Analys

Brent knuffar undan WTI från topplatsen

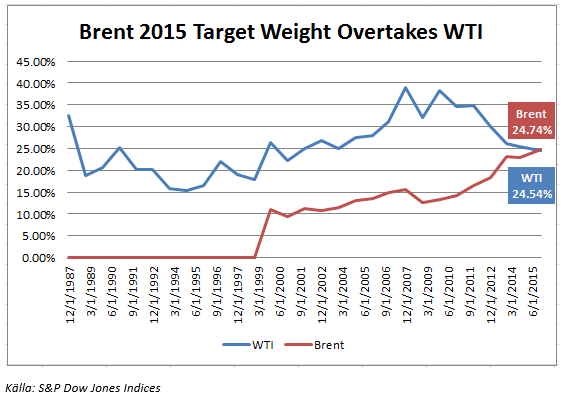

The S&P GSCI 2015 Rebalance Preview markerar ett historiskt skifte i den globala oljehandeln. Enligt det tillkännagivande som nyligen kommunicerades avseende re-balanseringen av indexvikterna kommer råoljan Brent att överta rollen som det ledande referenspriset för oljehandeln från WTI, West Texas Intermediate, och får den tyngsta vikten i råvaruindexet S&P GSCI. Det är därmed den första gången sedan 1997 som WTI inte är den viktigaste råvaran i detta index. Under perioden 1994 till och med 1997 hade naturgas en tyngre vikt än WTI.

År 1987 adderades WTI till S&P GSCI och fick då en vikt på cirka 35 procent, en vikt som reducerades till 32,6 procent i slutet av det året. Brent adderades till detta index så sent som 1999 och fick då vikten 7,5 procent. I slutet av 1999, i samband med den årliga översynen av indexet, ökade vikten för Brent till 10,9 procent, medan WTI fick se sin vikt reducerad till 26,3 procent.

I juni 2008 ökade vikten för WTI till 40,6 procent, men i samband med utgången av det tredje kvartalet 2014 rasade denna vikt till 25,5 procent medan vikten för Brent ökade till 22,9 procent. Pro forma-vikten för 2015 är 24,7, vilket är nästan dubbelt så stort som 2008 års nivåer och mer än tre gånger så stort som den vikt Brent hade när denna råolja introducerades i detta index.

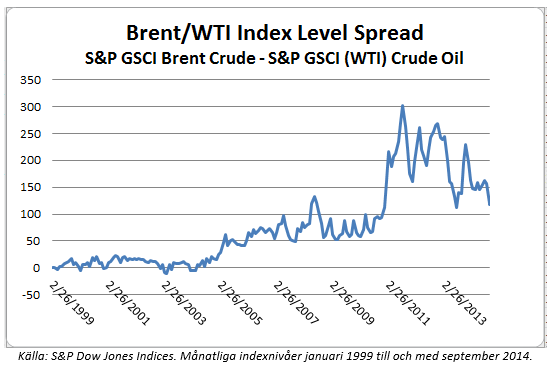

Dynamiken i oljehandeln har förändrats, något som är speciellt märkbart sedan 2010 när vi fick se en explosiv produktionstillväxt från skifferoljefälten i Texas och North Dakota. Vid samma tidpunkt kom den kanadensiska importen av olja till USA att öka kraftigt. Det ökade utbudet ledde till flaskhalsar och ett överutbud i oljedepåerna i Cushing vilket satte en prispress på WTI. Vi har sedan dess vid ett flertal tillfällen sett hur WTI, som egentligen är en råolja av en finare kvalité än Brent, handlas med rabatt mot Brentoljan. Nu har rörledningskapaciteten ökats och transporterna förbättras för att minska Brent-premien.

Diagrammet nedan visar hur premien för Brent gått från närmare 20 USD per fat till att de två olika råoljorna handlas i paritet.

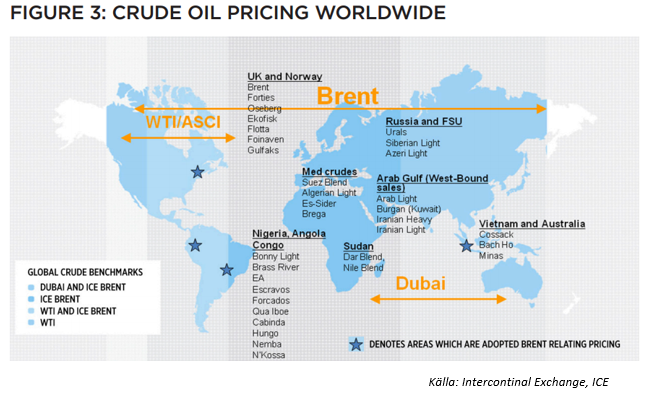

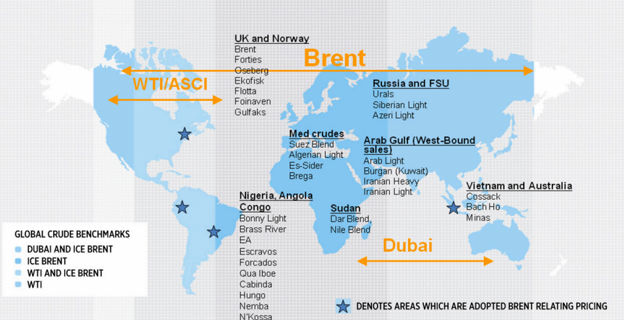

I Nordamerika, men också i viss mån Sydamerika, har WTI fortsatt att fungera som ett riktmärke för prissättningen av råolja, men allt fler USA-baserade aktörer har börjat använda Brent när de hedgar sin produktion på grund av den ökade globala och fundamentala betydelsen som denna råolja kommit att få på senare år. Det har även med den amerikanska lagstiftningen av oljeexport att göra. Det finns i dag ingen begränsning eller restriktioner av export eller import av Brent, något som gäller för WTI-oljan, vilket gör att Brent är ett effektivare instrument för att hedga oljeproduktion på den globala marknaden.

Nedan finns en karta som visar den ökade påverkan som Brentolja fått när det gäller att fungera som ett referenspris i prissättningen för oljehandeln.

Kan detta innebära en större möjlighet för producenterna att prissäkra sin produktion? Nyligen kollapsade Brent-kurvan som en följd av den negativa trenden för Atlantic Basin och den asiatiska importen från Västafrika. Detta har emellertid lett till en press på producenterna i Mellanöstern och kan komma att tvinga dessa att skära ned sin produktion. Det betyder att det finns både Bull- och Bear-tendenser när det gäller prissättningen av Brent. Detta gör det också troligt att vi kommer att få se hur denna råolja kommer att handlas i intervaller, sannolikt lägre intervaller.

På sikt är det sannolikt att vi kommer att få se fler utbudsstörningar i den globala oljeproduktionen. Den region som skulle kunna leverera en ökad produktion skulle kunna vara Mellanöstern, men frågan är om det kommer att ske i närtid. Även en ökad raffinaderikapacitet i Mellanöstern kan komma att spela en viktig roll för produktionsökningarna. På kort sikt ser vi att det är osannolikt att produktionen i Nigeria och Venezuela kan komma att öka så pass mycket att den kan ersätta utbudsstörningarna i Nigeria och Irak.

Analys

A sharp weakening at the core of the oil market: The Dubai curve

Down to the lowest since early May. Brent crude has fallen sharply the latest four days. It closed at USD 64.11/b yesterday which is the lowest since early May. It is staging a 1.3% rebound this morning along with gains in both equities and industrial metals with an added touch of support from a softer USD on top.

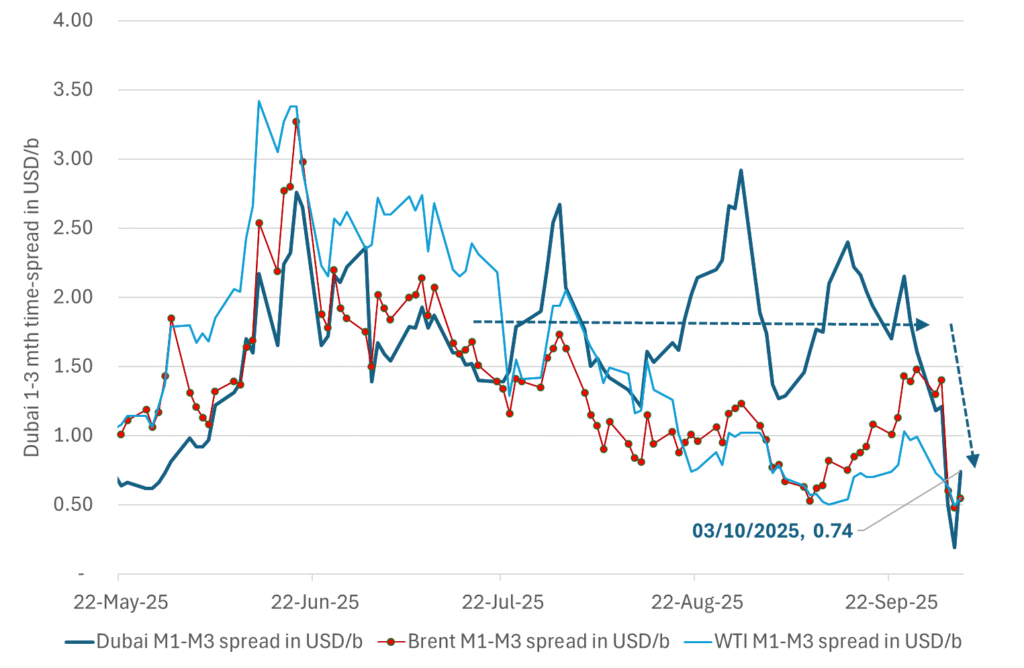

What stands out the most to us this week is the collapse in the Dubai one to three months time-spread.

Dubai is medium sour crude. OPEC+ is in general medium sour crude production. Asian refineries are predominantly designed to process medium sour crude. So Dubai is the real measure of the balance between OPEC+ holding back or not versus Asian oil demand for consumption and stock building.

A sharp weakening of the front-end of the Dubai curve. The front-end of the Dubai crude curve has been holding out very solidly throughout this summer while the front-end of the Brent and WTI curves have been steadily softening. But the strength in the Dubai curve in our view was carrying the crude oil market in general. A source of strength in the crude oil market. The core of the strength.

The now finally sharp decline of the front-end of the Dubai crude curve is thus a strong shift. Weakness in the Dubai crude marker is weakness in the core of the oil market. The core which has helped to hold the oil market elevated.

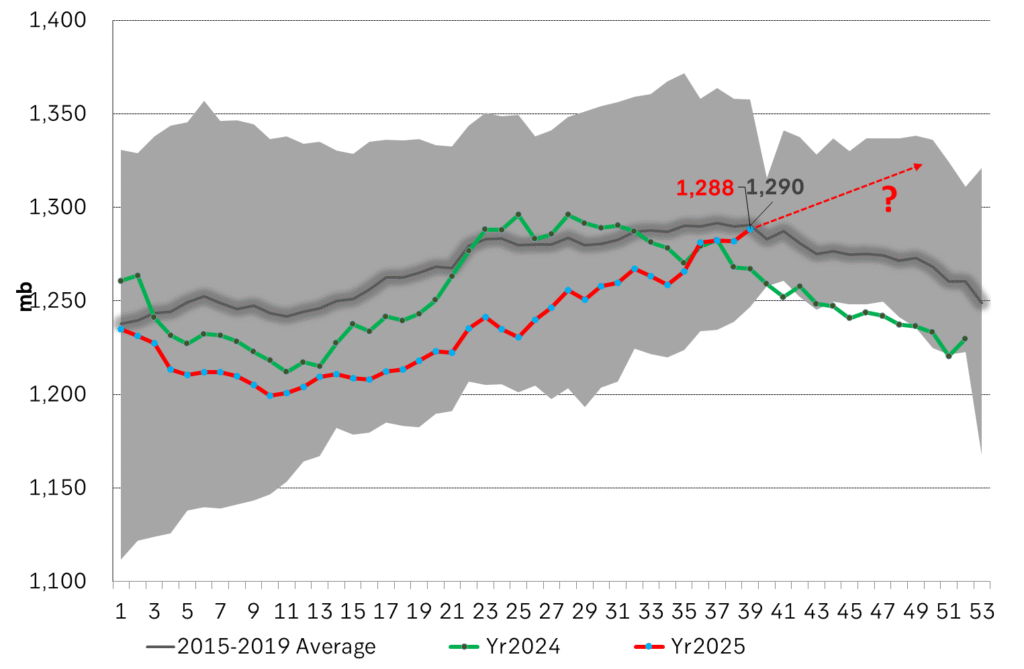

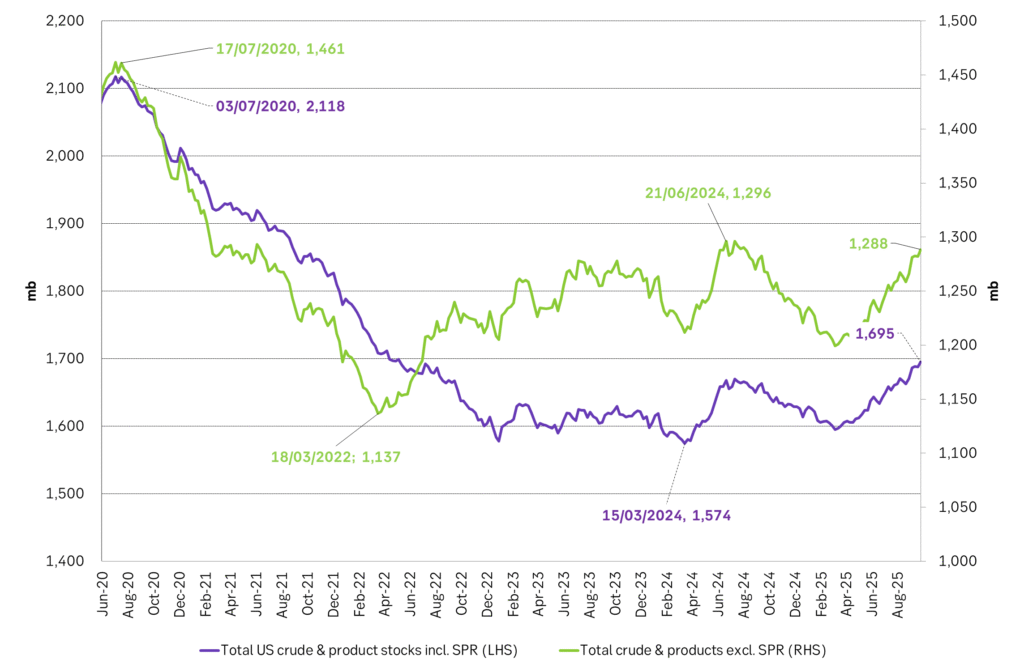

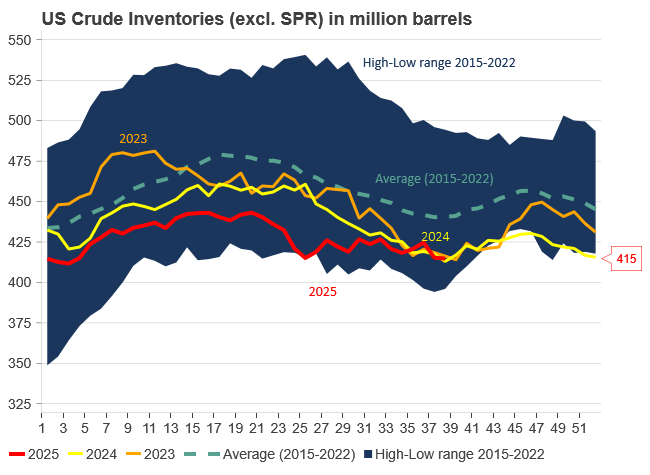

Facts supports the weakening. Add in facts of Iraq lifting production from Kurdistan through Turkey. Saudi Arabia lifting production to 10 mb/d in September (normal production level) and lifting exports as well as domestic demand for oil for power for air con is fading along with summer heat. Add also in counter seasonal rise in US crude and product stocks last week. US oil stocks usually decline by 1.3 mb/week this time of year. Last week they instead rose 6.4 mb/week (+7.2 mb if including SPR). Total US commercial oil stocks are now only 2.1 mb below the 2015-19 seasonal average. US oil stocks normally decline from now to Christmas. If they instead continue to rise, then it will be strongly counter seasonal rise and will create a very strong bearish pressure on oil prices.

Will OPEC+ lift its voluntary quotas by zero, 137 kb/d, 500 kb/d or 1.5 mb/d? On Sunday of course OPEC+ will decide on how much to unwind of the remaining 1.5 mb/d of voluntary quotas for November. Will it be 137 kb/d yet again as for October? Will it be 500 kb/d as was talked about earlier this week? Or will it be a full unwind in one go of 1.5 mb/d? We think most likely now it will be at least 500 kb/d and possibly a full unwind. We discussed this in a not earlier this week: ”500 kb/d of voluntary quotas in October. But a full unwind of 1.5 mb/d”

The strength in the front-end of the Dubai curve held out through summer while Brent and WTI curve structures weakened steadily. That core strength helped to keep flat crude oil prices elevated close to the 70-line. Now also the Dubai curve has given in.

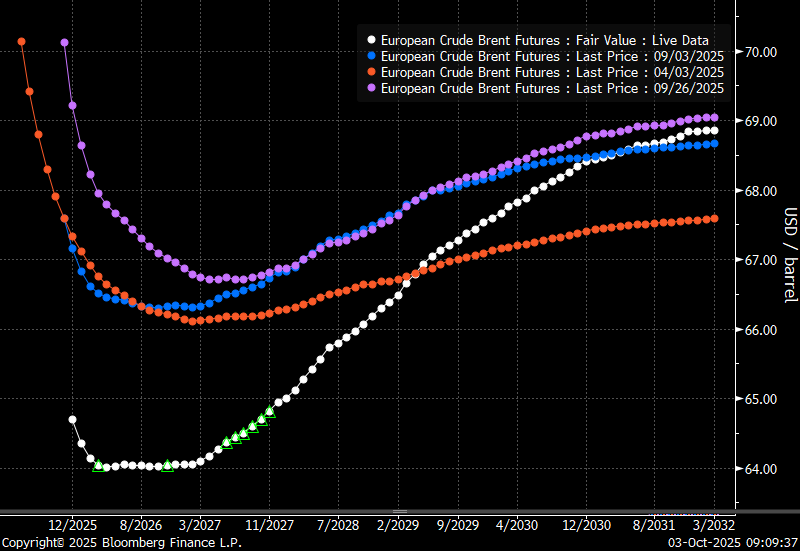

Brent crude oil forward curves

Total US commercial stocks now close to normal. Counter seasonal rise last week. Rest of year?

Total US crude and product stocks on a steady trend higher.

Analys

OPEC+ will likely unwind 500 kb/d of voluntary quotas in October. But a full unwind of 1.5 mb/d in one go could be in the cards

Down to mid-60ies as Iraq lifts production while Saudi may be tired of voluntary cut frugality. The Brent December contract dropped 1.6% yesterday to USD 66.03/b. This morning it is down another 0.3% to USD 65.8/b. The drop in the price came on the back of the combined news that Iraq has resumed 190 kb/d of production in Kurdistan with exports through Turkey while OPEC+ delegates send signals that the group will unwind the remaining 1.65 mb/d (less the 137 kb/d in October) of voluntary cuts at a pace of 500 kb/d per month pace.

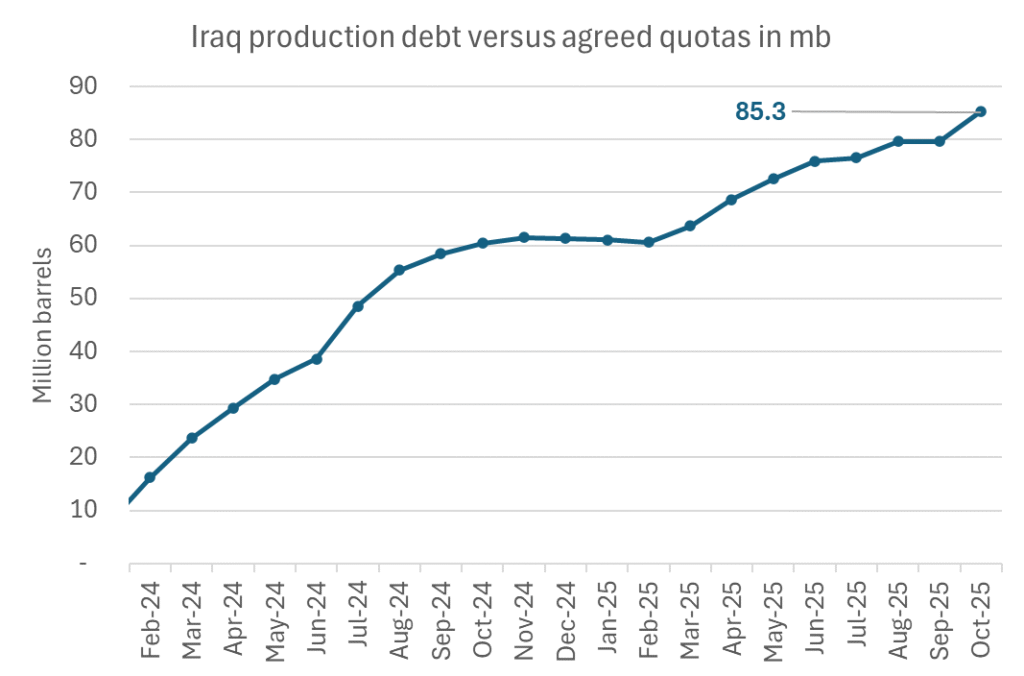

Signals of accelerated unwind and Iraqi increase may be connected. Russia, Kazakhstan and Iraq were main offenders versus the voluntary quotas they had agreed to follow. Russia had a production ’debt’ (cumulative overproduction versus quota) of close to 90 mb in March this year while Kazakhstan had a ’debt’ of about 60 mb and the same for Iraq. This apparently made Saudi Arabia angry this spring. Why should Saudi Arabia hold back if the other voluntary cutters were just freeriding? Thus the sudden rapid unwinding of voluntary cuts. That is at least one angle of explanations for the accelerated unwinding.

If the offenders with production debts then refrained from lifting production as the voluntary cuts were rapidly unwinded, then they could ’pay back’ their ’debts’ as they would under-produce versus the new and steadily higher quotas.

Forget about Kazakhstan. Its production was just too far above the quotas with no hope that the country would hold back production due to cross-ownership of oil assets by international oil companies. But Russia and Iraq should be able to do it.

Iraqi cumulative overproduction versus quotas could reach 85-90 mb in October. Iraq has however steadily continued to overproduce by 3-5 mb per month. In July its new and gradually higher quota came close to equal with a cumulative overproduction of only 0.6 mb that month. In August again however its production had an overshoot of 100 kb/d or 3.1 mb for the month. Its cumulative production debt had then risen to close to 80 mb. We don’t know for September yet. But looking at October we now know that its production will likely average close to 4.5 mb/d due to the revival of 190 kb/d of production in Kurdistan. Its quota however will only be 4.24 mb/d. Its overproduction in October will thus likely be around 250 kb/d above its quota with its production debt rising another 7-8 mb to a total of close to 90 mb.

Again, why should Saudi Arabia be frugal while Iraq is freeriding. Better to get rid of the voluntary quotas as quickly as possible and then start all over with clean sheets.

Unwinding the remaining 1.513 mb/d in one go in October? If OPEC+ unwinds the remaining 1.513 mb/d of voluntary cuts in one big go in October, then Iraq’s quota will be around 4.4 mb/d for October versus its likely production of close to 4.5 mb/d for the coming month..

OPEC+ should thus unwind the remaining 1.513 mb/d (1.65 – 0.137 mb/d) in one go for October in order for the quota of Iraq to be able to keep track with Iraq’s actual production increase.

October 5 will show how it plays out. But a quota unwind of at least 500 kb/d for Oct seems likely. An overall increase of at least 500 kb/d in the voluntary quota for October looks likely. But it could be the whole 1.513 mb/d in one go. If the increase in the quota is ’only’ 500 kb/d then Iraqi cumulative production will still rise by 5.7 mb to a total of 85 mb in October.

Iraqi production debt versus quotas will likely rise by 5.7 mb in October if OPEC+ only lifts the overall quota by 500 kb/d in October. Here assuming historical production debt did not rise in September. That Iraq lifts its production by 190 kb/d in October to 4.47 mb/d (August level + 190 kb/d) and that OPEC+ unwinds 500 kb/d of the remining quotas in October when they decide on this on 5 October.

Analys

Modest draws, flat demand, and diesel back in focus

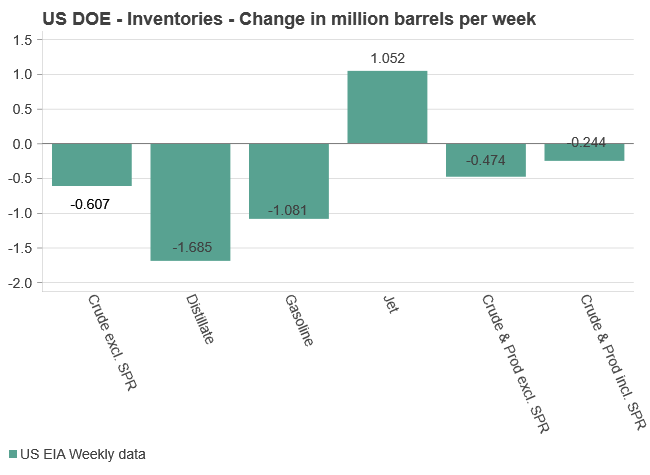

U.S. commercial crude inventories posted a marginal draw last week, falling by 0.6 million barrels to 414.8 million barrels. Inventories remain 4% below the five-year seasonal average, but the draw is far smaller than last week’s massive 9.3-million-barrel decline. Higher crude imports (+803,000 bl d WoW) and steady refinery runs (93% utilization) helped keep the crude balance relatively neutral.

Yet another drawdown indicates commercial crude inventories continue to trend below the 2015–2022 seasonal norm (~440 million barrels), though at 414.8 million barrels, levels are now almost exactly in line with both the 2023 and 2024 trajectory, suggesting stable YoY conditions (see page 3 attached).

Gasoline inventories dropped by 1.1 million barrels and are now 2% below the five-year average. The decline was broad-based, with both finished gasoline and blending components falling, indicating lower output and resilient end-user demand as we enter the shoulder season post-summer (see page 6 attached).

On the diesel side, distillate inventories declined by 1.7 million barrels, snapping a two-week streak of strong builds. At 125 million barrels, diesel inventories are once again 8% below the five-year average and trending near the low end of the historical range.

In total, commercial petroleum inventories (excl. SPR) slipped by 0.5 million barrels on the week to ish 1,281.5 million barrels. While essentially flat, this ends a two-week streak of meaningful builds, reflecting a return to a slightly tighter situation.

On the demand side, the DOE’s ‘products supplied’ metric (see page 6 attached), a proxy for implied consumption, softened slightly. Total demand for crude oil over the past four weeks averaged 20.5 million barrels per day, up just 0.9% YoY.

Summing up: This week’s report shows a re-tightening in diesel supply and modest draws across the board, while demand growth is beginning to flatten. Inventories remain structurally low, but the tone is less bullish than in recent weeks.

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals i en guldtrend

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEurobattery Minerals satsar på kritiska metaller för Europas självförsörjning

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanGuldpriset kan närma sig 5000 USD om centralbankens oberoende skadas

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanOPEC signalerar att de inte bryr sig om oljepriset faller kommande månader

-

Analys3 veckor sedan

Analys3 veckor sedanVolatile but going nowhere. Brent crude circles USD 66 as market weighs surplus vs risk

-

Nyheter3 veckor sedan

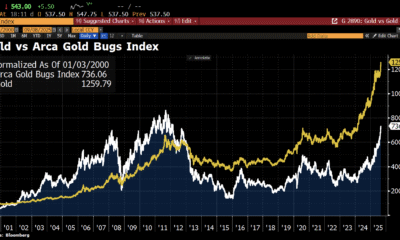

Nyheter3 veckor sedanAktier i guldbolag laggar priset på guld

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanKinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanTyskland har så höga elpriser att företag inte har råd att använda elektricitet