Nyheter

If gold could talk

All of us that have been actively following gold over the years, have read many articles of many writers that explain the basics and attractions of gold. And we still do. Many of those articles are almost scientific and likely to cause us losing interest pretty quickly. If the investment public would read those, they probably won’t understand them, let alone it will stimulate them to add gold to their portfolios.

All of us that have been actively following gold over the years, have read many articles of many writers that explain the basics and attractions of gold. And we still do. Many of those articles are almost scientific and likely to cause us losing interest pretty quickly. If the investment public would read those, they probably won’t understand them, let alone it will stimulate them to add gold to their portfolios.

Fortunately, there are also writers that have such a down-to-earth look at gold that they can explain what gold is all about.

The other day I came across such an article, written by Jeff Clark. A real enjoyable example of worthwhile reading. I am pleased with Jeff’s permission to relay and share it with you.

Henk J. Krasenberg

[hr]

Have you ever had any doubts about gold? Does it sometimes feel like it should be performing better? Are you concerned about its volatility? Do you worry about how it might perform in the future? Have you ever wondered about its true purchasing power? Maybe you’re nervous about a big drop in price again? I decided to go directly to the source to address these concerns: Gold himself. He put his arm around me and asked me to tell you a few things…

I hear that you’ve had some worries about me. I understand. Your world is a very uncertain place right now. And when it comes to money, it looks as though your leaders don’t understand some basic monetary principles, making things even more unsettling.

But I want you to know that the problems you’re experiencing are actually nothing new. I’ve seen these monetary, fiscal, and economic difficulties many times before. And I can tell you this: you’re safe with me. That’s a bold proclamation, but I’ve provided monetary protection numerous times throughout history – too many to count, in fact. I’ve served all kinds of people over the centuries, from kings and counts to serfs and servants.

To put your mind at ease let’s review my core characteristics, along with some history, to show how I can protect you against the monetary danger that’s likely to worsen in your near future. We’ll also take a look at your peculiar set of circumstances to see how I can be of service. By the time we’re done, I think you’ll feel much better about myability to help your portfolio withstand whatever is thrown its way.

ENDURING CHARACTERISTICS

Let’s start with the basics. I have some characteristics that no other matter on Earth has…

I cannot be:

- Printed (ask a miner how long it takes to find me and dig me up)

- Counterfeited (you can try, but a scale will catch it every time)

- Mistaken (how many metals are bright yellow?)

I cannot be destroyed by:

- Fire (it takes heat at least 1945.4° F to melt me)

- Water (I don’t rust or tarnish)

- Time (my coins remain recognizable after a thousand years)

I don’t need:

- Feeding (like cattle)

- Fertilizer (like corn)

- Maintenance (like printing presses)

I don’t have:

- Industrial Dependence (keeps my volatility lower)

- Counterparty Risk (remember MF Global?)

- Shelf life (I never expire)

As a metal, I am uniquely:

- Malleable (I spread without cracking)

- Ductile (I stretch without breaking)

- Beautiful (just ask a bride)

As money, I am:

- Liquid (easily convertible to cash worldwide)

- Portable (you can conveniently hold $50,000 in one hand)

- Divisible (you can use me in tiny fractions)

- Consistent (I am the same in any quantity, at any place)

- Private (no one has to know you own me)

”GOLD IS MONEY”

You’ve heard that statement before – but do you know what it really means? Money is a medium of exchange and a store of value. Almost anything can be used as money, but obviously some things work better than others. It’s hard to exchange things people don’t want or don’t store well. Over thousands of years, I have emerged as the best form of money (along with silver).

The paper dollars in your wallet are technically just a currency, not real money. In other words, they are a government substitute for money. Money must be durable, divisible, consistent, convenient, and have value in and of itself.

- It must be durable because you can’t have it disintegrating in your pocket or bank. That’s why you don’t use wheat; it can rot or be eaten by insects.

- It must be divisible, which is why you don’t use diamonds or artwork; they can’t be split into pieces without destroying the value of the whole.

- The lack of consistency is why you can’t use real estate. One property is always different from another.

- It must be convenient, which is why you don’t use other metals like iron. The coins would be too big to handle easily.

- It must have value in and of itself. This is why you shouldn’t use paper as money.

- And one more thing: it must not be easily duplicated. Not even the kings and emperors who clipped and diluted gold coins dared to use paper as money.

My function is as money and a store of value, so the proper comparison is to your dollars or Treasury Bills (of similar nominal value). And here is where I excel and serve my purpose: since 1913, the US dollar has lost 96% of its purchasing power. I have lost none. Remember, I am the only financial asset that is not simultaneously someone else’s liability. I don’t require the backing of any bank or government.

THE HISTORY LESSON

Because I am eons old, I’ve observed something throughout history that you may not be aware of: government fiat currencies are a relatively new invention, and none have held up. Eventually, they have all failed. Me? I’ve never defaulted. Remember this the next time you have any doubts about my long-term worth. Another of my roles is to protect your purchasing power. Here are a few examples of how I’ve kept my word:

- During the time of Christ, an ounce of me purchased a Roman citizen his toga (suit), a leather belt, and a pair of sandals. Today, one ounce will still buy a good suit, a leather belt, and a pair of shoes.

- In 400 BC, during the reign of King Nebuchadnezzar, an ounce of me bought 350 loaves of bread. Today, an ounce still buys about 350 loaves ($1,700 divided by 350 = $4.85/loaf).

- In 1979, my average price was $306.68. This bought an average-priced full-size bed. Thirty-three years later, $1,700 would still buy you a nice full-size bed (and then some). You can rest assured that over time, I will hold my value. And when you near the end of your life, you can pass me on to your loved ones, knowing full well they will have something that cannot be devalued, debased, or destroyed.

WHAT COLOR IS YOUR MONEY?

Like you, I’m concerned about the current state of fiscal and monetary affairs. It seems your government leaders have boxed themselves into a corner. They’ve incurred too much debt and are spending too much money . It’s important that you understand some lessons from history about this kind of behavior so that you’re certain of what I can do for you.

The common denominators that lead to the downfall of every fiat currency are the two big Ds: debts and deficits. With that in mind, consider the following:

- Morgan Stanley reported that there is ”no historical precedent” for an economy that exceeds a 250% debt-to-GDP ratio without experiencing some sort of financial crisis or high inflation. US total debt currently exceeds GDP by roughly 400%.

- Detailed studies of government debt levels over the past 100 years show that debts have never been repaid (in original currency units) when they exceed 80% of GDP. US government debt will exceed 100% of GDP this year.

- Investment legend Marc Faber reports that once a country’s payments on debt exceed 30% of tax revenue, the currency is ”done for.” By some estimates, the US will hit that ratio this year.

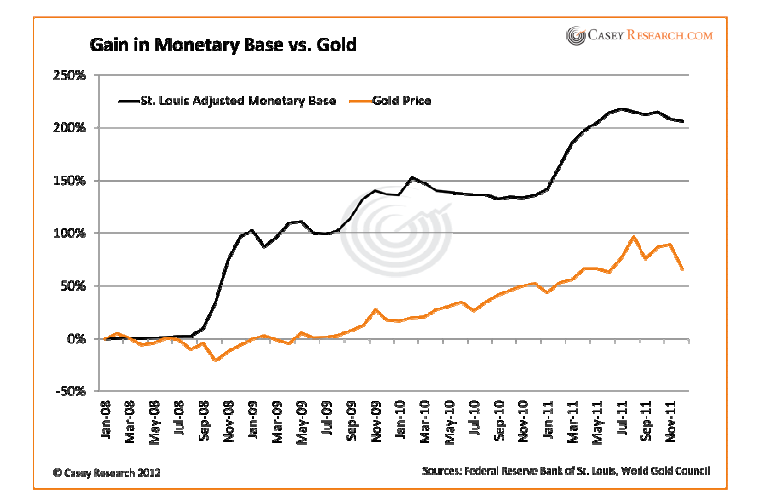

- Peter Bernholz, a leading expert on hyperinflation, states unequivocally that ”hyperinflation is caused by government budget deficits.” Next year’s US budget deficit is projected to be $1.3 trillion. The solution many of your leaders pursue is to print more paper money. Here’s an updated picture of the increase in the US monetary base vs. my rise in price since 2008, when your problems starting surfacing.

The monetary base has grown 205.8%, while my price is up 65.8%. This alone implies that my price in dollars is likely to climb much higher. This is also the reason why I’m not in a bubble, as some have tried to claim. It is your central banks and bond markets that are in a bubble. The fact that my price is rising is a warning that what your leaders are doing is unsustainable and potentially dangerous to your currency.

Think about this: the US has debt backed by debt, based on debt, dependent on debt, and leveraged with debt. You can, for example, buy a bond (i.e., lend money) on margin (i.e., with borrowed money). This is not a sound way to run financial markets.

Meanwhile, the warning bells continue to sound regarding Europe’s debt crisis. In just the past month:

- Moody’s cautioned that it may cut the AAA status of France, Austria, and the UK; and it downgraded six other European nations including Italy, Spain, and Portugal.

- Standard & Poor’s cut the AAA status of France and Austria, while Italy, Spain, Portugal, Cyprus, Malta, Slovakia, and Slovenia were downgraded.

- Fitch downgraded Belgium, Cyprus, Italy, Slovenia, and Spain, and stated there was a 50% chance of further cuts in the next two years.

- Standard & Poor’s downgraded 34 of Italy’s 37 banks.

- Moody’s warned recently that it may cut the credit ratings of 17 global financial institutions and 114 European ones.

The European crisis is far from over; and the path of least resistance for politicians is to create more paper money. This action can and will have clear and direct consequences: currencies will devalue, and inflation – perhaps hyperinflation – will result. Once again, I encourage you to use me to protect some of your wealth.

HOW MUCH IS ENOUGH?

Given the state of your monetary system, you should accumulate me (and my cousin silver) on a regular basis. Just buy some every month and put us in a safe place. After what I’ve witnessed throughout history, and based on the current path your government leaders insist on pursuing, I suggest using me as your savings vehicle instead of putting dollars in a bank. If you don’t own enough of me when these fiscal troubles really accelerate, I fear you will regret it. I’ve warned many in the past about the dilution of nations’ currencies, and those who didn’t heed my warnings experienced severe financial pain. Excuses won’t pay the mortgage nor feed the family when the effects of currency debasement hit your home and pocketbook.

Make sure you own enough of me to make a difference to your portfolio. This means having more than a couple coins or a few shares of GLD, the latter of which is only a proxy for my price.

How do you know if you own enough? Ask yourself:

- If inflation returns, or even hyperinflation hits…

- If the economy is flat…

- If uncertainty and fear continue around the globe…

- If stock markets languish…

- If stimulus from the world’s governments proves futile…

- If government interference in the economy continues to increase…

- If the value of the US dollar takes a major fall…

- If the world enters a recession or depression…

- If the world enters a recession or depression…

… would you feel that you own enough of me?

Buy a sufficient amount so that as your currency continues to lose value, your portfolio won’t. If you do your part, I promise I’ll do mine.

Yours Truly,

Gold

[hr]

IF GOLD COULD TALK By Jeff Clark, Senior Precious Metals Analyst and editor BIG GOLD Casey Research’s monthly advisory on gold, silver and large-cap precious metals stocks

Company Background

For over a quarter of a century, internationally renowned investor Doug Casey and his team at Casey Research have provided comprehensive research using a “Top-Down” approach. The first step involves forming an opinion on the macro-economic trends that will shape the global landscape in the years to come and identifying market dislocations that signal opportunities. Once the team spots a trend, intense research follows in order to hone in on specific investment strategies for making that trend your friend.

Contact details:

www.caseyresearch.com

with the compliments of Henk J. Krasenberg

EUROPEAN GOLD CENTRE

Nyheter

Silverpriset når 40 USD, högsta sedan 2011

Silverpriset steg precis över 40 USD per uns, vilket är den högsta nivån sedan 2011. Silverpriserna stiger på grund av ett betydande och långvarigt underskott i utbudet, där efterfrågan konsekvent överstiger produktionen. Drivkraften bakom detta är en stark industriell konsumtion, särskilt kopplad till energiomställningen och gröna teknologier som solenergi. Geopolitiska risker och global osäkerhet har dessutom ökat metallens attraktionskraft som en trygg tillgång, samtidigt som marknadens förväntningar på framtida tillväxt och efterfrågan bidrar till att stödja priserna. En svagare amerikansk dollar gör även att silverpriset i USD har lättare att stiga.

Nyheter

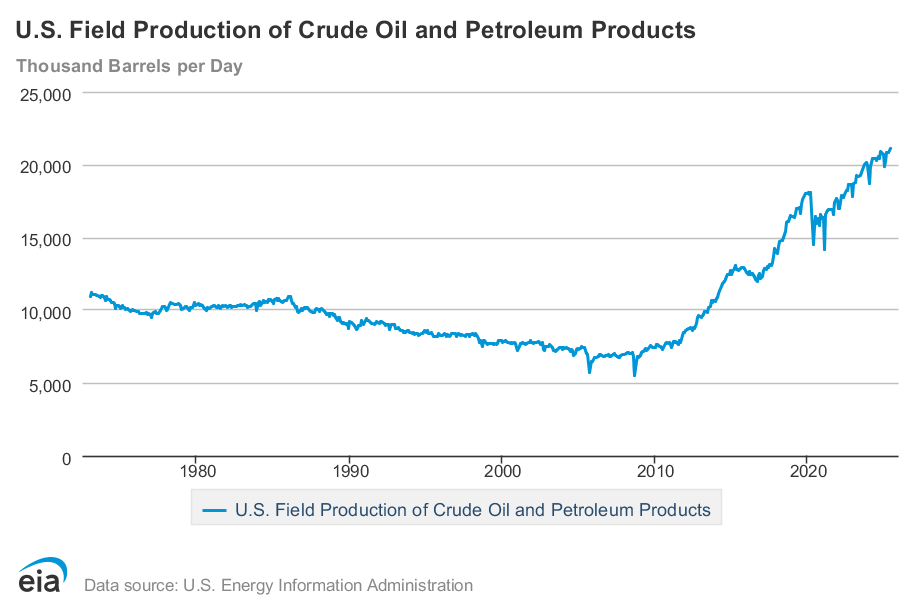

Nytt produktionsrekord av olja i USA, högsta efterfrågan på 20 år

Javier Blas uppmärksammar att USA har slagit ett nytt produktionsrekord av olja och oljeprodukter, det som brukar kallas liquids, vilket förutom olja även inkluderar vissa flytande produkter som görs av naturgas. Det är siffrorna för juni som har reviderats av EIA och som nu visar att produktionen under juni var 21,064 miljoner fat per dag, det är 396 000 fat mer än den initiala beräkningen.

EIA har också reviderat upp efterfrågan i juni betydligt. Sammanräkningen visar nu att den var 21,007 miljoner fat per dag, vilket är 607 000 fat högre än den initiala sammanräkningen. Det är den högsta efterfrågan för någon månad sedan juni 2005. Bensin, diesel och flygbränsle reviderades alla upp.

Nyheter

Mahvie Minerals är verksamt i guldrikt område i Finland

Mahvie Minerals utvecklar guldtillgångar i Finland, närmare bestämt Haveri beläget i Tammerfors guldbälte, och undersökningarna visar på mycket intressanta mängder. Bolaget planerar nu för att ta de nästa stegen framåt. Här presenterar VD Per Storm verksamheten.

-

Nyheter4 veckor sedan

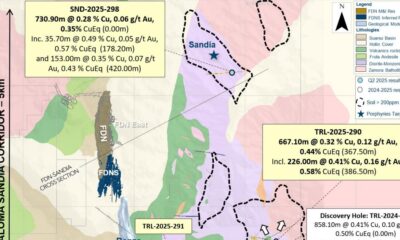

Nyheter4 veckor sedanLundin Gold rapporterar enastående borrresultat vid Fruta del Norte

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanOmgående mångmiljardfiasko för Equinors satsning på Ørsted och vindkraft

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanLundin Gold hittar ny koppar-guld-fyndighet vid Fruta del Norte-gruvan

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanMeta bygger ett AI-datacenter på 5 GW och 2,25 GW gaskraftverk

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanGuld stiger till över 3500 USD på osäkerhet i världen

-

Analys3 veckor sedan

Analys3 veckor sedanWhat OPEC+ is doing, what it is saying and what we are hearing

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAlkane Resources och Mandalay Resources har gått samman, aktör inom guld och antimon

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanAker BP gör ett av Norges största oljefynd på ett decennium, stärker resurserna i Yggdrasilområdet