Nyheter

Coal market likely to have reached its trough

Continuing economic weakness and plentiful supply have put significant pressure on coal prices in the Atlantic market. However, coal prices should recover slightly during the course of the year: not only a strengthening economic situation but also the greater attractiveness of coal-fired power generation should push up demand. Strong import pull from the Pacific market also provides support, so that prices may rise despite a fairly comfortable supply situation of late.

Continuing economic weakness and plentiful supply have put significant pressure on coal prices in the Atlantic market. However, coal prices should recover slightly during the course of the year: not only a strengthening economic situation but also the greater attractiveness of coal-fired power generation should push up demand. Strong import pull from the Pacific market also provides support, so that prices may rise despite a fairly comfortable supply situation of late.

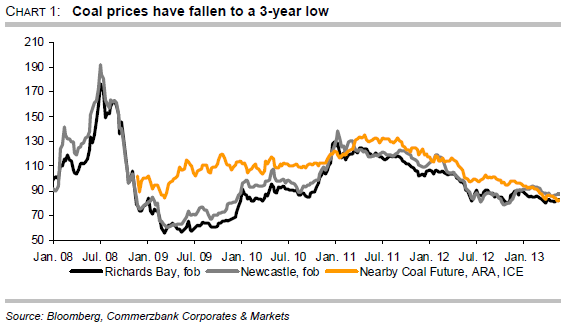

At the beginning of April coal at the ICE was trading at USD 78 per ton in north-west Europe, cheaper than at any time in the last three years. The coal price has fallen by 40% from the highs reached in late 2010 / early 2011 (Chart 1). Prices in Europe have been depressed not only by Europe’s economic malaise, but also by plentiful supply from the USA. American coal producers have been looking for new sales markets in Europe, since domestic demand for coal has slumped in view of the relative price advantage of gas-based electricity generation. Even so, the nearby coal future on the ICE has climbed somewhat from its lowpoint. Is this recovery – in the world’s second most important energy commodity after oil – set to continue? Below we take a closer look at the latest developments and outlook in the main supply and demand markets.

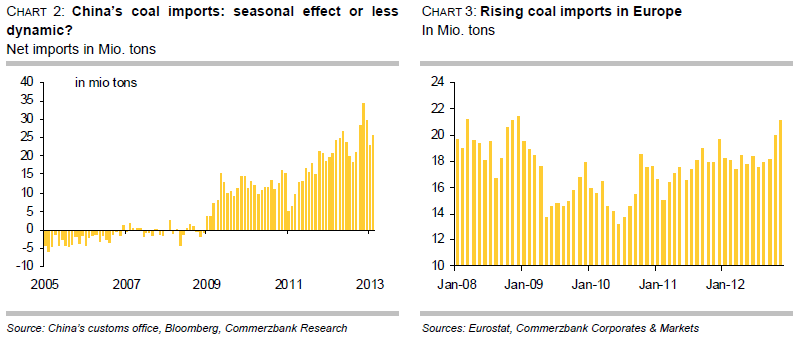

First of all we consider China, which occupies a prominent position in the coal market. Not only does it account for nearly half of the world’s coal consumption, these days it also dominates coal trading: having only become a net importer in 2009, by 2012 China had become the world’s biggest importer by a considerable margin. Last year in particular, China dramatically increased its imports of coal. The Australian research unit BREE, Bureau of Resources and Energy Economics, estimates the import volume at 210 Mio tons, 45% more than the previous year. Infrastructure problems and the relative price advantage of foreign coal were behind this massive jump in import demand. Currently it appears, at first sight, that momentum has weakened significantly: According to China’s customs statistics (though these cover not only thermal coal but also coking coal), net imports in Q1 were still 30% higher than in the previous year, but viewed over the period they were nearly 7% down on the previous quarter (Chart 2).

China’s coal imports continue to rise, but how strong?

However, the drop has to be seen against the background of remarkably strong growth in the final quarter of last year, and may have been further amplified by seasonal factors. Since China’s economic growth remains robust and demand for electricity is rising strongly, coal consumption is likely to continue growing strongly. The low prices of foreign coal provide further support for import demand.

However, import demand could be severely dampened if China – in line with current discussions – decides to ban imports of lower-quality coal in the future. Even if it were implemented, however, and China’s imports were to drop considerably, the sub-market for sub-bituminous coal sourced mainly from Indonesia would be affected the most. By contrast, the higher-quality coal market could become even tighter.

Strong demand from India will keep imports growing

After China, India is the main driver of coal demand. India’s coal production has not been able to keep up with demand, too. According to estimates, imports rose in 2012 by 17% to roughly 100 Mio tons. The Indian government’s plans to sell a stake in the state-controlled company Coal India Limited, which is responsible for more than 80% of domestic production and is the world’s largest coal producer, have given rise to further uncertainty about the supply situation. Following a threat of protracted strikes, however, these plans have been put on hold. In the long term it is thought that coal-based electricity production could grow by half as much again by 2018. On that basis, import demand should grow by an estimated 11% p.a. in this period. India could surpass China as the world’s largest importer before 2017.

Japan and South Korea remain important buyers of coal

Whereas Indian and Chinese import demand appears set to continue growing significantly, imports to Japan – formerly the world’s largest importer – are expected to rise only moderately. In view of the nuclear shortfall and high LNG prices, Japan is very keen to increase its reliance on coal-generated electricity, yet has only limited new capacities. The Australian research unit BREE even expects imports to diminish. However, this would be offset by rising import demand from South Korea.

EU demand for coal should remain buoyant for the time being

At first sight, demand growth in Europe is perhaps surprisingly positive. Despite Europe’s current economic weakness and its ambitious environmental policy objectives, which are clearly focused on low-emission energy production and therefore do not favour coal, imports to the EU rose last year by 5% to 173 Mio tons (chart 3). As well as structurally declining domestic coal production, this is also explained by low coal prices. Coal-fired power generation has become even more attractive following the massive drop in prices for carbon emission allowances. This trend is likely to have continued until recently, as German data on primary energy consumption indicate. In the first quarter, hard coal consumption rose by 10% year on year. Low prices meant that the use of hard coal for heat and electricity generation increased by 14.5%.

Significant expansion of Australian supply expected

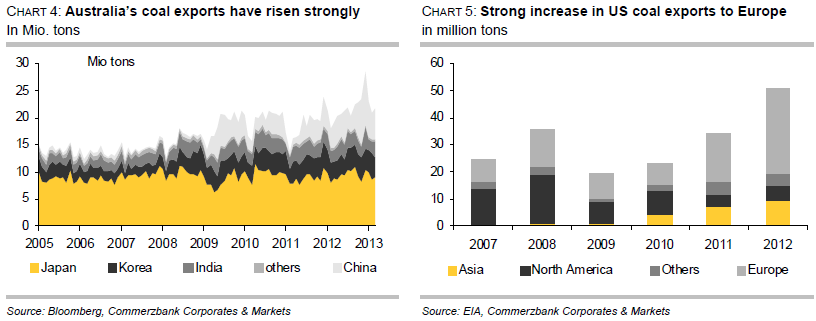

To sum up, demand for coal imports driven by China and India will therefore continue to expand significantly. But where is the supply coming from? There is good news from Australia, the world’s second-largest coal exporter, which is expected to see double-digit export growth in 2013 as several projects are nearing completion and about to start production. In 2012 Australia already increased its coal exports by an estimated 16% to 171 Mio tons (chart 4).

Indonesian export growth slowing down

The situation is more difficult for the other large suppliers on the world market. Indonesia – the world’s largest coal exporter by far – can expect only a moderate rise in exports over the coming years. In 2012, at 315 Mio tons its exports were only slightly higher than in 2011. The slowdown in export growth is due to the relatively low quality of Indonesian coal and higher transport costs for mines located further inland. What is more, a political debate is currently in progress about a plan to limit production so as to conserve resources for future generations. Otherwise, according to estimates, if production continues to grow at present rates, the country’s coal reserves will be exhausted within the next 20 years.

Colombia may focus more on the Pacific market

The news from Colombia is not so good either. The prospect of moderate export growth in 2013 for the most important exporting nation on the Atlantic market was dealt something of a blow at the beginning of the year by a strike – since ended – at the Cerrejon Mine and an attack by FARC militants on its railway line. Last year, Colombian exports stagnated at around 76mt because of lower demand from North America and pay disputes between mine operators and workers. However, export momentum is expected to pick up again in the next few years because, even if demand from the Atlantic market flattens off to some extent, growth in the Pacific market should more than make up for this. Low production costs make Colombian coal attractive for Asian customers, despite high transport costs. Furthermore, the expansion of the Panama canal should allow transit of capesize vessels from 2015 onwards which would make transport cheaper.

South Africa to place more emphasis on reliability of domestic supply

South Africa, which links the Atlantic and Pacific markets and has tended to shift towards the Pacific market, has similar problems to contend with. Here too, production is repeatedly interrupted by strikes, most recently in March when worked was halted in six mines for nearly a month. Only recently, the National Union of Mine workers, NUM, announced to seek 15-60% wage increases. Nevertheless, growth in 2013 is expected to be similar to that achieved in 2012, when exports increased by an estimated 5% to 75 Mio tons. In the longer term, though, export volume could suffer from the South African government’s intention to focus more on the reliability of supply of domestic energy producers, which would allow modest rises in exports at best. On the whole, in recent years, South Africa’s exports.

Slowdown in US export bloom

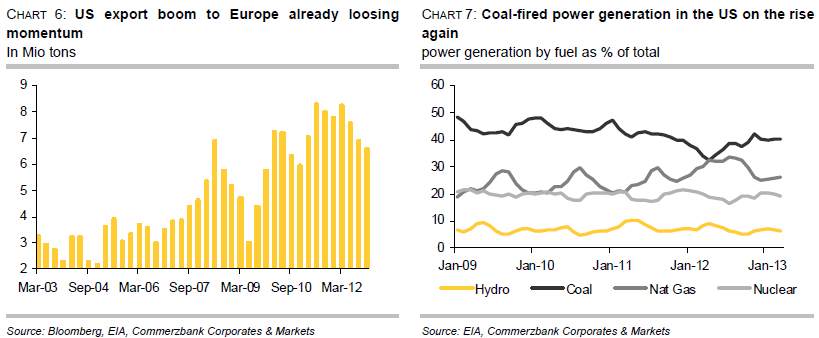

But in our opinion the most important factor for the European market is the trend of supply from the USA, where the export boom appears to have peaked. Helped by substitution effects in electricity generation due to very low US gas prices, exports grew by nearly half in 2012 to around 50m tons (chart 5 and chart 6). According to forecasts of the US Energy Information Administration (EIA), this substitution should fall back slightly, as US gas prices have in fact risen strongly in the last twelve months (chart 7). At the same time, higher demand for electricity is forecast, so that the EIA expects US coal demand to rise by 7.3% overall in 2013. With coal production expanding only slightly, coal exports are expected to fall by 15% in the current year. Medium-term projections even predict a significant drop in exports over the next few years, though these assume substantial cuts in production.

Coal prices likely to recover in H2

All in all, given the economic malaise in Europe and the uncertain outlook regarding Chinese import demand, we anticipate little potential for a strong price recovery in the short term. That said, we do not expect prices to fall further, as prices will be barely profitable for many producers. Yet lower prices would therefore lead to cutbacks in production. However, we expect prices to pick up in the second half of the year: a recovery in coal demand from electricity producers due to the increased price advantage, stabilisation of the economic situation in Europe, higher import demand from the Pacific market and the end of the US export boom are likely to drive the price back towards 90 USD per ton in H2.

Nyheter

Tyskland har så höga elpriser att företag inte har råd att använda elektricitet

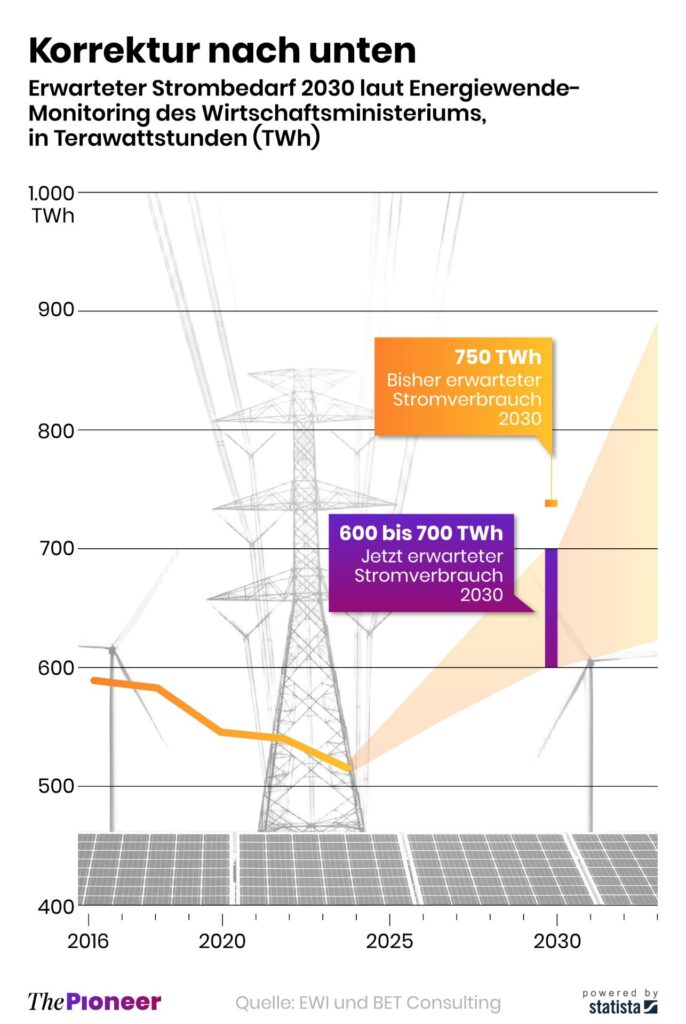

Tyskland har skrivit ner prognosen på hur mycket elektricitet landet kommer att behöva 2030. Hittills har prognosen varit 750 TWh, vilken nu har skrivits ner till 600-700 TWh,

Det kan vid en första anblick låta positivt. Men orsaken är inte att effektiviseringar. Utan priserna är så pass höga att företag inte har råd att använda elektriciteten. Elintensiv industri flyttar sin verksamhet till andra länder och få företag satsar på att etablera energikrävande verksamhet i landet.

Tyskland har inte heller någon plan för att förändra sin havererade energipolitik. Eller rättare sagt, planen är att uppfinna fusionskraft och använda det som energikälla. Något som dock inte löser problemet på några årtionden.

Nyheter

Kinas elproduktion slog nytt rekord i augusti, vilket även kolkraft gjorde

Kinas officiella statistik för elproduktion har släppts för augusti och den visar att landet slog ett nytt rekord. Under augusti producerades 936 TWh elektricitet.

Stephen Stapczynski på Bloomberg lyfter fram att det är ungefär lika mycket som Japan producerar per år, vilket innebär är de producerar ungefär lika mycket elektricitet per invånare.

Kinas elproduktion kom i augusti från:

| Fossil energi | 67 % |

| Vattenkraft | 16 % |

| Vind och Sol | 13 % |

| Kärnkraft | 5 % |

Stapczynskis kollega Javier Blas uppmärksammar även att det totala rekordet inkluderade ett nytt rekord för kolkraft. Termisk energi (där nästan allting är kol) producerade 627,4 TWh under augusti. Vi rapporterade tidigare i år att Kina under första kvartalet slog ett nytt rekord i kolproduktion.

Nyheter

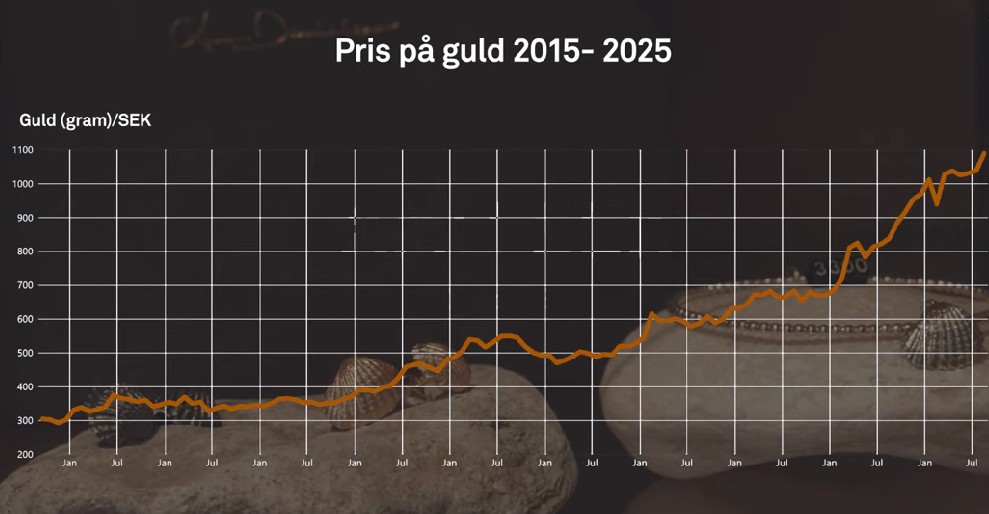

Det stigande guldpriset en utmaning för smyckesköpare

Guldpriset når hela tiden nya höjder och det märks för folk när de ska köpa smycken. Det gör att butikerna måste justera upp sina priser löpande och kunder funderar på om det går att välja något med lägre karat eller mindre diamant. Anna Danielsson, vd på Smyckevalvet, säger att det samtidigt gör att kunderna får upp ögonen för värdet av att äga guld. Det högre guldpriset har även gjort att gamla smycken som ligger hemma i folks byrålådor kan ha fått ett överraskande högt värde.

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMeta bygger ett AI-datacenter på 5 GW och 2,25 GW gaskraftverk

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAker BP gör ett av Norges största oljefynd på ett decennium, stärker resurserna i Yggdrasilområdet

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEtt samtal om koppar, kaffe och spannmål

-

Analys4 veckor sedan

Analys4 veckor sedanBrent sideways on sanctions and peace talks

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSommarens torka kan ge högre elpriser i höst

-

Analys4 veckor sedan

Analys4 veckor sedanBrent edges higher as India–Russia oil trade draws U.S. ire and Powell takes the stage at Jackson Hole

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMahvie Minerals är verksamt i guldrikt område i Finland

-

Analys3 veckor sedan

Analys3 veckor sedanIncreasing risk that OPEC+ will unwind the last 1.65 mb/d of cuts when they meet on 7 September