Uncategorized

Brent fell to a good $88 per barrel overnight

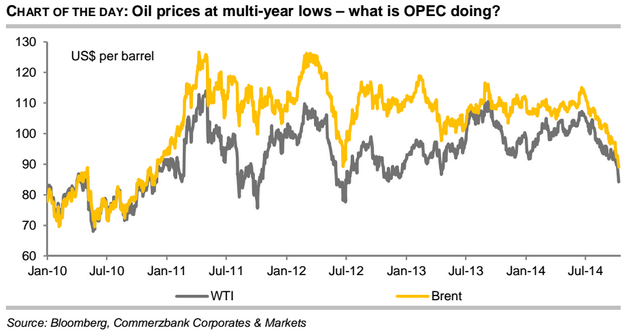

The oil market is gradually beginning to panic, as the two key oil prices have shed a further $3 since yesterday afternoon. Brent fell to a good $88 per barrel overnight, its lowest level since December 2010. WTI dropped to $83.5 per barrel and is thus the cheapest it has been since July 2012. Brent has plunged by 9% within the last two weeks and even by more than 20% as compared with its June high. The price slide has doubtless become more speculative in nature of late as the deteriorating global economic outlook, growing risk aversion and ample supply prompt more and more market players to bet on falling prices. The CFTC’s data due to be published this evening will only provide limited information given that they only reflect the week up to and including Tuesday. Iran added fuel to the flames yesterday when it followed Saudi Arabia’s lead and significantly lowered its prices as compared with international benchmarks. Just two days earlier, Iran had ruled out such a step. Thus the price war for market shares has entered its next round. This could hardly be a worse sign as far as OPEC’s external image is concerned. In difficult times, cooperation should really be the way forward. It will now be up to OPEC to halt the price slide by speaking out and, ultimately, by taking action. If OPEC maintains its passive stance, the market is likely to put OPEC’s pain threshold to the test. According to consultant firm Oil Movements, OPEC shipments are set to climb to a seven-month high in the four weeks to 25 October. This hardly sends out the right signal to the market even if Oil Movements does explain the increase by pointing to seasonally higher demand.

The oil market is gradually beginning to panic, as the two key oil prices have shed a further $3 since yesterday afternoon. Brent fell to a good $88 per barrel overnight, its lowest level since December 2010. WTI dropped to $83.5 per barrel and is thus the cheapest it has been since July 2012. Brent has plunged by 9% within the last two weeks and even by more than 20% as compared with its June high. The price slide has doubtless become more speculative in nature of late as the deteriorating global economic outlook, growing risk aversion and ample supply prompt more and more market players to bet on falling prices. The CFTC’s data due to be published this evening will only provide limited information given that they only reflect the week up to and including Tuesday. Iran added fuel to the flames yesterday when it followed Saudi Arabia’s lead and significantly lowered its prices as compared with international benchmarks. Just two days earlier, Iran had ruled out such a step. Thus the price war for market shares has entered its next round. This could hardly be a worse sign as far as OPEC’s external image is concerned. In difficult times, cooperation should really be the way forward. It will now be up to OPEC to halt the price slide by speaking out and, ultimately, by taking action. If OPEC maintains its passive stance, the market is likely to put OPEC’s pain threshold to the test. According to consultant firm Oil Movements, OPEC shipments are set to climb to a seven-month high in the four weeks to 25 October. This hardly sends out the right signal to the market even if Oil Movements does explain the increase by pointing to seasonally higher demand.

Uncategorized

Vattenfall tar nästa steg för ny kärnkraft vid Ringhals

Vattenfall tar nu nästa steg i arbetet för att möjliggöra ny kärnkraft vid Ringhals. Bland sex utvärderade leverantörer av små modulära reaktorer (SMR) har Vattenfall beslutat att gå vidare med brittiska Rolls-Royce SMR och amerikanska GE Hitachi Nuclear Energy.

Parallellt fortsätter Vattenfall att utreda förutsättningarna för att bygga storskaliga reaktorer.

─ Att göra ett urval av antalet möjliga SMR-leverantörer är ett av flera steg i det fortsatta arbetet för ny kärnkraft på Väröhalvön vid Ringhals. Det är också en förutsättning för att vi ska kunna fortsätta hålla ett högt tempo i arbetet med att bland annat förbereda ansökningar för prövning enligt kärntekniklagen och miljöbalken, säger Desirée Comstedt, chef för ny kärnkraft vid Vattenfall.

Nu följer ett omfattande arbete att analysera de två kvarvarande SMR-leverantörernas erbjudanden i detalj och att tillsammans med dessa ta fram en gemensam tidplan för alternativet att bygga små modulära reaktorer på Väröhalvön.

Parallellt fortsätter Vattenfall att utreda förutsättningarna för att bygga stora reaktorer. De leverantörer som ingår i utvärderingen av storskaliga reaktorer är amerikanska Westinghouse, franska EDF och sydkoreanska KHNP.

─ Vi har inte gjort något teknikval ännu, men oavsett om vi väljer små modulära reaktorer eller storskaliga reaktorer kommer ett framtida investeringsbeslut bland annat att kräva en rimlig riskdelningsmodell med staten. Detta för att sänka finansieringskostnaderna för nya reaktorer och därmed nå en rimlig kostnad för elproduktion som kunder är beredda att betala, säger Desirée Comstedt.

Utgångspunkten för Vattenfalls fortsatta arbete, oavsett reaktortyp, är att det ska vara möjligt att ha en ny reaktor i drift tidigast under första halvan av 2030-talet.

Uncategorized

Tradingmäklaren RoboMarkets lanserar aktiehandel via TradingView

Från och med september 2023 är det möjligt för svenska investerare att köpa och sälja amerikanska aktier direkt i TradingViews gränssnitt.

Det är den europeiska tradingmäklaren RoboMarkets som lanserar nyheten för sina kunder: Aktiehandel via TradingViews plattform – en av världens mest populära plattformar för teknisk analys och marknadsinformation.

TradingView är en webbplattform som erbjuder en mängd verktyg och funktioner för att analysera finansiella marknader inklusive realtidsdata, tekniska indikatorer och möjligheten att skapa anpassade strategier. Genom integrerat API ger RoboMarkets sina kunder tillgång till en omfattande uppsättning funktioner för att förbättra deras handelsupplevelse.

”Många investerare uppskattar idag TradingViews gränssnitt och vi är glada att våra kunder nu får möjligheten att koppla upp sitt vanliga konto eller investeringssparkonto hos RoboMarkets mot TradingViews plattform för handel med amerikanska aktier.” säger Maximilian Ström, Managing Director på RoboMarkets Nordic.

RoboMarkets lanserade i början av 2023 ett ISK med USD-konto för att möjliggöra handel med amerikanska aktier utan handelsrelaterade växlingsavgifter.

”RoboMarkets övriga utbud av instrument kommer att göras tillgängliga via TradingView längre fram”, avslutar Maximilian Ström.

Uncategorized

Iran oil tanker attack highlights persistence of geopolitical risks

Nitesh Shah, Director, Research, WisdomTree comments on the Iran oil tanker attacks this morning:

“Geopolitical risks are here to stay. Even though oil markets have failed to price them in, we are constantly being reminded that they exist. This morning an Iranian tanker traveling through the Red Sea off the coast of Saudi Arabia was hit by two missiles. Nobody has claimed the attack. Brent oil prices are up a modest 2% at the time of writing.

“Less than a month ago, Saudi oil producing facilities were attacked by Houthi rebels from Yemen. The attack was widely blamed on Iran (by Saudi Arabia, US, UK, Germany, France). The attack initially wiped off 5.7 million barrels of oil of the market and sent prices soaring 20%. However, all price gains quickly dissipated as Saudi Arabia got production back to pre-attack levels by the end of September.

“Today’s attacks are unlikely to have dented global oil supply by much. But that is beside the point. What is apparent is that attacks in the region are not isolated. During the course of May and June, there were multiple attacks on vessels moving in and around the Strait of Hormuz. We believe tension in the region is not de-escalating. And so, a higher geopolitical premium should be priced into oil. Oil prices have slid in the past month as demand forecasts have been scaled back. But we believe that small-scale demand revisions could pale in comparison to the risk of large supply disruptions if we continue to see an escalation of tension in the region.”

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMahvie Minerals växlar spår – satsar fullt ut på guld

-

Analys4 veckor sedan

Analys4 veckor sedanA muted price reaction. Market looks relaxed, but it is still on edge waiting for what Iran will do

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanJonas Lindvall är tillbaka med ett nytt oljebolag, Perthro, som ska börsnoteras

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOljan, guldet och marknadens oroande tystnad

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanDomstolen ger klartecken till Lappland Guldprospektering

-

Analys3 veckor sedan

Analys3 veckor sedanTightening fundamentals – bullish inventories from DOE

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanRyska staten siktar på att konfiskera en av landets största guldproducenter

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanSommarvädret styr elpriset i Sverige