lindvall redo att än en gång bygga ett bolag från grunden.

Tillsammans med Andres Modarelli har han startat Perthro med ambitionen att bli en långsiktigt hållbar och kostnadseffektiv producent inom upstream-sektorn – alltså själva oljeutvinningen. Deras timing är strategisk. Med ett inflationsjusterat oljepris som enligt Lindvall är lägre än på 1970-talet, men med fortsatt växande efterfrågan globalt, ser de stora möjligheter att förvärva tillgångar till attraktiva priser.

Perthro har redan säkrat bevisade oljereserver i Alberta, Kanada – en region med rik oljehistoria. Bolaget tittar även på ytterligare projekt i Oman och Brasilien, där Lindvall har tidigare erfarenhet. Enligt honom är marknadsförutsättningarna idealiska: världens efterfrågan på olja ökar, medan utbudet inte hänger med. Produktionen från befintliga oljefält minskar med cirka fem procent per år, samtidigt som de största oljebolagen har svårt att ersätta de reserver som produceras.

”Det här skapar en öppning för nya aktörer som kan agera snabbare, tänka långsiktigt och agera med kapitaldisciplin”, säger Lindvall.

Perthro vill fylla det växande gapet på marknaden – med fokus på hållbar tillväxt, hög avkastning och effektiv produktion. Med Lindvalls meritlista och branschkunskap hoppas bolaget nu kunna bli nästa svenska oljebolag att sätta avtryck på världskartan – och på börsen.

Nyheter

Oljan, guldet och marknadens oroande tystnad

Oljepriset är åter i fokus på grund av kriget i Mellanöstern. Är marknadens tystnad om de stora riskerna, det som vi egentligen verkligen bör oroa oss för? Och varför funderar Tyskland på att plocka hem sin guldreserv från New York? I veckans avsnitt av Världsekonomin pratar Katrine Kielos och Henrik Mitelman om olja, tystnad och guld. Europa är ju mer beroende av oljepriset än USA, hur orolig ska man vara för att det stiger? En krönika i Financial Times lyfte nyligen “marknadens oroande tystnad”, den syftade på skillnaden mellan den dystra geopolitiska utvecklingen i världen och en marknad som samtidigt återhämtat sig 20 procent sen början av april, trots tullkriget. Vad säger marknadens tystnad egentligen? I Tyskland pågår en debatt om att plocka hem sin guldreserv från USA. Handlar det om bristande förtroende för Donald Trump – och kan det rentav ha något med “hämndskatten” att göra?

Nyheter

Domstolen ger klartecken till Lappland Guldprospektering

Mark- och miljödomstolen har idag meddelat dom i målet om Stortjärnhobbens bearbetningskoncession. Beslutet innebär att Lappland Guldprospektering får tillträde till området – ett avgörande steg mot framtida gruvbrytning i regionen.

Bearbetningskoncessionen för Stortjärnhobben är en central del i Lappland Guldprospekterings långsiktiga satsning på hållbar gruvutveckling i området. Projektet har varit föremål för juridisk prövning och dagens dom ger nu tydlighet kring markanvändningen.

”Vi är mycket nöjda över beslutet och ser nu fram emot att kunna lägga i nästa växel vad gäller utvecklingen av Stortjärnhobbens guldprojekt. Domstolens beslut är ett synnerligen viktigt steg och ger oss nu rätten att nyttja och förfoga över området”, säger VD Fredrik Johansson.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanStor uppsida i Lappland Guldprospekterings aktie enligt analys

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanBrookfield ska bygga ett AI-datacenter på hela 750 MW i Strängnäs

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSommaren inleds med sol och varierande elpriser

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOPEC+ ökar oljeproduktionen trots fallande priser

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSilverpriset släpar efter guldets utveckling, har mer uppsida

-

Analys4 veckor sedan

Analys4 veckor sedanBrent needs to fall to USD 58/b to make cheating unprofitable for Kazakhstan

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanTradingfirman XTX Markets bygger datacenter i finska Kajana för 1 miljard euro

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanUppgången i oljepriset planade ut under helgen