Nyheter

David Hargreaves on Iron ore, week 14 2012

Iron Ore continues to dominate news in the bulk trade, as befits a mineral whose output is measured at over one billion tonnes per year and growing at over 6% annually. That alone is the combined exports of Canada and South Africa.

Iron Ore continues to dominate news in the bulk trade, as befits a mineral whose output is measured at over one billion tonnes per year and growing at over 6% annually. That alone is the combined exports of Canada and South Africa.

Of greatest importance is that as an export-driven trade, critical to producers such as Australia, Brazil, India and the CIS. Further, almost 60% of all is destined for China and 20% for Japan and South Korea. The market is effectively polarised.

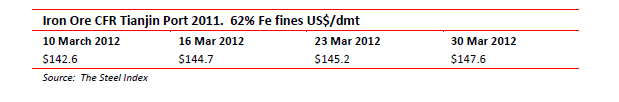

Contract pricing ruled for many years in annual bargains driven by the above importers and the major producing companies Vale SA (24% world production), Rio Tinto (14%) and BHPB (10%). Now it has all but broken down and been replaced by reference to the spot market. The growth of that mechanism owes much to the development of diversified production bases in West Africa and continued growth in the established mining locations. Much has been made of the possible economic slowdown in China. In context, this means that last year’s 9.3% increase may only be 8% this year. That is still another 80Mtpy. There are warnings of the spot price softening but this has not been borne out. It further nudged up to $145.2/t thisweek even as new investment and output news flows in. Increasingly, users are investing in mines to secure supplies.

- Japanese trader Marubeni is teaming up with South Korea’s steel maker Posco and ship builder STX to buy 30% of the Roy Hill project in Australia, whose plan is to hit 55Mtpy by 2014. That works out at about $220/t of output or 1.50 x the sales price.

- AIM listed but with loftier ambitions, London Mining (285p; Hi-Lo 438p-256p) is now fully funded to boost capacity at its Marampa, Sierra Leone mine to 5Mtpy. It has an offtake agreement with trading company Vitol. It also has an offtake contract with Glencore. Both have prepayment clauses. There is a further target of 9Mtpy.

Iron ore pricing. Wood MacKenzie sees iron ore supply and demand coming into balance over the next few years and the price slowly to decline. Their range is $157/t in 2012, $155/t in 2013 and $140/t in 2014. They warn of projects in the riskier and less developed regions suffering. Demand growth in China is pitched at 5% per year. They look for coking coal, essential to steel making, to average $200-215/t in the next few years.

Chrome Ore. A much misunderstood metal, its major end use is as ferro-chrome for use in steel making, particularly the stainless variety. This is achieved by mixing the ore with iron and coke, a relatively expensive process but with a resultant price enhancement. Resources are not a problem, measuring over 300 years at present rates of usage. However they lie selectively in RSA (70%) Russia and CIS (10%) and Zimbabwe (10%). South Africa has long been the dominant producer, but its share of supply as ferro-chrome (as opposed to chrome ore) has slipped from 50% in 2001 to 42% now, with China’s share up in the same period from 5% to 25%. Much of China’s output arises from raw ore shipped from RSA. This has been noticed in high places. They tell us the industry employs 200,000 people and its exports are worth R42bn to GDP. So there is a call to slap a duty of $100/t on raw chrome exports, to encourage local beneficiation. Problem: it is energy intensive and to show the comic-tragic nature of the situation, even as the call went out for the export tax, at least one ferrochrome producer was cutting back on its electricity usage at the behest of power generator Eskom. You can’t have your pasties and eat them, chaps

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

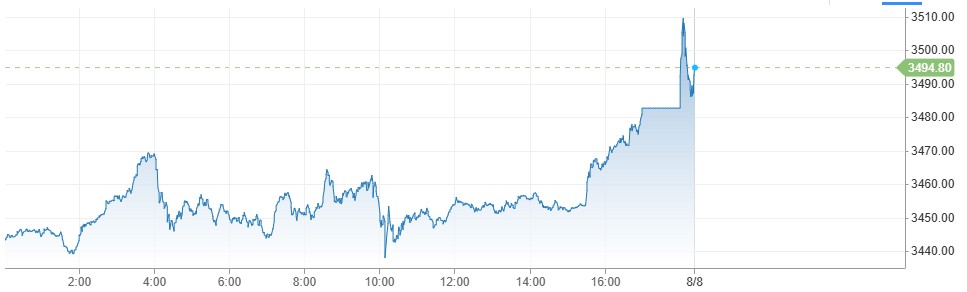

Guld stiger till över 3500 USD på osäkerhet i världen

Investerare har den senaste tiden sökt sig till guld som en säker hamn i en konfliktfylld värld. Trumps ständiga attacker på både vänner och fiender har skapat en stor oreda. Med en ökad sannolikhet för en sänkt ränta i USA så blir guld ännu mer tilltalande. Kring midnatt mellan torsdag och fredag svensk tid passerade den gula ädelmetallen 3500 USD per uns på Comex-börsen.

Nyheter

Lyten, tillverkare av litium-svavelbatterier, tar över Northvolts tillgångar i Sverige och Tyskland

Amerikanska Lyten, världsledande inom litium-svavelbatterier, har tecknat ett bindande avtal om att förvärva Northvolts återstående tillgångar i Sverige och Tyskland. I affären ingår batterifabrikerna Northvolt Ett och Ett Expansion i Skellefteå, Northvolt Labs i Västerås samt planerade Northvolt Drei i tyska Heide. Dessutom förvärvas alla immateriella rättigheter (IP) från Northvolt.

De tillgångar Lyten nu tar över har tidigare värderats till cirka 5 miljarder dollar och omfattar 16 GWh i befintlig batteriproduktionskapacitet samt ytterligare 15 GWh under uppbyggnad. Transaktionen, som är helt finansierad med eget kapital från privata investerare, väntas slutföras under det fjärde kvartalet 2025, förutsatt myndighetsgodkännande.

Återstart av verksamheter och jobbtillfällen

Lyten planerar att omedelbart återuppta verksamheten vid anläggningarna i Skellefteå och Västerås efter att affären slutförts. Bolaget har även för avsikt att återanställa en stor del av den personal som tidigare sagts upp från Northvolt och ser långsiktiga sysselsättningsmöjligheter som en nyckel till fortsatt framgång.

– Det här är ett avgörande ögonblick för Lyten. Förvärvet ger oss de anläggningar och den svenska kompetens som krävs för att snabbare möta den kraftigt ökande efterfrågan på våra litium-svavelbatterier, säger Dan Cook, vd och medgrundare av Lyten.

Positivt mottagande från svenska regeringen

Förvärvet välkomnas även från politiskt håll.

– Det här är en vinst för Sverige och för våra ambitioner inom energi och industriell innovation, säger Ebba Busch, Sveriges vice statsminister.

Fortsatt global expansion

Förvärvet i Sverige och Tyskland är en del av Lytens större strategi att bygga en stark närvaro i både Europa och Nordamerika. Tidigare i år har Lyten också köpt Northvolt Dwa i Polen – Europas största tillverkare av batterilagringssystem – samt förvärvat Northvolts IP-portfölj för energilagring. Bolaget har även uttryckt intresse för att ta över Northvolt Six i Quebec, Kanada.

Batterier för framtiden – även i rymden

Lyten har utvecklat en egen teknikplattform baserad på 3D-grafen och fokuserar på nästa generations litium-svavelbatterier – en teknik med potential att revolutionera batteribranschen. Förutom försäljning till drönar- och försvarsindustrin förbereder Lyten även en batterilansering på den internationella rymdstationen ISS senare i år.

En svensk medgrundare, Lars Herlitz

Även om Lyten är amerikanskt så finns det en svensk medgrundare, Lars Herlitz.

Nyheter

Lundin Gold hittar ny koppar-guld-fyndighet vid Fruta del Norte-gruvan

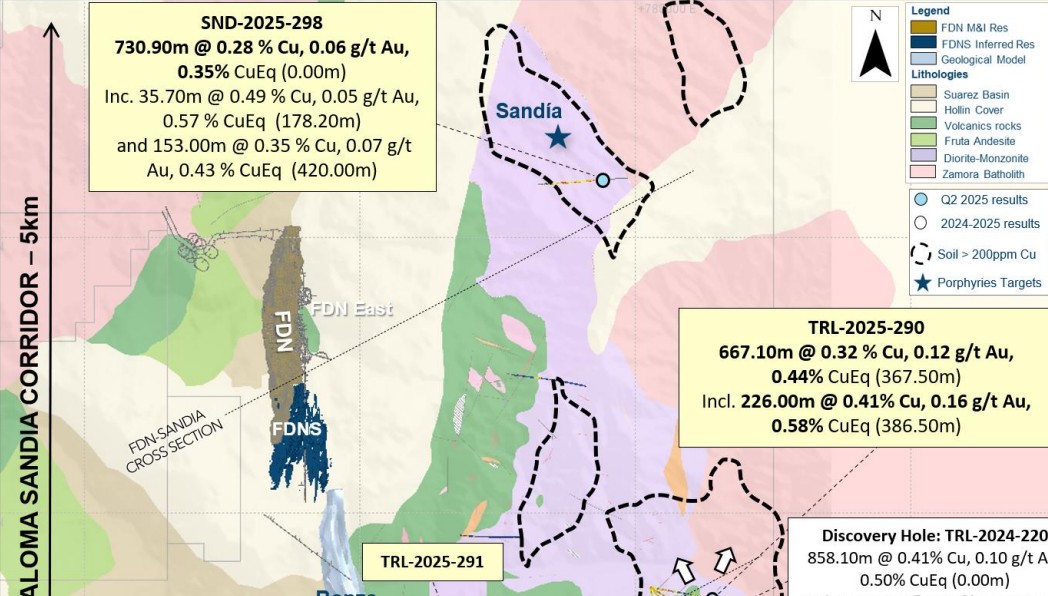

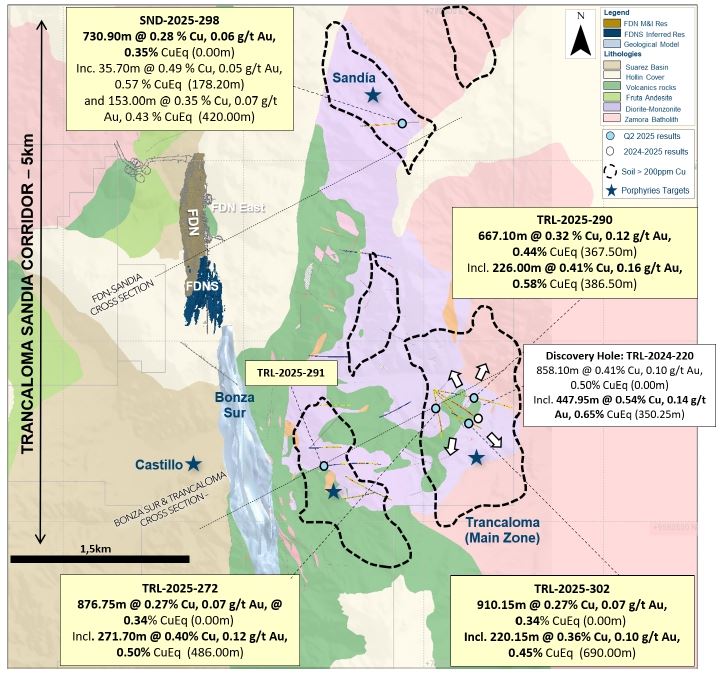

Gruvbolaget Lundin Gold har presenterat starka resultat från sin pågående prospektering vid Fruta del Norte-gruvan i Ecuador. Bolaget meddelar att man har utökat mineraliseringen vid Trancaloma samt upptäckt ett nytt koppar-guld-porfyrsystem vid Sandia, endast fyra kilometer norr om Trancaloma.

Enligt vd Ron Hochstein visar resultaten på den stora, ännu outnyttjade potentialen i området. ”Vi har nu bekräftat att mineraliseringen vid Trancaloma är kontinuerlig och sträcker sig både på djupet och i sidled. Samtidigt har vi upptäckt ett helt nytt system vid Sandia, vilket stärker bilden av en lovande porfyrkorridor direkt intill vår befintliga verksamhet,” säger han.

Bland höjdpunkterna från borrprogrammet märks ett borrhål vid Trancaloma som visade 667 meter med en koppar-ekvivalent (CuEq) på 0,44 %, inklusive 226 meter med 0,58 % CuEq. Vid Sandia påträffades 730 meter med 0,35 % CuEq från markytan, vilket bekräftar förekomsten av ett andra porfyrsystem.

Utforskningsprogrammet för 2025 är det största hittills inom området kring Fruta del Norte, med över 48 000 meter borrning genomförd hittills. Fokus ligger på att identifiera nya fyndigheter i närheten av den befintliga gruvan.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanUSA inför 93,5 % tull på kinesisk grafit

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanFusionsföretag visar hur guld kan produceras av kvicksilver i stor skala – alkemidrömmen ska bli verklighet

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanWestinghouse planerar tio nya stora kärnreaktorer i USA – byggstart senast 2030

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanRyska militären har skjutit ihjäl minst 11 guldletare vid sin gruva i Centralafrikanska republiken

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEurobattery Minerals förvärvar majoritet i spansk volframgruva

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanKopparpriset i fritt fall i USA efter att tullregler presenterats

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanLundin Gold rapporterar enastående borrresultat vid Fruta del Norte

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanKina skärper kontrollen av sällsynta jordartsmetaller, vill stoppa olaglig export