Nyheter

David Hargreaves on Exchange Traded Metals, week 41 2013

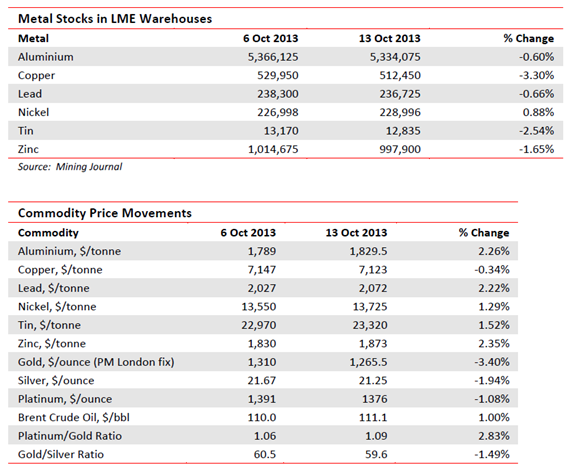

A week which saw warehouse stocks directionless, but a further fall in tin and prices of all bar copper nudge up, also had London hosting “LME Week”. Once a year in come the great and the good whose livelihoods depend on the market for the most important traded base metals, via the world’s largest clearing house, the London Metal Exchange.

A week which saw warehouse stocks directionless, but a further fall in tin and prices of all bar copper nudge up, also had London hosting “LME Week”. Once a year in come the great and the good whose livelihoods depend on the market for the most important traded base metals, via the world’s largest clearing house, the London Metal Exchange.

It culminates n a dinner where traditionally the speakers attempt to outdo each other in the boring stakes. This year it was a bit different because the exchange is now owned by the Chinese. Its CEO, Charles Li, spoke of looking beyond the offering of base metals, partnering with other bourses and increased access to China. Opinions were mixed on the direction of the metals, but most agreed the aluminium surplus will only be corrected by production cutbacks, that nickel, too, has a long term malaise look about it and copper supply, also, has been overdone. The warehousing system rightly came under fire. There are long delays getting materials out and consequently delivery premiums have risen. In the first nine months of 2013, over 3Mt moved in and out.

Aluminium. America’s Alcoa (AA.N $8.32; Hi-Lo $9.37-7.64) maintains its position in the top three for bauxite, alumina and refined metal and managed to turn out some credible results for the financial year end. Net income was $24M (2012 loss $134M) on slightly decreased sales. Noted was that the metal price has halved since 2008, so this performance was all about productivity gains. Well done.

Back to the LME. Its most valuable contract by value is probably aluminium. It was only launched in the early 1980s. Prior to that the US producer price held sway. It was never very popular since its mechanism was mostly unions asking for a wage increase, management conceding and sticking it on the price. Also, and still persisting, is the nonsensical habit of quoting in dollars per pound weight. With 40Mtpa mined, bought and sold (that is $80 bn) and the swap unit being tonnes, it makes no sense at all. Still, the Chicago Mercantile Exchange or CME intends to launch a rival contract to the London-based one. They have grounds given the recent problems but it could lead to a disorderly market or great arbitrage opportunities.

WIM says and we remember: The LME had the good sense to start pricing in dollars, the universal currency. If you, CME do launch, PLEASE make it tonnes and not lbs. If you insist on the latter, why not step-up to the plate with kilograms (don’t miss And Now Some Things… this week).

Nickel. It is the conference season in mining. They have just had one on nickel in Australia. Why not, world No 4 with 11% of production? Most of it comes from WA so that state’s Mines Minister had to put a spin on it. He says the price will return to its ‘former glory in the coming years’. Nothing like hedging your bets. He then SOTBOed his way through State and Federal reforms, innovation and have another tinnie. With respect, we would remind Mr Marmian (for it is he), that the price of nickel has had only two spikes above its present level since 1957. The unprecedented one of 2006-09 saw it transiently top $50,000/tonne (OK, CME 90c/lb), followed by an Eiger-like fall below $10,000. Today’s c.$13,800 is not life threatening. Just live within your means. Speaking of which, G-X and Vale who together have a grip on the production from the starter and most prolific area, Canada’s Sudbury basin, are said to be talking about joint activities. That could make sense as they speak for half of the country’s output. At Australia’s Paydirt Conference, one analyst nailed $8/lb (here we go, that’s c. $18,000/t) to the mast for post-2014

WIM says: Don’t rely on the post.

Copper will not go gently. It is nosing into surplus as Chinese demand softens but new developments continue apace. Chile’s CODELCO, at 12% of world output from the second largest producing country (17%) is gearing up. It is stateowned.

The government has sold $950M in international bonds, on a 5.775% yield, to help the cash-strapped miner. CODELCO has a $27 bn (no misprint) investment plan to keep it ahead of the game. This year, however, it will only be $4.0-4.5bn. Chile expects to produce c.5.7Mt of copper this year, 5% up on 2012, or 5.53Mt.

Peru’s Las Bambas Mine. This country remains a good jurisdiction although the natives are getting a little restless and el presidente has a colourful capitalist history (mining mostly) for a born-again socialist. The country houses the potentially major Las Bambas copper mine, on which we have reported previously. It belonged to Glencore, which has been forced to divest as part of China agreeing to the merger with Xstrata. OK, so far? So it is on the blocks. Well under development, they speak of it being worth $6 bn to date. Open to bidders, the favourites are Chinalco and Minmetals. Wonder where they spring from? Las Bambas is slated to produce 0.45Mt per year in its first five years and 300,000tpa thereafter. That puts it right up there with Antofagasta and Norilsk; also said to be sniffing is Newmont.

[hr]

About David Hargreaves

David Hargreaves is a mining engineer with over forty years of senior experience in the industry. After qualifying in coal mining he worked in the iron ore mines of Quebec and Northwest Ontario before diversifying into other bulk minerals including bauxite. He was Head of Research for stockbrokers James Capel in London from 1974 to 1977 and voted Mining Analyst of the year on three successive occasions.

Since forming his own metals broking and research company in 1977, he has successfully promoted and been a director of several public companies. He currently writes “The Week in Mining”, an incisive review of world mining events, for stockbrokers WH Ireland. David’s research pays particular attention to steel via the iron ore and coal supply industries. He is a Chartered Mining Engineer, Fellow of the Geological Society and the Institute of Mining, Minerals and Materials, and a Member of the Royal Institution. His textbook, “The World Index of Resources and Population” accurately predicted the exponential rise in demand for steel industry products.

Nyheter

Sommarvädret styr elpriset i Sverige

Många verksamheter tar nu ett sommaruppehåll och ute värmer solen, det är gott om vatten och vinden blåser. Lägre efterfrågan på el och goda förutsättningar för kraftproduktionen höll ner elpriserna under juni.

Elpriset på den nordiska elbörsen Nord Pool (utan påslag och exklusive moms) i elområde 1 och 2 (Norra Sverige) blev för juni 3,05 respektive 4,99 öre/kWh, vilket är rekordlågt och de lägsta på minst 25 år.

– Elpriset påverkas av en rad faktorer men vädret väger tyngst. På sommaren minskar efterfrågan på el och många verksamheter har ett uppehåll. Detta tillsammans med goda förutsättningar inom kraftproduktionen påverkar elpriset nedåt, säger Jonas Stenbeck, privatkundschef Vattenfall Försäljning Norden.

Den hydrologiska balansen, måttet för att uppskatta hur mycket vatten som finns lagrat ovanför kraftstationerna, ligger över normal nivå, särskilt i norra Skandinavien. Tillgängligheten för kärnkraften i Norden är just nu 82 procent av installerad effekt.

– De goda nordiska produktionsförutsättningarna gör elpriserna mindre känsliga för förändringar i omvärlden, säger Jonas Stenbeck.

Priserna på olja och gas kan dock ändras snabbt med anledning av en turbulent omvärld. På kontinenten har efterfrågan på gas sjunkit och nytt solkraftsrekord för Tyskland sattes på midsommarafton med en produktion på 52,5 GW.

– Många av de goda elvanor vi skaffade oss under elpriskrisen verkar leva kvar och gör nytta även på sommaren. De svenska hushållens elförbrukning under 2024 var faktiskt den lägsta detta millenium, säger Jonas Stenbeck.

| Medelspotpris | Juni 2024 | Juni 2025 |

| Elområde 1, Norra Sverige | 24,04 öre/kWh | 3,05 öre/kWh |

| Elområde 2, Norra Mellansverige | 24,04 öre/kWh | 4,99 öre/kWh |

| Elområde 3, Södra Mellansverige | 27,27 öre/kWh | 22,79 öre/kWh |

| Elområde 4, Södra Sverige | 62,70 öre/kWh | 40,70 öre/kWh |

Nyheter

Samtal om flera delar av råvarumarknaden

Ett samtal som sammanfattar ett relativt stabilt halvår på råvarumarknaden trots volatilitet och geopolitiska spänningar som sannolikt fortsätter in i andra halvan av året. Vi bjuds även på kommentarer från Carlos Mera, Rabobanks analyschef för jordbrukssektorn och Kari Kangas, skogsanalytiker.

Nyheter

Jonas Lindvall är tillbaka med ett nytt oljebolag, Perthro, som ska börsnoteras

Jonas Lindvall, ett välkänt namn i den svenska olje- och gasindustrin, är tillbaka med ett nytt företag – Perthro AB – som nu förbereds för notering i Stockholm. Med över 35 års erfarenhet från bolag som Lundin Oil, Shell och Talisman Energy, och som medgrundare till energibolag som Tethys Oil och Maha Energy, är Lindvall redo att än en gång bygga ett bolag från grunden.

Tillsammans med Andres Modarelli har han startat Perthro med ambitionen att bli en långsiktigt hållbar och kostnadseffektiv producent inom upstream-sektorn – alltså själva oljeutvinningen. Deras timing är strategisk. Med ett inflationsjusterat oljepris som enligt Lindvall är lägre än på 1970-talet, men med fortsatt växande efterfrågan globalt, ser de stora möjligheter att förvärva tillgångar till attraktiva priser.

Perthro har redan säkrat bevisade oljereserver i Alberta, Kanada – en region med rik oljehistoria. Bolaget tittar även på ytterligare projekt i Oman och Brasilien, där Lindvall har tidigare erfarenhet. Enligt honom är marknadsförutsättningarna idealiska: världens efterfrågan på olja ökar, medan utbudet inte hänger med. Produktionen från befintliga oljefält minskar med cirka fem procent per år, samtidigt som de största oljebolagen har svårt att ersätta de reserver som produceras.

”Det här skapar en öppning för nya aktörer som kan agera snabbare, tänka långsiktigt och agera med kapitaldisciplin”, säger Lindvall.

Perthro vill fylla det växande gapet på marknaden – med fokus på hållbar tillväxt, hög avkastning och effektiv produktion. Med Lindvalls meritlista och branschkunskap hoppas bolaget nu kunna bli nästa svenska oljebolag att sätta avtryck på världskartan – och på börsen.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanStor uppsida i Lappland Guldprospekterings aktie enligt analys

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanBrookfield ska bygga ett AI-datacenter på hela 750 MW i Strängnäs

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSilverpriset släpar efter guldets utveckling, har mer uppsida

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanUppgången i oljepriset planade ut under helgen

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanLåga elpriser i sommar – men mellersta Sverige får en ökning

-

Analys3 veckor sedan

Analys3 veckor sedanVery relaxed at USD 75/b. Risk barometer will likely fluctuate to higher levels with Brent into the 80ies or higher coming 2-3 weeks

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMahvie Minerals växlar spår – satsar fullt ut på guld

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanOljan, guldet och marknadens oroande tystnad